|

시장보고서

상품코드

1850382

EVA(Ethylene Vinyl Acetate) 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Ethylene Vinyl Acetate (EVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

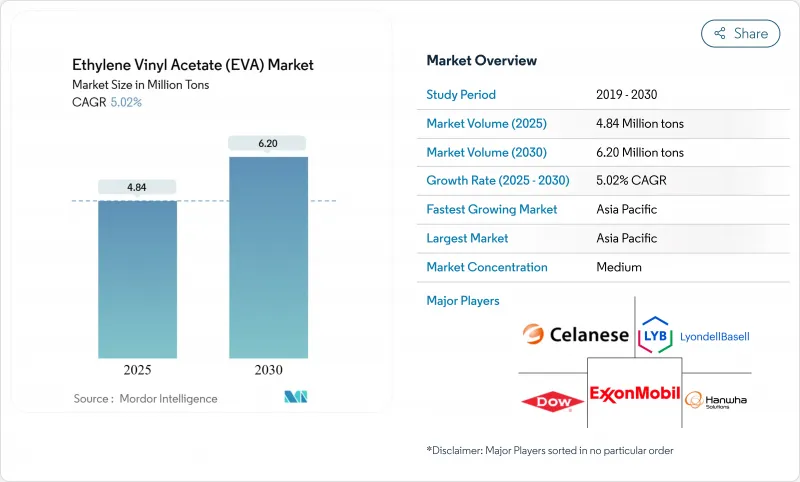

EVA 시장은 2025년에 484만 톤으로 추정되고, 2030년에는 620만 톤에 이를 것으로 예측됩니다.

수량 기준으로는 160만 톤의 확대가 예측되며, 이는 EVA가 연포장, 신발용 폼, 태양전지용 봉지재, 특수 필름 등 다용도로 사용할 수 있기 때문입니다. EVA의 낮은 가공 온도, 광범위한 폴리머 블렌드와의 호환성, 엄격한 씰 스루 오염 요구 사항을 충족하는 능력은 효율성 향상과 폐기물 감소를 요구하는 브랜드 소유자에게 필수적입니다. 아시아태평양에서 공급망의 현지화는 건조 지역에서 농업용 필름 소비가 증가함에 따라 이 지역 수요를 강화하고 있습니다. 한편, 초임계 CO2 발포와 같은 기술 혁신은 미드솔과 정형외과용 깔창의 경량화가 가능해져 퍼포먼스 양말에서 EVA의 제안 가치가 높아지고 있습니다. 원료 불안정이 계속되고 일회용 플라스틱에 대한 규제가 엄격해지고 있기 때문에 단기적인 수익성은 저하되고 있지만, 생산자는 수직 통합, 바이오매스 유래 등급, 클로즈드 루프 재활용의 시험을 통해 이러한 역풍에 대항하고 있으며, EVA 시장의 성장 궤도를 유지하고 있습니다.

세계의 EVA(Ethylene Vinyl Acetate) 시장 동향 및 인사이트

경량 EVA 폼이 신발 제조에 혁명 초래

2024년에 도입된 초임계 CO2 발포에 의해 생산자는 밀도가 0.15g/cm3 미만의 클로즈드 셀 EVA 구조를 만들어낼 수 있게 되어, 반발을 높이면서 신발의 완성 중량을 최대 30% 삭감할 수 있게 되었습니다. 신발 브랜드는 보다 가벼운 운동화를 요구하는 소비자의 요구에 부응하고 기업의 온실가스 감축 목표를 달성하기 위해 중국과 베트남 공장에서 이 기술을 빠르게 채택했습니다. 사내 발포 라인에 대한 투자로 인해 현재 공급이 안정되고 외주 미드솔에 대한 의존도가 떨어지고 있습니다. 경량화 뿐만 아니라 브랜드는 기존의 화학 발포보다 사이클 타임이 짧고, 휘발성 유기 화합물의 배출이 적다고 평가하고 있으며, EVA는 운동화와 의료용 신발 시장에서의 지위를 강화하고 있습니다.

농업 용도 분야에서 수요 증가

중국 북서부의 건조지대에서 실시한 실지 시험은 EVA 멀티필름이 토양 증발을 75% 줄이고 대두 수율을 19% 향상시킨 것으로 나타났습니다. EVA의 높은 신장성 및 내크랙성과 함께 인도나 북아프리카에서는 온실용, 사일리지용, 터널용 필름의 개량이 진행되고 있습니다. 세계적인 비료 비용의 상승은 농가의 경제성을 양분 흡수와 물 효율을 극대화하는 필름으로 더욱 기울이고 있습니다. 각국 정부가 수리를 배려한 농업을 추진하는 가운데 EVA 시장은 농가의 필름 초기 비용을 상쇄하는 정책 보조금의 혜택을 받고 있습니다.

비닐 아세테이트 단량체와 에틸렌 원료의 변동성

비닐 아세테이트와 에틸렌은 EVA 제조 비용의 최대 80%를 차지합니다. 지정학적 긴장과 2024년에 예정된 크래커의 운영 정지로 VAM의 스팟 가격은 전 분기 대비 18%나 변동하여 가공업자의 마진이 악화되었습니다. LyondellBasell과 같은 통합 기업은 원료 풀을 최적화하고 북미 에탄의 유리한 경제성을 활용하여 노출을 완화합니다. 그러나 비통합형 컨버터는 에스컬레이터의 폭이 넓은 가격 계약을 이용해야 하며 EVA 시장의 단기 수익성에 불확실성을 가져옵니다.

부문 분석

저밀도 EVA는 유연성, 투명성이 뛰어나 압출, 사출, 블로우 성형 라인에서의 가공이 용이하기 때문에 2024년 EVA 시장의 47%를 차지했습니다. 이 부문 중 고밀도 등급은 신발, 의료용 튜브, 쿠션용 폼의 보급에 따라 2030년까지의 CAGR이 6.56%가 될 것으로 예측되고 있습니다. 저비닐 아세테이트(12% 미만) 등급은 포장용 수축 필름에 사용되며 고 비닐 아세테이트(28-40%) 등급은 스포츠 신발의 중창에 탄성 회복을 제공합니다. 중밀도 등급은 라미네이트 파우치용의 강성과 강인성의 밸런스가 잡혀 있고, 고밀도 EVA는 전선 및 케이블의 피복용으로서 틈새 위치를 유지하고 있습니다. 셀라니즈 배터리 개스킷용 EVA와 폴리아미드 하이브리드와 같은 맞춤형 컴파운드를 통해 컨버터는 EVA 시장의 용융 지수와 밀봉 창을 미세 조정할 수 있습니다.

생산자는 바이오나프타와 공인 물질 수지 원료를 혼합하여 지속가능성을 높입니다. 다우 미츠이의 바이오매스 유래 포트폴리오는 가공 매개변수를 변경하지 않고 화석 탄소를 대체하며 브랜드에 스코프 3 배출 감소에 직접적인 경로를 제공합니다. 황변을 최소화하는 리사이클 대응 첨가제 패키지와 함께 저밀도 EVA의 EVA 시장에서의 리더십은 확고합니다.

필름은 2024년에 EVA 시장의 43%를 차지하였고, 식품 포장, 스트레치 푸드, 산업용 팔레트 수축이 견인했습니다. 시장 리더는 개선된 슬립제 분산과 실시간 두께 제어 센서로 지난 3년간 20% 가까운 다운 게이지율을 달성했습니다. 농업용 필름은 고성장 하위 부문이며, EVA 기반 온실 커버는 90% 이상의 광 투과율을 달성하여 대륙성 기후의 난방 비용을 절감합니다. 접착제는 두 번째로 큰 용도 클러스터를 형성하며, 핫멜트 EVA 시스템은 저온에서 다양한 기판을 접착하여 탄화물 발생 및 라인 유지보수를 줄입니다.

태양전지용 밀봉재는 가장 역동적인 하위 부문입니다. 봉지재 시트의 EVA 시장 규모는 세계 태양전지판 생산량 증가에 따라 2030년까지 연평균 복합 성장률(CAGR) 7.05%로 성장할 것으로 예측되고 있습니다. EVA는 폴리올레핀계 엘라스토머에 비해 내습성이 약간 떨어지는 것, 저비용이기 때문에 시장 우위성이 유지되고 있습니다. 라미네이터 제조업체는 모듈의 처리량을 향상시키기 위해 사이클 타임과 겔 함량의 목표를 미세 조정하고 있으며 EVA가 기존 기술임을 뒷받침합니다.

지역 분석

2024년 EVA 시장의 수량 점유율은 아시아태평양이 63%를 차지했습니다. 나프타 크래커와 에너지 효율적인 오토클레이브 프로세스가 통합된 중국은 최대의 EVA 생산 능력을 가지고 있습니다. 이 지역의 신발 공급망은 베트남과 인도네시아의 발포 압출기에 크게 의존하고 있으며, LONGi와 JinkoSolar와 같은 중국 태양전지판 제조업체는 밀봉 필름을 대량으로 소비하고 있습니다. 인도에서는 온실 근대화를 위한 정부 우대 조치가 EVA 농업용 필름의 보급을 뒷받침하고 있습니다.

북미는 여전히 재활용 가능한 연포장 기술 리더입니다. 미국의 컨버터는 고밀도 코어층에 대해 높은 VA의 EVA 밀봉층을 공압출하는 다층 다이 헤드를 갖춘 블로우 필름 라인을 업그레이드하여 구조 전체의 두께를 12-15% 삭감했습니다. 국내 태양광발전 제조에 대한 연방세 공제가 수요를 뒷받침하고 3층 봉지 시트로 국내 이동이 진행되고 있습니다.

유럽은 가장 엄격한 규제 환경에 직면하고 있습니다. 독일과 프랑스의 자동차 제조업체들은 고분자의 높은 제진성과 내화학성을 활용하여 배터리 전기자동차용 가교 EVA 차음 시트를 조달하고 있습니다. 그러나 새로운 포장 및 용기 포장 폐기물 규제는 재활용 가능한 경로를 의무화하고 있으며, 컴파운드 제조업체는 기존 재활용 흐름에 맞는 과산화물이 없는 가교 시스템을 개발하도록 장려하고 있습니다. 서유럽 제조업체는 고객의 넷 제로 목표를 달성하기 위해 바이오 나프타 기반 EVA 등급에 투자하고 있으며, 법규의 압력에도 불구하고 EVA 시장의 탄력성을 유지하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 경량 EVA 폼이 아시아태평양의 신발 제조 견인

- 농업 용도에서의 수요 증가

- 북미에서 재활용 가능한 유연한 식품 포장으로의 전환

- 신재생 에너지 성장

- 포장 업계에서 수요 증가

- 시장 성장 억제요인

- 비닐 아세테이트 단량체 및 에틸렌 원료 가격 변동

- EU와 미국에서 일회용 플라스틱의 규제 강화

- 증가 대체품의 위협

- 밸류체인 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 규모 및 성장 예측(가치 및 수량)

- 등급별

- 저밀도

- 중밀도

- 고밀도

- 용도별

- 필름

- 접착제

- 폼

- 태양전지의 캡슐화

- 기타 용도

- 최종 이용 산업별

- 패키지

- 태양광 발전

- 농업

- 신발 및 스포츠 용품

- 자동차 및 운송

- 전기 및 전자공학

- 기타

- 처리 기술별

- 압출

- 사출 성형

- 블로우 성형

- 기타 프로세스

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 이집트

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율(%)/랭킹 분석

- 기업 프로파일

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers Pvt Ltd.

- Braskem

- Celanese Corporation

- China Petrochemical Corporation.

- Clariant

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hyundai Chemical

- Innospec

- Jiangsu Sailboat Petrochemical Co., Ltd.

- Levima Group Co., Ltd.

- LOTTE Chemical Corporation

- LG Chem

- LyondellBasell Industries Holdings BV

- Repsol

- Saudi Arabian Oil Co.

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical

제7장 시장 기회 및 향후 전망

AJY 25.11.10The Ethylene vinyl acetate market stands at 4.84 million tons in 2025 and is forecast to reach 6.20 million tons by 2030, reflecting a healthy 5.02% CAGR over 2025-2030.

In volume terms, this projects a 1.6 million ton expansion, anchored in EVA's versatility across flexible packaging, footwear foams, solar encapsulation and specialty films. The low processing temperatures of EVA, its compatibility with a broad range of polymer blends and its ability to satisfy demanding seal-through-contamination requirements have made it indispensable to brand owners looking for efficiency gains and waste reduction. Supply chain localization in Asia-Pacific, coupled with rising agricultural film consumption in arid regions, is reinforcing regional demand. Meanwhile, innovations such as supercritical CO2 foaming enable lighter midsoles and orthopedic insoles, increasing EVA's value proposition in performance footwear. Ongoing feedstock volatility and escalating regulatory scrutiny of single-use plastics temper near-term profitability, but producers are countering these headwinds through vertical integration, biomass-derived grades and closed-loop recycling pilots, sustaining the Ethylene vinyl acetate market growth path.

Global Ethylene Vinyl Acetate (EVA) Market Trends and Insights

Lightweight EVA foams revolutionizing footwear manufacturing

Supercritical CO2 foaming introduced in 2024 allows producers to generate closed-cell EVA structures with densities below 0.15 g/cm3, trimming finished shoe weight by up to 30% while enhancing rebound. Footwear brands rapidly adopted this technology across Chinese and Vietnamese factories to meet consumer demand for lighter athletic shoes and to satisfy corporate greenhouse-gas reduction goals. Investment in in-house foaming lines now offers supply security, reducing reliance on outsourced midsoles. Alongside weight savings, brands cite lower cycle times and fewer volatile organic compound emissions than traditional chemical foaming, strengthening the Ethylene vinyl acetate market position in athletic and medical footwear.

Increasing demand from agricultural applications

Field trials in arid northwest China showed EVA mulch films cut soil evaporation by 75% and lifted soybean yields by 19%. These improvements, coupled with EVA's high elongation and crack resistance, are driving greenhouse, silage, and tunnel film upgrades across India and North Africa. Global fertilizer cost inflation is further tilting farmer economics toward films that maximize nutrient uptake and water efficiency. With governments promoting water-smart agriculture, the Ethylene vinyl acetate market benefits from policy subsidies that offset farmers' up-front film costs.

Volatility in vinyl acetate monomer & ethylene feedstocks

VAM and ethylene represent up to 80% of EVA production cost. Geopolitical tensions and planned cracker shutdowns in 2024 swung spot VAM prices by 18% quarter-to-quarter, eroding processor margins. Integrated players such as LyondellBasell are optimizing feedstock pools and leveraging favorable North American ethane economics to mitigate exposure. Non-integrated converters, however, must navigate price contracts with wider escalators, creating uncertainty for the Ethylene vinyl acetate market's short-term profitability.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward recyclable flexible food packaging in North America

- Growth of renewable energy driving solar encapsulation demand

- Regulatory crackdown on single-use plastics

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Low-density EVA accounted for 47% of the Ethylene vinyl acetate market in 2024, reflecting its superior flexibility, clarity and easy processing across extrusion, injection and blow-molding lines. Within this segment, high-density grades is projected to rise at a 6.56% CAGR through 2030 as footwear, medical tubing and cushioning foams proliferate. Low vinyl-acetate (less than 12%) variants serve packaging shrink films, whereas higher VA content (28-40%) delivers elastic recovery for sports-shoe midsoles. Medium-density grades balance stiffness and toughness for laminated pouches, while high-density EVA remains niche in wire-and-cable jacketing. Custom compounding-such as Celanese's EVA-polyamide hybrids for battery gaskets-is allowing converters to fine-tune melt indices and sealing windows inside the Ethylene vinyl acetate market.

Producers are boosting sustainability by blending bio-naphtha and certified mass-balance feedstocks. Dow-Mitsui's biomass-derived portfolio replaces fossil carbon without altering processing parameters, giving brands a direct route to Scope 3 emission reductions. Coupled with recyclate-ready additive packages that minimize yellowing, such offerings cement low-density EVA's leadership within the Ethylene vinyl acetate market.

Films captured 43% of the Ethylene vinyl acetate market in 2024, buoyed by food packaging, stretch hoods and industrial pallet shrink. Market leaders attained down-gauge ratios nearing 20% over the last three years, thanks to improved slip-agent dispersion and real-time thickness-control sensors. Agricultural films are a high-growth sub-segment; EVA-based greenhouse covers achieve greater than 90% light transmittance and cut heating costs in continental climates A&C Plastics. Adhesives form the second-largest application cluster, where hot-melt EVA systems bond diverse substrates at lower temperatures, reducing char formation and line maintenance.

Solar encapsulation is the most dynamic sub-segment. The Ethylene vinyl acetate market size for encapsulant sheets is expected to grow at a 7.05% CAGR to 2030 as global solar panel output scales. EVA's lower cost offsets its moderate moisture resistance compared with polyolefin elastomers, preserving its market edge. Laminator manufacturers continue to fine-tune cycle times and gel-content targets to push module throughput, anchoring EVA as the incumbent technology.

The Ethylene Vinyl Acetate Market Report Segments the Industry by Grade (Low Density, Medium Density, and More), Application (Films, Adhesives, and More), End-Use Industry (Packaging, Photovoltaic, and More), Processing Technology (Extrusion, Injection Molding, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia-Pacific retained a 63% volume share of the Ethylene vinyl acetate market in 2024. China commands the largest installed EVA capacity, supported by integrated naphtha crackers and energy-efficient autoclave processes. The region's footwear supply chain relies heavily on Vietnamese and Indonesian foam extruders, while Chinese solar panel makers such as LONGi and JinkoSolar consume vast quantities of encapsulant film. Government incentives for greenhouse modernization in India push EVA agricultural film uptake.

North America remains the technology leader in recyclable flexible packaging. Converters in the United States upgraded blown-film lines with multilayer die heads that co-extrude high-VA EVA seal layers against high-density core layers, reducing total structure thickness by 12-15%. Demand is buttressed by federal tax credits for domestic photovoltaic manufacturing, driving a domestic shift toward 3-layer encapsulant sheets.

Europe faces the strictest regulatory environment. German and French automakers source cross-linked EVA sound-deadening sheets for battery-electric vehicles, leveraging the polymer's high damping and chemical resistance. However, the new Packaging and Packaging Waste Regulation mandates recyclability pathways, encouraging compounders to develop peroxide-free cross-linking systems that remain compatible with existing recycling streams. Western European producers are investing in bio-naphtha-based EVA grades to meet customer net-zero targets, sustaining the Ethylene vinyl acetate market's resilience despite legislative pressure.

- Asia Polymer Corporation

- BASF-YPC Company Limited

- Benson Polymers Pvt Ltd.

- Braskem

- Celanese Corporation

- China Petrochemical Corporation.

- Clariant

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Hanwha Solutions

- Hyundai Chemical

- Innospec

- Jiangsu Sailboat Petrochemical Co., Ltd.

- Levima Group Co., Ltd.

- LOTTE Chemical Corporation

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Repsol

- Saudi Arabian Oil Co.

- Sinochem Holdings Corporation Ltd

- Sipchem Company

- Sumitomo Chemical Co. Ltd

- Zhejiang Petroleum & Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Lightweight EVA Foams Driving Footwear Manufacturing in Asia-Pacific

- 4.2.2 Increasing Demand from Agricultural Applications

- 4.2.3 Shift Toward Recyclable Flexible Food Packaging in North America

- 4.2.4 Growth of Renewable Energy

- 4.2.5 Increasing Demand from the Packaging Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Vinyl Acetate Monomer and Ethylene Feedstock Prices

- 4.3.2 Regulatory Crack-down on Single-Use Plastics in EU and US

- 4.3.3 Increasing Threat of Substitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Grade

- 5.1.1 Low Density

- 5.1.2 Medium Density

- 5.1.3 High Density

- 5.2 By Application

- 5.2.1 Films

- 5.2.2 Adhesives

- 5.2.3 Foams

- 5.2.4 Solar Cell Encapsulation

- 5.2.5 Other Applications

- 5.3 By End-use Industry

- 5.3.1 Packaging

- 5.3.2 Photovoltaic

- 5.3.3 Agriculture

- 5.3.4 Footwear and Sporting Goods

- 5.3.5 Automotive and Transportation

- 5.3.6 Electrical and Electronics

- 5.3.7 Others

- 5.4 By Processing Technology

- 5.4.1 Extrusion

- 5.4.2 Injection Molding

- 5.4.3 Blow Molding

- 5.4.4 Other Processes

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 South Africa

- 5.5.5.4 Egypt

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Asia Polymer Corporation

- 6.4.2 BASF-YPC Company Limited

- 6.4.3 Benson Polymers Pvt Ltd.

- 6.4.4 Braskem

- 6.4.5 Celanese Corporation

- 6.4.6 China Petrochemical Corporation.

- 6.4.7 Clariant

- 6.4.8 Dow

- 6.4.9 Exxon Mobil Corporation

- 6.4.10 Formosa Plastics Corporation

- 6.4.11 Hanwha Solutions

- 6.4.12 Hyundai Chemical

- 6.4.13 Innospec

- 6.4.14 Jiangsu Sailboat Petrochemical Co., Ltd.

- 6.4.15 Levima Group Co., Ltd.

- 6.4.16 LOTTE Chemical Corporation

- 6.4.17 LG Chem

- 6.4.18 LyondellBasell Industries Holdings B.V.

- 6.4.19 Repsol

- 6.4.20 Saudi Arabian Oil Co.

- 6.4.21 Sinochem Holdings Corporation Ltd

- 6.4.22 Sipchem Company

- 6.4.23 Sumitomo Chemical Co. Ltd

- 6.4.24 Zhejiang Petroleum & Chemical

7 Market Opportunities and Future Outlook

- 7.1 Increasing Demand for Photovoltaic (PV) Solar Cell Encapsulants

- 7.2 White-space and Unmet-need Assessment