|

시장보고서

상품코드

1851592

인플루엔자 진단 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Influenza Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

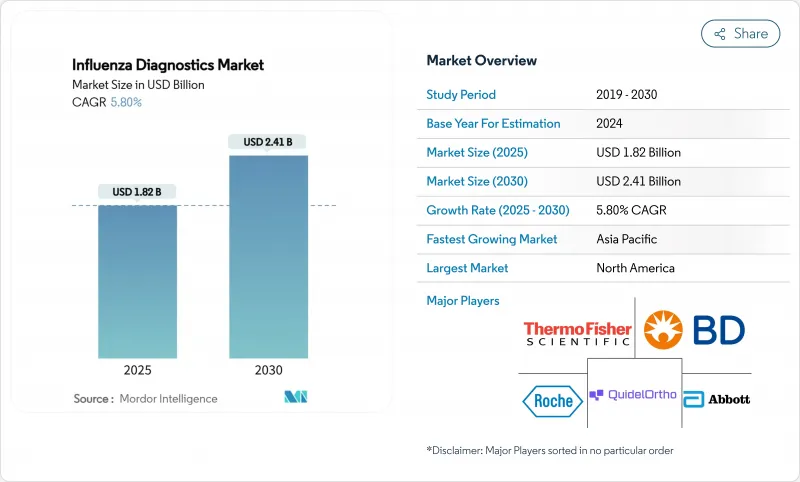

인플루엔자 진단 시장 규모는 2025년에 18억 2,000만 달러, 2030년에는 24억 1,000만 달러에 이를 것으로 예측되며 이 기간 동안 CAGR 5.8%를 나타낼 전망입니다.

이 건전한 궤도는 시장이 유행 시대의 불안정한 상태에서 일상적인 기술 중심의 호흡기 질환 관리로 전환하고 있음을 보여줍니다. 성장을 지원하는 것은 기존의 신속 항원 검사보다 높은 정확도를 제공하는 분자 플랫폼의 광범위한 채택, 모니터링 인프라에 대한 정부의 꾸준한 자금 지원, 가정용 및 POC(Point-of-Care) 솔루션에 대한 소비자 수요 증가입니다. 벤더는 분자 정밀도와 환자에 가까운 속도의 양립을 목표로 통합을 진행하고 있으며, AI 대응 소프트웨어는 검사실의 턴어라운드 시간을 단축하고 품질 관리를 향상시키고 있습니다. 지역 역학이 수요를 더욱 형성하고 있습니다. 북미는 설치 기준과 상환의 명확성을 선도하고 있는 반면, 아시아태평양은 공중 보건 검사실에 대한 지속적인 투자로 가장 빠른 보급을 기록하고 있습니다.

세계의 인플루엔자 진단 시장 동향과 인사이트

계절성 인플루엔자 및 인수 공통 감염 아웃브레이크의 유병률과 중증도 상승

CDC는 2024-2025년 시즌에 3만 9,053건의 검사를 통해 입원이 확인되었다고 기록했으며, 이는 2010-2011년 이후 높은 비율입니다. 동시에 캘리포니아에서는 고병원성 H5N1이 발생하여 낙농 노동자들 사이에서 38건의 인간 감염 예가 발생했기 때문에 가축의 감시가 확대되었습니다. 싱가포르의 Steadfast assay와 같은 새로운 키트는 3시간 이내에 고병원성 균주와 저병원성 균주를 구별하여 아웃브레이크에 대한 대응을 강화합니다. 이러한 사건으로 의료 시스템은 긴급 수준의 검사 능력을 일년 내내 유지할 필요가 있으며, 고정밀 분자 플랫폼의 조달이 유지되고 있습니다.

외래 환자에서 신속 POC 검사 채택 확대

사우샘프턴 대학의 병원 연구에 따르면, POC 인플루엔자 검사는 결과가 나올 때까지의 시간을 1시간 미만으로 단축시켜, 보다 신속한 항바이러스제의 투여 개시와 환자의 입원 기간의 단축을 가능하게 했습니다. 현재 96.3% 감도로 13분 만에 독감 A/B 결과를 반환하는 Abbot의 ID NOW와 같은 분자 옵션도 플랫폼에 포함되어 있습니다. AI를 탑재한 리더는 해석 시간을 2분으로 단축합니다. 운송 비용 절감과 방문 치료는 클리닉과 소매점에서 POC 보급의 경제적 논거가 됩니다.

