|

시장보고서

상품코드

1440255

반려동물 백신 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Companion Animal Vaccine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

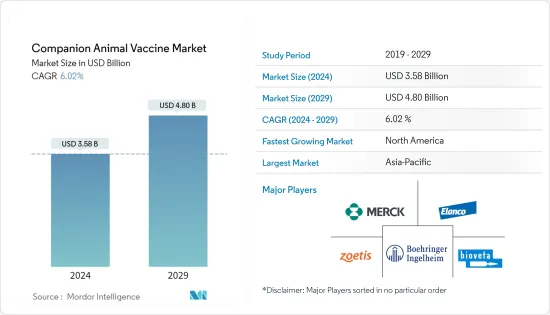

반려동물 백신 시장 규모는 2024년 35억 8,000만 달러에 이를 것으로 추정됩니다. 2029년까지 48억 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 6.02%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

COVID19의 팬데믹이 시장에 미치는 영향은 매우 클 것으로 예상됩니다. 팬데믹 기간 동안 반려동물 입양이 크게 증가했고, 그 결과 동물 의료가 증가하여 동물용 백신의 성장을 가속했습니다. 예를 들어, 2021년 6월에 발표된 인민질병동물약국(PDSA)의 PDSA 동물복지(PAW) 보고서에 따르면, 2020년 3월부터 2021년 5월까지 영국에서 200만 명이 반려동물을 입양했습니다. 이 중 10%는 개, 8%는 고양이, 13%는 토끼였습니다. 전 세계 여러 지역에서 이처럼 높은 반려동물 입양률로 인해 동물 건강관리에 대한 관심이 높아지면서 조사 대상 시장의 성장을 가속하고 있습니다. 또한, 코로나바이러스는 접촉이나 에어로졸 감염을 통해 동물에서 동물로 전파되어 다른 동물에게 전염될 수 있습니다. 그 결과, 시장 참여자들은 코로나19에 대한 반려동물 백신 생산에 참여하기 시작했습니다. 예를 들어, 2021년 7월 Zoetis는 동물의 건강과 복지를 보호하기 위해 11,000회분의 실험용 코로나19 감염 백신 11,000회분을 기부했습니다. 한편, 2021년 4월 러시아는 동물용 카니백-코브(Carnivac-Cov)라는 세계 최초의 코로나19 바이러스 백신을 등록했습니다. 따라서 가축과 야생 동물의 코로나19 감염 사례가 증가함에 따라 동물의 건강을 예방하기 위한 동물 백신의 수용이 촉진되어 산업의 성장이 급증했습니다. 그러나 규제가 해제된 이후 이 분야는 순조로운 회복세를 보이고 있습니다. 지난 2년 동안 수의사 진료 증가와 동물병원의 재개가 시장 회복을 이끌었습니다.

동물 질병 확산 증가, 생명공학 기술 발전, 동물 질병에 대한 인식이 높아지면서 반려동물 백신 시장이 성장하고 있습니다. 동물 물림 사고 증가, 동물 복지 캠페인, 정부의 우호적인 노력으로 반려동물 백신 시장 규모가 확대될 것으로 예상됩니다.

국민들의 반려동물에 대한 인식이 높아지면서 사회 복지와 건강한 라이프스타일을 위해 반려동물을 도입하는 사례가 증가했고, 그 결과 반려동물 보유율이 높아졌습니다. 예를 들어, 독일 Heimtiamarkt가 발행한 2022년 자료에 따르면 2021년 독일 가구의 47%가 반려동물을 키우고 있다고 합니다. 또한 유럽 반려동물 식품 산업: 사실과 수치 2022 보고서가 발표한 데이터에 따르면, 2021년 스페인의 추정 비율에 따르면 최소 1마리 이상의 고양이를 기르는 가구는 27%, 1마리 이상의 개를 기르는 가구는 16%였습니다. 따라서 반려동물 입양이 증가함에 따라 반려동물 예방접종 프로그램이 증가하여 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

