|

시장보고서

상품코드

1519917

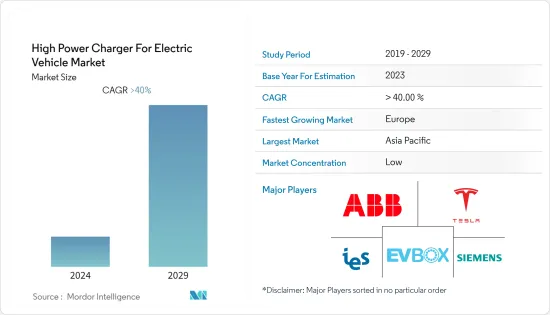

전기자동차용 고출력 충전기 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)High Power Charger For Electric Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

세계의 전기자동차용 고출력 충전기 시장 규모는 2024년 223억 6,000만 달러로 추정되고, 2024년부터 2029년까지 CAGR 33.30% 이상으로 성장할 전망이며, 2029년에는 941억 3,000만 달러에 이를 것으로 예측됩니다.

전기자동차용 고출력 충전기는 배터리 전기자동차(BEV) 및 플러그인 하이브리드 전기자동차(PHEV)의 판매 증가와 파워트레인 부품의 비용 저하에 의해 견인되고 있습니다. 세계 각국의 정부는 기존 자동차보다 전기자동차 채용을 장려하기 위해 다양한 제도와 정책을 내세우고 있습니다.

2022년에는 세계에서 1,000만대 이상의 전기자동차가 판매되었습니다. 이 기세는 2023년까지 계속되어 판매 대수는 더욱 35% 증가해, 약 1,400만대에 달한 것으로 평가되었습니다.

2030년에는 전 세계 자동차 판매량의 40% 이상을 전기차가 차지해 약 4,000만대에 달할 것으로 예상됩니다.

게다가 비재생 가능 에너지 대기업 각사가 자동차의 전동화 동향의 높아짐에 대응하기 위해 포트폴리오의 다양화를 추진하고 있으며, 그 투자와 인수 활동이 향후 수년간 시장 성장을 견인할 것으로 보입니다.

전기차의 보급과 판매 대수 증가, 정부에 의한 전기차의 보급을 촉진하는 엄격한 안전 기준 증가, 고출력 능력으로 제조된 전기자동차용의 선진 기술(고출력 기술)의 도입은 향후 수년간 전기자동차용 고출력 충전기 시장의 성장으로 이어질 것으로 예상됩니다.

급속 충전기 제조에서 클라우드 컴퓨팅 플랫폼에 의해 제어되는 RFID 기술을 통한 전자 결제 방법의 전개와 같은 기술 발전은 시장에 미래 성장 기회를 제공할 것으로 보입니다.

전기자동차용 고출력 충전기 시장 동향

50-150 kW 파워 유형이 시장을 석권

전기자동차용 고출력 충전기 시장에서는 50-150kW의 충전기 카테고리가 지배적인 부문으로 부상하고 있습니다. 이 부문은 충전 속도와 인프라 요구 사항 간의 균형을 제공하고 현재 EV 도입에 이상적이므로 다양한 지역의 대부분의 EV 랜드스케이프에 이상적입니다. 이 충전기는 중국과 인도와 같은 경제권에 가장 적합한 선택입니다.

배터리 기술과 충전 인프라의 기술적 진보로 EV에 대한 충전이 빠르고 효율적으로 이루어질 수 있습니다. 50-150kW의 출력 유형은 이 기술 진보의 최전선에 있습니다.

또한 정부와 비공개 회사는 특히 50-150kW의 EV 충전 인프라에 많은 투자를 하고 있습니다. 이 투자는 이 출력 범위의 고출력 충전기의 도입을 촉진하여 EV 촉진요인에 보다 사용하기 쉽습니다.

인도에서는 정부가 FAME India Scheme Phase II 하에 800억 루피라는 많은 돈을 허가했습니다. 이 배분은 특히 인도 석유(IOCL), 바랏 석유(BPCL), 힌드스탄 석유(HPCL) 등 석유 판매 회사(OMC)를 향한 것으로, 전국에 7,432곳의 공공 급속 충전소을 설치하기 위한 것입니다.

아시아태평양이 시장을 견인

아시아태평양은 EV 시장의 급성장, 정부 지원, 기술 진보, 주요 기업에 의한 연구개발 투자 증가 등의 요인으로 고출력 EV(전기자동차) 충전기 시장을 선도하고 있습니다. 중국은 세계 최대의 전기자동차 시장으로 일본, 한국, 인도 등 아시아태평양의 기타 국가에서도 EV 수요가 급속히 성장하고 있습니다. 이러한 EV 수요 증가로 EV를 빠르고 효율적으로 충전할 수 있는 고출력 충전기의 필요성이 높아지고 있습니다.

중국은 전기차 및 하이브리드 자동차 제조업체에 신차 판매량의 10% 이상을 차지하는 노르마를 부과하고 있습니다. 또, 베이징시에서는 시민에게 전기자동차로의 환승을 촉구하기 위해, 내연 엔진차의 등록 허가증을 월에 1만대 밖에 발행하고 있습니다.

중국 정부는 전기자동차의 사용을 장려합니다. 이 나라는 이미 트랙터 및 건설 기계에 사용되는 디젤 연료를 단계적으로 폐지할 계획을 발표하고 있습니다. 2040년까지 모든 디젤 차량과 가솔린 차량을 금지하려는 의도입니다.

또한 중국 정부는 전기자동차의 사용을 장려하고 있습니다. 이 나라는 이미 트랙터 및 건설 기계에 사용되는 디젤 연료를 단계적으로 폐지할 계획을 발표하고 있습니다. 이 나라는 2040년까지 디젤차와 가솔린차를 전폐할 의향입니다.

또한 아시아태평양 기업은 전략적 파트너십을 맺고 사업 범위와 능력을 확대하고 있습니다. 또한 주요 기업들은 첨단 EV 충전 기술을 개발하기 위해 연구 개발에 많은 투자를 하고 있습니다.

2023년 8월, CATL은 새로운 초고속 충전 LFP 배터리 'Shenxing'을 발표했습니다. 신흥은 발열을 억제하고 새로운 첨단 배터리 관리 시스템(BMS)을 탑재하고 모든 차종에 적합합니다.

전기자동차용 고출력 충전기 산업 개요

전기자동차용 고출력 충전기 시장은 적당히 집중되어 있으며, 소수의 기업로 명확한 우승자는 없습니다. 시장의 주요 기업은 ABB Ltd, Ev-Box BV, IES Synergy, Garo AB, XCharge Inc., Tesla Inc. 등으로 시장의 30% 이상을 차지하고 있습니다.

각 회사가 하고 있는 다양한 대처가 시장에서의 존재감을 높이는 것으로 이어지고 있습니다. 예를 들면

2023년 9월 Hitachi Industrial Products는 대용량 멀티포트 EV 충전기(250kW 및 500kW) 출시를 발표했습니다. 이에 따라 동시에 충전할 수 있는 대수를 늘림으로써 충전 시간의 단축과 충전 정체의 해소가 가능해집니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- EV 판매 확대가 시장 성장을 견인

- 시장 성장 억제요인

- 적절한 충전 인프라의 부족이 과제

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 출력 유형별

- 50 kW-150 kW 미만

- 150 kW-350 kW

- 350 kW 이상

- 차량 유형별

- 승용차

- 상용차

- 커넥터 유형별

- CHAdeMO

- SAE 콤보 충전 시스템

- 슈퍼 충전기

- GB/T

- 용도별

- 공공

- 프라이빗

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 네덜란드

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Royal Dutch Shell PLC(Acquired NewMotion)

- ABB Ltd

- XCharge Inc.

- Total SA(Acquired G2Mobility)

- Fastned BV

- IES Synergy

- EVgo Services LLC

- EVBOX

- Siemens AG

- Allego BV

- Phoenix Contact

- Tesla Inc.

- Garo AB

- ENSTO INDIA PRIVATE LIMITED

제7장 시장 기회 및 향후 동향

- 증가하는 정부 지원 및 인센티브가 성장 기회 제공

The High Power Charger For Electric Vehicle Market size is estimated at USD 22.36 billion in 2024, and is expected to reach USD 94.13 billion by 2029, growing at a CAGR of greater than 33.30% during the forecast period (2024-2029).

The high power charger for the electric vehicle market is being driven by increased sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), along with lower costs of powertrain components. Governments worldwide are launching various schemes and policies to encourage the adoption of EVs over conventional vehicles.

* More than 10 million electric cars were sold worldwide in 2022. The momentum was expected to continue into 2023, with sales projected to grow by another 35%, reaching approximately 14 million vehicles.

* Globally, EVs are expected to represent over 40% of auto sales in 2030, equating to around 40 million vehicles.

In addition, investments and acquisition activities of non-renewable energy giants that are diversifying their portfolios to meet the escalating vehicle electrification trend are likely to drive the market's growth in the coming years.

The growth in terms of adoption and sales of electric vehicles, increasing stringent safety norms promoting the adoption of electric vehicles by the government, and the introduction of advanced technology (high-power technology) for electric vehicles manufactured with high-power capabilities are expected to lead to a growth in the high-power charger for electric vehicles market in the coming years.

Technological advancements, such as the deployment of electronic payment methods through RFID technology, controlled by a cloud-computing platform in fast charger manufacturing, shall provide future growth opportunities for the market.

EV High Power Charger Market Trends

50-150 kW Power Type Segment is Dominating the Market

The 50-150 kW charger category is emerging as the dominant segment in the high-power charger for EV market. The segment is best suited for most of the EV landscape in different regions, offering a balance between charging speed and infrastructure requirements, making them ideal for the present EV adoption. These chargers are the most suitable option for economies like China and India.

Technological advancements in battery technology and charging infrastructure are making it possible to charge EVs faster and more efficiently. The 50-150 kW power type segment is at the forefront of this technological advancement.

Further, governments and private companies are investing heavily in EV charging infrastructure, particularly in the 50-150 kW power type segment. This investment is driving the deployment of high-power chargers in this power range, making them more accessible to EV drivers.

* In India, the government has sanctioned a substantial amount of INR 800 crores under the FAME India Scheme Phase II. This allocation is specifically directed towards the PSU Oil Marketing Companies (OMC) - namely Indian Oil (IOCL), Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL) - to facilitate the establishment of 7,432 public fast charging stations across the nation.

Asia Pacific is Leading The Market Concerned

Asia-Pacific is leading the market for high-power EV (Electric Vehicle) chargers driven by factors such as the rapid growth of the EV market, government support, technological advancements, and growing investment in R&D by key players. China is the world's largest market for electric vehicles, and the demand for EVs is growing rapidly in other countries in the Asia Pacific region, such as Japan, South Korea, and India. This growing demand for EVs is driving the need for high-power chargers that can charge EVs quickly and efficiently. For instance,

* China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

The Chinese government is encouraging people to use electric vehicles. The country has already announced plans to phase out diesel fuel used in tractors and construction equipment. By 2040, the country intends to outlaw all diesel and gasoline vehicles.

Moreover, the Chinese government is encouraging people to use electric vehicles. The country has already announced plans to phase out diesel fuel used in tractors and construction equipment. By 2040, the country intends to outlaw all diesel and gasoline vehicles.

Further, companies in Asia-Pacific are forming strategic partnerships to expand their reach and capabilities. Key players are also investing heavily in R&D to develop advanced EV charging technologies.

* In August 2023, CATL unveiled its new ultra-fast charging LFP battery called Shenxing, which will be made commercially available in the first quarter of 2024. Shenxing has reduced heat generation and is equipped with a new advanced battery management system (BMS), making it fit for any vehicle type.

High Power Charger For Electric Vehicle Industry Overview

The high-power charger for electric vehicles market is moderately concentrated, with few players having no clear winner in the market. Key players in the market include ABB Ltd, Ev-Box BV, IES Synergy, Garo AB, XCharge Inc., and Tesla Inc., which constitute over 30% of the market.

Various initiatives done by companies have led them to strengthen their presence in the market. For example,

* In September 2023, Hitachi Industrial Products announced the launch of a high-capacity multi-port EV charger (250 kW and 500 kW). This will enable to shorten the charging time and eliminate charging congestion by increasing the number of vehicles to be charged simultaneously.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing EV Sales is Driving the Market Growth

- 4.2 Market Restraints

- 4.2.1 Lack of Proper Charging Infrastructure is a Chgallenge

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Power Output Type

- 5.1.1 50 kW - Less than 150 kW

- 5.1.2 150 kW - 350 kW

- 5.1.3 350 kW and Above

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Connector Type

- 5.3.1 CHAdeMO

- 5.3.2 SAE Combo Charging System

- 5.3.3 Supercharger

- 5.3.4 GB/T

- 5.4 Application

- 5.4.1 Public

- 5.4.2 Private

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Netherlands

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 South America

- 5.5.4.2 Middle East & Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Royal Dutch Shell PLC (Acquired NewMotion)

- 6.2.2 ABB Ltd

- 6.2.3 XCharge Inc.

- 6.2.4 Total SA(Acquired G2Mobility)

- 6.2.5 Fastned BV

- 6.2.6 IES Synergy

- 6.2.7 EVgo Services LLC

- 6.2.8 EVBOX

- 6.2.9 Siemens AG

- 6.2.10 Allego BV

- 6.2.11 Phoenix Contact

- 6.2.12 Tesla Inc.

- 6.2.13 Garo AB

- 6.2.14 ENSTO INDIA PRIVATE LIMITED

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Government Support and Incentives Offer Growth Opportunities