변동하는 RIDT의 감도와 위음성 비율

많은 RIDT는 바이러스 양이 적은 초기 감염을 놓치고 있습니다. 한 시판용 키트에서는 위음성률이 30% 이상의 조사 결과도 있습니다. Panbio COVID-19/Flu A&B 패널의 인플루엔자에 대한 감도는 80.8%에 불과했습니다. WHO의 2024년 지침은 현재 중증 또는 고위험 사례에 대해 핵산 검사를 권장합니다. 클리닉에서는 RIDT 속도의 이점을 없애고 부문 확장을 억제하는 확인 PCR 워크플로우를 도입했습니다.

부문 분석

Rapid 형식은 41.6%의 매출 점유율로 우위를 유지했지만 임상의가 감도와 다중화를 우선함에 따라 인플루엔자 진단 시장은 재배치되고 있습니다. CRISPR 분석은 Broad Institute의 SHINE 테스트에 15분 안에 하위유형을 판별하여 2030년까지 연평균 복합 성장률(CAGR) 9.7%를 나타냈습니다. 인플루엔자 A/B, RSV, SARS-CoV-2를 번들한 분자 패널이 구급 부문의 업무 효율화를 실현합니다. CRISPR 플랫폼의 인플루엔자 진단 시장 규모는 워크플로우의 간소화와 장비 설치 면적의 축소로 모든 양식에서 가장 빠르게 확대될 것으로 예측됩니다. 직접형광항체검사와 바이러스배양검사는 균주 타이핑이나 항바이러스 감수성이 필요한 틈새 연구 분야에서 계속 이용되고 있지만 주류가 되는 구매결정에는 더 이상 영향을 주지 않았습니다.

RT-PCR과 등온 형식을 포함한 분자진단 방법은 AI 도구가 결과 해석을 간소화하기 때문에 보급이 가속화되었습니다. 멀티플렉스 CRISPR-Cas13a 스트립은 증폭 단계를 제거하면서 RT-qPCR과 100% 일치를 달성했습니다. 병원에서는 하나의 샘플에서 중복되는 호흡기 증상을 감별하는 신드로믹 패널이 선호되는 반면, 소매 클리닉에서는 빠른 워크인 인 카운터를 위해 CLIA 면책의 분자 카트리지를 채용하고 있습니다. 이러한 정확성과 속도의 수렴은 자본 장벽이 줄어들면서 분자 솔루션이 RIDT의 리더십을 침식한다는 것을 의미합니다.

지역 분석

북미의 리더십은 종합적인 감시 시스템과 성숙한 상환 모델에 기인합니다. CDC는 125개국에 걸쳐 있는 8개의 지역 감시 허브를 조정하고 있지만, 국내에서는 최대의 검사 거점을 유지하고 있습니다. 북미의 인플루엔자 진단 시장 규모는 서모피셔 사이언티픽이 20억 달러를 들여 국내 생산을 확대하고 공급망 안정화를 도모하고 있다는 데 기여하고 있습니다. 소매 약국에서는 CLIA 면제의 분자 카트리지가 방문 진료에 사용되는 한편, 의료 보험사에 의한 재택 채취 키트에의 환불이 증가해, 소비자의 액세스가 확대되고 있습니다.

아시아태평양의 CAGR은 8.1%로 가장 빠르지만, 이는 검사실의 급속한 증설과 정부의 자금 지원에 의한 것입니다. WHO는 동남아시아 전역에서 11개의 국립 인플루엔자 센터를 완전히 운영했습니다. 일본은 품질경영규칙을 ISO 13485 : 2016과 일치시키기 위해 업데이트하여 외국 어세이 개발자의 승인 경로를 원활하게 했습니다. 중국과 인도는 백신 관련 mRNA에 대한 투자를 진단제로 옮기고 CRISPR 카트리지의 지역 유통을 촉진합니다.

