|

시장보고서

상품코드

1850114

가상 이동통신망 사업자(MVNO) 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

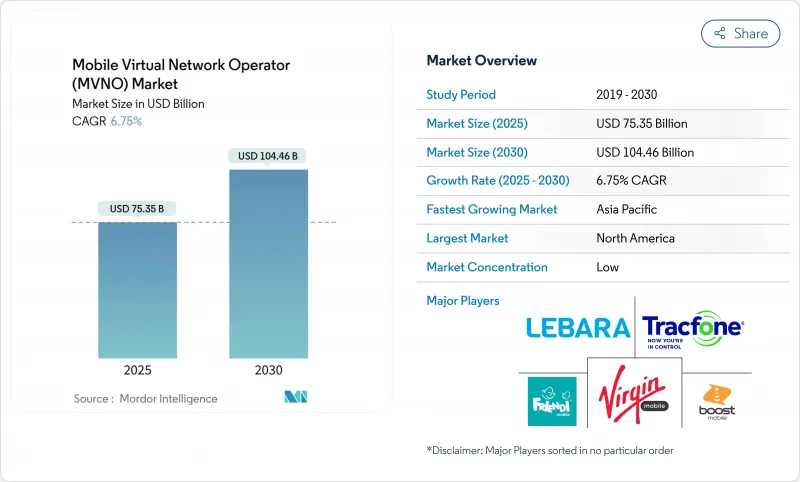

가상 이동통신망 사업자 시장 규모는 2025년에 753억 5,000만 달러, 2030년에는 1,044억 6,000만 달러에 이르고, CAGR 6.75%로 성장할 전망입니다.

이 성장은 핀테크와 통신 사업자의 융합, 도매 가격 개혁, eSIM을 이용한 활성화로 전환함으로써 가격 압력이 증가함에 따라 이 부문이 성장할 수 있음을 반영합니다. 영국과 독일에서 리볼루트의 MVNO 배포와 브라질에서 Nubank 서비스를 시작하는 등의 파트너십은 은행 업무와 연결성의 경계가 모호하다는 것을 보여줍니다. 동시에 한국과 같은 시장에서는 규제당국이 도매수수료를 최대 52% 낮추고 경쟁경제를 재구축하고 있습니다. 클라우드 배포 모델은 이미 가상 이동통신망 사업자 시장의 57%를 차지하고 있으며, 클라우드 네이티브 플랫폼은 설비 투자의 삭감과 출시 사이클의 고속화를 배경으로 CAGR 10.6%로 확장하고 있습니다. 경쟁사와의 차별화는 5G 네트워크의 슬라이싱, 위성-셀간 링크, AI를 활용한 서비스의 개인화에 달려 있습니다.

세계 가상 이동통신사(MVNO) 시장 동향과 통찰

모바일 가입자 수와 스마트폰 보급률 상승

2023년 말까지 아시아태평양의 모바일 연결 수는 18억을 넘어 인구 보급률 63%에 해당하며, 이 지역의 GDP에 8,800억 달러의 공헌을 하고 있습니다. 이러한 급증은 가상 이동통신망 사업자 시장에서 청소년 및 이주층에 맞는 계획을 제공하는 운영자에게 대응할 수 있는 틈새 시장을 열게 됩니다. Globe 필리핀은 고정 무선 액세스로 지역 수요를 캡처하고 Telkomsel은 앱퍼스트의 'by.U' 브랜드로 디지털 네이티브를 타겟팅하고 있습니다. 방글라데시, 인도, 파키스탄 등의 국가에서는 여전히 이용 격차가 크고 비용 중심의 MVNO에 규모 확대에 대한 길을 제공합니다. 스마트폰의 소유율이 높으면 데이터 통신을 많이 사용하는 습관이 촉진되어 MVNO가 제공하는 일반적인 사용량 기반 요금 체계가 강화됩니다. 이러한 요인이 함께 10년대 중반까지의 보급 전망이 높아집니다.

