|

시장보고서

상품코드

1626337

북미의 종이 포장 : 시장 점유율 분석, 산업 동향, 통계 및 성장 예측(2025-2030년)North America Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

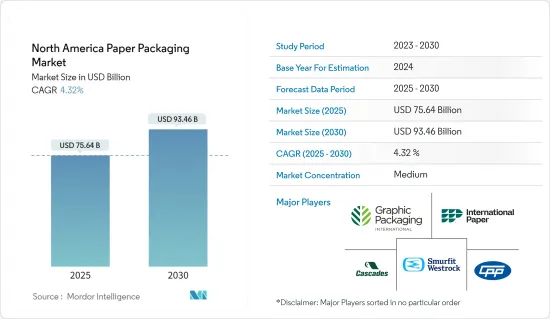

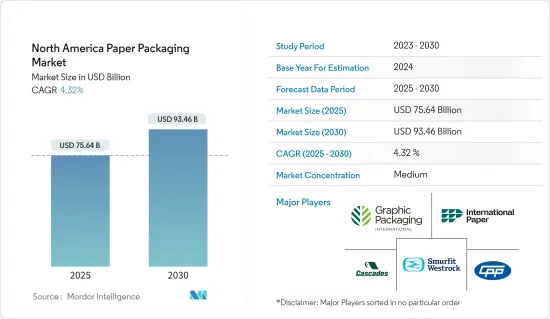

북미의 종이 포장 시장 규모는 2025년 756억 4,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 4.32%의 연평균 복합 성장률(CAGR)로 2030년에는 934억 6,000만 달러에 달할 전망입니다.

주요 하이라이트

- 종이 포장은 친환경 포장 솔루션의 주요 대안으로 각광받고 있습니다. 특히 부피가 큰 대체품에 비해 다양한 크기로 생산할 수 있는 다재다능한 특성으로 인해 거의 모든 최종 사용자 산업에 이상적으로 적합하며, 설치 면적을 작게 유지하면서 다양한 크기로 생산할 수 있습니다.

- 미국 인구 조사국에 따르면 2024년 펄프 공장은 61억 1,000만 달러의 수익을 올릴 것으로 예상됩니다. 또한 판지 공장은 미화 340 억 2,000만 달러, 제지 공장은 미화 395 억 5,000만 달러의 수익을 올릴 것으로 예상되며, 전자상거래가 소매업에서 점점 더 중요한 요소로 발전함에 따라 종이 포장은 큰 이익을 얻게 될 것입니다.

- 또한, 이 지역에는 조리식품, 편의식품, 즉석식품 등 여러 외식업체와 포장식품업체가 있어 골판지 포장의 가장 큰 시장 중 하나로 부상하고 있습니다. 바쁜 업무 일정과 편의성 때문에 가정 외 음식에 대한 수요가 높은 것도 시장 성장을 가속하는 중요한 요인으로 작용하고 있습니다. 국제 프랜차이즈 협회에 따르면, 미국의 퀵서비스 레스토랑(QSR) 수는 2024년 말까지 19만 9,808개에 달할 것으로 추정됩니다.

- 소비자들은 포장과 관련된 환경적 위험에 대한 인식이 높아지면서 보다 친환경적인 구매 선택을 하고 있습니다. 이러한 변화는 소비자, 정부 및 미디어가 제품, 포장 및 공정에서 보다 친환경적인 관행을 채택하도록 제조업체에 압력을 가하면서 더욱 가속화되고 있습니다. 주목할 만한 점은 소비자들이 친환경 포장에 대해 더 많은 비용을 지불할 의향이 있다는 점입니다. 이러한 추세로 인해 종이 포장 시장은 성장세를 보이고 있습니다.

- 그러나 삼림 파괴는 공급망 위험, 환경 문제, 규제 압력, 지속 가능한 혁신의 필요성 등 종이 포장 산업에 큰 문제에 직면해 있습니다. 삼림 파괴를 해결하기 위해서는 정부, 기업, 소비자, 환경 단체 등 이해관계자들이 협력하여 종이 포장 산업에서 책임감 있는 산림 관리와 지속 가능한 조달 관행을 추진해야 합니다.

북미의 종이 포장 시장 동향

북미의 종이 포장 시장 동향환경문제에 대한 우려로 종이 포장에 대한 수요가 발생합니다.

- 수십년동안 수많은 정부의 이니셔티브와 점점 더 엄격해지는 규제로 인해 포장재 폐기 및 재활용과 관련된 환경 문제에 대한 인식이 높아졌습니다. 미국산림제지협회(American Forest and Paper Association)의 보고서에 따르면, 2022년 미국의 종이 및 판지의 재활용률은 약 68%를 나타낼 것으로 예상됩니다.

- 특히 업계에서 흔히 골판지라고 불리는 골판지는 미국에서 가장 많이 재활용되는 포장재 중 하나로 꼽힙니다. 실제로 약 3,400만 톤의 골판지가 재활용을 위해 회수되고 있습니다. 또한 미국 전역에서 새 상자를 만드는 데 사용되는 재료의 약 50%는 재생 종이에서 조달됩니다.

- 최근 몇 년동안 일반 제품, 특히 식음료에 대해 보다 친환경적인 포장을 요구하는 움직임이 커지고 있습니다. 그 중 상당수는 일회용 플라스틱 사용을 크게 제한하는 캠페인의 형태를 띠고 있으며, 이 주제는 지난 5년 동안 대중의 큰 지지를 받았습니다.

- 소비자들은 구매력을 행사해 대형 외식 브랜드에 변화를 요구하고, 지속가능성을 추구하는 브랜드를 선택하며, 지속가능한 선택을 위해 기꺼이 더 많은 비용을 지불할 의향이 있습니다. 주요 외식 브랜드들은 플라스틱에서 벗어나 재활용이 가능한 섬유 및 종이 포장재와 같은 대체재로 전환하고 있습니다. 북미 정부는 플라스틱 프리 규제를 시행하고 있으며, 이는 상점과 소비자 브랜드가 공급망과 포장재 선택에 대해 다시 생각하게 만들고 있습니다.

- 포장 산업에서 가장 두드러진 추세는 순환 경제를 중심으로 한 것입니다. 현재 포장 업계는 100% 재활용 가능한 판지가 주류이며, 이는 환경 안전과 오염을 배제하는 기준에 부합합니다. 액체 포장 시장은 유기농 음료, 과일 주스, 코코넛 워터, 에너지 음료, 비유제품 음료(아몬드 우유, 두유 등) 등 다양한 음료에 대한 수요가 급증하면서 높은 성장이 예상되고 있습니다.

전자상거래와 제약 산업이 확대되면서 다양한 유형의 종이 포장에 대한 수요 창출

- 더 많은 소비자들이 온라인 쇼핑을 이용함에 따라 이러한 제품을 고객에게 안전하게 전달하기 위한 포장재에 대한 수요도 증가하고 있습니다. 골판지 포장과 종이 용기 포장은 다용도성, 내구성 및 비용 효율성으로 인해 전자상거래 업계에서 상품을 포장하는 데 사용되는 주요 재료 중 하나입니다.

- 전자상거래 수요 증가는 온라인 소매에 적합한 맞춤형, 지속 가능하고 효율적인 물류 및 주문 처리 작업에 최적화 된 포장재를 필요로함으로써 북미의 종이 포장 시장의 성장을 가속하고 있습니다. 미국 인구 조사국에 따르면 2024년 2분기 미국 소매 전자상거래 매출은 약 2,916억 달러로 전 분기 대비 증가했습니다.

- 처방약에 대한 수요가 증가함에 따라 이러한 의약품을 안전하게 보관, 운송 및 진열하기 위한 2차 및 3차 포장 솔루션에 대한 수요도 증가할 것입니다. 이러한 포장재에 대한 수요 증가는 제약 산업에 포장 솔루션을 제공하는 데 중요한 역할을 하는 북미의 종이 포장 시장의 기업들에게 도움이 될 것으로 예상됩니다.

- 캐나다 보건정보연구소(CIHI)에 따르면 2023년 캐나다의 비처방약 총 지출은 67억 캐나다달러(49억 달러)에 달했지만 처방약 지출은 411억 캐나다달러(302억7,000만 달러)로 증가했습니다. 이 소식통에 따르면 2020년에는 처방약에 대한 지출이 353억 캐나다 달러(260억 달러)를 기록할 것으로 예상했습니다.

북미의 종이 포장 산업 개요

북미의 종이 포장 산업 개요북미의 종이 포장 시장은 여러 유력 기업들이 경쟁하는 시장입니다. 시장 점유율 측면에서 이들 주요 기업 중 일부는 현재 시장을 선도하고 있습니다. 시장 점유율이 높은 이들 주요 기업들은 해외 고객 기반을 확대하는 데 주력하고 있습니다. 주요 기업으로는 International Paper, Smurfit Westrock, Graphic Packaging International, Cascades Inc. 및 Canadian Paper and Packaging 등이 있습니다.

- 2024년 3월 연포장 및 재료 과학 분야의 세계 리더인 ProAmpac은 2016년 설립된 UP Paper를 인수하여 100% 무표백 재생 크래프트 종이의 북미 최고 제조업체가 되어 다양한 포장 요구에 신속하게 대응하고 있습니다. 다양한 패키징 니즈에 빠르게 대응하고 있습니다. 프로암팩과 UP 페이퍼는 섬유 및 필름 기반 재료 과학에 대한 전문 지식을 활용하여 친환경 연포장 솔루션을 혁신하고 제공하는 것을 목표로 하고 있습니다.

- 2024년 2월 그래픽 패키징(Graphic Packaging)은 미국 오거스타(Augusta)에 있는 표백지 제조 시설을 7억 달러에 클리어워터 페이퍼(Clearwater Paper)에 매각했습니다. 클리어워터페이퍼는 이번 인수를 판지 제조 업계에서 입지를 강화하기 위한 전략적 움직임으로 보고 있습니다. 조정 후 EBITDA 평가액은 약 1억 달러에 달하며, 이번 거래는 그래픽 패키징의 포트폴리오 강화에 대한 약속을 강조하는 것입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- E-Commerce 증가에 의한 다양한 종이 제 포장 수요 창출

- 플라스틱 기반 포장 제품에 대한 규제가 수요 증가에 기여

- 시장 성장 억제요인

- 삼림 벌채에 의한 종이 제 포장재에 대한 영향

제6장 시장 세분화

- 제품 유형별

- 폴딩 카톤

- 골판지상자

- 기타 제품 유형

- 최종사용자 산업별

- 식품

- 음료

- 헬스케어

- 퍼스널케어

- E-Commerce

- 전기제품

- 기타 최종사용자 산업

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 개요

- International Paper Company

- Smurfit Westrock

- Cascades Inc.

- Packaging Corporation of America

- Graphic Packaging International Inc.

- Mondi PLC

- DS Smith PLC

- Sealed Air Corporation

- ProAmpac Holdings Inc.

- Canadian Paper and Packaging Co. Ltd

- Clearwater Paper Corporation

제8장 투자 분석

제9장 시장 전망

LSH 25.01.15The North America Paper Packaging Market size is estimated at USD 75.64 billion in 2025, and is expected to reach USD 93.46 billion by 2030, at a CAGR of 4.32% during the forecast period (2025-2030).

Key Highlights

- Paper packaging stands out as a leading choice among eco-friendly packaging solutions. Its versatility allows it to be produced in various sizes while maintaining a compact footprint, making it an ideal fit for nearly every end-user industry, especially when compared to bulkier alternatives.

- According to the US Census Bureau, in 2024, pulp mills are expected to generate a revenue of USD 6.11 billion. Also, paperboard mills are expected to generate a revenue of USD 34.02 billion, and paper mills are expected to generate a revenue of USD 39.55 billion in the same year. With e-commerce evolving as an increasingly critical element of retail, paper packaging stands to benefit substantially.

- Moreover, the region emerges as one of the largest markets for corrugated packaging as the area has several foodservices and packaged food companies, including ready-to-eat, convenience, and ready-to-make meals. The high demand for out-of-home food due to busy work-life schedules and convenience is also a key factor driving the market growth. According to the International Franchise Association, the number of quick-service restaurants (QSRs) in the United States is estimated to reach 199,808 units by the end of 2024.

- Consumers are increasingly aware of the environmental risks associated with packaging, leading them to favor more eco-friendly purchasing choices. This shift is further amplified by pressures from consumers, the government, and the media on manufacturers to adopt greener practices in their products, packaging, and processes. Notably, consumers are willing to pay a premium for eco-friendly packaging. As a result of these trends, the paper packaging market is poised for growth.

- However, deforestation poses significant challenges to the paper packaging industry, including supply chain risks, environmental concerns, regulatory pressures, and the need for sustainable innovation. Addressing deforestation requires collaboration among stakeholders, including governments, companies, consumers, and environmental organizations, to promote responsible forest management and sustainable sourcing practices in the paper packaging industry.

North America Paper Packaging Market Trends

Environmental Concerns Creating Demand for Paper Packaging

- Over the decades, due to numerous government initiatives and increasingly stringent regulations, there has been growing awareness regarding the environmental hazards related to the disposal and recycling of packaging materials. The American Forest and Paper Association reported that the recycling rate for paper and paperboard in the United States reached approximately 68% in 2022.

- Notably, cardboard, often referred to as corrugated in the industry, stands out as the top recycled packaging material in the United States. In fact, around 34 million tons of cardboard were recovered for recycling. Moreover, about 50% of the material used nationwide for producing new boxes is sourced from recycled paper.

- In recent years, there has been a significant push for more ecological packaging of common things, particularly food and beverages. This has mostly taken the form of campaigns to drastically restrict the use of single-use plastics, a subject that has gathered massive public support in the previous five years.

- Consumers are using their purchasing power more readily to force major foodservice brands to change, choosing brands with sustainable commitments and even being willing to pay more for sustainable choices. Major foodservice brands are moving away from plastics and toward alternatives like recyclable fiber and paper packaging. North American governments are enacting plastic-free regulations, which is causing merchants and consumer brands to reconsider their supply chains and packaging options.

- The most evident trends in the packaging industry revolve around a circular economy. Currently, the packaging industry is dominated by paperboards that are 100% recyclable, which caters to environmental safety and standards to eliminate pollution. The liquid packaging market is expected to grow at a higher rate owing to the surge in demand for various beverages, such as organic drinks, fruit juices, tender coconut water, energy drinks, and non-dairy drinks (almond and soy milk).

The Expanding E-commerce and Pharmaceutical Industries Creating Demand for Various Paper Packaging Types

- As more consumers shift toward online shopping, there is a corresponding increase in the need for packaging materials to deliver these products to customers safely. Corrugated and folding carton packaging are among the primary materials used for packaging goods in the e-commerce industry due to their versatility, durability, and cost-effectiveness.

- The increasing demand for e-commerce is driving the growth of the North American paper packaging market by necessitating packaging materials suitable for online retail, customizable, sustainable, and optimized for efficient logistics and fulfillment operations. According to the US Census Bureau, in the second quarter of 2024, retail e-commerce sales in the United States amounted to roughly USD 291.6 billion, marking an increase compared to the previous quarter.

- With higher demand for prescription drugs, there will be a corresponding increase in the requirement for secondary and tertiary packaging solutions to store, transport, and display these medications safely. This increased demand for packaging materials is expected to benefit companies in the North American paper packaging market, as they play a crucial role in providing packaging solutions for the pharmaceutical industry.

- According to the Canadian Institute for Health Information (CIHI), in 2023, the total expenditure on non-prescription drugs in Canada amounted to CAD 6.7 billion (USD 4.9 billion), while spending on prescription drugs increased to CAD 41.1 billion (USD 30.27 billion). According to the same source, in 2020, the expenditure on prescription drugs was recorded at CAD 35.3 billion (USD 26 billion).

North America Paper Packaging Industry Overview

The North American paper packaging market is competitive with several influential players. Some of these important players in terms of market share are currently leading the market. These influential players with significant market shares are focused on expanding their customer base abroad. Some of the key players in the market include International Paper, Smurfit Westrock, Graphic Packaging International, Cascades Inc., and Canadian Paper and Packaging Co. Ltd.

- March 2024: ProAmpac, a global leader in flexible packaging and material science, acquired UP Paper, a leading producer of recycled kraft paper. Established in 2016, UP Paper swiftly became a top North American producer of 100% unbleached recycled kraft paper, serving diverse packaging needs. Leveraging their expertise in fiber and film-based material science, ProAmpac and UP Paper are set to innovate and deliver eco-friendly flexible packaging solutions.

- February 2024: Graphic Packaging divested its bleached paperboard manufacturing facility in Augusta, United States, selling it to Clearwater Paper for USD 700 million. Clearwater Paper perceives this acquisition as a strategic move to bolster its presence in the paperboard manufacturing industry. With an Adjusted EBITDA valuation of approximately USD 100 million, the deal underscores Graphic Packaging's commitment to refining its portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Growth of E-commerce Creating Demand for Various Paper Packaging Types

- 5.1.2 Regulations on Plastic-based Packaging Products Contributes to Higher Demand

- 5.2 Market Restraints

- 5.2.1 Effects of Deforestation on Paper Packaging

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care and Household Care

- 6.2.5 E-commerce

- 6.2.6 Electrical Products

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Smurfit Westrock

- 7.1.3 Cascades Inc.

- 7.1.4 Packaging Corporation of America

- 7.1.5 Graphic Packaging International Inc.

- 7.1.6 Mondi PLC

- 7.1.7 DS Smith PLC

- 7.1.8 Sealed Air Corporation

- 7.1.9 ProAmpac Holdings Inc.

- 7.1.10 Canadian Paper and Packaging Co. Ltd

- 7.1.11 Clearwater Paper Corporation