|

시장보고서

상품코드

1629765

북미의 유리 포장 : 시장 점유율 분석, 산업 동향 및 성장 예측(2025-2030년)North America Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

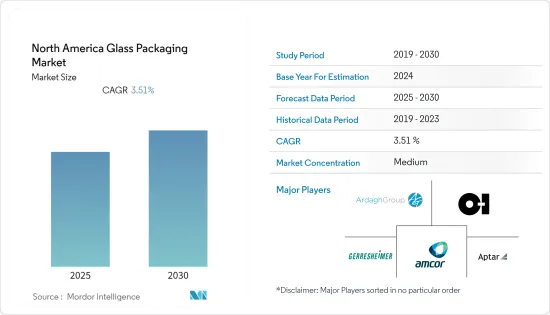

북미의 유리 포장 시장은 예측 기간 동안 CAGR 3.51%를 나타낼 것으로 예상됩니다.

주요 하이라이트

- 미국에서는 알코올 음료가 유리병 부문을 지배하고 있습니다. 증류주와 와인은 유리 용기의 비율이 높지만 맥주 부문은 유리 용기의 비율이 크게 감소했습니다. 반면 무알콜 음료 부문에서는 유리 용기의 비율이 매우 적으며 CSD, 우유 및 새로운 레디 투 드링크 음료에 사용됩니다.

- 2020년 전체 맥주의 82%는 국내에서 생산되고 18%는 세계 100여 개국에서 수입된다(출처: 미국 TTB와 미국 상무부, 2021년). 알코올 음료 시장과 3층 시스템은 해마다 빠르게 발전하고 있으며, 2012년 이후 전국적으로 2,300개 이상의 알코올 음료법이 제정되었습니다(출처: NBWA Industry Affairs, 2021). 이러한 사례는 유리 포장의 주요 채택을 다루고 있습니다.

- 유리 포장은 전체 알코올 음료 시장에서 큰 비중을 차지하고 있기 때문에 알코올 음료 수요가 지속적으로 증가함에 따라 유리 병 시장은 예측 기간 동안 증가할 것으로 예상되며, 2020년11월하이브리드 포장 공급업체 인 Berlin Packaging은 포장 공급업체 인 Consolidated Bottle을 인수했습니다. 공급업체 Consolidated Bottle을 인수하여 캐나다에서 입지를 확대했습니다. 통합된 사업은 고객에게 더 많은 포장 솔루션과 부가가치 서비스를 제공함으로써 캐나다의 유리병 수요 증가에 대응할 수 있을 것으로 기대됩니다.

- 소비자의 음주량은 세계 평균보다 약 50% 더 많으며, 캐나다 성인의 약 78%가 지난 1년 동안 술을 마셨다고 보고했습니다. 남성은 여성보다 술을 더 많이 마시고, 젊은 층은 노인보다 지난 1년간 더 많이 마셨으며, 2019/2020년 총 알코올 판매량은 0.2% 증가한 31억 1,600만 리터로 캐나다 통계청 자료에 따르면 캐나다 법정 음주 연령 이상 1인당 주당 9.5잔의 표준 음주량에 해당합니다. 표준 음주량에 해당합니다.

북미의 유리 포장 시장 동향

알코올 음료가 큰 시장 점유율을 차지할 것으로 예상

- Brewer's Associations에 따르면, 2020년 미국 내 수제 맥주 포장재 중 알루미늄이 81%, 유리가 19%를 차지할 것으로 예상됩니다.

- 7-12온스 같은 작은 병은 유리병 맥주 용량의 90% 이상을 차지하며 병맥주 용량의 점유율을 계속 확대하고 있습니다. 대형 병은 최근 몇 년동안 점유율이 떨어지고 있습니다. 몇년전까지만 해도 식료품점, 주류 판매점 등 많은 외부 소매점들은 22온스나 750ml와 같은 큰 병을 위한 공간을 대폭 확대했습니다. 그러나 소매업체들은 더 빠른 속도로 이동하는 포장재에 더 많은 공간을 할애하고 있습니다.