유럽은 체외 진단용 의약품 규제(IVDR)를 통해 영향력을 유지하고 있으며, 적합성 평가 요건을 분석의 15%에서 90% 근처까지 끌어올리고 있습니다. 2024년에 전환기간이 연장되어 당분간공급 부족은 회피되었지만, 컴플라이언스 비용이 상승하고, 연구개발이 적고, 보다 가치가 높은 검사로 이동할 가능성이 있습니다. 중동 및 아프리카와 남미는 다국간 원조와 관민 파트너십에 의한 능력 향상을 추구하고 있습니다. OECD는 유통 중에 경험한 물류 충격을 완화하기 위해 조달 대상의 다양화를 촉진합니다. 이와 같이 준비 태세에 편차가 있기 때문에 채용 곡선도 다르지만 호흡기 감시에 중점을 두고 있는 것은 공통적이며 견고한 검사법에 대한 세계적인 수요는 유지되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 계절성 및 인수 공통 감염증 인플루엔자의 유행률과 중증도의 상승

- 외래환자에 있어서 신속 POC 검사의 채용 확대

- 정부 자금에 의한 감시 프로그램과 유행 대책 예산

- AI를 활용한 결과 해석 소프트웨어가 분자 워크플로우의 스루풋 촉진

- 콤보 SARS-CoV-2/인플루엔자 멀티플렉스 패널의 상업화로 인스톨 베이스가 확대

- 재택 인플루엔자 검사 키트와 텔레헬스의 통합이 진행

- 시장 성장 억제요인

- RIDT의 가변 감도와 위음성률

- 분자진단 플랫폼의 높은 자본 비용과 달리기 비용

- CRISPR 기반 인플루엔자 분석에 대한 규제 불확실성

- PCR 분석의 중요 시약에 영향을 미치는 공급망의 혼란

- 공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 검사 유형별

- 기존 진단 검사

- 신속 인플루엔자 진단 검사(RIDTs)

- 직접 형광 항체(DFA) 검사

- 바이러스 배양

- 신속 세포 배양

- 분자 진단 검사

- 역전사 중합효소 연쇄반응(RT-PCR)

- 루프 매개 등온 증폭법(LAMP)

- 니킹 효소 증폭 반응(NEAR)

- CRISPR 기반 분석법

- 증후군 다중 PCR 패널

- 기존 진단 검사

- 최종 사용자별

- 병원 및 임상 실험실

- 독립 진단 검사실

- POC(Point-of-Care) 환경

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- F. Hoffmann-La Roche AG

- Abbott Laboratories(incl. ID NOW)

- QuidelOrtho Corporation

- Thermo Fisher Scientific(Cepheid, Mesa Bio)

- Becton, Dickinson & Co.

- bioMerieux SA

- Hologic Inc.

- Siemens Healthineers

- Danaher Corp.(Cepheid)

- Sekisui Diagnostics

- GenMark Diagnostics(Roche)

- Meridian Bioscience

- Luminex Corp.(DiaSorin)

- QIAGEN NV

- Bio-Rad Laboratories

- Fujirebio

- Cue Health

- Ellume

- Genetic Signatures

- Lucira Health

제7장 시장 기회와 향후 전망

KTH 25.11.13The influenza diagnostics market size stood at USD 1.82 billion in 2025 and is forecast to reach USD 2.41 billion by 2030, advancing at a 5.8% CAGR through the period.

This healthy trajectory follows the market's transition from pandemic-era volatility toward routine, technology-led respiratory disease management. Growth is anchored by wider adoption of molecular platforms that offer higher accuracy than legacy rapid antigen tests, steady government funding for surveillance infrastructure, and rising consumer demand for at-home and point-of-care (POC) solutions. Vendors are consolidating to combine molecular accuracy with near-patient speed, while AI-enabled software is shortening laboratory turnaround times and improving quality control. Regional dynamics further shape demand: North America leads on installed base and reimbursement clarity, whereas Asia Pacific records the fastest uptake thanks to ongoing investment in public-health laboratories.

Global Influenza Diagnostics Market Trends and Insights

Rising Prevalence & Severity of Seasonal and Zoonotic Influenza Outbreaks

A resurgence in seasonal influenza activity has intensified global diagnostic demand, with the CDC logging 39,053 laboratory-confirmed hospitalizations during the 2024-2025 season, the highest rate since 2010-2011.Concurrently, highly pathogenic H5N1 outbreaks generated 38 human cases in California among dairy workers, prompting expanded livestock surveillance. New kits, such as Singapore's Steadfast assay, differentiate highly and low pathogenic strains within three hours, enhancing outbreak response. These events push health systems to retain emergency-level testing capacity year-round, sustaining procurement of high-accuracy molecular platforms.

Growing Adoption of Rapid Point-of-Care Tests in Outpatient Settings

Hospital studies from the University of Southampton showed that POC influenza testing cuts result time to under one hour, enabling faster antiviral initiation and shorter patient stays. Platforms now include molecular options like Abbott's ID NOW, which returns influenza A/B results in 13 minutes with 96.3% sensitivity. AI-enhanced readers further reduce interpretation time to two minutes. Lower transport costs and same-visit treatment support economic arguments for widespread POC deployment in clinics and retail health sites.

Variable Sensitivity & False-Negative Rate of RIDTs

Many RIDTs miss early infections when viral load is low; studies place false-negative rates above 30% for certain commercial kits. The Panbio COVID-19/Flu A&B panel delivered only 80.8% sensitivity for influenza. WHO's 2024 guidance now recommends nucleic-acid tests for severe or high-risk cases. Clinics have introduced confirmatory PCR workflows that erase the speed advantage of RIDTs, curbing segment expansion.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded Surveillance Programs & Pandemic-Preparedness Budgets

- AI-Powered Result-Interpretation Software Boosting Molecular Workflow Throughput

- High Capital & Running Cost of Molecular Diagnostic Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rapid formats remained dominant with a 41.6% revenue share, yet the influenza diagnostics market is repositioning as clinicians prioritize sensitivity and multiplexing. CRISPR assays show 9.7% CAGR by 2030, led by the Broad Institute's SHINE test that discriminates subtypes in 15 minutes. Molecular panels that bundle influenza A/B, RSV, and SARS-CoV-2 deliver operational efficiency for emergency departments. The influenza diagnostics market size for CRISPR platforms is forecast to expand fastest among all modalities, driven by simplified workflows and shrinking instrument footprints. Direct fluorescent antibody and viral culture testing continue to serve research niches where strain typing or antiviral susceptibility is required, but they no longer influence mainstream purchasing decisions.

Molecular diagnostics, including RT-PCR and isothermal formats, see accelerated uptake as AI tools streamline result interpretation. Multiplex CRISPR-Cas13a strips achieved 100% concordance with RT-qPCR while removing amplification steps. Hospitals prefer syndromic panels that differentiate overlapping respiratory symptoms within a single sample, whereas retail clinics adopt CLIA-waived molecular cartridges for rapid walk-in encounters. This convergence of accuracy and speed positions molecular solutions to erode RIDT leadership as capital barriers abate.

The Influenza Diagnostics Market Report is Segmented by Test Type (Traditional Diagnostic Tests {Rapid Influenza Diagnostic Tests, Viral Culture, and More} and Molecular Diagnostic Tests {RT-PCR, LAMP, and More}), End User (Hospitals and Clinical Laboratories, Independent Diagnostic Laboratories, and More), and Geography (North America, Europe, Asia Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's leadership stems from comprehensive surveillance systems and mature reimbursement models. The CDC coordinates eight regional surveillance hubs spanning 125 countries, yet maintains its largest testing footprint domestically. The influenza diagnostics market size in North America benefits from Thermo Fisher Scientific's USD 2 billion investment to expand domestic manufacturing, aimed at insulating supply chains. Retail pharmacies integrate CLIA-waived molecular cartridges for same-visit care, while health insurers increasingly reimburse home-collection kits, broadening consumer access.

Asia Pacific posts the fastest 8.1% CAGR owing to rapid laboratory build-outs and government funding. WHO's milestone of 11 fully operational national influenza centers across South-East Asia evidences this progress. Japan updated quality-management regulations to align with ISO 13485:2016, smoothing approval pathways for foreign assay developers. China and India funnel vaccine-related mRNA investments into diagnostics, fostering locally made CRISPR cartridges for regional distribution.

Europe remains influential through the In Vitro Diagnostic Regulation (IVDR), which raises conformity-assessment requirements from 15% to nearly 90% of assays. Transition extensions granted in 2024 prevent immediate supply shortages but raise compliance costs that could shift R&D to fewer, higher-value tests. Middle East & Africa and South America pursue capacity growth via multilateral aid and public-private partnerships; the OECD urges diversified sourcing to mitigate logistic shocks experienced during the pandemic. This uneven readiness shapes divergent adoption curves, yet shared emphasis on respiratory surveillance sustains global demand for robust assays.

- Roche

- Abbott Laboratories (incl. ID NOW)

- QuidelOrtho

- Thermo Fisher Scientific (Cepheid, Mesa Bio)

- Beckton Dickinson

- bioMerieux

- Hologic

- Siemens Healthineers

- Danaher Corp. (Cepheid)

- Sekisui Diagnostics

- GenMark Diagnostics (Roche)

- Meridian Bioscience

- Luminex Corp. (DiaSorin)

- QIAGEN

- Bio-Rad Laboratories

- Fujirebio

- Cue Health

- Ellume

- Genetic Signatures

- Lucira Health

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence & Severity Of Seasonal And Zoonotic Influenza Outbreaks

- 4.2.2 Growing Adoption Of Rapid Point-Of-Care (POC) Tests In Outpatient Settings

- 4.2.3 Government-Funded Surveillance Programs & Pandemic Preparedness Budgets

- 4.2.4 AI-Powered Result-Interpretation Software Boosting Molecular Workflow Throughput

- 4.2.5 Commercialization Of Combo SARS-CoV-2/Flu Multiplex Panels Expanding Installed Base

- 4.2.6 Increasing Integration Of Telehealth With Home-Based Flu Testing Kits

- 4.3 Market Restraints

- 4.3.1 Variable Sensitivity & False-Negative Rate Of RIDTs

- 4.3.2 High Capital & Running Cost Of Molecular Diagnostic Platforms

- 4.3.3 Regulatory Uncertainty For CRISPR-Based Influenza Assays

- 4.3.4 Supply Chain Disruptions Affecting Critical Reagents For PCR Assays

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Test Type

- 5.1.1 Traditional Diagnostic Tests

- 5.1.1.1 Rapid Influenza Diagnostic Tests (RIDTs)

- 5.1.1.2 Direct Fluorescent Antibody (DFA) Tests

- 5.1.1.3 Viral Culture

- 5.1.1.4 Rapid Cell Culture

- 5.1.2 Molecular Diagnostic Tests

- 5.1.2.1 Reverse-Transcriptase PCR (RT-PCR)

- 5.1.2.2 Loop-Mediated Isothermal Amplification (LAMP)

- 5.1.2.3 Nicking-Enzyme Amplification Reaction (NEAR)

- 5.1.2.4 CRISPR-based Assays

- 5.1.2.5 Syndromic Multiplex PCR Panels

- 5.1.1 Traditional Diagnostic Tests

- 5.2 By End User

- 5.2.1 Hospitals & Clinical Laboratories

- 5.2.2 Independent Diagnostic Laboratories

- 5.2.3 Point-of-Care Settings

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Australia

- 5.3.3.6 Rest of Asia Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 F. Hoffmann-La Roche AG

- 6.3.2 Abbott Laboratories (incl. ID NOW)

- 6.3.3 QuidelOrtho Corporation

- 6.3.4 Thermo Fisher Scientific (Cepheid, Mesa Bio)

- 6.3.5 Becton, Dickinson & Co.

- 6.3.6 bioMerieux SA

- 6.3.7 Hologic Inc.

- 6.3.8 Siemens Healthineers

- 6.3.9 Danaher Corp. (Cepheid)

- 6.3.10 Sekisui Diagnostics

- 6.3.11 GenMark Diagnostics (Roche)

- 6.3.12 Meridian Bioscience

- 6.3.13 Luminex Corp. (DiaSorin)

- 6.3.14 QIAGEN NV

- 6.3.15 Bio-Rad Laboratories

- 6.3.16 Fujirebio

- 6.3.17 Cue Health

- 6.3.18 Ellume

- 6.3.19 Genetic Signatures

- 6.3.20 Lucira Health