또한 최근 몇 년동안 반려동물의 인수공통전염병 발병 건수가 크게 증가하여 시장 성장에 기여하고 있습니다. 예를 들어, 2022년 5월 미국 농무부가 발표한 데이터에 따르면 2022년 약 3,796만 마리의 조류가 고병원성 조류 인플루엔자 바이러스의 영향을 받았으며, 2022년 1월 캐나다 정부가 발표한 데이터에 따르면 2020년 퀘벡주에서 274명의 라임병 환자가 보고된 반면, 2021년에는 709명의 라임병 환자가 보고되었습니다. 에 비해 2021년에는 709명의 라임병 환자가 보고된 것으로 나타났습니다. 질병 치료 및 확산 방지에 대한 필요성이 증가함에 따라 예측 기간 동안 반려동물용 백신에 대한 수요가 증가할 것으로 예상됩니다.

주요 시장 기업의 제품 출시는 시장 성장을 가속할 것으로 예상됩니다. 예를 들어, 2021년10 월, 동물 위생의 세계 리더 인 베링거인겔하임은 0.5ml 포장의 고양이용 Purevax 백신 접종 시리즈를 출시했습니다. Purevax의 혁신적인 패키지는 고양이 백신 접종을 더욱 편리하게 만들고 고양이 환자에게 더 편안한 예방 접종 경험을 제공합니다.

그러나 높은 백신 개발 비용과 규제 문제로 인해 예측 기간 동안 시장 성장은 억제될 것으로 예상됩니다.

반려동물 백신 시장 동향

반려동물 백신 시장 동향

애견 부문은 예측 기간 동안 반려동물용 백신에서 큰 비중을 차지할 것으로 예상

백신 접종은 감염병을 예방하는 가장 안전하고 비용 효율적인 방법 중 하나이기 때문에 오랫동안 반려견 치료의 초점이 되어 왔습니다. 이 부문은 개 입양 증가와 시장 참여자들의 제품 출시에 의해 주도되고 있습니다. 예를 들어, 2021년 2월 캐나다동물보건연구소(CAHI)는 2020년 반려동물 인구 조사 결과를 발표했는데, 캐나다의 개 개체수가 계속 증가하여 760만 마리에서 770만 마리로 증가했다고 밝혔습니다. 또한, 2020년 캐나다 가정에서는 약 319만 마리의 대형견(50파운드 또는 23킬로그램 이상)이 반려동물로 키우고 있었습니다. 소형견(최대 20파운드 또는 9킬로그램)은 약 197만 마리였습니다. 따라서 개 개체 수 증가는 예측 기간 동안 부문의 성장을 가속할 것으로 예상됩니다.

또한, 시장 참여자들의 전략적 활동은 예측 기간 동안 이 부문의 성장을 가속할 것으로 예상됩니다. 예를 들어, 2022년 8월 미시간 주 농업 및 농촌 개발국(MDARD)은 지역 동물 관리 기관, 미시간 주 동물 관리관 협회, 지역 수의사, 미시간 주립대 수의 진단 실험실(MSU VDL), 미국 농무부(USDA)가 북부 로워 반도 북부의 일부 개가 앓고 있는 개 파보바이러스와 유사한 질병의 보고에 대해 참고자료를 요청하고 있습니다.

따라서 앞서 언급한 요인으로 인해 각 부문은 예측 기간 동안 꾸준히 성장할 것으로 예상됩니다.

북미는 예측 기간 동안 반려동물 백신 시장에서 큰 시장 점유율을 차지할 것으로 예상됩니다.

북미는 예측 기간 동안 유모세포백혈병 시장에서 상당한 성장을 보일 것으로 예상됩니다. 시장 성장을 이끄는 주요 요인은 개, 고양이 및 기타 동물과 같은 반려동물의 입양 증가, 인수공통전염병 증가, 고급 동물 의료 인프라의 가용성입니다.

