|

시장보고서

상품코드

1440437

펨테크 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Femtech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

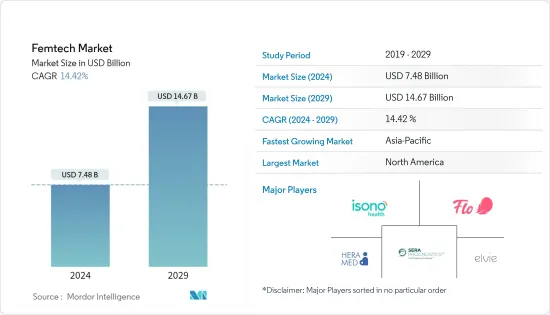

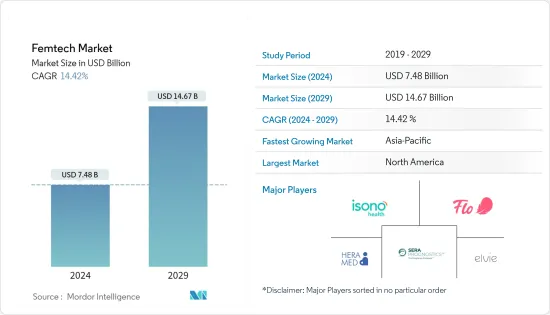

펨테크 시장 규모는 2024년에 74억 8,000만 달러로 추정되며, 2029년까지 146억 7,000만 달러에 달할 것으로 예측되고 있으며, 예측 기간(2024-2029년) 중 14.42%의 CAGR로 성장합니다.

신종 코로나바이러스 감염증(COVID-19)의 대유행은 조사 대상 시장에 큰 영향을 미쳤습니다. 전염병 기간 중 여성들은 생활 습관의 변화, 정신건강 문제, 대사 증후군 및 기타 만성질환의 발병 위험 증가로 인해 여러 가지 건강 상태에 직면했습니다. 2022년 3월 세계보건기구(WHO)가 발표한 기사에 따르면 신종 코로나바이러스 감염증(COVID-19) 팬데믹 이후 여성과 소녀들은 경제적 불확실성의 위험 증가, 주요 지원 및 의료 서비스에 대한 접근성 감소, 사회적 스트레스 증가를 목격했습니다. 이는 특히 저소득 및 중산층 가구의 커뮤니티에서 두드러지게 나타나고 있습니다.

또 다른 정보원에 따르면 COVID-19는 여성과 여아에게 심각한 경제적 피해를 입히고 더 많은 여성 인구를 극심한 빈곤에 빠뜨릴 수 있다고 합니다. 이 관계자는 여성 인구의 빈곤율이 2021년에 전년 대비 12.5%로 상승하고 2030년 말까지 전염병 이전 수준으로 돌아갈 것으로 예상된다고 말했습니다. 이러한 요인들이 불안, 우울증, 우울증을 유발했습니다. 여성의 호르몬 균형이 깨졌습니다. 이로 인해 가족 기술 산업의 주요 기업은 전 세계 원격 지역에 솔루션을 제공하기 위해 혁신적인 소프트웨어, 서비스 및 제품 개발에 더욱 집중하고 있습니다. 이는 팬데믹 기간 중 조사 대상 시장에 상당히 긍정적인 영향을 미쳤으며, 시장은 예측 기간 중 이러한 성장 추세가 지속될 것으로 예상됩니다.

디지털 헬스 솔루션의 채택 증가, 인공지능 및 가상 지원의 발전, 펨테크 산업의 투자 및 자금 증가 등의 요인이 시장 성장에 크게 기여할 것으로 예상됩니다.

여성의 건강과 행복과 관련된 솔루션에 자금을 지원하는 것에 대한 투자자들의 관심이 높아지고 있습니다. 이는 시장 성장을 가속할 것으로 예상됩니다. 2022년 11월, 여성 건강에 초점을 맞춘 원격 치료 스타트업인 Maven Clinic은 Intermountain Ventures, Sequoia Capital, CVS Health Ventures의 추가 참여로 General Catalyst가 주도하는 General Catalyst가 주도하는 2022년 최대 규모의 펨테크 라운드 시리즈 E 투자로 9,000만 달러의 자금을 조달했습니다. 회사 측에 따르면 Maven은 총 3억 달러 이상의 자금을 조달했다고 합니다. 이러한 투자는 조사 대상 시장의 성장을 가속할 것으로 예상됩니다.

따라서 생식 건강에 대한 수요 증가, 디지털 건강 솔루션에 대한 전반적인 수요 증가, 제품 혁신 등의 요인으로 인해 펨테크 시장은 예측 기간 중 성장할 것으로 예상됩니다. 그러나 개발도상국의 펨테크 제품 및 용도에 대한 인식 부족과 관련 사이버 보안 및 개인 정보 보호 문제에 대한 인식 부족은 조사 대상 시장에 부정적인 영향을 미칠 수 있는 몇 가지 요인입니다.

펨테크 시장 동향

생식건강 분야는 시장에서 상당한 점유율을 차지할 것으로 예상

현재 여성들은 경력 중시 및 만혼화로 인해 고령에 임신하는 경향이 있습니다. 여성의 고령화, 환경적 요인 등 여러 요인으로 인해 임신 전, 임신 중, 임신 후 문제를 경험하는 여성들이 증가함에 따라 생식 건강을 위한 펨테크 솔루션에 대한 수요가 증가할 것으로 예상됩니다.

CDC가 2021년 4월에 검토한 생식 건강 및 불임에 관한 자주 묻는 질문에 따르면 전 세계에서 매년 약 35%의 부부가 불임으로 고통받고 있습니다. 또한 2022년 11월 필리핀 정부가 발표한 자료에 따르면 15-49세 필리핀 여성의 합계출산율(TFR)은 2022년 도시 여성 1인당 1.7명, 농촌 여성 1인당 2.2명으로 감소했습니다. 지난 10년동안. 따라서 필리핀은 이미 여성 1인당 2.1 명의 대체 출산 수준인 2.1 명을 밑돌고 있습니다. 남성과 여성의 불임 발생률은 최종사용자들 사이에서 펨테크의 서비스, 제품 및 용도에 대한 수요를 증가시키고 있습니다. 따라서 예측 기간 중 부문의 성장을 가속할 것으로 예상됩니다.

또한 생식 건강 관련 앱과 기기에 대한 투자 증가와 전 세계 주요 정부의 구상도 이 분야의 성장을 가속할 것으로 예상됩니다. 예를 들어 2022년 6월 일본 기업은 여성 직원의 건강을 고려한 '펨테크(Femtech)' 또는 '피메일 기술'을 도입했습니다. 이는 일본 경제산업성의 주도하에 시행되었습니다. 이러한 노력은 부문별 성장을 가속할 것으로 예상됩니다. 따라서 여성 불임 증가와 제품 개발 등의 요인으로 인해 이 부문은 분석 기간 중 성장할 것으로 예상됩니다.

조사 대상 시장에서 상당한 점유율을 차지할 것으로 예상되는 북미지역

북미는 여성의 만성질환 유병률 증가, 불임 증가, 지역내 대상 인구의 펨테크 제품 및 서비스에 대한 인식 증가로 인해 예측 기간 중 큰 점유율을 차지할 것으로 예상됩니다.

높은 여성 암 발병률, 생활습관병 발병률 증가, 첨단 기술 제품의 보급률 증가 등으로 미국을 비롯한 지역 국가에서 펨테크 시장이 성장하고 있습니다. CDC가 2022년 1월에 조사한 여성 건강 데이터에 따르면 미국에서는 현재 18세 이상 여성의 12.7%가 담배를 피우고 있으며, 20세 이상 여성의 41.8%가 비만, 45.2%가 고혈압을 앓고 있는 것으로 나타났습니다. 이러한 요인들은 여성의 불임과 관련이 있으므로 이 지역 인구의 대부분은 현재 불임을 극복하기 위해 펨테크 제품 및 서비스를 이용하는 경향이 있습니다. 따라서 이 지역 시장 성장을 가속할 것으로 예상됩니다.

더 나은 의료 인프라의 존재, 여성 건강 장애에 대한 인식 증가, 여성의 노동력 참여 증가는 지역 시장 성장에 긍정적인 영향을 미칠 준비가 되어 있습니다. 북미에 기반을 둔 펨테크 기업 간의 투자 증가는 이 지역 시장 성장을 가속하는 데 도움이 될 것입니다. 예를 들어 2022년 8월, 미국에 본사를 둔 펨테크 스타트업은 여성을 신체 및 생리주기의 호르몬 단계로 연결하는 것을 목표로 하는 피트니스 및 웰니스 피치에서 Teal Capital이 주도하는 라운드에서 320만 달러의 시드 펀딩을 유치했습니다. 정서적 이익. 또한 2022년 4월, 펨테크 스타트업인 Conceive는 결과 중심의 불임 치료 솔루션에 사용될 370만 달러의 자금을 유치했습니다. 이러한 투자는 이 지역 시장 수요를 촉진하는 데 도움이 될 것입니다.

따라서 만성질환 발생률 증가와 주요 기업의 존재로 인해 북미에서는 펨테크 제품 및 서비스에 대한 수요가 증가하고 있으며, 이 지역은 분석 기간 중 큰 시장 점유율을 유지할 것으로 예상됩니다.

펨테크 산업 개요

펨테크 시장에는 시장 성장에 크게 기여하고 있는 많은 기업이 있습니다. 주요 업체로는 Nuvo Cares, Elvie, HeraMED, Flo Health, Inc, Natural Cycles USA Corp, iSono Health, Sera Prognostics, Athena Feminine Technologies, NUROKOR LIMITED, Canopie 등이 있다, NUROKOR LIMITED, Canopie 등이 있습니다. 신제품 개발, 새로운 애플리케이션 및 인수는 시장에서의 입지를 강화하기 위해 이들 기업이 시행하고 있는 전략의 일부입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 촉진요인

- 디지털 헬스 솔루션의 채택 증가

- 인공지능과 가상 지원의 진보

- 펨테크 업계에 대한 투자와 자금조달의 증가

- 시장 구속

- 개발도상국에서 펨테크 제품과 애플리케이션에 관한 인식의 결여

- 사이버 보안과 프라이버시 문제

- Porter's Five Forces

- 신규 진출업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁의 강도

제5장 시장 세분화

- 유형별

- 디바이스

- 소프트웨어

- 서비스

- 용도별

- 생식건강

- 임신·간호

- 골반과 자궁 헬스케어

- 일반적인 헬스케어와 웰니스

- 기타

- 최종사용자별

- 병원

- 불임 클리닉

- 기타

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Nuvo Cares

- Elvie

- HeraMED

- Flo Health, Inc.

- Natural Cycles USA Corp

- iSono Health

- Sera Prognostics

- Athena Feminine Technologies

- NUROKOR LIMITED

- Canopie

제7장 시장 기회와 향후 동향

KSA 24.03.12The Femtech Market size is estimated at USD 7.48 billion in 2024, and is expected to reach USD 14.67 billion by 2029, growing at a CAGR of 14.42% during the forecast period (2024-2029).

The onset of the COVID-19 pandemic had a significant impact on the market studied. During the pandemic, women faced several health conditions due to changed lifestyle habits, mental health issues, and increased risk of developing metabolic syndrome and other chronic diseases. As per an article published by WHO in March 2022, after the onset of the COVID-19 pandemic, women and girls are witnessing an increasing risk of economic uncertainties, a decrease in access to key support and health services, and an increase in stress in households. This is especially seen in low- and middle-income communities.

In addition, according to the source above, COVID-19 also inflicted deep economic damage on women and girls and is poised to push more female populations into extreme poverty. Also, the source mentioned that poverty rates among the female population rose to 12.5% in 2021 from previous years, and it is expected to come back to the pre-pandemic levels by the end of 2030. Such factors led to anxiety, depression, and hormonal imbalance among women. Thus, the family technology industry's major players increased their focus on developing innovative software, services, and products with the aim of providing solutions in remote areas across the world. This impacted the studied market considerably in a positive manner during the pandemic, and the market is expected to continue this growth trend over the forecast period.

Factors such as a rise in the adoption of digital health solutions, advancement in artificial intelligence and virtual assistance, and growth in investments and funding in the Femtech industry are expected to contribute largely to the growth of the studied market.

There is an increase in the focus of investors to provide funding for solutions related to women's health and well-being. This is expected to boost the market's growth. In November 2022, Maven Clinic, a teletherapy startup focused on women's health, raised USD 90 million in Series E funding in 2022's largest Femtech round, led by General Catalyst, with additional participation from Intermountain Ventures, Sequoia Capital, and CVS Health Ventures. As per the company, Maven has raised more than USD 300 million in total funding. Such investments are predicted to fuel the growth of the studied market.

Therefore, due to factors such as increased demand for reproductive health, overall increasing demand for digital health solutions, and product innovations, the Femtech market is expected to witness growth over the forecast period. However, lack of awareness about Femtech products and applications in developing nations and related cybersecurity and privacy concerns are a few factors that may have an adverse impact on the market studied.

Femtech Market Trends

Reproductive Health Segment is Expected to Hold a Significant Share of the Market

There is a current trend among women to become pregnant at a later age owing to an increased focus on careers and late marriage. Many factors, such as the older age of women and environmental factors, contribute to an increase in the number of women experiencing trouble before, during, or after pregnancy, and therefore the demand for femtech solutions for reproductive health is expected to grow.

The reproduction health and infertility FAQs reviewed in April 2021 by CDC, globally, about 35% of couples suffer from infertility yearly. In addition, according to the data updated by the Government of the Philippines in November 2022, the total fertility rate (TFR) of Filipino women aged 15 to 49 years declined to 1.7 children per urban woman and 2.2 children in rural women in 2022 from the past decade. Hence, the Philippines is already below the replacement fertility level of 2.1 children per woman. These incidences of infertility among men and women are increasing the demand for Femtech services, products, and applications among end users is increasing. Hence, it is expected to propel the segment growth during the forecast period.

Furthermore, the increase in investment toward reproductive health-related apps and devices and initiatives taken by major governments worldwide is also expected to propel the segment growth. For instance, in June 2022, companies in Japan introduced 'Femtech' or 'Female technology,' under which attention is being paid to the health of female employees. This initiative was undertaken by the Ministry of Economy, Trade, and Industry in Japan. Such initiatives are expected to drive segmental growth. Thus, owing to the factors such as increasing infertility among women and product developments, the segment is predicted to witness growth during the analysis period.

North America Expected to Hold Significant Share of the Market Studied

North America is anticipated to hold a significant share over the forecast period owing to the rising prevalence of chronic diseases among women, increasing infertility, and growing awareness about femtech products and services among the target population in the region.

Due to the high prevalence of cancer among women, rising incidence of lifestyle-related disorders, and high adoption of technologically advanced products, the market for femtech is growing in the United States, among other countries in the region. The Women's health data reviewed in January 2022 by CDC shows that in the United States, 12.7% of women of age 18 or more currently smoke a cigarette, 41.8% of women of age 20 and over are obese, and 45.2% have hypertension. As these factors are correlated with female infertility, most of the population in the region is now inclined toward femtech products and services to overcome infertility. Hence, it is expected to drive the market's growth in the country.

The presence of better healthcare infrastructure, growing awareness about women's health disorders, and increased participation by women in the workforce are poised to positively influence the regional market's growth. The increase in the investments among femtech companies based in the North American region will help to boost the market growth in the region. For instance, in August 2022, a United States-based femtech startup scored USD 3.2 million in seed funding in a round led by Thiel Capital with a fitness and wellness pitch that aims to connect women to the hormonal phases of their menstrual cycle for physical and emotional gain. In addition, in April 2022, a femtech startup, Conceive, received USD 3.7 million in funding that would be used for its outcomes-oriented fertility solution. Such investments would help to propel the market demand in the region.

Thus, the rising incidence of chronic diseases and the presence of key players are increasing the demand for femtech products and services in North America, and the region is expected to hold a significant market share during the analysis period.

Femtech Industry Overview

The femtech market has a large number of companies that are significantly contributing to the market growth. Some major players are Nuvo Cares, Elvie, HeraMED, Flo Health, Inc., Natural Cycles USA Corp, iSono Health, Sera Prognostics, Athena Feminine Technologies, NUROKOR LIMITED, and Canopie, among others. New product developments, New applications, and acquisitions are some of the strategies being undertaken by these companies to strengthen their market presence.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in Adoption of Digital Health Solution

- 4.2.2 Advancement in Artificial Intelligence and Virtual Assistance

- 4.2.3 Growth in Investments and Funding in Femtech Industry

- 4.3 Market Restaints

- 4.3.1 Lack of Awareness About Femtech Products and Applications in Developing Nations

- 4.3.2 Cybersecurity and Privacy Concerns

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Devices

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Application

- 5.2.1 Reproductive Health

- 5.2.2 Pregnancy & Nursing care

- 5.2.3 Pelvic & Uterine Healthcare

- 5.2.4 General Healthcare & Wellness

- 5.2.5 Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Fertility Clinics

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nuvo Cares

- 6.1.2 Elvie

- 6.1.3 HeraMED

- 6.1.4 Flo Health, Inc.

- 6.1.5 Natural Cycles USA Corp

- 6.1.6 iSono Health

- 6.1.7 Sera Prognostics

- 6.1.8 Athena Feminine Technologies

- 6.1.9 NUROKOR LIMITED

- 6.1.10 Canopie