|

시장보고서

상품코드

1521408

프로브 카드 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Probe Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

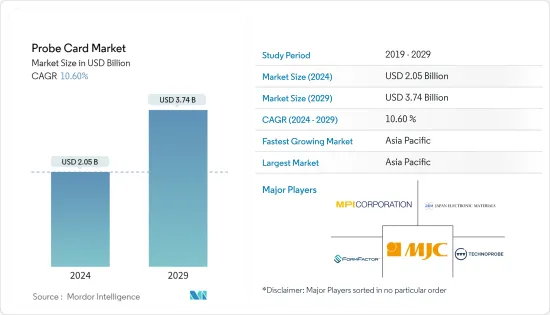

프로브 카드 시장 규모는 2024년에 20억 5,000만 달러로 추정되고, 2029년에는 37억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR 10.60%로 성장할 전망입니다.

주요 하이라이트

- 반도체 생산 증가, 반도체 파운드리 설립을 위한 정부 및 주요 벤더의 지속적인 투자가 시장 성장을 가속하고 있습니다.

- 패키징 기술의 진보는 반도체 칩을 테스트하기 위한 고효율 프로브 카드 수요를 더욱 높여줍니다. MEMS 기술은 테스트 시점의 장점과 정확도가 높기 때문에 프로브 카드 시장의 견인 역할을 하고 있습니다. 자동차, 통신, 소비자용 전자기기, 의료 등 다양한 산업에서 반도체 칩의 사용이 증가하고 있는 것도 시장의 성장을 높이고 있습니다.

- 그러나 프로브 카드와 관련된 높은 비용은 시장 성장을 억제합니다. 원재료 가격 상승은 프로브 카드의 제조 비용을 증가시켜 시장 성장을 억제합니다.

- 소비자용 전자기기, 자동차, 로봇 및 기타 용도에서 주로 DRAM, 파운드리 IC, 로직 IC 등 반도체 메모리 칩 수요가 증가하고 있기 때문에 칩의 기능을 테스트하는 프로브 카드 수요가 확대되고 있습니다. 소비자 수요 증가로 반도체 제조의 급격한 성장이 DRAM, 파운드리, 로직 IC 시장을 견인하고 있습니다.

- 프로브 카드와 관련된 높은 비용은 시장 성장을 제한하는 여러 과제를 제시합니다. 초기 투자 요구 사항, 생산 비용 및 유지 보수 비용 증가, 확장성 및 유연성 저하, 신기술 채택 지연, 중소기업 진입 장벽 등이 프로브 카드 비용이 많이 드는 요인의 일부입니다.

- 중국과 미국 사이에 이어지는 무역 마찰은 메모리 시장의 성장에 큰 영향을 미칩니다. 중국의 입장에서 보면 미국 상무부가 2022년 10월에 발동한 상업 제한은 메모리 생산 확대에 대한 불확실성을 낳았습니다. 그 결과, 메모리 업계의 주요 기업인 YMTC와 CXMT의 웨이퍼 생산 능력은 향후 5년간 총 약 180kWpm로 제한될 것으로 예상됩니다.

프로브 카드 시장 동향

MEMS가 기술 부문을 독점

- MEMS 프로브 카드 수요가 증가하고 있습니다. MEMS 프로브 카드는 반도체 디바이스와 테스트 장비 간의 정확하고 신뢰할 수 있는 전기적 연결을 촉진하기 때문에 반도체 테스트 프로세스에 필수적인 구성 요소입니다.

- MEMS 프로브 카드는 반도체 디바이스의 패드와의 접촉을 확립하고 전기 테스트를 용이하게 하는 작은 프로브로 구성되어 있습니다. 이러한 프로브는 반도체 제조법을 이용하여 제조되므로 소형이고 뛰어난 기능을 갖추고 있습니다.

- MEMS 기술을 사용하면 iC I/O 및 전원 연결과 접촉하는 프로브를 미크론 수준의 정확도로 제조할 수 있습니다. 그 정밀도로 MEMS 프로브는 첨단 포장 및 첨단 반도체 공정 노드의 정밀 피치 및 다 핀화 요구에 대응하기에 적합합니다.

- 그러나 모든 MEMS 프로브가 동일하게 만들어지는 것은 아닙니다. MEMS 프로브 카드는 첨단 2.5/3D 패키지, 자동차 산업용 IC 테스트에 필요한 넓은 온도 범위, RF 용도에서 고 대역폭 및 효율적인 신호 무결성의 새로운 요구 사항, 한 번의 터치 다운으로 수천 개별 DRAM 메모리 장치를 테스트하는 비용 절감과 같은 문제에 대응하고 이러한 개발의 최전선에 서 있습니다.

- 수년간 자동차에 탑재되는 집적 회로(IC)는 일관되게 증가해 왔습니다. 모바일 커넥티비티, 자동차 안전, 전동 자동차 등 자동차 용도의 지속적인 발전은 반도체 함량을 전례 없는 수준으로 끌어올릴 것으로 예상됩니다. 특히 자동차의 안전성과 전력 진보는 엄격한 작동 조건 하에서도 탁월한 성능과 신뢰성을 필요로 하므로 MEMS 프로브 카드에 대한 높은 수요가 발생합니다.

- 운전 지원 시스템의 도입이 엄격해짐에 따라 MEMS 프로브 카드 수요가 확대될 것으로 예상됩니다. 게다가 정부 지원과 연료 가격 상승으로 전기차가 보급되고 있습니다.

- 예를 들어 국제에너지기구(IEA)는 넷제로 시나리오에서 2030년까지 전기자동차(EV)의 판매 대수가 자동차 판매 대수 전체의 약 65%를 차지할 것으로 예측했습니다. 이를 달성하기 위해서는 2023년부터 2030년까지 EV의 판매 대수가 매년 25% 전후의 성장률을 나타낼 필요가 있습니다. 이러한 EV 판매의 급격한 성장은 ADAS 시스템과 인포테인먼트 시스템에 대한 큰 수요를 창출하여 MEMS 프로브 카드 수요가 증가합니다.

- OICA에 따르면 2023년에는 세계에서 약 9,400만 대의 자동차가 생산됩니다. 전년 대비 약 10% 증가를 보여줍니다. 중국, 일본, 독일은 자동차 및 상용차의 최대 생산국입니다.

아시아태평양이 현저한 성장을 이룰 전망

- 다양한 지역 산업의 역학 변화를 고려하면 아시아태평양은 시장 성장에 크게 기여할 것으로 예상됩니다. 이 지역은 주로 중국과 일본에 유명한 반도체 제조 업체, 주요 반도체 재료 공급업체, 첨단 장비, 특수 반도체가 있습니다.

- 세계의 고대역폭 메모리(HBM)와 다이나믹 랜덤 액세스 메모리(DRAM) 시장에서의 한국의 경쟁 우위도 프로브 카드 시장을 지원하는 원동력이 되고 있습니다. 또한 안전, 자동화, 전동화, 보안 목적으로 자동차 전자에 반도체가 통합되어 있는 것도 이 지역의 프로브 카드 시장의 성장에 기여하고 있습니다.

- 이 지역은 더 새롭고 지속 가능한 미래를 위해 자동차 산업에 대한 투자가 활발합니다. 이 때문에 IGBT 반도체, AC-DC 컨버터, 차량용 IC 등 수요가 높고, 이 지역의 프로브 카드 수요를 뒷받침하고 있습니다. 중국의 자동차 및 모빌리티 산업은 국내 시장에서의 호조적인 실적과 유망한 장래성으로 세계적으로 유명합니다. 중국공업정보화부의 예측에 의하면, 동국의 자동차 생산 대수는 2025년까지 3,500만대에 달할 전망이며, 세계 톱의 자동차 제조업체로서의 지위를 굳힐 전망입니다.

- Invest Korea의 보고서에 따르면 한국 정부는 전기자동차(EV) 보조금을 2023년 말까지 확대했습니다. 한국 정부는 2030년까지 신차 판매 대수에서 차지하는 수소 자동차와 전기자동차의 비율을 33% 증가시키는 것을 목표로 하고 있습니다.

- NITI Ayog에 따르면 인도의 EV 금융 산업은 2030년까지 500억 달러에 이를 것으로 예상됩니다. 인도 정부는 2030년까지 자가용차로 30%, 버스로 40%, 상용차로 70%, 이륜차로 80%라는 야심찬 EV 보급 목표를 내걸고 있습니다. SMEV의 데이터에 따르면 인도에서는 사륜 전기자동차 판매가 현저하게 급증했고, 2024년도에는 9만432대가 판매되어 전년도 대비 대폭적인 성장을 보였습니다.

- 중국은 5G 인프라 개발의 최전선에 있습니다. MIIT 보고에 따르면 2023년도 중국의 5G 기지국 수는 338만국이었습니다. 인터넷 서비스의 보급은 스마트폰, 노트북, 태블릿 단말기 수요를 증가시키고, 국내 시장의 성장을 조장하는 환경을 더욱 만들어 냅니다.

- 예를 들어, 중국 국가 통계국에 따르면, 중국에서의 소비자용 전자 기기 및 소비자용 전자 기기의 매출은 2023년 12월의 772억 5,000만 위안(10.67달러)에 대해, 2024년 1월과 2월은 1,309억 5,000만 위안(18.08달러)으로 증가했습니다.

프로브 카드 산업 개요

프로브 카드 시장은 세계적 기업과 중소 기업이 존재하기 때문에 매우 단편화되었습니다. 이 시장의 주요 진출기업으로는 Formfactor Inc., Tecnoprobe SpA, Micronics Japan, Japan Electronic Materials Corporation, Mpi Corporation 등이 있습니다. 시장 진출 기업은 제품 라인업을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

*2024년 5월-FormFactor는 TechInsight의 고객 만족도 조사에서 탁월한 성능이 다시 인정되었다고 발표했습니다. 반도체 제조업체는 이 조사를 통해 고객 서비스, 고성능 및 제품 품질에 대한 공급업체를 전 세계적으로 평가했습니다. FormFactor는 특히 프로브 카드 제조에서 11년 연속 테스트 서브시스템의 주요 공급업체로 선정되었습니다.

*2024년 3월-Micronics Japan의 독일 자회사인 MJC Europe Gmbh는 2024년 1월에 새로운 사무소로 이전하기로 결정했습니다. 이번 전략적 이전은 로직 칩용 프로브 카드나 테스트 소켓의 판매 강화를 목적으로 한 것으로, 특히 유럽의 자동차 관련 부문에 주력해 나갑니다. 뮌헨의 새로운 사무실은 유럽 반도체 산업의 중심지라는 전략적 위치에 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- COVID-19 후유증과 기타 거시경제 요인이 시장에 미치는 영향

- 업계의 매력-Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 기술 스냅샷

- 가격 동향 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 컨슈머 일렉트로닉스 및 IoT 수요 증가

- 전자제품의 소형화

- 반도체 산업에 있어서의 기술의 진보 및 혁신

- 시장의 과제 및 억제요인

- 프로브 카드와 관련된 높은 비용

- 프로브 카드 솔루션의 이점에 관한 소비자의 인식 부족

제6장 시장 세분화

- 기술별

- MEMS

- 세로형

- 캔틸레버

- 특수기술

- 기타

- 용도별

- DRAM

- 플래시

- 파운드리 및 로직

- 파라메트릭

- 기타

- 유형별

- 표준 프로브 카드

- 첨단 프로브 카드

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 벤더의 시장 점유율 분석(2023년)

- 기업 프로파일

- Formfactor Inc.

- Technoprobe SPA

- Micronics Japan Co. Ltd

- Japan Electronic Materials Corporation

- Mpi Corporation

- Feinmetall Gmbh

- Korea Instruments Co. Ltd

- Wentworth Laboratories Inc.

- GGB Industries Inc.

- Protec Mems Technology

- Nidec SV Probe

- Star Technologies Inc.

- Willtechnology Co Ltd

- TSE Co. Ltd

제8장 투자 분석

제9장 시장의 미래

AJY 24.08.05The Probe Card Market size is estimated at USD 2.05 billion in 2024, and is expected to reach USD 3.74 billion by 2029, growing at a CAGR of 10.60% during the forecast period (2024-2029).

Key Highlights

- Increased semiconductor production and continuous government and key vendor investment in establishing semiconductor foundries are driving the growth of the market.

- The advancement in packaging technology further boosts the demand for highly efficient probe cards to test semiconductor chips. MEMS technology gained traction in the probe card market due to the benefits and accuracy it offers during testing. The augmented use of semiconductor chips in several industry verticals, including automotive, communication, consumer electronics, and healthcare, is also increasing the growth of the market.

- However, the high cost associated with the probe cards restricts the growth of the market. An increase in the prices of raw materials enhances the production cost of probe cards, which, in turn, restricts the growth of the market.

- The increased demand for semiconductor memory chips, mainly DRAM and Foundry and Logic ICs, across consumer electronics, automotive and robotics, and other applications creates a huge demand for probe cards to test the chips' functionality. Due to growing consumer demand, exponential growth in semiconductor manufacturing drives the DRAM, foundry, and logic IC market.

- The high cost associated with probe cards presents multiple challenges that are restricting the growth of the market. Significant initial investment requirements, increased production and maintenance costs, reduced scalability and flexibility, slower adoption of new technologies, and barriers to entry for smaller players are some of the factors that result in higher costs for probe cards.

- The ongoing trade tensions between China and the United States have significantly impacted the growth of the memory market. From a Chinese standpoint, the commercial restrictions imposed by the US Department of Commerce in October 2022 created uncertainty regarding the expansion of memory production. As a result, the combined wafer capacities of the top memory companies, YMTC and CXMT, are expected to be limited to approximately 180kWpm over the next five years.

Probe Card Market Trends

MEMS to Dominate the Technology Segment

- The demand for MEMS probe cards is increasing. They are essential components in the semiconductor testing process, as they facilitate accurate and dependable electrical connection between the semiconductor device and the testing equipment.

- MEMS probe cards consist of tiny probes that establish contact with the pads on a semiconductor device, facilitating electrical testing. These probes are manufactured utilizing semiconductor fabrication methods, which allow for their small dimensions and exceptional functionality.

- MEMS technology allows for the production of probes that contact the I/Os and power connections on ICs at micron-level perfection. Due to their accuracy, MEMS probes are suitable for supporting the fine-pitch and high-pin count requirements of advanced packaging and advanced semiconductor process nodes.

- However, not all MEMS probes are created equal. MEMS probe cards are at the forefront of these developments, addressing issues with advanced 2.5/3D packages, the wide temperature ranges needed to test ICs for the automotive industry, the emerging requirements for high bandwidth and efficient signal integrity in RF applications, and lowering the cost to test thousands of DRAM memory devices in a single touch down.

- Over the years, the integrated circuit (IC) content in automobiles has consistently increased. The continuous development of automotive applications, such as mobile connectivity, automotive safety, and electrically powered vehicles, is anticipated to push the semiconductor content to unprecedented levels. Particularly, the advancements in automotive safety and electrical power will necessitate exceptional performance and reliability, even in challenging operating conditions, which create high demand for MEMS probe cards.

- With the increasing stringency in the implementation of driver assistance systems, the demand for MEMS probe cards is expected to grow. In addition, electric vehicles are gaining traction due to government support and increased fuel prices.

- For instance, the International Energy Agency (IEA) projected that electric vehicle (EV) sales will make up approximately 65% of total car sales by 2030 in the Net Zero Scenario. In order to achieve this, there must be an annual growth rate of around 25% in EV sales from 2023 to 2030. Such an exponential growth in EV sales creates a huge demand for ADAS systems and infotainment systems, resulting in increased demand for MEMS probe cards.

- According to OICA, in 2023, approximately 94 million motor vehicles were produced worldwide. Indicating an increase of around 10% compared to the previous year. China, Japan, and Germany were among the largest producers of cars and commercial vehicles.

Asia Pacific Expected to Witness Significant Growth

- Considering the changing dynamics of various regional industries, Asia-Pacific is anticipated to remain among the prominent contributors to the market's growth. The region has well-known semiconductor manufacturers, major semiconductor materials suppliers, advanced equipment, and specialized semiconductors, primarily in China and Japan.

- South Korea's competitive advantage in the global high-bandwidth memory (HBM) and dynamic random-access memory (DRAM) markets is another driving force behind the probe card market. The integration of semiconductors into automotive electronics for safety, automation, electrification, and security purposes also contributes to the growth of the probe card market in the region.

- The region is highly investing in its automotive industry, owing to a newer and sustainable future. This creates a high demand for IGBT semiconductors, AC-DC converters, automotive ICs, etc., thus propelling the demand for probe cards in the region. The Chinese automotive and mobility industry is globally renowned for its strong performance in the domestic market and promising prospects. The Chinese Ministry of Industry and Information Technology forecasts that the country's vehicle production is expected to hit 35 million by 2025, solidifying its position as the top car manufacturer worldwide.

- According to a report from Invest Korea, the South Korean government expanded electric vehicle (EV) subsidies until the end of 2023. By 2030, the government of Korea aims to increase the share of hydrogen and electric vehicles in new vehicle sales by 33%.

- According to NITI Ayog, India's EV finance industry is expected to reach USD 50 billion by 2030. The Indian government has set ambitious targets for EV adoption, aiming for 30% for private cars, 40% for buses, 70% for commercial vehicles, and 80% for two-wheelers by 2030, as stated in the NITI Ayog report. According to SMEV data, India witnessed a remarkable surge in the sale of four-wheel electric vehicles, with 90,432 units sold in FY 2024, showcasing a significant increase compared to the previous fiscal year.

- China is at the forefront of 5G infrastructure development. As reported by MIIT, China had 3.38 million 5G base stations in FY 2023. The widespread availability of internet services increases the demand for smartphones, laptops, and tablets, further creating a conducive environment for the growth of the country's market.

- For instance, according to the National Bureau of Statistics of China, the sales of consumer electronics and household appliances in China increased to CNY 130.95 billion (USD 18.08) in January/February 2024, compared to CNY 77.25 billion (USD 10.67) in December 2023.

Probe Card Industry Overview

The Probe Card market is highly fragmented due to the presence of global players and small and medium-sized enterprises. Some of the major players in the market are Formfactor Inc., Technoprobe SpA, Micronics Japan Co Ltd, Japan Electronic Materials Corporation, and Mpi Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

* May 2024 - FormFactor announced that it has been acknowledged again for its outstanding performance in TechInsight's customer satisfaction survey. Semiconductor manufacturers globally assess their suppliers on customer service, high performance, and product quality through this survey. FormFactor has been consistently selected as a leading provider of Test Subsystems for eleven consecutive years, particularly in producing probe cards.

* March 2024 - MJC Europe Gmbh, a German subsidiary of Micronics Japan Co. Ltd, decided to move to a new office in January 2024. This strategic relocation aims to enhance sales prospects for probe cards and test sockets designed for logic chips, specifically focusing on the automotive sector in Europe. The company's new office in Munich is strategically positioned within the semiconductor industry hubs of Europe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.5 Pricing Trend Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Consumer Electronics and IOT

- 5.1.2 Miniaturization of Electronic Products

- 5.1.3 Technological Advancement And Innovations in Semiconductor Industry

- 5.2 Market Challenges/restraints

- 5.2.1 High Costs Associated with Probe Cards

- 5.2.2 Lack of Awareness Among Consumers Regarding The Benefits of Probe Card Solution

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 MEMS

- 6.1.2 Vertical

- 6.1.3 Cantilever

- 6.1.4 Speciality

- 6.1.5 Other Technologies

- 6.2 By Application

- 6.2.1 DRAM

- 6.2.2 Flash

- 6.2.3 Foundry and Logic

- 6.2.4 Parametric

- 6.2.5 Other Applications

- 6.3 By Type

- 6.3.1 Standard Probe Card

- 6.3.2 Advanced Probe Card

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share Analysis - 2023

- 7.2 Company Profiles*

- 7.2.1 Formfactor Inc.

- 7.2.2 Technoprobe S.P.A.

- 7.2.3 Micronics Japan Co. Ltd

- 7.2.4 Japan Electronic Materials Corporation

- 7.2.5 Mpi Corporation

- 7.2.6 Feinmetall Gmbh

- 7.2.7 Korea Instruments Co. Ltd

- 7.2.8 Wentworth Laboratories Inc.

- 7.2.9 GGB Industries Inc.

- 7.2.10 Protec Mems Technology

- 7.2.11 Nidec SV Probe

- 7.2.12 Star Technologies Inc.

- 7.2.13 Willtechnology Co Ltd

- 7.2.14 TSE Co. Ltd