|

시장보고서

상품코드

1628708

일본의 플라스틱 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Japan Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

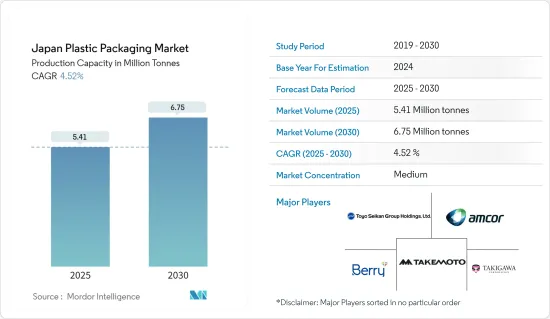

생산능력 기준 일본의 플라스틱 포장 시장 규모는 예측 기간(2025-2030년) 동안 4.52%의 연평균 복합 성장률(CAGR)로 성장하여 2025년 541만 톤에서 2030년 675만 톤으로 성장할 것으로 예상됩니다.

일본의 플라스틱 포장 시장을 주도하는 것은 식음료 산업입니다. 플라스틱 포장은 가볍고 깨지지 않으며, 취급이 용이해 소비자들이 선호하고 있습니다.

주요 하이라이트

- 일본에서 플라스틱 포장은 내구성, 유연성, 비용 효율성 측면에서 소비자들이 선호하고 있습니다. 이 포장 형태는 플라스틱 필름, 용기 및 기타 고분자 재료를 사용하여 외부 요인에 대한 장벽을 형성합니다. 이러한 다용도성으로 인해 다양한 제품을 포장할 수 있는 경량화 솔루션이 되고 있습니다. 식음료, 화장품, 의약품 등의 산업에서 플라스틱 용기 포장에 대한 의존도가 높아지고 있으며, 이는 제품 수요의 원동력이 되고 있습니다.

- 일본의 플라스틱 용기 포장 제조업체는 다양한 최종 사용 산업에 맞는 경질 및 연질 포장 솔루션 개발에 집중함으로써 큰 성장을 이룰 준비가 되어 있으며, 2024년 10월, Toppan Inc. 와 공동으로 양산용 재생 BOPP 필름 개발에 성공했으며, 2024년 10월부터 샘플 배포를 시작할 예정입니다.

- 새로운 충전 기술과 내열성 PET 병의 등장은 국내 시장의 가능성을 넓혔습니다. 수요 증가에 따라 음료 제조업체는 일본에서 PET 병 생산을 강화하고 있습니다.

- 2024년 9월, 코카콜라 보틀러스 재팬(CCBJ)은 아이치현 도카이 공장에 새로운 무균 생산라인을 발표했습니다. 이 라인은 분당 약 600개의 소형 페트병을 생산할 수 있어 CCBJ 수요 급증에 대한 대응력을 강화할 수 있습니다.

- 그러나 플라스틱 폐기물의 급증으로 일본 소비자들은 유리, 금속 등 친환경적인 포장재에 대한 요구가 높아지고 있습니다. 이 지역에서는 재활용이 가능하고 환경 친화적인 알루미늄과 유리의 채택이 눈에 띄게 증가하고 있습니다. 이러한 플라스틱 이탈은 향후 제품 수요에 도전이 될 수 있습니다.

일본 플라스틱 포장 시장 동향

병과 항아리가 시장을 독점할 전망

- 플라스틱의 경량성이 수요 증가를 촉진합니다. 일본에서는 음료 및 식품 부문의 플라스틱 병 및 병에 대한 의존도가 높아지면서 플라스틱 포장에 대한 수요가 증가하고 있습니다.

- PET 병의 용도는 음료 외에도 확대되어 일본의 화장품 및 의약품 부문에서 각광을 받고 있습니다. 시장 역학은 첨단 충전 기술 및 내열성 PET 병 출시와 같은 혁신으로 진화하고 있으며, PET 병은 다양한 부문에서 선두를 달리고 있지만 폴리에틸렌(PE) 병은 음료, 화장품, 위생용품, 세제 등 생활용품에 대한 선호도가 높습니다.

- 일본 기업들은 음료용 페트병 생산을 늘리고 있으며, 이러한 추세는 시장 성장을 가속할 것이며, 2024년 3월 일본 대기업인 Otsuka Foods는 탄산비타민 음료 'MATCH' 시리즈 신제품 2종을 출시할 계획을 발표하였습니다. MATCH 파인애플 소다'와 260g 페트병의 'MATCH 젤리'입니다.

- 일본 청량음료협회는 2030년까지 병에서 병으로 재활용을 50%까지 달성하겠다는 야심찬 목표를 세웠습니다. 각 업계는 PET 수지 사용량을 줄이기 위해 PET 병의 경량화를 추진하고 있습니다. 일본 청량음료협회(JSDA)의 데이터에 따르면 일본의 무알콜 음료 부문에서 PET 병이 철과 유리를 추월했습니다. 또한 정부의 엄격한 규제로 인해 일본은 PET 병 회수 및 재활용 분야에서 세계적인 리더로 자리 매김하고 있으며, 이는 시장 성장을 가속하는 요인으로 작용하고 있습니다.

- 일본 경제산업성의 보고서에 따르면 2023년 일본의 플라스틱 포장 생산량은 전년 대비 10만 톤 감소(9.01% 감소)했습니다. 그러나 2024년에는 109만 톤으로 회복될 것으로 예상되어 잠재적인 시장 성장 가능성을 시사하고 있습니다.

음료 산업이 크게 성장하고 있습니다.

- 일본의 음료 산업은 건강 지향적 음료에 대한 수요 증가에 힘입어 크게 성장하고 있습니다. 소비자들은 면역력 향상, 소화 개선, 인지 기능 향상 등 건강상의 이점을 약속하는 음료에 점점 더 많은 관심을 보이고 있습니다. 이러한 추세는 특히 노년층과 생활습관 관련 건강 문제에 직면한 사람들 사이에서 두드러지게 나타나고 있습니다.

- 일본에서는 플라스틱 병과 용기에 흔히 볼 수 있는 경질 플라스틱 포장이 음료 및 식품 용도에 널리 사용되고 있습니다. 이러한 제품 수요는 주스, 탄산 청량음료 및 기타 음료를 포장하기 위한 HDPE 병과 PET 병의 사용으로 인해 두드러지게 증가하고 있습니다. 주목할 만한 점은 동양제관과 같은 제조업체가 음료 용도에 특화된 내열 및 내압 PET 병을 생산하고 있다는 점입니다.

- 천연 재료와 과학적 진보의 융합에 초점을 맞춘 기술 혁신이 일본 음료 산업을 재구성하고 있으며, 2024년에는 청량음료, 스포츠 음료, 에너지 음료 등의 부문이 기능성 음료에 대한 소비자의 다양한 취향을 보여줄 것으로 예상됩니다. 기업들은 혁신, 타겟 마케팅, 지속가능성을 우선시함으로써 급성장하는 일본 기능성 음료 시장에서 입지를 다질 수 있습니다.

- 또한 미국 농무부(USDA) 데이터에 따르면 일본의 무알콜 음료 시장은 2023년 약 400억 달러로 평가되며 수입이 약 10억 달러를 차지할 것으로 예상됩니다. 미국은 일본의 무알콜 음료의 주요 공급국이며, 수출은 주로 생수와 주스가 주류를 이루고 있습니다. 건강 음료와 무알콜 맥주가 주요 소비 트렌드로 부상하고 있으며, 이는 플라스틱 포장 수요에 큰 영향을 미치고 있습니다.

- 일본의 무알콜 음료에 대한 강한 구매 의욕은 플라스틱 포장 부문을 강화하고 있습니다. 일본 대기업인 아사히 그룹 홀딩스(Asahi Group Holdings)의 보고서에 따르면 2023년에는 RTD(Ready-to-Drink) 홍차가 청량음료 부문을 이끌며 매출의 약 30%를 차지할 것으로 예상했습니다. 일본에서는 다양한 무알콜 음료 유형으로 인해 경질 및 연질 포장 솔루션에 대한 수요가 증가하고 있습니다.

일본의 플라스틱 포장 산업 개요

일본의 플라스틱 포장 시장은 주로 Amcor Group, Takemoto Yohki, Toyo Seikan Group Holdings Ltd, Berry Global Inc. 확대를 목표로 제품 혁신, 협업, M&A, 투자 등의 전략을 적극적으로 추진하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업 매력 - Porter의 Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 역학

- 시장 성장 촉진요인

- 시장이 해결해야 할 과제

제6장 산업 규제와 시책과 기준

제7장 시장 내역

- 포장 유형별

- 연질 플라스틱 포장

- 경질 플라스틱 포장

- 제품 유형별

- 보틀 및 자(jar)

- 트레이 및 용기

- 파우치

- 백

- 필름 및 랩

- 기타

- 산업별

- 식품

- 음료

- 의료

- 퍼스널케어 및 가정용품

- 기타

제8장 경쟁 구도

- 기업 개요

- Amcor Group

- Takemoto Yohki Co. Ltd.

- Berry Global

- Takigawa Corporation

- Toyo Seiken Group Holdings Ltd.

- Sonoco Products Company

- Sealed Air Corporation

- Hosokawa Yoko Co. ltd.

- Toppan Inc.

- Kodama Plastics Co. Ltd.

- 히트맵 분석

- 경쟁사 분석 - 신규 기업과 기존 기업

제9장 투자 분석

제10장 시장의 미래

LSH 25.01.21The Japan Plastic Packaging Market size in terms of production capacity is expected to grow from 5.41 million tonnes in 2025 to 6.75 million tonnes by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

The food and beverage industry drives the plastic packaging market in Japan. Consumers favor plastic packaging for its lightweight and unbreakable nature, enhancing ease of handling.

Key Highlights

- In Japan, consumers favor plastic packaging for its durability, flexibility, and cost-effectiveness. This packaging form employs plastic films, containers, and other polymer-based materials, creating a barrier against external elements. This versatility makes it a lightweight solution for packaging various goods. Industries such as beverage, food, cosmetics, and pharmaceuticals increasingly rely on plastic container packaging, which drives the product demand.

- Japanese manufacturers of plastic packaging are poised for substantial growth by focusing on the development of both rigid and flexible packaging solutions tailored to diverse end-use industries. In October 2024, Toppan Inc., in collaboration with RM Tohcello Co. Ltd. and Mitsui Chemicals Inc., has successfully created a recycled BOPP film primed for mass production. Starting October 2024, these companies will commence the distribution of samples for this innovative film.

- New filling technologies and the advent of heat-resistant PET bottles have broadened market possibilities in the country. In response to rising demand, beverage manufacturers are ramping up PET bottle production in Japan.

- In September 2024, Coca-Cola Bottlers Japan Inc. (CCBJI) unveiled a new aseptic production line at its Tokai Plant in Aichi Prefecture. This line boasts a production capacity of around 600 small PET bottles per minute, bolstering CCBJI's ability to meet surging demand.

- However, a surge in plastic waste has led Japanese consumers to gravitate towards eco-friendlier packaging materials such as glass and metal. The region has seen a notable uptick in the adoption of aluminum and glass, celebrated for their recyclability and eco-friendly attributes. This shift away from plastic could pose challenges for product demand in the future.

Japan Plastic Packaging Market Trends

Bottles and Jars Segment is Expected to Dominate the Market

- The lightweight nature of plastics fuels their rising demand. In Japan, the food and beverage sector's increasing reliance on plastic bottles and jars propels the need for plastic packaging.

- Plastic bottles extend their utility beyond beverages, finding prominence in Japan's cosmetics and pharmaceuticals sectors. Market dynamics are evolving with innovations like advanced filling technologies and the launch of heat-resistant PET bottles. While PET bottles lead in various sectors, polyethylene (PE) bottles are the preferred choice for beverages, cosmetics, sanitary items, and household items such as detergents.

- Japanese companies are increasingly producing PET bottles for beverages, a trend poised to fuel market growth. In March 2024, Otsuka Foods Co., Ltd., a prominent player based in Japan, unveiled its plans to launch two new products in its MATCH line of carbonated vitamin drinks: MATCH Pineapple Soda in a 500-ml PET bottle and MATCH Jelly in a 260-gram PET bottle in the Japanese market.

- The Japan Soft Drink Association has set an ambitious goal of achieving 50% bottle-to-bottle recycling by 2030. Industry players are lightening the weight of PET bottles to reduce the amount of PET resin used. Data from the Japan Soft Drink Association (JSDA) highlights that PET bottles have overtaken steel and glass in the country's non-alcoholic beverage sector. Furthermore, stringent government regulations have positioned Japan as a global leader in PET bottle collection and recycling, a factor poised to stimulate market growth.

- As reported by the Ministry of Economy, Trade and Industry (METI) Japan, the country's plastic packaging production saw a dip of 0.1 million tons (-9.01 percent) in 2023 compared to the prior year. However, projections indicate a rebound to 1.09 million tons in 2024, signaling potential market growth.

Beverage Industry Set for Significant Growth

- Japan's beverage industry is expanding significantly, fueled by a rising demand for health-oriented drinks. Consumers are increasingly gravitating towards beverages that promise health benefits, including immunity enhancement, better digestion, and sharper cognitive functions. This trend is especially evident among the elderly and those facing health challenges linked to their lifestyles.

- In Japan, rigid plastic packaging, commonly found in plastic bottles and containers, is widely favored for food and beverage applications. The demand for these products is notably driven by the use of HDPE and PET bottles for packaging juices, carbonated soft drinks, and other beverages. Notably, manufacturers such as Toyo Seikan Co. Ltd. are producing heat and pressure-resistant PET bottles tailored specifically for beverage applications.

- Innovations are reshaping Japan's beverage landscape, with a focus on merging natural ingredients and scientific advancements. In 2024, segments such as soft drinks, sports drinks, and energy drinks are poised to showcase the varied consumer preferences for functional beverages. By prioritizing innovation, targeted marketing, and sustainability, companies can cement their foothold in Japan's burgeoning functional beverage arena.

- Additionally, data from the US Department of Agriculture (USDA) reveals that Japan's non-alcoholic beverage market was valued at approximately USD 40 billion in 2023, with imports accounting for about USD 1 billion. The U.S. stands as Japan's chief supplier of non-alcoholic drinks, with exports predominantly comprising mineral water and juices. Healthy beverages and non-alcoholic beers are emerging as leading consumer trends, significantly influencing the demand for plastic packaging.

- Japan's surging appetite for non-alcoholic drinks is bolstering its plastic packaging sector. As reported by Asahi Group Holdings, a prominent Japanese firm, Ready-to-Drink (RTD) tea led the soft drinks segment in 2023, capturing roughly 30% of sales. The diverse range of non-alcoholic beverages in Japan is driving a heightened demand for both rigid and flexible packaging solutions in the nation.

Japan Plastic Packaging Industry Overview

The Japanese plastic packaging market is moderately consolidated with the presence of global and domestic players such as Amcor Group, Takemoto Yohki Co. Ltd, Toyo Seikan Group Holdings Ltd, Berry Global Inc. and Takigawa Corporation. These companies are actively pursuing strategies such as product innovations, collaborations, mergers and acquisitions, and investments to expand their business and capture a larger market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand of Plastic Packaging Solutions for Multiple End-User Industries in Japan

- 5.1.2 Rising Popularity of Plastic Bottles for Beverage Industry in Japan

- 5.2 Market Challenges

- 5.2.1 Increasing Environmental Concerns Regarding Plastic Packaging Recycling in Japan

6 INDUSTRY REGULATION, POLICY AND STANDARDS

7 MARKET SEGEMENTATION

- 7.1 By Packaging Type

- 7.1.1 Flexible Plastic Packaging

- 7.1.2 Rigid Plastic Packaging

- 7.2 By Product Type

- 7.2.1 Bottles and Jars

- 7.2.2 Trays and containers

- 7.2.3 Pouches

- 7.2.4 Bags

- 7.2.5 Films and Wraps

- 7.2.6 Other Product Types

- 7.3 By End-User Vertical

- 7.3.1 Food

- 7.3.2 Beverage

- 7.3.3 Healthcare

- 7.3.4 Personal Care and Household

- 7.3.5 Other End-Users

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amcor Group

- 8.1.2 Takemoto Yohki Co. Ltd.

- 8.1.3 Berry Global

- 8.1.4 Takigawa Corporation

- 8.1.5 Toyo Seiken Group Holdings Ltd.

- 8.1.6 Sonoco Products Company

- 8.1.7 Sealed Air Corporation

- 8.1.8 Hosokawa Yoko Co. ltd.

- 8.1.9 Toppan Inc.

- 8.1.10 Kodama Plastics Co. Ltd.

- 8.2 Heat Map Analysis

- 8.3 Competitor Analysis - Emerging vs. Established Players