- 와인 글라스 포장 제조업체는 최신 트렌드에 발맞추어 제품을 혁신하고 있습니다. 예를 들어, 2020년 9월 Ardagh Group, Glass, North America(Ardagh Group의 사업부이자 미국 증류주 시장용 유리병의 국내 제조업체인 Ardagh Group, Glass, North America)는 가족 소유의 독립 증류주 공급업체인 Heaven Hill Brands와 미국 내 프리미엄 증류주 병을 미국에서 생산하기 위한 장기 공급 계약을 체결했습니다.

- 시장 성장을 이끄는 주요 요인 중 하나는 캐나다의 맥주 소비량으로, Beer Canada에 따르면 2020년 총 맥주 소비량은 2,112만 헥토리터에 달했습니다. 그러나 2019년과 비교했을 때, 2019년부터 2020년까지 캐나다의 캔맥주 판매량은 12.3% 증가한 반면 병맥주 판매량은 15.1% 감소했습니다. 이는 코로나19 팬데믹 기간 동안 시장 성장에 어려움을 겪었습니다.

- 또한, 2019/2020 회계연도 와인 매출은 5.2% 증가한 7.8억 캐나다 달러로 지난 8년 동안 가장 큰 성장률을 기록했습니다. 지난해 캐나다 대부분의 지역에서 맥주가 주류로 선택된 반면, 퀘벡(전체 매출의 44.0%)과 브리티시컬럼비아(34.3%)에서는 와인이 1위를 차지했습니다. 그러나 서스캐처원 주민(15.2%)은 와인을 구매하는 경향이 가장 낮은 것으로 나타났습니다(출처: 캐나다 통계청).

바이알이 큰 시장 점유율을 차지할 것으로 예상

- 미국 의약품 규제 당국은 각 회사에 더 큰 바이알로 코로나19 백신 생산을 가속화할 수 있는 권한을 부여했습니다. 미국 식품의약국(FDA)은 또한 백신 제조업체가 현재 바이알에서 최대 11회분까지 추출할 수 있도록 허용했습니다. 또한 2021년 4월, 미국 의약품 규제 당국은 Moderna Inc.가 코로나19 백신 생산 속도를 높이기 위해 한 바이알에 최대 15회 분량을 채울 수 있도록 허가했습니다.

- 또한 2020년 6월, 미국 정부 바이오메디컬 첨단연구개발청(Biomedical Advanced Research and Development Authority, BARDA)은 코로나19 백신용 유리 바이알의 국내 생산 능력을 확대하기 위해 코닝에 2억 4,000만 달러(한화 약 2,400억원)를 지원했습니다. 미화 2억 4,000만 달러를 수여했습니다.

- 마찬가지로 2020년 6월 SiO2는 미국 정부로부터 미화 1억 4,300만 달러 상당의 계약을 체결하여 생산 능력을 4억 용량으로 확대했습니다. 이 회사는 2021년 4월까지 국내 우선 공급을 위해 1억 2천만 바이알, 10억 바이알을 공급할 계획입니다. 이 회사는 최근 앨라배마 주 오번(Auburn, Alabama)에 위치한 제조 공장의 미화 1억 6,300만 달러 규모의 확장도 발표했습니다.

- 캐나다 정부는 몬트리올의 로열 마운트 공장에 인접한 새로운 바이오 제조 시설의 설계, 건설, 시운전 및 인증에 약 1억 2,600만 달러를 투자했습니다. 바이오 의약품 제조 센터라고 불리는 이 새로운 바이오 의약품 제조 시설은 백신 및 기타 바이오 의약품 제조를 지원할 예정입니다. 이를 통해 이 지역의 바이알 병에 대한 수요가 증가할 것으로 예상됩니다.

북미의 유리 포장 산업 개요

북미의 유리 포장 산업은 적당히 통합되어 있으며, 상당한 수의 지역적 및 세계 진입자가 존재합니다. 기술 혁신은 제품 제공과 음료에 대한 투자 증가로 시장을 주도하고 있습니다.

- 2021년 10월 - Owens-Illinois Glass Inc.와 독일의 Krones AG는 확대되는 유리 시장을 위해 공동 혁신을 통해 유리를 설계하는 전략적 제휴를 체결했습니다. 협약의 중점 분야에는 유리 충전 및 포장 라인의 속도와 효율성 향상, 혁신적이고 지속 가능한 유리 시스템 개발, 시장 동향에 대한 대응력과 유연성 강화, 유리 직접 디지털 인쇄 기술과 같은 디지털 솔루션의 발전이 포함됩니다.

