|

시장보고서

상품코드

1521693

디지털 화물 매칭 플랫폼 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Digital Freight Matching Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

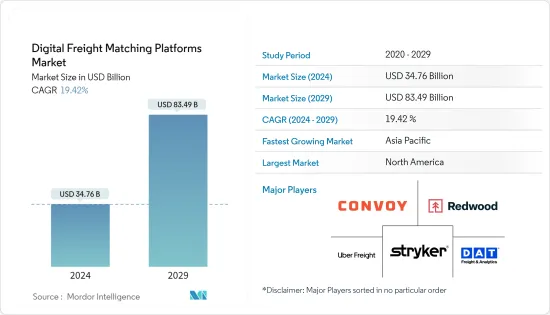

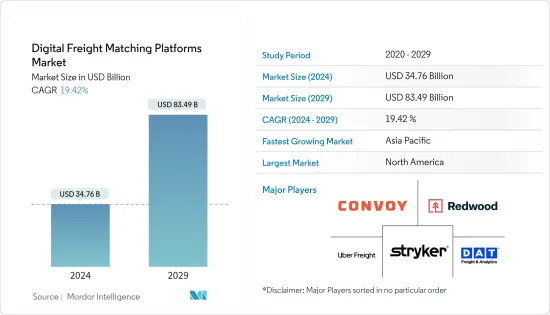

디지털 화물 매칭 플랫폼의 시장 규모는 2024년 347억 6,000만 달러로 추정되며, 2029년에는 834억 9,000만 달러에 달할 것으로 예상되며, 예측 기간(2024-2029년) 동안 19.42%의 CAGR로 성장할 것으로 예상됩니다.

주요 하이라이트

- 공급망 자동화 및 디지털화에 대한 수요 증가가 시장 성장의 원동력입니다. 디지털 화물 매칭 플랫폼은 화주와 운송업체를 실시간으로 연결하여 솔루션을 제공합니다. 이는 애플리케이션과 플랫폼을 통해 제공되는 비교적 새로운 기술로, 화주가 화물의 요구 사항을 공유하고 운송 회사가 화물을 효율적으로 찾고 예약하는 데 도움을 줄 수 있습니다.

- 시장 성장의 주요 촉진요인 중 하나는 온라인 판매의 붐입니다. 온라인 쇼핑의 발전으로 소비자에게 상품을 공급하기 위한 운송 서비스에 대한 수요가 증가하고 있습니다. 수요에 효율적으로 대응하기 위해 DFM 플랫폼은 E-Commerce 기업이 운송 회사의 용량을 활용할 수 있도록 돕고 있습니다.

- 국제 무역량이 증가함에 따라 화물 운송 서비스에 대한 수요가 증가하고 있습니다. 기업들은 화물 운송 이용이 증가하는 것을 이용하여 기술 혁신을 통해 효율성을 향상시키고 있습니다. 운송 및 공급망 지연은 매출 손실로 이어질 수 있으며, 지연이 다른 운송 서비스에 연쇄적으로 영향을 미치면 기업에 막대한 손실을 초래할 수 있습니다. 효율성을 높이고 지연을 피하기 위해 화물 매칭 플랫폼과 같은 다양한 화물 관리 솔루션이 널리 보급되고 있습니다.

디지털 화물 매칭 플랫폼 시장 동향

모바일 기반 부문이 전체 시장을 지배

대부분의 시장 기업들은 구글 플레이와 애플 앱스토어에서 모바일 애플리케이션을 제공하고 있습니다. 중국에 기반을 둔 Full Truck Alliance(Jiangsu ManYun Software Technology)는 Yunmanman 및 Huochebang과 같은 모바일 앱을 통해 운임 매칭 및 부가가치 서비스를 제공하고 있습니다. 모바일 기술 기반 플랫폼은 웹 기술보다 빠르며, 앱은 오프라인에서도 실행할 수 있습니다.

이러한 앱은 화물에 대한 실시간 가시성을 제공하여 화주와 운송업체가 화물을 추적하고, 경로를 모니터링하고, 적시에 최신 정보를 받을 수 있도록 합니다.

2023년 5월, Transfix Inc.는 부정행위를 최소화하고 디지털 예약을 강화하기 위해 고안된 운송업체 식별 솔루션인 Highway와의 협업을 발표했습니다. 이 통합을 통해 운송 회사 규정 준수 및 온보딩 절차의 투명성과 효율성을 높일 수 있습니다. 모바일 앱은 지리적 위치 서비스 및 IoT 통합을 활용하여 경로를 최적화하고 화물의 안전을 보장합니다.

북미가 전체 시장을 지배

인터넷과 스마트폰 보급률이 높은 북미지역은 첨단 기술 인프라가 발달되어 있습니다. 따라서 현지 운송업체와 운송업체는 디지털 화물 매칭 플랫폼에 접근할 수 있습니다. 이 지역의 현대적인 연결 환경은 화주와 운송업체가 디지털 화물 매칭 시스템에 원활하게 접근할 수 있도록 지원합니다.

북미에서의 이러한 가용성 향상은 DFM 솔루션의 전반적인 채택과 성공에 큰 영향을 미칠 것입니다. 발달된 기술 생태계는 이 지역에 디지털 운임 매칭 시장의 성장을 촉진하는 환경을 제공하고 있습니다.

북미 물류 부문은 초고속 인터넷과 휴대전화를 보유한 인구가 많기 때문에 디지털 플랫폼을 효과적으로 활용할 수 있는 최적의 조건을 갖추고 있습니다. 이러한 플랫폼에 쉽게 접근할 수 있게 되면 업무 효율성이 향상되고, 의사결정 과정이 빨라지며, 진화하고 빠르게 반응하는 화물 생태계를 촉진할 수 있습니다.

2024년 3월, 볼트 익스프레스는 동급 최고의 디지털 화물 매칭 시스템을 출시한다고 발표했습니다. 이 새로운 디지털 시스템은 API, EDI 또는 XML을 통해 대량의 배송 계정과 원활하게 통합하여 화물 매칭을 간소화합니다. 볼트는 이메일, 전화 또는 문자로 전송된 새로운 요청을 읽고 즉시 처리하기 위해 첨단 인공지능(AI)을 사용하여 화물 설정을 간소화하고 가장 까다롭고 긴급한 배송 문제에 대한 적시적절한 해결책을 제공하도록 보장합니다. 적시에 해결책을 제공합니다.

디지털 화물 매칭 플랫폼 산업 개요

여러 기업이 존재하기 때문에 디지털 화물 매칭 플랫폼 시장은 더욱 통합될 필요가 있으며, 경쟁이 치열할 것으로 예상됩니다. 경쟁에 대응하고 효율성, 무결성 및 안전성을 보장하기 위해 시장의 주요 서비스 제공 업체는 지속적으로 기술을 업그레이드하고 있습니다. 이들 업체들은 경쟁사와의 경쟁력을 확보하고 시장 점유율을 높이기 위해 파트너십, 제품 업그레이드, 협업에 중점을 두고 있으며, Uber Freight(Uber Technologies Inc.), Redwood, Convoy Inc., Stryker Corporation, DAT Solutions 등이 있습니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 성과

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 운송업체와 하주 간의 신뢰할 수 있는 접속에 대한 요구 상승

- 화물 실시간 가시화에 대한 수요

- 시장 성장 억제요인

- 물류 업계 세분화

- 데이터 보안에 대한 우려

- 시장 기회

- 수작업을 줄이는 요구 상승

- 밸류체인/공급망 분석

- 세계의 디지털 운임 매칭 시장의 주요 성장 전략

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향

제5장 시장 세분화

- 서비스 전망별

- 부가가치 서비스

- 화물 매칭 서비스

- 플랫폼 전망별

- 웹 기반

- 모바일 기반

- 수송 방식별

- 철도화물

- 도로화물

- 해상화물

- 항공화물

- 최종사용자별

- 식품 및 음료

- 소매·E-Commerce

- 제조업

- 석유 및 가스

- 자동차

- 헬스케어

- 기타 최종사용자

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 기타 아시아태평양

- 라틴아메리카

- 브라질

- 아르헨티나

- 기타 라틴아메리카

- 중동 및 아프리카

- 아랍에미리트

- 사우디아라비아

- 카타르

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 상황

- 시장 집중 개요

- 기업 개요

- Uber Freight(Uber Technologies, Inc.)

- Redwood

- C.H. Robinson Worldwide Inc.

- XPO Inc.

- Convoy Inc

- Stryker Corporation

- DAT Solutions

- Cargomatic Inc.

- Flexport

- Roper Technologies Inc.

- Loji Logistics

- Freight Technologies, Inc.

- 기타 기업

제7장 시장 기회와 향후 동향

제8장 부록

ksm 24.08.01The Digital Freight Matching Platforms Market size is estimated at USD 34.76 billion in 2024, and is expected to reach USD 83.49 billion by 2029, growing at a CAGR of 19.42% during the forecast period (2024-2029).

Key Highlights

- An increasing need for automation and digitalization in supply chains drives the market's growth. Digital freight matching platforms provide solutions for shippers and carriers by connecting them in real time. It is a relatively new technology offered through an application or a platform that enables shippers to share their load requirements and assist carriers in finding and booking loads efficiently.

- One of the main drivers for market growth has been a boom in online sales. The development of online shopping has resulted in a growing demand for transport services to supply the consumer with products. To effectively meet demand, DFM platforms help e-commerce companies utilize carriers' capacity.

- The demand for freight services is increasing due to the growing volume of international trade. Companies are taking advantage of the increasing use of freight transport to improve their efficiency through technology innovation. Delays in the shipping and supply chain may lead to a loss of sales, which could amount to huge losses for firms when delays cascade into other transport services. Various freight management solutions, e.g., freight matching platforms, are becoming widely accepted to improve efficiency and avoid delays.

Digital Freight Matching Platforms Market Trends

The Mobile-Based Segment Dominates the Overall Market

Most market players provide mobile applications on Google Play and Apple Inc.'s App Store. China-based Full Truck Alliance (JiangSu ManYun Software Technology Co. Ltd) provides freight matching and value-added services through mobile apps such as Yunmanman and Huochebang. Platforms based on mobile technology are faster than web technologies, and apps can be run offline.

These apps provide real-time visibility of shipments, allowing shippers and carriers to track cargo, monitor routes, and receive timely updates.

In May 2023, Transfix Inc. unveiled a collaboration with Highway, a carrier identification solution engineered to minimize fraud and enhance digital bookings. This integration boosts transparency and efficiency in carrier compliance and onboarding procedures. By leveraging geolocation services and IoT integration, mobile apps optimize routes and ensure cargo safety, resulting in more reliable and efficient freight operations and boosting their adoption in the logistics industry.

North America Dominates the Overall Market

With a high penetration of the Internet and smartphones, North America has developed an advanced technology infrastructure. Therefore, local carriers and transporters may access digital freight matching platforms. The region's modern connectivity landscape provides seamless access to digital freight matching systems for shippers and carriers.

This increased availability in North America significantly impacts the overall adoption of DFM solutions and their success. A developed technological ecosystem provides the region with an environment conducive to the growth of the digital freight matching market.

The logistics sector in North America is well-placed to exploit digital platforms effectively, given the large number of people with high-speed Internet and mobile phones. The ease of access to these platforms will improve operational efficiency, speed up the decision-making process, and stimulate an evolving and responsive freight ecosystem.

In March 2024, Bolt Express announced the launch of its best-in-class digital freight matching system. This new digital system streamlines freight matching by seamlessly integrating via API, EDI, or XML with high-volume shipping accounts. For all other ad-hoc customer shippers, Bolt simplifies shipment set-up by using the power of advanced artificial intelligence (AI) to read and instantly process new requests submitted via email, phone, or text to ensure they receive a timely solution to their most challenging and urgent shipping problems.

Digital Freight Matching Platforms Industry Overview

Due to the presence of several players, the digital freight matching platform market needs to be more cohesive and expected to be subject to competition. To keep pace with competition and guarantee efficiency, integrity, and security, the leading service providers in the market are constantly upgrading their technology. These players focus on partnerships, product upgrades, and collaboration to gain a competitive edge over their competitors and capture a significant market share. Several players include Uber Freight (Uber Technologies Inc.), Redwood, Convoy Inc., Stryker Corporation, and DAT Solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Need for Reliable Connections between Carriers and Shippers

- 4.2.2 Demand for Real-time Visibility of Shipments

- 4.3 Market Restraints

- 4.3.1 High Fragmentation of the Logistics Industry

- 4.3.2 Data Security Concerns

- 4.4 Market Oppourtunities

- 4.4.1 Rising Need to Reduce the Manual Work

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Major Growth Strategy In The Global Digital Freight Matching Market

- 4.7 Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Service Outlook

- 5.1.1 Value-Added Services

- 5.1.2 Freight Matching Services

- 5.2 By Platform Outlook

- 5.2.1 Web-Based

- 5.2.2 Mobile-Based

- 5.3 By Transportation Mode

- 5.3.1 Rail Freight

- 5.3.2 Road Freight

- 5.3.3 Ocean Freight

- 5.3.4 Air Freight

- 5.4 By End User

- 5.4.1 Food & Beverages

- 5.4.2 Retail & E-Commerce

- 5.4.3 Manufacturing

- 5.4.4 Oil & Gas

- 5.4.5 Automotive

- 5.4.6 Healthcare

- 5.4.7 Other End Users

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Latin America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of Latin America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Qatar

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Uber Freight (Uber Technologies, Inc.)

- 6.2.2 Redwood

- 6.2.3 C.H. Robinson Worldwide Inc.

- 6.2.4 XPO Inc.

- 6.2.5 Convoy Inc

- 6.2.6 Stryker Corporation

- 6.2.7 DAT Solutions

- 6.2.8 Cargomatic Inc.

- 6.2.9 Flexport

- 6.2.10 Roper Technologies Inc.

- 6.2.11 Loji Logistics

- 6.2.12 Freight Technologies, Inc.*

- 6.3 Other Companies