|

시장보고서

상품코드

1445738

PBM(Pharmacy Benefit Management) : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Pharmacy Benefit Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

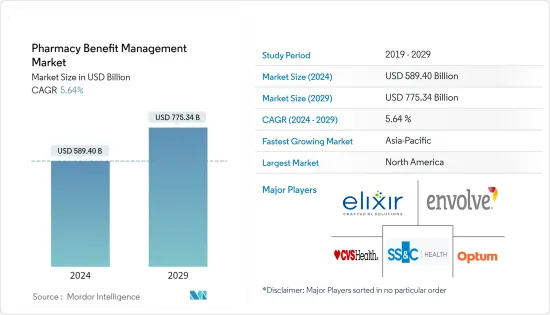

PBM(Pharmacy Benefit Management) 시장 규모는 2024년 5,894억 달러로 추정됩니다. 2029년까지 7,753억 4,000만 달러에 달할 것으로 예측되며, 예측 기간(2024-2029년) 동안 5.64%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

주요 하이라이트

- COVID-19는 약물 혜택 관리 시장의 성장에 영향을 미쳤으며, 2021년1월Research in Social and Administrative Pharmacy에 게재 된 기사에 따르면 다양한 의약품, 특히 메트포르민 및 오메프라졸과 같은 처방약에 대한 수요가 증가함에 따라 병원은 인력 공급과 약물 관리에 어려움을 겪고 있습니다. 메트포르민, 오메프라졸과 같은 처방약에 대한 수요가 증가함에 따라 병원은 인력, 의약품 공급 및 약국 관리 측면에서 어려움에 직면하고 있습니다. 또한 다양한 약국 관리 서비스를 제공하는 기업들은 수익이 크게 증가했다고 보고했습니다.

- 예를 들어, 2021년연례 보고서에 따르면 Optum Inc.의 Optum RX(광범위한 소매 체인 및 독립 약국 네트워크를 갖춘 풀 서비스 처방약 혜택 제공)의 수익은 2020년874 억 9,800만 달러에서 2021년913 억 1, 400만 달러로 4% 증가했습니다. 400만 달러로 4% 증가했습니다. 따라서 팬데믹 기간 동안 관찰된 이점으로 인해 PBM 솔루션의 채택은 해마다 증가 할 수 있습니다.

- 약물 급여 관리에 대한 관심이 높아짐에 따라 정확도가 향상되고 약국 매장의 안전성과 효율성이 향상될 뿐만 아니라 환자의 건강 결과도 개선될 것입니다. 이는 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

- 예를 들어, 2022년 3월 Rite Aid의 약국 복리후생 관리자(PBM) 사업부인 Elixir는 PCMA(Pharmaceutical Care Management Association)의 회원으로 가입했다고 밝혔습니다. PCMA에 엘릭서가 추가됨에 따라 환자들은 합리적인 가격의 처방약을 이용할 수 있게 되었습니다. 따라서 제약사, 소매 약국 및 건강 보험사들 사이에서 의약품 혜택 관리 서비스에 대한 수요가 증가하고 있으며, 이는 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

- 치료비, 입원비, 건강검진비, 입원비 등 의료비 상승에 따라 보험을 이용하는 사람들이 늘고 있습니다. 또한 PBM은 의료 제품과 의약품을 결합하여 엔드 투 엔드 의료 솔루션을 지원합니다. 이를 통해 보험사는 환자에 대한 종합적인 정보를 얻을 수 있고, 보험사는 환자에게 효과적인 프로그램을 제공할 수 있습니다. 이는 또한 의약품 혜택 관리 시스템에 대한 수요를 자극하고 시장 성장을 가속할 것으로 예상됩니다.