- 2021년 2월 - Ardagh Group은 Absolut의 최신 한정판 보드카 병 'Absolut Movement'를 출시했습니다. 프로스트 블루 컬러의 유리병은 16개의 소용돌이로 이루어진 나선형 디자인으로 끝없는 변화의 순환을 상징하는 16개의 소용돌이가 위로 향하는 디자인을 가지고 있습니다. 소용돌이의 상향 흐름은 사회의 성장을 의미합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 산업 밸류체인 분석

- COVID-19유리 포장 시장에 대한 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

제6장 시장 세분화

- 유형별

- 보틀 및 용기

- 바이알

- 앰플

- 시린지 및 카트리지

- 산업별

- 식품

- 음료

- 소프트드링크

- 우유

- 주류

- 기타 음료

- 화장품 및 향료

- 의약품

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 개요

- Owens Illinois Inc.

- Amcor Limited

- Ardagh Packaging Group PLC

- Piramal Glass Ltd.

- Gerresheimer AG

- Sonoco Products Company

- Reynolds Packaging

- Gallo Glass Co.

- AptarGroup

- Vitro SAB DE CV

제8장 투자 분석

제9장 시장의 미래

LSH 25.01.22The North America Glass Packaging Market is expected to register a CAGR of 3.51% during the forecast period.

Key Highlights

- Alcoholic beverages dominated the glass bottles segment in the United States. A high percentage of distilled spirits and wines are packaged using glass containers, while in the beer segment, the percentage of glass containers has decreased significantly. On the other hand, in the non-alcoholic segment, glass holds a tiny percentage and is used in CSDs, milk, and newer ready-to-drink beverages.

- In 2020, 82% of all beer was domestically produced, and 18% was imported from more than 100 different countries around the world (source: U.S. TTB and U.S. Commerce Department, 2021). The alcohol beverage marketplace and the three-tier system have evolved rapidly over the years. Since 2012, over 2,300 alcohol beverage laws have been passed around the country (Source: NBWA Industry Affairs, 2021). Such instances address the major adoption of glass packaging.

- Glass packaging has a significant share in the overall alcoholic beverage market, and hence, with the ongoing increase in demand for alcoholic beverages, the market for glass bottles is expected to increase in the forecast period. In November 2020, Hybrid packaging supplier Berlin Packaging expanded its Canadian presence with the acquisition of packaging supplier Consolidated Bottle. The combined businesses are expected to offer even more packaging solutions and value-added services to their customers, thereby catering to the growing demand for glass bottles in the country.

- The consumer drinks about 50% more than the worldwide average, and about 78% of Canadian adults report having consumed alcohol in the past year. Men drink more than women, and young adults are more likely to be past-year drinkers than older adults. The total volume of alcohol sold increased by 0.2% to 3,116 million liters in 2019/2020, which is equivalent to 9.5 standard drinks per week per person over the legal drinking age in Canada as per the data from Statistics Canada.

North America Glass Packaging Market Trends

Alcoholic Beverages Expected to Witness Significant Market Share

- According to Brewer's Associations, in 2020, the percentage of package market for US craft beer packaging indicated that aluminum could take 81% share whereas glass packaging took 19%.

- Smaller-sized bottles, such as those of 7-12 ounces, compose more than 90% of beer volume in glass bottles and continue to gain a share of bottled beer volume. Large-format bottles have lost their share in recent years. A few years ago, many off-premise retailers like grocery and liquor stores greatly expanded their space dedicated to large bottles such as 22 ounce or 750 milliliters. However, retailers are increasingly reallocating space to faster-moving packages.

- Wine glass packaging manufacturers are innovating their offerings keeping in pace with the latest trends. For instance, in September 2020, Ardagh Group, Glass, North America, a business division of Ardagh Group and the domestic manufacturer of glass bottles for the US spirits market, confirmed a long-term supply agreement with Heaven Hill Brands, the independent, family-owned, and operated distilled spirits supplier, to manufacture its premium spirits bottles in the United States.

