|

시장보고서

상품코드

1851416

미국의 온도 센서 시장 : 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)US Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

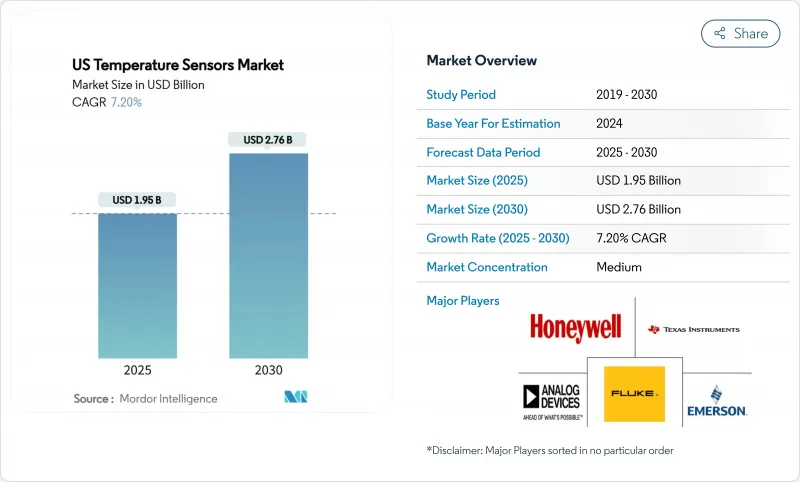

미국의 온도 센서 시장 규모는 2025년 19억 5,000만 달러로, 예측 기간 중(2025-2030년) CAGR은 7.20%로 확대되어, 2030년에는 27억 6,000만 달러에 달할 것으로 예측됩니다.

서브 디그리 정밀도 요구, 온쇼어 반도체 생산을 강화하는 연방 정부의 인센티브, 전기자동차(EV) 밸류체인과 데이터센터 냉각 시스템에서 실시간 모니터링의 보급이 성장 엔진을 계속 움직이고 있습니다. 이미 4,000억 달러를 넘는 민간 반도체 투자의 유동성이 인프로세스 열 진단에 의존하는 새로운 공장을 개방하고 자율 공장과 예지 보전 프로그램이 지속적인 센서 개수를 촉진하고 있습니다. 분산형 광섬유 솔루션, 고급 적외선 어레이, AI 지원 에지 디바이스는 측정 정확도와 통합 분석을 결합할 수 있는 공급업체의 경쟁 해자를 확장합니다. 동시에 의료, 에너지 저장, 석유화학 현장에서는 안전규제가 강화되어 기존 유선설비에서도 교환 사이클이 활발합니다.

미국 온도 센서 시장 동향과 통찰

Industry 4.0 및 스마트 팩토리 도입 확대

산업의 디지털화는 AI, 로봇 공학, 커넥티드 계장을 융합시킴으로써 공장 플로어를 재구축하고, 온도 센싱은 그 수렴의 중심에 위치하고 있습니다. 과거에는 소수의 중요한 자산을 샘플링했던 예지보전 프로그램은 이제 기계 고장 몇 시간 전에 온도 편차를 표시하는 수백 개의 노드에서 전체 생산 라인을 덮고 있습니다. Texas Instruments의 새로운 센서에 내장된 에지 AI 칩셋은 로컬 데이터 스트림을 크런치하고 클라우드 대기 시간 없이 밀리초 수준의 경고를 자동 응답 트리거로 만들 수 있습니다. FOUNDATION Fieldbus와 PROFINET과 같은 상호 운용 가능한 프로토콜은 시스템 통합을 단순화하고 견고한 하우징과 확장 온도 범위는 먼지가 많은 진동 영역에서 안정적인 서비스를 보장합니다. 그 결과 미국 온도 센서 시장은 전통적인 PLC 네트워크로의 교체 판매와 그린필드의 스마트 공장으로부터의 새로운 수요를 계속 즐기고 있습니다.

웨어러블 가전으로 증가하는 온도 감지 수요

소형화된 저전력 다이는 임상 수준의 온도 정밀도를 일상 기기에 제공하여 소비자는 질병의 조기 발견을 위해 체온을 +-0.1℃ 이내에서 추적할 수 있게 되었습니다. 신축성 있는 기판은 현재 자극없이 며칠 동안 피부에 적합하며, 듀얼 센서 귀 구멍형 설계는 원격 의료 워크플로우에 적합한 연속 측정을 제공합니다. 5세대 셀룰러 링크 및 엣지 컴퓨팅 칩은 암호화된 스트림을 의료 대시보드로 전송하여 임상의가 원격으로 개입할 수 있도록 합니다. 센서 제조업체들에게 이러한 설계의 승리는 소비자를 위한 대량 생산 채널 외에도 전력 예산이 마찬가지로 엄격한 산업용 IoT에서도 기술을 활용할 수 있습니다. 그 결과 미국 온도 센서 시장은 가파른 혁신 곡선을 그렸습니다.

반도체와 백금족 금속 가격 변동

갈륨, 게르마늄, 백금의 가격 변동은 RTD 및 고정밀 칩 기반 프로브의 비용 구조를 흔들립니다. 중국이 갈륨과 게르마늄의 정련을 주도하고 있기 때문에 미국의 바이어는 수출 규제의 영향을 받기 쉽고, 백금 박막은 연료전지와 촉매 컨버터 수요가 급증하고 있기 때문에 공급 부족에 직면하고 있습니다. 한편, 연료전지와 촉매 컨버터 수요가 높아지는 가운데, 백금 박막은 공급 부족에 직면합니다. 예산 불투명도로 업그레이드 프로젝트가 지연되고 미국 온도 센서 시장의 당면 수량이 줄어들 수 있습니다.

부문 분석

유선 디바이스는 2024년 매출의 69.20%를 유지하면서 안전한 루프와 기존 DCS 케이블 배선에서의 하드 와이어 신뢰성을 유지했지만, 무선 노드는 레트로 피팅의 용이성과 설치 비용 감소로 CAGR 10.90% 규모로 확대되고 있습니다. 무선 제품의 미국 온도 센서 시장 규모는 데이터센터 및 식품 공장에서의 견조한 채택을 반영하여 2030년까지 8억 6,000만 달러에 이를 것으로 예측됩니다. 매사추세츠 공과대학(MIT)에서 개발된 셀프 파워 수확기는 배터리 유지 보수 장벽을 제거하고 펌프, 킬른 및 회전 장비에서 이용 사례를 확장합니다. 광대한 공장에서 LoRaWAN과 5G NB-IoT는 밀리와트 전력 예산으로 킬로미터 규모의 도달을 가능하게 하며, 공장 관리자는 케이블 그루브를 파지 않고 세밀한 히트맵을 얻을 수 있습니다.

주파수 호핑과 AES-128 암호화가 표준이 되면서 한때 무선을 뒤덮었던 신뢰성에 대한 우려는 희미해지고 있습니다. 에지 마이크로컨트롤러는 현재 패킷 페이로드를 줄이기 위해 판독 값을 전처리하여 공장 백본의 혼잡을 완화하고 있습니다. 한편, 거버넌스 프로토콜이 고정 케이블과 아날로그 출력을 필요로 하는 원자력, 제약, 항공우주 라인에서는 유선 접속의 현상이 계속되고 있습니다. 4-20mA 루프를 Wi-Fi 및 Sub-GHz 라디오로 브리지하는 믹스 모드 게이트웨이를 번들하는 공급업체는 하이브리드 배포에 자본 참여하고 미국 온도 센서 시장 점유율을 확대합니다.

열전대는 2,300°C까지의 극열을 커버함으로써 2024년 매출의 32.30%를 가져왔지만, 분산형 광섬유 시스템은 산업계가 포인트 체크보다 공간 분해능을 갈망하고 있기 때문에 CAGR 11.90%로 급상승하고 있습니다. DTS의 미국 온도 센서 시장 규모는 2030년까지 4억 7,000만 달러 이상에 달할 것으로 예측됩니다. EMI의 영향을 받지 않는 파이버 라인은 전자 장치가 고장나는 고전압 베이와 유도로를 통과합니다. Luna Innovations의 고해상도 유닛은 서브mm의 입자 크기를 달성하고 배터리 모듈과 극저온 파이프라인을 매핑합니다.

저항 온도 검출기는 +-0.1 °C 서미스터는 비용에 중점을 둔 가전제품을 포착하고 적외선 어레이는 예측 유지 보수를 위한 적외선 이미징을 해제합니다. HART, Modbus 및 이더넷 프로토콜을 제공하는 하이브리드 송신기는 디지털 트윈으로의 통합을 단순화합니다. 센싱 요소, 헤드 마운트 송신기 및 분석 펌웨어를 풀 스택으로 제공하는 공급업체는 경상 수익을 강화하고 미국 온도 센서 시장에서의 지위를 높이고 있습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 인더스트리 4.0과 스마트 팩토리 도입 확대

- 웨어러블 가전에 있어서의 온도 센싱 수요 증가

- 자동차 일렉트로닉스와 EV의 열 관리 요건 증가

- 콜드체인 IoT 센서의 mRNA 백신 물류에서의 채용

- 데이터센터 액냉의 급성장으로 분산형 센싱이 필요

- 연방 정부의 온쇼어링 장려책이 공장 내 열 프로세스 센서를 뒷받침

- 시장 성장 억제요인

- 반도체 가격과 백금족 금속 가격의 난고하

- 디자인 인사이클이 길고, 규제 분야에서는 센서의 교환이 지연

- 중요 인프라의 무선 센서에 대한 사이버 보안 문제

- 광섬유 설치업자의 부족이 분산형 센싱의 보급을 억제

- 규제 상황

- 기술의 전망

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- 유선

- 무선

- 기술별

- 적외선

- 열전대

- 저항 온도 검출기(RTD)

