|

시장보고서

상품코드

1910681

에너지 효율 유리 : 시장 점유율 분석, 업계 동향 및 통계, 성장 예측(2026-2031년)Energy-efficient Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

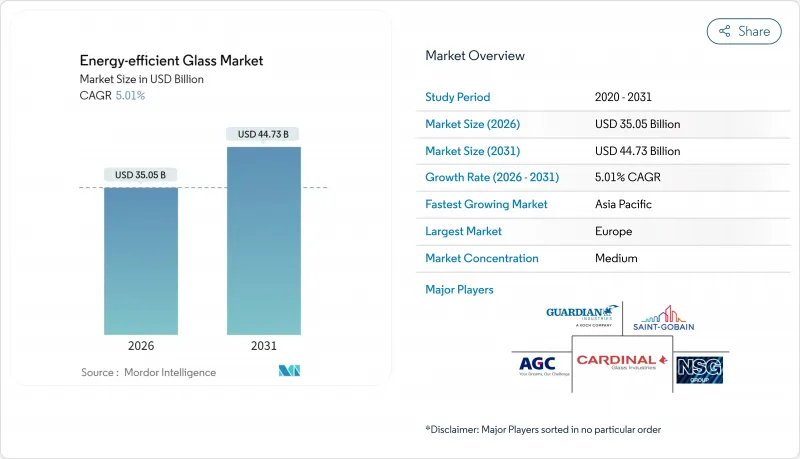

에너지 효율 유리 시장 규모는 2026년에는 350억 5,000만 달러로 추정되고 있으며, 2025년 333억 8,000만 달러에서 성장이 예상됩니다.

2031년까지의 예측으로는 447억 3,000만 달러에 이르고, 2026년부터 2031년에 걸쳐 CAGR5.01%로 성장할 것으로 전망되고 있습니다.

이 성장은 건축물의 에너지 절약 기준 강화, 녹색 빌딩 인증 및 전기자동차의 항속 거리를 연장하는 저방사율 유리(Low-E 유리)로의 자동차 산업의 전환으로 인한 것입니다. 진공 단열 유리 리노베이션 기술의 발전, EU 탄소 국경 조정 메커니즘, 다층은 코팅 기술은 원료 가격의 변동에도 불구하고 제품 차별화를 유지하고 이익률을 보호합니다. 마그네트론 스퍼터링 설비를 갖춘 제조업체는 설비 리드 타임이 최대 3년에 이르기 때문에 가격 결정력을 유지하고 있습니다. 동시에, 유리 제조업체와 태양광 발전 기술 혁신기업과의 연계에 의해 넷 제로 목표를 달성하는 건축물 일체형 태양광 파사드가 실현되어 새로운 수익원이 개척되고 있습니다.

세계의 에너지 효율 유리 시장 동향과 인사이트

세계 건축물 에너지 기준의 엄격화

최신 국제 에너지 절약 기준(IECC)에서는 창의 허용 U값이 최대 17% 낮아졌으며 건축가는 저방사율(Low-E) 삼중 유리 및 진공 유리 솔루션으로의 전환을 강요하고 있습니다. 캘리포니아의 2025년 타이틀 24 기준에서는 수직창의 U값을 0.47로 제한하고 있으며, 이 수준을 달성하기 위해서는 첨단 소프트코팅 유리 기술이 필수적입니다. 캐나다의 2030년 넷 제로 대응 건축물 목표에서는 고정창의 U값을 0.27로 설정해, 삼중 유리 수요를 가속시키고 있습니다. 이러한 기준은 기존에 허용된 성능과 비용의 절충을 없애기 때문에 사양 결정 시 초기 비용보다 성능이 중요해졌습니다. 아시아태평양의 주요 도시에서 규제 갱신이 잇따르는 가운데, 다층은 코팅 기술을 가진 공급업체는 보다 큰 우위성을 획득하고 있습니다. 중기 컴플라이언스 마감일은 고성능 유닛의 안정적인 주문 기반을 지원합니다.

그린빌딩인증(LEED, BREEAM) 확대

인증 프레임워크는 외피 효율과 탄소 함유량의 투명성을 평가합니다. LEED v4.1의 인증 포인트는 환경 제품 선언(EPD)에 의존하며, 제조업체가 탄소 실적를 정량화하도록 촉구합니다. 미국 그린 빌딩 협회(USGBC)는 2030년까지 35조 달러가 넷 제로 자산으로 유입되어야 한다고 추정하고 있으며, 그 대부분은 운영 부하를 줄이는 외관에 할당되었습니다. BREEAM 인증을 취득한 런던의 크리스탈 빌딩 등의 뛰어난 랜드마크는 U값이 1.0 W/m2K 가까이를 달성하고 있어, 선진적인 유리가 인증 포인트를 획득해 그것이 임대료 프리미엄으로 이어지는 것을 나타내고 있습니다. 개발자들은 현재 재료 가격의 표면적 수치보다 총 소유 비용을 강조하고 있으며, 저방사율 제품 수요를 뒷받침하고 있습니다.

