|

시장보고서

상품코드

1910462

고급차 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)Luxury Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

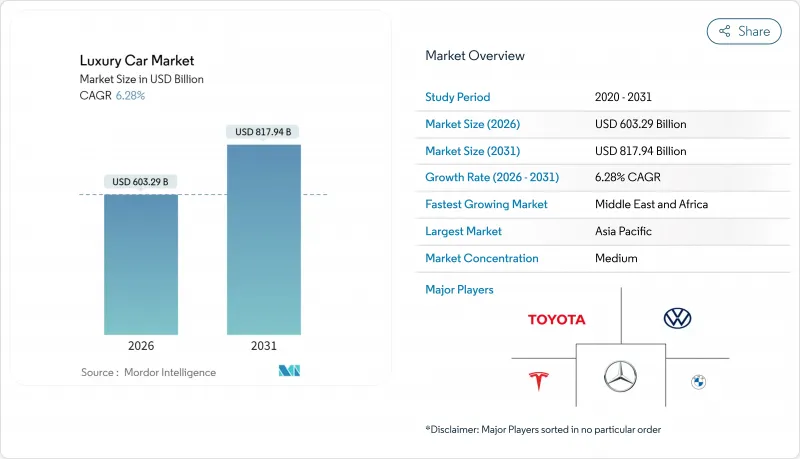

고급차 시장은 2025년 5,676억 5,000만 달러로 평가되었고, 2026년에는 6,032억 9,000만 달러, 2031년까지 8,179억 4,000만 달러에 이를 것으로 예측됩니다. 2026년부터 2031년에 걸쳐 CAGR은 6.28%를 나타낼 전망입니다.

아시아태평양의 급속한 부유층 증가, 배터리 전기자동차(BEV) 플래그십 모델의 가속적인 전개, 개인화된 친환경 모빌리티에 대한 주목 증가가 성장의 핵심을 이루고 있습니다. 소유 비용 상승과 공급망 문제가 지속되는 가운데, 고급 자동차 제조업체가 소프트웨어, 맞춤형 및 직접 판매 채널 수익을 창출함으로써 고급 자동차 시장은 자동차 업계 전체를 뛰어넘는 성장을 유지하고 있습니다. 중국의 고급 브랜드와 테슬라의 순수한 EV 전략이 기존의 구미 브랜드에 대해, 보다 신속한 전동화, 보다 충실한 디지털 서비스, 보다 효율적인 소매 네트워크의 구축을 강요하는 가운데, 경쟁 압력은 강해지고 있습니다.

세계의 고급차 시장 동향과 인사이트

프리미엄 모델의 급속한 전기화

배터리식 전기자동차(BEV) 파생 모델은 가장 빠르게 성장하는 구동 방식입니다. 프리미엄 제조업체 각 사는 EV를 규제 대응책이 아니라, 정숙성과 첨단 기술을 자랑하는 「헬로 효과」의 쇼케이스로서 자리매김하고 있습니다. 인도에서는 현지 생산 EQS 580 SUV를 필두로 메르세데스 벤츠의 EV 판매 대수가 2024년 5월까지 전년 대비 94% 증가했습니다. BMW는 같은 해 인도에서 1,249대의 순수한 EV를 판매하고 51개 도시에 급속 충전기를 설치하여 판매를 지원했습니다. 초고급 브랜드는 신중한 자세를 유지하고 있습니다. 애스턴 마틴은 파워트레인의 추가 개선을 위해 2026년 첫 EV 출시를 연기했습니다. 페라리는 정숙성이 높은 구동계에서도 감정적인 매력을 유지하기 위해 인공 배기음에 대한 특허를 출원했습니다. 고급차 시장에서는 사운드, 승차감, 장인기 등의 아이덴티티를 브랜드가 얼마나 유지할 수 있는지가 전동화의 성공을 판단하기 위한 중요한 요소가 될 것입니다.

아시아 및 중동에서 부유층 인구 증가

아시아태평양의 고급차 시장은 부유층 소비자 기반의 확대에 견인되어 급성장하고 있습니다. 특히, 처음으로 자동차를 구입하는 분, 보다 고급인 차로의 교체를 검토하는 분들의 부유층 레벨이 상승함에 따라, 고급차에 대한 수요도 높아지고 있습니다. 인도는 최근 고급차 판매량이 2배로 증가하는 등 중요한 역할을 담당하고 있습니다. 예측에 의하면 초부유층은 앞으로도 계속 증가할 것으로 보고 있으며, 소비지향의 변화와 장기적인 시장 전망의 장점을 시사하고 있습니다.

걸프 지역에서는 원유가격 상승이 가처분 소득을 끌어올려 고급차에 대한 견고한 수요를 뒷받침하고 있습니다. BMW등의 브랜드가 현저한 성장을 이루고 있어, 이 지역에서의 프리미엄 자동차에의 열의를 뒷받침하고 있습니다. 경제적인 강인성과 고급이동수단에 대한 선호도가 더해져, 걸프 지역은 고급차 제조업체에게 주요 시장으로서의 지위를 확고하게 하고 있습니다.

반도체 및 부품 부족

2022년 반도체 부족 이후 새로운 웨이퍼 제조시설이 가동되기 시작했음에도 불구하고 자동차용 특수 마이크로컨트롤러공급은 여전히 박박하고 있습니다. 특히 인포테인먼트 시스템과 쾌적성 시스템에 필수적인 부품에서 두드러집니다. 이로 인해 고급 자동차 제조업체는 엄격한 선택을 강요받습니다.특정 기능이 부족한 상태에서 차량을 납품하거나 고객에게 인도를 연기하는 것입니다.

예를 들어, 메르세데스 벤츠의 경우, 회사의 플래그쉽 모델인 S 클래스의 할당을 연기하지 않을 수 없었습니다. 이것은 고급 모델조차도 칩 부족의 영향을 면할 수 없습니다는 것을 돋보이게합니다. 이러한 혼란은 생산량이 적고 고부가가치의 럭셔리 차량에 가장 심각한 타격을 줍니다. 특수 부품에 의존하는 이러한 모델은 생산 조정의 여지가 제한되어 있습니다.

부문 분석

SUV는 2025년에 고급차 시장 규모의 55.78%를 차지했고, 2031년까지 연평균 복합 성장률(CAGR)7.84%로 확대될 것으로 예측되고 있습니다. 메르세데스 벤츠의 SUV 라인업은 기록적인 수익을 달성했고, AMG G 63은 판매 첫날에 120대가 넘는 선행 예약을 획득했습니다. 세단은 운전자와 초고급 자동차 틈새 시장에서 문화적 가치를 유지하고 있지만, 젊은층이 SUV의 다목적성을 중시하는 경향 때문에 상대적인 점유율은 떨어지고 있습니다. 엔트리급 고급 해치백이나 MPV는 지역 한정의 소규모 시장에 머물러 슈퍼카는 판매 대수가 극히 조금이라도 브랜드의 매력을 지지하고 있습니다. SUV의 놀라운 기세는 당분간이 바디 스타일이 고급 자동차 시장의 주요 수익원임을 확고하게합니다.

현재 SUV 중심 제품 로드맵은 R&D 우선순위를 지배하고 있습니다. 아우디는 BMW iX와 메르세데스 EQ UV 출시에 앞서 플래그쉽 PPE EV 개발 리소스를 Q6 e-tron으로 마이그레이션했습니다. 랜드로버는 레인지로버의 고객이 요구하는 특주 소재나 컬러 바리에이션에 대응하기 위해, SV 비스포크 스튜디오를 확충해, 전술한 매스커스터마이제이션 증가 경향을 강화하고 있습니다. 배출가스 규제가 강화되는 가운데 전동화 SUV 모델은 틈새 파생 모델이 아니라 기본 규제 대응 전략이 되어 고급차 시장을 SUV 주도의 성장 궤도로 유지합니다.

2025년 시점에서도 내연기관 모델은 고급차 시장의 68.35%를 차지했지만, 배터리 전기자동차(BEV)의 신규 참가는 CAGR 8.79%로 성장할 전망입니다. 메르세데스 벤츠와 BMW는 이미 400V 아키텍처를 주력 모델로 주류화하고 있으며, 포르쉐는 2027년 이후 새로운 내연 기관 플랫폼에 대한 투자를 동결했습니다. 하이브리드 자동차는 급속 충전의 밀도가 부족한 지역에서 과도한 완충재로서의 역할을 합니다. 렉서스는 중국에서 발매한 미니밴 「LM」에 하이브리드차를 채택했습니다. 초고급 브랜드는 단계적인 도입을 선호합니다. 애스턴 마틴은 승차감과 캐빈 사운드의 특성을 더욱 정교하게 하기 위해 EV의 데뷔를 2026년으로 연기했습니다. 파워트레인의 다양화는 규제의 강제, 인프라의 준비 상황, 브랜드의 전통의 밸런스를 유지하는 행위로 계속되고 있습니다만, 길게 보면, 고급차 시장에서는 전동화가 주류가 될 것입니다.

전기 전용 스케이트보드는 소프트웨어로 정의된 인테리어도 쉽게 만듭니다. 테슬라는 자체 개발 칩셋과 완전 자동 운전 업데이트를 통해 프리미엄 EV 시장에서 마인드 쉐어를 장악하고 라이벌 기업에 수직 통합의 심화를 촉진하고 있습니다. 메르세데스의 MB.OS는 2025년 이후 모든 EQ 모델에 도입되어 유료 기능 오버더 에어 업그레이드가 가능해져 4년의 사이클에서 1대당 수익을 1,200달러 끌어올릴 수 있을 것입니다. 이러한 디지털 수익화는 BEV의 점유율 확대를 가속화하는 근거를 강화하는 것입니다.

지역별 분석

2025년 아시아태평양은 고급차 시장 점유율의 42.75%를 차지했습니다. 이는 중국의 규모와 프리미엄차 판매량이 5만대(시간당 6대 상당)로 급성장한 인도의 공헌 때문입니다. 그러나 메르세데스 벤츠는 주식시장의 변동을 배경으로 2025년 1분기의 납차량이 연조될 가능성을 경고하고 있으며, 이 지역이 자본 시장의 변동에 민감하다는 것을 뒷받침하고 있습니다. 중국 국내 브랜드는 NEV의 보급률이 40.9%를 웃돌아 기존 기업에 대해 기술 제휴와 브랜드 메시지의 현지화를 강요하는 가운데 독일 점유율을 침식하고 있습니다.

중동은 석유와 연동된 가처분 소득과 인프라 확대에 힘입어 2031년까지 7.96%라는 가장 높은 CAGR을 보이고 있습니다. BMW는 X7 및 7 시리즈 수요에 견인해 2024년 걸프 협력 회의 회원국 전체에서 15.4%의 판매량 증가를 기록했습니다. UAE의 자동차 총 판매 대수는 15.7% 증가하여 견고한 거시경제의 추풍을 확인하고 있습니다. 남아프리카공화국과 튀르키예는 점진적인 성장을 보이고 있지만 통화 난고로 인해 구매 결정이 지연될 수 있습니다. 럭셔리 자동차 제조업체는 지역 생산 기지와 달러 지급 옵션으로 위험을 완화합니다.

북미는 성숙한 것, 부유층의 인구통계가 금리에 의한 지불의 인플레이션을 상쇄해, 고급차 시장에 있어서 안정된 기둥으로 계속하고 있습니다. 캐나다의 자원에 의한 임시수입은 고급차의 보급을 도와주고, 멕시코에서는 중산계급의 부 증가와 크레딧의 이용 개선이 함께, 고급차로의 이행이 진행되고 있습니다. 유럽은 유로 7 규제와 플릿 CO2 벌금에 의한 규제 부담이 가장 무거운 것, 확고한 브랜드 충성심은 유지되고 있습니다. 자동차 제조업체 각사는 자사 배터리 공장과 재생에너지 크레딧을 활용하여 고수익 전기 SUV에 주력함으로써 컴플라이언스 비용을 흡수하고 수익성을 지키려고 합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 고급 SUV 수요의 급증

- 프리미엄 모델의 급속한 전동화

- 아시아 및 중동의 부유층 인구 증가

- 첨단 ADAS와 안전성에 대한 기대 증가

- 온라인 및 DTC(Direct-to-Consumer) 판매 채널로의 전환

- 대량 맞춤화 및 주문 옵션

- 시장 성장 억제요인

- 높은 차량 구입 및 소유 비용

- 반도체 및 부품 부족

- 거시 경제적 수요의 변동성

- SUV에 대한 기후 규제 압력

- 가치/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측(금액(달러), 수량(단위))

- 차량 유형별

- 해치백

- 세단

- 스포츠 다목적차(SUV)

- 다목적차(MPV)

- 스포츠/슈퍼카

- 드라이브 유형별

- 내연기관(ICE)

- 하이브리드 전기자동차

- 배터리식 전기자동차

- 차량 클래스별

- 엔트리급 럭셔리

- 미들급 럭셔리

- 울트라 럭셔리 / 슈퍼카

- 판매 채널별

- 정규 판매점

- 소비자 직접 판매 / 온라인

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 튀르키예

- 이집트

- 남아프리카

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Mercedes-Benz Group AG

- BMW AG

- Volkswagen Group

- Toyota Motor Corporation(Lexus)

- Jaguar Land Rover Automotive PLC

- Stellantis NV(Maserati, Alfa Romeo)

- Tesla Inc.

- Volvo Car Group

- Hyundai Motor Group(Genesis)

- Nissan Motor Co.(Infiniti)

- Geely Holding(Lotus, Zeekr)

- FAW 그룹(Hongqi)

- SAIC Motor(IM, Roewe)

- BYD Co.(Yangwang)

- Lucid Group

- Rivian Automotive

- Ferrari NV

- Aston Martin Lagonda

- Rolls-Royce Motor Cars

- McLaren Automotive

제7장 시장 기회와 장래의 전망

SHW 26.01.26The luxury car market is expected to grow from USD 567.65 billion in 2025 to USD 603.29 billion in 2026 and is forecast to reach USD 817.94 billion by 2031 at 6.28% CAGR over 2026-2031.

Rapid wealth creation in Asia-Pacific, the accelerating rollout of battery-electric flagships, and a widening emphasis on personalized, eco-conscious mobility are the core growth engines. Despite ownership-cost inflation and lingering supply-chain kinks, the luxury car market continues to outpace the broader auto sector as premium makers monetize software, customization, and direct sales channels. Competitive pressure is intensifying as Chinese up-market brands and Tesla's pure-play EV strategy push established European and U.S. marques toward faster electrification, richer digital services, and leaner retail footprints.

Global Luxury Car Market Trends and Insights

Rapid Electrification of Premium Models

Battery-electric derivatives represent the fastest-growing drivetrain, supported by premium makers that position EVs as halo showcases for quiet torque and cutting-edge tech rather than regulatory compliance plays. In India, Mercedes-Benz's EV sales grew 94% year-on-year through May 2024, led by the locally-built EQS 580 SUV. BMW delivered 1,249 pure EVs in India the same year, supporting them with fast chargers in 51 cities. Ultra-luxury brands remain cautious: Aston Martin shifted its first EV launch to 2026 for additional powertrain refinement. Ferrari filed patents for synthetic exhaust acoustics to retain emotional appeal in silent drivetrains. The luxury car market will increasingly judge electrification success on how well brands preserve identity traits such as sound, ride, and craftsmanship.

Rising HNWI Population in Asia and Middle East

Asia-Pacific's luxury vehicle market is surging, driven by an expanding base of affluent consumers. As wealth levels rise, especially among first-time buyers and those seeking upgrades, the demand for premium mobility intensifies. India is a pivotal player, with luxury vehicle sales doubling in recent years. Projections show a continued rise in ultra-high-net-worth individuals, hinting at a shift towards aspirational consumption and a promising long-term market outlook.

In the Gulf region, buoyant oil prices have bolstered disposable incomes, fueling a robust demand for luxury vehicles. Brands such as BMW have grown significantly, underscoring the region's enthusiasm for premium automotive offerings. With a blend of economic resilience and a penchant for high-end mobility, the Gulf solidifies its status as a prime market for luxury OEMs.

Semiconductor and Component Shortages

Even with new wafer fabrication facilities launching post the 2022 chip shortage, there's still a tight supply of specialty automotive microcontrollers. This is especially true for those integral to infotainment and comfort systems. As a result, premium OEMs face tough choices: they deliver vehicles missing certain features or push back customer handovers.

Take Mercedes-Benz, for instance. The luxury automaker recently had to delay allocations of its flagship S-Class, underscoring that even elite models aren't shielded from these chip shortages. Such disruptions hit hardest in low-volume, high-content luxury vehicles. These models, dependent on specialized components, have limited leeway in production adjustments.

Other drivers and restraints analyzed in the detailed report include:

- Enhanced ADAS and Safety Expectations

- Online/Direct-to-Consumer Retail Shift

- Anti-SUV Climate Regulation Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs controlled 55.78% of the luxury car market size in 2025 and are predicted to post an 7.84% CAGR to 2031. Mercedes-Benz's SUV roster secured record revenue and over 120 early orders for the AMG G 63 on its first retail day. Sedans keep cultural cachet in chauffeur-driven contexts and certain ultra-luxury niches; however, their relative share diminishes as younger owners prioritize the multi-utility profile of SUVs. Entry-luxury hatchbacks and MPVs remain minor, geography-specific plays, while supercars anchor brand desirability despite negligible volume. Ferocious SUV momentum cements the body style as the luxury car market's leading profit contributor for the foreseeable horizon.

SUV-centric product roadmaps now dominate R&D prioritization. Audi moved flagship PPE EV development resources toward its Q6 e-tron to pre-empt BMW iX and Mercedes EQS SUV launches. Land Rover is extending its SV Bespoke studio to cater to Range Rover clients seeking one-off materials and colorways, reinforcing the mass-customization uptick discussed earlier. As emission targets tighten, electrified SUV variants will become the default compliance strategy rather than a niche derivative, keeping the luxury car market on an SUV-led growth trajectory.

Internal-combustion models still represented 68.35% of the luxury car market size in 2025, but battery-electric entries are sprinting ahead at a 8.79% CAGR. Mercedes-Benz and BMW have already mainstreamed 400-volt architectures into core models, and Porsche has frozen new ICE platform investment beyond 2027. Hybrids offer a transitional buffer in regions lacking fast-charging density; Lexus saw a hybrid uptake for its LM minivan launch in China. Ultra-luxury marques favor a staggered roll-in; Aston Martin rescheduled its debut EV to 2026, arguing for additional refinement of ride and cabin sound characteristics. Powertrain diversification remains a balancing act between regulatory compulsion, infrastructure readiness, and brand heritage yet the long arc points toward electrified dominance within the luxury car market.

Electric-only skateboards also facilitate software-defined interiors. Tesla commands premium-EV mindshare via in-house chipsets and full-self-driving updates, nudging rivals toward deeper vertical integration. Mercedes' MB.OS will roll out across all EQ models after 2025, enabling paid feature over-the-air upgrades that could lift revenue per vehicle by USD 1,200 over a four-year cycle. Such digital monetization strengthens the rationale for accelerated BEV share gains.

The Luxury Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, Sports Utility Vehicles, and More), Drive Type (Internal Combustion Engine, and More), Vehicle Class (Entry-Level Luxury, and More), Sales Channel (Authorized Dealership and Direct-to-Consumer/Online), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific commanded 42.75% of the luxury car market share in 2025, underpinned by China's scale and India's meteoric rise to 50,000 premium units sold, equal to six vehicles every hour. Nevertheless, Mercedes-Benz warned of softer Q1 2025 deliveries amid equity volatility, validating the region's sensitivity to capital-market swings. China's domestic marques erode German share as NEV penetration tops 40.9%, pressuring incumbents to localize tech partnerships and brand messaging.

The Middle East shows the steepest 7.96% CAGR through 2031, buoyed by oil-linked disposable income and infrastructure expansion. BMW tallied a 15.4% volume uplift across Gulf Cooperation Council states 2024, led by X7 and 7 Series demand. UAE total automotive sales advanced 15.7%, confirming robust macro tailwinds. South Africa and Turkiye add incremental gains but are subject to currency gyrations that can delay purchase decisions; premium makers mitigate risk with regional production hubs and U.S.-dollar invoicing options.

North America remains a mature but steady pillar for the luxury car market, with affluent demographics offsetting interest-rate-driven payment inflation. Canada's resource windfall aids luxury penetration, while Mexico is graduating toward premium vehicles as rising middle-class wealth intersects with improved credit access. Europe faces the heaviest regulatory drag via Euro 7 and fleet CO2 fines, yet maintains entrenched brand loyalty. OEMs are converging on high-margin electric SUVs to absorb compliance costs, leveraging in-house battery plants and renewable-energy credits to defend profitability.

- Mercedes-Benz Group AG

- BMW AG

- Volkswagen Group

- Toyota Motor Corporation (Lexus)

- Jaguar Land Rover Automotive PLC

- Stellantis NV (Maserati, Alfa Romeo)

- Tesla Inc.

- Volvo Car Group

- Hyundai Motor Group (Genesis)

- Nissan Motor Co. (Infiniti)

- Geely Holding (Lotus, Zeekr)

- FAW Group (Hongqi)

- SAIC Motor (IM, Roewe)

- BYD Co. (Yangwang)

- Lucid Group

- Rivian Automotive

- Ferrari NV

- Aston Martin Lagonda

- Rolls-Royce Motor Cars

- McLaren Automotive

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Luxury-SUV Demand Boom

- 4.2.2 Rapid Electrification of Premium Models

- 4.2.3 Rising HNWI Population in Asia and Middle East

- 4.2.4 Enhanced ADAS and Safety Expectations

- 4.2.5 Online/Direct-To-Consumer Retail Shift

- 4.2.6 Mass-Customization and Bespoke Options

- 4.3 Market Restraints

- 4.3.1 High Purchase and Ownership Cost

- 4.3.2 Semiconductor and Component Shortages

- 4.3.3 Macroeconomic Demand Volatility

- 4.3.4 Anti-SUV Climate Regulation Pressure

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD), Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicles (SUVs)

- 5.1.4 Multi-purpose Vehicles (MPVs)

- 5.1.5 Sports / Exotic

- 5.2 By Drive Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric

- 5.2.3 Battery Electric

- 5.3 By Vehicle Class

- 5.3.1 Entry-level Luxury

- 5.3.2 Mid-level Luxury

- 5.3.3 Ultra-luxury / Exotic

- 5.4 By Sales Channel

- 5.4.1 Authorized Dealership

- 5.4.2 Direct-to-Consumer / Online

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle-East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Mercedes-Benz Group AG

- 6.4.2 BMW AG

- 6.4.3 Volkswagen Group

- 6.4.4 Toyota Motor Corporation (Lexus)

- 6.4.5 Jaguar Land Rover Automotive PLC

- 6.4.6 Stellantis NV (Maserati, Alfa Romeo)

- 6.4.7 Tesla Inc.

- 6.4.8 Volvo Car Group

- 6.4.9 Hyundai Motor Group (Genesis)

- 6.4.10 Nissan Motor Co. (Infiniti)

- 6.4.11 Geely Holding (Lotus, Zeekr)

- 6.4.12 FAW Group (Hongqi)

- 6.4.13 SAIC Motor (IM, Roewe)

- 6.4.14 BYD Co. (Yangwang)

- 6.4.15 Lucid Group

- 6.4.16 Rivian Automotive

- 6.4.17 Ferrari NV

- 6.4.18 Aston Martin Lagonda

- 6.4.19 Rolls-Royce Motor Cars

- 6.4.20 McLaren Automotive