|

시장보고서

상품코드

1628806

스마트 가스 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Smart Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

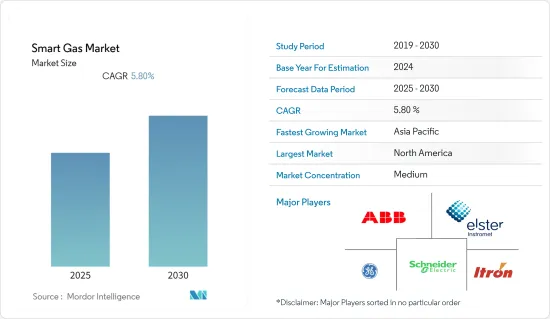

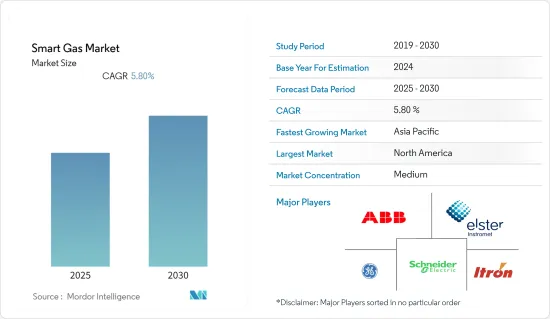

스마트 가스 시장은 예측 기간 동안 CAGR 5.8%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 에너지 손실을 줄이고 에너지 안보를 강화하기 위한 수요 증가는 시장 성장의 중요한 촉진요인으로 간주됩니다. 최종사용자 수가 증가함에 따라 부정행위가 없는 데이터를 대조하는 것은 여전히 이 시장에서 어려운 과제입니다.

- 가스 보급의 확대와 많은 지역에서 전개되고 있는 많은 규제 정책은 시장 성장 기회로 인식되어야 합니다. 최근 유럽은 소비자의 사용료를 절약하기 위해 많은 스마트 가스 계량기를 도입했습니다.

- 그러나 스마트 시스템에 따른 설치 비용의 증가는 시장 성장을 억제할 것으로 예상됩니다. 스마트 시스템은 대부분의 서비스 제공업체와 사용자가 설치하는 표준 장비보다 상대적으로 비쌉니다. 이러한 시스템은 디지털 구성요소와 연결 시스템을 사용하여 작동 및 데이터 전송이 가능하기 때문에 계측 장비, 센서 및 분석기와 같은 솔루션의 비용이 증가합니다.

- 또한, 스마트 가스 솔루션 도입에 따른 통합 문제가 이러한 시스템의 채택을 억제하고 있습니다. 이러한 시스템은 기존 환경에 통합될 수 있도록 지원해야 합니다.

- 유럽, 북미, 아시아태평양에서는 COVID-19 이후 가정용, 상업용, 산업용 스마트 가스 시장이 크게 성장하고 있습니다. 예측 기간 동안 더욱 확대될 것으로 보입니다.

스마트 가스 시장 동향

상업 및 산업용이 대폭 증가

- 스마트 가스 시장의 상업용 최종사용자는 가스 소비에 주거용과 유사한 유량과 압력을 필요로 하는 소규모 사업자입니다. 가스 가격은 상업용 공간의 위치와 가용성에 따라 달라질 수 있습니다.

- 상업용 가스는 일반적으로 가정용 가스보다 비용이 더 비싸기 때문에 스마트 가스 미터와 같은 스마트 가스 솔루션을 채택하려는 기업의 의지가 더욱 높아졌습니다. 또한, 상업용 기업들은 스마트 미터 설치에 적합한 통신 및 네트워크 인프라가 잘 갖춰진 지역에 위치하는 것이 바람직하며, 이는 스마트 미터의 도입을 촉진하고 있습니다.

- 산업계는 일반적으로 가스 소비량이 많고, 그 용도는 발전 용도와는 달리 제조 공정에 필수적인 요소입니다. 화학 공장이나 비료 공장과 같은 산업에서 가스는 생산의 핵심 원료로 사용됩니다.

- 이러한 산업에서 모니터링 및 제어 기능은 PLC 및 SCADA 인터페이스 기능을 통해 존재합니다. 각 분야가 점차 인더스트리 5.0으로 전환하고 IoT가 증가함에 따라 스마트 가스 시장은 예측 기간 동안 긍정적인 성장을 보일 것으로 예상됩니다. 에너지 비용과 가스 소비가 많은 산업은 이 시장의 초기 채택자가 될 것입니다.

- 영국 비즈니스-에너지 - 산업전략부에 따르면, 주요 에너지 공급업체들은 2021년 영국 전역의 비주거용 건물에 4,500개의 스마트 가스 계량기를 설치했는데, 이는 전년 대비 약 162% 증가한 수치입니다.

유럽이 큰 비중을 차지할 것으로 예상

- 유럽은 다양한 규제 정책으로 인해 스마트 가스 시장의 적극적인 발전으로 인해 예측 기간 동안 큰 성장을 보일 것으로 예상됩니다. 현재 유럽에서 가장 큰 단일 국가 점유율을 차지하고 있는 국가는 영국으로, 현재 인프라를 기반으로 한 에너지 계량기의 동시 보급으로 인해 영국이 가장 큰 시장 점유율을 차지하고 있습니다.

- 유럽위원회에 따르면, 유럽은 2024년까지 약 2억 2,500만 개의 전력용 스마트미터와 약 5,100만 개의 가스용 스마트미터를 도입할 예정이며, 잠재적 투자 규모는 470억 유로(502억 달러)에 달할 것으로 예상했습니다.

- 또한 유럽위원회는 2024년까지 유럽 소비자의 거의 77%가 전력용 스마트 미터를 보유하게 될 것으로 예상하고 있습니다. 또한, 유럽위원회는 2024년까지 유럽 소비자의 약 77%가 전력용 스마트 미터를 보유하게 될 것으로 예상하고 있습니다.

- 또한 영국 비즈니스, 에너지 및 산업 전략부에 따르면 2021년 주요 전력 및 가스 공급업체는 영국 내 주택 사용자를 위해 약 340만 개의 스마트 미터를 설치했습니다. 이 중 전력용 스마트미터는 약 202만 개, 가스용 스마트미터는 약 142만 개로 전년 대비 약 16% 증가했습니다. 따라서 이러한 요인들이 이 지역의 스마트 가스 시장을 주도하고 있습니다.

스마트 가스 산업 개요

스마트 가스 시장의 경쟁은 완만하고 여러 대기업이 진입하고 있습니다. 시장 점유율은 현재 몇몇 대기업이 시장을 독점하고 있습니다. 그러나 업계 전반의 분석이 발전함에 따라 신규 진입자들이 시장에서의 존재감을 높이고 있으며, 이를 통해 신흥 경제권에서 사업을 확장하고 있습니다.

- 2022년 6월 - ABB 인도는 인도에서 가장 빠르게 성장하는 도시가스 유통 기업 중 하나인 THINK Gas의 전체 네트워크 운영을 자동화할 것이라고 발표했습니다. 또한 이 회사는 방대한 도시가스 네트워크의 효율성, 가용성 및 신뢰성을 극대화하는 디지털 솔루션을 제공한다고 밝혔습니다. 분산된 지점에 여러 원격 단말기를 통합합니다.

- 2022년 1월-Itron, Inc.는 자사의 Intelis 가정용 초음파 가스 계량기가 캐나다 측정국(Measurement Canada)으로부터 캐나다의 초음파 계량기 PS-G-06 잠정 사양을 충족하는 형식 승인을 받았다고 발표했습니다. 회사 측에 따르면, 이는 캐나다 측정국이 승인한 최초의 차단 밸브가 내장된 초음파 가스 계량기라고 합니다.

기타 혜택:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 유리한 정부 규제

- 탄소발자국 절감과 에너지 안보에 대한 요구

- 시장 성장 억제요인

- 사용자수 증가에 의한 데이터 불규칙성

- 고액의 설비 투자

- 업계 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자·소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 기기별

- 자동 검침(AMR) 미터

- 지능형 검침 인프라(AMI) 미터

- 가스 미터 통신 모듈

- 솔루션별

- 감시제어·데이터 수집(SCADA)

- 지리정보 시스템(GIS)

- 기업 자산 관리(EAM)

- 모바일 인력 관리(MWM)

- 미터 데이터 분석

- 가스 누출 감지

- 미터 데이터 관리(MDM)

- 서비스별

- 시스템 통합

- 프로그램 관리

- 설치

- 최종사용자별

- 주택

- 상업·산업

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 개요

- ABB Ltd.

- Elster Group GmbH

- General Electric Company

- Itron, Inc.

- Schneider Electric SE

- Oracle Corporation

- Sensus

- CGI Inc.

- Aclara Technologies LLC

- Aidon Oy

- Capgemini SA

- Badger Meter

제7장 투자 분석

제8장 시장 기회와 향후 동향

ksm 25.01.16The Smart Gas Market is expected to register a CAGR of 5.8% during the forecast period.

Key Highlights

- The increasing need to reduce energy losses and increase energy security are considered significant drivers for the market's growth. Due to the growing number of end-users, collating the data with no irregularities stays challenging in this market.

- Grown gas adoption and numerous regulatory policies rolled out in many areas should be perceived as a growth opportunity for the market. Recently, the EU rolled out many smart gas meters for consumers to save usage expenses for them.

- However, the increased installation costs associated with smart systems are predicted to restrain the market growth. Smart systems are comparatively more costly than the standard equipment installed by most service providers and users. Since these systems use digital components and connectivity systems, allowing them to operate and transmit data, hence, increasing the expense of the solutions like the metering equipment, sensors, analyzers, etc.

- Also, integration challenges involved with deploying smart gas solutions are restraining the adoption of these systems. These systems need help in integration into the existing environments.

- There is a significant growth of smart gas post-COVID-19 in Europe, North America, and Asia Pacific regions for domestic, commercial, and industrial purposes. It is expected to see more over the forecasted period.

Smart Gas Market Trends

The Commercial and Industrial Application to Increase Significantly

- The commercial end-users in the smart gas market are small businesses whose gas consumption requires gas flows and pressure similar to that of the residential segment. The prices for the gases might vary according to the location of the commercial spaces and their availability.

- The cost of the gases for commercial use is generally higher than that for domestic use, further motivating businesses to adopt smart gas solutions like smart gas meters. Commercial enterprises also support the adoption, preferably located in areas with better communication and network infrastructure suitable for smart meter installation.

- Industries generally have a high gas consumption volume, where the applications may vary from their power generation uses and are an essential component for the manufacturing processes. Industries, such as chemical and fertilizer plants, have gases used as core raw materials for production.

- Monitoring and control features in these industries are present through PLC and SCADA interface features. With the sectors slowly transitioning toward industry 5.0 and increasing IoT, the smart gas market is expected to have a positive growth over the forecast period. Industries with high energy costs and gas consumption are supposed to be the early adopters in the market.

- According to UK Department for Business, Energy and Industrial Strategy, the giant energy suppliers had 4.5 thousand smart gas meters installed in non-residential buildings around Great Britain in 2021, which shows an increase of roughly 162 % compared to the previous year.

Europe Expected to Hold a Significant Share

- Europe is expected to show significant growth during the forecast period, owing to the various regulatory policies that led to the positive development of the smart gas market. The United Kingdom currently accounts for the most significant single country share in Europe due to the simultaneous roll-out of energy meters supported by current infrastructure.

- According to the European Commission, around 225 million smart meters for electricity and about 51 million meters for gas will be rolled out in the EU by 2024, representing a potential investment of EUR 47 billion( USD 50.2 billion).

- In addition, the European Commission also stated that by 2024, it is expected that almost 77% of European consumers will have a smart meter for electricity. About 44% of the consumers will have one for gas.

- Moreover, according to UK Department for Business, Energy and Industrial Strategy, in 2021, significant electricity and gas suppliers installed around 3.4 million smart meters for residential users in Great Britain. Out of which, approximately 2.02 million smart electricity meters and about 1.42 million smart gas meters were installed, an increase of roughly 16% compared to the previous year. Therefore such factors are driving the market for smart gas in the region.

Smart Gas Industry Overview

The Smart Gas Market is moderately competitive and includes several significant players. Regarding market share, some of the major players currently dominate the market. However, with the advancement in analytics across the industry, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- June 2022 - ABB India announced the company would automate operations across THINK Gas's entire network, which is one of India's fastest-growing companies in the city gas distribution business. In addition, the company stated it would deliver a digital solution to maximize its expansive city gas network's efficiency, availability, and reliability. It will incorporate multiple remote terminals across distributed locations.

- January 2022 - Itron, Inc. announced that the company's Intelis residential ultrasonic gas meter had received type approval from Measurement Canada, assuring it complies with PS-G-06 provisional specifications for ultrasonic meters in Canada. As the company states, it is the first ultrasonic gas meter with an internal shutoff valve approved by Measurement Canada.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Favorable Government Regulations

- 4.2.2 Need for Reduction Carbon Footprint and Energy Security

- 4.3 Market Restraints

- 4.3.1 Irregularities in Data Due to Increased Number of Users

- 4.3.2 High Capital Expenditure

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Devices

- 5.1.1 Automatic Meter Reading (AMR) Meters

- 5.1.2 Advanced Metering Infrastructure (AMI) Meters

- 5.1.3 Gas Meter Communication Modules

- 5.2 By Solutions

- 5.2.1 Supervisory Control and Data Acquisition (SCADA)

- 5.2.2 Geographical Information System (GIS)

- 5.2.3 Enterprise Asset Management (EAM)

- 5.2.4 Mobile Workforce Management (MWM)

- 5.2.5 Meter Data Analytics

- 5.2.6 Gas Leak Detection

- 5.2.7 Meter Data Management (MDM)

- 5.3 By Services

- 5.3.1 System Integration

- 5.3.2 Program Management

- 5.3.3 Installation

- 5.4 By End-user

- 5.4.1 Residential

- 5.4.2 Commercial & Industrial

- 5.5 Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Latin America

- 5.5.5 Middle-East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Ltd.

- 6.1.2 Elster Group GmbH

- 6.1.3 General Electric Company

- 6.1.4 Itron, Inc.

- 6.1.5 Schneider Electric SE

- 6.1.6 Oracle Corporation

- 6.1.7 Sensus

- 6.1.8 CGI Inc.

- 6.1.9 Aclara Technologies LLC

- 6.1.10 Aidon Oy

- 6.1.11 Capgemini SA

- 6.1.12 Badger Meter

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록