|

시장보고서

상품코드

1445949

세계 핀테크(Fintech)용 AI 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)AI in Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

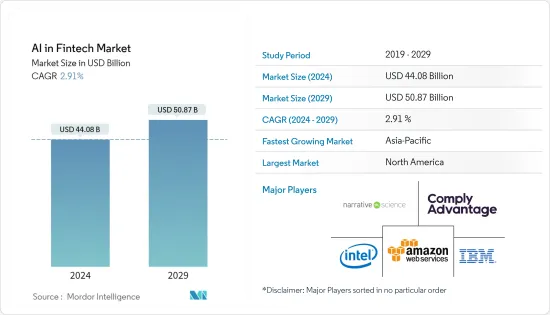

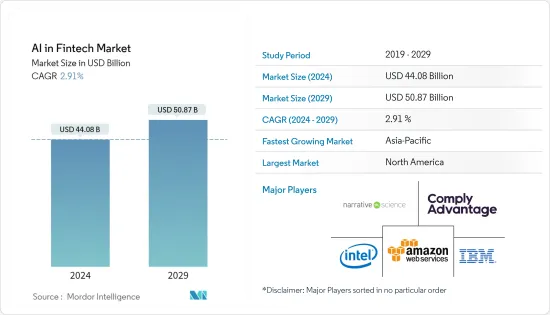

핀테크(FinTech)용 AI 시장 규모는 2024년 440억 8,000만 달러로 추정되고, 2029년까지 508억 7,000만 달러에 이를 것으로 예측되고 있으며, 예측 기간(2024년-2029년) 중 복합 연간 성장률(CAGR) 2.91%로 성장.

COVID-19의 유행의 발달로 사람들이 금융 서비스와 관련된 방식의 변화가 가속화되고 있습니다. 결제와 부를 중시하는 Fintech 기업은 새로운 자원에 투자하거나 거래량 증가로 인한 시스템 스트레스에 견딜 수 있는 용량을 확대하여 기존 인프라를 강화하는 데 중점을 둡니다. 핀테크 기업에게는 이것이 어려워 보였지만, 이들 기업은 수익을 거래량에 의존하고 있기 때문에 이러한 노력은 AI 솔루션의 큰 요구를 초래하고 있습니다. 이러한 요인으로 인해 핀테크용 AI 시장 솔루션 수요가 가속될 것으로 예상됩니다.

주요 하이라이트

- 금융회사는 메인프레임 컴퓨터와 관계형 데이터베이스를 조기에 채택해 왔습니다. 그들은 다음 수준의 계산 능력을 열심히 기다리고있었습니다. 인공지능(AI)은 인간의 지능 측면에서 파생된 기술을 보다 광범위하게 적용하여 결과를 향상시킵니다. 지난 몇 년동안 컴퓨터의 군 경쟁은 Fintech 기업에 혁명을 가져왔습니다. 머신러닝, 인공지능, 신경망, 빅데이터 분석, 진화 알고리즘 등의 기술을 통해 컴퓨터는 그 어느 때보다 거대하고 다양하며 다양하고 깊은 데이터세트를 처리할 수 있습니다.

- 또한 AI와 머신러닝은 고객에 대한 방대한 정보를 처리할 수 있기 때문에 은행과 핀테크에 이익을 제공합니다. 이 데이터와 정보는 고객이 원하는 시기 적절한 서비스/제품에 대한 결과를 얻기 위해 비교되며 기본적으로 고객 관계를 구축하는 데 도움이 됩니다.

- 또한, 머신러닝은 특히 추세 모델을 만들기 위해 전례없는 비율로 도입되었습니다. 은행 및 보험 회사는 웹 및 모바일 애플리케이션을 위한 머신러닝 기반 솔루션을 도입하고 있습니다. 이를 통해 실시간 행동 데이터를 기반으로 고객의 제품 경향을 예측함으로써 실시간 타겟 마케팅이 더욱 강화되었습니다.

- 일부 기존 시장 기업들은 은행을 위한 AI 채팅봇과 같은 솔루션을 명시적으로 제공함으로써 틈새 시장을 구축하고 있습니다. 예를 들어, 2021년 6월에는 Talisma와 Active.Ai가 제휴하여 대화 AI 지원 채팅봇을 사용하여 BFSI에서 고객 경험을 개선했습니다.

- 또한 일부 신용카드 회사는 기존의 사기 탐지 워크플로우에 예측 분석을 도입하여 오탐지를 줄이고 있습니다. 이 조사 대상 시장은 신용 카드 회사 및 기타 금융 기관을위한 AI 기반 자금 세탁 방지(AML) 및 부정 행위 탐지 솔루션을 제공하는 여러 기업에 의해 더욱 기세가 증가하고 있습니다.

- 예를 들어 2022년 6월 AI 주도 자금세탁방지(AML) 소프트웨어 개발사인 Lucinity는 사기 행위 관리 회사 SEON과 제휴하여 AML 규정 준수 소프트웨어에 실시간 부정 행위 방지 기능을 통합했습니다. SEON의 사기 방지 솔루션은 Lucinity 플랫폼을 통해 이용 가능하며 거래 모니터링에서 실시간 사기 감지 및 예방에 이르기까지 고객에게 컴플라이언스 위험 서비스를 제공합니다.

- 또한 AI 지원 인프라는 효율적인 데이터 관리가 가능하고 충분한 처리 능력을 제공하고 민첩성, 유연성 및 확장성이 있으며 다양한 양의 데이터를 수용할 수 있는 용량을 갖추고 있어야 합니다. 따라서 Fintech 중소기업의 경우 AI를 지원하는 데 필요한 하드웨어 및 소프트웨어 요소를 조립하는 것이 더 어려워질 것입니다. 또한 AI와 딥러닝 용도의 민주화가 확대됨에 따라 기술 대기업뿐만 아니라 중소기업에서도 사용할 수 있게 되었습니다. 이 작업을 수행하는 AI 전문가 수요도 마찬가지로 증가하고 있으며, 훈련을 받은 자원의 부족이 핀테크용 AI의 큰 과제가 되고 있습니다.

Fintech용 AI 시장 동향

부정 검출은 상당한 성장이 예상된다.

- 인공지능은 금융 사기와 사기 행위를 신속하고 효과적으로 감지하는 방법을 식별하는 데 도움이 됩니다. 이렇게 하면 기계가 엄청난 양의 데이터 세트를 정확하게 처리할 수 있게 되지만 인간은 이로 인해 어려움을 겪을 수 있습니다. 부정 행위를 감지하기 위해 인공지능을 사용하면 다양한 이점이 있습니다. 고속으로 계산할 수 있는 것은 AI와 머신러닝의 장점으로 잘 알려져 있습니다. 거래 방법이나 결제 등 사용자의 앱 이용 습관을 파악하여 실시간으로 이상을 발견할 수 있도록 합니다. 수동 방법보다 효율적이기 때문에 오탐지가 줄어들어 전문가가 더 복잡한 문제에 집중할 수 있습니다.

- Certified Fraud Examiners(ACFE)와 분석의 선구자인 SAS가 실시한 새로운 여론조사에 따르면 지난해 부정 검출을 위한 인공지능(AI)과 머신러닝(ML)의 사용이 국제적으로 증가했습니다. 조사에 의하면 조직의 13%가 부정행위의 검출과 저지를 위해 인공지능(AI)과 머신러닝을 채용하고 있으며, 또한 25%가 향후 1-2년 이내에 도입을 계획하고 있습니다. 약 200%의 성장을 보여줍니다. 여론조사에 의하면 부정검사관은 이 기술과 업계를 넘어 널리 보급되고 있는 기타 부정대책 기술의 개발을 확인했습니다.

- 또한 인도준비은행(RBI)은 2022년도 인도 전역에서 약 9,103건의 은행 사기 사건이 발생했다고 보고했습니다. 이는 전년 대비 증가하여 지난 10년간의 경향이 역전되었습니다. 은행 사기 총액은 1조 3,800억 루피에서 6,040억 루피로 감소했습니다. 은행 사기 사건이 이처럼 급증함에 따라 AI 시장 관계자는 고객의 폭넓은 요구에 부응하는 새로운 솔루션과 툴을 개발할 수 있을 것으로 보입니다.

- 시장 기업은 고객에게 더 나은 서비스를 제공하기 위해 협력하고 있습니다. 예를 들어 2023년 2월 마스터카드는 중동 및 아프리카 디지털 상거래의 주요 공급업체인 네트워크 인터내셔널과 제휴하여 부정 행위, 거부, 지불 거절을 해결하고 인수자의 비용과 위험을 최소화합니다. 했습니다. 이 제휴를 통해 네트워크는 마스터 카드의 Brighterion 인공지능(AI) 기술을 지역 전반에 걸쳐 배포하고, 수입업체와 기업에게 거래 사기 스크리닝 및 가맹점 모니터링을 제공합니다.

- 또한, 2022년 3월에는 세계 보험 업계에 AI 주도 의사 결정 자동화 및 최적화 솔루션을 제공하는 Shift Technology와 손해 보험 업계에 기술 솔루션을 제공하는 세계 공급자인 Duck Creek Technologies가 솔루션 파트너십을 발표했습니다. AI를 활용한 부정 검출 기능은 2022년에 시장 투입됩니다. 완전히 통합되면 Duck Creek Claims 사용자는 실시간 불법 경고를 청구 관리 소프트웨어 시스템에 직접 받게 됩니다.

북미가 가장 큰 시장 점유율을 차지

- 북미는 유명한 AI 소프트웨어 및 시스템 공급업체, 금융 기관의 AI 프로젝트에 대한 공동 투자, 대부분의 핀테크용 AI 솔루션을 채택하여 핀텍용 AI 시장을 지배할 것으로 예상됩니다. 이 지역은 향후 몇 년간 이 분야에서 상당한 성장이 예상될 것으로 예상됩니다. 게다가 북미는 많은 AI 핀테크 기업의 비즈니스 허브 역할을 하고 있으며 Sidetrade와 같은 기업들은 북미 거점을 캘거리에 두기로 했습니다.

- AI에 대한 정부의 이니셔티브와 투자. 예를 들어 시장을 견인할 것입니다. 스탠포드 대학의 최근 조사 데이터에 따르면 2022 회계 연도에 미국 정부는 인공지능(AI) 계약에 33억 달러를 지출했습니다. 연방 정부 기관의 기술 지출은 2021년 27억 달러에서 연간 6억 달러 이상 증가하고 있으며 의사결정 과학, 컴퓨터 비전, 자율 부문이 투자의 대부분을 차지하고 있습니다. 미국 정부가 인공 기술에 13억 달러를 지출한 2017년 이후 AI 계약에 대한 총 지출은 2.5배 이상으로 증가했습니다.

- 시장 선수는 이 지역의 고객에게 더 나은 서비스를 제공하기 위해 협력하고 있습니다. 예를 들어 2022년 8월 NACUSO의 CUSO of the Year Award를 수상하고 스코어링 개선을 통해 신용 액세스 향상에 기여한 Zest AI는 세계 데이터, 분석, 기술 기업인 Equifax, Inc. 제휴를 발표했습니다. 이 제휴를 통해 Zest AI의 인수 기술을 이용하는 신용조합은 Equifax가 제공하는 데이터를 더 분석하고, 특히 기존 은행 부족이었던 신용조합이 더 많은 신청을 보다 신속하게 받아들일 수 있도록 됩니다. 이것은 Zest AI와 국가소비자보고청과의 첫 대규모 판매관계입니다.

- 일부 엔터프라이즈 솔루션은 기업이 차선책 소프트웨어로 소매 뱅킹을 성장시키고, 금융 사기를 탐지하고 해결하며, 멀티채널 고객 경험 솔루션으로 고객 관계를 개선하는 데 도움이 됩니다. 덧붙여서, 2022년 4월, 공동 매출금의 기업인 Versapay는 미국에 본사를 둔 핀테크 스타트업 DadeSystems의 인수를 완료했다고 오늘 발표했습니다. Versapay의 일련의 매출(AR) 자동화 솔루션은 인수의 결과로 AI 및 머신러닝 기능과 마찬가지로 확장되었습니다. 또한 성장하는 직원에게 중요한 기술을 추가하면서 Versapay의 기업 및 중간 시장의 거점을 확장합니다.

- 이 지역의 은행은 데이터를 기록하고 부정 행위와 싸우기 위해 블록체인 기술을 사용하기 시작했습니다. 블록체인은 각 트랜잭션의 세부사항을 기록하므로 해커 시도를 쉽게 감지할 수 있습니다. 이 기술을 사용하면 세계 결제가 가능하며 저수수료로 신속한 거래가 가능합니다. 블록체인 분산 대장 기술(DLT)은 다양한 상점과 분산 네트워크 간의 데이터 기록 및 공유를 지원합니다. 또한 암호화 및 알고리즘 기법은 금융 네트워크 전체에서 데이터를 동기화합니다. 트랜잭션 데이터는 다양한 위치에 저장할 수 있으므로 이는 중요한 단계입니다. 이를 통해 블록체인의 상호 운용성과 업계를 넘어서는 데이터 교환에 대한 길을 열 수 있습니다.

