|

시장보고서

상품코드

1686312

관개 기계 - 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Irrigation Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

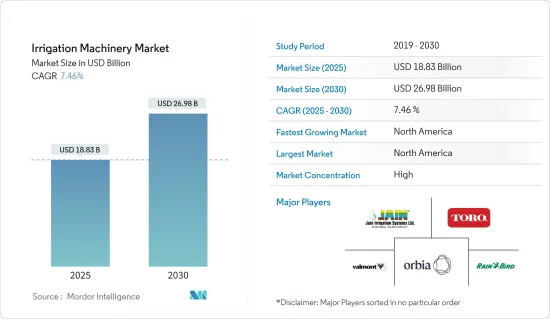

관개 기계 시장 규모는 2025년에 188억 3,000만 달러, 2030년에는 269억 8,000만 달러에 달할 것으로 예측됩니다. 예측 기간 중(2025년-2030년) CAGR은 7.46%를 나타낼 전망입니다.

주요 하이라이트

- 기후 변화와 지구 온난화의 진행은 강우 패턴의 변화를 가져오고 농업에서 관개를 어렵게 만듭니다. 따라서 관개 기계의 사용으로 인해 전 세계 수천 에이커의 면적에 서비스를 제공하는 것이 쉬워졌습니다. 현대 관개 방법으로 가장 많이 사용되는 것은 스프링클러 관개와 드립 관개입니다.

- 정부의 보조금이나 정책, 기술 혁신, 물 부족에 대한 우려의 고조 등 중요한 요인이, 시장의 성장을 가속하고 있습니다. 또, 관개 기계 시장은 자연 관개 시스템의 부족과 작물 생산성에 대한 수요 증가에 의해 성장할 것으로 예측되고 있습니다.

- 스프링클러 관개 기계는 세계의 관개 기계 시장에서 가장 큰 부문입니다. 시장을 선도하는 일부 기업은 혁신적인 제품을 개발하고 강력한 시장 기반을 유지하기 위해 연구 개발에 투자합니다. 관개 시스템은 더 나은 수확량과 다른 관련 이점을 위해 사용되고 있으며, 주요 시장 기업에 의한 첨단 모델의 지속적인 도입과 결합하여 시장 조사의 최대 부문이되었습니다.

- 북미는 가장 급성장하고 있는 시장으로 여겨지고 있습니다. 이 지역에 거점을 두는 기업은 신제품을 발매하고 있으며, 이에 따라 보다 빠른 혁신과 제품 발매로 조사 시장을 독점하고 있습니다.

관개 기계 시장 동향

정부의 보조금과 금융기관의 지원

정부기관은 농가에게 여러 급부금과 보조금을 제공함으로써 선진적인 관개기술의 채용을 촉진하기 위해 다양한 국가에서 관개기계를 추진하고 있습니다. Atlas에 따르면, 2019년부터 2020년에 걸쳐 세계의 총 관개 면적은 7,461만 3,000헥타르 증가했습니다. 물 관개에 대한 보조금이 증가함에 따라 물 소비량과 작물 수확량이 증가할 것으로 예상됩니다.

이와 함께 우간다는 주로 농업에 의존하고 있는 지역입니다. R농부들의 어려움을 덜어주기 위해 세계은행은 우간다 정부간 재정 이전 성과 프로그램(UgIFT)의 일환으로 우간다 농업부와 40개 지방 정부를 지원하고 있습니다. 이를 위해 UgIFT에 3억 달러를 추가 대출하는 것을 승인했습니다.

인도 정부는 “Per Drop More Crop '제도 하에서 물 이용 효율을 촉진하기 위해 농가에게 드립이나 스프링클러 관개 시스템의 도입을 장려하기 위해 농가에게는 표시 단가의 55%, 기타 경작자에게는 45%의 보조금이나 자금 지원을 제공하고 있습니다 이를 통해 시장 강화가 기대됩니다. 현대적이고 고급 관개 시스템을 도입하기위한 저금융 및 보조금에 대한 정부의 호의적 정책으로 관개 기계 시장은 세계적으로 큰 성장을 이룰 가능성이 높습니다.

북미가 시장을 독점

북미에서 관개 시스템의 도입률은 지난 몇 년 동안 증가하고 있습니다. 물 부족은 중요한 과제이며 관개 기계 시스템 사용의 주요 촉진요인입니다.

장비의 고도화와 보조금이라는 형태의 정부의 대처가 시장 성장의 원동력이 되고 있습니다. 집은 유연한 금리와 상환 스케줄로 농업 설비 대출이라는 형태로 적시 보조금을 이용할 수 있게 되었습니다.

예를 들어, 미국 정부는 USDA Direct Operating Loans, USDA Operating Microloans, USDA Guaranteed Operating Loans를 통해 농기구의 대출을 실시했습니다. 따라서 농업 대출의 한도액이 더욱 인상되었습니다.

캐나다 통계국의 보고에 따르면, 2020년 캐나다의 총 관개 면적은 60만 5,907헥타르였습니다. 관개의 대부분을 차지하고 사료 작물은 205,866 헥타르입니다.

관개 기계 산업 개요

관개 기계 시장은 통합되어 있으며, 주요 기업이 시장에서 큰 점유율을 차지하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 신규 참가업체의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 관개 유형별

- 스프링클러 관개

- 펌프 유닛

- 튜브

- 커플러

- 스프레이 , 스프링클러 헤드

- 피팅과 액세서리

- 센서

- 컨트롤러

- 인젝터

- 유량계

- 점적 관개

- 밸브

- 역류 방지 장치

- 압력조절기

- 필터

- 이미터

- 튜브

- 기타 점적 관개

- 피벗 관개

- 기타 관개 유형

- 스프링클러 관개

- 용도 유형별

- 곡물 및 곡류

- 콩류 및 지방종자

- 과일 및 야채

- 기타 용도

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 사우디아라비아

- 캄보디아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 페루

- 기타 남미

- 중동 및 아프리카

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 점유율 분석

- 가장 채용된 전략

- 기업 프로파일

- Nelson Irrigation Corporation

- Orbia(Netafim Limited)

- EPC Industries Limited

- Jain Irrigation Systems Limited

- Tl Irrigation Co.

- The Toro Company

- Valmont Industries

- Deere & Company

- Lindsay Corporation

- Rain Bird Corporation

- Rivulus Irrigation

제7장 시장 기회와 앞으로의 동향

SHW 25.04.29The Irrigation Machinery Market size is estimated at USD 18.83 billion in 2025, and is expected to reach USD 26.98 billion by 2030, at a CAGR of 7.46% during the forecast period (2025-2030).

Key Highlights

- The climatic changes and the increase in global warming have brought changes in rainfall patterns, making irrigation in agriculture difficult. Hence, the use of irrigation machinery has made it easy to serve thousands of acres around the world. The most-used modern irrigation methods are sprinkler and drip irrigation. They primarily serve to sustain crop growth and moisture.

- Crucial factors, such as government subsidies and policies, technological innovations, and increasing concern over water scarcity, are driving the market's growth. Also, the market for irrigation machinery is anticipated to grow with increased scarcity of natural irrigation systems and enhanced demand for crop productivity.

- Sprinkler irrigation machinery is the largest segment in the global irrigation machinery market. Several leading market players are investing in R&D to develop innovative products and maintain a strong market foothold. The growing usage of efficient irrigation systems for their better yield output and other associated benefits is coupled with the continuous introduction of advanced models by key market players to make it the largest segment of the market studied.

- North America is considered the fastest-growing market. The companies located in the region are launching new products, thereby dominating the studied market with faster innovations and product launches. Government policies are also supplementing the growth of the market by providing various subsidies to the farmers.

Irrigation Machinery Market Trends

Subsidies from Governments and Support from Financial Institutions

Government organizations are promoting irrigation machinery in various countries to encourage the adoption of advanced irrigation technologies by providing multiple benefits or subsidies to farmers. These subsidies are helping farmers buy irrigation machinery to simplify the irrigation practices on the farm, thereby aiding the increased land under irrigation around the world. For instance, according to the World Data Atlas, the total irrigated area worldwide increased by 74,613 thousand hectares from 2019 to 2020. Additionally, in the United States, increasing water conservation and subsidies for drip irrigation are anticipated to enhance water consumption and crop yield. This is expected to augment the demand for drip irrigation machinery.

Along with this, Uganda is a region primarily dependent on agriculture. Still, the lack of water infrastructure and increasingly erratic rainfall due to climate change are just two of the challenges faced by its farmers. To help ease the hardships of farmers, the World Bank is supporting the Ministry of Agriculture and 40 local governments across Uganda as part of the Uganda Intergovernmental Fiscal Transfers Program for Results (UgIFT). In Sep 2020, the Board of Directors approved USD 300 million in additional financing to the UgIFT to boost local government (LGs) service delivery in education, health, water and environment, and micro irrigation, including in areas hosting large populations of refugees. This initiative helped farmers buy irrigation equipment at a lower cost, learn to use the irrigation equipment, and understand when and how to water crops.

The Indian government, under the Per Drop More Crop scheme, offers subsidies or financial assistance at a rate of 55% of the indicative unit cost to farmers and a rate of 45% to other cultivators in order to encourage farmers to install drip and sprinkler irrigation systems to promote the water use efficiency. This is expected to strengthen the market. Owing to favorable government policies regarding low-interest loans and subsidies for implementing modern and advanced irrigation systems, the irrigation machinery market is likely to witness significant growth worldwide.

North America Dominates the Market

The rate of adoption of irrigation systems in North America has increased over the past few years. Water scarcity is a significant challenge and a key driver for using irrigation machinery systems. Micro irrigation systems, such as drip and sprinklers, reduce water wastage and increase productivity.

The growing sophistication of equipment and government initiatives in the form of subsidies is driving market growth. Water development programs at the federal, state, and local levels and improvements in groundwater pumping technologies are contributing to the expansion of the irrigated area in North America. Farmers in the region have been able to avail themselves of timely subsidies in the form of agriculture equipment loans at flexible interest rates and repayment schedules. This has helped even small-scale farmers invest in agricultural irrigation equipment, thereby expanding the market of irrigation systems.

For instance, the US government extends loans on farm equipment through USDA Direct Operating Loans, USDA Operating Microloans, and USDA Guaranteed Operating Loans. The 2018 Farm Bill further increased the farm loan limit for US farmers to better access credit for high capital costs related to agriculture systems, including irrigation systems. The availability of loans and subsidies is propelling the demand for agricultural irrigation machinery, resulting in the growth of the market studied in the country.

As reported by Statistique Canada, the total irrigated area in the country in 2020 was 605,907 hectares. With 345,581 hectares, the field crops contributed to most of the irrigation, while the forage crops accounted for 205,866 hectares. The large, irrigated area in the country is driving the market for irrigation machinery subsequently in the region.

Irrigation Machinery Industry Overview

The irrigation machinery market is consolidated, with major players occupying a significant share of the market studied. These players include Orbia (Netafim Limited), Jain Irrigation Systems Limited, The Toro Company, Vamont Industries, and Rain Bird Corporation. These key players are investing in new product launches and acquisitions for business expansions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of Substitute Products

- 4.4.4 Threat of New Entrants

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Irrigation Type

- 5.1.1 Sprinkler Irrigation

- 5.1.1.1 Pumping Unit

- 5.1.1.2 Tubing

- 5.1.1.3 Couplers

- 5.1.1.4 Spray/Sprinklers Heads

- 5.1.1.5 Fittings and Accessories

- 5.1.1.6 Sensors

- 5.1.1.7 Controllers

- 5.1.1.8 Injectors

- 5.1.1.9 Flow Meters

- 5.1.2 Drip Irrigation

- 5.1.2.1 Valves

- 5.1.2.2 Backflow Preventers

- 5.1.2.3 Pressure Regulators

- 5.1.2.4 Filters

- 5.1.2.5 Emitters

- 5.1.2.6 Tubing

- 5.1.2.7 Other Drip Irrigations

- 5.1.3 Pivot Irrigation

- 5.1.4 Other Irrigation Types

- 5.1.1 Sprinkler Irrigation

- 5.2 By Application Type

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Fruits and Vegetables

- 5.2.4 Other Application Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Netherlands

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Saudi Arabia

- 5.3.3.5 Cambodia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Peru

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Adopted Strategies

- 6.3 Company Profiles

- 6.3.1 Nelson Irrigation Corporation

- 6.3.2 Orbia (Netafim Limited)

- 6.3.3 EPC Industries Limited

- 6.3.4 Jain Irrigation Systems Limited

- 6.3.5 T-l Irrigation Co.

- 6.3.6 The Toro Company

- 6.3.7 Valmont Industries

- 6.3.8 Deere & Company

- 6.3.9 Lindsay Corporation

- 6.3.10 Rain Bird Corporation

- 6.3.11 Rivulus Irrigation