국내 반려동물 보험 가입 건수 증가도 시장 성장을 가속화할 것으로 예상됩니다. 예를 들어, 보험정보협회가 발표한 2022년 통계에 따르면 2021년 말 기준 미국에서는 390만 마리의 반려동물이 보험에 가입해 2020년 대비 20% 증가한 것으로 나타났습니다. 반려동물 보험 가입률이 가장 높은 곳은 뉴욕주(19.3%), 뉴욕주(8.4%), 플로리다주(6.1%) 등 3개 주입니다. 따라서 반려동물 수용이 증가함에 따라 반려동물 보험의 가용성이 증가함에 따라 반려동물 소유주들이 반려동물의 건강관리에 더 많은 지출을 하고 있습니다. 이는 반려동물을 더 잘 치료할 수 있는 첨단 혁신 백신을 개발하고 이용할 수 있는 기회를 제공합니다.

또한, 이 지역의 반려동물 입양 건수 증가는 예측 기간 동안 시장 성장에 기여할 것입니다. 예를 들어, 발표된 2021년 반려동물 인구 조사에 따르면 캐나다의 반려견 수는 2019년부터 2021년까지 7억 6천만 마리에서 7억 7천만 마리로 증가했습니다. 또한 2021년에는 810만 마리의 고양이가 가족 반려동물로 키웠습니다.

또한 반려동물 건강에 대한 높은 지출이 시장 성장을 가속할 것으로 예상됩니다. 예를 들어, 미국 반려동물 제품 협회의 연구 2021-2022에 따르면 2021년 미국에서 반려동물에 대한 지출은 약 1,096억 달러로 2020년의 1,036억 달러에서 증가할 것으로 추정됩니다. 반려동물에 대한 높은 지출이 기회를 창출하고 있습니다. 효과적인 백신의 개발이 목표이며, 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

또한, 시장 기업은 제품 출시, 제품 개발, 협업, 합병, 인수 및 확장과 같은 다양한 전략을 채택하여 시장에서의 입지를 강화하여 시장 성장을 가속하고 있습니다. 예를 들어, 2022년 9월Merck Animal Health는 두 가지 주요 개 호흡기 병원체의 이중 예방을 목표로하는 Nobivac Intra-Trac Oral BbPi를 출시했습니다.

따라서 위의 요인으로 인해 조사 대상 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

반려동물 백신 산업 개요

반려동물 백신 시장의 경쟁은 중간 정도입니다. 시장 점유율 측면에서 Elanco Animal Health Incorporated, Boehringer Ingelheim GmbH, Merck &Co. Inc., Zoetis Inc. 및 Bioveta AS와 같은 주요 기업이 가장 큰 시장 점유율을 보유하고 있습니다. 주요 기업들은 세계 제품 포트폴리오를 확장하고 세계 시장에서의 입지를 확보하기 위해 인수, 제휴, 신제품 출시 등 다양한 전략적 제휴를 통해 진화하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력 - Porter의 Five Forces 분석

- 바이어의 교섭력

- 공급 기업의 교섭력

- 신규 진출업체의 위협

- 대체 제품의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화(금액별 시장 규모)

- 기술별

- 약독화 생백신

- 불활화 백신

- 톡소이드 백신

- 재조합 백신

- 기타 기술

- 동물 유형별

- 개

- 고양이

- 기타 동물 유형

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Elanco Animal Health Incorporated

- Boehringer Ingelheim GmbH

- Brilliant Bio Pharma

- Merck &Co. Inc.

- Virbac

- Zoetis Inc.

- Indian Immunologicals Ltd

- Bioveta AS

- Durvet Inc.

- HIPRA

- Phibro Animal Health Corporation

- Hester Biosciences Limited

제7장 시장 기회와 향후 동향

LSH 24.03.14The Companion Animal Vaccine Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 4.80 billion by 2029, growing at a CAGR of 6.02% during the forecast period (2024-2029).

