|

시장보고서

상품코드

1445956

세계 해군용 액추에이터 및 밸브 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2024-2029년)Naval Actuators And Valves - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

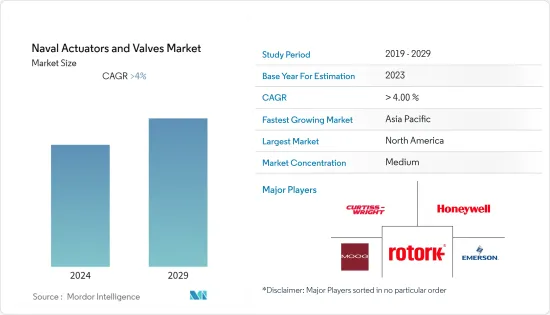

Equal-4.64의 관점에서 해군용 액추에이터 밸브 시장 규모는 예측 기간(2024년부터 2029년) 동안 복합 연간 성장률(CAGR) 4.64%로 평가될 전망이며, 2024년의 33억 4,000만 달러에서 2029년까지 41억 8,000 만미 달러로 성장할 것으로 예상됩니다.

주요 하이라이트

- 해전 전선에서 고성능 레이더와 장거리 조준 시스템 등 신기술의 출현으로 각국은 해군 능력의 근대화와 업그레이드를 추진하고 있습니다. 액추에이터 밸브는 모든 해군 함선 서브시스템의 중요한 부분을 형성하기 때문에 새로운 해군 함정의 도입은 사양에 따른 시스템 성능을 보장하기 위해 액추에이터 밸브에 대한 병렬 수요를 초래할 수 있습니다.

- 엄격한 규제 정책은 예측 기간 동안 시장 성장을 억제할 것으로 예상됩니다. 해양 산업은 주로 해양 활동과 관련된 위험 때문에 엄격하게 규제됩니다.

- 첨단 통합 전투 시스템이나 해군 사용의 인기 증가는 시장에 새로운 기회를 제공할 것으로 예상되며, 이는 향후 기간에 초점을 맞추고 있는 시장에 긍정적인 영향을 미칠 것으로 예상 .

해군용 액추에이터 밸브 시장 동향

방어부문이 시장을 독점할 것으로 예상

국제전략정세의 심각한 변화로 인해 국제안보시스템의 구성은 진행 중인 여러 세계분쟁을 부추기는 패권주의, 일국주의, 강권정치의 증대에 의해 손상되었습니다. 미국, 영국, 중국, 인도 등의 군사대국은 해군 화력의 증강에 주력하고 있으며, 국가안보에 대한 진화하는 위협에 대처하기 위해 여러 함대의 근대화와 조달계약이 진행 중입니다.

2022년 러시아와 우크라이나 간의 전쟁으로 각국의 국방예산이 더욱 부풀어 오르고 있어 세계적으로 군의 작전 준비를 재평가할 필요성이 높아지고 있습니다. 2022년 세계 군사 지출은 전년 대비 3.7% 증가했으며 지난 2조 2,000억 달러에 이르렀습니다. 러시아와 우크라이나 전쟁은 2022년 지출 증가의 주요 원동력이었습니다. 2022년 최대 지출국 5개는 미국, 중국, 러시아, 인도, 사우디아라비아로 세계 군사 지출의 63%를 차지했습니다.

30년간의 조선계획에 따르면 미국은 2024년까지 314척의 유효함대 규모를 달성하기 위해 55척의 신조선을 조달할 것을 구상하고 있습니다. 아시아태평양에서는 중국과 인도와 같은 유력한 국가들도 해군 함대의 규모와 능력을 강화하고 있으며 경쟁자들에 대한 기술적 이점을 얻습니다. 이러한 유도 프로그램은 방어 플랫폼을 위한 새로운 해군 함정의 설계 및 건조에 있어서의 액추에이터 밸브 수요를 촉진하는 것으로 상정되고 있습니다.

예측기간 동안 북미가 시장을 독점

이 시장은 국내 평화와 안전을 확보하는 것 외에도 이 지역에서 군사적 우위를 달성하기 위해 미국 해군의 선진 무기 조달에 의해 움직이고 있습니다. 미국은 육지, 하늘 및 물의 모든 영토에 대한 군사력을 강화하기 위해 엄청난 기술력을 여러 무기 시스템의 원주민 개발에 투자해 왔습니다.

2023년도 예산안에서 미국 해군은 해군에 1,805억 달러, 해병대에 503억 달러를 포함한 총액 2,308억 달러의 예산 요구를 제안했습니다. 미국 해군 확장 프로젝트의 일환으로 미국 해군은 2023 회계 연도 예산으로 해군에서 다양한 군함과 항공 모함 함대를 제외하거나 포함하여 함대를 현대화 할 계획을 제안했습니다. USS 니밋츠는 2025년도까지 전투부대에서 벗어나 제럴드 R. 포드급 항공모함이 민첩한 전력의 함대에 쉽게 가해지는 것을 단계적으로 받아들일 예정입니다.

이 국가는 유도 로켓, 탄도 미사일, 무장 무인 항공기, 잠수함, 수상 군함 등 선진 무기에 대한 군사 파트너 수요에 부응하고 있습니다. 이 프로그램은 Serco가 관련 하위 구성요소의 평가 및 수리 서비스를 포함하여 SubHDR 안테나 페데스탈 그룹(APG)에 수리 및 오버홀을 제공해야 합니다. 이러한 유도 및 MRO 프로그램은 이 지역의 액추에이터 및 밸브 수요를 촉진하고 군함에 탑재된 다른 제어 시스템과의 원활한 통합을 촉진하고 가능하게 한다고 가정합니다.

해군용 액추에이터 밸브 산업 개요

해군 액추에이터 밸브 시장은 본질적으로 반 통합되어 있습니다. 시장의 유명한 기업으로는 MOOG Inc., Honeywell International Inc., Rotork PLC, Emerson Electric Co., Curtiss-Wright Corporation 등이 있습니다.

여러 나라에서 지정학적 불안이 증대됨에 따라 안보 환경이 새롭게 되어, 선진적인 해군 시스템에 대한 수요가 높아지고 있습니다. 장기 계약을 획득하고 세계 존재감을 확대하기 위해 기업은 새로운 해군 자산 조달에 많은 투자를 하고 있습니다.

지속적인 R&D는 해군 함정에 통합된 서브시스템 및 기타 기술의 정확성과 효율성 발전을 촉진합니다. 방위비가 상승함에 따라 기업간 경쟁이 더욱 격화될 것으로 예상됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체 제품의 위협

- 경쟁 기업간 경쟁 관계의 격렬

제5장 시장 세분화

- 액추에이터의 유형

- 기계

- 유압

- 공압

- 전기

- 하이브리드

- 플랫폼

- 방어

- 상업

- 재료

- 알루미늄

- 스테인레스 스틸

- 합금 베이스

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 멕시코

- 브라질

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 이집트

- 이스라엘

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- MOOG Inc.

- Honeywell International Inc.

- Rotork PLC

- Emerson Electric Co.

- Curtiss-Wright Corporation

- Flowserve Corporation

- IMI PLC

- Diakont

- Schlumberger Limited

- Wartsila Corporation

- AUMA Riester GmbH &Co. KG

- Bosch Rexroth AG(Robert Bosch GmbH)

제7장 시장 기회와 미래 동향

BJH 24.03.15The Naval Actuators And Valves Market size in terms of Equal-4.64 is expected to grow from USD 3.34 billion in 2024 to USD 4.18 billion by 2029, at a CAGR of 4.64% during the forecast period (2024-2029).

Key Highlights

- The emergence of new technologies, such as high-performance radar and long-distance targeting systems, on the naval warfare front has driven nations to modernize and upgrade their naval capabilities. As actuators and valves form a critical part of all naval vessel subsystems, the induction of new naval vessels may create a parallel demand for actuators and valves to ensure systems performance as per the specifications.

- Stringent regulatory policies are expected to restrain the market's growth during the forecast period. The marine industry is heavily regulated, primarily because of the risks associated with marine activities.

- The increasing popularity of advanced integrated combat systems or the use of naval forces is expected to provide new opportunities for the market, which is anticipated to positively affect the market in focus during the upcoming period.

Naval Actuators And Valves Market Trends

Defense Segment is Expected to Dominate the Market

Due to the profound changes in the international strategic landscape, the configuration of the international security system has been undermined by the growing hegemonism, unilateralism, and power politics that have fueled several ongoing global conflicts. Military powerhouses, such as the United States, the United Kingdom, China, and India, have been focused on augmenting their naval firepower, and several fleet modernization and procurement contracts are underway to address the evolving threats to their national security.

In 2022, the war between Russia and Ukraine further fueled the defense budgets across various countries and the need to reassess the operational readiness of the armed forces globally. The world military expenditure rose by 3.7% in 2022 from the previous year to reach a record high of USD 2.2 trillion. The Russia-Ukraine war was a major driver of the growth in spending in 2022. The five biggest spenders in 2022 were the United States, China, Russia, India, and Saudi Arabia, accounting for 63% of the global military spending.

According to its 30-year shipbuilding plan, the US envisions procuring 55 new ships to achieve an effective fleet size of 314 ships by 2024. In Asia-Pacific, prominent countries such as China and India are also enhancing their naval fleet size and capabilities to achieve technological superiority over their rival countries. Such induction programs are envisioned to drive the demand for actuators and valves in designing and constructing new naval vessels for defense platforms.

North America to Dominate the Market during the Forecast Period

The market is driven by the procurement of advanced weaponry by the US Navy to achieve military dominance in the region, besides ensuring internal peace and security. The United States has invested its vast technological prowess toward the indigenous development of several weapon systems to foster its military prowess over all dominion - land, air, and water.

In the FY2023 budget proposal, the US Navy proposed a total budget request of USD 230.8 billion, including USD 180.5 billion for the Navy and USD 50.3 billion for the Marine Corps. As part of the country's naval expansion projects, the US Navy, in its FY2023 budget, proposed plans to modernize its fleet with the exclusion and inclusion of various warships and carrier fleets in the Navy. The USS Nimitz is to be removed from the battle force by the FY2025, gradually accepting the Gerald R Ford-class carriers to be inducted readily into the fleet of agile force.

The country caters to the demand from its military partners for advanced weaponry, such as guided rockets, ballistic missiles, armed UAVs, submarines, and surface warships. The program entails Serco providing repair and overhauls to the SubHDR Antenna Pedestal Group (APG), including evaluation and repair services to related sub-components. Such induction and MRO programs are envisioned to drive the demand for actuators and valves in the region to facilitate and enable seamless integration with other control systems installed in the fleet of naval vessels.

Naval Actuators And Valves Industry Overview

The naval actuators and valves market is semi-consolidated in nature. Some prominent players in the market include MOOG Inc., Honeywell International Inc., Rotork PLC, Emerson Electric Co., and Curtiss-Wright Corporation.

The emerging security environment, fueled by the growing geopolitical unrest in several countries, is resulting in the growing demand for advanced naval systems. To gain long-term contracts and expand their global presence, players are investing significantly in the procurement of new naval assets.

Continuous R&D has been fostering the advancements of accuracy and efficiency of subsystems and other technologies integrated onboard naval vessels. The competition between the players is expected to increase with the surge in defense expenditure.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Actuator Type

- 5.1.1 Mechanical

- 5.1.2 Hydraulic

- 5.1.3 Pneumatic

- 5.1.4 Electrical

- 5.1.5 Hybrid

- 5.2 Platform

- 5.2.1 Defense

- 5.2.2 Commercial

- 5.3 Material

- 5.3.1 Aluminum

- 5.3.2 Stainless Steel

- 5.3.3 Alloy-based

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Egypt

- 5.4.5.4 Israel

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 MOOG Inc.

- 6.2.2 Honeywell International Inc.

- 6.2.3 Rotork PLC

- 6.2.4 Emerson Electric Co.

- 6.2.5 Curtiss-Wright Corporation

- 6.2.6 Flowserve Corporation

- 6.2.7 IMI PLC

- 6.2.8 Diakont

- 6.2.9 Schlumberger Limited

- 6.2.10 Wartsila Corporation

- 6.2.11 AUMA Riester GmbH & Co. KG

- 6.2.12 Bosch Rexroth AG (Robert Bosch GmbH)