|

시장보고서

상품코드

1445714

세계 Wi-Fi 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Wi-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

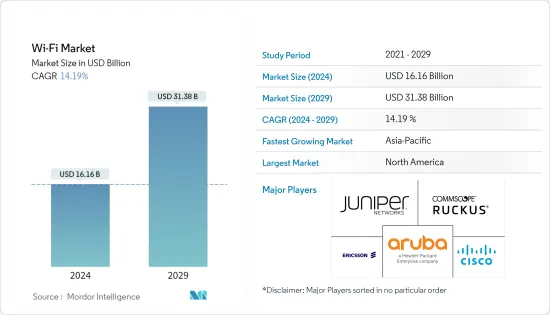

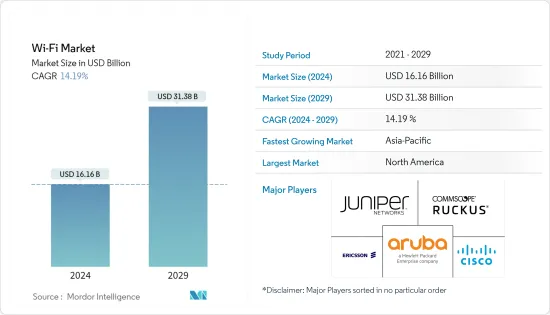

Wi-Fi 시장 규모는 2024년에 161억 6,000만 달러로 추정되고, 2029년까지 313억 8,000만 달러에 이를 것으로 예측되며, 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 14.19%로 성장할 전망입니다.

최근 재택근무가 메가 동향이 되고 있습니다. 대규모 원격 근무으로의 마이그레이션 속도는 휴대폰, 노트북, 태블릿, 데스크톱과 같은 개인 기기를 사용합니다.

주요 하이라이트

- 직원이 개인 Wi-Fi 인터넷 연결을 사용하여 기업 네트워크에 액세스하는 것도 관찰되었습니다. COVID-19의 유행에 의한 이 예기치 않은 혼란은 비즈니스와 중요한 기능의 운영을 유지하기 위해 Wi-Fi의 사용을 촉진했습니다. 게다가 세계 여러 산업이 음성, 비디오, IoT 장치 등의 대역폭을 대량으로 소비하는 용도을 다루면서 COVID-19의 유행으로부터 다시 시작되었습니다. 따라서 Wi-Fi에 대한 수요가 높아지면 무선 네트워크가 과다 가입되어 관련 IT 팀이 용도 성능을 억제할 수 있습니다.

- 머신 투 머신 용도는 점점 더 무선 연결을 향해 추진되고 있습니다. 소매업 및 제조업을 위한 연결에 대한 여러 투자가 성장에 기여하고 있습니다. 이러한 증가로 인해 2.4GHz 및 5GHz 스펙트럼에서 혼잡이 발생하여 6GHz 스펙트럼 할당에 대한 수요가 증가합니다.

- 또한, 에지 네트워크와 컴퓨팅을 통해 엔터프라이즈 아키텍처는 IoT 용도 및 통신의 비즈니스 크리티컬 데이터 세트 분석 처리를 최적화합니다. 워크로드의 50% 이상이 기업 데이터센터 외부에서 실행됩니다. 이를 통해 5G 및 Wi-Fi 6에서 가능하게 되는 멀티 액세스 에지 덕분에 저지연, 실시간 통신 및 고해상도 비디오 용도에 대한 요구 사항을 더욱 높일 수 있습니다.

- 서비스의 경우 제어 장치의 연결된 네트워크는 변환이나 IP 기반 표준 없이 상호 직접 통신할 것으로 예상됩니다. 무선 연결 및 컴퓨팅 플랫폼을 갖춘 이 통합 방식은 설계 혁신을 가능하게 할 수 있습니다.

- 국제전기통신연합(ITU)은 올해 세계 인구의 66%에 해당하는 53억명이 인터넷을 이용할 것으로 추정하고 있습니다. 이는 2019년부터 24% 증가했으며, 이 기간 동안 추정 11억 명이 인터넷에 참가한 것입니다. 인터넷을 이용하는 사람들이 많아지고 있기 때문에 국내외의 Wi-Fi 라우터 제조업체는 시장에서 큰 점유율을 얻기 위해 신제품을 발표하고 대역폭을 강화할 기회가 늘어날 것입니다.