The impact of the COVID-19 pandemic on the market is expected to be significant. Pet adoption has increased tremendously during the pandemic, which has resulted in increased animal health care and thus drives the growth of veterinary vaccines. For instance, according to the People's Dispensary for Sick Animals (PDSA) PDSA Animal Wellbeing (PAW) report published in June 2021, 2 million people in the United Kingdom has acquired a pet between March 2020 to May 2021. Out of these pets, 10% are dogs, 8% are cats and 13% are rabbits. Such a high rate of pet adoption in different regions around the world has increased focus on the healthcare of animals and thus drives the growth of the studied market. Additionally, the coronavirus spreads from animal to animal with contact or aerosol transmission, thus infecting other animals. As a result, the market players are getting involved in manufacturing companion animal vaccines against COVID-19. For instance, in July 2021, Zoetis donated over 11,000 doses of its experimental COVID-19 vaccine to help protect the health and well-being of animals. On the other hand, in April 2021, Russia registered the first global COVID-19 vaccine called Carnivac-Cov for animals. Thus, the growing cases of COVID-19 infections in domestic and wild animals promoted the acceptance of animal vaccines for safeguarding preventive animal health, thus soaring industry growth. However, the sector has been recovering well since restrictions were lifted. An increase in veterinary visits, and reopening of veterinary clinics have been leading the market recovery over the last two years.

The market is driven by the rising prevalence of animal diseases, technological advancements in biotechnology, and increasing awareness of animal diseases. Rising incidents of animal bites, animal welfare campaigns, and favourable government initiatives are expected to boost the size of the companion animal vaccines market.

A high degree of public awareness about companion animals among the population has led to an increase in the adoption of these animals for social well-being and a healthy lifestyle, which in turn, led to an increase in pet ownership. For instance, the 2022 data published by the Der Deutsche Heimtiermarkt stated that 47% of the households in Germany had pets in 2021. Additionally, the data published by the European Pet Food Industry: Facts and Figures 2022 report showed that the estimated percentage of Spain households owing at least one cat was 27%, and one dog was 16% in 2021. Thus, the rising adoption of pets increases the vaccination programs for companion animals, which is expected to fuel the market growth over the forecast period.

Furthermore, the number of zoonotic disease cases in companion animals has risen significantly in recent years, contributing to market growth. For instance, as per the data published by USDA in May 2022, around 37.96 million birds were affected by the highly pathogenic avian influenza virus 2022. The large bird population affected by the disease requiring efficient therapeutic measures is adding to the growth of the companion animal vaccine market in the region. Additionally, from the data published by the Government of Canada in January 2022, it has been observed that 709 cases of Lyme disease were reported in Quebec in 2021 compared to 274 cases in 2020. Thus, with the rise in the number of cases, the necessity to treat and prevent the disease from spreading has increased, which is anticipated to boost the demand for companion animal vaccines over the forecast period.

Product launches by the key market players are expected to boost market growth. For instance, in October 2021, Boehringer Ingelheim, a global leader in animal health, has introduced the Purevax vaccination series for cats in 0.5 ml packaging. Purevax's innovative packaging makes cat vaccination more convenient, providing for a more comfortable immunization experience for feline patients.

However, the high vaccine development cost and regulatory concerns are expected to restrain the market growth over the forecast period.

Companion Animal Vaccines Market Trends

Dogs Segment is Expected to Hold a Major Share in the Companion Animal Vaccine Over the Forecast Period

Vaccination has long been a focal topic of dog treatment since it is one of the safest and most cost-effective ways of preventing infectious diseases. the segment is driven by rising in the adoption of dogs and product launches by the market players. For instance, in February 2021, the Canadian Animal Health Institute (CAHI) shared the results of its 2020 Pet Population Survey, the Canadian dog population continued to grow, increasing from 7.6 million to 7.7 million. In addition, in 2020, approximately 3.19 million large dogs (weighing more than 50 pounds or 23 kilograms) were kept as pets in Canadian households. Small dogs (up to 20 pounds or 9 kilograms) had a population of around 1.97 million. Thus, growing dog population is expected to boost the segment growth over the forecast period.

Moreover, strategic activities by the market players are expected to propel the growth of the segment over the forecast period. For instance, in August 2022, the Michigan Department of Agriculture and Rural Development (MDARD) is collaborating with local animal control agencies, the Michigan Association of Animal Control Officers, local veterinarians, the Michigan State University Veterinary Diagnostic Laboratory (MSU VDL), and the United States Department of Agriculture to learn more about reports of a canine parvovirus-like illness affecting several dogs in the northern Lower Peninsula.

Thus, owing to the aforementioned factors, the respective segment is estimated to grow steadily, during the forecast period.

North America is Expected to Have the Significant Market Share in the Companion Animal Vaccine Market Over the Forecast Period

North America is anticipated to witness significant hairy cell leukemia market growth over the forecast period. The major factors driving the market growth are the rising adoption of companion animals such as dogs, cats, and other animals, the increasing number of zoonotic diseases, and the availability of advanced veterinary healthcare infrastructure.

The rising number of pet insurance in the country is also expected to increase the market growth. For instance, according to the 2022 statistics published by the Insurance Information Institute, it has been observed that in the United States, 3.9 million pets were insured at the end of 2021, with an increase of 20% compared to 2020. In addition, California (19.3%), New York (8.4%), and Florida (6.1%) are the three states with the highest percentage of insured pets. Thus, the growing pet adoption increases the availability of pet insurance, due to which pet owners are spending more on pet health care. This creates opportunities for developing and available advanced and innovative vaccines for better treatment of pets.

Additionally, the growing number of pet adoption in the region contributes to the market growth over the forecast period. For instance, the 2021 Pet Population Survey published showed that the number of dogs in Canada increased from 7.6 million to 7.7 million (from 2019 to 2021). Additionally, 8.1 million cats were kept as family pets in 2021.

Furthermore, the high spending on pet health is expected to fuel market growth. For instance, as per the American Pet Products Association Survey 2021-2022, it was estimated that in 2021 around USD 109.6 billion was spent on pets in the United States, up from USD 103.6 billion in 2020. The high spending on pets is creating opportunities for the development of effective vaccines, which is anticipated to fuel market growth over the forecast period.

Moreover, the market players are adopting various strategies, such as product launches, product developments, collaborations, mergers, acquisitions, and expansions to increase their market positions, thereby propelling the market growth. For instance, in September 2022, Merck Animal Health launched NobivacIntra-Trac Oral BbPifor dual prevention of two major canine respiratory pathogens.

Therefore, owing to the factors mentioned above, the studied market is expected to grow over the forecast period.

Companion Animal Vaccines Industry Overview

The companion animal vaccine market is moderately competitive. Regarding market share, major players, such as Elanco Animal Health Incorporated, Boehringer Ingelheim GmbH, Merck & Co. Inc., Zoetis Inc., and Bioveta AS, among others, hold the largest market shares. Key players are evolving through various strategic alliances, such as acquisitions, collaborations, and new product launches, to expand their global product portfolios and secure their positions in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of Companion Animals, such as Dogs and Cats

- 4.2.2 Increasing Cases of Zoonotic Diseases

- 4.3 Market Restraints

- 4.3.1 High Cost of Vaccine Development and Regulatory Concern

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers/Consumers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - in USD Millions)

- 5.1 By Technology

- 5.1.1 Live Attenuated Vaccines

- 5.1.2 Inactivated Vaccines

- 5.1.3 Toxoid Vaccines

- 5.1.4 Recombinant Vaccines

- 5.1.5 Other Technologies

- 5.2 By Animal Type

- 5.2.1 Dogs

- 5.2.2 Cats

- 5.2.3 Other Animal Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 COMPANY PROFILES

- 6.1.1 Elanco Animal Health Incorporated

- 6.1.2 Boehringer Ingelheim GmbH

- 6.1.3 Brilliant Bio Pharma

- 6.1.4 Merck & Co. Inc.

- 6.1.5 Virbac

- 6.1.6 Zoetis Inc.

- 6.1.7 Indian Immunologicals Ltd

- 6.1.8 Bioveta AS

- 6.1.9 Durvet Inc.

- 6.1.10 HIPRA

- 6.1.11 Phibro Animal Health Corporation

- 6.1.12 Hester Biosciences Limited