|

시장보고서

상품코드

1444840

곡물 저장 사일로 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Grain Storage Silos - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

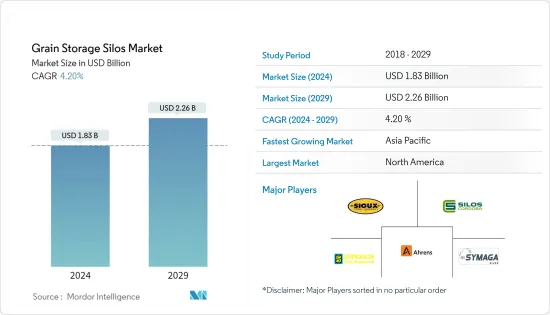

세계의 곡물 저장 사일로(Grain Storage Silos) 시장 규모는 2024년에 18억 3,000만 달러로 추정되며, 2029년에는 22억 6,000만 달러에 달할 것으로 예상되며, 예측기간 중(2024-2029년) CAGR 4.20%로 추이하며 성장할 것으로 예상됩니다.

주요 하이라이트

- 인구 증가로 인해 전 세계적으로 농업 생산성이 증가하고 있습니다. 생산성 향상에도 불구하고 곡물 손실로 인한 식량 자급률은 심각한 문제 중 하나입니다. 이러한 곡물 손실은 적절한 저장 시설의 부재로 인해 발생하며, 이는 가격 하락과 농가의 수익 감소로 이어집니다. 적절한 수확 후 저장 시설의 필요성은 전 세계 곡물 사일로 시장을 지원합니다. 따라서 이 시장의 중요한 동인으로는 곡물 가격의 변동과 대용량 저장에 대한 수요 증가가 있습니다.

- 이와 함께 주요 기업의 투자 증가와 기술 개발도 시장을 주도하고 있습니다. 예를 들어, 인도에서는 2021년에 인도 최대 민간 부문 농업 수확 후 관리 회사인 NCML(National Commodities Management Services Limited)이 하리아나 주에 4개의 공공 저장 사일로 시설을 시작했습니다. 매년 곡물 재고가 증가함에 따라 더 큰 저장 용량을 확보해야 할 필요성이 대두되고 있으며, 이는 전 세계적으로 시장을 주도하고 있습니다.

- 또한 개발도상국과 선진국 모두 향후 사용 및 수출을 위해 대용량의 곡물을 저장하기 때문에 곡물 저장은 매우 중요합니다. 따라서 해충, 설치류, 조류에 의한 곡물의 부패는 농작물에 막대한 손실을 초래합니다. 예를 들어, 북미의 곡물 사일로 시장은 매우 큽니다. 이 지역의 농부들은 마케팅 연도가 끝날 때 상당한 재고를 보유하는 경우가 거의 없습니다. 밀과 보리, 옥수수, 대두 및 기타 곡물의 재고는 거의 전량 비축되어 있습니다. 또한, 이 지역의 기업들은 대량의 곡물을 저장하기 위해 사일로의 저장 용량을 확장하고 있습니다. 따라서 이러한 요인은 예측 기간 동안 시장 성장에 도움이됩니다.

곡물 저장 사일로 시장 동향

대용량 저장고에 대한 수요 증가

미국, 러시아, 인도, 브라질 등 세계 주요 곡물 생산국의 곡물 저장 수요 증가가 연구 기간 동안 곡물 저장 사일로 산업을 주도했습니다. 또한 곡물 저장에 필요한 투입 비용과 막대한 투자가 증가하면서 모든 지역에서 사일로에 대한 수요가 증가했습니다. 국제곡물위원회(IGC)에 따르면 전 세계 밀 재고량은 2020년 2억 7,600만 톤에서 2021년 2억 7,800만 톤으로 증가했으며, 2021년에는 2억 7,800만 톤에 달할 것으로 예상됩니다. 이러한 곡물 생산량 증가는 예측 기간 동안 시장의 성장으로 이어졌습니다.

또한 이집트는 곡물, 특히 밀을 수입에 의존하고 있습니다. 우크라이나와 러시아 간의 분쟁으로 인해 밀 공급에 문제가 발생했습니다. 밀 공급을 다변화하기 위한 추가 조치에도 불구하고 국제 가격 상승은 이집트가 국제 공급처에서 대량의 밀을 구매하는 데 방해가 될 것입니다. 따라서 이집트는 계속해서 새로운 사일로를 건설하고 저장 용량을 확장하여 가격 급등을 견디기 위해 수입을 제한할 수 있었습니다.

이와 함께 사일로는 곡물 운송의 자동화로 인해 비용 효율적인 곡물 저장 수단으로 장기적으로 운영 비용을 절감할 수 있습니다. 사일로의 적재 및 하역 비용도 곡물 창고보다 낮은데, 이는 자동화가 SCADA(감독 제어 및 데이터 수집) 시스템에 의해 운영되기 때문입니다. 비용 효율성과 사일로의 큰 저장 용량이라는 이점이 전 세계적으로 곡물 저장 사일로 시장을 주도하고 있습니다.

북미가 시장을 독점

2020년 곡물 저장 사일로 사용에서 가장 큰 비중을 차지한 지역은 북미 지역입니다. 미국 농무부(USDA)에 따르면 지난 10년 동안 농장 내 저장량은 16억 부셸, 농장 밖 저장량은 22억 부셸 증가하여 각각 14%와 24%의 성장률을 기록했습니다. 국내 생산자들은 대부분 장기 저장이 가능한 평바닥형 또는 호퍼바닥형 사일로를 선호합니다. 이로 인해 미국 내 평바닥 사일로 또는 호퍼 바닥 사일로 시장이 증가했습니다.

또한 미국의 곡물 저장 능력은 지난 20년 동안 크게 향상되었습니다. USDA에 따르면 2020년 미국의 곡물 저장 용량은 약 253억 부셸입니다. 옥수수, 대두, 밀 및 기타 작물의 저장량은 절대적인 양, 수확 시기 및 생산지에 따라 다릅니다. 전국적으로 옥수수가 곡물 재고를 가장 많이 차지합니다. 수확 후 옥수수는 미국 곡물 재고의 4분의 3 이상을 차지하며, 옥수수 재고의 대부분은 농장에 보관되어 있습니다. 2021년 전체 옥수수 재고량 중 72억 3천만 부셸이 농장에 저장되어 있으며, 이는 2020년 대비 3% 증가한 수치입니다. 이러한 주요 곡물 작물의 재고량 증가는 예측 기간 동안 시장 성장으로 이어집니다.

이와 함께 USDA에 따르면 최근 미국과 중국이 주요 원자재에 관세를 부과하면서 미국 농가의 곡물 잉여가 누적되어 전체 저장 가능량의 20%가 대두, 옥수수, 밀로 채워진 것으로 나타났습니다. 기존 저장고가 최대 용량에 도달함에 따라 예측 기간 동안 미국 전역에 더 많은 대형 저장 사일로의 필요성이 더욱 높아질 것으로 예상됩니다.

곡물 저장 사일로 산업 개요

곡물 저장 사일로 시장은 세분화되어 있으며 대기업이 차지하는 시장 점유율은 낮아지고 있습니다. Ahrens Agri, Buhler Group, Sioux Steel Company, Symaga, Silos Cordoba가 조사 대상 시장의 주요 기업입니다. 신제품 출시, 제휴 및 인수는 세계 시장의 선도 기업들이 채택하는 주요 전략입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진 요인

- 시장 성장 억제 요인

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 세분화

- 유형

- 스틸 사일로

- 금속 사일로

- 기타 유형

- 제품

- 평평한 바닥(Flat Bottom) 사일로

- 호퍼 바닥(Hopper Bottom) 사일로

- 피드 호퍼

- 농장 사일로

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 러시아

- 기타 유럽

- 아시아 태평양

- 중국

- 일본

- 인도

- 호주

- 기타 아시아 태평양

- 남미

- 브라질

- 기타 남미

- 중동 및 아프리카

- 남아프리카공화국

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 가장 채택된 전략

- 시장 점유율 분석

- 기업 개요

- Rostfrei Steels

- Superior Grain Equipment

- Henan Sron Silo Engineering Co.

- Silos Cordoba

- Sioux Steel Company

- Skess Corporation

- Nelson

- Symaga

- Arsenal Steel Silos

- Ahrens Agri

제7장 시장 기회 및 향후 동향

LYJ 24.03.22The Grain Storage Silos Market size is estimated at USD 1.83 billion in 2024, and is expected to reach USD 2.26 billion by 2029, growing at a CAGR of 4.20% during the forecast period (2024-2029).

Key Highlights

- Agricultural productivity is increasing worldwide due to the increasing population. Despite the expanding productivity, self-sufficiency is one of the critical problems due to grain losses. This grain loss happens due to proper storage facilities' unavailability, which leads to a price drop and a decrease in the profits for the farmers. The need for appropriate post-harvest storage facilities aids the market for grain silos across the globe. Therefore, the critical drivers for this market include fluctuating grain prices and rising demand for large-capacity storage.

- Along with this, the primary company's increasing investments and technological developments are also driving the market. For instance, in India, in 2021, National Commodities Management Services Limited (NCML), India's largest private-sector agriculture post-harvest management company, launched four public storage silo facilities in Haryana. Due to the increase in grain stocks every year, there is a need to have larger storage capacities, which is driving the market globally.

- Furthermore, the storage of grains is of great importance in developing and developed countries as they store large grain capacities for future use and export. Thus, the spoilage of grains by pests, rodents, and birds causes significant losses to the crops. For instance, The market for grain silos is huge in North America. Farmers in the region rarely hold substantial inventories at the end of a marketing year. Inventories of wheat and barley, corn, soybeans, and other grains are almost entirely held off-farm. Additionally, companies in the region are also expanding the silo's storage capacity to store a large volume of grains. Hence, these factors aid the market growth in the forecast period.

Grain Storage Silos Market Trends

Rising Demand for Large Capacity Storage

The growing demand for grain storage from the leading grain-producing countries in the world, namely, the United States, Russia, India, Brazil, and others, have driven the grain storage silos industry during the study period. Further, rising input costs and heavy investments required in grain storage led to a rise in demand for silos across all regions. According to the International Grains Council (IGC), the global wheat stock increased from 276 million metric tons in 2020, and the stock accounted for 278.0 million tons in 2021. This increase in the production of grains led to the market's growth in the forecast period.

Further, Egypt relies on imports for grains, especially wheat. The conflict between Ukraine and Russia caused wheat supply challenges. Even with additional measures to diversify its wheat supply, rising global prices would impede Egypt's ability to purchase large volumes of wheat from international sources. Therefore, Egypt continued to build new silos and expand its storage capacity, which may allow Egypt to limit imports to withstand price spikes.

Along with this, silos are cost-effective modes of grain storage due to the automation of grain transport, resulting in low operational costs in the long run. The loading and unloading costs of silos are also low than grain warehouses, as automation is operated by the Supervisory Control and Data Acquisition (SCADA) system. The benefits of cost-effectiveness and the large holding capacity of silos are driving the grain storage silos market globally.

North America Dominates the Market

North America held the largest share in using silos for grain storage in 2020. As per the United States Department of Agriculture (USDA), in the last ten years, the on-farm storage increased by 1.6 billion bushels and off-farm storage by 2.2 billion bushels, registering a growth of 14% and 24%, respectively. The producers in the country mostly prefer flat-bottom or hopper-bottom silos as they can be used for long-term storage. It increased the market for flat-bottom silos or hopper-bottom silos in the United States.

Moreover, the US grain storage capacity improved substantially in the last 20 years. According to USDA, in 2020, the national grain storage capacity was approximately 25.3 billion bushels. Corn, soybeans, wheat, and other crop storage differ concerning the absolute quantity, harvest timing, and production location. Nationally, corn dominates grain inventories. Post-harvest corn makes up more than three-quarters of US grain inventories, with the majority of corn inventory held on-farm. Of the total corn stocks, 7.23 billion bushels were stored on farms in 2021, an increase of 3% from 2020. This increase in the stocks of major grain crops leads to market growth during the forecast period.

Along with this, as per USDA, the recent imposition of tariffs by both the United States and China on primary commodities led to the accumulation of grain surplus for the US farmers, resulting in 20% of the total available storage filled with soybean, corn, and wheat. It is anticipated to further boost the need for more large storage silos across the country during the forecast period, as the existing ones are reaching full capacity.

Grain Storage Silos Industry Overview

The grain storage silos market is fragmented, in which major players account for less market share. Ahrens Agri, Buhler Group, Sioux Steel Company, Symaga, and Silos Cordoba are the major players in the market studied. New product launches, partnerships, and acquisitions are the major strategies adopted by the leading companies in the market globally.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Steel Silos

- 5.1.2 Metal Silos

- 5.1.3 Other Types

- 5.2 Product

- 5.2.1 Flat Bottom Silos

- 5.2.2 Hopper Bottom Silos

- 5.2.3 Feed Hoppers

- 5.2.4 Farm Silos

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United Sates

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Rostfrei Steels

- 6.3.2 Superior Grain Equipment

- 6.3.3 Henan Sron Silo Engineering Co.

- 6.3.4 Silos Cordoba

- 6.3.5 Sioux Steel Company

- 6.3.6 Skess Corporation

- 6.3.7 Nelson

- 6.3.8 Symaga

- 6.3.9 Arsenal Steel Silos

- 6.3.10 Ahrens Agri