|

시장보고서

상품코드

1851334

진동 센서 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Vibration Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

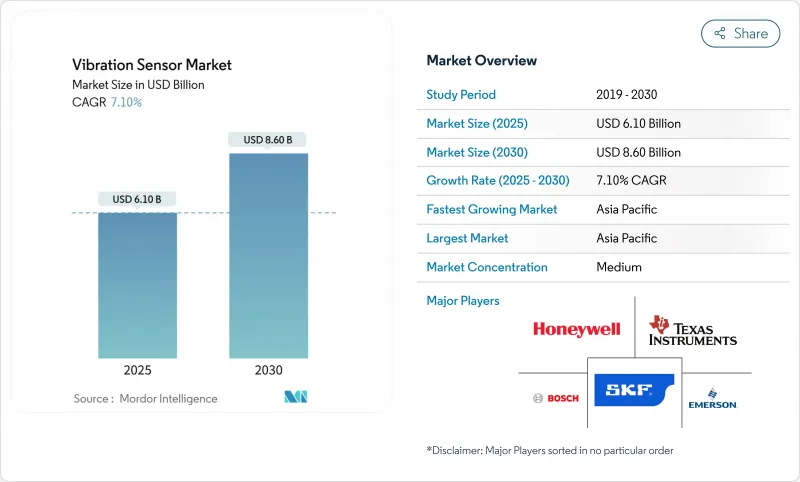

진동 센서 시장 규모는 2025년에 61억 달러, 2030년에는 86억 달러에 달할 것으로 예상되며, 기간 중 CAGR은 7.10%를 나타낼 전망입니다.

예지 보전 프로그램에 대한 지속적인 투자, MEMS 설계의 소형화, 기계 건강 규제의 엄격화에 의해 공장, 풍력 발전소, 자동차 공장에서의 채용이 가속됩니다. 아시아태평양 제조업체, 풍력 터빈 소유자 및 자동차 조립업체는 센서 가격 하락과 지역 반도체 생산 능력 확장에 도움을 주었으며 이 지출의 대부분을 지시했습니다. 무선 연결은 설치 비용을 낮추고 에지 AI 펌웨어는 데이터 트래픽을 줄이고 센서를 원격지와 위험한 현장에서 사용할 수 있도록 했습니다. 한편 중국이 2025년 세라믹 센싱 엘리먼트에 사용되는 희토류의 수출 규제를 개시함으로써 공급망의 다양화가 시급해졌습니다.

세계의 진동 센서 시장 동향과 인사이트

연속 공정 산업에서의 예지 보전 프로그램의 보급

아시아태평양의 플랜트 운영자는 고주파수 데이터를 분석 엔진으로 스트리밍하는 고밀도 센서 그리드에 의존하는 예측 보전을 활용하여 예기치 않은 다운타임 비용을 최대 50% 절감했습니다. 노르딕 슈가의 증기 건조기 리노베이션과 같은 초기 프로젝트에서는 13일간의 고장 예측 창이 입증되어 대규모 화학 공장 및 철강 공장에서의 투자 회수가 검증되었습니다. 지속적인 모니터링이 정기적 인 진입 점검을 대체하고 노드에 내장 된 엣지 컴퓨팅 칩이 대기 시간을 밀리 초 수준으로 단축했습니다. Industry 4.0 업그레이드에 대한 중국의 자극책은 기세를 유지하고 시설당 수천 개의 장치를 통합했습니다. 그 결과 진동 센서 시장은 자본 지출 사이클이 아닌 유지 보수 예산으로 장기적인 지속 수요를 얻었습니다.

위험한 석유 및 가스 현장에서 무선 MEMS 센서의 상승

해외 플랫폼과 정유소에서는 ATEX 구역을 통과하는 비용이 많이 드는 케이블을 설치할 필요가 없는 인증된 무선 노드를 채택했습니다. 배터리 수명은 3년을 넘었고, 압전 에너지 수확기는 서비스 간격을 더욱 연장했습니다. 운영자는 시간당 5만 달러의 비용이 많이 드는 처리량을 중단하지 않고도 복고풍 기능을 평가했습니다. 각 센서에 내장된 FFT 처리는 실용적인 베어링 마모 지표를 생성하여 현장에서 진동 분석가의 필요성을 줄였습니다. 이러한 이점으로 인해 대응 가능한 베이스가 넓어지고, 역사적으로 디지털 유지관리의 도입이 지연되고 있던 탄화수소 경제권의 진동 센서 시장이 활성화되었습니다.

극단적 인 온도에서 압전 센서의 교정 드리프트

압전소자에서는 110°C를 넘으면 출력편차가 발생하여, 중간 정도의 가열속도에서는 오차가 1.06%에 달했습니다. 열주기가 일상적으로 이루어지는 터빈과 항공우주 엔진에서는 빈번한 재교정이 라이프 사이클 비용을 증가 시켰습니다. 고온 단결정의 대체품은 600℃를 넘어도 확실하게 동작했지만, 비싼 가격 설정이었습니다. 개발자는 보상 회로와 듀얼 센서 구성을 모색했지만 복잡한 설계로 인해 대중 시장에 대한 호소는 제한적이었습니다. 그 결과 성능과 가격의 절충이 발생하여 진동 센서 시장의 가혹한 틈새 분야에서의 전개가 지연되었습니다.

부문 분석

가속도계는 2024년에 54.4%의 매출을 계상해 자동차, 스마트폰, 공장용 모터에 있어서 3축의 범용성에 의해 61억 달러의 진동 센서 시장 규모를 지지했습니다. 정유소 및 파이프라인 엔지니어는 속도와 베어링 건강 상태 간의 직접적인 상관관계를 평가했으며, 무선 속도 장치는 금액이 작고 2030년까지 연평균 복합 성장률(CAGR) 9.1%를 나타낼 전망입니다.

소형화의 추진은 보쉬 센서텍의 BMA580과 같은 차세대 가속도계에 박차를 가해 히어러블의 감도 목표를 충족하면서 패키지 용적을 76% 삭감했습니다. 이러한 칩의 에지 필터링은 비정상적인 값만 전송하여 전송 데이터를 차단하고 메쉬 네트워크의 대역폭을 절약합니다. 에너지 수확의 병렬 발전으로 노드 수명이 연장되고 원격 자산의 유지 보수 간격이 5년이 되었습니다. 이러한 향상으로 인해 진동 센서 시장은 전통적으로 전력 및 크기 제한에 묶여 있던 웨어러블 및 상태 기반 윤활 시스템으로 확장되었습니다.

압전소자는 저주파 감도 덕분에 2024년 46.3%의 점유율을 유지했지만 반도체 공장이 웨이퍼 수준의 경제성을 실현했기 때문에 MEMS 출하량은 CAGR 10.3%로 확대됐습니다. 진동 센서 시장은 이산 아날로그 프론트엔드를 컴팩트한 시스템 온칩 패키지에 담은 단일 다이 집적화의 이점을 얻었습니다.

텍사스 기기의 초음파 렌즈 세척 데모는 프로그래머블 진동을 이용하여 자동차 카메라의 먼지를 제거하는 MEMS의 범용성을 강조했습니다. 주조의 진보는 구조물의 건강 모니터링에 적합한 서브 G 진동을 측정하는 다축 어레이를 실현했습니다. 반면에 압전 저항과 커패시턴스 설계는 듀티 사이클이 드문드문 초저전력 웨어러블을 지원했습니다. 이와 같이 다양화된 포트폴리오를 통해 OEM은 대역폭, 비용, 전력에 따라 아키텍처를 선택할 수 있게 되어 진동 센서 시장 전체의 보급이 확대되었습니다.

진동 센서 시장은 제품 유형(가속도계, 속도 센서, 변위 센서, 기타), 기술(압전, 압전 저항, 정전 용량, 스트레인 게이지, MEMS), 재료(수정, 압전 세라믹, 도프 실리콘, 기타), 최종 이용 산업(자동차, 항공우주 및 방위, 기타), 지역(북미, 유럽, 아시아, 태평양, 남)

지역 분석

아시아태평양은 2024년에 34.2%의 점유율로 선두가 되었습니다. 중국의 풍력 터빈 전개와 인도의 반도체 설계 센터가 지역 수요를 밀어 올렸기 때문입니다. 이 지역의 CAGR은 8.3%로 세계 평균을 웃돌아 2030년까지 선두를 유지합니다. 일본의 정밀기계 제조업체가 로봇용 고분해능 센서를 발주해 이 지역의 진동 센서 시장이 더욱 확대됐습니다.

북미는 화학 플랜트의 ISO 컴플라이언스와 내 방사선 장치가 필요한 항공우주 프로그램에 견인되었습니다. 미국 국방부에서는 사이버 보안에 대한 노출을 줄이기 위해 에어 갭이 있는 에지 처리 장치가 선호됩니다. 캐나다 광산 노동자는 유선 연결이 현실적이지 않은 원격지의 갱내에 견고한 무선 메쉬 네트워크를 설치하여 진동 센서 시장에 틈새 수요를 추가했습니다.

유럽에서는 엔진 공장을 순찰하는 BMW의 센서가 달린 로보독으로 대표되는 첨단 성숙도를 보여주었습니다. 북유럽의 해상풍력발전소에서는 요와 블레이드의 고조파를 감시하기 위해 15MW의 터빈에 고채널 수의 시스템을 설치했습니다. 엄격한 노동안전지령이 꾸준한 업그레이드를 보장하고 거시경제의 역풍에도 불구하고 진동 센서 시장은 저견도를 유지했습니다.

남미와 중동 및 아프리카는 신흥국이면서 활황을 유지했습니다. 브라질 광산업자와 농산물 가산업자는 MEMS 비용의 하락을 도와 상태 모니터링 키트의 도입을 시작했습니다. 걸프 지역의 NOC는 플레어 스택이나 컴프레서에 ATEX 규격의 무선 센서를 채용해 위험 구역에서의 진동 센서 시장 전개를 급속히 확대했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 상용 프로세스 산업에 있어서 예지 보전 프로그램의 보급(아시아태평양)

- 위험한 석유 및 가스 현장에 있어서 무선 MEMS 센서의 대두(중동)

- 자동차 조립에 있어서 엣지 AI 대응 진단(유럽)

- EU와 북미에서 ISO 20816 준거의 의무화

- 풍력 터빈 설치 확대(북유럽과 중국)

- 웨어러블과 히어러블에 의한 소형화 수요

- 시장 성장 억제요인

- 극단적인 온도에서 압전 센서의 교정 드리프트

- 클라우드 기반 애널리틱스의 데이터 보안 우려(방어)

- 특수 압전 세라믹 재료의 부족(중국 수출 할당량)

- 밸류체인 분석

- 기술의 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 투자분석

- 시장의 거시경제 요인 평가

제5장 시장 규모와 성장 예측

- 제품 유형별

- 가속도계

- 속도 센서

- 변위 센서

- 자이로스코프(진동 등급)

- 기술별

- 압전식

- 압저항식

- 정전용량식

- 스트레인 게이지식

- MEMS

- 소재별

- 석영

- 압전 세라믹스

- 도핑 실리콘

- 기타

- 최종 이용 산업별

- 자동차

- 항공우주 및 방위

- 석유 및 가스

- 산업 제조

- 발전(풍력 포함)

- 헬스케어

- 소비자 가전 및 웨어러블

- 기타

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 대만

- 일본

- 한국

- 인도

- ASEAN

- 기타 아시아태평양

- 남미

- 멕시코

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 파트너십, 자금 조달)

- 시장 점유율 분석

- 기업 프로파일

- Emerson Electric Co.

- SKF AB

- Honeywell International Inc.

- Analog Devices Inc.

- TE Connectivity Ltd

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- National Instruments Corp.

- Rockwell Automation Inc.

- NXP Semiconductors NV

- Parker Hannifin Corp.

- Baker Hughes(Bently Nevada)

- Wilcoxon Sensing Technologies

- PCB Piezotronics Inc.

- Meggitt PLC(Sensing Systems)

- IMI Sensors

- ifm electronic GmbH

- Siemens AG

- Omron Corporation

- Hansford Sensors Ltd

제7장 시장 기회와 향후 전망

KTH 25.11.12The vibration sensor market size is valued at USD 6.10 billion in 2025 and is forecast to reach USD 8.60 billion by 2030, reflecting a 7.10% CAGR during the period.

Continued investment in predictive maintenance programs, miniaturized MEMS designs, and stricter machinery-health regulations accelerated adoption across factories, wind farms, and vehicle plants. Asia-Pacific manufacturers, wind turbine owners, and automotive assemblers directed much of this spending, aided by falling sensor prices and local semiconductor capacity expansions. Wireless connectivity reduced installation costs, and edge-AI firmware cut data traffic, making sensors viable for remote or hazardous sites. Meanwhile, supply-chain diversification gained urgency after China's 2025 export controls on rare-earth inputs used in ceramic sensing elements.

Global Vibration Sensor Market Trends and Insights

Proliferation of Predictive Maintenance Programs in Continuous Process Industries

Asia-Pacific plant operators used predictive maintenance to reduce unplanned downtime costs by up to 50%, relying on dense sensor grids that stream high-frequency data to analytics engines. Early projects such as the Nordic Sugar steam-dryer retrofit demonstrated 13-day fault-prediction windows, validating payback for large chemical and steel sites. Continuous monitoring displaced periodic walk-by inspections, and edge-computing chips embedded in nodes lowered latency to millisecond levels. Chinese stimulus for Industry 4.0 upgrades-maintained momentum, embedding thousands of devices per facility. Consequently, the vibration sensor market gained long-run recurring demand from maintenance budgets rather than capital expenditure cycles.

Rise of Wireless MEMS Sensors for Hazardous Oil and Gas Sites

Offshore platforms and refineries adopted certified wireless nodes that eliminated costly cable runs through ATEX zones. Battery lives exceeded three years, and piezoelectric energy harvesters further prolonged service intervals. Operators valued retrofit capability without shutting down throughput that could otherwise cost USD 50,000 per hour. Embedded FFT processing in each sensor produced actionable bearing-wear metrics, reducing the need for on-site vibration analysts. These benefits widened the addressable base and lifted the vibration sensor market in hydrocarbon economies that historically lagged digital-maintenance adoption.

Calibration Drift of Piezoelectric Sensors at Extreme Temperatures

Piezoelectric elements experienced output deviations above 110 °C, with errors hitting 1.06% at moderate heating rates. Frequent recalibration raised lifecycle costs in turbines and aerospace engines where thermal cycling was routine. High-temperature single-crystal alternatives operated reliably beyond 600 °C but commanded premium pricing. Developers explored compensation circuits and dual-sensor configurations, yet complex designs limited mass-market appeal. The resulting performance-price trade-off slowed deployments in harsh-duty niches of the vibration sensor market.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI Enabled Diagnostics in Automotive Assembly

- Mandatory ISO 20816 Compliance in EU and North America

- Data-Security Concerns in Cloud-based Analytics (Defense)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accelerometers generated 54.4% revenue in 2024, underpinning the vibration sensor market size of USD 6.10 billion through their tri-axial versatility in vehicles, smartphones, and factory motors. Wireless velocity devices, though smaller in value, led growth at 9.1% CAGR to 2030 as refinery and pipeline engineers valued velocity's direct correlation with bearing health.

The miniaturization push spurred next-generation accelerometers such as Bosch Sensortec's BMA580, which reduced package volume by 76% while meeting sensitivity targets for hearables. Edge filtering in these chips cuts outbound data by transmitting only anomalies, conserving bandwidth in mesh networks. Parallel advances in energy harvesting prolonged node life, enabling five-year maintenance intervals on remote assets. Together, these enhancements allowed the vibration sensor market to broaden into wearables and condition-based lubrication systems previously constrained by power or size limits.

Piezoelectric elements retained a 46.3% share in 2024 thanks to low-frequency sensitivity, but MEMS shipments expanded at a 10.3% CAGR as semiconductor fabs delivered wafer-level economies. The vibration sensor market benefited from single-die integration that collapsed discrete analog front-ends into compact system-on-chip packages.

Texas Instruments' ultrasonic lens-cleaning demo highlighted MEMS versatility, using programmable vibrations to remove contaminants from automotive cameras. Foundry advances enabled multi-axis arrays measuring sub-g vibrations suitable for structural-health monitoring. Meanwhile, piezoresistive and capacitive designs served ultra-low-power wearables where duty cycles were sparse. This diversified portfolio allowed OEMs to choose architectures based on bandwidth, cost, and power, expanding overall penetration of the vibration sensor market.

Vibration Sensor Market is Segmented by Product Type (Accelerometers, Velocity Sensors, Displacement Sensors, and More), Technology (Piezoelectric, Piezoresistive, Capacitive, Strain-Gauge, and MEMS), Material (Quartz, Piezoelectric Ceramics, Doped Silicon, and Others), End-Use Industry (Automotive, Aerospace and Defense, and More), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific led with a 34.2% share in 2024 as China's wind-turbine roll-outs and India's semiconductor design centers lifted local demand. The region's 8.3% CAGR also out-paced global averages, preserving its leadership through 2030. Japanese precision-machinery firms ordered high-resolution sensors for robotics, further enlarging the vibration sensor market in the bloc.

North America followed, driven by ISO compliance in chemical plants and aerospace programs requiring radiation-tolerant devices. US defense retrofits favored edge-processed units that remained air-gapped, mitigating cybersecurity exposure. Canadian miners installed ruggedized wireless mesh networks across remote pits where wired runs were impractical, adding niche demand to the vibration sensor market.

Europe exhibited advanced maturity, exemplified by BMW's sensor-equipped robo-dogs patrolling engine plants. Nordic offshore wind farms fitted high-channel-count systems on 15 MW turbines to monitor yaw and blade harmonics. Strict worker-safety directives assured steady upgrades, keeping the vibration sensor market resilient despite macroeconomic headwinds.

South America and the Middle East/Africa remained emerging but dynamic. Brazilian miners and agribusiness processors began installing condition-monitoring kits, aided by falling MEMS costs. Gulf-region NOCs embraced ATEX-rated wireless sensors for flare stacks and compressors, quickly expanding the vibration sensor market footprint in hazardous-area deployments.

- Emerson Electric Co.

- SKF AB

- Honeywell International Inc.

- Analog Devices Inc.

- TE Connectivity Ltd

- Bosch Sensortec GmbH

- Texas Instruments Inc.

- National Instruments Corp.

- Rockwell Automation Inc.

- NXP Semiconductors N.V.

- Parker Hannifin Corp.

- Baker Hughes (Bently Nevada)

- Wilcoxon Sensing Technologies

- PCB Piezotronics Inc.

- Meggitt PLC (Sensing Systems)

- IMI Sensors

- ifm electronic GmbH

- Siemens AG

- Omron Corporation

- Hansford Sensors Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of Predictive Maintenance Programs in Continuous Process Industries (Asia Pacific)

- 4.2.2 Rise of Wireless MEMS Sensors for Hazardous Oil and Gas Sites (Middle East)

- 4.2.3 Edge-AI Enabled Diagnostics in Automotive Assembly (Europe)

- 4.2.4 Mandatory ISO 20816 Compliance in EU and North America

- 4.2.5 Expansion of Wind Turbine Installations (Nordics and China)

- 4.2.6 Miniaturization Demand from Wearables and Hearables

- 4.3 Market Restraints

- 4.3.1 Calibration Drift of Piezoelectric Sensors at Extreme Temperatures

- 4.3.2 Data-Security Concerns in Cloud-based Analytics (Defense)

- 4.3.3 Shortage of Specialty Piezo-ceramic Materials (China Export Quotas)

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

- 4.8 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Accelerometers

- 5.1.2 Velocity Sensors

- 5.1.3 Displacement Sensors

- 5.1.4 Gyroscopes (Vibration-Grade)

- 5.2 By Technology

- 5.2.1 Piezoelectric

- 5.2.2 Piezoresistive

- 5.2.3 Capacitive

- 5.2.4 Strain-Gauge

- 5.2.5 MEMS

- 5.3 By Material

- 5.3.1 Quartz

- 5.3.2 Piezoelectric Ceramics

- 5.3.3 Doped Silicon

- 5.3.4 Others

- 5.4 By End-Use Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Oil and Gas

- 5.4.4 Industrial Manufacturing

- 5.4.5 Power Generation (incl. Wind)

- 5.4.6 Healthcare

- 5.4.7 Consumer Electronics and Wearables

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Taiwan

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 India

- 5.5.3.6 ASEAN

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Mexico

- 5.5.4.2 Brazil

- 5.5.4.3 Argentina

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Emerson Electric Co.

- 6.4.2 SKF AB

- 6.4.3 Honeywell International Inc.

- 6.4.4 Analog Devices Inc.

- 6.4.5 TE Connectivity Ltd

- 6.4.6 Bosch Sensortec GmbH

- 6.4.7 Texas Instruments Inc.

- 6.4.8 National Instruments Corp.

- 6.4.9 Rockwell Automation Inc.

- 6.4.10 NXP Semiconductors N.V.

- 6.4.11 Parker Hannifin Corp.

- 6.4.12 Baker Hughes (Bently Nevada)

- 6.4.13 Wilcoxon Sensing Technologies

- 6.4.14 PCB Piezotronics Inc.

- 6.4.15 Meggitt PLC (Sensing Systems)

- 6.4.16 IMI Sensors

- 6.4.17 ifm electronic GmbH

- 6.4.18 Siemens AG

- 6.4.19 Omron Corporation

- 6.4.20 Hansford Sensors Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment