|

시장보고서

상품코드

1444783

세계 랩온어칩 및 마이크로어레이(바이오칩) 시장 : 점유율 분석, 산업 동향·통계, 성장 예측(2024-2029년)Lab-on-a-chip and Microarrays (Biochip) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

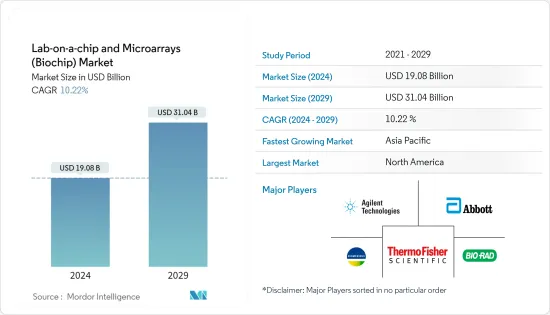

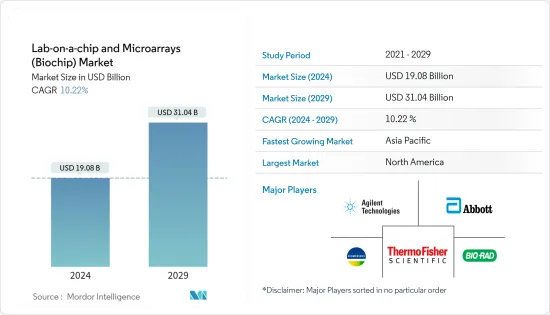

세계 랩온어칩 및 마이크로어레이(바이오칩) 시장 규모는 2024년 190억 8,000만 달러에 이르고, 2024-2029년의 예측 기간 동안 CAGR 10.22%로 성장하며, 2029년까지 310억 4,000 만 달러에 달할 것으로 예측되고 있습니다.

COVID-19의 유행은 랩온어칩 및 마이크로어레이(바이오칩) 시장에 큰 영향을 미쳤습니다. 예를 들어, 2021년 1월에 Nature Communication 잡지에 게재된 논문에서는 이 마이크로어레이가 진단 툴로서, COVID-19에 의한 질환 부담을 보다 정확하게 추정하기 위한 역학 툴로서, 항체를 상관시키기 위한 연구 도구로 사용할 수 있는 것으로 보고되었습니다. 임상 결과와 관련된 반응. 이와 같이 COVID-19의 팬데믹은 실험실 온칩 진단 도구 수요를 증가시켰습니다. 그러나 현재 시나리오에서는 다른 만성 질환 및 감염의 존재로 인해 연구 대상 시장 수요가 예측 기간 동안 증가할 것으로 예상됩니다.

연구 대상 시장의 성장을 가속하는 요인은 포인트 오브 케어 검사 수요 증가, 만성 질환의 발생률 증가, 암 연구에 있어서의 단백질체학와 유전체학의 응용 증가입니다. 대부분 시장 관계자들은 기술적으로 고급 새로운 진단 테스트 개발에 중점을 둡니다. 만성 질환은 세계에서 사망과 장애의 주요 원인이되었습니다. 예를 들어, 2022년 3월 저널 Plos One에 게재된 기사에서는 인도 노인의 21%가 적어도 하나의 만성 질환을 앓고 있다고 보고했습니다. 인도 노인의 장애와 사망의 주요 원인은 만성 질환입니다.

마찬가지로 2022년 1월에 유럽 공중보건회의가 발표한 또 다른 기사에서는 유럽에서는 2030년까지 300만 명 이상이 암을 앓고 있다고 보고되었습니다. 세계적으로 만성 질환(CD)이 장애와 질병의 주요 원인임을 알고 있습니다. 이러한 질병은 만성이므로 정확하고 적시에 임상 의사 결정이 필요합니다. 이 방향에서 만성 질환 진단을 위한 새로운 실험실 칩 기반 POC 시스템의 개발을 위한 연구가 신흥 분야가 되고 있습니다. 따라서 만성질환의 높은 발생률이 연구대상 시장의 성장을 가속할 것으로 예상됩니다.

바이오칩은 생물 의학 및 생명 공학 연구 분야에서 점점 더 많이 사용되고 있습니다. 기술이 발전함에 따라 단백질체학에서 바이오칩 채택이 증가하고 있습니다. 단백질 바이오칩의 장점은 소형화 추세로 인해 샘플 소비량이 적다는 것입니다. 마이크로어레이의 이러한 특성은 전체 프로테옴 분석에 중요합니다. 단백질체학는 바이오 마커와 의약품에 널리 채택되었습니다. 예를 들어, 2021년 4월, PathogenDx Inc.는 미국 식품의약국이 특허받은 COVID-19 다중 바이러스 진단 분석인 DetectX-Rv에 비상사용허가(EUA)를 발행했다고 보고했습니다. DetectX-Rv는 SARS-CoV-2 면봉으로부터 핵산을 정성적으로 검출하기 위한 RT-PCR 및 DNA 마이크로어레이 하이브리드화 테스트입니다. 따라서 이러한 신제품 승인도 연구 대상 시장의 성장에 기여하고 있습니다.