기존의 플로트 유리와의 초기 비용 비교

고부가가치 코팅이나 복층 유리는 표준 플로트 유리비로 40-80% 고가가 되어 초기 비용 중시 분야에서는 도입이 제한됩니다. 삼중 유리는 이중 유리 대비 15-25%의 가격차, 단열 유리(VIG)는 200-300%의 프리미엄 가격이 되기 때문에 주로 고사양 상업 프로젝트에 채용되고 있습니다. 신흥 시장에서는 자본 비용 절감을 우선하여 성능 향상을 뒷받침하는 경향이 있으며, 단기적으로는 판매 수량의 성장이 둔화되고 있습니다. 그러나 공공요금의 인상과 탄소가격 설정의 개시로 투자회수기간이 단축되고 도입저항이 완화되고 있습니다. 공공 부문의 보조금과 우대 대출은 특히 에너지 빈곤 가구를 대상으로 한 리노베이션 공사에서 비용 장벽을 더욱 줄여줍니다.

부문 분석

소프트코트 제품은 2025년 시점에서 에너지 효율 유리 시장의 61.82%를 차지했고 2031년까지 연평균 복합 성장률(CAGR) 5.51%를 나타낼 전망입니다. 이것은 0.04 미만의 비교할 수없는 방사율과 다층 유리 구조 사이의 호환성을 반영합니다. 건축기준에 따른 창의 열관류율(U값)의 조임과 함께 소프트코트 제품과 관련된 에너지 효율 유리 시장 규모는 꾸준히 확대될 것으로 예측됩니다. 첨단 멀티 실버 적층 기술은 가시광선 투과율을 손상시키지 않고 태양열 취득률을 최적화하고, 자연 채광을 요구하는 오피스 빌딩과 차내 쾌적성을 요구하는 EV 제조업체 모두에게 지지되고 있습니다. 하드코트 열분해 유리는 내구성과 내상성이 열성능 목표를 웃도는 단층 점포 프런트나 효율 요구가 겸손한 지역에서도 여전히 유용합니다. 공급업체는 엣지 헤이즈를 줄이고 수율 손실을 억제하는 폐쇄형 필드 캐소드 어레이를 채택하여 점보라이트 전체에서 스퍼터 균일성을 지속적으로 개선하고 있습니다.

자동차 수요의 급증이 소프트 코트 기술의 우위성을 더욱 확고한 것으로 하고 있습니다. 프리미엄 EV 브랜드에서는 저방사율 프런트 유리가 공장 출하 사양이 되어 ISO 9050 등의 규제 프레임워크이 성능 지표를 세계적으로 통일함으로써 인증 사이클이 단축되고 있습니다. 그러나 스퍼터링 라인 부족은 공급을 억제하고 합병과 장기 공급 계약에 의한 할당 확보의 움직임이 가속화되고 있습니다. 일류 플로트 제조업체는 수직 통합을 활용하고 은공급 체인을 관리함으로써 비용 급등을 최소화하고 있습니다. 자본 투자가 수요를 늦추는 경우, 고선택성 코팅의 스팟 프리미엄은 예측 기간 동안 지속될 수 있습니다.

에너지 효율 유리 보고서는 코팅 유형(하드 코트 파일로리틱 및 소프트 코트 마그네트론 스퍼터링), 유리 구조 유형(단층, 복층, 삼중층), 최종 사용자 산업(건축, 건설, 자동차, 태양전지판 및 기타 최종 사용자 산업), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)로 분류됩니다. 시장 예측은 금액(달러) 기준으로 제공됩니다.

지역별 분석

유럽은 신축 건물에 거의 제로 에너지를 의무화하는 EU 건축물 에너지 성능 지령을 배경으로 2025년 시점에서 에너지 효율 유리 시장의 34.21%의 점유율을 유지했습니다. 독일과 영국은 개정된 Part L 규정에 따라 사양을 추진했으며, 프랑스의 RE2020은 제조 과정의 탄소 배출량을 우선시하고 전기로에서 제조된 저탄소 플로트 유리로의 주문을 촉진했습니다.

아시아태평양은 2031년까지 연평균 복합 성장률(CAGR) 5.76%로 가장 높은 성장률을 나타내며 중국 단독으로 세계 신규 건설의 약 절반을 차지하고 있습니다. 주요 도시의 엄격한 건축 기준에서는 3층 유리 성능이 요구되고 인도의 스마트 시티 구상에서는 외피 효율을 중시한 그린빌 인증이 추진되고 있습니다.

북미에서는 미국 인플레이션 억제법에 근거한 세액 공제나 캐나다의 넷 제로 대응 로드맵에 의해 꾸준한 성장을 기록하고 있습니다. 캘리포니아의 타이틀 24와 북동부 각 도시의 건축 성능 기준이 개수 프로젝트의 기반이 되고 있습니다. 남미·중동 및 아프리카는 규모가 작은 것 전략적 의의가 높고, 에너지 요금의 상승이나 극단적인 기후 조건하에서의 냉방 수요가 일사 제어 유리 수요를 밀어 올리고 있습니다. 그러나 현지 제조 능력은 여전히 수요를 따라 잡지 못했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트 지원(3개월간)

자주 묻는 질문

목차

제1장 서론

- 조사 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 세계의 건축물 에너지 기준의 엄격화

- 그린빌딩인증(LEED, BREEAM) 증가

- 전기자동차용 저방사율(Low-E) 유리에 대한 OEM 수요

- 진공 단열 유리(VIG)의 급속한 개수 도입

- EU CBAM에 의한 저탄소 판유리 공급 체인의 우대

- 시장 성장 억제요인

- 기존의 플로트 유리에 비해 높은 초기 비용

- 소다재 및 에너지 가격의 변동이 이익률에 영향

- 세계의 마그네트론 스퍼터 코팅 설비의 한정된 생산 능력

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모와 성장 예측

- 코팅 유형별

- 하드 코팅(열분해)

- 소프트 코팅(마그네트론 스퍼터링)

- 유리 유형별

- 단일

- 이중

- 삼중

- 최종 사용자 업계별

- 건축 및 건설

- 자동차

- 태양광 패널

- 기타 최종 사용자 산업(산업용 등)

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/순위 분석

- 기업 프로파일

- Abrisa Technologies

- AGC Inc.

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- Guardian Industries Holdings

- Morley Glass & Glazing Ltd

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- SCHOTT

- Sisecam

- TuffX Glass

- Vitro

- Xinyi Glass Holdings Limited

제7장 시장 기회와 향후 전망

KTH 26.01.22Energy-efficient Glass market size in 2026 is estimated at USD 35.05 billion, growing from 2025 value of USD 33.38 billion with 2031 projections showing USD 44.73 billion, growing at 5.01% CAGR over 2026-2031.

Growth flows from stricter building-energy codes, green-building certifications, and the automotive shift to low-E glazing that extends electric-vehicle range. Technological gains in vacuum-insulated glass retrofits, the EU Carbon Border Adjustment Mechanism, and multi-layer silver coatings sustain product differentiation while protecting margins despite raw-material volatility. Producers with magnetron-sputter capacity enjoy pricing power as equipment lead times stretch up to three years. Simultaneously, collaborations between glassmakers and photovoltaic innovators unlock building-integrated solar facades that satisfy net-zero goals and open new revenue pools.

Global Energy-efficient Glass Market Trends and Insights

Stricter Global Building-Energy Codes

The latest International Energy Conservation Code trims allowable window U-factors by up to 17%, pushing architects toward low-E triple panes and vacuum solutions. California's 2025 Title 24 limits vertical fenestration U-factors to 0.47, a level achievable only with advanced soft-coat glazing. Canada's path to net-zero-ready buildings by 2030 sets a 0.27 target for fixed windows, accelerating triple-glazing demand. These codes eliminate loopholes that once permitted trade-offs, so performance now outweighs upfront cost during specification. Suppliers with multi-silver stacks find greater leverage as code updates proliferate across Asia-Pacific capitals. Compliance deadlines over the medium term underpin a dependable order pipeline for high-performance units.

Growth in Green-Building Certifications (LEED, BREEAM)

Certification frameworks reward envelope efficiency and embodied-carbon transparency. LEED v4.1 credits hinge on Environmental Product Declarations, nudging fabricators to quantify carbon footprints. The United States Green Building Council estimates USD 35 trillion must flow into net-zero assets by 2030, much of it earmarked for facades that cut operational loads. BREEAM Outstanding landmarks such as London's Crystal achieve U-values near 1.0 W/m2K, highlighting how advanced glazing delivers certification points that translate into rental premiums. Developers now value total cost of ownership over headline material prices, reinforcing demand for low-emissivity products.

High Upfront Cost Versus Conventional Float Glass

Premium coatings and multiple panes lift prices 40-80% above standard float, constraining adoption where first-cost sensitivity dominates. Triple units carry 15-25% mark-ups over double panes, while VIG commands 200-300% premiums, placing it mostly in high-spec commercial projects. Emerging markets often defer performance gains for capital savings, slowing near-term volume. Yet escalating utility tariffs and nascent carbon pricing are shortening payback horizons, easing resistance. Public-sector subsidies and concessional lending further erode the cost barrier, particularly in retrofits targeting energy-poverty households.

Other drivers and restraints analyzed in the detailed report include:

- OEM Demand for Low-E Glazing in EVs

- EU CBAM Favoring Low-Carbon Flat-Glass Supply Chains

- Limited Global Magnetron-Sputter Coating Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soft-coat products held 61.82% share of the energy-efficient glass market in 2025 and are growing at a 5.51% CAGR through 2031, reflecting unmatched emissivity below 0.04 and compatibility with multi-pane assemblies. The energy-efficient glass market size attached to soft-coat offerings is forecast to expand steadily as building codes ratchet down window U-factors. Advanced multi-silver stacks optimize solar heat-gain coefficients without sacrificing visible transmittance, appealing to both office towers seeking daylighting and EV makers requiring cabin comfort. Hard-coat pyrolytic glass remains relevant in monolithic storefronts and regions with modest efficiency requirements where durability and scratch resistance outweigh thermal targets. Suppliers continually refine sputter uniformity across jumbo lites, using closed-field cathode arrays that cut edge haze and reduce yield loss.

A surge in automotive demand further cements soft-coat ascendance. Low-E windshields are now factory-specified by premium EV brands, and regulatory frameworks such as ISO 9050 harmonize performance metrics globally, shortening qualification cycles. However, sputter-line scarcity tempers supply, prompting mergers and long-term offtake agreements that lock in allocations. Tier-one float producers leverage vertical integration to control silver supply chains, minimizing cost spikes. Should capital commitments lag demand, spot premiums for high-selectivity coatings may persist well into the forecast horizon.

The Energy-Efficient Glass Report is Segmented by Coating Type (Hard-Coat Pyrolytic and Soft-Coat Magnetron-Sputtered), Glazing Type (Single, Double, and Triple), End-User Industry (Building and Construction, Automotive, Solar Panel, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 34.21% share of the energy-efficient glass market in 2025 on the back of the EU Energy Performance of Buildings Directive that requires near-zero-energy new builds. Germany and the UK drove specification with updated Part L rules, while France's RE2020 prioritized embodied carbon, steering orders toward low-carbon float made with electric furnaces.

Asia-Pacific posts the briskest 5.76% CAGR through 2031 as China alone accounts for roughly half of global new construction. Stringent Tier-1 city codes now reference triple-pane performance, and India's Smart Cities Mission fosters green-building certifications that spotlight envelope efficiency.

North America records steady gains aided by tax credits under the U.S. Inflation Reduction Act and Canada's net-zero-ready roadmap. Title 24 in California and city-level building-performance standards across the Northeast anchor retrofit pipelines. South America and the Middle East and Africa remain smaller but strategic: rising energy tariffs and extreme-climate cooling needs boost solar-control glazing uptake, though local fabrication capacity still lags demand.

- Abrisa Technologies

- AGC Inc.

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- Guardian Industries Holdings

- Morley Glass & Glazing Ltd

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- SCHOTT

- ?i?ecam

- TuffX Glass

- Vitro

- Xinyi Glass Holdings Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter global building-energy codes

- 4.2.2 Growth in green-building certifications (LEED, BREEAM)

- 4.2.3 OEM demand for low-E glazing in EVs

- 4.2.4 Rapid retrofit uptake of vacuum-insulated glass (VIG)

- 4.2.5 EU CBAM favouring low-carbon flat-glass supply chains

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional float glass

- 4.3.2 Volatile soda-ash and energy prices impacting margins

- 4.3.3 Limited global magnetron-sputter coating capacity

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Coating Type

- 5.1.1 Hard-coat (pyrolytic)

- 5.1.2 Soft-coat (magnetron-sputtered)

- 5.2 By Glazing Type

- 5.2.1 Single

- 5.2.2 Double

- 5.2.3 Triple

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Solar Panel

- 5.3.4 Other End-user Industries (Industrial, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abrisa Technologies

- 6.4.2 AGC Inc.

- 6.4.3 CARDINAL GLASS INDUSTRIES, INC

- 6.4.4 Central Glass Co., Ltd.

- 6.4.5 Corning Incorporated

- 6.4.6 Fuyao Group

- 6.4.7 Guardian Industries Holdings

- 6.4.8 Morley Glass & Glazing Ltd

- 6.4.9 Nippon Sheet Glass Co., Ltd

- 6.4.10 Saint-Gobain

- 6.4.11 SCHOTT

- 6.4.12 ?i?ecam

- 6.4.13 TuffX Glass

- 6.4.14 Vitro

- 6.4.15 Xinyi Glass Holdings Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment