|

시장보고서

상품코드

1628807

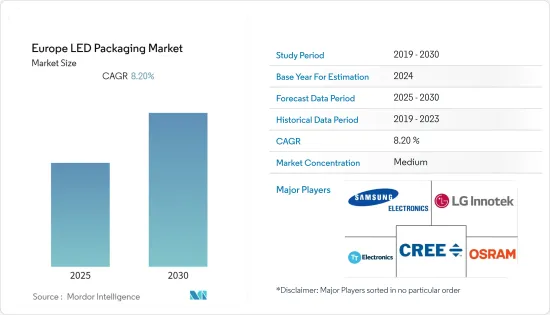

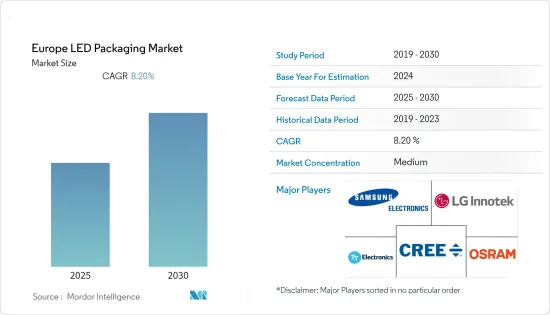

유럽의 LED 패키징 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe LED Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

유럽의 LED 패키징 시장은 예측 기간 동안 8.2%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- LED 패키징 시장의 성장을 주도하는 것은 살균 시스템 전염병으로 인해 효율적인 UV LED 패키지에 대한 수요가 급증하고 있으며, UV LED는 UV 경화 및 생물 의학 연구에도 사용되고 있습니다. 자외선은 UV-A, UV-B, UV-C로 분류됩니다. COVID-19는 UV-C LED에 대한 수요를 증가시키고 있으며, 이 빛은 박테리아와 바이러스의 핵산을 파괴하고 DNA를 파괴하여 살균 효과를 발휘합니다. 현재 UV-C LED는 공기, 물 및 표면 살균 시스템에 사용되어 긴 수명과 신뢰성을 제공합니다.

- 최근 정부의 노력과 규제는 에너지 절약, 효율성 및 환경적 이점으로 인해 LED의 사용을 촉진하고 있습니다. 이에 따라 다재다능하고 복잡한 디자인의 칩을 구현할 수 있는 SMD LED의 시장이 확대되고 있습니다. 조명기구에 사용되는 SMD LED 패키지는 다른 기존 광원에 비해 에너지 효율이 뛰어나 지속적으로 성장하고 있습니다. 이러한 성장은 SMD LED의 가격이 급락하여 소비자들이 쉽게 구매할 수 있는 가격대가 되었기 때문이기도 합니다.

- LED 패키징 시장은 자동차 내부 및 외부 조명에 대한 수요를 주도하고 있으며, LED 패키징 기술의 최신 트렌드는 CSP 기술로, CSP 기술은 기존 LED 패키지보다 높은 광학 밀도, 우수한 루멘 유지율, 색상 안정성, 낮은 전류 소비, 신뢰성 등의 특징으로 인해 최근 자동차 업계에서 최근 자동차 업계에서 그 성장세를 보이고 있습니다.

- 또한, 이 지역의 차량용 디스플레이 시장은 향후 몇 년 동안 큰 폭의 시장 개척이 예상됩니다. 예를 들어, 증강현실 지원 OLED가 차량용 디스플레이 시장에 도입되면서 유럽의 주요 자동차 제조업체 중 일부는 중앙 스택 디스플레이 및 계기판 디스플레이에 대한 수요가 높아짐에 따라 2020년부터 대부분의 차량에 대시보드 및 기타 스크린에 OLED를 통합하기 시작했습니다. 디스플레이를 통합하기 시작했습니다.

- 시장은 가격 경쟁이 심화되고 LED 패키지를 제공하는 제조업체가 증가함에 따라 치열한 경쟁을 목격하고 있습니다. 전 세계 TV 소비자층은 포화상태에 이르렀고, 소비자들은 기대에 부응하는 한 기존 제품을 계속 사용할 것이기 때문에 새로운 기술을 채택한 제품에 대한 수요는 제한적입니다. 또한, LED 패키징 시장에서의 가격 경쟁이 치열해지면서 LED 제조업체들은 혁신적인 조명 솔루션을 개발해야 하는 상황에 직면해 있습니다.

- LED 패키징 사업은 COVID-19의 확산으로 인해 유럽 시장에서 하락세를 보였고, COVID-19의 확산으로 인해 많은 유럽 국가들이 더 엄격한 감염 통제 조치를 취했습니다. 이 시장의 주요 기업 중 일부는 LED 패키징 사업에서 전례 없는 부진을 겪었습니다. 현재 진행 중인 무역 분쟁, 지정학적 불확실성, 자동차 제조업의 지속적인 쇠퇴는 유럽의 LED 패키징 시장의 또 다른 중요한 도전 과제입니다.

유럽의 LED 패키징 시장 동향

주택 분야 수요 증가가 시장 견인

- 주택 부문은 LED와 같은 에너지 효율이 높은 조명에 대한 소비자 수요의 변화로 인해 주택 부문이 주도하고 있습니다. 또한, 최근 정부의 노력과 소비자의 인식이 높아짐에 따라 업계에 큰 영향을 미칠 것으로 예상됩니다.

- 유럽연합(EU)의 주거용 조명 총 소비량은 특히 일부 국가의 복지 향상과 주택 당 램프 수의 급속한 증가로 인해 증가하고 있으며, LED 전구의 효율성과 발광 특성이 빠르게 향상되고 있으며, LED 조명은 미래에 상당한 에너지를 절약 할 수있을 것으로 예상되며, LED 조명의 수명은 기존 조명의 5 배에서 25 배에 달합니다. LED 조명의 수명은 기존 조명의 5배에서 25배에 달합니다.

- 모든 조명 중에서 LED 조명은 큰 비중을 차지하고 있습니다. 각국 정부의 인식 제고와 정책 강화로 LED 보급률이 전 세계적으로 증가하고 있으며, LED의 세계 보급률은 전년 동기 대비 지속적으로 상승하고 있습니다.

- 국제에너지기구에 따르면, 2019년 LED 판매량은 광원(전구, 튜브 전구, 모듈)과 조명기구를 모두 포함하여 100억 개 이상의 기록적인 판매량을 기록할 것으로 예상됩니다. 주거용과 상업용 모두 LED의 도입이 활발히 진행되고 있으며, LED 판매량은 형광등보다 더 많이 판매되고 있습니다. 프랑스 IEA에 따르면, 상업용 건물은 청정에너지로의 전환에 따라 탄소발자국을 최소화할 수 있도록 해야 합니다.

- LED에 대한 관심이 높아짐에 따라 산업계는 지능형 조명 시스템(커넥티드 라이팅)을 도입할 수 있으며, LED는 색상 변화 및 밝기 측면에서 유연성이 높기 때문에 네트워크화된 시스템은 기존 광원보다 LED 사용의 이점을 얻을 가능성이 더 높습니다. 가능성이 높습니다.

동북아 지역 정부의 노력이 시장 성장을 크게 견인

- 2019년 12월 유럽연합 집행위원회는 에너지 효율 및 에너지 라벨에 관한 새로운 규정을 채택했으며, EU 회원국은 비효율적인 할로겐 램프와 소형 형광등을 2021년까지 단계적으로 폐지하고 LED 램프와 조명기구에 대한 최소 성능 및 품질 기준을 도입하기로 결의했습니다. 결의했습니다. 이 규정은 가정용, 상업용, 산업용, 가로등 및 기타 용도에 적용됩니다. 새로운 규정은 2021년 9월 1일부터 시행됩니다.

- 부품 기반 SSL(고체조명)은 LED, OLED, LD를 기반으로 기존 기술에 도전장을 내밀고 있습니다. 이에 따라 단기적으로 모든 전등은 SSL을 기반으로 하고, SSL 시장이 대규모로 확대될 것으로 예상됩니다.

- 영국에서는 영국 정부의 에너지 효율화 프로그램을 통해 LED 조명 시장의 도입이 진행되고 있습니다. 정부는 기존의 전통적인 광원을 LED 램프로 대체하기 위해 다양한 리베이트 및 요금 프로그램을 제공하여 인센티브를 제공하고 있습니다. 정부는 이 프로그램을 시행하기 위해 여러 전력 공급업체와 협력하고 있습니다.

- 스마트 조명 제어 솔루션의 설치 및 사용을 장려하는 정부의 지원과 보조금으로 인해 실외 스마트 조명 애플리케이션 중 가장 큰 시장 점유율을 차지하는 것은 고속도로 및 도로 조명 애플리케이션 분야입니다. 에너지 라벨 리 스케일링은 더 엄격하게 설계되어 처음에는 "A"또는 "B"등급을 획득 할 수있는 제품이 거의 없으며 더 효율적인 제품이 점차 시장에 진입 할 수있는 여지가 남아 있습니다. 이 규정은 기존 재고를 판매하기 위해 기존 라벨을 부착한 제품을 실제 매장에서 계속 판매할 수 있는 18개월의 기간을 규정하고 있습니다.

