|

시장보고서

상품코드

1445722

동물 표준실험실 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Veterinary Reference Laboratory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

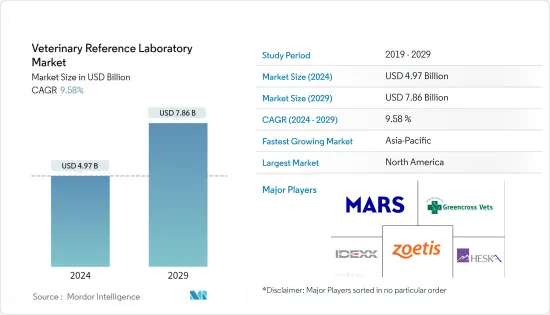

동물 표준실험실 시장 규모는 2024년 49억 7,000만 달러로 추정됩니다. 2029년까지 78억 6,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) 동안 9.58%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

코로나19 팬데믹은 수의학 질환에 대한 연구 개발 활동과 반려동물에 필요한 다양한 의약품의 물류 공급에 혼란을 일으켰습니다. 예를 들어, 프론티어스가 2022년 5월에 발표한 기사에 따르면, 영국에서 개가 암을 포함한 만성 질환 진단을 받으면 팬데믹 기간 동안 치료를 받을 확률이 감소했다고 합니다. 이는 긴급하지 않은 문제에 대한 치료를 받기가 어려웠고 수의사에 대한 접근성이 부족했기 때문인 것으로 알려졌습니다. 그러나 코로나19 감염자 수가 감소하고 규제가 완화됨에 따라 조사 대상 시장은 수년 내에 잠재력을 최대한 회복할 것으로 예상됩니다.

시장 성장을 이끄는 주요 요인은 반려동물/반려동물 입양 증가, 반려동물 보험 수요 증가, 동물 건강관리 비용 증가, PCR 검사, 신속 검사 및 기타 검사 절차에 대한 수요 증가 등입니다.

반려동물 입양 증가는 시장 성장을 가속하는 주요 요인입니다. 예를 들어, 'European Pet Food Industry: Facts and Figures 2022' 보고서에 따르면 2021년 독일의 개는 1,030만 마리, 고양이는 1,670만 마리로 집계됐습니다. 같은 자료에 따르면 2021년 독일 가정의 21%는 고양이를 한 마리 이상 키우고 있으며, 개 한 마리를 키우는 비율은 19%였습니다. 이는 인구 중 고양이 입양률이 개보다 높다는 것을 보여줍니다.

또한, 2022년에 발표된 반려동물사료 제조업체 협회(PFMA)의 2022년 반려동물 인구 데이터에 따르면, 2022년 영국에는 3,490만 마리의 반려동물이 있을 것으로 추정된다(개 1,300만 마리, 고양이 1,200만 마리). 마찬가지로 2022년 유럽 반려동물사료 산업 : 사실과 수치 2021에서 발표 한 데이터에 따르면 2021년영국에서 1,200 만 마리의 개와 1,200 만 마리의 고양이가보고되었습니다. 같은 소식통에 따르면 2021년 영국에서 반려동물을 키우는 가구의 추정 비율은 고양이 1마리가 33%, 개 1마리가 27%였습니다고 합니다. 따라서 반려동물 수용이 증가함에 따라 수의학 표준 검사 기관에 대한 수요가 증가할 것으로 예상됩니다.

주요 시장 기업의 발전은 시장 성장을 가속할 것으로 예상됩니다. 예를 들어, 2021년 9월 Heska Corporation은 신속 진단 테스트의 선도적인 개발업체인 Biotech Laboratories USA LLC의 과반수 지분을 인수했습니다.

따라서, 반려동물 입양 증가와 주요 시장 기업들의 개발 증가 등의 요인이 시장 성장을 가속할 것으로 예상됩니다. 그러나 현장 진료(POC) 서비스를 위한 휴대용 기기에 대한 수요 증가와 반려동물 관리 비용의 상승은 이러한 성장을 저해할 것으로 예상됩니다.

수의학표준연구소 시장 동향

반려동물 부문은 예측 기간 동안 상당한 시장 점유율을 유지할 것으로 예상됩니다.

반려동물 부문은 반려동물의 만성질환 및 감염성 질환의 높은 유병률, 반려동물 입양 증가, 평균 수명 연장으로 인한 질병 위험이 더욱 높아짐에 따라 수의학 표준 검사 시장에서 큰 비중을 차지할 것으로 예상됩니다. 예를 들어, 2021년 3월 Frontiers가 발표한 기사에 따르면, 반려견의 주요 사망 원인은 암으로 추정되는데, 이는 많은 사례가 임상 증상이 나타난 진행 단계에서 발견되어 예후가 좋지 않은 것도 한 요인으로 작용하고 있습니다. 따라서 반려동물의 암 유병률이 증가함에 따라 수의학 참조 검사 기관의 이용이 증가할 것으로 예상됩니다.