- 또한 공용 Wi-Fi 네트워크(사전 공유 키가 있는 네트워크)는 안전한 옵션이 아닙니다. 이러한 네트워크는 소매점과는 다른 의도를 가질 수 있지만, 장치나 데이터를 보호하기 위한 일정 수준의 보증이나 법적 의무가 없는 것이 위협이 됩니다. 다시 말하지만, 사용자는 인터셉트 및 데이터를 읽고 변경할 수 없는지 확인하는 데 도움이 필요합니다.

Wi-Fi 시장 동향

실내는 상당한 시장 점유율을 차지할 것으로 예상

- Wi-Fi의 인기는 최근 점점 더 높아지고 있습니다. 근거리 통신망(LAN)은 라우팅이나 케이블 없이도 작동할 수 있어 기업과 가정에서 선호되는 옵션입니다. Wi-Fi는 노트북, 스마트폰, 태블릿 컴퓨터, 전자 게임기 등의 연결된 장치에 무선 광대역 인터넷 액세스를 제공하는 데에도 사용됩니다.

- 또한 GPS는 일반적으로 벽에 의해 차단되는 기술이며 위치 추적을 위해 건물 내에서 더 나은 수신이 필요합니다. 이를 해결하기 위해 Wi-Fi는 실시간 위치추적 시스템(RTLS)의 자산 태그 위치를 계산하기 위한 일반적인 기술의 선택으로 부상하고 있습니다.

- Wi-Fi는 일반적으로 작동 범위가 짧아지지만 신호는 최대 150m까지 연장할 수 있습니다. 정밀도는 일반적으로 환경에 배포되는 액세스 포인트의 수에 의해 결정됩니다. 영역 내의 액세스 포인트 수는 정확하고 정확한 위치 정보 생성에 직접 비례합니다. Wi-Fi 포지셔닝 시스템에서는 추가 하드웨어나 인프라 유지보수가 필요하지 않습니다. 대부분의 사무실 공간, 가정 및 기타 시설에는 이미 Wi-Fi 인프라가 설치되어 있으므로 추가 투자 없이 기본 수준의 포지셔닝 기능을 제공할 수 있습니다.

- 또한 Wi-Fi 통화는 실내 Wi-Fi 설정의 또 다른 주요 애플리케이션입니다. 모바일 가입률이 높아짐에 따라 휴대폰 네트워크는 서비스를 제공하거나 현대적인 건물에 침투하기가 어렵습니다. 사람들은 대부분의 데이터를 Wi-Fi를 통해 실행하기 시작했습니다.

- 또한 음성 통화는 Skype와 같은 OTT 애플리케이션의 형식 또는 펨토셀 및 UMA와 같은 노력으로 Wi-Fi를 통해 전송되어 사용자의 가정에서 모바일 음성 서비스의 도달 범위를 향상시킬 수 있습니다. 또한 국내 통화와 국제 통화에 동일한 요금을 청구하기 때문에 일반적인 네트워크 요금을 대체하는 매력적인 선택입니다.

- 또한 대부분의 가정은 '스마트 홈'으로 바뀌고 있으며 많은 기능을 활용하려면 인터넷이 필요합니다. Amazon Echo 및 Google Home과 같은 스마트 TV 및 스마트 스피커의 출현으로 무선 라우터 시장의 성장이 촉진되었습니다.

아시아태평양이 가장 빠르게 성장하는

- 중국에는 확립된 5G 에코시스템이 있으며 예측기간 동안 더욱 성장할 것으로 예상됩니다. 하지만 5G 기술은 현재의 모바일 광대역과 함께 핫스팟 기술로 작용할 것으로 예상되며, 성장은 완만해질 것으로 예상됩니다. 중국은 아시아태평양에서 가장 광범위한 5G 네트워크를 가지고 있습니다. 산업정보화성에 따르면 중국은 지난해 60만 개 이상의 5G 기지국을 건설할 것으로 예상하고 있습니다.

- 중국에서 Wi-Fi는 실내 용도에도 널리 사용됩니다. 가전 산업이 호조를 보이는 이 나라에서는 예측 기간 동안 Wi-Fi의 급속한 보급이 예상될 것으로 예상됩니다. 또한 2020년 11월 중국에 본사를 둔 기업 ZTE는 6개의 셋톱박스를 갖춘 최초의 Wi-Fi인 ZTE ZXV10 B860AV6을 출시했습니다. 이것은 높은 안정성과 낮은 지연과 함께 고속 인터넷 액세스를 제공합니다. 또한 Wi-Fi 6 전송 QoS 솔루션과 집 전체의 스마트 네트워킹 솔루션을 지원합니다.

- 또한 일본 정부는 스마트 시티 개발에 대한 투자 촉진을 목표로 하는 노력에 동의했습니다. 국토관리부의 발표에 따르면 정부는 먼저 현대적인 도시공간과 도시관리 개발을 위한 IT 이용을 주로 다루는 '스마트시티 원칙'에 합의했습니다. 이를 통해 캄보디아와 일본 사이에 도시 개발을 위한 관민 플랫폼이 효과적으로 구축되었습니다.

- 에어아시아는 2022년 11월, 기술 기업 설탕 상자와의 제휴를 발표하고, 모든 항공기에서 기내 Wi-Fi를 제공하기 시작했습니다. 이 서비스를 통해 에어아시아인디아편을 이용하는 여행자는 1,000편이 넘는 국제영화와 인도영화, 웹 시리즈의 에피소드, 쇼트 무비에 액세스하여 기내에 설치된 시스템에서 OTT 앱에서 버퍼 프리 컨텐츠 스트리밍할 수 있습니다.

- 게다가 2020년 12월 최신 정보에 따르면 한국은 세계 최초로 공공버스 내에 전국 규모의 무료 무선 인터넷 네트워크를 확립했습니다. 이는 국가가 정보에 쉽게 접근할 수 있도록 하고 통신 비용을 줄이기 위해 이루어졌습니다. 또한 한국 정부는 공공 구역에 무료 Wi-Fi 액세스 포인트를 1만 곳에 설치할 계획입니다. 올해까지 전국의 교통기관의 역이나 커뮤니티 서비스 센터 등의 공공 장소에 합계 4만 1,000의 액세스 포인트를 설치하고 싶습니다.

Wi-Fi 산업 개요

Wi-Fi 시장은 경쟁이 치열하여 여러 선도 기업이 존재합니다. 시장에서 탁월한 점유율을 가진 대기업은 해외로의 고객 기반 확대에 주력하고 있습니다. 이러한 기업들은 시장 점유율과 수익성을 향상시키기 위해 전략적 협력 이니셔티브를 활용합니다. 시장 진출기업은 자사의 제품 기능을 강화하기 위해 무선 라우터 기술을 다루는 신흥 기업을 인수할 수도 있습니다. 시장의 최근 동향은 다음과 같습니다.

2022년 11월, 세계 IoT 솔루션 제공업체인 Quectel Wireless Solutions는 Qualcomm의 QCA206x Wi-Fi 6E 칩을 기반으로 하는 Wi-Fi 및 Bluetooth 모듈 FC6xE 시리즈 출시를 발표했습니다. Wi-Fi를 보다 빠르고 안전하며 신뢰할 수 있도록 만들어졌습니다. 이 시리즈에는 블루투스 오디오 기능도 있습니다.

2022년 2월, CommScope는 Vodafone Germany과의 제휴를 발표하고, Touchstone TG6442DOCSIS 3.1 케이블 게이트웨이를 배포하여 독일 전역의 수백만 가입자에게 Wi-Fi 6 성능을 제공했습니다. 이 파트너십을 통해 Vodafone Germany는 고객의 가정 내 Wi-Fi 연결을 강화하고 낮은 지연 시간과 더 빠른 광대역 속도를 제공할 수 있으며, Wi-Fi 및 기타 지연에 민감한 용도에서 안정성 높은 Ultra HD 비디오를 실현할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

- 업계의 밸류체인 분석

- COVID-19가 Wi-Fi 업계에 주는 영향

- Wi-Fi 규격과 규제의 진화

제5장 시장 역학

- 시장 성장 촉진요인

- 주요 시장에서의 스마트 가전 디바이스 수요 증가

- 신흥 지역에서의 야외 Wi-Fi 도입에 초점을 맞춘 진행중인 스마트 시티 프로젝트

- Wi-Fi 기술의 지속적인 기술 발전(Wi-Fi 6 표준 구현 등)

- 시장의 과제

- 엄격한 정부 가이드라인과 데이터 규제

- 고밀도 환경에서의 운영상의 과제

- 옥외 지역에서의 도입에 관한 우려

제6장 세계 Wi-Fi 시장 - 세분화

- 제품 유형별

- 액세스 포인트

- 게이트웨이

- 라우터와 익스텐더

- 서비스(설계, 구현, 지원)

- 기타 디바이스 유형

- 기타 솔루션

- 용도 유형별

- 실내(주택, 기업, 교육)

- 옥외(공공 서비스, 수송, 공공시설 등)

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Cisco Systems Inc.

- Aruba Networks(HP Enterprise)

- CommScope(Ruckus Networks(Arris International))

- Juniper Networks Inc.

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- Aerohive Networks(Extreme Networks)

- MetTel Inc.

- Cloud4Wi Inc.

- Fortinet Inc.

- Purple Wi-Fi Ltd

- SingTel

- Ubiquiti Inc.

- Motorola Solutions Inc.

- New H3C Technologies Co. Ltd

제8장 투자 분석

제9장 시장의 미래

BJH 24.03.15The Wi-Fi Market size is estimated at USD 16.16 billion in 2024, and is expected to reach USD 31.38 billion by 2029, growing at a CAGR of 14.19% during the forecast period (2024-2029).

Working from home has become a megatrend these days. The speed of the shift to large-scale remote work has resulted in personal devices, including mobile phones, laptops, tablets, desktops, etc.

Key Highlights

- Employees are also observed using personal Wi-Fi internet connections to access the corporate network. This unexpected disruption due to the COVID-19 pandemic boosted the use of Wi-Fi to keep businesses and critical functions operational. Moreover, multiple industries globally bounced back from the COVID-19 pandemic by engaging in bandwidth-hungry applications, such as voice, video, and IoT devices. Therefore, as the demand for Wi-Fi increases, wireless networks become oversubscribed, leading the allied IT teams to throttle application performance.

- Machine-to-machine applications are increasingly driven toward wireless connections. Multiple investments in connectivity for retail and manufacturing are contributing to the growth. Such growth creates congestion in the 2.4 and 5 GHz spectrums, driving the demand for the 6 GHz spectrum allocation.

- Further, edge networks and computing have led enterprise architectures to optimize processing for business-critical analysis of data sets from IoT applications and communications. More than 50% of the workloads are performed outside the enterprise data center. This further boosts the requirement for low-latency, real-time communications, and high-definition video applications thanks to the multi-access edge enabled by 5G and Wi-Fi 6.

- For services, the connected networks of control devices are expected to communicate directly with each other without translation or IP-based standards. This integrated approach with wireless connectivity and compute platforms may enable design innovation.

- In the current year, the International Telecommunication Union (ITU) estimates that 5.3 billion people, or 66% of the world's population, will be utilizing the Internet. This represents a 24% increase from 2019, with an estimated 1.1 billion people joining the Internet during that time. With so many more people using the internet, both local and international Wi-Fi router makers will have more chances to come out with new products and boost bandwidth in order to get a big share of the market.

- Additionally, public Wi-Fi networks (those with a pre-shared key) do not represent a safe option. While these networks may have different intentions than retail stores, the absence of a level of assurance or legal obligation for them to secure a device or data poses a threat. Again, users need help to be sure of the intercept and their inability to read and modify their data.

WiFi Market Trends

Indoor is Expected to Account For Significant Market Share

- The popularity of Wi-Fi has invariably increased in recent years. Local area networks (LANs) can now operate without the use of wiring or cables, making them the preferred choice for businesses and homes. Wi-Fi has also been utilized to provide wireless broadband Internet access for connected devices, such as laptops, smartphones, tablet computers, and electronic gaming consoles.

- Further, GPS is a technology typically obstructed by walls and needs better reception inside buildings for location tracking. To counter this, Wi-Fi has emerged as a popular technology choice for calculating the position of an asset tag for a real-time location system (RTLS).

- Although Wi-Fi generally has shorter operation ranges, the signal can be extended up to 150 meters. The accuracy is typically determined by the number of access points deployed in the environment. The number of access points in the area is directly proportional to the production of a precise and accurate location. Wi-Fi positioning systems do not require additional hardware or infrastructure maintenance. Since most office spaces, homes, and other facilities already have Wi-Fi infrastructure installed, providing a base level of positioning capability is possible without additional investments.

- Moreover, Wi-Fi calling is another primary application in indoor Wi-Fi settings. Increasing mobile subscription rates have been causing cellular networks to face difficulties distributing their offerings and penetrating modern buildings; people have begun running most of their data through Wi-Fi.

- Further, voice calls can be transmitted over Wi-Fi either in the form of OTT applications such as Skype or as initiatives such as femtocells and UMA to enhance the reach of mobile voice services in users' homes. Moreover, charging the same rate for domestic and international calls has made it an attractive alternative to general network tariffs.

- Further, most households are being transformed into "smart homes," which require the internet to facilitate many functions. The advent of smart TVs and smart speakers, such as Amazon Echo and Google Home, boosted the growth of the wireless router market.

Asia-Pacific to Witness the Fastest Growth

- China has an established 5G ecosystem, which is expected to grow further in the forecast period. However, the 5G technology is likely to serve as a hotspot technology along with the current mobile broadband, and the growth is expected to be gradual. In the Asia-Pacific region, China has one of the most extensive 5G networks. According to the Ministry of Industry and Information Technology, China expected to build over 600,000 5G base stations last year.

- In China, wi-fi is also widely used for indoor applications. With its robust consumer electronics industry, the country is expected to witness the rapid adoption of wi-fi over the forecast period. Additionally, in November 2020, a China-based company, ZTE, launched its first wi-fi with six set-top boxes, the ZTE ZXV10 B860AV6, which offers high-speed internet access along with high stability and low latency. Additionally, it supports wi-fi 6 transmission QoS solutions and a smart networking solution for the whole house.

- Further, the Government of Japan agreed to an initiative that seeks to drive investments in the development of smart cities. According to an announcement by the Ministry of Land Management, the government had earlier agreed to "smart city principles," which deal primarily with the use of IT to develop modern urban spaces and urban management. This has effectively created a public-private platform for urban development between Cambodia and Japan.

- In November 2022, AirAsia announced its partnership with technology firm Sugarbox and started providing in-flight Wi-Fi on all its aircraft. The service will enable travelers on AirAsia India flights to access over 1,000 international and Indian movies, web series episodes, and short movies, and stream buffer-free content from OTT apps from the system installed in the flight.

- Furthermore, according to a December 2020 update, South Korea established a free nationwide wireless internet network on public buses for the first time in the world. This was done to give citizens easy access to information and reduce communication costs. Also, the South Korean government plans to install 10,000 free wi-fi access points in public areas. By this year, it hopes to have installed 41,000 access points in total at public locations across the country, such as transportation stations and community service centers.

WiFi Industry Overview

The Wi-Fi market is highly competitive, with several major players. The major players with prominent shares in the market focus on expanding their customer bases across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and profitability. The companies operating in the market also acquire start-ups working on wireless router technologies to strengthen their product capabilities. Some of the recent developments in the market are:

In November 2022, Quectel Wireless Solutions, a global IoT solutions provider, announced the launch of the FC6xE series of Wi-Fi and Bluetooth modules based on Qualcomm's QCA206x Wi-Fi 6E chip. It is made to make Wi-Fi faster, more secure, and more reliable. The series also has Bluetooth audio capabilities.

In February 2022, CommScope announced its partnership with Vodafone Germany to deploy its Touchstone TG6442 DOCSIS 3.1 cable gateways to deliver Wi-Fi 6 performance to millions of subscribers across Germany. The partnership would enable Vodafone Germany to enhance its customers' in-home Wi-Fi connections and offer faster broadband speeds with lower latency, enabling reliable ultra-HD video over Wi-Fi and other delay-sensitive applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Wi-Fi Industry (Recent Changes in Work Environment has Led to Increasing Demand for Indoor Wi-Fi Products and the Impact of BYOD Trends)

- 4.5 Evolution of Wi-Fi Standards and Regulations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in Demand for Smart Consumer Electronics Devices in the Major Markets

- 5.1.2 Ongoing Smart City Projects Focused on Deployment of Outdoor Wi-Fi in Emerging Regions

- 5.1.3 Ongoing Technological Advancements in Wi-Fi Technology (Wi-Fi 6 Standard Implementation, Etc.)

- 5.2 Market Challenges

- 5.2.1 Stringent government guidelines and data regulations

- 5.2.2 Operational Challenges in Denser Environments

- 5.2.3 Concerns Related to Implementation in Outdoor Areas

6 GLOBAL WI-FI MARKET - SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Access Points

- 6.1.2 Gateways

- 6.1.3 Routers and Extenders

- 6.1.4 Services (Design, Implementation, and Support)

- 6.1.5 Other Device Types

- 6.1.6 Other Solutions

- 6.2 By Application Type

- 6.2.1 Indoor (Residential, Enterprises, Education)

- 6.2.2 Outdoor (Public Services, Transportation, Public Utilities, Etc.)

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Aruba Networks (HP Enterprise)

- 7.1.3 CommScope (Ruckus Networks (Arris International))

- 7.1.4 Juniper Networks Inc.

- 7.1.5 Telefonaktiebolaget LM Ericsson

- 7.1.6 Huawei Technologies Co. Ltd

- 7.1.7 Aerohive Networks (Extreme Networks)

- 7.1.8 MetTel Inc.

- 7.1.9 Cloud4Wi Inc.

- 7.1.10 Fortinet Inc.

- 7.1.11 Purple Wi-Fi Ltd

- 7.1.12 SingTel

- 7.1.13 Ubiquiti Inc.

- 7.1.14 Motorola Solutions Inc.

- 7.1.15 New H3C Technologies Co. Ltd