- 또한, 전 세계적으로 의료 지출이 증가함에 따라 의약품 재고 및 공급을 모니터링하고 환자에게 저렴한 의약품을 제공하기 위해 기술적으로 진보된 소프트웨어 및 솔루션의 도입이 증가할 것으로 예상됩니다. 이로 인해 예측 기간 동안 시장 성장이 확대될 것으로 예상됩니다. 예를 들어, 메디케어 메디케이드 서비스 센터가 발표한 2021년 데이터에 따르면 2021년 국민 의료 서비스는 2.7% 증가한 4조 3,000억 달러(1인당 1만 2,914달러)로 GDP의 18.3%를 차지할 것으로 예상됩니다. 같은 자료에 따르면 2021년 민간 의료보험 지출은 5.8% 증가한 1조 2,114억 달러, 처방약 지출은 7.8% 증가한 3,780억 달러에 달할 것으로 예측했습니다.

- 또한, 첨단 소프트웨어 및 솔루션 개발에 대한 기업 활동의 활성화도 시장 성장에 기여하고 있습니다. 예를 들어, Optum은 2022년 2월 복잡한 증상을 가진 환자의 치료를 간소화하고 고가의 특수 의약품 비용을 절감하기 위해 특수 약물 관리 솔루션인 Optum Specialty Fusion을 출시했습니다. 와 임상 경험을 활용하여 환자에게 가장 적은 비용으로 가장 효율적인 특수치료에 대한 실시간 통찰력을 지불자와 의료진에게 제공합니다. 따라서 의료비 지출 증가, 처방약 수요 증가 등의 요인으로 인해 해당 시장은 예측 기간 동안 성장할 것으로 예상됩니다. 그러나 약국 자동화 시스템 도입에 대한 거부감과 기밀 유지에 대한 엄격한 규제 절차는 예측 기간 동안 의약품 혜택 관리 시장의 성장을 저해할 수 있습니다.

약제 급여 관리 시장 동향

전문 약국 부문은 예측 기간 동안 큰 폭의 성장세를 보일 것으로 예상

- 전문 약국에서는 다발성 외상, 두부 외상, 심한 화상과 같은 희귀하거나 복잡한 의학적 상태를 치료하기 위한 의약품을 제공합니다. 이들은 표준화 된 프로세스를 통해 특수한 취급, 보관 및 유통 요구 사항이있는 의약품을 효율적으로 공급할 수 있도록 설계되었습니다. 이러한 의약품은 일반적으로 복잡한 질병을 치료하는 데 사용되는 고가의 제품입니다. 전문 약국 부문은 만성 질환 부담 증가, 기업 활동 증가로 인한 처방약 수요 증가 등의 요인으로 인해 예측 기간 동안 의약품 혜택 관리 시장에서 상당한 성장을 보일 것으로 예상됩니다.

- 회사의 전문 약국 소프트웨어 및 솔루션 개발 활동이 계속 증가함에 따라 예측 기간 동안 부문의 성장이 가속화 될 것으로 예상됩니다. 예를 들어, 2022년 4월Southern Scripts는 미국 기업과 직원이 특수 의약품의 높은 비용을 절감 할 수 있도록 설계된 새로운 솔루션 인 RxCompass를 출시했습니다. 네트워크를 활용하여 회원들이 단계별 프로세스를 통해 가장 합리적인 가격으로 자신의 필요에 가장 적합한 전문의약품 관리 프로그램을 선택할 수 있는 최초의 회원 중심 약국 내비게이션 솔루션을 개발했습니다.

- 또한 2022년 3월, VPL은 약사가 약사를 위해 약사를 위해 만든 임상 중심의 전문 약국 소프트웨어인 TrajectRx를 출시했으며, TrajectRx는 약국에서 환자 치료 시점까지의 이행 프로세스를 명확히 하고, 환자 치료의 연속성을 연장하며, 지불자 준수 및 인증 기관과 협력하여 의약품이 비용 효율적이고 안전하게 제공될 수 있도록 지원합니다. 지불자 준수 및 인증 기관과 협력하여 의약품이 비용 효율적이고 안전하게 제공될 수 있도록 보장합니다. 따라서 앞서 언급한 요인으로 인해 조사 대상 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

북미는 예측 기간 동안 상당한 시장 점유율을 차지할 것으로 예상

- 북미에서는 투약 실수 증가, 약물 혜택 관리 채택 증가, 의료비 증가 등의 요인으로 인해 예측 기간 동안 약물 혜택 관리 시장이 크게 성장할 것으로 예상됩니다.