- One of the main factors driving the growth of the market is beer consumption in the country. According to Beer Canada, the total beer sales accounted for 21.12 million hectoliters in 2020. However, the sale has fallen as compared to the year 2019. From 2019 to 2020, sales of canned beers grew by 12.3 %, while bottled beer sales decreased by 15.1 % in Canada. This challenged the market growth during a COVID-19 pandemic.

- Moreover, wine sales rose 5.2% to CAD 7.8 billion in FY 2019/2020, which is the largest increase in eight years. While beer was the alcoholic beverage of choice across much of Canada last year, wine claimed the top spot in Quebec (44.0% of total sales) and British Columbia (34.3%). However, residents of Saskatchewan (15.2%) were least likely to buy wine (source: Statistics Canada).

Vials Expected to Witness Significant Market Share

- The US Drug Regulator gave clearance to various companies to speed up COVID-19 vaccine output with bigger vials. The US Food and Drug Administration (FDA) also authorized vaccinators to extract a maximum of 11 doses from the current vials. Further, In April 2021, the US drug regulator gave Moderna Inc. the clearance to speed up the output of its COVID-19 vaccine by letting it fill a single vial with up to 15 doses.

- In addition, In June 2020, the US government's Biomedical Advanced Research and Development Authority (BARDA) awarded USD 204 million to Corning to expand its domestic manufacturing capacity for glass vials for COVID-19 vaccines.

- Similarly, In June 2020. SiO2 received a contract worth USD 143 million from the US government to scale up its manufacturing capacity to 400 million doses. The company is expected to provide 120 million vials for domestic priorities and 1 billion vials by April 2021. The company also recently announced a USD 163 million expansion of its manufacturing plant in Auburn, Alabama.

- The Government of Canada invested around USD 126 million to design, construct, commission, and qualify a new biomanufacturing facility adjacent to its Royalmount site in Montreal. The new biomanufacturing facility, called the Biologics Manufacturing Centre, will support the manufacturing of vaccines and other biologics. This is expected to boost the demand for vials in the region.

North America Glass Packaging Industry Overview

The North America Glass Packaging is moderately consolidated, with a considerable number of regional and global players. The innovation drives the market in the product offerings and increasing investments in beverages.

- October 2021: Owens-Illinois Glass Inc. and Krones AG of Germany signed a strategic collaboration to design glass through collaborative innovation for the expanding glass market. The focus areas of the agreement would include improvements in glass filling and the speed and efficiency of packaging lines, development of innovative and sustainable glass systems, enhanced agility and flexibility of responding to market trends, and advancements in digital solutions, such as direct-to-glass digital printing technology.

- February 2021 - Ardagh Group launched Absolut's latest limited-edition vodka bottle, 'Absolut Movement,' to inspire people in celebration of inclusivity. The frosted blue glass bottle features an upward spiral design of 16 swirls, symbolic of the never-ending cycle of change. The upward flow of the swirling spiral indicates social growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of the COVID-19 on the Glass Packaging Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Demand from the Food and Beverage Industry and Emergence of Premium Packaging

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.2 Market Restraints

- 5.2.1 High Competition from Substitute Packaging Solutions

- 5.2.2 Usage of Substitute Products (Plastic)

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Bottles and Containers

- 6.1.2 Vials

- 6.1.3 Ampoules

- 6.1.4 Syringe and Cartridges

- 6.2 By End-User Vertical

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.2.1 Soft Drinks

- 6.2.2.2 Milk

- 6.2.2.3 Alcoholic Beverages

- 6.2.2.4 Other Beverages

- 6.2.3 Cosmetics and Prefumery

- 6.2.4 Pharmaceuticals

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Owens Illinois Inc.

- 7.1.2 Amcor Limited

- 7.1.3 Ardagh Packaging Group PLC

- 7.1.4 Piramal Glass Ltd.

- 7.1.5 Gerresheimer AG

- 7.1.6 Sonoco Products Company

- 7.1.7 Reynolds Packaging

- 7.1.8 Gallo Glass Co.

- 7.1.9 AptarGroup

- 7.1.10 Vitro SAB DE CV

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록