|

시장보고서

상품코드

1629786

말레이시아의 석유 및 가스 미드스티림 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Malaysia Oil and Gas Midstream - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

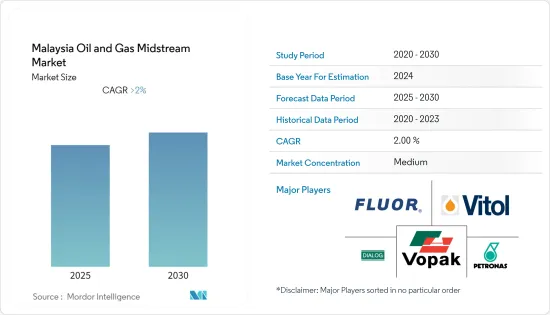

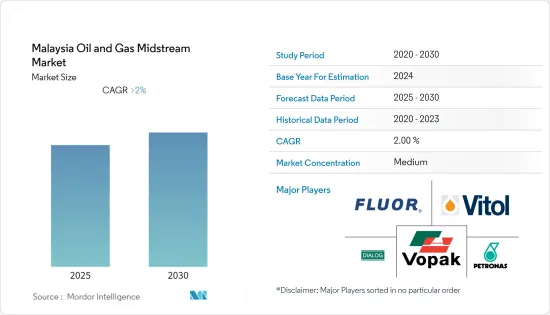

말레이시아의 석유 및 가스 미드스티림 시장은 예측 기간 동안 CAGR 2% 이상 기록할 것으로 예상됩니다.

COVID-19는 2020년 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 전염병이 발생하기 전의 수준에 도달했습니다.

주요 하이라이트

- 중기적으로는 석유 및 가스 수요 증가와 파이프라인 프로젝트 증가가 시장을 견인할 것으로 예상됩니다.

- 한편, 석유 및 가스 생산량 감소는 시장 성장을 저해할 것으로 예상됩니다.

- 아시아 국가들과의 가스 거래가 증가함에 따라 주변 국가들은 말레이시아에 저장을 요구하고 있습니다. 말레이시아 기업들은 증가하는 저장 수요를 충족시킬 수 있습니다. 이는 말레이시아의 석유 및 가스 미드스티림 시장에 큰 기회를 가져다 줄 것으로 예상됩니다.

말레이시아의 석유 및 가스 시장 동향

LNG 터미널 부문이 시장을 독점할 것으로 전망

- 액화천연가스(LNG) 터미널 부문은 말레이시아 국내 및 인근 지역의 천연가스 수요 증가로 인해 말레이시아의 미드스티림 시장을 장악할 것으로 예상됩니다. 대부분의 국가는 환경 대기질 관리를 위해 이산화탄소 배출량을 줄이기를 원하고 있으며, 이로 인해 다양한 최종사용자 부문에서 천연가스 소비가 증가하고 있습니다.

- 사투 말레이시아 터미널은 말레이시아 사라왁 주에 위치한 LNG 터미널로 3개의 LNG 트레인을 보유하고 있으며, 연간 810만 톤(MTPA)의 생산능력을 보유하고 있습니다. 페트로나스 빈툴루 LNG 콤플렉스(Petronas Bintulu LNG Complex)로도 알려진 말레이시아 LNG 콤플렉스의 일부입니다.

- 2021년 현재 말레이시아의 천연가스 수입량은 하루 약 25억 입방미터로 2020년 대비 2021년 수입량이 감소했습니다. 이러한 수입량 감소는 새로운 LNG 터미널의 가동을 의미합니다.

- 예를 들어, 2022년 1월 말레이시아 사바 주와 페트로나스는 연간 200만 톤(mmty) 규모의 액화천연가스(LNG) 터미널 계획을 발표했습니다. 시피탄 석유 및 가스 산업 단지에 계획된 이 새로운 시설은 사바주의 산업 및 상업 비즈니스에 청정에너지 유통을 확대하기 위한 페트로나스와 사바주의 협력 관계의 일환입니다.

- 또한 2021년 8월에는 인도 석유공사(IOC)가 말레이시아 국영 페트로나스(Petronas)와 액화천연가스(LNG) 터미널 건설, 연료 소매 및 가스 유통을 포함한 합작 투자에 참여하면서 이 부문의 성장을 주도하고 있습니다.

가스 생산량 감소로 시장 억제

- 말레이시아는 주요 에너지원을 석유와 가스에 크게 의존하고 있으며, BP의 통계에 따르면 2021년 각국의 1차 에너지 소비에서 석유와 가스가 차지하는 비중은 70%에 육박합니다. 이는 말레이시아의 석유 및 가스 의존도가 얼마나 높은지 보여줍니다. 말레이시아는 단기적으로 의존도를 낮추고 다른 에너지원으로 다각화하기 위한 조치를 취하고 있지만, 이러한 추세는 앞으로도 계속될 것으로 예상됩니다.

- 또한 2015년부터 2020년까지 말레이시아 국내 천연가스 생산량은 2015년 76억 7,700만 입방미터에서 2020년에는 68억 7,700만 입방미터로 감소할 것으로 예상됩니다. 그러나 2021년에는 742억 입방미터로 급격한 증가를 기록했지만, 향후 몇 년 동안 생산량은 감소할 것으로 예상됩니다.

- 말레이시아의 생산량 감소의 원인은 유전의 노후화, 특히 말레이시아 반도 앞바다의 얕은 바다에 있는 대규모 자원이 말레이시아의 미드스티림 시장을 제약하고 있습니다.

- 또한, 말레이시아의 석유 파이프라인 네트워크는 미비한 수준일 수 있습니다. 이 나라에서 미드스티림 석유 제품의 육상 운송은 주로 유조선과 차량에 의존하고 있습니다. 파이프라인은 인도네시아 두마이 정유소에서 말레이시아 말라카 정유소까지 석유 제품을 운송하고 있습니다.

- 천연가스 소비 및 생산량 감소와 제한된 파이프라인 네트워크로 인해 말레이시아의 석유 및 가스 미드스티림 사업은 제약을 받고 있습니다. 그러나 석유 및 가스 소비 증가와 이 부문에 대한 투자 증가는 예상 기간 동안 시장을 주도할 것으로 보입니다.

말레이시아의 석유 및 가스 산업 개요

말레이시아의 석유 및 가스 미드스티림 시장은 비교적 통합되어 있습니다. 주요 기업으로는 Fluor Corporation, Petroliam Nasional Berhad(PETRONAS), Dialog Group Berhad, Vitol Group, Royal Vopak N.V. 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 100만 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 유형

- 운송

- 저장

- LNG 터미널

제6장 경쟁 상황

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Petroliam Nasional Berhad(PETRONAS)

- Dialog Group Berhad

- Vitol Group

- Royal Vopak NV

- Fluor Corporation

- Gas Malaysia Berhad

- MISC Berhad

제7장 시장 기회와 향후 동향

ksm 25.01.23The Malaysia Oil and Gas Midstream Market is expected to register a CAGR of greater than 2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing demand for oil and gas and increasing pipeline projects are expected to drive the market.

- On the other hand, the country's decreasing oil and gas production is expected to hinder the market's growth.

- Nevertheless, increasing gas trading with Asia has resulted in neighboring countries turning to Malaysia for storage. Companies in Malaysia can meet the rising storage demands. This is expected to create enormous opportunities for the Malaysia oil and gas midstream market.

Oil and Gas in Malaysia Market Trends

LNG Terminals Segment is Expected to Dominate the Market

- The Liquefied natural gas (LNG) terminals segment is expected to dominate the midstream market of Malaysia due to the increasing demand for natural gas in the country and neighboring regions. The majority of countries want to reduce their carbon emissions to control the air quality in the environment, which has increased the consumption of natural gas in various end-user segments.

- Satu Malaysia Terminal is an LNG terminal in Sarawak, Malaysia. It constitutes three LNG trains and has a capacity of 8.1 million metric tons per annum (MTPA). It is a part of the Malaysia LNG Complex, also known as the Petronas Bintulu LNG Complex.

- As of 2021, the natural gas imports in the country were around 2.5 billion cubic meters per day. The imports were less in 2021 compared to 2020. This decrease in imports signifies the operation of new LNG terminals.

- For instance, in January 2022, the Malaysian State of Sabah and Petronas announced plans for a two million metric tons/year (mmty) liquefied natural gas (LNG) terminal. The new facility planned for the Sipitang Oil and Gas Industrial Park is a part of Petronas's collaboration with the state to expand Sabah's distribution of cleaner energy to industrial and commercial businesses.

- Furthermore, in August 2021, the Indian Oil Corporation (IOC) entered a joint venture with Malaysia's state-run Petronas to include building liquefied natural gas (LNG) terminals, fuel retailing, and gas distribution, driving the growth of the segment.

Decreasing Production of Gas to Restrain the Market

- Malaysia heavily relies on oil and gas as its primary energy source. According to BP statistics, in 2021, the share of oil and gas in countries' primary energy consumption was close to 70%. This signifies the dependency on oil and gas in Malaysia. Although the country has been taking steps to reduce its dependency and diversify to other sources for the short term, the trend is expected to continue.

- Moreover, between 2015 to 2020, the country noticed a decline in domestic natural gas production, reducing to 68.7 billion cubic meters in 2020 compared to 76.7 billion cubic meters in 2015. However, a sharp rise was recorded in 2021 at 74.2 billion cubic meters, but the production is expected to decline in the coming years.

- Malaysia's diminishing output is due to aging fields, notably its larger resources in the shallow waters offshore of Peninsular Malaysia, which constrain the country's midstream market.

- Furthermore, Malaysia's oil pipeline network could be more modest. The country primarily relies on tankers and vehicles to transfer midstream petroleum products onshore. The pipeline transports oil products from Indonesia's Dumai oil refinery to Malaysia's Melaka oil refinery.

- As a result of lower natural gas consumption and production and a limited pipeline network, Malaysia's oil and gas midstream business is constrained. However, an increase in oil and gas consumption, as well as increased investment in the sector, is going to drive the market over the projected period.

Oil and Gas in Malaysia Industry Overview

The Malaysian oil and gas midstream market is moderately consolidated. A few major companies (in no particular order) include Fluor Corporation, Petroliam Nasional Berhad (PETRONAS), Dialog Group Berhad, Vitol Group, and Royal Vopak N.V., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE ANALYSIS

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Transportation

- 5.1.2 Storage

- 5.1.3 LNG Terminals

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Petroliam Nasional Berhad (PETRONAS)

- 6.3.2 Dialog Group Berhad

- 6.3.3 Vitol Group

- 6.3.4 Royal Vopak NV

- 6.3.5 Fluor Corporation

- 6.3.6 Gas Malaysia Berhad

- 6.3.7 MISC Berhad