|

시장보고서

상품코드

1851260

분자진단 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Molecular Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

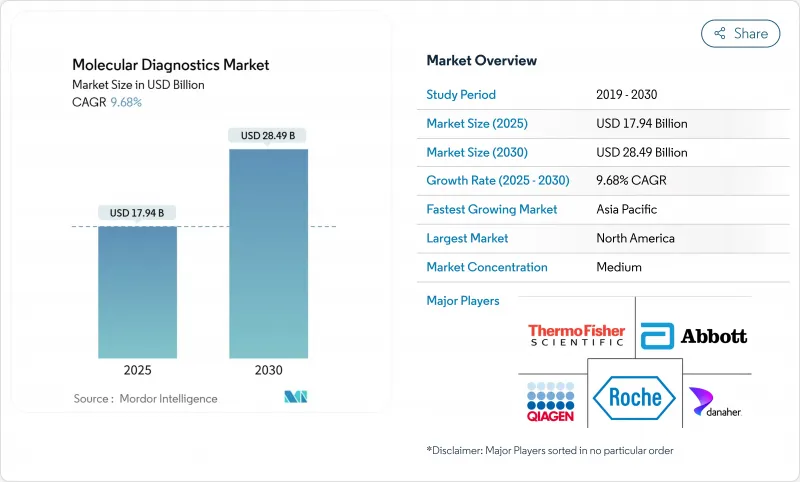

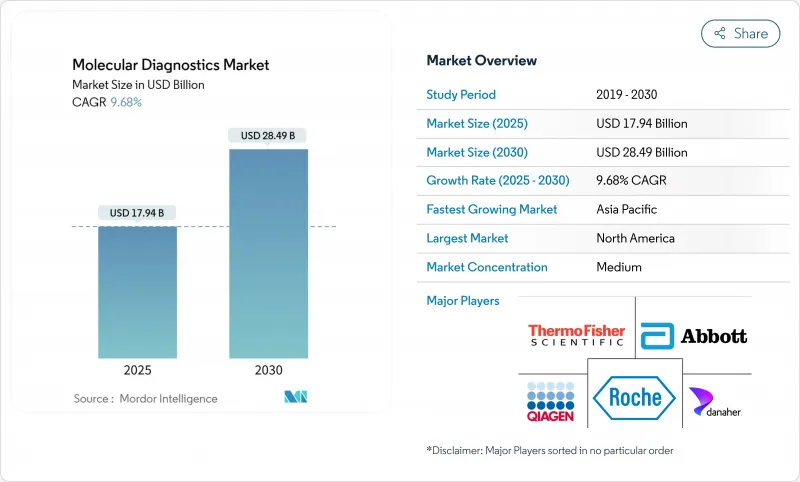

분자진단 시장의 2025년 시장 규모는 179억 4,000만 달러로, 2030년에는 284억 9,000만 달러에 달할 것으로 예상되며, 기간 동안 9.68%의 연평균 복합 성장률(CAGR)을 나타낼 전망입니다.

성장을 지원하는 것은 응급 및 외래에서 신속한 멀티플렉스 검사의 광범위한 채용, 정밀 종양학 검사에 대한 상환 강화, 참조 데이터베이스를 개선하는 국가 유전체 개념에 대한 지속적인 투자입니다. 한편 아시아태평양은 의욕적인 집단 유전체학 프로젝트와 검사시설 인프라의 확대를 배경으로 가장 급속히 매출을 늘리고 있습니다. 기술 공급업체는 PCR, 아이소서멀, 시퀀싱 기반 워크플로우를 결합한 통합 플랫폼을 선호합니다. 동시에 소매업체와 1차 케어 네트워크는 소비자의 첫 접점에서 분자 검사를 가능하게 하는 CLIA 규칙의 합리화를 활용하여 기존 검사실에서 검사량을 이동시키고 있습니다.

세계의 분자진단 시장 동향과 인사이트

POC(Point-of-Care) PCR 수요를 가속화하는 신드로믹 호흡기 패널

멀티플렉스 호흡기 패널은 여러 병원체를 동시에 감지하여 현재 45-90분 내에 결과를 제공합니다. 임상적 채택으로 불필요한 항생제 처방이 20-30% 감소하고 스튜어드십 노력이 강화되었습니다. 이러한 검사는 호흡기 사례의 약 20%에서 발견되는 동시 감염도 발견하므로 단일 병원체 검사에 흔한 진단의 맹점을 줄일 수 있습니다. 병원 네트워크는 감염 통제 프로토콜 내에서 패널의 사용을 성문화하고 계절 피크가 아니라 일년 내내 사용량을 보장합니다. 그 결과, 카트리지식 시스템공급업체는 시약 수요의 지속성을 보고하고 있으며, 이러한 추세는 경상 수익을 높이고 분자진단 시장이 분산화를 중시하고 있음을 뒷받침합니다.

CLIA 면제 분자 장치 소매 약국 진출

2024년 12월에 발효된 미국 CLIA 규정 개정은 인력 요건과 요금 체계를 간소화하여 약국이 중간 정도의 복잡성의 분자 분석을 실시할 수 있게 되었습니다. CVS 헬스는 1,600점포에서 인플루엔자 A/B와 COVID-19의 3인원 PCR을 도입해, 한 번의 내점에서 검사와 처방 상담을 할 수 있도록 했습니다. Kroger는 2,100개 매장에서 콜레스테롤과 포도당의 분자 검사를 실시하여 스크리닝 시간을 90초로 단축했습니다. 이 움직임은 약국을 제1선 진단 허브로 재지정하고, 충분한 서비스를 받지 못한 지역사회에의 접근을 넓히고, 샘플의 흐름을 중앙 검사실로부터 멀리 하는 것입니다. 휴대용 플랫폼 제조업체는 높은 검사 빈도와 소비자의 가시성으로 인해 혜택을 누리고 분자진단 시장에서 장기 수익원을 지원합니다.

효소 공급망의 제약으로 인한 비용 상승

의료기기 제조업체는 지정학적 긴장이 트레이드레인을 혼란시키는 동안 물류비와 원재료비가 매출액의 20% 가까이까지 상승하는 것을 목격하고 있습니다. 고순도 효소는 특히 영향을 받고 있으며, PTFE의 부족으로 인해 수탁 제조업체는 능력의 외주를 강요하고 있습니다. 소규모 분석 개발 기업은 완충제 성분과 안정제 확보에 어려움을 겪고 있으며 제조 지연, 정가 상승, 신규 시장 진입 지연 등을 초래하고 있습니다. 가격에 민감한 신흥국에서는 단가 상승이 검사의 보급을 저해하고 분자진단 시장의 단기적인 확대를 막고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 신드로믹 호흡기 패널의 채용이 북미의 PoC PCR 수요를 가속

- CLIA 면제의 분자 디바이스가 소매 약국에 진출, 액세스가 확대

- EMA가 승인한 동반진단약이 유럽의 암 영역의 검사 수 촉진

- 포퓰레이션 유전체학에 대한 대처가 APAC 전체에서의 NGS 검사 보급을 촉진

- AI를 활용한 바이오인포매틱스 파이프라인이 하이 스루풋 연구소의 결과 턴어라운드를 단축

- 전국적인 항균제 내성 감시 프로그램이 병원에서의 멀티플렉스 PCR 패널 조달을 촉진

- 시장 성장 억제요인

- PCR 키트의 비용 상승을 일으키는 효소 공급망의 제약

- 신규 어세이의 상업화를 늦추는 EU IVDR의 백로그

- 종합적 NGS 패널의 상환 범위는 한정적

- 엄격한 데이터 프라이버시 규제가 클라우드 기반의 결과 전달을 방해

- 규제 또는 기술적 전망

- Porter's Five Forces 분석

- 구매자의 협상력

- 공급기업의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 기술별

- PCR

- 차세대 염기서열 분석(NGS)

- In Situ Hybridization

- 칩 및 마이크로어레이

- 질량 분석

- 기타 기술

- 용도별

- 감염성 질환

- 종양학

- 약물유전체학

- 미생물학

- 유전병 스크리닝

- 인간 백혈구 항원(HLA) 타입 검사

- 혈액 검사

- 제품별

- 시약 및 키트

- 기기 및 시스템

- 소프트웨어 및 서비스

- 샘플 유형별

- 혈액, 혈청 및 혈장

- 소변

- 기타 샘플 유형(타액, 조직, 면봉)

- 최종 사용자별

- 병원

- 진단 및 참조 실험실

- 학술 및 연구 기관

- 기타 최종 사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Danaher

- Hologic Inc.

- Illumina Inc.

- Qiagen NV

- Becton, Dickinson and Company

- bioMrieux SA

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Sysmex Corporation

- Siemens Healthineers AG

- DiaSorin SpA

- Seegene Inc.

- Guardant Health

- Labcorp

- Exact Sciences Corporation

- 10x Genomics

- DNA Genotek, Inc.

- PathoNostics BV

제7장 시장 기회와 향후 전망

KTH 25.11.12The molecular diagnostics market is valued at USD 17.94 billion in 2025 and is forecast to reach USD 28.49 billion by 2030, advancing at a 9.68% CAGR through the period.

Growth is underpinned by wider adoption of rapid multiplex testing in emergency and outpatient settings, stronger reimbursement for precision oncology assays, and sustained investments in national genome initiatives that improve reference databases. North America keeps a leading position because of established payer frameworks and accelerated retail-pharmacy testing, while Asia Pacific posts the quickest revenue climb on the back of ambitious population-genomics projects and expanding laboratory infrastructure. Technology suppliers are prioritizing integrated platforms that combine PCR, isothermal and sequencing-based workflows, a strategy that shortens turnaround and lowers per-test costs. At the same time, retailers and primary-care networks are capitalizing on streamlined CLIA rules that enable molecular testing at the consumer's first point of contact, shifting volumes away from traditional laboratories.

Global Molecular Diagnostics Market Trends and Insights

Syndromic respiratory panels accelerating point-of-care PCR demand

Multiplex respiratory panels simultaneously detect multiple pathogens and now deliver results in 45-90 minutes, a shift that improves early therapy and isolation decisions in intensive-care units. Clinical adoption has lowered unnecessary antibiotic prescriptions by 20-30%, reinforcing stewardship initiatives. Because these assays also uncover co-infections in roughly 20% of respiratory cases, they reduce diagnostic blind spots that are common with single-pathogen tests. Hospital networks are codifying panel use within infection-control protocols, ensuring year-round volumes instead of seasonal peaks. As a result, suppliers of cartridge-based systems report sustained reagent demand, a trend that lifts recurring revenue and underlines the molecular diagnostics market's focus on decentralization.

CLIA-waived molecular devices entering retail pharmacies

Revisions to U.S. CLIA rules effective December 2024 simplified personnel requirements and fee structures, enabling pharmacies to run moderate-complexity molecular assays. CVS Health introduced a three-in-one combo PCR for influenza A/B and COVID-19 across 1,600 outlets, giving customers testing and prescription consultation in a single visit. Kroger followed with cholesterol and glucose molecular testing across 2,100 sites, shrinking screening time to 90 seconds. The move repositions pharmacies as first-line diagnostic hubs, broadening access for underserved communities and redirecting sample flow away from central laboratories. Manufacturers of portable platforms benefit from higher test frequency and consumer visibility, supporting long-term revenue streams in the molecular diagnostics market.

Enzyme supply chain constraints causing cost spikes

Medical device makers have watched logistics and raw-material expenses climb to nearly 20% of revenue as geopolitical tensions disrupt trade lanes. High-purity enzymes are particularly exposed, with PTFE shortages forcing contract manufacturers to insource capabilities. Smaller assay developers struggle to secure buffer components and stabilizers, prompting production delays, higher list prices and slower entry into new markets. In emerging economies, where price sensitivity is acute, the resulting unit-cost escalation inhibits test adoption, capping near-term expansion of the molecular diagnostics market.

Other drivers and restraints analyzed in the detailed report include:

- EMA-approved companion diagnostics boosting oncology test volumes

- Population genomics initiatives driving NGS test uptake

- EU IVDR backlog delaying new assay commercialization

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Roche

- Abbott Laboratories

- Thermo Fisher Scientific

- Danaher

- Hologic

- Illumina

- QIAGEN

- Beckton Dickinson

- bioMerieux

- Agilent Technologies

- Bio-Rad Laboratories

- Sysmex

- Siemens Healthineers

- DiaSorin

- Seegene

- Guardant Health

- LabCorp

- Exact Sciences

- 10x Genomics

- DNA Genotek, Inc.

- PathoNostics B.V.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Syndromic Respiratory Panels Adoption Accelerating PoC PCR Demand in North America

- 4.2.2 CLIA-Waived Molecular Devices Entering Retail Pharmacies Expanding Access

- 4.2.3 EMA-Approved Companion Diagnostics Boosting Oncology Test Volumes in Europe

- 4.2.4 Population Genomics Initiatives Driving NGS Test Uptake Across APAC

- 4.2.5 AI-Enabled Bioinformatics Pipelines Shortening Result Turnaround in High-Throughput Labs

- 4.2.6 National Antimicrobial-Resistance Surveillance Programs Fueling Multiplex PCR Panel Procurement in Hospitals

- 4.3 Market Restraints

- 4.3.1 Enzyme Supply Chain Constraints Causing Cost Spikes for PCR Kits

- 4.3.2 EU IVDR Backlog Delaying New Assay Commercialization

- 4.3.3 Limited Reimbursement Coverage for Comprehensive NGS Panels

- 4.3.4 Stringent Data-Privacy Regulations Hindering Cloud-Based Result Delivery

- 4.4 Regulatory or Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technology

- 5.1.1 PCR

- 5.1.2 Next-Generation Sequencing (NGS)

- 5.1.3 In Situ Hybridization

- 5.1.4 Chips & Microarrays

- 5.1.5 Mass Spectrometry

- 5.1.6 Other Technologies

- 5.2 By Application

- 5.2.1 Infectious Disease

- 5.2.2 Oncology

- 5.2.3 Pharmacogenomics

- 5.2.4 Microbiology

- 5.2.5 Genetic Disease Screening

- 5.2.6 Human Leukocyte Antigen Typing

- 5.2.7 Blood Screening

- 5.3 By Product

- 5.3.1 Reagents & Kits

- 5.3.2 Instruments & Systems

- 5.3.3 Software & Services

- 5.4 By Sample Type

- 5.4.1 Blood, Serum & Plasma

- 5.4.2 Urine

- 5.4.3 Other Sample Types (Saliva, Tissue, Swabs)

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Diagnostic & Reference Laboratories

- 5.5.3 Academic & Research Institutes

- 5.5.4 Other End Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 F. Hoffmann-La Roche Ltd

- 6.4.2 Abbott Laboratories

- 6.4.3 Thermo Fisher Scientific Inc.

- 6.4.4 Danaher

- 6.4.5 Hologic Inc.

- 6.4.6 Illumina Inc.

- 6.4.7 Qiagen N.V.

- 6.4.8 Becton, Dickinson and Company

- 6.4.9 bioMrieux SA

- 6.4.10 Agilent Technologies Inc.

- 6.4.11 Bio-Rad Laboratories Inc.

- 6.4.12 Sysmex Corporation

- 6.4.13 Siemens Healthineers AG

- 6.4.14 DiaSorin S.p.A.

- 6.4.15 Seegene Inc.

- 6.4.16 Guardant Health

- 6.4.17 Labcorp

- 6.4.18 Exact Sciences Corporation

- 6.4.19 10x Genomics

- 6.4.20 DNA Genotek, Inc.

- 6.4.21 PathoNostics B.V.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment