|

시장보고서

상품코드

1851279

비디오 분석 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Video Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

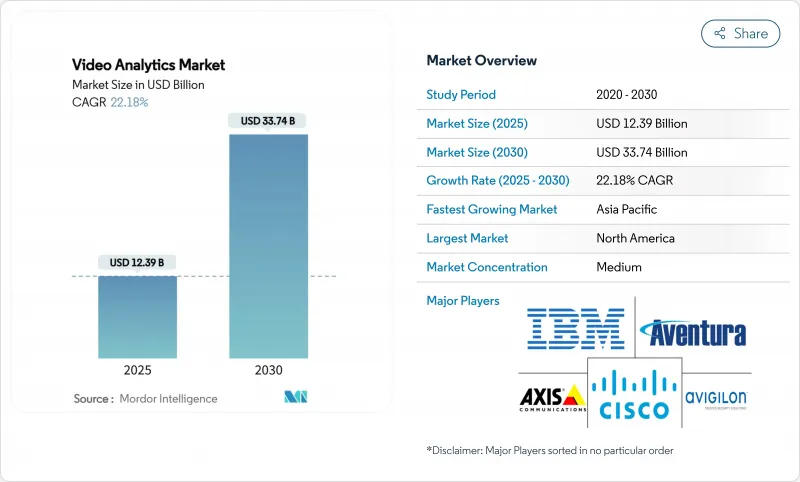

비디오 분석 시장 규모는 2025년에 123억 9,000만 달러로 추정되며 예측 기간(2025-2030년)의 CAGR은 22.18%로, 2030년에는 337억 4,000만 달러에 달할 것으로 예상됩니다.

왕성한 수요는 AI 대응 엣지 컴퓨팅, 급속한 5G 배포, 고해상도 카메라 비용 저하 때문입니다. 미국에서는 신체 장착형 카메라에 대한 규제 강화, 아시아태평양에서는 스마트 시티에 대한 투자, 유럽에서는 엄격한 데이터 보호 규칙이 채택 패턴을 형성하고 있습니다. GPU를 둘러싼 공급망의 스트레스와 반도체 가격의 단축이 단기적으로는 이폭을 압박하지만, 저소비 전력 가속기의 진보에 의해 비용 장벽은 완화되고 있습니다. 클라우드 하이퍼스케일러와 AI 네이티브 벤더 간의 전략적 제휴는 수직 솔루션 시장 출시 시간을 단축하고 개방형 API 에코시스템은 소매, 의료 및 운송에서 타사 혁신을 가속화합니다.

세계의 비디오 분석 시장 동향과 인사이트

GCC에서 CCTV 모니터링에서 AI 기반 분석으로 전환

걸프 협력 회의는 수동 CCTV에서 이상을 감지하고, 사고를 예측하고, 자원 배분을 최적화하는 지능형 분석으로 전환하고 있습니다. 사우디아라비아의 비전 2030과 UAE의 스마트 시티 프로그램은 기존 카메라 시설의 AI 리노베이션에 공적 자금을 투입하고 있으며, 두바이 최대의 쇼핑몰은 Icetana 기술로 업그레이드 한 후 실시간 이상 감지를 입증했습니다. 기술에 대한 사회의 높은 신뢰와 석유 수입으로부터의 다양화는 지속적인 투자를 지원합니다. 에지 지원 어플라이언스는 대역폭 비용을 줄이고 범 GCC 상호 운용성 표준은 도시 플랫폼 간의 데이터 공유를 보장하기 위해 등장합니다. 이러한 요인을 종합하면 예상 CAGR이 4.2포인트 상승합니다.

스마트 시티에 대한 노력

세계 지자체가 교통 관제, 공공 안전 허브, 환경 모니터링 인프라에 비디오 분석을 통합하고 있습니다. 오렌지 카운티는 52개의 교차로에 AI 분석를 도입하여 교통 안전 지표를 개선하고 칼트랜스의 비전 제로 목표에 부합했습니다. 서울의 스마트 교통 관리 플랫폼은 라이브 기상 피드를 정체 방지에 활용하고, 코펜하겐은 사이클링 교통 비디오를 도시 계획에 활용하고 있습니다. 5G 회선은 밀리초 수준의 응답 시간을 허용하고 정적 모니터링에서 동적 군중 관리로 범위를 확장합니다. 장기적인 스마트 시티 자금 파이프라인은 이 드라이버의 CAGR을 3.8% 상승시킵니다.

석유 및 가스 원격지에서의 GPU 전력 소비의 높이

오프 그리드 시설은 디젤 발전기에 의존하기 때문에 다중 GPU 클러스터는 비용이 많이 들고 실용적이지 않습니다. 하이 엔드 GPU공급 제약이 더욱 장애물을 높이고 있습니다. 액셀러의 Metis PCIe 액셀러레이터는 분석 성능을 유지하면서 기존 GPU 설정보다 5배 낮은 에너지 소비와 4배 낮은 비용을 보였습니다. 그러나 열 관리, 유지 보수 물류 및 원격지의 제한된 기술자가 채용을 늦추고 예측 CAGR 로 2.8% 포인트 감산되었습니다.

부문 분석

고객은 하드웨어 업그레이드보다 AI 모델을 선호하기 때문에 2024년 비디오 분석 시장에서 소프트웨어 솔루션이 62%를 차지했습니다. 구독 가격 SaaS는 기업이 CapEx를 OpEx로 교환하고 탄력적인 클라우드 용량을 활용하여 CAGR 25.4%를 나타낼 것으로 예측됩니다. 하이브리드 프레임워크는 기밀성이 높은 스트림을 On-Premise로 유지하면서 메타데이터를 클라우드로 전송하여 주권과 확장성의 균형을 맞춥니다. 하드웨어 가속기는 특히 대기 시간 예산이 심한 물류 야드와 빠른 서비스 레스토랑에서 가장자리 추론의 견인 역할을 하고 있습니다. 버지니아 대학의 SMAST 네트워크는 트랜스포머 기반 모델이 정확도를 크게 향상시켰음을 강조합니다.

서비스는 병렬로 확장됩니다. 매니지드 서비스는 24시간 365일 분석 전문 지식이 부족한 조직에 어필하고 전문 서비스는 여러 사이트의 롤아웃, API 통합, 컴플라이언스 검증에 필수적입니다. SaaS가 널리 보급됨에 따라 관리 서비스 제공업체는 건전성 모니터링, 모델 업데이트 및 사이버 위생 검사를 카메라별 가격으로 번들로 제공합니다. 이러한 추세를 종합하면 소프트웨어의 이점을 확인하고 비디오 분석 시장 규모에서 소프트웨어 수익의 장기적인 가중치를 강화하고 있습니다.

2024년 비디오 분석 시장 점유율은 침입 방어와 경계 방어가 28%를 유지하며, 중요한 인프라와 캠퍼스 보안 지침이 그 중심이 되었습니다. 얼굴인증과 인구통계 분석은 패치워크적인 규제에도 불구하고 2030년까지 연평균 복합 성장률(CAGR) 24.1%로 성장할 전망입니다. 공항은 수동 감시 목록을 통해 스크리닝을 도입하고 소매업체는 동의 규칙을 충족하면 마케팅 세분화에 얼굴 기반 데모 그래픽을 사용합니다. 교통분석도 스마트시티 프로젝트의 혜택을 누리고 있으며, AMPR 시스템만으로도 2027년까지 48억 달러에 달할 것으로 예상됩니다.

행동 인식은 단순한 배회 감지를 넘어 성숙하고, 최신 알고리즘은 폭력적인 제스처를 실시간으로 분리하고 신속한 보안 개입을 지원합니다. 소매점의 히트 맵핑은 구매자의 움직임과 머천다이징 사이의 루프를 닫습니다. 이용 사례의 폭이 넓어짐에 따라 용도의 다양화가 진행되고 분석 스위트는 하나의 라이선스로 여러 요구에 대응할 수 있게 되었습니다.

지역 분석

북미는 2024년 매출 점유율 38%로 비디오 분석 시장을 선도했으며, 이는 신체 장착형 카메라 프로그램에 대한 연방 정부 및 주 정부로부터의 보조금과 적극적인 소매점 손실 방지 이니셔티브에 의해 지원되었습니다. 유행 후 경기 자극 조치가 도시 모니터링 업그레이드를 가속화하고 5G 배포가 저지연 에지 배포를 지원합니다. 캐나다는 특정 공급업체의 진입을 금지했기 때문에 공공 부문의 구매자는 공급망의 다양화를 추진하여 국내 및 유럽 공급업체가 진입할 수 있게 되었습니다.

아시아태평양은 거대 도시 건설, 공장 자동화, 국가 AI 정책의 혜택을 받아 2030년까지 연평균 복합 성장률(CAGR)이 22%를 나타낼 것으로 예측됩니다. 중국의 광대한 감시 시설은 수출 규제가 해외의 부품 조달에 영향을 미치는 자국산의 알고리즘 트레이닝을 촉진합니다. 일본과 한국은 산업의 품질관리를 중시하고 있지만 동남아시아 정부는 운송의 근대화에 중점을 두고 있습니다. 호주는 인건비가 높기 때문에 소매업이나 접객업에서는 분석 주도의 셀프 서비스 모델이 장려되고 있습니다.

유럽에서는 혁신과 엄격한 프라이버시 규칙이 균형을 이룹니다. EU의 AI법은 얼굴 인식을 고위험으로 분류하고 있으며, 공급업체는 바이어스 테스트와 감사 추적을 통합해야 합니다. 헬스케어에서는 GDPR(EU 개인정보보호규정)에 준거한 마스킹에 의해 도입이 가속되고, 스칸디나비아에서는 스마트 시티의 파일럿이 환경 센서와의 융합을 실현하고 있습니다. 국가 안보에 대한 우려는 메이드 인 유럽의 하드웨어 개념에 박차를 가하고 지역 칩 주권을 지원하고 공급망의 탄력성을 강화합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- GCC의 스마트 시티 구상에서 CCTV 감시에서 AI 기반 분석으로의 전환

- 북미의 비디오 분석과 소매 POS 통합

- 미국법 집행에 있어서 신체 장착 카메라 분석의 의무화

- 자율주행차 플릿용 엣지 베이스 분석

- GDPR(EU 개인정보보호규정) 준거의 프라이버시 마스킹이 유럽 헬스케어 도입을 뒷받침

- 산업 안전 분석을 가속화하는 5G 개인 네트워크

- 시장 성장 억제요인

- 석유 및 가스 원격지에서 GPU 전력 소비의 높이

- 라틴아메리카 소매 업계에서 카메라 펌웨어의 단편화

- 미국 얼굴 분석에서 BIPA에 의한 소송 위험

- 중동 공항의 현지어 데이터 세트 부족

- 가치/공급망 분석

- 규제 전망

- 기술적 전망과 스냅샷

- 사례 연구와 이용 사례

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 구성 요소별

- 소프트웨어

- On-Premise

- 클라우드 기반(SaaS)

- 하드웨어 가속기

- 서비스

- 관리형 서비스

- 전문 서비스

- 소프트웨어

- 용도별

- 침입 및 경계 보호

- 군중 및 인원 계수

- 얼굴 인식 및 인구 통계

- 교통 및 차량 분석(ANPR, 사고 감지)

- 행동 인식(배회, 폭력)

- 소매 히트맵 및 전환율 분석

- 배포 모드별

- 엣지

- On-Premise/서버

- 클라우드

- 기업 규모별

- 대기업

- 중소기업

- 업계별

- 정부 및 공공안전

- BFSI

- 헬스케어 및 생명과학

- 소매 및 전자상거래

- 운송 및 물류

- 중요 인프라 및 에너지

- 접객 및 엔터테인먼트

- 제조 및 산업

- 기타(교육 등)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 북유럽(DK, SE, NO, FI)

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- ASEAN

- 호주

- 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- GCC(SA, UAE, 카타르 등)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- Genetec Inc.

- Cisco Systems, Inc.

- Motorola Solutions, Inc.(Avigilon)

- Honeywell International Inc.

- Bosch Security Systems GmbH

- Dahua Technology Co., Ltd.

- BriefCam Ltd.(Canon Group)

- IBM Corporation

- Qognify Ltd.

- Verint Systems Inc.

- Agent Video Intelligence Ltd.(Irisity)

- AllGoVision Technologies Pvt. Ltd.

- Senstar Corporation

- Digital Barriers PLC

- IronYun Inc.

- iOmniscient Pty Ltd.

- Herta Security, SL

- ObjectVideo Labs LLC

- Identiv Inc.

- ISS Inc.(AxxonSoft)

- Viseum UK Group

- Iveda Solutions Inc.

제7장 시장 기회와 향후 전망

KTH 25.11.12The Video Analytics Market size is estimated at USD 12.39 billion in 2025, and is expected to reach USD 33.74 billion by 2030, at a CAGR of 22.18% during the forecast period (2025-2030).

Strong demand comes from AI-enabled edge computing, rapid 5G rollouts, and the falling cost of high-resolution cameras. Regulatory mandates for body-worn cameras in the United States, smart-city investments in Asia Pacific, and strict data-protection rules in Europe collectively shape adoption patterns. Supply-chain stress around GPUs and tighter semiconductor pricing put short-term pressure on margins, yet advances in low-power accelerators are easing cost barriers. Strategic alliances between cloud hyperscalers and AI-native vendors shorten time-to-market for vertical solutions, while open API ecosystems accelerate third-party innovation across retail, healthcare, and transportation.

Global Video Analytics Market Trends and Insights

Migration from CCTV Monitoring to AI-Based Analytics in GCC

The Gulf Cooperation Council is shifting from passive CCTV toward intelligent analytics that detect anomalies, predict incidents, and optimise resource allocation. Saudi Arabia's Vision 2030 and the UAE's smart-city programmes channel public funding into AI retrofits for existing camera estates, while Dubai's largest mall demonstrated real-time anomaly detection after upgrading with Icetana technology. High societal trust in technology and diversification away from oil revenue underpin sustained investment. Edge-ready appliances reduce bandwidth costs, and pan-GCC interoperability standards are emerging to ensure data-sharing across city platforms. These factors collectively add 4.2 percentage points to the forecast CAGR.

Smart-City Initiatives

Municipalities worldwide embed video analytics in traffic control, public-safety hubs, and environmental monitoring infrastructure. Orange County deployed AI analytics across 52 intersections, improving road-safety metrics and aligning with Caltrans' Vision Zero goal. Seoul's Smart Traffic Management platform applies live weather feeds to prevent congestion, while Copenhagen leverages cycling-traffic video for urban planning. 5G links enable millisecond-level response times, widening the scope from static surveillance to dynamic crowd management. Long-term smart-city funding pipelines give this driver a 3.8 percentage-point lift on CAGR.

High GPU Power Consumption in Remote Oil and Gas Sites

Off-grid facilities rely on diesel generators, making multi-GPU clusters costly and impractical. Supply constraints on high-end GPUs further intensify the hurdle. Axelera's Metis PCIe accelerator showcased 5X lower energy draw and 4X lower cost than conventional GPU setups while sustaining analytic performance. Yet thermal management, maintenance logistics, and limited technical personnel at remote sites slow adoption, subtracting 2.8 percentage points from the forecast CAGR.

Other drivers and restraints analyzed in the detailed report include:

- Integration of Video Analytics with Retail POS in North America

- Mandates for Body-Worn-Camera Analytics in U.S. Law Enforcement

- Fragmented Camera Firmware in Latin-American Retail

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software solutions commanded 62% of the video analytics market in 2024 as customers prioritised AI models over hardware upgrades. Subscription-priced SaaS is forecast to grow at 25.4% CAGR as enterprises trade CapEx for OpEx and tap elastic cloud capacity. Hybrid frameworks keep sensitive streams on-premise while sending metadata to the cloud, balancing sovereignty and scalability. Hardware accelerators gain traction for edge inference, especially in logistics yards and quick-service restaurants where latency budgets are strict. The University of Virginia's SMAST network underscores the jump in accuracy now achievable through transformer-based models.

Services expand in parallel. Managed offerings appeal to organisations lacking 24/7 analytics expertise, while professional services remain vital for multi-site roll-outs, API integrations, and compliance validation. As SaaS penetration deepens, managed-service providers bundle health monitoring, model updates, and cyber-hygiene checks into per-camera pricing. Together, these trends affirm software's primacy and reinforce the long-term weighting of software revenue in the video analytics market size.

Intrusion and perimeter protection retained 28% video analytics market share in 2024, anchored by critical-infrastructure and campus security mandates. Facial recognition and demographics analytics is expected to compound at 24.1% CAGR through 2030 despite patchwork regulation. Airports deploy passive watch-list screening, while retailers use face-based demographics for marketing segmentation, provided that consent rules are met. Traffic analytics also gain lift from smart-city projects, and ANPR systems alone are projected to reach USD 4.8 billion by 2027.

Behaviour recognition has matured beyond simple loitering detection; modern algorithms now isolate violent gestures in real time, aiding rapid security intervention. Retail heat-mapping closes the loop between shopper movement and merchandising. The breadth of use cases keeps application diversification high and positions analytics suites to address multiple needs within one licence.

Video Analytics Market Report is Segmented by Component (Software, Hardware Accelerators, Services), Application (Intrusion Protection, Crowd Counting, Facial Recognition and More), Deployment Mode (Edge, On-Premise, Cloud), Organization Size (Large Enterprises, Smes), End-User Vertical (Government, BFSI, Healthcare, Retail, Transportation and Morfe), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the video analytics market with 38% revenue share in 2024, anchored by federal and state grants for body-worn-camera programmes and aggressive retail loss-prevention initiatives. Post-pandemic stimulus accelerated city surveillance upgrades, while 5G rollouts underpin low-latency edge deployments. Canada's ban on selected vendors prompted public-sector buyers to diversify supply chains, opening space for domestic and European providers.

Asia Pacific is projected to post 22% CAGR through 2030, benefitting from megacity construction, factory automation, and national AI policies. China's vast surveillance estate fosters home-grown algorithm training, though export restrictions affect foreign component sourcing. Japan and South Korea emphasise industrial quality control, whereas Southeast Asian governments focus on transport modernisation. Australia's high labour costs encourage analytics-driven self-service models across retail and hospitality.

Europe balances innovation with stringent privacy rules. The EU AI Act classifies face recognition as high-risk, compelling vendors to embed bias testing and audit trails. Healthcare adoption accelerates through GDPR-compliant masking, while smart-city pilots in Scandinavia integrate environmental-sensor fusion. National security concerns spur made-in-Europe hardware initiatives, supporting regional chip sovereignty and reinforcing supply-chain resilience.

- Hikvision Digital Technology Co., Ltd.

- Axis Communications AB

- Genetec Inc.

- Cisco Systems, Inc.

- Motorola Solutions, Inc. (Avigilon)

- Honeywell International Inc.

- Bosch Security Systems GmbH

- Dahua Technology Co., Ltd.

- BriefCam Ltd. (Canon Group)

- IBM Corporation

- Qognify Ltd.

- Verint Systems Inc.

- Agent Video Intelligence Ltd. (Irisity)

- AllGoVision Technologies Pvt. Ltd.

- Senstar Corporation

- Digital Barriers PLC

- IronYun Inc.

- iOmniscient Pty Ltd.

- Herta Security, S.L.

- ObjectVideo Labs LLC

- Identiv Inc.

- ISS Inc. (AxxonSoft)

- Viseum UK Group

- Iveda Solutions Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Migration from CCTV Monitoring to AI-Based Analytics in GCC Smart-City Initiatives

- 4.2.2 Integration of Video Analytics with Retail POS in North America

- 4.2.3 Mandates for Body-Worn-Camera Analytics in U.S. Law-Enforcement

- 4.2.4 Edge-Based Analytics for Autonomous Vehicle Fleets

- 4.2.5 GDPR-Compliant Privacy Masking Boosting European Healthcare Adoption

- 4.2.6 5G Private Networks Accelerating Industrial Safety Analytics

- 4.3 Market Restraints

- 4.3.1 High GPU Power Consumption in Remote Oil and Gas Sites

- 4.3.2 Fragmented Camera Firmware in Latin-American Retail

- 4.3.3 Litigation Risks from BIPA on U.S. Facial Analytics

- 4.3.4 Lack of Local-Language Datasets in Middle-East Airports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook and Snapshot

- 4.7 Case Studies and Implementation Use-Cases

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 On-Premise

- 5.1.1.2 Cloud-Based (SaaS)

- 5.1.2 Hardware Accelerators

- 5.1.3 Services

- 5.1.3.1 Managed Services

- 5.1.3.2 Professional Services

- 5.1.1 Software

- 5.2 By Application

- 5.2.1 Intrusion and Perimeter Protection

- 5.2.2 Crowd and People Counting

- 5.2.3 Facial Recognition and Demographics

- 5.2.4 Traffic and Vehicle Analytics (ANPR, Incident Detection)

- 5.2.5 Behaviour Recognition (Loitering, Violence)

- 5.2.6 Retail Heat-Mapping and Conversion

- 5.3 By Deployment Mode

- 5.3.1 Edge

- 5.3.2 On-Premise / Server

- 5.3.3 Cloud

- 5.4 By Organisation Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-User Vertical

- 5.5.1 Government and Public Safety

- 5.5.2 BFSI

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Retail and E-Commerce

- 5.5.5 Transportation and Logistics

- 5.5.6 Critical Infrastructure and Energy

- 5.5.7 Hospitality and Entertainment

- 5.5.8 Manufacturing and Industrial

- 5.5.9 Others (Education, etc.)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics (DK, SE, NO, FI)

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 ASEAN

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC (SA, UAE, Qatar, etc.)

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Hikvision Digital Technology Co., Ltd.

- 6.4.2 Axis Communications AB

- 6.4.3 Genetec Inc.

- 6.4.4 Cisco Systems, Inc.

- 6.4.5 Motorola Solutions, Inc. (Avigilon)

- 6.4.6 Honeywell International Inc.

- 6.4.7 Bosch Security Systems GmbH

- 6.4.8 Dahua Technology Co., Ltd.

- 6.4.9 BriefCam Ltd. (Canon Group)

- 6.4.10 IBM Corporation

- 6.4.11 Qognify Ltd.

- 6.4.12 Verint Systems Inc.

- 6.4.13 Agent Video Intelligence Ltd. (Irisity)

- 6.4.14 AllGoVision Technologies Pvt. Ltd.

- 6.4.15 Senstar Corporation

- 6.4.16 Digital Barriers PLC

- 6.4.17 IronYun Inc.

- 6.4.18 iOmniscient Pty Ltd.

- 6.4.19 Herta Security, S.L.

- 6.4.20 ObjectVideo Labs LLC

- 6.4.21 Identiv Inc.

- 6.4.22 ISS Inc. (AxxonSoft)

- 6.4.23 Viseum UK Group

- 6.4.24 Iveda Solutions Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment