|

시장보고서

상품코드

1521699

항체 CDMO(개발제조수탁기관) : 시장 점유율 분석, 업계 동향 및 통계, 성장 동향 예측(2024-2029년)Antibody Contract Development And Manufacturing Organization - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

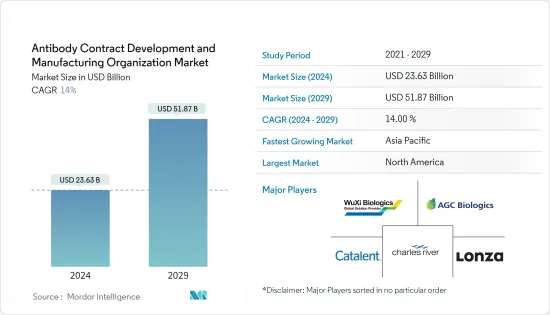

항체 CDMO(개발제조수탁기관)(Antibody Contract Development And Manufacturing Organization) 시장 규모는 2024년에 236억 3,000만 달러로 추정되며, 2029년에는 518억 7,000만 달러에 이를 것으로 예측되며, 예측기간 중(2024-2029년) CAGR은 14%로 추이하며 성장할 전망입니다.

이 시장을 견인하고 있는 것은 임상 연구의 비율 증가나 항체 치료의 개발 자금 증가, 암의 이환율의 상승, 항체의 막대한 제조 비용, 항체의 제조에 수반하는 과제 등입니다.

예를 들어, 2022년 10월 미국 보건사회복지성(HHS) 내의 기관인 BARDA는 특히 HHS 전략적 준비·대응국(ASPR) 내의 기관인 BARDA는 COVID-19에 있어서 mAb의 적용 범위 을 넓히기 위해 새로운 단일 클론 항체(mAb) 후보 및 전달 솔루션 개발을 추진하기 위해 Vir에게 약 5,000만 달러의 새로운 자금을 조달했습니다. 마찬가지로 2023년 3월 Antiverse Ltd는 300만 달러의 자금을 조달하여 자체 항체 개발을 가능하게 했습니다. 이와 같이 항체의약품의 개발·연구에 대한 투자가 많기 때문에 예측기간 중에 CDMO 서비스 수요가 높아질 것으로 예상됩니다.

게다가, 항체는 암의 잠재적인 치료 옵션이며, 암의 부담 증가는 약물 개발과 제조 활동을 증가시킬 것으로 예상되며, 예측 기간 동안 CDMO 서비스 수요를 촉진할 것으로 예상됩니다. 예를 들어 Canadian Cancer Statistics 2023 보고서에 따르면 캐나다에서는 2022년 23만 3,900건에 대해 2023년에는 약 23만 9,200건의 새로운 암 증례가 보고되었습니다. 이와 같이 암의 부담 증가는 의약품 연구·제조 서비스에 대한 수요를 만들어 내고 이 부문의 성장에 기여할 것으로 기대되고 있습니다. 국립암 연구센터가 2022년에 갱신한 데이터에 따르면 2022년 일본에서 새롭게 진단되는 암 환자수는 전립선암이 9만 6,400명, 간암이 4만 400명, 악성 림프종은 3만 7,100명으로 추정됩니다. 따라서 시장 확대는 예측되는 암 유병률의 상승에 의해 추진될 것으로 예상됩니다.

공동 연구, 제휴, M&A 등 시장 진출기업의 전략적 활동은 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다. 예를 들어, 2022년 4월, Asahi Kasei Medical은 생물학적 제제 CDMO 서비스 제공업체인 Bionova Scientific LLC를 인수하여 항체 CDMO 부문으로 사업 영역을 확장했습니다. 게다가 2023년 9월에는 한국 CDMO인 Samsung Biologics가 세계 바이오파마인 Bristol Myers Squibb와 항체 항암제의 대규모 제조에 관한 계약을 체결했다고 발표했습니다.

항체 개발을 위한 자금 조달 확대, 암 부담 증가, 시장 진출기업에 의한 전략적 활동 등 위의 요인은 모두 예측 기간 중 시장 성장을 뒷받침할 것으로 예상됩니다. 그러나 아웃소싱 시 품질에 대한 우려와 선도적인 바이오의약품 기업에서 최소 아웃소싱 관행은 예측 기간 동안 시장 확대를 방해할 수 있습니다.

항체 CDMO(개발제조수탁기관) 시장 동향

단클론 항체 부문은 예측 기간 동안 큰 시장 점유율을 차지하는 전망

- 몇 가지 중요한 요인으로, 단클론 항체 부문은 항체 CDMO 시장에서 가장 빠르게 성장하는 부문입니다. 단클론항체(mAbs)는 암, 자가면역질환, 감염증 등 다양한 질환에서 큰 치료효과가 기대되고 있습니다.

- 또한, 일부 단클론항체 요법은 임상시험에서 현저한 성공을 거두었으며 다양한 적응증으로 약사 승인을 받았습니다. 따라서 바이오파마회사는 단클론항체 개발에 투자하고 있으며 항체 CDMO 시장 성장을 뒷받침할 것으로 예상됩니다. 예를 들어, 2023년 1월, 영국 정부는 리버풀에 영국 제2투자존을 출시하고, 미국의 제약 제조업체 TriRx는 단클론항체의 제조 능력을 강화하기 위해, 당초 1,000만 파운드(12.22달러)의 투자를 실시 했습니다.

- 유사하게, 2023년 9월, AboreRS Pharma는 류마티스 관절염과 같은 자가면역 질환을 치료하기 위한 단일클론 항체의 개발을 목적으로 하는 2,730만 유로(2,883만 달러)의 시리즈 A 자금 조달을 발표했습니다. 따라서, 단클론항체에 대한 높은 투자는 CDMO 서비스에 대한 수요를 촉진하고 이 부문의 성장을 뒷받침할 것으로 예상됩니다.

- 바이오파마 기업은 성장과 수익성에 헤아릴 수 없기 때문에 mAb의 개발과 제조에 높은 관심을 기울이고 있습니다. 예를 들어, 2022년 10월, CDMO의 Fujifilm Diosynth Biotechnologies는 Argenx와 제휴하여 efgartigimod라는 단클론항체(mAb) 단편을 생산했습니다. 이 mAb는 심한자가 면역 질환으로 고통받는 환자의 치료에 사용됩니다. 단클론항체는 질병의 원인이 되는 분자나 세포를 특이적으로 표적으로 함으로써 만성 질환의 치료에 현저한 성공을 거두고 있어 환자의 예후 개선으로 뒤를 잇습니다. 마찬가지로 2023년 6월 CDMO의 Chime Biologics는 LBL-007 mAb의 개발과 제조를 가속화하고 신속한 임상 진출을 도모하기 위해 Leads Biolabs와 BeiGene과 삼자 전략적 제휴를 맺었습니다고 발표했습니다.

- 따라서, 단클론항체에 대한 투자 증가와 CDMO의 바이오파마 기업과의 전략적 제휴는 예측 기간 동안 동일한 부문의 성장을 가속할 것으로 예상됩니다.

북미가 예측 기간 동안 큰 시장 점유율을 차지할 전망

- 북미는 확립된 바이오파마기업이 복수 존재하는 것, 항체치료의 연구개발활동이 활성화하고 있는 것, 만성질환의 유병률이 상승하고 있는 것, 항체치료에 대한 투자가 많음, 시장 진출기업에 의한 전략적 활동이 활발한 것 등으로부터 세계의 항체 CDMO 시장에서 큰 점유율을 차지할 것으로 예상됩니다.

- 제약회사는 특히 생물제제의 연구개발에 많은 투자를 하고 있습니다. 이러한 연구개발 활동의 활성화에 의해 특히 항체 개발에 특화된 CDMO 서비스 필요성이 높아지고 있습니다. 예를 들어, 2023년 9월 Star Therapeutics는 포트폴리오 기업과 항체 치료 계획을 강화하기 위해 시리즈 C 자금 조달 라운드에서 9,000만 달러를 조달했습니다. 시리즈 C의 자금 조달은 현재 I상 시험(NCT05776069)에서 VGA039의 임상 개발을 지원합니다. 이와 같이 고액의 투자로 인해 생명공학기업은 전문지식을 활용하고 비용을 절감하고 스케줄을 가속화하기 위해 개발·제조활동을 전문 CDMO에 위탁하는 것이 늘고 있습니다.

- 게다가 류마티스 관절염과 같은 자가면역 질환 부담 증가는 R&D 활동을 증가시키고, CDMO 서비스 수요를 촉진하고, 시장 성장을 뒷받침할 것으로 예상됩니다. 예를 들어 미국암협회(ACS)가 2024년 1월 발표한 데이터에 따르면 암 이환율은 2022년 193만 건에서 2024년 200만 건으로 증가하고 2년간 6만 건 이상 증가합니다. 미국 질병 예방관리센터가 2023년 6월 발표한 통계에 따르면 2040년까지 미국 18세 이상 성인의 25.9%, 7,840만 명이 의사로부터 관절염으로 진단될 것으로 추정되고 있습니다. 이러한 경향은 단클론항체 부문의 성장을 뒷받침하고 있으며, CDMO는 이러한 특수 치료법의 맞춤화 및 제조에 중요한 역할을 합니다.

- 여러 기업이 인수 및 제휴를 통해 항체 개발 제조 위탁 기관 부문에 진출하고 있습니다. 예를 들어, 2023년 10월, Eurofins CDMO Alphora Inc.는 북미 수탁 개발 및 제조 업계에서 다양화와 성장을 목표로 하는 비전의 일환으로 mAbs와 치료 단백질에 초점을 맞춘 바이오로직 이니셔티브를 시작했습니다.

- 따라서, 단클론항체에 대한 투자 증가, 만성질환 부담 증가, 시장 진출기업의 전략적 활동이 예측기간 동안 북미 시장을 밀어올릴 것으로 예상됩니다.

항체 CDMO(개발제조수탁기관) 업계 개요

항체 CDMO(개발제조수탁기관) 시장은 세계적·지역적으로 사업을 전개하는 복수의 기업이 존재하고, 경쟁은 중간 정도입니다. 시장 전체에서 사업을 전개하는 주요 기업은 합병, 제휴, 인수 등 조직 내 전략적 이니셔티브를 채택하는 데 주력하고 있습니다. 세계 항체 의약품 개발 및 제조 위탁 시장의 주요 기업은 Lonza, Catalent Inc., Samsung Biologics, WuXi Biologics, AGC Biologics, Charles River Laboratories 등입니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 전제 조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 임상연구 증가와 항체연구에 대한 고액투자

- 암 환자 증가

- 항체 제조 비용의 상승과 제조에 따른 과제

- 시장 성장 억제요인

- 외주시의 품질 문제

- 대기업 바이오파마 기업에 의한 아웃소싱의 제한

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자·소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계 강도

제5장 시장 세분화(시장 규모-달러)

- 제품별

- 단클론항체

- 폴리클로날 항체

- 기타

- 공급원별

- 포유류

- 미생물

- 치료 영역별

- 종양학

- 신경학

- 순환기

- 감염증

- 면역 질환

- 기타

- 최종 사용자별

- 바이오파마 기업

- 연구기관

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 영국

- 독일

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아 태평양

- 인도

- 일본

- 중국

- 호주

- 한국

- 기타 아시아 태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 북미

제6장 경쟁 구도

- 기업 프로파일

- Lonza

- Catalent Inc.

- Samsung Biologics

- WuXi Biologics

- AGC Biologics

- AbbVie Inc.

- Boehringer Ingelheim International GmbH

- Charles River Laboratories

- FUJIFILM Holdings Corporation

- mAbxience

제7장 시장 기회 및 향후 동향

LYJThe Antibody Contract Development And Manufacturing Organization Market size is estimated at USD 23.63 billion in 2024, and is expected to reach USD 51.87 billion by 2029, growing at a CAGR of 14% during the forecast period (2024-2029).

The market is driven by the increasing rate of clinical research and increasing funding for the development of antibody therapeutics, the rising incidence of cancer, the high cost of manufacturing antibodies, and challenges associated with the manufacturing of antibodies.

For instance, in October 2022, BARDA, an agency within the US Health and Human Services (HHS), specifically within the HHS Administration for Strategic Preparedness and Response (ASPR), awarded Vir approximately USD 50 million in new funding to advance the development of novel monoclonal antibody (mAb) candidates and delivery solutions to widen the applicability of mAbs in COVID-19. Similarly, in March 2023, Antiverse Ltd (Antiverse) raised USD 3 million in funding, enabling in-house antibody development. Thus, high investment in developing and researching antibody drugs is expected to fuel the demand for CDMO services during the forecast period.

Further, antibody is a potential treatment option for cancer, and the growing burden of cancer is expected to increase drug development and manufacturing activities, which are likely to propel demand for CDMO services during the forecast period. For instance, as per the Canadian Cancer Statistics 2023 report, about 239.2 thousand new cancer cases were reported in 2023 in Canada, compared to 233.9 thousand in 2022. Thus, the growing burden of cancer is expected to create the demand for drug research and manufacturing services, which is expected to contribute to the segment's growth. According to the data updated by the National Cancer Center of Japan in 2022, an estimated 96.4 thousand new prostate cancer cases, 40.4 thousand new liver cancer cases, and 37.1 thousand malignant lymphoma cases were diagnosed in Japan in 2022. Thus, market expansion is expected to be propelled by the projected rise in cancer prevalence.

Strategic activities by market players, such as collaborations, partnerships, and mergers and acquisitions, are expected to propel the market's growth during the forecast period. For instance, in April 2022, Asahi Kasei Medical expanded its business vertical into the antibody CDMO space by acquiring Bionova Scientific LLC, a biologics CDMO service provider. Additionally, in September 2023, Samsung Biologics, a Korean CDMO, announced an agreement for the large-scale manufacturing of an antibody cancer drug substance with global biopharma company Bristol Myers Squibb.

All these factors mentioned above, such as growing funding for antibody development, increasing cancer burden, and strategic activities by the market players, are expected to boost the market's growth during the forecast period. However, quality concerns during outsourcing and minimal outsourcing practices among large biopharma companies may hinder market expansion during the forecast period.

Antibody Contract Development And Manufacturing Organization Market Trends

Monoclonal Antibodies Segment is Expected to Hold Significant Market Share Over the Forecast Period

- Due to several critical factors, the monoclonal antibody segment is the fastest-growing segment in the antibody CDMO market. Monoclonal antibodies (mAbs) have demonstrated significant therapeutic potential across various diseases, including cancer, autoimmune disorders, and infectious diseases.

- In addition, several monoclonal antibody therapies have achieved notable success in clinical trials and have received regulatory approvals for various indications. Hence, the biopharmaceutical company is investing in developing monoclonal antibodies, which is anticipated to boost the growth of the antibody CDMO market. For instance, in January 2023, the UK government launched England's second Investment Zone in Liverpool, in which US pharmaceutical manufacturer TriRx made an initial GBP 10 million (USD 12.22) investment to enhance its capabilities to manufacture monoclonal antibodies.

- Similarly, in September 2023, AbolerIS Pharma announced a EUR 27.3 million (USD 28.83 million) Series A financing for advancing monoclonal antibodies for treating autoimmune diseases such as rheumatoid arthritis. Hence, high investment in monoclonal antibodies is expected to propel the demand for CDMO services, thereby boosting the segment's growth.

- Biopharmaceutical companies are highly interested in mAb development and manufacturing, as it offers immense potential for growth and profitability. For instance, in October 2022, Fujifilm Diosynth Biotechnologies, a CDMO, partnered with Argenx to manufacture a monoclonal antibody (mAb) fragment called efgartigimod. This mAb will be used to treat patients suffering from severe autoimmune diseases. Monoclonal antibodies have shown remarkable success in treating chronic illnesses by specifically targeting disease-causing molecules or cells, which leads to better patient outcomes. Similarly, in June 2023, Chime Biologics, a CDMO, announced that it had established three-way strategic cooperation with Leads Biolabs and BeiGene to accelerate LBL-007 mAb development and manufacturing for speedy clinical advancement.

- Hence, increasing investment in monoclonal antibodies and strategic collaboration of CDMO with biopharmaceutical companies is anticipated to boost the segment's growth during the forecast period.

North America is Expected to Hold a Significant Market Share Over the Forecast Period

- North America is expected to hold a significant share of the global antibody CDMO market owing to the presence of several established biopharmaceutical companies, increasing research and development activities for antibody therapeutics, rising prevalence of chronic diseases, high investment for antibody therapeutics, and strategic activities by the market players.

- Pharmaceutical companies are investing heavily in R&D, particularly in biologics. This heightened R&D activity increases the need for specialized CDMO services, particularly in antibody development. For instance, in September 2023, Star Therapeutics raised USD 90 million in an oversubscribed Series C financing round to bolster plans for its portfolio companies and antibody therapies. The Series C financing will support the clinical development of VGA039, which is currently in a Phase I trial (NCT05776069). Thus, due to high investment, biotech companies increasingly outsource their development and manufacturing activities to specialized CDMOs to leverage their expertise, reduce costs, and accelerate timelines.

- Moreover, the growing burden of cancer and autoimmune diseases such as rheumatoid arthritis is expected to increase R&D activities and thus propel the demand for CDMO services, likely boosting market growth. For instance, according to the data published by the American Cancer Society (ACS) in January 2024, the incidence of cancer cases will increase from 1.93 million in 2022 to 2.00 million in 2024, an increase of more than 60,000 cases in two years. As per the statistics released in June 2023 by the Centers for Disease Control and Prevention, it is estimated that 25.9% or 78.4 million adults in the United States aged 18 and above will be diagnosed with arthritis by a medical doctor by 2040. This trend is propelling the growth of the monoclonal antibody segment, as CDMOs play a crucial role in customizing and producing these specialized therapies.

- Several companies are penetrating the antibody contract development and manufacturing organization space via acquisition and partnerships. For instance, in October 2023, Eurofins CDMO Alphora Inc. launched a Biologics initiative, focusing on mAbs and therapeutic proteins as part of its vision to diversify and grow within North America's contract development and manufacturing industry.

- Hence, increasing investment in monoclonal antibodies, the growing burden of chronic diseases, and strategic activities by market players are expected to boost the market in North America during the forecast period.

Antibody Contract Development And Manufacturing Organization Industry Overview

The antibody contract development and manufacturing organization market is moderately competitive, with the presence of several companies operating globally and regionally. The major players operating across the market focus on adopting in-organic strategic initiatives such as mergers, partnerships, and acquisitions. Some key players in the global antibody contract development and manufacturing organization market are Lonza, Catalent Inc., Samsung Biologics, WuXi Biologics, AGC Biologics, and Charles River Laboratories.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Rate of Clinical Research and High Investment in Antibody Research

- 4.2.2 Rising Incidence of Cancer Cases

- 4.2.3 High Cost of Manufacturing Antibodies and Challenges Associated with Manufacturing

- 4.3 Market Restraints

- 4.3.1 Quality Issues While Outsourcing

- 4.3.2 Limited Outsourcing Opted by Big Biopharma Companies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD)

- 5.1 By Product

- 5.1.1 Monoclonal Antibodies

- 5.1.2 Polyclonal Antibodies

- 5.1.3 Other Products

- 5.2 By Source

- 5.2.1 Mammalian

- 5.2.2 Microbial

- 5.3 By Therapeutic Area

- 5.3.1 Oncology

- 5.3.2 Neurology

- 5.3.3 Cardiology

- 5.3.4 Infectious Diseases

- 5.3.5 Immune-mediated Disorders

- 5.3.6 Other Therapeutic Areas

- 5.4 By End User

- 5.4.1 Biopharmaceutical Companies

- 5.4.2 Research Laboratories

- 5.4.3 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Italy

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 Japan

- 5.5.3.3 China

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of the Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Lonza

- 6.1.2 Catalent Inc.

- 6.1.3 Samsung Biologics

- 6.1.4 WuXi Biologics

- 6.1.5 AGC Biologics

- 6.1.6 AbbVie Inc.

- 6.1.7 Boehringer Ingelheim International GmbH

- 6.1.8 Charles River Laboratories

- 6.1.9 FUJIFILM Holdings Corporation

- 6.1.10 mAbxience