|

시장보고서

상품코드

1627134

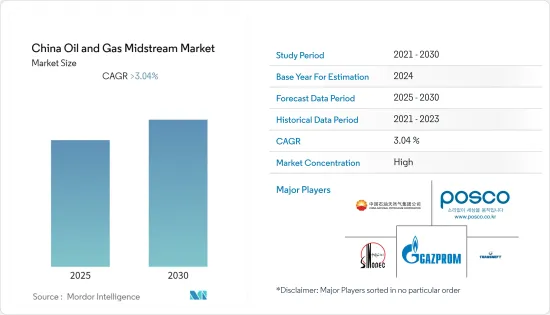

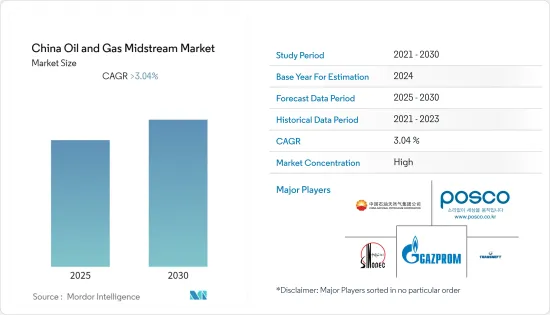

중국의 석유 및 가스 미드스트림 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Oil and Gas Midstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

중국의 석유 및 가스 미드스트림 시장은 예측 기간 동안 3.04% 이상의 CAGR을 나타낼 것으로 예상됩니다.

코로나19는 2020년 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 전염병 이전 수준에 도달했습니다.

주요 하이라이트

- 장기적으로 천연가스 생산과 소비 증가는 예측 기간 동안 중국의 석유 및 가스 미드스트림 시장을 끌어올릴 것으로 예상됩니다.

- 한편, 국내 석유 생산량이 감소함에 따라 예측 기간 동안 파이프가 폐기될 가능성이 있어 이 부문에 대한 우려가 확산되고 있습니다.

- 중국 정부의 석유 및 가스 증산 이니셔티브는 석유 및 가스 파이프라인 개발의 새로운 길을 열어 미드스트림 부문 진출기업들에게 기회를 제공할 것으로 예상됩니다.

중국의 석유 및 가스 미드스트림 시장 동향

수송 부문이 괄목할 만한 성장세를 기록합니다.

- 중국의 석유-가스 미드스트림 부문은 석유-가스 운송, 파이프라인, 저장시설로 구성되며, 2021년 현재 중국의 천연가스 파이프라인은 약 11만km, 석유 파이프라인은 약 2만 7,441km에 달할 전망입니다.

- PetroChina의 2021년 석유 파이프라인 총 길이는 약 7,340km, 가스 파이프라인 총 길이는 약 17,329km입니다. 전체적으로 2021년 파이프라인 길이는 전년 대비 감소했습니다.

- 2022년 현재 중국은 최대 규모의 LNG 수입 능력을 개발 중입니다. 또한 향후 몇년내에 연간 2억 톤 이상의 수입 능력을 추가할 계획이며, 그 중 8,530만 톤은 이미 개발 단계에 있습니다. 이는 베트남, 태국 등 다른 아시아 국가들의 프로젝트 파이프라인보다 높은 수준입니다.

- 2021년 중국의 천연가스 생산량은 2,075억 8,000만 입방미터(bcm)로 전년 대비 15bcm 이상 증가했습니다. 또한 천연가스 소비량도 증가하고 있습니다. 소비량 증가는 예측 기간 동안 파이프라인의 성장을 가속할 수 있습니다.

- 따라서 가스 생산량 증가와 해당 부문에 대한 투자 증가로 인해 운송 부문은 예측 기간 동안 큰 성장을 이룰 것으로 예상됩니다.

석유 및 가스 소비 증가가 시장 주도

- 중국은 세계 2위의 석유 및 가스 소비국이자 세계 6위의 석유 및 가스 생산국입니다. 중국의 에너지 시장은 국영 석유 및 가스 회사가 국내 매장량 개발, 파이프라인 건설 및 운영, 전략 석유 비축(SPR) 관리 및 충전을 담당하는 국영 석유 및 가스 회사가 주도하고 있습니다.

- 2021년 중국의 천연가스 소비량은 3,787억 입방미터(bcm)에 달하고, 전년 대비 약 13% 증가할 것으로 예상됩니다. 소비량 증가는 투자자들에게 필요한 용량 증설에 대한 인센티브를 제공하고 미래 투자를 촉진하여 산업 성장을 가속할 것입니다.

- 천연가스 수요 증가에 따라 2030년까지 약 85억 달러를 투자하여 23개의 가스 저장시설을 건설할 계획입니다. 저장시설의 완공은 향후 예정된 가스 파이프라인과 함께 향후 미드스트림 부문의 성장을 가속할 것으로 기대됩니다.

- 지난 1월 중국의 석유 및 가스기업 시노펙은 중국 북서부 신강위구르자치구 타림분지에서 약 1억 톤의 매장량을 가진 새로운 석유 및 가스 광구를 발견했습니다. 8,800만 톤, 천연가스 2,900억 입방미터로 추정됩니다. 새로운 석유 및 가스 발견은 국내 석유 및 가스 수요를 뒷받침하고 있습니다.

- 지난 10월 시노펙 서남석유 및 가스회사는 중국 사천분지에서 새로운 셰일가스를 발견했습니다. 이 셰일가스는 Jinshi 103HF 시추정 시추 후 발견되었으며, 예상 자원량은 3,878억 입방미터(bcm)다. 하루 천연가스 생산량은 258,600입방미터에 달하며, 이 새로운 발견은 국내 석유 및 가스 수요를 뒷받침할 것입니다.

- 이러한 발전과 석유 및 가스 소비 증가로 인해 중국의 석유 및 가스 미드스트림 시장은 예측 기간 동안 더욱 성장할 것으로 예상됩니다.

중국의 석유 및 가스 미드스트림 산업 개요

중국의 석유 및 가스 미드스트림 시장은 비교적 통합되어 있습니다. 주요 기업으로는 China National Petroleum Corporation, POSCO, PJSC Gazprom, PJSC Transneft, China Petroleum & Chemical Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 2027년까지 석유생산·소비량 예측(단위 : 1,000팰릿/일)

- 2027년까지 천연가스 생산·소비량(일량 10억 입방 ft)

- LNG 터미널 설치용량과 2027년까지 예측

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 유형

- 운송

- LNG 터미널

- 저장

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 주요 기업의 전략

- 기업 개요

- China National Petroleum Corporation

- POSCO

- PJSC Gazprom

- PJSC Transneft

- China Petroleum & Chemical Corporation

제7장 시장 기회와 향후 동향

LSH 25.01.21The China Oil and Gas Midstream Market is expected to register a CAGR of greater than 3.04% during the forecast period.

The COVID-19 pandemic negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, increasing natural gas production and consumption are expected to boost the Chinese oil and gas midstream market during the forecast period.

- On the other hand, the decreasing oil production in the country has caused concern in the sector, which may lead to the possible decommissioning of pipes during the forecast period.

- The Chinese government's initiative to increase oil and gas production in the country is expected to provide an opportunity for the players in the midstream sector as new production fields would open new avenues for the development of oil and gas pipelines.

China Oil & Gas Midstream Market Trends

Transportation Sector to Witness Significant Growth

- China's oil and gas midstream consists of oil and gas transportation, pipelines, and storage facilities. As of 2021, the country had nearly 110,000 km of natural gas pipelines, while the oil pipeline accounted for almost 27,441 km.

- PetroChina's oil pipelines had a total length of about 7,340 km in 2021, while the gas pipelines had a full length of around 17,329 km. Overall, pipeline length decreased in 2021 compared to the previous year.

- As of 2022, the country has the largest LNG import capacity under development. The country is also planning to add over 200 million metric tons (MMT) in annual import capacity within the next few years, of which 85.3 million metric tons are already in the development stage. This capacity is higher than the project pipelines of other Asian countries such as Vietnam and Thailand.

- China produced 207.58 billion cubic meters (bcm) of natural gas in 2021, an increase of over 15 bcm compared to the previous year. The country is also witnessing increasing consumption of natural gas. The growing consumption may boost the growth of pipelines in the country during the forecast period.

- Hence, the transportation segment is expected to witness significant growth during the forecast period due to the rising production of gas and growing investment in the sector.

Increasing Oil and Gas Consumption to Drive the Market

- China is the second-largest consumer of oil and gas and the sixth-largest producer of oil and gas globally. The energy market in the country is dominated by state-owned oil and gas companies that develop the country's domestic reserves, build and operate pipelines, and manage and fill its strategic petroleum reserves (SPR).

- The country's natural gas consumption amounted to 378.7 billion cubic meters (bcm) in 2021, an increase of roughly 13% compared to the previous year. The increasing consumption incentivizes the investors for the required increase in capacity and boosts future investments, thereby boosting the industry's growth.

- With the rising demand for natural gas, the country is planning to build 23 gas storage facilities by 2030, with an investment of around USD 8.5 billion. The completion of the storage facilities, along with the upcoming gas pipelines, is expected to boost the midstream sector in the country in the future.

- In January 2022, Sinopec, a Chinese oil and gas enterprise, discovered a new oil and gas area with approximately 100 million ton of reserves in the Tarim Basin of northwest China's Xinjiang Uygur Autonomous region. These latest reserves in Sinopec's Shunbei oil and gas field are estimated to provide 88 million metric ton (MMT) of condensate oil and 290 billion cubic meters of natural gas. The new oil and gas discoveries also support the demand for oil and gas within the country.

- In October 2022, Sinopec Southwest Oil & Gas Company of China Petroleum & Chemical Corporation (Sinopec) made a new shale gas discovery in the Sichuan basin in China. The shale gas has been discovered following the drilling of the Jinshi 103HF exploratory well, which has an anticipated resource capacity of 387.8 billion cubic meters (bcm). With daily natural gas production reaching 258,600 cubic meters, the new discovery will support the oil and gas needs within the country.

- Owing to such developments and increasing oil and gas consumption, the Chinese oil and gas midstream market is expected to grow further during the forecast period.

China Oil & Gas Midstream Industry Overview

The Chinese oil and gas midstream market is moderately consolidated. The major companies include (in no particular order) China National Petroleum Corporation, POSCO, PJSC Gazprom, PJSC Transneft, and China Petroleum & Chemical Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Oil Production and Consumption Forecast in thousand barrels per day, till 2027

- 4.2 Natural Gas Production and Consumption in billion cubic feet per day, till 2027

- 4.3 LNG Terminals Installed Capacity and Forecast, till 2027

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Supply Chain Analysis

- 4.8 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Transportation

- 5.1.2 LNG Terminals

- 5.1.3 Storage

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China National Petroleum Corporation

- 6.3.2 POSCO

- 6.3.3 PJSC Gazprom

- 6.3.4 PJSC Transneft

- 6.3.5 China Petroleum & Chemical Corporation