|

시장보고서

상품코드

1536787

자동차용 액추에이터 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Automotive Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

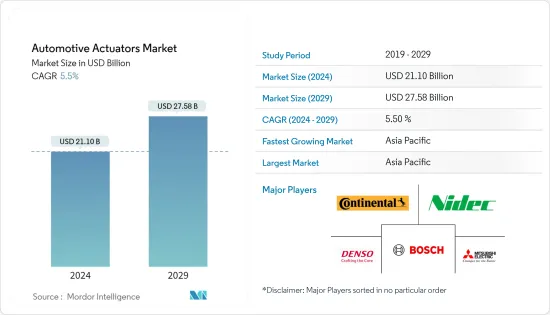

자동차용 액추에이터 시장 규모는 2024년에 211억 달러로 추정되고, 2029년에는 275억 8,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2024-2029년) CAGR은 5.5%로 성장할 것으로 예측됩니다.

중기적으로는 이 지역에서 전기차의 보급이 자동차용 액추에이터 수요를 높일 것으로 예상됩니다. 이 성장은 특히 승용차에서 연비 효율과 편안함에 대한 요구가 증가하고 있기 때문입니다. 따라서 자동차용 액추에이터 시장은 예측 기간 동안 큰 성장이 예상됩니다.

자율주행차나 ADAS(선진운전지원시스템) 등 자동차 산업의 기술 진보로 액추에이터 사용량이 급속히 증가하고 있습니다. 다양한 ADAS 중에서도 어댑티브 크루즈 컨트롤(ACC)과 어댑티브 프론트 라이팅 시스템(AFS)의 기능은 최근 자동차에서 점점 인기를 얻고 있습니다. 이 시스템은 자동 브레이크 어시스트, 레인 유지 어시스트 등을 포함하여 운전 안전을 크게 향상시킵니다.

연료를 절약하는 자동차에 대한 수요 증가 및 첨단 액추에이터 제품에 대한 수요 증가는 주요 제조업체들에게 연구개발 활동에 대한 투자를 촉구하고 향후 수년간 시장이 크게 성장할 가능성 높습니다.

자동차용 액추에이터 시장 동향

스로틀 액추에이터와 브레이크 액추에이터가 크게 성장

자동차의 배출가스 저감에 대한 요구가 높아지는 가운데 예측기간 중 내연기관차와 하이브리드 전기자동차 모두에서 소형 및 경량의 EGR 액추에이터와 스로틀 액추에이터에 대한 요구가 높아질 것으로 보입니다.

스로틀 밸브 액추에이터는 주로 가속기의 입력에 따라 연소를 위해 엔진으로 들어가는 공기의 양을 조정합니다. 자동차 엔진 경영 시스템의 요구가 증가함에 따라 공압 액추에이터 수요는 향후 몇 년동안 증가할 것으로 예상됩니다.

하이브리드 전기자동차는 기존의 IC 엔진 차량에 비해 연비가 좋기 때문에 소비자로부터 호평을 받고 있습니다. 배출가스 감축을 요구하는 규제당국으로부터의 압력이 높아짐에 따라 자동차업계는 하이브리드차의 생산을 늘리고 예측기간 중 시장의 대폭적인 성장이 전망되고 있습니다.

기존의 디젤 엔진은 통합 스로틀 제어 장치를 포함한 고급 연료 관리 시스템을 활용합니다. 이러한 엔진은 효율성 향상, 기능성 강화, 운전 안전성 향상, 이산화탄소 배출량 감소 등에 의해 보급되고 있습니다. 고급 스로틀 액추에이터는 다른 차량 기능과의 통합을 가능하게 하고 엔진 회전 속도를 모니터링하여 다양한 지형에서 부드러운 주행을 가능하게 합니다.

전기 액추에이터 수요는 전국적인 전기자동차 수요가 증가함에 따라 앞으로 수년간 증가할 것으로 예상됩니다. 주요 자동차 제조업체는 국내에서 새로운 EV 모델을 출시하고 있으며, 이는 시장 성장을 높일 것으로 예상됩니다.

- 2023년 2월, Geely 자동차는 신형 전기자동차 '갤럭시' 라인업의 첫 모델인 'L7'을 출시했습니다. L7은 고급 안전성 및 편안함을 갖추고 있습니다.

승객에게 더 나은 편안함을 제공하는 기능에 대한 수요는 증가하고 있으며, 이는 성장하는 액추에이터 업계에서 최고 제조업체가 차별화를 도모하는 중요한 요소입니다.

그 결과, OEM 각사는 최고의 액추에이터를 고객에게 제공함으로써 운전자 및 동승자의 체험을 향상시키기 위해 다액의 투자를 실시하고 있으며, 이것이 향후 수년간 시장 성장을 끌어올릴 것으로 예상하고 있습니다.

아시아태평양이 주요 시장 점유율을 차지

아시아태평양의 자동차 부품 제조 산업은 더 빠르게 성장할 것으로 예상됩니다. 인도, 일본, 중국은 미국과 독일과 같은 국가에 대한 주요 공급업체로 부상하고 있습니다. 이 성장의 원동력은 승용차 및 상용차의 판매 증가입니다.

중국은 아시아태평양 자동차 제조 시장의 주요 기업이며 최상급 자동차 제조 업체가 큰 존재감을 보여줍니다. 이 때문에 예측기간을 통해 시장에 유리한 기회가 생길 것으로 예상됩니다.

중국 정부는 자동차 산업의 성장을 가속하기 위해 자동차 판매를 촉진하고 전기자동차 구매에 보조금을 지급하는 여러 인센티브 플랜을 실시했습니다.

중국 기차공업협회(CAAM)에 따르면 2023년 1월부터 5월까지 중국의 승용차 판매량은 11.1% 증가했습니다. 이 기간 동안 전년 동기 대비 1,061만 대가 판매되었습니다. 순수한 전기차, 플러그인 하이브리드차, 수소연료전지차 등 신에너지차 판매량도 46.8% 증가했습니다.

인도 정부는 자동차 배출 가스 증가와 친환경 자동차 수요 증가에 대응하기 위해 엄격한 규제를 실시했습니다. 이 노력은 예측 기간 동안 시장 확대를 촉진할 것으로 예상됩니다. 그 결과 많은 자동차 제조업체들이 다양한 제도하에 인도에 투자하고 있습니다.

자동차의 전동화 동향 증가는 자동차용 액추에이터 시장을 견인하는 중요한 요인입니다. 주요 자동차 및 자동차 부품 제조업체는 지능형 조종실, 전자 연료 분사 시스템과 같은 지능형 운전 시스템을 공동 개발하고 있으며 예측 기간 동안 시장이 크게 성장할 가능성이 높습니다.

- 2023년 2월 BAIC 그룹과 Bosch China는 지능형 조종실, 지능형 운전, 지능형 연결 분야에서 종합적이고 면밀한 전략적 협력을 수행하고 자동차 이용 장면을 확대하기 위한 전략적 협력 협정에 서명했습니다.

이러한 지역 전체가 발전함에 따라 액추에이터 수요는 향후 수년간 증가할 것으로 보입니다.

자동차용 액추에이터 산업 개요

자동차 액추에이터 시장은 Robert Bosch GmbH, Nidec Corporation, Denso Corporation, Johnson Electric 및 Aptiv PLC와 같은 여러 주요 제조업체가 큰 점유율을 차지합니다. 일부 주요 제조업체들은 제품 포트폴리오를 강화하기 위해 지역 전반에 걸쳐 제조 시설을 확장하고 있으며, 이는 예측 기간 동안 시장 성장을 뒷받침할 것으로 보입니다. 예를 들면

- 2023년 9월, Marelli는 복잡한 차량 기능의 작동을 단순화하도록 설계된 전기자동차용 다목적 스마트 액추에이터의 새로운 시리즈를 발표했습니다.

- 2023년 6월 KOSTAL 그룹은 폭스바겐 그룹을 위한 최신 SAC(스마트 액추에이터 충전) 기술과 충전 시스템을 생산하기 위해 5,386만 달러를 투자했습니다.

- 2022년 9월, Knorr-Bremse AG는 IAA Transportation에서 e-모빌리티 변혁을 위한 제품 포트폴리오를 발표했습니다. Knorr-Bremse는 eCUBATOR라는 e-모빌리티 혁신 부문을 설립했습니다. 주요 기술은 에너지 관리 시스템, 전기 기계식 액추에이터, 추가 드라이브 및 파워트레인 통합 기능, 전자 브레이크 시스템 등을 포함합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 자동차 안전기능에 대한 수요 증가

- 시장 성장 억제요인

- 액추에이터와 관련된 높은 비용

- 업계의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 용도 유형별

- 스로틀 액추에이터

- 시트 조정 액추에이터

- 브레이크 액추에이터

- 클로저 액추에이터

- 기타

- 차종별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Continental AG

- BorgWarner Inc.

- Aptiv PLC

- Robert Bosch GmbH

- Mitsubishi Electric Corporation

- Nidec Corporation

- Johnson Electric Holdings Limited

- Hitachi Ltd

- CTS Corporation

- Denso Corp.

- Hella KGaA Hueck & Co.

제7장 시장 기회 및 향후 동향

제8장 주요 공급자 정보

AJY 24.08.27The Automotive Actuators Market size is estimated at USD 21.10 billion in 2024, and is expected to reach USD 27.58 billion by 2029, growing at a CAGR of 5.5% during the forecast period (2024-2029).

Over the medium term, the adoption of electric vehicles in the region is expected to drive up the demand for automotive actuators. This growth is attributed to the increasing need for fuel efficiency and comfort, particularly in passenger vehicles. Therefore, the automotive actuators market is anticipated to experience significant growth during the forecast period.

Due to technological advancements in the automotive industry, such as autonomous vehicles and advanced driver assistance systems (ADAS), the usage of actuators has increased rapidly. Among the various ADAS, the adaptive cruise control (ACC) and adaptive front-lighting system (AFS) features have become increasingly popular in modern vehicles. These systems include automated brake assist, lane keep assist, and others, which have greatly improved driving safety.

The growing demand for cars that save fuel and the increasing demand for advanced actuator products are pushing major manufacturers to invest in R&D activities, which is likely to witness major growth for the market in the coming years.

Automotive Actuators Market Trends

Throttle Actuator and Brake Actuator Witnessing Major Growth

With the increasing demand for reduced vehicle emissions, there is likely to be a higher need for compact and lightweight EGR actuators and throttle actuators from both ICE and hybrid electric vehicles during the forecast period.

The throttle valve actuator regulates the amount of air that enters the engine for combustion, primarily based on the accelerator's input. With the growing need for engine management systems in vehicles, the demand for pneumatic actuators is expected to increase in the coming years.

Hybrid electric vehicles have been well-received by consumers due to their ability to provide better fuel economy in comparison to conventional IC engine vehicles. As a result of mounting pressure from regulatory authorities to reduce emissions, the automotive industry has increased the production of hybrid vehicles, which is expected to lead to significant growth for the market during the forecast period.

Conventional diesel engines utilize advanced fuel management systems, including integrated throttle control units. These engines are popular due to their increased efficiency, enhanced functionality, improved operational safety, and reduced carbon emissions. Advanced throttle actuators allow for integration with other vehicle functions, enabling smooth driving over various terrains by monitoring engine speed.

The demand for electric actuators is expected to increase in the coming years due to the rising demand for electric vehicles nationwide. Major vehicle manufacturers are launching new EV models in the country, which is expected to enhance the market's growth. For example,

- In February 2023, Geely launched the L7, the first model in the new Galaxy electric vehicle lineup. The L7 is equipped with advanced safety and comfort features.

There is an increasing demand for features that provide better comfort to passengers, which has become a crucial factor for top manufacturers to distinguish themselves in the growing actuators industry.

Consequently, OEMs invest heavily to improve the driving and passenger experience by providing the best actuators to their customers, which is anticipated to boost the market's growth in the coming years.

Asia-Pacific Holds the Major Market Share

The automotive component manufacturing industry in Asia-Pacific is projected to experience faster growth. India, Japan, and China are emerging as major suppliers to countries like the United States and Germany. This growth is driven by increasing sales of passenger cars and commercial vehicles.

China is a major player in the Asia-Pacific vehicle manufacturing market, with a significant presence of top automotive manufacturers. This is expected to create lucrative opportunities in the market throughout the forecast period.

The Chinese government has implemented multiple incentive plans to boost automobile sales and provide subsidies for purchasing electric vehicles to encourage growth in the automotive industry.

China's passenger car sales increased by 11.1% from January to May 2023, according to the China Association of Automobile Manufacturers (CAAM). During this period, 10.61 million units were sold compared to the same period of the previous year. The sales of new energy vehicles, which include pure electric vehicles, plug-in hybrids, and hydrogen fuel-cell vehicles, also increased by 46.8%.

The Indian government has implemented strict regulations in response to rising vehicular emissions and increased demand for eco-friendly automobiles. This initiative is expected to drive market expansion over the forecast period. As a result, many car manufacturers are investing in India under various schemes.

The growing trend of vehicle electrification is a significant factor driving the automotive actuators market. Major vehicle and automotive component manufacturers are collaborating to develop intelligent driving systems, including intelligent cockpits, electronic fuel injection systems, and others, which are likely to witness major growth in the market during the forecast period. For instance,

- In February 2023, the BAIC Group and Bosch China signed a strategic cooperation agreement to conduct comprehensive and in-depth strategic cooperation in the fields of intelligent cockpits, intelligent driving, and intelligent connectivity to expand vehicle usage scenarios.

With such development across the region, the demand for actuators is likely to increase in the coming years.

Automotive Actuators Industry Overview

The automotive actuators market is dominated by several key players, such as Robert Bosch GmbH, Nidec Corporation, Denso Corporation, Johnson Electric, and Aptiv PLC, which have captured significant shares in the market. Several key manufacturers are expanding their manufacturing facilities across the region to enhance their product portfolio, which is likely to boost the market's growth during the forecast period. For instance,

- In September 2023, Marelli introduced a new range of multipurpose smart actuators for electric cars designed to simplify complex vehicle functions' actuation.

- In June 2023, KOSTAL Group invested USD 53.86 million to produce the latest SAC (Smart Actuator Charging) technologies and charging systems for the Volkswagen Group.

- In September 2022, Knorr-Bremse AG introduced a product portfolio for the e-mobility transformation at IAA Transportation. Knorr-Bremse set up an e-mobility innovation unit called eCUBATOR. Key technologies include energy management systems, electromechanical actuators, additional drive and powertrain integration functions, and electronic braking systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in demand for Safety Features in Vehicles

- 4.2 Market Restraints

- 4.2.1 High Cost Associated with Actuators

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Application Type

- 5.1.1 Throttle Actuator

- 5.1.2 Seat Adjustment Actuator

- 5.1.3 Brake Actuator

- 5.1.4 Closure Actuator

- 5.1.5 Other Application Types

- 5.2 By Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 BorgWarner Inc.

- 6.2.3 Aptiv PLC

- 6.2.4 Robert Bosch GmbH

- 6.2.5 Mitsubishi Electric Corporation

- 6.2.6 Nidec Corporation

- 6.2.7 Johnson Electric Holdings Limited

- 6.2.8 Hitachi Ltd

- 6.2.9 CTS Corporation

- 6.2.10 Denso Corp.

- 6.2.11 Hella KGaA Hueck & Co.