호주동물약품협회(AMA)가 지난 11월 발표한 자료에 따르면 호주는 반려동물의 건강, 영양 및 충분한 액세서리를 유지하기 위해 연간 330억 달러 이상을 지출하고 있습니다. 330억 달러의 지출 중 14%는 수의사에게, 9%는 건강 관리 제품에 쓰인다. 같은 소식통에 따르면 2022년 호주의 수의사 서비스와 반려견 건강관리 제품에 대한 연간 가계 지출은 각각 631달러와 323달러였습니다. 마찬가지로 고양이 수의사 서비스와 건강 관리 제품에 대한 연간 가계 지출은 388 달러와 388 달러였습니다. 따라서 반려동물 관리 지출 증가는이 부문의 성장을 가속할 것으로 예상됩니다.

European Pet Food Industry: Facts and Figures 2021 보고서가 발표한 데이터에 따르면 2021년 독일에는 1,030만 마리의 개와 1,670만 마리의 고양이가 있는 것으로 보고됐습니다. 같은 자료에 따르면, 독일에서 고양이를 한 마리 이상 기르는 가정의 비율은 21%였습니다. 2021년 개 1마리를 키우는 비율은 19%였습니다. 이는 인구 중 고양이의 입양률이 개보다 높다는 것을 보여줍니다.

독일 하임티어마르크트의 2022년 자료에 따르면 2021년 독일 가구의 47%가 반려동물을 키우고 있으며, 그 중 3,470만 마리의 개, 고양이, 작은 동물, 관상용 조류가 포함되어 있습니다. 같은 자료에 따르면, 독일에서는 개보다 고양이가 더 많이 입양된 것으로 나타났습니다. 독일 가구의 26%에서 약 1,670만 마리의 고양이가 살고 있습니다. 반면 21%의 가구에는 1,030만 마리의 개가 살고 있습니다. 따라서 반려동물의 보급 증가는 이 부문의 성장을 가속할 것으로 예상됩니다.

따라서 반려동물의 각종 만성질환 및 감염성 질환의 유병률 증가, 반려동물 입양 증가 등의 요인이 이 부문의 성장을 견인할 것으로 예상됩니다.

북미는 예측 기간 동안 상당한 시장 점유율을 차지할 것으로 예상

북미는 수년 동안 수의학 표준 시장에서 큰 비중을 차지해 왔으며, 동물 개체수(특히 반려동물) 증가와 질병 부담 증가, 더 나은 수의학 치료의 존재, 수의학 치료의 존재로 인해 예측 기간 동안에도 비슷한 추세를 보일 것으로 예상됩니다. 서비스 개선 및 이 지역의 수의학 의료 지출 증가.

캐나다 동물위생연구소(CAHI)의 2022년 9월 데이터에 따르면, 2022년 캐나다 가구의 절반 이상(60%)이 적어도 한 마리 이상의 개나 고양이를 키우고 있습니다. 데이터는 또한 개 수가 790만 마리로 증가했다는 것을 자세히 보여줍니다. 고양이의 수는 2022년에 850만 마리까지 증가했습니다. 따라서 동물의 인구 기반이 크기 때문에 동물의 암 부담은 더 높아질 것으로 예상되며, 이는 이 지역의 성장을 가속할 것으로 예상됩니다.

북미에서 미국은 이 지역에서 가장 많은 수의 동물을 보유한 국가 중 하나이며, 높은 동물 의료비와 동물 암 발병률로 인해 수의 종양학 시장에서 큰 점유율을 차지할 것으로 예상됩니다. 예를 들어, 2021-2022년 미국 반려동물제품협회(APPA)의 전국 반려동물 소유자 조사에 따르면 미국 가구의 약 70%, 즉 약 9,050만 가구가 반려동물을 소유하고 있으며, 고양이와 개가 반려동물을 기르는 주요 반려동물로 나타났습니다. 인구는 각각 4,530만 명과 6,900만 명입니다. 이 소식통에 따르면 반려동물 주인은 수의사 수술에 개는 약 458달러, 고양이는 약 201달러를 지출했으며, 정기적인 수의사 진료에 개와 고양이는 각각 242달러와 178달러를 지출했다고 합니다. 이 데이터는 이 나라에 반려동물이 많고 반려동물에 대한 지출이 다른 지역에 비해 일반적으로 높다는 것을 보여줍니다.

주요 시장 기업의 발전도 시장 성장을 가속할 것으로 예상됩니다. 예를 들어, 2021년 12월 Neogen Corporation은 워싱턴에 본사를 둔 반려동물 유전자 검사 회사인 Genetic Veterinary Sciences Inc.를 인수했습니다.

따라서 동물의 각종 질병 유병률 증가, 반려동물 입양 증가, 주요 시장 기업의 개발 증가 등의 요인이 이 지역 시장의 성장을 가속할 것으로 예상됩니다.

수의학표준연구소 산업 개요

시장은 본질적으로 적당히 통합되어 있습니다. 주요 시장 기업들은 더 높은 경쟁력을 확보하기 위해 지역 확장 전략, 인수 합병, 공동 연구 이니셔티브와 같은 중요한 비즈니스 전략에 착수했습니다. 주요 기업으로는 IDEXX Laboratories Inc., GD Animal Health, Greencross Limited, Heska Corporation, Zoetis Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

제5장 시장 세분화

- 서비스 유형별

- 임상화학

- 혈액학

- 면역진단

- 분자진단

- 기타 서비스 유형

- 용도별

- 병리학

- 세균학

- 바이러스학

- 기생충학

- 기타 용도

- 동물 유형별

- 반려동물

- 가축

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 프랑스

- 독일

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 기업 개요와 경쟁 구도

- 기업 개요

- IDEXX Laboratories Inc.

- GD Animal Health

- Greencross Limited

- Heska Corporation

- Zoetis Inc.

- Mars Inc.

- Neogen Corporation

- Boehringer Ingelheim International GmbH

- Veterinary Diagnostic Laboratory-University of Minnesota

제7장 시장 기회와 향후 동향

LSH 24.03.19The Veterinary Reference Laboratory Market size is estimated at USD 4.97 billion in 2024, and is expected to reach USD 7.86 billion by 2029, growing at a CAGR of 9.58% during the forecast period (2024-2029).

The COVID-19 pandemic disrupted the R&D activities of veterinary diseases and the logistics supply of various essential pharmaceutical products for pets. For instance, according to an article published by Frontiers in May 2022, in the United Kingdom, a dog's chronic illness diagnosis, including cancer, reduced the odds of seeking care during the pandemic, reportedly due to difficulties in accessing care for non-urgent issues and lack of access to veterinarians. However, with the declining COVID-19 cases and ease of restrictions, the studied market is expected to regain its full potential over the years.

The major factors driving the growth of the market are the increase in companion animal/pet adoption, the increasing demand for pet insurance, the growing animal healthcare expenditure, and the growing demand for PCR testing, rapid testing, and other testing procedures.

The rising adoption of companion animals is a major factor driving the market's growth. For instance, according to the data published by the European Pet Food Industry: Facts and Figures 2022 report, Germany had 10,300,000 dogs and 16,700,000 cats in 2021. As per the same source, the percentage of German households owning at least one cat was 21%, and one dog was 19% in 2021. This shows that the adoption of cats was higher among the population than dogs.

Additionally, as per the Pet Food Manufacturer's Association (PFMA)'s Pet Population 2022 data published in 2022, 34.9 million pets were estimated in the United Kingdom in 2022 (13 million dogs and 12 million cats). Similarly, according to the data published by the European Pet Food Industry: Facts and Figures 2021 in 2022, 12,000,000 dogs and 12,000,000 cats were reported in the United Kingdom in 2021. As per the same source, the estimated percentage of UK households owning at least one cat was 33%, and one dog was 27% in 2021. Thus, the increasing adoption of pets is expected to increase the demand for veterinary reference laboratories.

The developments by key market players are expected to increase the market's growth. For instance, in September 2021, Heska Corporation acquired majority ownership of Biotech Laboratories USA LLC, a leading developer of rapid assay diagnostics testing.

Thus, factors such as the rising pet adoption and the increasing developments by key market players are expected to boost the market's growth. However, rising demand for portable devices for point-of-care (POC) services and high pet care costs are expected to hinder this growth.

Veterinary Reference Laboratory Market Trends

Companion Animal Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The companion animal segment is expected to hold a major share of the veterinary reference laboratory market due to the high prevalence of chronic and infectious diseases in companion animals, growing pet adoption, and increasing life expectancy, further increasing the risk of diseases. For instance, according to an article published by Frontiers in March 2021, cancer is considered the leading cause of death in dogs, partly because many cases are identified at an advanced stage when clinical signs have developed and the prognosis is poor. Thus, the rising prevalence of cancer in companion animals is expected to increase the usage of veterinary reference laboratories.

According to the data published by Animal Medicines Australia (AMA) in November 2022, Australia spends over USD 33 billion annually to keep pets healthy, nourished, and well-accessorized. Out of the USD 33 billion spending, 14% is spent on veterinarians and 9% on healthcare products. According to the same source, the annual household spending for veterinarian services and healthcare products for dogs was USD 631 and USD 323, respectively, in Australia in 2022. Similarly, the annual household spending for veterinarian services and healthcare products for cats was USD 388 and USD 280, respectively, in Australia in 2022. Thus, the rising pet care expenditure is also expected to enhance the segment's growth.

According to the data published by the European Pet Food Industry: Facts and Figures 2021 report, 10,300,000 dogs and 16,700,000 cats were reported in Germany in 2021. As per the same source, the percentage of German households owning at least one cat was 21%, and one dog was 19% in 2021. This shows that the adoption of cats was higher among the population than dogs.

According to Der Deutsche Heimtiermarkt data, updated in 2022, 47% of the households in Germany had pets in 2021, including 34.7 million dogs, cats, small animals, and ornamental birds. Also, as per the same source, the number of cats adopted was higher in Germany compared to the adoption of dogs. About 16.7 million cats live in 26% of German households, compared to 10.3 million dogs in 21% of households. Thus, the rising pet adoption is also expected to boost segment growth.

Hence, factors such as the rising prevalence of various chronic and infectious diseases in companion animals and the growing pet adoption are expected to boost the segment's growth.

North America is Expected to Have a Significant Market Share Over the Forecast Period

The North American region has held a significant share in the veterinary reference market over the years and is expected to show the same trend over the forecast period due to the large animal population (especially pets) and increasing disease burden, presence of better veterinary care and services, and increasing veterinary healthcare expenditure in the region.

According to the data from the Canadian Animal Health Institute (CAHI) in September 2022, more than half of Canadian households (60%) owned at least one dog or cat in 2022. The data also detailed that the dog population increased to 7.9 million while the cat population increased to 8.5 million in 2022. Thus, with a large population base of animals, the burden of cancer among animals is expected to be higher, which is anticipated to drive growth in the region.

In North America, the United States is expected to hold a significant share of the veterinary oncology market as the country has one of the highest numbers of animals in the region, coupled with high animal health expenditure and a high burden of animal cancer cases. For instance, according to the 2021-2022 American Pet Product Association (APPA) National Pet Owners Survey, about 70% of the US households owned a pet, i.e., about 90.5 million homes, and cats and dogs were the major pets with a total population of 45.3 million and 69 million, respectively. As per the same source, pet owners spent about USD 458 for dogs and USD 201 for cats for surgical vet visits, and for the routine vet, they spent USD 242 and USD 178 for dogs and cats, respectively. This data shows the presence of a large pet population in the country and spending on them, which is usually high compared to other regions.

The developments by key market players are also expected to boost the market's growth. For instance, in December 2021, Neogen Corporation acquired a Washington-based companion animal genetic testing company Genetic Veterinary Sciences Inc.

Hence, factors such as the rising prevalence of various diseases in animals, the growing pet adoption, and the increasing developments by key market players are expected to boost the market's growth in the region.

Veterinary Reference Laboratory Industry Overview

The market is moderately consolidated in nature. The key market players have undertaken crucial business strategies like regional expansion strategies, mergers and acquisitions, and collaborative research initiatives to gain a higher competitive edge. Some of the key players are IDEXX Laboratories Inc., GD Animal Health, Greencross Limited, Heska Corporation, and Zoetis Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Companion animal/Pet Adoption

- 4.2.2 Increasing Demand for Pet Insurance

- 4.2.3 Growing Animal Healthcare Expenditure

- 4.2.4 Growing Demand for PCR testing, Rapid Testing, and Other Testing Procedures

- 4.3 Market Restraints

- 4.3.1 Rising Demand for Portable Devices for Point-of-care (POC) Services

- 4.3.2 High Pet Care Cost

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Service Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Haematology

- 5.1.3 Immunodiagnostics

- 5.1.4 Molecular Diagnostics

- 5.1.5 Other Service Types

- 5.2 By Application

- 5.2.1 Pathology

- 5.2.2 Bacteriology

- 5.2.3 Virology

- 5.2.4 Parasitology

- 5.2.5 Other Applications

- 5.3 By Animal Type

- 5.3.1 Companion Animal

- 5.3.2 Livestock Animal

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPANY PROFILES AND COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IDEXX Laboratories Inc.

- 6.1.2 GD Animal Health

- 6.1.3 Greencross Limited

- 6.1.4 Heska Corporation

- 6.1.5 Zoetis Inc.

- 6.1.6 Mars Inc.

- 6.1.7 Neogen Corporation

- 6.1.8 Boehringer Ingelheim International GmbH

- 6.1.9 Veterinary Diagnostic Laboratory-University of Minnesota