|

시장보고서

상품코드

1692519

반도체 장치 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

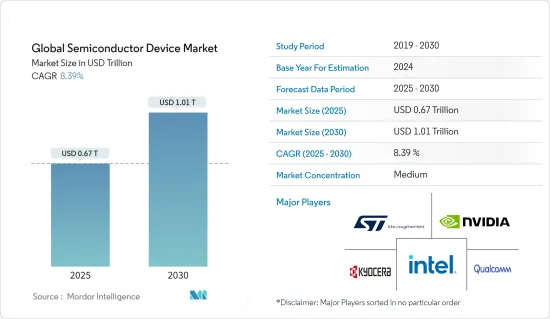

세계의 반도체 장치 시장 규모는 2025년 6,700억 달러로 추정되고, 2030년에는 1조100억 달러에 달할 것으로 예측되고, 예측기간(2025-2030년)의 CAGR은 8.39%를 나타낼 전망입니다.

출하량에서는 2025년 8,800억개에서 2030년에는 1조 2,300억개로 성장하며, 예측기간(2025-2030년)의 CAGR은 7.02%로 예측됩니다.

반도체 장치는 일반적으로 반도체 제조 또는 집적 회로(IC) 제조라는 복잡한 공정을 통해 제조됩니다.

반도체 장치는 스마트폰과 컴퓨터부터 의료 기기, 재생 에너지 시스템에 이르기까지 모든 것을 구동하는 현대 전자제품의 중추입니다.

크고 부피가 큰 부품이 필요했던 기존의 진공관 기술과 달리 반도체 장치는 매우 작은 크기로 제조할 수 있습니다. 이러한 소형화 덕분에 스마트폰, 피트니스 트래커, 스마트워치와 같이 가볍고 휴대하기 쉬운 휴대용 및 웨어러블 전자기기의 개발이 가능해졌습니다.

최근 몇 년 동안 반도체 장치 시장은 AI 및 IoT와 같은 첨단 기술의 채택이 증가하면서 큰 변화를 겪었습니다. 이러한 첨단 기술은 헬스케어에서 자동차에 이르기까지 다양한 산업 분야에서 혁신적인 변화를 가져왔으며, 반도체 장치 시장에 새로운 길을 열어주었습니다.

데이터 소비의 폭발적인 성장은 5G의 주요 시장 동력 중 하나입니다. 커넥티드 장치, 스마트폰, IoT 애플리케이션의 확산으로 사람들은 매일 엄청난 양의 데이터를 생성하고 있습니다. 5G의 더 높은 대역폭과 용량은 이러한 데이터 소비의 급증을 지원하여 사용자에게 원활한 연결을 가능하게 할 것입니다.

또한 반도체 공급망은 설계, 제조, 테스트 및 유통과 관련된 상호 연결된 단계로 구성된 복잡한 네트워크입니다. 이 프로세스는 칩 설계로 시작하여 웨이퍼 제작, 조립 및 테스트가 이어집니다. 마지막으로 칩은 다양한 전자 기기에 사용되는 주문자 상표 부착 생산업체(OEM)에 배포됩니다. 원격 근무, 전자상거래, 5G 도입과 같은 추세로 인해 전자 기기에 대한 수요가 급증하면서 반도체 제조업체의 공급 능력을 앞질렀습니다. 이러한 수요 증가는 전체 공급망에 부담을 주어 공급 부족으로 이어졌습니다.

코로나19 확산의 중요한 후유증 중 하나는 데이터 사용량 증가입니다. 또한 원격 근무 환경의 증가로 인해 데이터 생성량이 늘어나는 새로운 기회가 생겼고, 다양한 데이터 센터 공급업체는 데이터에 대한 끊임없는 수요에 맞춰 새로운 데이터 센터에 지속적으로 투자하고 있습니다. 전국 소프트웨어 및 서비스 기업 협회(NASSCOM)에 따르면 2025년 인도의 데이터센터 시장 투자액은 약 46억 달러에 달할 것으로 예상됩니다.

반도체 장치 시장 동향

통신 산업이 가장 큰 최종 사용자에게

- 반도체는 이더넷 컨트롤러, 어댑터, 스위치를 아우르는 유선 통신에서 중추적인 역할을 합니다.

- 무선 통신에서 반도체는 마이크로파, 적외선, 위성, 방송 라디오, 모바일 통신 시스템, Wi-Fi, Bluetooth 및 Zigbee와 같은 기술에 사용됩니다. 시스템 온 칩(SoC) 및 FPGA(현장 프로그래밍 가능 게이트 어레이) 장치는 무선 통신 시스템, 특히 5G의 진화를 주도합니다. 한편 저에너지 마이크로컨트롤러(MCU)는 블루투스 기능을 향상시키는 데 중추적인 역할을 합니다.

- 무선 통신을 지원하는 반도체 시장은 5G 도입이 확대되면서 큰 변화를 겪고 있습니다. GSMA에 따르면 2025년 한국과 일본의 전체 연결 중 5G 모바일 연결이 차지하는 비중은 각각 73%와 68%에 달할 것으로 예상됩니다. 또한, 2030년에는 걸프협력회의 국가에서는 모바일 연결의 95%가, 아시아에서는 93%가 5G가 될 것입니다.

- 5Gamericas.org에 따르면 2023년 전 세계 5세대(5G) 가입 건수는 약 19억 건을 기록했으며, 2028년에는 80억 건으로 급증할 것으로 예상됩니다. 5G 기술은 이전 기술에 비해 다운로드 속도가 빨라지고 지연 시간이 현저히 줄어듭니다.

현저한 성장을 이루는 중국

- 수년에 걸쳐 중국의 반도체 산업은 빠르게 성장하여 세계에서 가장 큰 칩 소비국 중 하나가 되었습니다. 중국은 강력한 국내 공급망을 개발하여 수입 반도체 부품에 대한 의존도를 낮추는 것을 목표로 하고 있습니다.

- 예를 들어, 2024년 5월 중국은 국내 반도체 산업을 확장하기 위해 정부가 지원하는 3단계 투자 펀드를 설립했는데, 이는 현재까지 가장 중요한 단계입니다. 이러한 움직임은 미국의 제재를 고려할 때 자급자족을 달성하려는 중국의 의지를 강조합니다.

- 이 펀드의 총 등록 자본금은 3,440억 위안(미화 475억 달러)입니다. 중국 집적회로 산업 투자 펀드는 중국의 상위 2개 칩 파운드리 업체인 반도체제조국제공사와 화홍반도체, 그리고 몇몇 소규모 기업에 자금을 지원합니다.

- 게다가 가전 산업의 급속한 성장, 국내 제조를 촉진하고 해외 기술에 대한 의존도를 낮추려는 정부의 노력, 반도체 생산 시설에 대한 투자 증가, 인공지능 및 사물인터넷과 같은 신흥 기술의 부상, 전기 자동차에 대한 수요 증가로 인해 반도체 산업에 대한 투자도 증가하고 있습니다.

- 중국의 탄탄한 통신 산업도 중요한 시장 동인입니다. 예를 들어, 중국 국가통계국에 따르면 2023년 3월 중국은 통신 산업에서 약 1,510억 위안(207억 9,000만 달러)의 누적 매출을 올렸습니다. 그 달의 전년 대비 성장률은 약 4.8%였습니다.

반도체 장치 산업 개요

반도체 장치 시장은 반통합형 시장입니다. 통합의 증가, 기술 발전, 지정학적 시나리오에 따라 변동합니다. 파운드리와 IDM의 수직 통합이 증가함에 따라 연구 대상 시장의 치열한 경쟁은 수익에서 비롯되는 투자 능력을 고려할 때 더욱 심화될 것으로 예상됩니다. 주요 진출기업으로는 Intel Corporation, Nvidia Corporation, 교세라 주식회사, Qualcomm Incorporated, STMicroelectronics NV 등이 있습니다.

2024년 3월 : Amazon Web Services와 Nvidia는 차세대 AI 혁신을 발전시키기 위해 협력을 확대한다고 발표했습니다. 고객이 고급 생성 인공 지능 기능을 활용할 수 있도록 블랙웰은 가장 안전하고 진보된 인프라, 소프트웨어 및 서비스를 제공하기 위해 양사 간의 오랜 전략적 협력을 확장하는 엔비디아 GB200 그레이스 블랙웰 슈퍼 칩과 B100 텐서 코어 GPU를 제공할 예정입니다.

2024년 2월 : Intel Corporation은 AI 시대를 위한 지속 가능한 시스템 파운드리인 인텔 파운드리를 공개했습니다. 또한 2020년대까지 리더십을 공고히 하기 위한 확장된 프로세스 로드맵도 공개했습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 기술 동향

- 산업의 밸류체인 및 공급 체인 분석

- COVID-19 후유증과 기타 거시경제 요인이 시장에 미치는 영향

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- IoT 및 AI등의 기술 채택 증가

- 5G 배포 증가 및 5G 스마트폰에 대한 수요 증가

- 시장의 과제

- 반도체 칩 부족으로 인한 공급망 중단

제6장 시장 세분화

- 장치 유형별

- 이산 반도체

- 광전자

- 센서

- 집적회로

- 아날로그

- 로직

- 메모리

- 마이크로

- 마이크로프로세서(MPU)

- 마이크로컨트롤러(MCU)

- 디지털 신호 프로세서

- 산업별

- 자동차

- 통신(유선, 무선)

- 소비자

- 산업

- 컴퓨팅 및 데이터 스토리지

- 정부(항공우주 및 방위)

- 지역별

- 미국

- 유럽

- 일본

- 중국

- 한국

- 대만

- 기타

제7장 반도체 파운드리 전망

- 파운드리 사업의 매출 및 주조 제조업체 시장 점유율

- 반도체 매출 : IDM vs 패브리스

- 팹 소재지에 의한 2021년 12월 말까지의 웨이퍼 생산 능력

- 반도체 기업 주요 5개사의 웨이퍼 생산 능력 및 노드 기술별 웨이퍼 생산 능력의 추이

제8장 경쟁 구도

- 기업 프로파일

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics NV

- Micron Technology Inc.

- Advanced Micro Devices Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc

- Analog Devices Inc.

- SK Hynix Inc.

- Samsung Electronics Co. Ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Wolfspeed Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

제9장 시장 전망

HBR 25.05.13The Global Semiconductor Device Market size is estimated at USD 0.67 trillion in 2025, and is expected to reach USD 1.01 trillion by 2030, at a CAGR of 8.39% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 0.88 trillion units in 2025 to 1.23 trillion units by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

Semiconductor devices are typically manufactured through a complex process called semiconductor fabrication or integrated circuit (IC) manufacturing. This process involves precise manipulation of the semiconductor material to create components with specific electrical behavior.

Semiconductor devices are the backbone of modern electronics, powering everything from smartphones & computers to medical devices and renewable energy systems. One of the primary advantages of semiconductor devices is their small size and compactness.

Unlike older vacuum tube technology, which requires large and bulky components, semiconductor devices can be manufactured in extremely small sizes. This miniaturization has allowed for the development of portable and wearable electronics that are lightweight and easy to carry, such as smartphones, fitness trackers, and smartwatches.

The semiconductor devices market has witnessed a significant transformation in recent years due to the increasing adoption of advanced technologies like AI and IoT. These advanced technologies have paved the way for revolutionary changes in various industries, ranging from healthcare to automotive, and have opened up new avenues for the semiconductor devices market.

The explosive growth of data consumption is one of the primary market drivers of 5G. With the proliferation of connected devices, smartphones, and IoT applications, people generate an enormous amount of data daily. 5G's higher bandwidth and capacity will support this surge in data consumption, enabling seamless connectivity for users.

Moreover, the semiconductor supply chain is a complex network of interconnected stages involving design, manufacturing, testing, and distribution. The process begins with chip design, followed by wafer fabrication, assembly, and testing. Finally, the chips are distributed to original equipment manufacturers (OEMs) who use them in various electronic devices. The surge in demand for electronic devices, driven by trends like remote working, e-commerce, and 5G adoption, has outpaced the supply capacity of semiconductor manufacturers. This increased demand has strained the entire supply chain, leading to shortages.

One of the significant aftereffects of the outbreak of COVID-19 is the increased usage of data. Moreover, it presented new opportunities for growing data generation due to increased remote working environments; various data center vendors consistently invest in new data centers in line with the insatiable need for data. According to the National Association of Software and Service Companies (NASSCOM), India's data center market investment is anticipated to reach approximately USD 4.6 billion in 2025.

Semiconductor Device Market Trends

Communication Industry to be the Largest End User

- Semiconductors play a pivotal role in wired communications, encompassing ethernet controllers, adapters, and switches. They feature Power over Ethernet (PoE) interface controllers, crucial for supporting Voice over Internet Protocol (VoIP), alongside powerline transceivers.

- In wireless communication, semiconductors are used in microwave, infrared, satellite, broadcast radio, mobile communications systems, Wi-Fi, and technologies such as Bluetooth and Zigbee. System-on-chip (SoC) and field-programmable gate array (FPGA) devices drive the evolution of wireless communication systems, notably 5G. Meanwhile, low-energy microcontrollers (MCUs) are pivotal in enhancing Bluetooth functionalities. Wireless sensor networks find applications in diverse fields, from environmental and structural monitoring to asset tracking.

- The market for semiconductors that power wireless communication is undergoing significant change with the increasing implementation of 5G. According to the GSMA, in 2025, the share of 5G mobile connections of total connections in South Korea and Japan are anticipated to account for 73% and 68%, respectively. Further, 95% of mobile connections will be 5G by 2030 in GCC states and 93% in Asia. The increasing adoption of 5G smartphones and networks creates new market opportunities.

- According to 5Gamericas.org, in 2023, the global count of fifth-generation (5G) subscriptions hit an estimated 1.9 billion, projected to soar to 8 billion by 2028. Compared to its predecessors, 5G technology boasts faster download speeds and significantly lower latency.

China to Witness Significant Growth

- Over the years, China's semiconductor industry has rapidly expanded and become one of the largest consumers of chips in the world. China aims to reduce its dependence on imported semiconductor components by developing a robust domestic supply chain.

- For instance, in May 2024, China established the third phase of a government-supported investment fund to expand its domestic semiconductor industry, which is the most significant phase to date. This move highlights China's determination to achieve self-sufficiency in light of US sanctions.

- The fund has a total registered capital of CNY 344 billion (USD 47.5 billion). The China Integrated Circuit Industry Investment Fund offers funding to the country's top two chip foundries, Semiconductor Manufacturing International Corporation and Hua Hong Semiconductor, and a few smaller companies.

- Moreover, the rapid growth of the consumer electronics industry, the government's efforts to promote domestic manufacturing and reduce reliance on foreign technology, which have led to increased investment in semiconductor production facilities, the rise of emerging technologies, such as artificial intelligence and internet of things, and the increasing demand for electric vehicles.

- The robust telecom industry in China is also a significant market driver. For instance, according to the National Bureau of Statistics of China, in March 2023, China generated a cumulative revenue of about CNY 151 billion (20.79 USD Billion) from its telecommunications industry. It had a year-on-year growth rate of approximately 4.8% that month.

Semiconductor Device Industry Overview

The semiconductor device market is semi-consolidated. It fluctuates with growing consolidation, technological advancement, and geopolitical scenarios. In addition to this increasing vertical integration of Foundries and IDMs, intense competition in the market studied is expected to rise, considering their ability to invest, which results from their revenues. Some players include Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Incorporated, and STMicroelectronics NV.

March 2024 - Amazon Web Services and Nvidia announced the extension of their collaboration to advance Gen AI innovation. To help customers unlock advanced generative artificial intelligence capabilities, Blackwell will offer the NVIDIA GB200 Grace Blackwell super chip and B100 Tensor core GPUs, which will extend the long-standing strategic collaboration between the two companies to deliver the most secure and advanced infrastructure, software, and services.

February 2024 - Intel Corporation unveiled Intel Foundry, a sustainable systems foundry tailored for the AI era. They also revealed an extended process roadmap to solidify their leadership well into the 2020s. The company emphasized strong customer backing and ecosystem support, with key partners like Synopsys, Cadence, Siemens, and Ansys, all geared to expedite chip design for Intel Foundry's clientele through advanced tools and design flows.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Technologies like IoT and AI

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processors

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Communication (Wired and Wireless)

- 6.2.3 Consumer

- 6.2.4 Industrial

- 6.2.5 Computing/Data Storage

- 6.2.6 Government (Aerospace and Defense)

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Korea

- 6.3.6 Taiwan

- 6.3.7 Rest of the World

7 SEMICONDUCTOR FOUNDRY LANDSCAPE

- 7.1 Foundry Business Revenue and Market Shares by Foundries

- 7.2 Semiconductor Sales - IDM vs Fabless

- 7.3 Wafer Capacity By End of December 2021 Based on Fab Location

- 7.4 Wafer Capacity By Top 5 Semiconductor Companies and an Indication of Wafer Capacity by Node Technology

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 Nvidia Corporation

- 8.1.3 Kyocera Corporation

- 8.1.4 Qualcomm Incorporated

- 8.1.5 STMicroelectronics NV

- 8.1.6 Micron Technology Inc.

- 8.1.7 Advanced Micro Devices Inc.

- 8.1.8 NXP Semiconductors NV

- 8.1.9 Toshiba Corporation

- 8.1.10 Texas Instruments Inc

- 8.1.11 Analog Devices Inc.

- 8.1.12 SK Hynix Inc.

- 8.1.13 Samsung Electronics Co. Ltd

- 8.1.14 Fujitsu Semiconductor Ltd

- 8.1.15 Rohm Co. Ltd

- 8.1.16 Infineon Technologies AG

- 8.1.17 Renesas Electronics Corporation

- 8.1.18 Wolfspeed Inc.

- 8.1.19 Broadcom Inc.

- 8.1.20 ON Semiconductor Corporation