저비용 음성 및 데이터 계획에 대한 수요

지속적인 인플레이션은 소비자의 가치에 대한 감도를 날카롭게 하여 가상 이동통신망 사업자 시장 내 저렴한 가격 중심공급자에게 해지를 촉구하고 있습니다. 영국에서는 기존 MNO가 2024년 후반에 처음으로 계약 회선을 잃는 반면, MVNO는 170만명의 가입자를 늘렸습니다. MobileX는 AI에 의해 조정된 번들을 월3.48달러부터 판매하고 있으며, 해지율은 0.5% 미만으로 억제되고 있습니다. 온라인 판매는 소매 비용을 줄이고 더 많은 할인을 가능하게 하며, 앱 기반 지원을 통해 서비스 제공 비용을 더욱 줄일 수 있습니다. 호스트 경력에 의한 통합은 독립 기업을 위협하지만, 민첩한 MVNO는 브랜드 제휴 및 커뮤니티 기반 소개를 통해 규모의 불리를 상쇄하고 이익 획득의 창구를 넓히고 있습니다.

격렬한 가격 경쟁으로 인한 마진 압박

스위칭 마찰 저하와 풍부한 서브브랜드가 요금 플랜을 비용 방향으로 밀어 올려 가상 이동통신망 사업자 시장 전체의 EBITDA를 압박하고 있습니다. Lycamobile은 영국의 170만 회선에도 불구하고 2022년에는 2,510만 파운드의 적자와 싸웠고, 5,100만 파운드의 부가가치세(VAT) 분쟁과 5G 서비스의 장기 정지가 중하되었습니다. 호스트 MNO는 소유하는 할인 브랜드를 통해 가격 경쟁을 격화시키고 독립 시스템을 붕괴시킵니다. MobileX 창업자 피터 애더턴은 MNO가 TracFone과 Mint Mobile을 인수함에 따라 홀세일 파트너 수가 줄어들고 협상력이 강화되었다고 지적했습니다. 2025년에 완료된 VodafoneThree의 합병은 영국에서 규모의 압력을 더욱 강화하고 소규모 MVNO는 전문화하거나 인수 제안을 받아들일 수밖에 없습니다.

부문 분석

2024년 가상 이동통신망 사업자 시장의 57%를 클라우드 배포가 차지하고 설비 투자를 억제하는 확장 가능한 인프라로의 급속한 이행을 반영하고 있습니다. 사업자가 트래픽 급증 시 탄력적인 용량과 자동화된 패치 관리를 요구하는 가운데 클라우드 네이티브 플랫폼은 2030년까지 10.6%의 연평균 복합 성장률(CAGR)을 기록합니다. 이 시프트는 보다 신속한 기능 배포를 가능하게 하고 고객의 탈퇴를 1% 미만으로 억제하는 AI 기반 보존 툴을 촉진합니다. CompaxDigital의 T-Mobile과의 공동 제안은 중견 MVNO에 고급 BSS/OSS 스택을 제공하여 시작 기간을 수개월에서 수주로 단축합니다. Gigs와 같은 신흥기업은 'MVNO-in-a-box'를 판매하기 위해 7,300만 달러를 조달하고, 자산이 적은 참가 기업에 대한 벤처기업의 의욕을 부각하고 있습니다.

클라우드 민첩성은 가상화 코어가 온디맨드로 대역폭을 할당하므로 5G 네트워크 슬라이싱을 더욱 지원합니다. 이러한 유연성을 통해 MVNO는 호스트 MNO에서 용량을 너무 많이 사지 않고 게이머 및 원격 의료 제공업체와 같은 마이크로 부문을 타겟팅할 수 있습니다. 반대로, 소블린 데이터 호스팅이 필요한 방어 및 은행 고객에게는 On-Premise 설치가 적합합니다. 클라우드 관리 플레인과 에지 사이트 사용자 플레인 기능의 하이브리드 전략을 통해 Full MVNO는 세분화된 보안을 보장하면서 자동화의 이점을 누릴 수 있습니다. 많은 도시에서 퍼블릭 클라우드 대기 시간이 10ms 미만으로 떨어지면 오프프레미스 풀코어의 경제적 이점이 점점 더 강해질 것으로 보입니다.

완전한 MVNO는 SIM의 직접 소유, HLR/HSS의 제어, 완전한 고객 라이프사이클 데이터로부터 이익을 얻어 2024년에 41%의 수익 점유율을 확보했습니다. 컨텐츠나 클라우드 스토리지 등의 부가가치 서비스를 번들함으로써 보다 높은 ARPU를 획득하고 있습니다. 그러나 라이트 MVNO와 브랜드 MVNO는 신속한 시장 진입과 최소한의 선행 자본으로 CAGR 13.2%로 확대되고 있습니다. 소매업체와 앱 기업은 통신에 대한 전문 지식이 없어도 기존 에코시스템에 연결성을 추가할 수 있는 가벼운 모델에 매료되고 있습니다.

서비스 오퍼레이터 계약은 코어를 임대하면서 과금과 정책을 소유할 수 있는 타협의 산물입니다. 리셀러 계약은 매장 트래픽을 활용하여 선불 번들을 판매하는 월마트와 같은 대형 매장을 여전히 유치하고 있습니다. 독일의 1&1은 5G 주파수 대역을 확보한 후 완전한 MVNO에서 국내 네 번째 MNO로 진화하여 상승 지향 경로를 입증했습니다. 이러한 진화는 가입자 기반이 중요한 질량을 초과하면 야심찬 사업자에게 청사진을 제공합니다. 그러나 라이트 모델은 보다 빨리 보급될 가능성이 높고, 브랜드 진입 장벽을 낮추는 것으로 모바일 가상 네트워크 오퍼레이터 시장에 활력을 줄 것으로 보입니다.

MVNO 시장 보고서는 배포 모델(클라우드, On-Premise), 운영 형태(재판매업자, 서비스 사업자, 기타), 가입자 유형(소비자, 기업, IoT 특화형), 용도(할인, 비즈니스, 셀룰러 M2M, 기타), 네트워크 기술(2G/3G, 5G, 기타), 유통 채널(온라인/디지털만, 기존 소매점, 기타)

지역 분석

북미는 세계 평균 4배의 ARPU 수준과 도매 경쟁을 촉진하는 규제 환경에 힘입어 2024년 점유율 38.5%로 가상 이동통신망 사업자 시장을 선도했습니다. 사업자는 대규모 포스트페이드 베이스를 활용하여 프리미엄 회선을 카니버리화하지 않고 밸류 부문의 서브브랜드를 업셀하고 있습니다. Verizon이 TracFone을 인수하면 선불 사용자가 2,000만 명 증가하여 이 부문의 전략적 중요성이 확인되었습니다.

아시아태평양은 CAGR 10.1%로 성장하고 있으며, 2027년까지 총 증가수로 유럽을 추월할 것으로 예측됩니다. 이는 인도, 인도네시아, 중국에서 스마트폰의 저가격화와 주파수대 경매의 자유화가 원동력이 되고 있습니다. 정부의 오픈 액세스 의무화와 급속한 5G 배포로 이 지역은 은행 계좌가 없는 사람들을 대상으로 하는 핀테크의 지원을 받은 MVNO에게 비옥한 땅이 되었습니다. 또한 클라우드 네이티브의 진출기업은 풍부한 개발자의 재능을 찾아 SIM 당 운영 비용을 낮추고 있습니다.

유럽에서는 가입자 규제 당국이 해약료와 로밍료를 조화시켜 국경을 넘은 MVNO에 있어서 호재료가 되고 있기 때문에 가입자수는 견고한 성장을 유지하고 있습니다. 영국의 VodafoneThree는 8년간 110억 파운드의 투자를 계획하고 있지만, 적어도 3개의 독립적인 MVNO를 지원하는 약속을 지켜야 하고 경쟁의 치열함을 유지하고 있습니다. 중동 및 아프리카의 신흥 클러스터는 사업자가 현지 핀텍 파트너에 네트워크 API를 배포함으로써 견인력을 증가시키고, 라틴아메리카의 컨버전스 추세는 Nubank 확대 이후 가속화됩니다. 이러한 역학을 종합하면 지역 역학은 가상 이동통신망 사업자 시장에서 시장 조정을위한 중요한 렌즈로 자리 매김됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 휴대폰 가입자 수와 스마트폰 보급률 증가

- 저비용 음성 및 데이터 요금제에 대한 수요

- IoT/M2M 접속 확대

- 오픈 도매 액세스와 eSIM 대응 진입을 위한 규제 추진

- 핀테크-통신사 융합 산란 은행 브랜드 MVNO

- 위성에서 휴대폰으로의 파트너십을 통해 세계 MVNO 커버리지를 실현

- 시장 성장 억제요인

- 격렬한 가격 경쟁으로 인한 이익 압박

- 네트워크 품질과 도매 요금을 호스트 MNO에 의존

- MVNO 모델을 회피한 디바이스 OEM에 의한 eSIM 소유권의 관리

- 프라이빗 스펙트럼 공유에 의해 기업은 서비스를 자기 프로비저닝할 수 있다

- 밸류체인 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 투자분석

제5장 시장 규모와 성장 예측

- 전개 모델별

- 클라우드

- On-Premise

- 동작 모드별

- 리셀러

- 서비스 오퍼레이터

- Full MVNO

- 라이트/브랜드 MVNO

- 가입자 유형별

- 소비자

- 기업

- IoT 특유

- 용도별

- 할인

- 비즈니스

- 셀룰러 M2M

- 미디어 및 엔터테인먼트

- 소매

- 로밍

- 이민

- 통신 도매

- 네트워크 기술별

- 2G/3G

- 4G/LTE

- 5G

- 위성/NTN

- 유통 채널별

- 온라인/디지털 전용

- 전통적인 소매점

- 캐리어 서브브랜드 스토어

- 타사/도매

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 콜롬비아

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- ASEAN

- 기타 아시아태평양

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- TracFone Wireless(Verizon)

- Tesco Mobile

- Virgin Mobile

- Lycamobile

- Lebara Group

- Boost Mobile(T-Mobile)

- Cricket Wireless(ATandT)

- Giffgaff

- 1and1 Drillisch

- PosteMobile

- Truphone

- Kajeet

- Ting Mobile

- Google Fi

- Altice Mobile

- Asahi Net

- FreedomPop

- Airvoice Wireless

- FRiENDi Mobile

- Voiceworks

제7장 시장 기회와 장래의 전망

SHW 25.11.07The mobile virtual network operator market size reached USD 75.35 billion in 2025 and is on track to hit USD 104.46 billion by 2030, advancing at a 6.75% CAGR.

Growth reflects the segment's ability to thrive amid price pressure, spurred by fintech-telco convergence, wholesale price reforms, and the move toward eSIM-enabled activation. Partnerships such as Revolut's MVNO roll-out in the UK and Germany and Nubank's service launch in Brazil illustrate the blurring line between banking and connectivity. At the same time, regulators in markets like South Korea are cutting wholesale fees by up to 52%, reshaping competitive economics. The cloud deployment model already commands 57% of the mobile virtual network operator market, and cloud-native platforms are expanding at 10.6% CAGR on the back of lower capex and faster launch cycles. Competitive differentiation increasingly hinges on 5G network slicing, satellite-to-cell links, and AI-driven service personalization.

Global Mobile Virtual Network Operator (MVNO) Market Trends and Insights

Rising Mobile-Subscriber Base and Smartphone Penetration

Mobile connections crossed 1.8 billion in Asia Pacific by end-2023, equal to 63% population penetration and contributing USD 880 billion to regional GDP. The surge opens addressable niches for operators that tailor plans to youth or migrant cohorts within the mobile virtual network operator market. Globe Philippines captured rural demand with fixed-wireless access, while Telkomsel's app-first "by.U" brand courts digital natives. Countries such as Bangladesh, India, and Pakistan still exhibit wide usage gaps, offering cost-led MVNOs a path to scale. High smartphone ownership propels data-heavy habits, reinforcing usage-based tariffs common to MVNO offers. These factors collectively lift adoption prospects through mid-decade.

Demand for Low-Cost Voice and Data Plans

Persistent inflation sharpens consumer sensitivity to value, pulling churn toward budget-centric providers inside the mobile virtual network operator market. In the UK, incumbent MNOs lost contract lines for the first time in late 2024, while MVNOs added 1.7 million subscribers. MobileX sells AI-tailored bundles from USD 3.48 per month and holds churn below 0.5%, an illustration of how data-driven pricing sustains loyalty. Online distribution trims retail overheads, enabling deeper discounts, and app-based support further reduces cost-to-serve. Although consolidation by host carriers threatens independents, agile MVNOs offset scale disadvantages through brand partnerships and community-based referrals, lengthening the window for profit capture.

Margin Squeeze from Intense Price Competition

Lower switching friction and plentiful sub-brands push tariffs toward cost, compressing EBITDA across the mobile virtual network operator market. Lycamobile battled £25.1 million losses in 2022 despite 1.7 million UK lines, burdened by a GBP 51 million VAT dispute and prolonged 5G service outages. Host MNOs intensify price warfare through owned discount brands, undercutting independents. MobileX founder Peter Adderton notes that MNO acquisitions of TracFone and Mint Mobile leave fewer wholesale partners, tightening negotiation leverage. The completed VodafoneThree merger in 2025 adds further scale pressure in the UK, forcing smaller MVNOs either to specialize or accept buy-out offers.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of IoT/M2M Connections

- Regulatory Push for Open Wholesale Access and eSIM-Enabled Entry

- Dependence on Host MNOs for Network Quality and Wholesale Fees

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments accounted for 57% of the mobile virtual network operator market in 2024, reflecting rapid migration toward scalable infrastructure that lowers capex. Cloud-native platforms are posting a 10.6% CAGR through 2030 as operators seek elastic capacity during traffic spikes and automated patch management. The shift enables faster feature rollouts and facilitates AI-based retention tools that keep customer churn below 1%. CompaxDigital's joint offer with T-Mobile brings advanced BSS/OSS stacks to mid-tier MVNOs, cutting launch times from months to weeks. Start-ups like Gigs raised USD 73 million to market "MVNO-in-a-box," underscoring venture appetite for asset-light entrants.

Cloud agility further supports 5G network slicing because virtualized cores allocate bandwidth on demand. This flexibility equips MVNOs to target micro-segments such as gamers or tele-medicine providers without over-buying capacity from host MNOs. Conversely, on-premise installations remain relevant for defense or banking clients requiring sovereign data hosting. A hybrid strategy-cloud management plane paired with edge-site user-plane functions-gives full MVNOs granular security while still harvesting automation gains. As public-cloud latency falls below 10 milliseconds in many metros, the economic case for full off-premise cores will continue to strengthen.

Full MVNOs secured 41% revenue share in 2024, benefitting from direct SIM ownership, HLR/HSS control, and complete customer-life-cycle data. They capture higher ARPU by bundling value-added services such as content or cloud storage. Light or brand MVNOs, however, are expanding at 13.2% CAGR owing to quicker go-to-market and minimal upfront capital. Retailers and app firms gravitate toward this lighter model to append connectivity to existing ecosystems without deep telecom expertise.

Service-operator constructs offer a compromise, allowing ownership of billing and policy while leasing the core. Reseller agreements still attract big-box merchants like Walmart that leverage store traffic to sell prepaid bundles. Germany's 1&1 demonstrated an upward mobility pathway, evolving from full MVNO to the nation's fourth MNO after securing 5G spectrum. Such evolution provides a blueprint for ambitious operators once the subscriber base crosses critical mass. Yet light models will likely proliferate faster, energizing the mobile virtual network operator market by lowering brand-entry barriers.

The MVNO Market Report is Segmented by Deployment Model (Cloud and On-Premise), Operational Mode (Reseller, Service Operator, and More), Subscriber Type (Consumer, Enterprise, and IoT-Specific), Application (Discount, Business, Cellular M2M, and More), Network Technology (2G/3G, 5G, and More), Distribution Channel (Online/Digital-only, Traditional Retail Stores, and More), and Geography.

Geography Analysis

North America led the mobile virtual network operator market with a 38.5% share in 2024, underpinned by ARPU levels four times the global mean and a regulatory climate that fosters wholesale competition. Operators leverage large post-paid bases to upsell value-segment sub-brands without cannibalizing premium lines. The TracFone acquisition by Verizon added 20 million prepaid users, affirming the segment's strategic weight.

Asia Pacific is advancing at a 10.1% CAGR and is set to overtake Europe in gross additions by 2027, powered by smartphone affordability and liberalized spectrum auctions in India, Indonesia, and China. Government mandates for open access plus rapid 5G rollouts make the region fertile ground for fintech-backed MVNOs targeting unbanked populations. Cloud-native entrants also find abundant developer talent, lowering operating cost per SIM.

Europe maintains steady subscriber growth as regulators harmonize termination rates and roaming fees, a boon for cross-border MVNOs. The UK's VodafoneThree entity plans GBP 11 billion investment over eight years but must honor undertakings to support at least three independent MVNOs, preserving competitive intensity. Emerging clusters in the Middle East and Africa gain traction as operators deploy network APIs to local fintech partners, while Latin America's convergence trend accelerates after Nubank's expansion. Collectively, these dynamics position geography as a critical lens for go-to-market adjustments inside the mobile virtual network operator market.

- TracFone Wireless (Verizon)

- Tesco Mobile

- Virgin Mobile

- Lycamobile

- Lebara Group

- Boost Mobile (T-Mobile)

- Cricket Wireless (ATandT)

- Giffgaff

- 1and1 Drillisch

- PosteMobile

- Truphone

- Kajeet

- Ting Mobile

- Google Fi

- Altice Mobile

- Asahi Net

- FreedomPop

- Airvoice Wireless

- FRiENDi Mobile

- Voiceworks

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile-subscriber base and smartphone penetration

- 4.2.2 Demand for low-cost voice and data plans

- 4.2.3 Expansion of IoT/M2M connections

- 4.2.4 Regulatory push for open wholesale access and eSIM-enabled entry

- 4.2.5 Fintech-telco convergence spawning bank-branded MVNOs

- 4.2.6 Satellite-to-cell partnerships enabling global MVNO coverage

- 4.3 Market Restraints

- 4.3.1 Margin squeeze from intense price competition

- 4.3.2 Dependence on host MNOs for network quality and wholesale fees

- 4.3.3 Device-OEM control of eSIM ownership bypassing MVNO model

- 4.3.4 Private-spectrum sharing lets enterprises self-provision service

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Operational Mode

- 5.2.1 Reseller

- 5.2.2 Service Operator

- 5.2.3 Full MVNO

- 5.2.4 Light / Brand MVNO

- 5.3 By Subscriber Type

- 5.3.1 Consumer

- 5.3.2 Enterprise

- 5.3.3 IoT-specific

- 5.4 By Application

- 5.4.1 Discount

- 5.4.2 Business

- 5.4.3 Cellular M2M

- 5.4.4 Media and Entertainment

- 5.4.5 Retail

- 5.4.6 Roaming

- 5.4.7 Migrant

- 5.4.8 Telecom Wholesale

- 5.5 By Network Technology

- 5.5.1 2G/3G

- 5.5.2 4G/LTE

- 5.5.3 5G

- 5.5.4 Satellite/NTN

- 5.6 By Distribution Channel

- 5.6.1 Online/Digital-only

- 5.6.2 Traditional Retail Stores

- 5.6.3 Carrier Sub-brand Stores

- 5.6.4 Third-Party/Wholesale

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Colombia

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Rest of Asia Pacific

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Nigeria

- 5.7.6.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TracFone Wireless (Verizon)

- 6.4.2 Tesco Mobile

- 6.4.3 Virgin Mobile

- 6.4.4 Lycamobile

- 6.4.5 Lebara Group

- 6.4.6 Boost Mobile (T-Mobile)

- 6.4.7 Cricket Wireless (ATandT)

- 6.4.8 Giffgaff

- 6.4.9 1and1 Drillisch

- 6.4.10 PosteMobile

- 6.4.11 Truphone

- 6.4.12 Kajeet

- 6.4.13 Ting Mobile

- 6.4.14 Google Fi

- 6.4.15 Altice Mobile

- 6.4.16 Asahi Net

- 6.4.17 FreedomPop

- 6.4.18 Airvoice Wireless

- 6.4.19 FRiENDi Mobile

- 6.4.20 Voiceworks

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment