|

시장보고서

상품코드

1445419

세계 바이오 베이스 폴리머 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Bio-based Polymers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

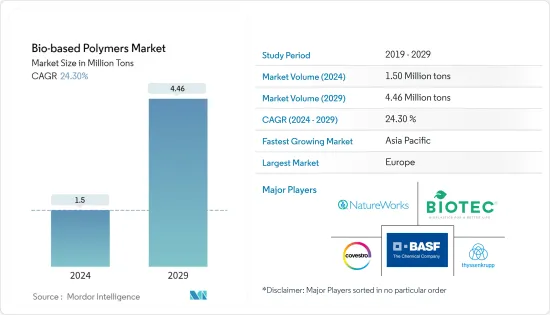

바이오베이스 폴리머 시장 규모는 2024년 150만 톤으로 추정되고, 2029년까지 446만 톤에 이를 것으로 예측되며, 예측기간(2024년-2029년) 동안 복합 연간 성장률(CAGR) 24.30%로 성장할 전망입니다.

COVID-19는 바이오 폴리머 시장의 성장에 영향을 미쳤습니다. 그러나 유행중 및 유행후 포장 식품 및 온라인 식품 배달에 대한 수요가 증가함에 따라 포장 코팅의 소비가 촉진되어 바이오 중합체의 소비가 발생했습니다.

단기적으로 지속 가능한 플라스틱에 대한 수요 증가는 시장 수요를 견인하는 주요 요인 중 하나입니다.

반면에, 바이오플라스틱의 성능 문제와 석유계 폴리머에 비해 바이오 폴리머와 관련된 가격의 높이가 조사 대상 시장의 성장을 방해할 것으로 예상됩니다.

생분해성 플라스틱의 용도 증가는 향후 기회가 될 수 있습니다.

또한 포장 산업은 시장을 독점하고 있으며 예측 기간 동안 성장할 것으로 예상됩니다.

유럽은 세계 시장을 독점하고 있으며, 가장 큰 소비국은 프랑스와 영국 등입니다.

바이오 폴리머 시장 동향

포장 산업에서 수요 증가

- 포장은 바이오 폴리머의 가장 큰 시장 중 하나입니다. 이 폴리머는 우수한 투명성과 광택, 식품 유지에 대한 내성, 향기 장벽을 보여줍니다. 또한 패키지에 강성, 비틀림 유지력, 인쇄 적성도 부여합니다.

- 바이오 폴리머는 주로 슈퍼마켓 과일 및 채소 포장, 빵 가방과 베이커리 상자, 병, 봉투, 진열대의 판지 창, 쇼핑백과 운반 가방 등에 사용됩니다. 예를 들어 인도 상무부에 따르면 2022년도 인도의 신선한 야채 수출액은 약 8억 200만 달러에 달했습니다. 가공 채소의 경우 같은 해 수출액은 약 4억 2,500만 달러에 달했습니다. 이는 2020년에 비해 신선한 야채 부문에서 10.87%, 가공 야채에서 0.21% 증가한 것으로 나타났습니다. 그러므로 신선한 야채와 가공 야채의 수출 증가로 국내 바이오 폴리머 수요가 창출될 것으로 예상됩니다.

- 포장용 바이오 폴리머 시장은 유럽 및 북미에서 빠르게 성장하고 있습니다. 식품 안전에 대한 FDA 및 관련 기관의 개입이 증가함에 따라 음료 및 간식 소비에서 생분해성 및 식품 등급 플라스틱의 사용이 주로 촉진되고 있습니다.

- 레스토랑 체인과 식품 가공 업계에서는 식품 포장에 생분해성 소재를 채용하는 케이스가 늘고 있습니다. 일부 플라스틱에는 발암성이 있음이 입증되었기 때문에 특히 신흥국에서는 식품 안전에 대한 소비자의 의식도 빠르게 증가하고 있습니다.

- 아시아태평양, 남미, 중동의 개발도상지역 성장은 다양한 식품안전기관의 식품포장기준의 향상으로 가까운 미래에 더욱 증가할 것으로 예상됩니다.

- 또한, 생분해성 고분자는 폐기가 용이하기 때문에 포장 산업 수요가 더욱 높아지고 있습니다.

유럽이 시장을 독점

- 유럽은 바이오 폴리머의 가장 큰 점유율을 보유하고 세계 시장을 독점하고 있습니다.

- 이 지역의 국민 의식과 정부의 이니셔티브는 특히 운반 가방, 식품 포장, 푸드서비스(칼집 등), 유기 폐기물 캐디 라이너 등에서 생분해성 고분자의 사용을 지지해 왔습니다.

- 이 지역의 다양한 국가들은 보다 친환경적인 포장을 제공하는데 주력하고 있습니다. 이로 인해 포장 분야에서 폴리유산 수요가 증가했습니다.

- 영국은 유럽의 주요 국가 중 하나이며 바이오 폴리머 포장재에 대한 수요가 증가하고 있습니다. 패키징 제품의 지속가능성 요소에 대한 의식이 높아지고 최근 정부의 이니셔티브는 조사 대상이 되는 국내 시장의 성장에 바람직한 시장 시나리오를 낳고 있습니다.

- 일회용 플라스틱의 금지는 바이오 폴리머 포장 제품 수요에 직접적인 영향을 미치는 주요 요인 중 하나입니다. 예를 들어 영국 정부는 2021년 플라스틱 오염 대책으로 영국 내에서 일회용 플라스틱 칼, 접시, 폴리스티렌 컵을 금지할 계획을 발표했습니다.

- 패키징 업계에서 활동하는 신흥 기업뿐만 아니라 기존 벤더 여러 회사도 국내 바이오 폴리머 패키징 추진에 솔선하고 있습니다. 예를 들어, 2022년 6월 영국에 본사를 둔 기업 마법의 버섯 회사는 식물 기반의 지속 가능한 포장을 위해 340만 유로(331만 달러)의 자금을 확보했습니다.

- 현재 영국 포장 부문의 연간 매출은 110억 파운드이며 직원 수는 85,000명을 넘고 있습니다.

- 유럽연합(EU)은 2050년 실질 제로 배출 목표를 향해 노력하고 있으며, 유럽 그린딜을 시행함으로써 증가하는 환경과 지속가능성 위기를 추진하고 있습니다. 보다 지속 가능한 사회에 대한 추세는 유럽 경제 플라스틱의 생산, 사용, 폐기와 관련이 있습니다.

- 소형 포장의 요구 증가와 라이프 스타일 변화에 따른 소비 습관의 확대는 예측 기간 동안 바이오 폴리머 수요를 증가시킬 것으로 예상됩니다.

바이오 폴리머 산업 개요

바이오 폴리머 시장은 본질적으로 부분적으로 통합되어 있습니다. 시장의 주요 기업으로는(순차적), BASF SE, Covestro AG, Biotec Biologische Naturverpackungen GmbH & Co. KG., thyssenkrupp AG, NatureWorks LLC 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 환경보전을 위해 친환경 폴리머를 선택

- 많은 국가에서의 비분해성 폴리머에 관한 규제

- 선진국과 개발도상국에 있어서의 소비자의 의식의 향상

- 생분해성 폴리머의 비독성 특성

- 억제요인

- 석유계 폴리머에 비해 가격이 높다

- 저소득국가의 의식이 낮음

- 업계의 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체 제품 및 서비스의 위협

- 경쟁도

제5장 시장 세분화

- 유형

- 전분계 플라스틱

- 폴리유산(PLA)

- 폴리하이드록시알카노에이트(PHA)

- 폴리에스테르(PBS, PBAT, PCL)

- 셀룰로오스 유도체

- 용도

- 농업

- 섬유

- 일렉트로닉스

- 포장

- 헬스케어

- 기타 용도

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 세계 기타 지역

- 브라질

- 사우디아라비아

- 세계 기타 지역

- 아시아태평양

제6장 경쟁 구도

- 합병과 인수, 합작사업, 협업 및 계약

- 시장 점유율(%)**/랭킹 분석

- 유력 기업이 채용한 전략

- 기업 프로파일

- BASF SE

- Biologische Naturverpackungen GmbH &Co. KG.

- Cardia Bioplastics

- Covestro AG

- Corbion

- Cortec Group Management Services, LLC

- DuPont de Nemours, Inc.

- FKuR

- FP International

- Innovia Films

- Merck KGaA

- YIELD10 BIOSCIENCE, INC.(Metabolix Inc.)

- NatureWorks LLC

- Novamont SpA

- Rodenburg Biopolymers

- SHOWA DENKO KK

- thyssenkrupp AG

제7장 시장 기회와 미래 동향

- 생분해성 플라스틱의 용도 확대

- 약물전달에서의 조사 증가

- 신흥국의 규제 강화

The Bio-based Polymers Market size is estimated at 1.5 Million tons in 2024, and is expected to reach 4.46 Million tons by 2029, growing at a CAGR of 24.30% during the forecast period (2024-2029).

COVID-19 impacted the bio-based polymer market's growth. However, the increased demand for packaged food and online food deliveries during the pandemic and post-pandemic propelled the consumption of packaging coatings, which resulted in the consumption of bio-based polymers.

Over the short term, increasing demand for sustainable plastics is one of the major factors driving market demand.

On the flip side, the performance issue with bioplastics and the high prices associated with bio-based polymers compared to petroleum-based polymers are expected to hinder the growth of the market studied.

The increasing applications of biodegradable plastics are likely to present an opportunity in the future.

Moreover, the packaging industry dominates the market and is expected to grow during the forecast period.

Europe dominated the market across the world, with the largest consumption coming from countries such as France and the United Kingdom.

Bio-based Polymers Market Trends

Increasing Demand from Packaging Industry

- Packaging is one of the largest markets for bio-based polymers. These polymers exhibit excellent clarity and gloss, resistance to food fats and oils, and an aroma barrier. Additionally, they also provide stiffness, twist retention, and printability to the packaging.

- Bio-based polymers are mostly used in fruit and vegetable packaging in supermarkets, for bread bags and bakery boxes, bottles, envelopes, display carton windows, and shopping or carrier bags, among others. For instance, according to the Department of Commerce (India), the export value of fresh vegetables from India amounted to about USD 802 million in the fiscal year 2022. For processed vegetables, the value stood at nearly USD 425 million in the same year, which shows an increase of 10.87% from the fresh vegetable segment and 0.21% from processed vegetables compared with 2020. Therefore, an increase in the exports of fresh and processed vegetables is expected to create demand for bio-based polymers in the country.

- The bio-based polymer market for packaging is growing rapidly in the European and North American regions. The increasing intervention of the FDA and related organizations in terms of food safety is largely promoting the usage of biodegradable and food-grade plastics for beverage and snack consumption.

- The restaurant chains and food processing industries are increasingly adapting biodegradable materials for food packaging. Consumer awareness is also rising rapidly, especially in emerging economies, in terms of food safety, as some plastics are proven carcinogenic.

- The growth in developing regions, like Asia-Pacific, South America, and the Middle East, is expected to increase in the near future due to the improving food packaging standards of various food and safety organizations.

- Moreover, the higher ease of disposing of biodegradable polymers has further added to their growing demand from the packaging industry.

Europe Region to Dominate the Market

- Europe holds the largest share of bio-based polymers and dominates the global market.

- Public awareness and government initiatives in the region have supported the use of biodegradable polymers in carrier bags, food packaging, food services (cutlery, etc.), and organic waste caddy liners, among others.

- Various countries in the region have been focusing on offering more eco-friendly packaging. This has increased the demand for polylactic acid in the packaging sector.

- The United Kingdom (UK) is among the leading countries in Europe, where the demand for bio-based polymer packaging has been increasing. The higher awareness about the sustainability factors of packaging products, along with recent government initiatives, are creating a favorable market scenario for the growth of the studied market in the country.

- The ban on single-use plastics is among the primary factors that will directly impact the demand for bio-based polymer packaging products. For instance, in 2021, the UK government announced plans to ban single-use plastic cutlery, plates, and polystyrene cups in England to tackle plastic pollution.

- Several existing vendors, as well as startups operating in the packaging industry, are also taking the initiative to promote bio-based polymer packaging in the country. For instance, in June 2022, Magical Mushroom Company, a UK-based company, secured funding of EUR 3.4 million (USD 3.31 million) for its plant-based sustainable packaging.

- Currently, the packaging sector in the United Kingdom has annual sales of GBP 11 billion, and it employs more than 85,000 people.

- The European Union (EU) is working towards the 2050 net-zero emissions goal and tackling the increasing environmental and sustainability crises by implementing the European Green Deal. The inclination towards a more sustainable society is intertwined with the European economy's production, use, and disposal of plastic.

- The growing need for small-size packaging and the growing consumption habits associated with the change in lifestyles are anticipated to propel the demand for bio-based polymers over the forecast period.

Bio-based Polymers Industry Overview

The bio-based polymer market is partially consolidated by nature. Some of the major players in the market (not in any particular order) include BASF SE, Covestro AG, BIOTEC Biologische Naturverpackungen GmbH & Co. KG., thyssenkrupp AG, and NatureWorks LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Preference toward Eco-friendly Polymers to Preserve Environment

- 4.1.2 Regulation on Non-degradable Polymers in Many Countries

- 4.1.3 Increasing Consumer Awareness in Developed and Developing Nations

- 4.1.4 Non-toxic Nature of Biodegradable Polymers

- 4.2 Restraints

- 4.2.1 Higher Price Compared to Petroleum-based polymers

- 4.2.2 Low Awareness in Low Income Countries

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Starch-based Plastics

- 5.1.2 Poly Lactic Acid (PLA)

- 5.1.3 PolyHydroxy Alkanoates (PHA)

- 5.1.4 Polyesters (PBS, PBAT, and PCL)

- 5.1.5 Cellulose Derivatives

- 5.2 Application

- 5.2.1 Agriculture

- 5.2.2 Textile

- 5.2.3 Electronics

- 5.2.4 Packaging

- 5.2.5 Healthcare

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of World

- 5.3.4.1 Brazil

- 5.3.4.2 Saudi Arabia

- 5.3.4.3 Rest of the World

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.3 Cardia Bioplastics

- 6.4.4 Covestro AG

- 6.4.5 Corbion

- 6.4.6 Cortec Group Management Services, LLC

- 6.4.7 DuPont de Nemours, Inc.

- 6.4.8 FKuR

- 6.4.9 FP International

- 6.4.10 Innovia Films

- 6.4.11 Merck KGaA

- 6.4.12 YIELD10 BIOSCIENCE, INC. (Metabolix Inc.)

- 6.4.13 NatureWorks LLC

- 6.4.14 Novamont SpA

- 6.4.15 Rodenburg Biopolymers

- 6.4.16 SHOWA DENKO K.K.

- 6.4.17 thyssenkrupp AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications of Bio-degradable Plastics

- 7.2 Increasing Research in Drug Delivery

- 7.3 Rising Regulations in Emerging Countries