- 서미스터

- 온도 트랜스미터

- 광섬유

- 기타

- 최종 사용자 업계별

- 화학제품 및 석유화학제품

- 석유 및 가스

- 금속 및 광업

- 발전

- 식음료

- 자동차

- 의료

- 항공우주 및 군사

- 컨슈머 및 일렉트로닉스

- 기타 최종 사용자 산업

- 접촉별

- 접촉

- 비접촉

- 용도 환경별

- 산업 공정 모니터링

- HVAC 및 빌딩 자동화

- 헬스케어 및 웨어러블

- 전기자동차 배터리 관리

- 데이터센터 및 통신

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Texas Instruments Inc.

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc.

- Siemens AG

- Panasonic Corp.

- ABB Ltd

- Emerson Electric Co.

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors NV

- Robert Bosch GmbH

- DENSO Corp.

- FLIR Systems(Teledyne)

- Omron Corp.

- Maxim Integrated(ADI)

- Fluke Process Instruments

- Sensirion AG

- Amphenol Advanced Sensors

- Silixa Ltd

- AP Sensing GmbH

제7장 시장 기회와 장래의 전망

JHS 25.11.13The US Temperature Sensors Market size is estimated at USD 1.95 billion in 2025, and is expected to reach USD 2.76 billion by 2030, at a CAGR of 7.20% during the forecast period (2025-2030).

Sub-degree accuracy demands, federal incentives that strengthen on-shore semiconductor production, and the diffusion of real-time monitoring across electric-vehicle (EV) value chains and data-center cooling systems keep the growth engine running. Liquidity in private semiconductor investments already past USD 400 billion has unlocked new fabs that rely on in-process thermal diagnostics, while autonomous factories and predictive maintenance programs drive continuous sensor retrofits. Distributed fiber-optic solutions, advanced infrared arrays, and AI-enabled edge devices are widening the competitive moat for suppliers able to pair measurement precision with integrated analytics. At the same time, tighter safety regulations in healthcare, energy storage, and petrochemical sites ensure that replacement cycles remain brisk even in legacy wired installations.

US Temperature Sensors Market Trends and Insights

Expansion of Industry 4.0 and smart-factory adoption

Industrial digitalization reshapes factory floors by fusing AI, robotics, and connected instrumentation, and temperature sensing sits at the heart of that convergence. Predictive maintenance programs that once sampled a few key assets now blanket entire production lines with hundreds of nodes that flag thermal deviations hours before mechanical breakdowns. Edge AI chipsets embedded in new sensors from Texas Instruments crunch local data streams so millisecond-level alerts can trigger automated responses without cloud latency. Interoperable protocols such as FOUNDATION Fieldbus and PROFINET simplify system integration, while ruggedized housings and extended temperature ranges ensure reliable service in dusty, high-vibration zones. As a result, the US temperature sensors market keeps enjoying replacement sales into heritage PLC networks and fresh demand from green-field smart factories.

Growing demand for temperature sensing in wearable consumer electronics

Miniaturized, low-power die have brought clinical-grade temperature accuracy into everyday devices, letting consumers track core body temperature within +-0.1 °C for early illness detection. Stretchable substrates now conform to skin for days without irritation, and dual-sensor ear-canal designs deliver continuous readings that fit into telehealth workflows. Fifth-generation cellular links and edge computing chips send encrypted streams to healthcare dashboards so clinicians can intervene remotely, a capability valued by aging-in-place programs. For sensor makers, these design wins offer high-volume consumer channels plus technology leverage across industrial IoT where power budgets are equally tight. The resulting pull keeps the US temperature sensors market on a steep innovation curve.

Volatility in semiconductor and platinum-group metal prices

Price swings in gallium, germanium, and platinum upset cost structures for RTDs and high-precision chip-based probes. China's command of gallium and germanium refining keeps US buyers vulnerable to export restrictions, while platinum thin films face supply tightness amid intensified fuel-cell and catalytic-converter demand. Budget uncertainty can delay upgrade projects, trimming near-term volumes inside the US temperature sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Rising automotive electronics and EV thermal-management requirements

- Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- Cyber-security concerns over wireless sensors in critical infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired devices retained 69.20% of 2024 revenue thanks to hard-wired reliability in safety-critical loops and existing DCS cabling, yet wireless nodes are scaling 10.90% CAGR on retrofit ease and lower installation costs. The US temperature sensors market size for wireless products is forecast to reach USD 0.86 billion by 2030, reflecting robust adoption in data centers and food plants. Self-powered harvesters developed at MIT remove battery maintenance barriers and widen use cases in pumps, kilns, and rotating equipment. In sprawling factories, LoRaWAN and 5G NB-IoT enable kilometer-scale reach with milliwatt power budgets, giving plant managers granular heat maps without trenching cable.

Reliability fears that once shadowed wireless have faded as frequency-hopping and AES-128 encryption become standard. Edge microcontrollers now pre-process readings to slash packet payloads, reducing congestion on factory backbones. Meanwhile, wired incumbency endures in nuclear, pharma, and aerospace lines where governance protocols require fixed cabling and analog outputs. Suppliers that bundle mixed-mode gateways bridging 4-20 mA loops with Wi-Fi or Sub-GHz radios capitalize on hybrid roll-outs and expand their stake in the US temperature sensors market.

Thermocouples brought in 32.30% of 2024 turnover by covering extreme heat up to 2,300 °C, but distributed fiber-optic systems are rocketing at 11.90% CAGR as industries crave spatial resolution over point checks. The US temperature sensors market size for DTS is projected to exceed USD 470 million by 2030. Immune to EMI, fiber lines navigate high-voltage bays and induction furnaces where electronics fail. High-definition units from Luna Innovations achieve sub-millimeter granularity, mapping battery modules and cryogenic pipelines alike.

Resistance Temperature Detectors still dominate pharma cleanrooms and metrology labs that stipulate +-0.1 °C accuracy. Thermistors capture cost-sensitive appliances, while infrared arrays unlock thermal imaging for predictive maintenance. Hybrid transmitters delivering HART, Modbus, or Ethernet protocols simplify integration into digital twins. Vendors that supply full stacks sensing element, head-mount transmitter, and analytics firmware bolster recurring revenue and deepen their position inside the US temperature sensors market.

US Temperature Sensors Market Report is Segmented by Type (Wired, Wireless), Technology (Infrared, Thermocouple, RTD, Thermistor and More), End-User Industry (Chemical and Petrochemical, Oil and Gas, Metal and Mining and More), Connectivity (Contact, Non-Contact), Application Environment (Industrial Process Monitoring, HVAC and Building Automation and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Texas Instruments Inc.

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc.

- Siemens AG

- Panasonic Corp.

- ABB Ltd

- Emerson Electric Co.

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors NV

- Robert Bosch GmbH

- DENSO Corp.

- FLIR Systems (Teledyne)

- Omron Corp.

- Maxim Integrated (ADI)

- Fluke Process Instruments

- Sensirion AG

- Amphenol Advanced Sensors

- Silixa Ltd

- AP Sensing GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Industry 4.0 and smart-factory adoption

- 4.2.2 Growing demand for temperature sensing in wearable consumer electronics

- 4.2.3 Rising automotive electronics and EV thermal-management requirements

- 4.2.4 Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- 4.2.5 Rapid growth of data-center liquid-cooling needs distributed sensing

- 4.2.6 Federal on-shoring incentives boosting in-fab thermal-process sensors

- 4.3 Market Restraints

- 4.3.1 Volatility in semiconductor and platinum-group metal prices

- 4.3.2 Lengthy design-in cycles slow sensor replacement in regulated sectors

- 4.3.3 Cyber-security concerns over wireless sensors in critical infrastructure

- 4.3.4 Shortage of fiber-optic installers curbs distributed sensing roll-out

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry Intensity

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector (RTD)

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Connectivity

- 5.4.1 Contact

- 5.4.2 Non-Contact

- 5.5 By Application Environment

- 5.5.1 Industrial Process Monitoring

- 5.5.2 HVAC and Building Automation

- 5.5.3 Healthcare and Wearables

- 5.5.4 Electric-Vehicle Battery Management

- 5.5.5 Data Centers and Telecom

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Honeywell International Inc.

- 6.4.3 TE Connectivity Ltd

- 6.4.4 Analog Devices Inc.

- 6.4.5 Siemens AG

- 6.4.6 Panasonic Corp.

- 6.4.7 ABB Ltd

- 6.4.8 Emerson Electric Co.

- 6.4.9 STMicroelectronics

- 6.4.10 Microchip Technology Inc.

- 6.4.11 NXP Semiconductors NV

- 6.4.12 Robert Bosch GmbH

- 6.4.13 DENSO Corp.

- 6.4.14 FLIR Systems (Teledyne)

- 6.4.15 Omron Corp.

- 6.4.16 Maxim Integrated (ADI)

- 6.4.17 Fluke Process Instruments

- 6.4.18 Sensirion AG

- 6.4.19 Amphenol Advanced Sensors

- 6.4.20 Silixa Ltd

- 6.4.21 AP Sensing GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment