|

시장보고서

상품코드

1686614

발포 폴리프로필렌(EPP) 폼 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Expanded Polypropylene (EPP) Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

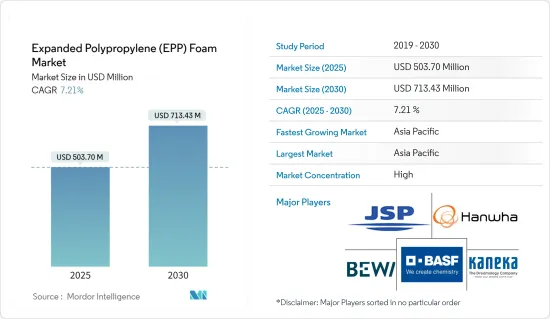

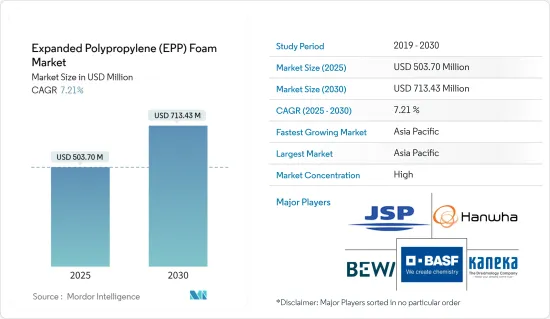

발포 폴리프로필렌 폼 시장 규모는 2025년에 5억 370만 달러로 추정되고, 예측 기간인 2025-2030년 CAGR 7.21%로 성장할 전망이며, 2030년에는 7억 1,343만 달러에 달할 것으로 예측됩니다.

시장은 2020년 COVID-19 팬데믹에 의해 부정적인 영향을 받았습니다. 그러나 2021년에는 회복하고 예측기간 동안 안정된 성장이 예상됩니다.

주요 하이라이트

- 단기적으로는 비독성 재활용 가능한 소재의 성질과 포장 업계 수요 증가가 시장 수요를 자극하는 원동력의 하나가 되고 있습니다.

- 자동차 산업은 지난 몇 년동안 감소해 왔으며, 시장에서 입수할 수 있는 다른 구조용 폼보다 가격이 높아 시장 성장을 방해할 수 있습니다.

- 그 반면, 다른 구조용 폼 중에서는 고가격인 것이, 예측 기간 중에 조사되는 시장 성장 억제요인이 될 가능성이 높습니다.

- 바이오 폴리프로필렌 폼 수요 증가, 다른 제품의 대체품으로 등장, 전기자동차 채용 증가 등이 향후 몇 년동안 시장에 기회를 가져올 것으로 보입니다.

- 아시아태평양이 시장을 독점하고 있으며 예측 기간 중 가장 높은 CAGR이 예상됩니다.

발포 폴리프로필렌(EPP) 폼 시장 동향

자동차 산업에서의 사용 증가

- 자동차 산업은 현재 EPP 폼의 최대 소비자입니다. EU의 배기가스 규제가 엄격해지고, 폐자동차의 재활용에 관한 법률이 도입되었기 때문에 EPP 폼 수요는 해마다 증가하고 있습니다.

- 회수성이 뛰어나 충격 에너지를 흡수하는 EPP 폼은 범퍼 사용률을 높이고 있습니다. 범퍼 바 시스템에 내장된 EPP 성형 부품은 충돌 시 압력을 줄이고 섀시에 전달되는 충격 에너지를 최소화합니다.

- 좌석 및 기타 자동차 부품의 EPP 폼 사용량을 늘림으로써 차량 전체의 중량이 -10% 감소합니다. 연료 소비량은 -7% 삭감되었습니다. 재사용 및 재활용 가능한 재료의 자동차에서 차지하는 비율도 동시에 증가하고 있습니다.

- 또한 전기자동차 증가는 EPP 폼 시장의 성장을 가속하고 있습니다. EPP는 전기차 경량화, 단열화, 에너지 흡수 능력 강화에 중요한 역할을 하기 때문입니다.

- EPP 폼은 도어 패드, 헤드 라이너, 매트의 제조에도 사용되고 있습니다. EPP 폼은 콕핏 내 공기 온도를 일정하게 유지해 배터리 동작에 이상적인 상태를 만들어 낼 수 있습니다.

- IEA의 2021년 전망에 의하면, 세계의 전기자동차 판매 대수는 2021년에 배증해, 660만 대에 이르렀습니다. 2022년에는 판매량이 크게 증가했고, 2022년 1분기에는 전 세계적으로 200만 대의 전기차가 판매됐습니다.

- 2021년 자동차 총생산 대수는 아시아·오세아니아 지역이 4,673만 대, 아메리카 지역이 1,615만 대로, 2020년 대비 각각 6%, 3% 증가했습니다. 그러나 유럽의 2021년 자동차 생산량은 1,634만 대로 2020년 대비 4% 감소했습니다.

- 이상으로부터, 자동차 용도가 시장을 독점할 가능성이 있습니다.

아시아태평양이 시장을 독점

- 아시아태평양이 세계 시장 점유율을 독점. 아시아 태평양에서는 중국이 GDP에서 최대의 경제 대국입니다.

- 중국은 아시아태평양 최대의 EPP 폼의 소비국이며, 제조국이기도 합니다. 이 나라에 있어서 제조 활동의 활발화는, 이 지역에 있어서의 플라스틱과 폴리머의 소비를 증가시키고 있어, 이것이 발포 폴리프로필렌(EPP) 시장을 견인할 것으로 기대되고 있습니다.

- 이 나라의 자동차 산업은 제품의 진화를 형성하고 있어(이 나라에서 공해의 심각화에 의해) 환경에 대한 우려가 높아지고 있기 때문에 이 나라는 연비를 확보해, 배출 가스를 최소한으로 억제하는 제품의 제조에 주력하고 있습니다

- 중국의 자동차 제조업은 세계 최대입니다. 2021년 자동차 생산량은 2,608만 대에 달했으며, 2020년 2,523만 대에서 3% 증가했습니다. 자동차 생산량의 증가는 EPP 양식의 수요를 촉진할 것으로 추정됩니다.

- 또한, 식품 및 식품 업계에서는 중국 시장 경쟁이 점점 치열해지고 있으며, 기업은 더 많은 자원과 비즈니스 기회를 찾고 해외 시장에 진입하게 되고 있습니다.

- 인도의 포장 산업은 수출과 수입으로 실적을 올리고 국내 기술과 혁신의 성장을 가속하고 다양한 제조업에 부가 가치를 부여하고 있습니다. 포장 업계는 인도에서 조사된 시장의 거대한 성장을 촉진하는 촉매 역할을 하고 있습니다. 또한 인도에서는 최근 몇 년간 포장 식품에 대한 큰 수요를 볼 수 있습니다. 이 시나리오는 예측 기간 동안에도 계속될 것으로 예상되어 시장의 수요를 끌어올리고 있습니다.

- 인도의 가구 시장도 매우 호조입니다. National Investment Promotion and Facilitation Agency에 따르면, 인도에 있어서의 렌탈 가구 및 가전 시장의 총액은 2021년도에 33,500캐롤 루피에 이르렀습니다. 2023년 말에는 610억 9,000만 달러에 이른 것으로 평가되고 있습니다.

- 이러한 요인으로부터, 이 지역의 발포 폴리프로필렌 폼 시장은 예측 기간 중에 안정된 성장이 전망됩니다.

발포 폴리프로필렌(EPP) 폼 산업 개요

발포 폴리프로필렌 시장은 통합되어 있습니다. 시장의 주요 기업으로는 BASF SE, JSP, Hanwha Solutions, BEWI (Izoblok), and Kaneka Corporation 등이 있습니다(순부동).

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 비독성 재활용 가능한 소재의 특성

- 포장 업계로부터 수요 증가

- 성장 억제요인

- 자동차 산업 감소

- 다른 구조용 발포체 중에서는 고가격

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 가격 분석

제5장 시장 세분화

- 원료별

- 합성 폴리프로필렌

- 바이오 베이스 폴리프로필렌

- 형태별

- 가공 EPP

- 성형 EPP

- 기타 형태

- 용도별

- 자동차

- 댄니지

- 가구

- 식품 포장

- 에어컨

- 스포츠 및 레저

- 기타 용도

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작사업, 제휴 및 협정

- 시장 랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- BASF SE

- BEWi(IZOBLOK)

- Clark Foam Products Corporation

- Hanwha Solutions

- JSP

- KK Nag Pvt. Ltd

- Kaneka Corporation

- Knauf Industries

- Polyfoam Australia Pty Ltd

- Signode Industrial Group Llc

- Sonoco Products Company

- Woodbridge

제7장 시장 기회 및 향후 동향

- 바이오 베이스 폴리프로필렌 폼 수요 증가

- 다른 제품의 대체품으로서의 대두

- 전기자동차의 보급 확대

The Expanded Polypropylene Foam Market size is estimated at USD 503.70 million in 2025, and is expected to reach USD 713.43 million by 2030, at a CAGR of 7.21% during the forecast period (2025-2030).

The market was negatively impacted due to the COVID-19 pandemic in 2020. However, the condition recovered in 2021, and it is expected to observe a stable growth trajectory over the forecast period.

Key Highlights

- Over the short term, the non-toxic and recyclable nature of the material and the rising demand from packaging industries are some of the driving factors which are stimulating the market demand.

- The declining automobile Industry through previous years and higher prices, among other structural foams available in the market, may hinder the market's growth.

- On the flip side, higher prices, among other structural foams, are likely to act as restraints for the market studied during the forecast period.

- The rising demand for bio-based polypropylene foam, its emergence as a replacement for other products, and the increasing adoption of electric vehicles are likely to create opportunities for the market in the coming years.

- The Asia-Pacific region dominated the market and is expected to witness the highest CAGR over the forecast period.

Expanded Polypropylene (EPP) Foam Market Trends

Increasing Usage in the Automotive Industry

- The automotive sector is currently the largest consumer of EPP foams. The demand for EPP foams has increased over the years as the EU regulations on emissions have become more rigorous, and laws on recycling vehicles withdrawn from use have been introduced.

- Excellent recoverability and the ability to absorb the impact energy of EPP foams increase the usage of EPP foams in bumpers. In a collision, molded EPP parts built into bumper bar systems reduce pressure and minimize the amount of impact energy transmitted to the chassis.

- Increasing usage of EPP foams in seating and other automotive components reduces the overall weight of the vehicle by ~10%. The fuel consumption was reduced by ~7%. The share of recyclable materials in vehicles that can be reused is increasing simultaneously.

- In addition, increasing electric cars are promoting the EPP foam market's growth, as EPP plays a significant role in making electric cars lightweight and thermally insulated and enhancing energy absorption capabilities.

- EPP foams are also used in the manufacturing of door pads, headliners, and mats. They make it possible to maintain a constant air temperature in the cockpit and generate ideal conditions for battery operations.

- According to the IEA 2021 Outlook, worldwide electric car sales doubled in 2021 and reached 6.6 million. The sales increased strongly in 2022, with 2 million electric cars sold across the globe in the first quarter of 2022.

- The Asia-Oceania and Americas regions recorded 46.73 million and 16.15 million of total automotive production in 2021, registering an increase of 6% and 3%, respectively, compared to 2020. However, Europe recorded 16.34 million of automotive production in 2021, a decrease of 4% compared to 2020.

- The aforementioned aspects may result in the automotive application dominating the market.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the global market share. In Asia-Pacific, China is the largest economy in terms of GDP.

- China is the largest consumer and manufacturer of EPP foams in the Asia-Pacific region. The growing manufacturing activities in the country are increasing the consumption of plastics and polymers in the region, which is expected to drive the expanded polypropylene (EPP) foam market.

- The country's automotive sector has been shaping product evolution, with the country focusing on manufacturing products that ensure fuel economy and minimize emissions, owing to the increasing environmental concerns (due to mounting pollution in the country).

- The Chinese automotive manufacturing industry is the largest in the world. In 2021, the automotive production in the country reached 26.08 million, which increased by 3%, compared to 25.23 million vehicles produced in 2020. The increase in automotive production is estimated to drive the demand for EPP foam.

- Additionally, the market competition in China has become increasingly fierce in the food and beverage industry, which has enabled companies to tap into overseas markets to seek more resources and business opportunities.

- The Indian packaging industry has made a mark with its exports and imports, thus driving technology and innovation growth in the country and adding value to the various manufacturing sectors. The packaging industry is enacting the role of catalyst in promoting the huge growth of the market studied in India. Furthermore, the country has been exhibiting a significant demand for packed foods for the past few years. This scenario is expected to continue during the forecast period, thus boosting the demand for the market studied.

- The Indian furniture market is also very strong. According to InvestIndia (National Investment Promotion and Facilitation Agency), the total rental furniture and appliances market in India reached INR 33,500 crores during FY21. The market is expected to garner USD 61.09 billion by the end of 2023.

- Due to all such factors, the market for expanded polypropylene foam in the region is expected to have steady growth during the forecast period.

Expanded Polypropylene (EPP) Foam Industry Overview

The expanded polypropylene foam market is consolidated. Some of the major players in the market include BASF SE, JSP, Hanwha Solutions, BEWI (Izoblok), and Kaneka Corporation, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Non-toxic and Recyclable Nature of the Material

- 4.1.2 Rising Demand from the Packaging Industry

- 4.2 Restraints

- 4.2.1 Declining Automobile Industry Through Previous Years

- 4.2.2 Higher Price Among Other Structural Foams

- 4.3 Industry Value Chain Analysis

- 4.4 Porter Five Forces

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Analysis

5 MARKET SEGMENTATION (Market Size by Revenue)

- 5.1 Raw Material

- 5.1.1 Synthetic Polypropylene

- 5.1.2 Bio-based Polypropylene

- 5.2 Foam

- 5.2.1 Fabricated EPP

- 5.2.2 Molded EPP

- 5.2.3 Other Foams

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Dunnage

- 5.3.3 Furniture

- 5.3.4 Food Packaging

- 5.3.5 HVAC

- 5.3.6 Sports and Leisure

- 5.3.7 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 BEWi (IZOBLOK)

- 6.4.3 Clark Foam Products Corporation

- 6.4.4 Hanwha Solutions

- 6.4.5 JSP

- 6.4.6 K K Nag Pvt. Ltd

- 6.4.7 Kaneka Corporation

- 6.4.8 Knauf Industries

- 6.4.9 Polyfoam Australia Pty Ltd

- 6.4.10 Signode Industrial Group Llc

- 6.4.11 Sonoco Products Company

- 6.4.12 Woodbridge

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand for Bio-based Polypropylene Foam

- 7.2 Emergence as a Replacement for Other Products

- 7.3 Increasing Adoption Of Electric Vehicles