유럽의 LED 패키징 산업 개요

시장은 공급업체들의 합병과 인수를 목격하고 있으며, 그 결과 기술 발전과 시장 성장을 촉진할 수 있는 유리한 기회를 제공하고 있습니다. 일부 주요 업체들은 라벨링 산업을 위한 새로운 기술과 솔루션에 투자하고 있으며, 이는 시장 투자를 더욱 촉진할 것으로 예상됩니다.

- 2021년 1월 - 오스람 그룹은 칩 스케일 패키지 LED인 Osconiq C 2424를 출시했습니다. 업계 최고의 효율로 실외 조명기구의 효율성과 비용 효율성을 향상시킬 수 있습니다. 또한 수명이 깁니다.

- 2020년 10월-Cree, Inc.는 SMART Global Holdings와 LED 제품 사업부(이하 "Cree LED")를 최대 3억 달러에 매각하기로 합의했다고 발표했습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 에너지 효율적 LED를 채용하기 위한 정부 이니셔티브와 규제

- 스마트 조명 솔루션 수요 증가

- 시장 성장 억제요인

- 시장 경쟁 격화

- 산업 밸류체인 분석

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향 평가

제5장 시장 세분화

- 유형별

- 칩온보드(COB)

- 면 구현 디바이스(SMD)

- 칩 스케일 패키지(CSP)

- 업계별

- 주거용

- 상업용

- 기타 업계별

- 국가별

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

제6장 경쟁 구도

- 기업 개요

- Cree Inc.

- OSRAM Licht AG

- Samsung Electronics Co. Ltd

- LG Innotek

- TT Electronics

- Nichia Corporation

- Seoul Semiconductor Co. Ltd

- Stanley Electric Co. Ltd

- Lumileds Holding BV

- Everlight Electronics Co. Ltd

제7장 투자 분석

제8장 시장 전망

ksm 25.01.16The Europe LED Packaging Market is expected to register a CAGR of 8.2% during the forecast period.

Key Highlights

- The LED packaging market's growth is driven by the surge of demand for efficient UV LED packages amid the pandemic of disinfection systems. UV LEDs are also used in UV curing and biomedical research. UV radiation can be classified into UV-A, UV-B, and UV-C. The pandemic has boosted the demand for UV-C LEDs, with the light having germicidal properties by killing the bacteria and viruses by destroying their nucleic acids and disrupting the DNAs. Currently, UV-C LEDs are used in air, water, and surface disinfection systems while offering longer lifetimes and reliability.

- The recent government initiatives and regulations are promoting the use of LEDs for energy conservation, efficiency, and environmental benefits. This has driven the market for SMD LEDs that are versatile and can accommodate chips with complex designs. SMD LED packages used in luminaires are growing continuously due to the superior energy efficiency of these LEDs compared to other conventional light sources. This growth can also be attributed to the steep fall in the price of SMD LEDs, thereby making them affordable for consumers.

- LED packages market is also driven by the automotive interior and exterior lighting due to the high demand for central stack displays and instrument cluster displays. The latest trend in LED packaging technology is CSP technology, which has gained momentum in recent years in the automotive vertical owing to its features such as high optical density, good lumen maintenance, color stability, reduced current consumption, and reliability over conventional LED packages.

- Additionally, the automotive display market in the region is expected to experience substantial developments in the coming years. For instance, the introduction of augmented reality-enabled OLED in the automotive display market and some of the major automotive manufacturers in Europe have started to integrate OLED displays in dashboards and other screens from 2020 in most of their vehicles due to the high demand for central stack displays and instrument cluster displays.

- The market is witnessing intense competition owing to the surged price pressure and increased number of manufacturers offering these LED packages. The global consumer base for TVs has reached saturation as consumers keep using old products as long as they serve their expectations, resulting in limited demand for new technology-based products. Additionally, the increased pricing competition in the LED packaging market has pressured LED manufacturers to develop innovative lighting solutions.

- The LED packaging business saw a decline in the European Market market due to the COVID-19 pandemic. Many countries in Europe implemented more stringent infection control measures because of the spread of COVID-19. Some of the primary critical players in the market saw an unprecedented slump in the LED packaging business. The ongoing trade disputes, geopolitical uncertainties, and the continued decline in automotive manufacturing are the other crucial challenges in the European LED packaging market.

Europe LED Packaging Market Trends

Increasing Demand from Residential Segment to Drive the Market

- The residential sector is being driven by a shift in consumer demand toward energy-effective lightings, such as LEDs. Moreover, recent government initiatives and growing awareness among consumers expect to impact the industry significantly.

- Total residential lighting consumption in the European Union is increasing, owing to rising welfare, particularly in some countries, and a fast increasing number of lamps per home. The efficacy and luminous properties of LED bulbs are rapidly improving. LED lights are predicted to save a significant amount of energy in the future. LED lamps have a lifespan of 5 to 25 times that of traditional lights.

- Out of all the lighting sources, LED lights hold a significant share. The growing awareness and increasing policies of the various governments have globally increased the penetration rate of LEDs. The global LED penetration is on the continuous surge YoY.

- According to International Energy Agency, the sales of LEDs are reaching at a record number of sales of more than 10 billion units in 2019, including both light sources (bulbs, tubes, modules) and luminaires. Both residential and commercial LED deployment is advancing and LED sales are now exceeding that of fluorescent lamps. According to IEA France, commercial buildings should be in line with the clean energy transition, thereby minimizing the carbon footprint.

- The increasing prominence of LEDs can also lead to intelligent lighting systems (connected lighting) in industries. Because LEDs are more flexible in terms of color change and brightness, networked systems are more likely to profit from the usage of LEDs over traditional lighting sources.

Government Initiatives in the Region is Significantly Driving the Market Growth

- The European Commission adopted new regulations on energy efficiency and energy-labeling in December 2019. EU member states voted to phase out inefficient halogen lamps and compact fluorescent lamps in 2021 while introducing minimum performance and quality standards for LED lamps and luminaires. This regulation applies to applications including household, commercial, industrial and street lighting. The new rules will come into force on September 1, 2021.

- The SSLs (Solid-State Lighting) based on components is based on LEDs, OLEDs, and LDs challenges conventional technologies. It is thereby anticipated that in the short term, all-electric lighting will be based on SSLs, and the market for SSLs will increase on a massive scale.

- The UK Government Energy Efficiency program has increased the adoption of the LED lighting market in the UK. The government incentivizes by offering various rebate and tariff programs to replace existing traditional light sources with the LED lamps; the government has collaborated with multiple electricity providers for the program's implementation.

- One of the most significant market shares is held by the highways & roadways lighting application segment of the outdoor smart lighting application owing to government support and subsidies encouraging the installation and use of smart lighting control solutions. The rescaling of energy labels is stricter and designed, so that very few products are initially able to achieve the "A" and "B" ratings, leaving space for more efficient products to gradually enter the market with the most energy-efficient products currently on the market will typically now be labeled as "C" or "D." The rules provide for an 18-month period where the products bearing the old label can continue to be sold on the market in physical retail outlets to sell the existing stock.

Europe LED Packaging Industry Overview

The market is witnessing mergers and acquisitions by vendors, thereby, offering lucrative opportunities to the companies that enable them to boost technological advancements and market growth. Some of the prominent players in the market are investing in new technologies and solutions for the labeling industry, which is expected to drive the investment in the market further.

- January 2021 - Osram group has launched Osconiq C 2424, a chip scale package LED. Outdoor luminaires may be made more efficient and cost-effective with their industry-leading efficiency. Furthermore, it has a long lifespan.

- October 2020 - Cree, Inc. announced that it had reached a deal with SMART Global Holdings, Inc. to sell its LED Products business unit ('Cree LED') for up to USD 300 million, comprising fixed upfront and deferred payments, as well as contingent consideration.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives and Regulations to Adopt Energy-efficient LEDs

- 4.2.2 Increasing Demand for Smart Lighting Solutions

- 4.3 Market Restraints

- 4.3.1 High Level of Competition into the Market

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Chip-on-board (COB)

- 5.1.2 Surface-mount Device (SMD)

- 5.1.3 Chip Scale Package (CSP)

- 5.2 By End-user Vertical

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Other End-user Verticals

- 5.3 Country

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Italy

- 5.3.5 Spain

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cree Inc.

- 6.1.2 OSRAM Licht AG

- 6.1.3 Samsung Electronics Co. Ltd

- 6.1.4 LG Innotek

- 6.1.5 TT Electronics

- 6.1.6 Nichia Corporation

- 6.1.7 Seoul Semiconductor Co. Ltd

- 6.1.8 Stanley Electric Co. Ltd

- 6.1.9 Lumileds Holding BV

- 6.1.10 Everlight Electronics Co. Ltd

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

샘플 요청 목록