|

시장보고서

상품코드

1686590

실리콘 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Silicone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

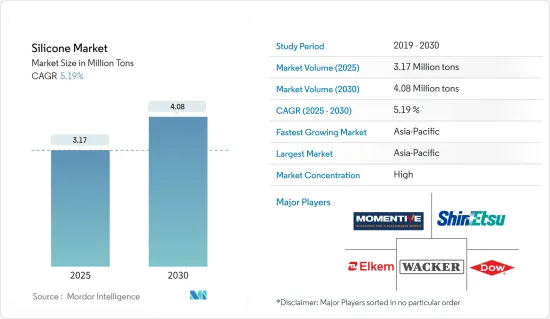

실리콘 시장 규모는 2025년에 317만 톤으로 추정되고, 예측 기간인 2025-2030년 CAGR 5.19%로 성장할 전망이며, 2030년에는 408만 톤에 달할 것으로 예측되고 있습니다.

COVID-19는 실리콘 시장을 방해했습니다. 팬데믹 초기 단계에서 봉쇄 및 이동 제한은 세계 공급망을 혼란스럽게 만들고 원료 조달 지연과 생산 중단으로 이어졌습니다. 그 결과 실리콘 제품이 일시적으로 부족하여 제조 업무에 영향을 미쳤습니다. 그러나 봉쇄 조치가 완화되고 경제활동이 재개되면 자동차, 건설, 일렉트로닉스, 헬스케어 등 다양한 업계에서 실리콘에 대한 막대한 수요가 방출되게 되었습니다.

실리콘 시장을 견인하는 주요 요인은 헬스케어 산업에서의 실리콘 사용량 증가, 송전 및 배전 부문에서의 수요 증가, 자동차 산업에서의 실리콘의 용도 증가입니다.

반면 정부의 규제와 대체품과의 경쟁이 시장 성장을 방해할 것으로 예상됩니다.

다양한 최종 사용자로부터의 전기활성 폴리머(EAP)에 대한 잠재적인 수요 증가와 건설에서 에너지 효율 및 지속가능성에 대한 실리콘 기반 재료의 기여 증가는 예측 기간 동안 실리콘 시장의 기회로 작용할 것으로 보입니다.

아시아태평양은 다른 지역 중 실리콘 시장을 독점할 것으로 예상되며, 중국과 인도는 이 지역의 성장을 이끌고 있습니다.

실리콘 시장 동향

시장을 독점하는 산업 프로세스 부문

- 제조 공정 분야에서 실리콘의 주요 용도로는 소포제, 공업용 코팅제, 유체, 오일, 상온 가황 실란트, 성형품, 폴리머용 첨가제 등이 있습니다.

- 실리콘은 공간이나 무게의 제한으로 해양 시추에서 널리 사용되고 있으며, 거품이나 폐기물의 관리가 불가결합니다. 실리콘은 시추 진흙에 갇힌 가스를 방출시킵니다. 거품의 존재는 작업에 방해가 되며 유지보수 작업에 시간이 걸리기 때문에 소포제는 에너지 소비량과 화학물질 사용량을 줄이는 동시에 생산량을 향상시킵니다.

- 이처럼 세계의 석유 및 가스 산업의 확대는 실리콘 수요의 혜택을 받을 것으로 예상되고 있습니다. 현재 진행 중인 다양한 확장 프로젝트가 성장을 촉진할 것으로 예상됩니다. 인도는 아시아태평양 지역의 석유 및 가스 분야에서 중요한 경제권입니다. 인도 브랜드 에퀴티 재단(IBEF)이 발표한 보고서에 따르면 인도의 석유 수요는 2045년까지 1,100만 배럴에 이를 것으로 예측되고 있습니다. 또한 인도의 천연가스 소비량은 2024년 말까지 250억 입방미터 증가한 것으로 평가되고 있습니다.

- 또한 Energy Institute가 발표한 데이터에 따르면 2022년 세계의 석유 생산량은 44억 720만 톤에 달했습니다.

- 또, 석유 수출국 기구(OPEC)가 발표한 보고서에 의하면, 원유 수요는 증가하고 있어, 2023년에는 일량 1억 189만 배럴로 증가했습니다. 이것은 석유 및 가스 산업으로부터의 실리콘 수요의 증가로 이어집니다.

- 2023년 세계 최대의 원유 수입국인 중국은 중국 세관의 데이터에 따르면 1일 1,130만 배럴의 원유를 수입하여 전년부터 10% 증가했습니다. 중국 정유소에서는 수송용 연료 수요를 충족하고 확대되는 석유화학제품 원료를 생산하기 위해 2023년에 가장 많은 원유가 수입되었습니다.

- 이상과 같은 요인으로부터, 예측 기간 중 시장은 회복 후의 견조한 성장이 전망됩니다.

아시아태평양이 시장을 독점할 전망

- 아시아태평양은 실리콘의 최대 소비국이며, 중국, 인도, 일본 시장이 이 지역의 성장을 견인하고 있습니다.

- 반도체는 일렉트로닉스 분야의 중요한 부품의 하나이며, 반도체, PCB, ECU의 보호에 실리콘이 봉입, 피복, 부착되기 때문에 실리콘이 사용됩니다. 반도체산업협회 및 세계반도체무역통계(WSTS)에 따르면 2023년 1월 중국의 반도체 판매액은 116억 6,000만 달러였습니다.

- 게다가, 중국에는 China Shipbuilding Industry Corporation(CSIC), China State Shipbuilding Corporation(CSSC), COSCO shipping, CMHI, Sinotrans 등 여러 대형 조선 대기업이 있습니다. 중국의 조선소는, 화물선, 컨테이너선, 석유 유조선, 함정, 여객선, 호화 여객선 등, 다종다양한 선박을 건조하고 있어, 이것이 실리콘 수요로 이어지고 있습니다.

- 또한 인도브랜드 에퀴티재단(IBEF)에 따르면 인도의 반도체 제품 수요는 2025년도까지 4,000억 달러에 달할 것으로 예상되고 있습니다. 또, 우타르 프라데시주 정부는, 생산 연동 장려금 제도에 의해, 인도가 칩 산업에 대한 투자로서 76,000카롤 인돌피(90억 9,366만 달러)의 혜택을 받는 것으로 추정되고 있는 것으로부터, 이 나라의 반도체 허브가 되는 것을 목표로 하고 있습니다.

- 중국의 가전제품 시장은 2024년에 플러스 성장으로 회복됩니다. 중국의 가전제품 소매 총매출액은 2조 2,000억 위안(3050억 달러)에 달할 것으로 예상되며, 성장률은 2024년에는 추가로 5%까지 상승할 것으로 전망되고 있습니다.

- 이와 같이, 상기 요인이 예측 기간 동안 아시아태평양의 실리콘 수요 증가에 기여할 것으로 예상됩니다.

실리콘 산업 개요

실리콘 시장은 통합되어 있습니다. 주요 기업에는 Wacker Chemie AG, Dow, Shin-Etsu Chemical, Momentive, Elkem ASA가 포함됩니다.(순부동)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 자동차 산업에서 용도 증가

- 헬스케어 산업에서 용도 확대

- 송배전 분야에서 수요 증가

- 성장 억제요인

- 정부의 규제

- 대체품과의 경쟁

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 폼별

- 엘라스토머

- 유체

- 수지

- 기타

- 최종 사용자별

- 수송

- 건설자재

- 일렉트로닉스

- 헬스케어

- 공업 프로세스

- 퍼스널케어 및 소비자 제품

- 기타 최종 사용자(섬유 및 코팅)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 말레이시아

- 인도네시아

- 베트남

- ASEAN 국가

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 튀르키예

- 러시아

- 노르딕

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 나이지리아

- 카타르

- 이집트

- 아랍에미리트(UAE)

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 점유율(%)** 및 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- BRB International(PETRONAS Chemicals Group Berhad)

- CHT Germany GmbH

- Dow

- DyStar Singapore Pte Ltd

- Elkem ASA

- Evonik Industries AG

- Hoshine Silicon Industry Co. Ltd

- Jiangsu Mingzhu Silicone Rubber Material Co. Ltd

- KANEKA CORPORATION

- Mitsubishi Chemical Corporation

- Momentive

- Shin-Etsu Chemical Co. Ltd

- Wacker Chemie AG

- Wynca Tinyo Silicone Co. Ltd

- Zhejiang Sucon Silicone Co. Ltd

제7장 시장 기회 및 향후 동향

- 전기활성 폴리머(EAP)에 대한 잠재 수요 증가

- 건설에서 에너지 효율 및 지속가능성에 대한 실리콘계 재료의 공헌 증대

The Silicone Market size is estimated at 3.17 million tons in 2025, and is expected to reach 4.08 million tons by 2030, at a CAGR of 5.19% during the forecast period (2025-2030).

COVID-19 hampered the silicone market. During the early stages of the pandemic, lockdowns and restrictions on movement disrupted global supply chains, leading to delays in raw material procurement and production shutdowns. This resulted in temporary shortages of silicone products and impacted manufacturing operations. However, as lockdown measures eased and economic activities resumed, enormous demand for silicone was released across various industries such as automotive, construction, electronics, and healthcare.

The major factors driving the silicone market are the increased usage of silicone in the healthcare industry, the growing demand from the power transmission and distribution segment, and rising applications of silicone in the automotive industry.

On the flip side, government regulations and competition from substitutes are expected to hinder the growth of the market.

Rising potential demand for electroactive polymers (EAP) from various end users and increasing contribution of silicone-based materials to energy efficiency and sustainability in construction are likely to act as an opportunity in the silicone market during the forecast period.

Asia-Pacific is expected to dominate the silicone market among other regions, with China and India leading the region's growth.

Silicone Market Trends

The Industrial Processes Segment to Dominate the Market

- The main applications of silicones in the field of manufacturing processes include antifoaming agents, industry coatings, fluids and oils, room-temperature vulcanizing sealants, moldings, and additives for polymers.

- Silicones are widely used in offshore drilling because of space and weight limitations, where the management of foam and waste is essential. Silicones allow the gas trapped in the drilling mud to be released. Due to the presence of foam, which hinders the process and requires time for maintenance work, antifoaming agents reduce energy consumption and chemical use while boosting production.

- Thus, expanding the global oil and gas industry is anticipated to benefit from the demand for silicone. Various expansion projects underway are expected to drive the growth. India is a significant economy in Asia-Pacific in the oil and gas segment. According to the report released by the India Brand Equity Foundation (IBEF), the oil demand in India is projected to reach 11 million barrels by 2045. In addition, India's natural gas consumption is expected to increase by 25 billion cubic meters by the end of 2024.

- Moreover, according to the data published by the Energy Institute, global oil production reached 4,407.2 million metric tons in 2022.

- Also, according to the report released by the Organization of the Petroleum Exporting Countries (OPEC), there is a rise in demand for crude oil, which increased to 101.89 million barrels per day in 2023. This leads to increased demand for silicone from the oil and gas industries.

- In 2023, China, the globe's top importer of crude oil, brought in 11.3 million barrels of crude oil daily, marking a 10% rise from the previous year, as per data from China's customs. Refineries in China saw their highest crude oil imports in 2023 to meet the nation's rising demand for refining, aiming to meet transportation fuel needs and generate raw materials for its expanding petrochemical.

- Due to all the above factors, the market is expected to witness post-recovery solid growth during the forecast period.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the largest consumer of silicone, with the Chinese, Indian, and Japanese markets driving growth in the region over the years.

- Semiconductors are one of the significant parts of the electronics segment, which involves the usage of silicones as silicone encapsulates, coats, and adheres to the protection of semiconductors, PCBs, and ECUs. According to the Semiconductor Industry Association and the World Semiconductor Trade Statistics (WSTS), the semiconductor sales value in China stood at USD 11.66 billion in January 2023.

- Moreover, China has several large shipbuilding conglomerates, including China Shipbuilding Industry Corporation (CSIC), China State Shipbuilding Corporation (CSSC), COSCO shipping, CMHI, and Sinotrans. China's shipyards build a wide variety of ships, including freighters, containerships, oil tankers, naval vessels, passenger craft, luxury carriers, and so on, which leads to the demand for silicone.

- Also, according to the India Brand Equity Foundation (IBEF), the demand for semiconductor goods in India is expected to be USD 400 billion by FY 2025. The Government of Uttar Pradesh also aims to become a semiconductor hub in the country, given that India is estimated to benefit from INR 76,000 crore (USD 9,093.66 million) as an investment into the chip industry under the Production Linked Incentive scheme.

- China's consumer electronics market is set to bounce back with positive growth in 2024, driven by growing market demand and innovation while increasing retail spending. China's total retail sales of consumer electronics are expected to reach CNY 2.2 trillion (USD 305 billion), and the growth rate is expected to increase further to 5% in 2024.

- Thus, the above-mentioned factors are expected to contribute to the increasing demand for silicone in Asia-Pacific during the forecast period.

Silicone Industry Overview

The silicone market is consolidated. The major players (not in any particular order) include Wacker Chemie AG, Dow, Shin-Etsu Chemical Co. Ltd, Momentive, and Elkem ASA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Application in Automotive Industry

- 4.1.2 Increasing Usage in Healthcare Industry

- 4.1.3 Growing Demand from Power Transmission and Distribution

- 4.2 Restraints

- 4.2.1 Government Regulation

- 4.2.2 Competition from Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Form

- 5.1.1 Elastomers

- 5.1.2 Fluids

- 5.1.3 Resins

- 5.1.4 Other Forms

- 5.2 End User

- 5.2.1 Transportation

- 5.2.2 Construction Materials

- 5.2.3 Electronics

- 5.2.4 Healthcare

- 5.2.5 Industrial Processes

- 5.2.6 Personal Care and Consumer Products

- 5.2.7 Other End Users (Textiles and Coatings)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 ASEAN Countries

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BRB International (PETRONAS Chemicals Group Berhad)

- 6.4.2 CHT Germany GmbH

- 6.4.3 Dow

- 6.4.4 DyStar Singapore Pte Ltd

- 6.4.5 Elkem ASA

- 6.4.6 Evonik Industries AG

- 6.4.7 Hoshine Silicon Industry Co. Ltd

- 6.4.8 Jiangsu Mingzhu Silicone Rubber Material Co. Ltd

- 6.4.9 KANEKA CORPORATION

- 6.4.10 Mitsubishi Chemical Corporation

- 6.4.11 Momentive

- 6.4.12 Shin-Etsu Chemical Co. Ltd

- 6.4.13 Wacker Chemie AG

- 6.4.14 Wynca Tinyo Silicone Co. Ltd

- 6.4.15 Zhejiang Sucon Silicone Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Potential Demand For Electro Active Polymers (EAP)

- 7.2 Increasing Contribution of Silicone-based Materials to Energy-efficiency and Sustainability in Construction