따라서 포인트 오브 케어 검사 수요 증가, 만성 질환 발생률 증가, 암 연구에서 단백질체학와 유전체학의 응용 증가로 연구 대상 시장은 예측 기간 동안 크게 성장할 것으로 예상됩니다. 그러나 실험실 칩 기술의 설계 제약과 대체 기술의 가용성은 연구 대상 시장의 성장을 둔화시킬 수 있습니다.

랩온어칩 및 마이크로어레이(바이오칩) 시장 동향

랩온어칩 부문은 예측 기간 동안 상당한 성장이 예상됩니다.

랩온어칩(LOC) 부문은 만성 질환 증가와 기술의 발전으로 시장의 긍정적인 성장이 예상됩니다. 또한, 맞춤형 의료의 도입이나 랩 온칩 기술의 용이한 이용도 증가하고 있어, 세계에서 같은 수요가 높아질 것으로 예상됩니다. 또한 LOC의 다양한 용도가 빠르게 성장하고 있습니다. 입자 또는 세포의 검출, 입자 패킹, 선별, 전기영동, PCR 등을 위한 전극을 구비한 실험실 칩 장치가 시판되고 있습니다.

COVID-19의 증례 수가 증가함에 따라 이 질병의 치료와 예방에 관한 연구 연구의 수가 증가하고 있습니다. 이로 인해 실험실 칩 수요가 증가했습니다. 예를 들어, 2021년 1월, 앨버타 대학의 연구자들은 협력하여 COVID-19 항체를 신속하게 검출하기 위한 핸드헬드 LOC 디바이스를 개발했습니다. 또한 캘리포니아 대학 어바인의 과학자들이 개발한 실험실 칩 기술을 이용한 저비용 이미징 플랫폼은 코로나 바이러스의 신속한 진단 및 항체 검사에 이용될 수 있습니다.

또한, 시장에서는 실험실 칩(LOC) 플랫폼 기반 면역분석이 자주 개발되고 있습니다. 이러한 고급 LOC 플랫폼에는 마이크로플루이딕스 칩, 종이, 측면 유동, 전기화학 및 새로운 바이오센서 개념이 포함됩니다. POC(Point of Care) 진단에 대한 수요의 급속한 증가는 예측 기간 동안이 분야를 추진할 것으로 예상되는 가장 두드러진 추진력입니다. 예를 들어, Onera Health는 2022년 2월에 웨어러블 디바이스용 초저전력 생체 신호 센서 서브시스템인 Onera Biomedical-Lab-on-Chip을 출시했습니다. 이 생물 의학을위한 소형 칩은 여러 생체 신호를 처리하도록 설계되어 건강 장비에 큰 기회를 생성합니다. 따라서 이러한 개발은 이 부문의 성장을 추진하고 있습니다.

따라서 만성 질환 증가, 기술 진보 증가, 개인화 의학 채택 증가, 실험실 온칩 기술 접근이 용이함으로 이 부문은 예측 기간 동안 크게 성장할 것으로 예상됩니다.

북미는 예측기간 중 상당한 성장이 예상된다.

북미는 이 지역의 주요 시장 기업의 존재와 건강 관리 인프라의 발전으로 예측 기간 동안 크게 성장할 것으로 예상됩니다. 또한, 이 지역에서는 마이크로어레이 기술의 연구개발에 대규모 투자를 하고 있는 헬스케어 대기업과의 대규모 협력 활동도 보였습니다. 예를 들어, Illumina Inc.는 2022년 9월에 보다 빠르고 강력하며 지속가능한 시퀀싱을 가능하게 하는 새로운 양산 규모 시퀀서인 NovaSeq X 시리즈를 출시했습니다. 이 혁신적인 신기술인 NovaSeq X Plus는 기존 시퀀서의 2.5배 처리량인 연간 20,000개 이상의 총 게놈을 생성할 수 있어 게놈 발견과 임상 통찰력을 크게 가속화하여 질병 이해하고 결국 환자의 삶을 변화시킵니다. 따라서 이 지역의 이러한 발전은 연구 대상 시장 성장을 가속하고 있습니다.

포인트 오브 케어(POC) 진단 분야에서도 자원이 제한된 환경에서 분자진단, 감염, 만성 질환 등 다양한 용도에 마이크로플루이딕스 기술이 널리 사용되고 있습니다. 예를 들어, 저널 'Frontiers of Bioengineering and Biotechnology'에 2021년 1월에 게재된 기사에서는 래터럴 플로우 어세이(LFA)가 POC 검사에서 널리 사용되고 있으며 특정 바이오마커를 동정함으로써 암 등의 질병의 진단이나 예후 진단에 사용할 수 있다고 보고했습니다. LFA는 항체 및 핵산의 증폭을 통해 일련의 병원체 및 단백질을 검출하는데 널리 사용됩니다. 따라서 마이크로플루이딕스공학 연구의 최신 진보는 자체 완성되고 자동화되어 사용하기 쉽고 신속한 통합 장치를 제조하는 것을 목표로 합니다.

게다가 이 지역에서 보고된 만성질환의 발생률이 높다는 것도 이 부문의 성장에 기여하고 있습니다. 예를 들어, 2021년 11월에 발표된 캐나다의 암 통계에 따르면, 2021년에 추정 22만 9,200명의 캐나다인이 암으로 진단되었다고 보고되었습니다. 마찬가지로 국제 당뇨병 연맹(IDF)이 발표한 2021년에 따르면 멕시코의 성인은 1,400만 명이었습니다. 당뇨병과 함께 살고 있습니다. 그러므로 이 지역에서 만성 질환을 앓고 사는 사람들의 수가 그다지 많다는 것도 이 지역에서 연구 대상이 되고 있는 시장의 성장에 기여하고 있습니다.

최근 몇 년동안 미국에서는 학술 연구에서 높은 처리량 스크리닝(HTS) 기술에 대한 관심이 크게 증가하고 있습니다. 예를 들어, 2022년 10월, Ginkgo Bioworks는 머크와 제휴하여 머크의 의약품 활성 성분(API) 제조 노력에서 생체촉매로 사용할 수 있는 최대 4개의 효소를 개발했습니다. 이 제휴를 통해 Ginkgo는 세포 공학 및 효소 설계에 대한 풍부한 경험 외에도 자동 고 처리량 스크리닝, 제조 공정 개발/ 최적화, 바이오인포매틱스 및 분석 능력을 활용하여 표적 생체 촉매 발현에 이상적입니다. 균주를 제공합니다.

따라서 이 지역의 주요 시장 선수의 존재, 만성 질환 증가, 건강 관리 인프라의 발전으로 이 지역은 예측 기간 동안 상당한 성장을 이룰 것으로 예상됩니다.

랩 칩 마이크로어레이(바이오칩) 산업 개요

Raboon Chip Microarray(바이오칩) 시장은 세계 및 지역적으로 사업을 전개하는 여러 회사가 존재하기 때문에 적당한 경쟁을 볼 수 있습니다. 가장 큰 시장 선수는 Abbott Laboratories, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation(Cepheid), Fluidigm Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Micronit BV, Illumina Inc., Palanx Biotech, Group Inc., BioMerieux SA, Qiagen NV, Merck Kommanditgesellschaft auf Aktien 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 연구의 전제조건과 시장의 정의

- 연구 범위

제2장 연구 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 포인트 오브 케어 검사 수요 증가

- 만성질환의 발생률 증가

- 암 연구에서 단백질체학와 유전체학의 응용 증가

- 시장 성장 억제요인

- 랩온어칩 기술 설계상의 제약

- 대체기술의 이용가능성

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 유형별

- 실험실 온칩

- 마이크로어레이

- 제품별

- 기기

- 시약 및 소모품

- 소프트웨어 및 서비스

- 용도별

- 임상 진단

- 창약

- 유전체학 및 단백질체학

- 기타 용도

- 최종 사용자별

- 바이오테크놀러지 기업 및 제약 기업

- 병원 및 진단센터

- 학술연구기관

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Abbott Laboratories

- Agilent Technologies Inc.

- Bio-Rad Laboratories Inc.

- Danaher Corporation(Cepheid)

- Fluidigm Corporation

- Thermo Fisher Scientific Inc.

- PerkinElmer Inc.

- Micronit BV

- Illumina Inc.

- Phalanx Biotech Group Inc.

- BioMerieux SA

- Qiagen NV

- Merck Kommanditgesellschaft auf Aktien

제7장 시장 기회와 미래 동향

JHS 24.03.20The Lab-on-a-chip and Microarrays Market size is estimated at USD 19.08 billion in 2024, and is expected to reach USD 31.04 billion by 2029, growing at a CAGR of 10.22% during the forecast period (2024-2029).

The COVID-19 pandemic significantly impacted the lab-on-a-chip and microarrays (biochips) market. For instance, an article published by the journal Nature Communication in January 2021 reported that this microarray could be used as a diagnostic tool, as an epidemiologic tool to estimate the disease burden of COVID-19 more accurately, and as a research tool to correlate antibody responses with clinical outcomes. Thus, the COVID-19 pandemic increased the demand for lab-on-a-chip diagnostic tools. However, in the current scenario, it is anticipated that with the presence of other chronic and infectious diseases, the demand for the studied market is expected to increase over the forecast period.

The factors driving the growth of the studied market are increasing demand for point-of-care testing, increasing incidences of chronic diseases, and increasing application of proteomics and genomics in cancer research. Most market players are focusing on the development of new and technologically advanced diagnostic tests. Chronic diseases are the leading cause of death and disability across the world. For instance, an article published by the journal Plos One in March 2022 reported that 21% of the elderly in India had at least one chronic disease. Chronic diseases are the leading causes of disability and mortality among the elderly population in India.

Similarly, another article published by European Public Health Conference in January 2022 reported that more than 3 million people will be affected by cancer by 2030 in Europe. Globally, chronic diseases (CDs) are found to be the leading causes of disability and morbidity. Since those diseases are chronic, accurate and timely clinical decision-making is required. In this direction, research toward developing new lab-on-a-chip-based POC systems for the diagnosis of chronic diseases is an emerging area. Thus, a high incidence of chronic diseases is expected to drive the growth of the studied market.

Biochips are increasingly being used in the field of biomedical and biotechnological research. With the advancement of technologies, there has been a rise in the adoption of biochips in proteomics. The advantages of protein biochips are the low sample consumption due to their inclination toward miniaturization. These characteristics of microarrays are important for proteome-wide analysis. Proteomics is being widely adopted for biomarker and drug discoveries. For instance, in April 2021, PathogenDx Inc. reported that the USFDA had issued an Emergency Use Authorization (EUA) for its patented COVID-19 multiplexed viral diagnostic assay, DetectX-Rv. DetectX-Rv is an RT-PCR and DNA microarray hybridization test intended for the qualitative detection of nucleic acids from SARS-CoV-2 swabs. Thus, such approvals for new products are also contributing to the growth of the studied market.

Thus, due to the increasing demand for point-of-care testing, increasing incidences of chronic diseases, and increasing application of proteomics and genomics in cancer research, the studied market is expected to witness significant growth over the forecast period. However, the design constraints of lab-on-chip technology and the availability of alternative technologies may slow down the growth of the studied market.

Lab-on-a-chip and Microarrays Market Trends

Lab-on-a-chip Segment Expected to Witness Significant Growth over the Forecast Period

The lab-on-a-chip (LOC) segment is expected to have positive market growth due to the increasing number of chronic diseases and rising technological advancements. There is also a rise in the adoption of personalized medicine and easy accessibility of lab-on-chip technology, which will boost the demand for the same across the world. Also, there are various applications of LOC that are growing rapidly. Lab-on-a-chip devices equipped with electrodes for particle or cell detection, particle packing, sorting, electrophoresis, PCR, etc., are commercially available.

With the increasing number of COVID-19 cases, there is a growing number of research studies to treat and prevent this disease. This has boosted the demand for labs-on-a-chip. For instance, in January 2021, researchers at the University of Alberta joined forces to develop a handheld LOC device for the rapid detection of COVID-19 antibodies. Also, a low-cost imaging platform utilizing the lab-on-a-chip technology created by the University of California by Irvine scientists may be available for rapid coronavirus diagnostic and antibody testing.

Furthermore, the market has witnessed frequent developments in lab-on-a-chip (LOC) platform-based immunoassays. Such advanced LOC platforms include microfluidic chips, paper, lateral flow, electrochemistry, and new biosensor concepts. The rapid increase in demand for point-of-care diagnosis is the most prominent driver expected to propel the segment during the forecast period. For instance, in February 2022, Onera Health launched the Onera Biomedical-Lab-on-Chip, an ultra-low-power biosignal sensor subsystem for wearable devices. This biomedical compact chip is designed to process multiple biosignals, which creates a massive opportunity for health devices. Thus, such developments are propelling the growth of this segment.

Thus, due to the increasing number of chronic diseases, rising technological advancements, rise in the adoption of personalized medicine, and easy accessibility of lab-on-chip technology, the segment is expected to witness significant growth over the forecast period.

North America Expected to Witness a Significant Growth Over the Forecast Period

North America is expected to witness significant growth over the forecast period owing to the presence of key market players in the region and the development of healthcare infrastructure. In addition, the region has witnessed major collaborative activities with healthcare giants that are extensively investing in R&D in microarray technology. For instance, in September 2022, Illumina Inc. launched the NovaSeq X Series, new production-scale sequencers, enabling faster, more powerful, and more sustainable sequencing. This revolutionary new technology, NovaSeq X Plus can generate more than 20,000 whole genomes per year, 2.5 times the throughput of prior sequencers, greatly accelerating genomic discovery and clinical insights to understand the disease and ultimately transform patient lives. Thus, such developments in the region are driving the growth of the studied market.

The field of point-of-care (POC) diagnostics also widely uses microfluidic technology for various applications, like molecular diagnostics, infectious diseases, and chronic diseases, in resource-limited settings. For instance, an article published by the journal Frontiers of Bioengineering and Biotechnology in January 2021 reported that Lateral Flow Assays (LFAs) were widely being used in POC testing and can be used for diagnosis and prognosis of diseases like cancer by identifying specific biomarkers. LFAs have widely been used to detect an array of pathogens and proteins via antibody and nucleic acid amplification. Thus, the latest advances in the research in microfluidics aim to produce integrated devices that are self-contained, automated, easy to use, and rapid.

Moreover, the high incidence of chronic diseases reported in the region is also contributing to the growth of this segment. For instance, as per the Canadian Cancer Statistics released in November 2021 reported that an estimated 229,200 Canadians were diagnosed with cancer in 2021. Similarly, according to the International Diabetes Federation (IDF) published, in 2021, an estimated 14 million adults in Mexico were living with diabetes. Thus, such a high number of people living with chronic diseases in the region is also contributing to the growth of the studied market in the region.

Over the last few years, the interest in high throughput screening (HTS) technologies within academic research has increased drastically in the United States. For instance, in October 2022, Ginkgo Bioworks entered into a collaboration with Merck to engineer up to four enzymes for use as biocatalysts in Merck's active pharmaceutical ingredient (API) manufacturing efforts. Through this collaboration, Ginkgo is to leverage its extensive experience in cell engineering and enzyme design, as well as its capabilities in automated high throughput screening, manufacturing process development/optimization, bioinformatics, and analytics to deliver optimal strains for expression of targeted biocatalysts.

Thus, due to the presence of key market players in the region, the increase in chronic diseases, and the development of healthcare infrastructure, the region is expected to witness significant growth over the forecast period.

Lab-on-a-chip and Microarrays Industry Overview

The lab-on-a-chip and microarrays (biochip) market is moderately competitive, with the presence of a few companies operating globally and regionally. Some of the largest market players include Abbott Laboratories, Agilent Technologies Inc., Bio-Rad Laboratories Inc., Danaher Corporation (Cepheid), Fluidigm Corporation, Thermo Fisher Scientific Inc., PerkinElmer Inc., Micronit BV, Illumina Inc., Phalanx Biotech Group Inc., BioMerieux SA, Qiagen NV, and Merck Kommanditgesellschaft auf Aktien.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Point-of-care Testing

- 4.2.2 Increasing Incidences of Chronic Diseases

- 4.2.3 Increasing Application of Proteomics and Genomics in Cancer Research

- 4.3 Market Restraints

- 4.3.1 Design Constraints of Lab-on-chip Technology

- 4.3.2 Availability of Alternative Technologies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Lab-on-a-chip

- 5.1.2 Microarray

- 5.2 By Products

- 5.2.1 Instruments

- 5.2.2 Reagents and Consumables

- 5.2.3 Software and Services

- 5.3 By Application

- 5.3.1 Clinical Diagnostics

- 5.3.2 Drug Discovery

- 5.3.3 Genomics and Proteomics

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Biotechnology and Pharmaceutical Companies

- 5.4.2 Hospitals and Diagnostic Centers

- 5.4.3 Academic and Research Institutes

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle-East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle-East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Agilent Technologies Inc.

- 6.1.3 Bio-Rad Laboratories Inc.

- 6.1.4 Danaher Corporation (Cepheid)

- 6.1.5 Fluidigm Corporation

- 6.1.6 Thermo Fisher Scientific Inc.

- 6.1.7 PerkinElmer Inc.

- 6.1.8 Micronit BV

- 6.1.9 Illumina Inc.

- 6.1.10 Phalanx Biotech Group Inc.

- 6.1.11 BioMerieux SA

- 6.1.12 Qiagen NV

- 6.1.13 Merck Kommanditgesellschaft auf Aktien