Fintech용 AI 업계 개요

핀텍을 위한 AI 시장은 많은 세계 선수들에 의해 세분화되고 있습니다. 혁신에 초점을 맞추면 대기업의 다양한 인수와 제휴가 곧 이루어질 것으로 예상됩니다. 시장의 주요 기업로는 IBM Corporation, Intel Corporation, Narrative Science, Microsoft Corporation 등이 있습니다.

2023년 2월, Brunei의 바이두리 은행은 인공지능(AI)을 사용하여 신용 위험 관리를 최신화하기 위해 싱가포르에 본사를 둔 Software-as-a-Service(SaaS) Fintech Finbots.ai 를 선택했습니다. Finbots.ai에 따르면, 회사의 AI 신용 모델링 솔루션인 CreditX를 통해 Baiduri Bank는 몇 분의 시간과 비용으로 고품질의 신용 스코어 카드를 설계하고 배포할 수 있습니다. 이를 통해 신용 위험을 최소화하고 소매업체 및 중소기업(SME)의 효율성과 민첩성을 향상시키고 충분한 서비스를 제공하지 않는 신용 시장에 대한 은행의 금융 포용 캠페인을 촉진합니다.

2023년 2월 Scotiabank는 고객 자산 관리를 강화하기 위한 새로운 도구인 Scotia Smart Investor를 도입했습니다. 캐나다 금융업자는 AI를 활용한 추천과 실시간 맞춤형 지원을 결합한 Assistance를 통해 새로운 장치를 도입했습니다. Scotia Smart Investor는 Scotiabank에 연결된 투자 신탁 딜러인 Scotia Securities에 의해 만들어졌습니다. 이 도구에는 AI를 활용한 조언 엔진이 포함되어 있어 사용자의 재무 목표를 설계, 계획, 모니터링 및 업데이트할 수 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

- 금융 기술의 AI의 새로운 용도

- 기술의 스냅샷

- 시장에 대한 COVID-19의 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 금융기관에 있어서의 프로세스 자동화 수요 증가

- 데이터 소스의 가용성 향상

- 시장 성장 억제요인

- 숙련된 노동력의 필요성

제6장 시장 세분화

- 유형별

- 솔루션

- 서비스

- 전개별

- 클라우드

- 온프레미스

- 용도별

- 채팅봇

- 신용 스코어링

- 정량적 및 자산 관리

- 부정 검출

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 세계 기타 지역

제7장 경쟁 구도

- 기업 프로파일

- IBM Corporation

- Intel Corporation

- ComplyAdvantage.com

- Narrative Science

- Amazon Web Services Inc.

- IPsoft Inc.

- Next IT Corporation

- Microsoft Corporation

- Onfido

- Ripple Labs Inc.

- Active.Ai

- TIBCO Software(Alpine Data Labs)

- Trifacta Software Inc.

- Data Minr Inc.

- Zeitgold

- Sift Science Inc.

- Pefin Holdings LLC

- Betterment Holdings

- WealthFront Inc.

제8장 투자 분석

제9장 시장의 미래

BJH 24.03.15The AI in Fintech Market size is estimated at USD 44.08 billion in 2024, and is expected to reach USD 50.87 billion by 2029, growing at a CAGR of 2.91% during the forecast period (2024-2029).

The COVID-19 pandemic outbreak has been accelerating the change in the way how people interact with financial services. Payment- and wealth-focused fintech companies have focused on bolstering their existing infrastructure by investing in new resources or expanding capacity to withstand the stress to their systems from higher transaction volumes. Though it seemed challenging for fintech companies, such actions have provided a significant need for AI solutions as these companies depend on transaction volumes for revenue. Such factors are expected to spearhead the demand for AI solutions in the fintech market.

Key Highlights

- Financial firms have been the early adopters of the mainframe computer and relational database. They eagerly waited for the next level of computational power. Artificial Intelligence (AI) improves results by applying methods derived from the aspects of human intelligence at a broader scale. The computational arms race for past years has revolutionized fintech companies. Technologies, such as machine learning, AI, neural networks, Big Data Analytics, evolutionary algorithms, and much more, have allowed computers to crunch huge, varied, diverse, and deep datasets than ever before.

- Moreover, AI and machine learning have benefited banks and fintech as they can process vast amounts of information about customers. This data and information are then compared to obtain results about timely services/products that customers want, which has aided, essentially, in developing customer relations.

- Additionally, machine learning is being adopted at unprecedented rates, specifically to create propensity models. Banks and insurance companies are introducing machine learning-based solutions for web and mobile applications. This has further enhanced the real-time target marketing by predicting the product propensity of the customers based on behavioral data in real-time.

- Several market incumbents are establishing a niche by explicitly offering solutions, like AI Chatbots for banking. For instance, in June 2021, Talisma and Active.Ai has partnered to enable improved customer experience in BFSI using conversation AI enabled Chatbot.

- Moreover, several credit card companies implement predictive analytics into their existing fraud detection workflows to reduce false positives. The studied market further gains traction with several players offering AI-based Anti-money Laundering (AML) and Fraud detection solutions for credit card companies and other financial institutions.

- For instance, in June 2022, Lucinity, a developer of AI-driven anti-money laundering (AML) software has partnered with fraud management company SEON to include real time fraud prevention capabilities in AML compliance software. SEON's fraud prevention solution will be available through Lucinity's platform, providing customers with compliance risk services from transaction monitoring to real-time fraud detection and prevention.

- Further, AI-ready infrastructure should be capable of efficient data management, have enough processing power, be agile, flexible, and scalable, and have the capacity to accommodate different volumes of data. Therefore, it would be more challenging for fintech small businesses to assemble the necessary hardware and software elements to support AI. Moreover, as the democratization of AI and deep learning applications expands, not only for tech giants but is now viable for small and medium-sized businesses. The demand for AI professionals to do the work has ballooned as well, and the scarcity of trained resources is the major challenge for AI in fintech.

AI in Fintech Market Trends

Fraud Detection is Expected to Witness Significant Growth

- Artificial intelligence can assist in identifying rapid and effective ways to detect financial fraud and malpractice. They allow machines to process enormous datasets accurately, which people sometimes struggle with. Using artificial intelligence for fraud detection has various advantages. The ability to compute quickly is a well-known benefit of AI and machine learning. It creates a grasp of a user's app usage habits, such as transaction methods, payments, and so on, allowing it to spot anomalies in real-time. It reduces false positives and allows specialists to focus on more complex issues because it is more efficient than manual techniques.

- According to a new poll conducted by Certified Fraud Examiners (ACFE) and analytics pioneer SAS, the use of Artificial Intelligence (AI) and Machine Learning (ML) for fraud detection increased internationally last year. According to the poll, 13% of organizations employ artificial intelligence (AI) and machine learning to detect and deter fraud, with another 25% planning to do so in the next year or two, representing roughly 200% growth. According to the poll, fraud examiners identified this and other anti-fraud tech developments in a cross-industry that are extensively spreading.

- Further, the Reserve Bank of India (RBI) reported around 9,103 bank fraud incidents across India in fiscal year 2022. This increased over the previous year, reversing the last decade's trend. The total value of bank scams fell from INR 1.38 trillion to INR 604 billion. Such high rise in the bank fraud cases would allow the AI market players to develop new solutions or tools to cater wide range of needs of the customer.

- The players in the market are collobarting to provide better service to its customer. For instance, in february 2023, Mastercard partnered with Network International, the Middle East and Africa's premier provider of digital commerce, to address fraud, declines, and chargebacks to minimise costs and risk for acquirers. Through the collaboration, Network will roll out Mastercard's Brighterion Artificial Intelligence (AI) technology across the region, providing acquirers and businesses with transaction fraud screening and merchant monitoring.

- Further, in March 2022, Shift Technology, a provider of AI-driven decision automation and optimisation solutions for the global insurance industry, and Duck Creek Technologies, a global provider of technology solutions to the P&C insurance industry, have announced a solution partnership to bring AI-enabled fraud detection capabilities to market in 2022. Once fully integrated, Duck Creek Claims users will receive real-time fraud alerts directly into their claims management software system.

North America Accounts For the Largest Market Share

- North America is expected to dominate the AI in Fintech market due to prominent AI software and systems suppliers, combined investment by financial institutions into AI projects, and the adoption of most AI in Fintech solutions. The region is expected to experience significant growth in this area in the coming years. Additionally, North America serves as the business hub for many AI Fintech firms, with companies like Sidetrade choosing to locate their North American operations in Calgary.

- Government initiatives and investments towards AI. would drive the market for instance. In fiscal year 2022, the U.S. government spent USD 3.3 billion on artificial intelligence (A.I.) contracts, according to data from a recent Stanford University study. Spending by federal government agencies on technology climbed by over USD 600 million annually, from USD 2.7 billion in 2021, with the decision science, computer vision, and autonomous segments receiving the majority of investment. Since 2017, when the U.S. government spent USD 1.3 billion on artificial technology, total spending on A.I. contracts has climbed by over 2.5 times.

- The players in the market are collobarting to provide better service to the customer in the region. For instance, in august 2022, Zest AI, the recipient of NACUSO's CUSO of the Year Award and a player in improving credit access through better scoring announced a partnership with Equifax, Inc., a worldwide data, analytics, and technology firm. The collaboration will allow credit unions that use Zest AI's underwriting technology to analyze more of the data sourced by Equifax to accept more applications with better speed, particularly those who have traditionally been underbanked. This is Zest AI's first big distribution relationship with a National Consumer Reporting Agency.

- Some companies' solutions help businesses grow retail banking with next-best-action software, detect and combat financial fraud, and improve client relationships with multichannel customer experience solutions. For insatnce, in April 2022, Versapay, a player in Collaborative Accounts Receivable, said today that it has finalised its acquisition of DadeSystems, a fintech startup based in the United States. Versapay's array of accounts receivable (AR) automation solutions has been expanded, as have its AI and machine learning capabilities, as a result of the acquisition. It also broadens Versapay's enterprise and mid-market footprint while adding critical skills to its growing staff.

- Banks in the region have started using blockchain technology to record data and combat fraud. Blockchain records the details of each transaction, making it easier to detect hacker attempts This technology permits worldwide payments and allows for speedy transactions with low commissions. The Distributed Ledger Technology (DLT) of Blockchain assists in the recording and sharing data across different stores and a distributed network. Furthermore, cryptographic and algorithmic methods synchronize data across the financial network. This is a significant step since transaction data can be stored in different locations. It paves the way for blockchain interoperability and cross-industry data exchange.

AI in Fintech Industry Overview

AI in the Fintech market is moving towards fragmented due to many global players. Various acquisitions and collaborations of large companies are expected to occur shortly, focusing on innovation. Some major players in the market include IBM Corporation, Intel Corporation, Narrative Science, and Microsoft Corporation.

In February 2023, Baiduri Bank in Brunei chose Singapore-based Software-as-a-Service (SaaS) fintech Finbots.ai to modernize its credit risk management with artificial intelligence (AI). According to Finbots.ai, its AI credit modeling solution, creditX, will allow Baiduri Bank to design and deploy high-quality credit scorecards in a fraction of the time and cost. This will minimize credit risk, increase efficiency and agility for retail and small and medium-sized organizations (SMEs), as well as expedite the bank's financial inclusion campaign for the underserved credit market.

In February 2023, Scotiabank introduced a new tool, Scotia Smart Investor, to give customers greater asset control. The Canadian lender introduced the new device via assistance+, combining AI-powered recommendations with real-time personalized assistance. Scotia Smart Investor was created by Scotia Securities, Scotiabank's linked mutual fund dealer. The tool, which includes an AI-powered advice engine, will assist users in designing, planning, monitoring, and updating financial goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Emerging Uses of AI in Financial Technology

- 4.4 Technology Snapshot

- 4.5 Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand For Process Automation Among Financial Organizations

- 5.1.2 Increasing Availability of Data Sources

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By Application

- 6.3.1 Chatbots

- 6.3.2 Credit Scoring

- 6.3.3 Quantitative & Asset Management

- 6.3.4 Fraud Detection

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Intel Corporation

- 7.1.3 ComplyAdvantage.com

- 7.1.4 Narrative Science

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 IPsoft Inc.

- 7.1.7 Next IT Corporation

- 7.1.8 Microsoft Corporation

- 7.1.9 Onfido

- 7.1.10 Ripple Labs Inc.

- 7.1.11 Active.Ai

- 7.1.12 TIBCO Software (Alpine Data Labs)

- 7.1.13 Trifacta Software Inc.

- 7.1.14 Data Minr Inc.

- 7.1.15 Zeitgold

- 7.1.16 Sift Science Inc.

- 7.1.17 Pefin Holdings LLC

- 7.1.18 Betterment Holdings

- 7.1.19 WealthFront Inc.