- 2022년 7월 Oxford University Press에 게재된 기사에 따르면, 미국의 전체 처방약 지출은 전년도 4%에서 2022년 6%로 증가할 것으로 예상됩니다. 따라서 의약품 지출 증가는 이 지역의 처방약에 대한 수요가 높다는 것을 의미하며, 이는 약국 관리 시스템의 필요성을 촉진하고 시장 성장을 가속할 것으로 예상됩니다.

- 이 지역에서 PBM 시스템을 채택하는 경향이 증가하고 있는 것은 시장 성장을 가속하는 중요한 요인입니다. 예를 들어, 2022년 5월 미국 상원의원 마리아 캔트웰(워싱턴주 민주당)과 척 그래슬리(아이오와주 민주당)는 연방거래위원회에 권한을 부여하여 처방전 비용을 절감하는 2022년 약제급여관리자 투명성법(Drug Benefit Managers Transparency Act)이라는 법안을 제출했습니다. 그리고 주 법무장관은 부당하고 기만적인 PBM 상행위를 저지할 수 있습니다. 또한 2021년 10월에는 미국 소매업체 월마트와 코스트코를 포함한 약 40개 비영리 연합이 고용주에게 약국 복리후생 관리(PBM) 서비스를 제공하는 새로운 회사를 설립했습니다.

- 마찬가지로 2021년 10월, Mark Cuban Cost Plus Drug Company PBC와 약 40개 대규모 공공 및 민간 고용주의 비영리 연합인 구매자 Business Group on Health는 새로운 약국 복리후생 관리 회사 PBM을 설립했습니다. 단체, 정부를 대신하여 환자가 이용할 수 있는 약품을 선택하고, 해당 약품에 대한 비용 할인을 협상하고, 약국에 대한 지불을 처리합니다. 따라서 약물 혜택 관리 시스템의 채택 증가 및 기업 활동의 성장과 같은 요인으로 인해 조사 대상 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

약제 급여 관리 산업 개요

약물 급여 관리 시장은 경쟁이 치열하고 여러 세계 및 국제 시장 기업이 존재하고 있습니다. 주요 기업들은 파트너십, 계약, 협업, 신제품 출시, 지리적 확장, 합병, 인수합병 등 다양한 성장 전략을 통해 시장에서의 입지를 강화하기 위해 노력하고 있습니다. 주요 기업으로는 CVS Health, Optum, SS&C Technologies, Inc., Elixir Rx Solutions, LLC, Centene Corporation(Envolve Health) 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체 제품의 위협

- 경쟁 기업간 경쟁도

제5장 시장 세분화

- 서비스별

- 전문 약국

- 의약품 제제 관리

- 복리후생 플랜 설계 및 컨설팅

- 기타 서비스

- 비즈니스 모델별

- 정부 보건 프로그램

- 고용주 주최 프로그램

- 건강보험 관리

- 최종사용자별

- 약제 급부 관리 기구

- 통신 판매 약국

- 소매 약국

- 기타 최종사용자

- 지역

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 개요

- Optum, Inc.

- Centene Corporation(Envolve Health)

- CVS Health

- SS&C Technologies, Inc.

- Anthem, Inc.

- Elixir Rx Solutions, LLC

- Express Scripts Holding Company

- Benecard Services, LLC

- CaptureRx

- Change Healthcare

- Abarca Health

- ProCare Rx

- Cigna

제7장 시장 기회와 향후 동향

LSH 24.03.19The Pharmacy Benefit Management Market size is estimated at USD 589.40 billion in 2024, and is expected to reach USD 775.34 billion by 2029, growing at a CAGR of 5.64% during the forecast period (2024-2029).

Key Highlights

- COVID-19 impacted the growth of the pharmacy benefit management market. According to an article published in Research in Social and Administrative Pharmacy, in January 2021, due to the rise in demand for different pharmaceuticals, especially prescription drugs such as metformin, omeprazole, and others, hospitals have faced difficulties in personnel, drug supply, and pharmaceutical care. Also, the companies providing a diversified array of pharmacy care services have reported a significant increase in their revenue.

- For instance, as per the 2021 Annual Report, the revenue of Optum Inc. from Optum RX (a full-service prescription drug benefit provide) with a broad network of retail chains and independent pharmacies) was USD 91,314 million in 2021, with an increase of 4%, as compared to USD 87,498 million in 2020. Thus, the adoption of PBM solutions may increase over the years due to the benefits observed during the pandemic.

- The rising inclination towards pharmacy benefits management increases the accuracy, improves the safety and efficiency of the pharmacy store as well as improves patient health outcomes. This is anticipated to fuel the market growth over the forecast period.

- For instance, in March 2022, Elixir, the pharmacy benefit manager (PBM) division of Rite Aid, revealed its membership in the Pharmaceutical Care Management Association (PCMA). The addition of Elixir to PCMA boosts patients' access to affordable prescription drugs. Thus, the growing demand for pharmacy benefit management services among drug manufacturers, retail pharmacies, and health insurance providers is expected to fuel the market growth over the forecast period.

- The increase in the number of persons utilizing insurance to deal with the rise in medical costs, such as paying for treatment, hospitalization, health check-up, and hospitalization charges. Additionally, PBM combines medical and pharmaceutical products to support end-to-end healthcare solutions that enable the insurers to have comprehensive information about the patients, which enables the insurers to offer patients effective programs. This is also expected to fuel the demand for pharmacy benefit management systems, hence bolstering market growth.

- Furthermore, the rising health spending across the globe is expected to increase the adoption of technologically advanced software and solutions to monitor the inventory and supply of drugs as well as provide affordable medications to patients. This is anticipated to augment the market growth over the forecast period. For instance, according to the 2021 data published by the Centers for Medicare and Medicaid Services, the National Health Service increased by 2.7% to USD 4.3 trillion in 2021 (USD 12,914 per person), which accounted for 18.3% of GDP. In addition, as per the same source, private health insurance spending increased by 5.8% to USD 1,211.4 billion in 2021, and prescription drug spending increased by 7.8% to USD 378 billion in 2021.

- Moreover, the rising company activities in developing advanced software and solutions are also contributing to market growth. For instance, in February 2022, Optum launched Optum Specialty Fusion, a specialty medication management solution, to simplify care for patients with complex conditions and lower the cost of expensive specialty drugs. Specialized Fusion offers payers and providers of healthcare real-time insight into the most efficient specialty treatments at the patient's lowest cost by utilizing Optum's data and clinical experience. Therefore, owing to the factors such as growing health expenditure and increasing demand for prescription drugs, the studied market is expected to grow over the forecast period. However, the reluctance to adopt pharmacy automation systems and stringent regulatory processes on confidentiality are likely to hinder the growth of the pharmacy benefit management market over the forecast period.

Pharmacy Benefit Management Market Trends

Specialty Pharmacy Segment is Expected to Witness Significant Growth Over the Forecast Period

- Specialty pharmacies provide drugs to treat rare or complex medical conditions, such as multiple trauma, head injuries, severe burns, and others. They are designed to efficiently supply drugs with special handling, storage, and distribution requirements with standardized processes. These medications are usually high-cost products used to treat complex diseases. The specialty pharmacy segment is expected to witness significant growth in the pharmacy benefit management market over the forecast period owing to the factors such as the growing demand for prescription drugs owing to the rising burden of chronic diseases and the increasing company activities.

- The growing company's activities in developing specialty pharmacy software and solutions are expected to increase segment growth over the forecast period. For instance, in April 2022, Southern Scripts launched RxCompass, a new solution designed to support United States companies and their employees in mitigating the high costs of specialty medications. Southern Scripts uses its PBM expertise and industry network to create the first member-centric pharmacy navigation solution that can lead members through a step-by-step process to choose the specialty drug management program that best addresses their unique needs at the most affordable price.

- Also, in March 2022, VPL launched TrajectRx, a clinically minded specialty pharmacy software built for pharmacists by pharmacists.TrajectRx clarifies the fulfillment process from the pharmacy to the point of patient care and aids in extending the continuity of patient care, providing compliance with payors and accrediting authorities, and ensuring medications are delivered cost-effectively and securely. Therefore, owing to the aforementioned factors, the studied market is anticipated to grow over the forecast period.

North America is Expected to Have the Significant Market Share Over the Forecast Period

- North America is anticipated to witness significant growth in the pharmacy benefit management market over the forecast period owing to the factors such as the increasing number of medication errors, increasing adoption of pharmacy benefit management, and rising healthcare expenditure.

- According to an article published in Oxford University Press in July 2022, it has been observed that overall prescription drug spending was expected to increase from 4% in the previous year to 6% in 2022 in the United States. Thus, the increased drug spending indicates the high demand for prescription drugs in the region, which is anticipated to propel the need for pharmacy management systems, bolstering market growth.

- The growing inclination towards adopting PBM systems in the region is the key factor driving the market growth. For instance, in May 2022, the United States Sens Maria Cantwell (D-Wash.) and Chuck Grassley (D-Iowa) introduced a bill, the Pharmacy Benefit Manager Transparency Act of 2022, to reduce prescription costs by empowering the Federal Trade Commission and state attorneys general to halt unfair and deceptive PBM business practices. Also, in October 2021, a nonprofit coalition of nearly 40 companies, including United States retailers Walmart and Costco, launched a new firm that would offer pharmacy benefit management (PBM) services for employers.

- Similarly, in October 2021, Mark Cuban Cost Plus Drug Company PBC and the Purchaser Business Group on Health, a nonprofit coalition of nearly 40 large public and private employers, launched a new pharmacy-benefit management company. PBMs, on behalf of businesses, labor organizations, and governments, choose which medications patients have access to, negotiate discounts on the costs of those medications, and handle payments to pharmacies. Therefore, owing to the factors such as the rising adoption of pharmacy benefit management systems and growing company activities, the studied market is expected to grow over the forecast period.

Pharmacy Benefit Management Industry Overview

The pharmacy benefit management market is competitive, with the presence of several global and international market players. The key players are adopting different growth strategies to enhance their market presence, such as partnerships, agreements, collaborations, new product launches, geographical expansions, mergers, and acquisitions. Some of the key companies in the market are CVS Health, Optum, SS&C Tecnologies, Inc., Elixir Rx Solutions, LLC, and Centene Corporation (Envolve Health), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Inclination Towards Pharmacy Benefit Management System (PBMS)

- 4.2.2 Increasing Health Expenditure

- 4.2.3 Growing Demand for Prescription Products

- 4.3 Market Restraints

- 4.3.1 Reluctance To Adopt Pharmacy Automation Systems and Stringent Regulatory Procedures on Confidentiality

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Service

- 5.1.1 Specialty Pharmacy

- 5.1.2 Drug Formulatory Management

- 5.1.3 Benefit Plan Design and Consultation

- 5.1.4 Other Services

- 5.2 By Business Model

- 5.2.1 Government Health Programs

- 5.2.2 Employer-Sponsored Programs

- 5.2.3 Health Insurance Management

- 5.3 By End-User

- 5.3.1 Pharmacy Benefit Management Organization

- 5.3.2 Mail Order Pharmacies

- 5.3.3 Retail Pharmacies

- 5.3.4 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Optum, Inc.

- 6.1.2 Centene Corporation (Envolve Health)

- 6.1.3 CVS Health

- 6.1.4 SS&C Technologies, Inc.

- 6.1.5 Anthem, Inc.

- 6.1.6 Elixir Rx Solutions, LLC

- 6.1.7 Express Scripts Holding Company

- 6.1.8 Benecard Services, LLC

- 6.1.9 CaptureRx

- 6.1.10 Change Healthcare

- 6.1.11 Abarca Health

- 6.1.12 ProCare Rx

- 6.1.13 Cigna