|

시장보고서

상품코드

1629770

중동 및 아프리카의 플라스틱 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Middle East And Africa Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

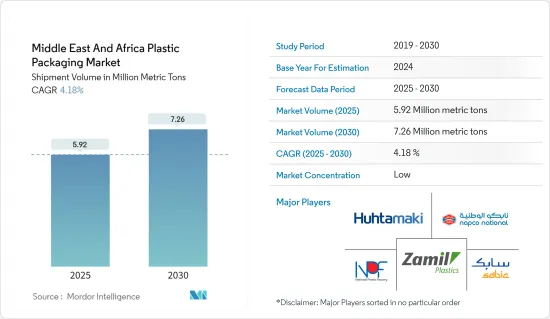

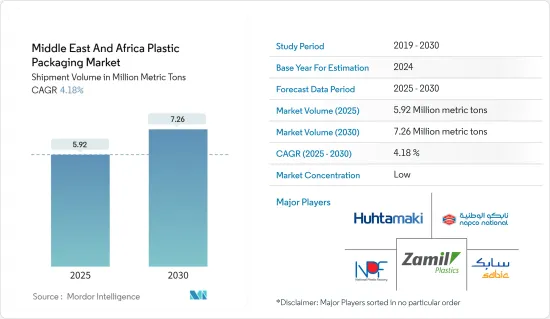

중동 및 아프리카의 플라스틱 포장 시장 규모는 출하량 기준으로 2025년 592만 톤에서 2030년 726만 톤으로 확대될 것이며, 예측 기간(2025-2030년) 동안 4.18%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 소비자의 취향이 점점 더 건강 지향적이고 지속가능한 제품으로 바뀌고 중동 및 아프리카의 규제가 진화함에 따라 플라스틱 포장 전문가들은 기술 혁신에 대한 압력을 느끼고 있습니다. 이러한 수요 변화에 맞춰 재료, 디자인, 기술을 조정하고 있습니다.

- 음료 부문은 생수와 청량음료의 소비 증가에 힘입어 플라스틱 포장의 주요 최종사용자로 부상하고 있습니다. 아랍에미리트와 이집트 연구진의 최근 조사에 따르면, 이러한 경향이 두드러지게 나타나고 있습니다. 아랍에미리트의 엄격한 수질 기준에도 불구하고, UAE에서는 80% 이상의 참가자가 생수를 선택했습니다.

- 산화 분해성 플라스틱은 증가 추세에 있습니다. 아랍에미리트, 사우디아라비아, 예멘, 코트디부아르, 남아프리카공화국, 가나, 토고 등 중동 및 아프리카 국가들은 산화분해성 플라스틱을 권장할 뿐만 아니라 사용을 의무화하는 국가도 있습니다.

- 동아프리카와 서아프리카는 국내 경제가 호황을 누리고, 소비 시장이 급성장하고, 소득이 증가하고, 젊은 층이 증가함에 따라 이 대륙은 플라스틱 포장 산업의 매우 중요한 거점으로 부상하고 있습니다.

- 지역 정부 기관은 탄소 배출과 에너지 소비를 줄이기 위한 프로젝트를 지원하고 있으며, 이는 시장의 전망을 밝게 하고 있습니다. 예를 들어, 2024년 2월 카타르 지방 자치부(MoM)는 현지 재활용 공장에 재활용 가능한 재료를 무료로 제공하기 시작하면서 지속가능성과 순환 경제에 대한 약속을 강조했습니다.

- 또 다른 움직임으로 2023년 12월, 플라스틱 폐기물 퇴치 동맹은 두바이의 사우디 투자 재활용 회사(Saudi Investment Recycling Company, SIRC)와 양해각서를 체결하였습니다. 이 전략적 제휴는 사우디아라비아에서 효과적인 폐기물 관리 솔루션을 개발하고 특히 특정 플라스틱과 관련된 문제를 해결하는 것을 목표로 합니다.

- 신소재는 점차 기존 플라스틱을 대체하고 있으며, 이는 시장 공급업체들에게 도전이 되고 있습니다. 또한, 환경에 대한 관심 증가와 종이로 만든 포장재와 같은 지속가능한 포장재에 대한 수요 증가는 시장 성장에 걸림돌이 될 수 있습니다.

중동 및 아프리카의 플라스틱 포장 시장 동향

소프트 패키징은 괄목할 만한 성장을 이룰 것으로 예상

- 중동 및 아프리카에서는 사우디아라비아, 아랍에미리트, 이집트 등의 국가들이 의약품 포장에 대한 수요 증가를 주도하고 있습니다. 이러한 집중적인 노력과 다양한 산업 분야에서 연질 플라스틱 솔루션, 특히 파우치에 대한 수요 증가로 인해 시장 확대가 가속화되고 있습니다.

- 구조화된 포장에 대한 수요가 증가함에 따라 이 부문은 예측 기간 동안 상당한 물량 성장을 보일 것으로 예상됩니다. 또한 육류 및 유제품 소비가 증가함에 따라 플라스틱 포장에 대한 수요도 증가할 것입니다. 이러한 모든 요인들이 연질 플라스틱 포장 시장의 급격한 성장에 기여하고 있습니다.

- 중동 플라스틱 가방 및 파우치 제조업체는 원유 및 폴리프로필렌과 같은 비용 효율적인 원료 및 원료를 사용할 수 있다는 이점이 있습니다. 이러한 장점은 플라스틱 파우치의 현지 생산과 E-Commerce에서의 사용을 촉진합니다.

- 아랍에미레이트의 소비자 식품 선호도 변화는 포장 산업, 특히 식음료 산업에 큰 성장 기회를 가져다주고 있습니다. 아랍에미리트 금융 기관인 Alpen Capital의 보고서에 따르면, 중동 및 아프리카의 식품 산업은 전략적 위치와 지역 인구 증가로 인해 성장할 것으로 추정됩니다. 팬데믹 이후 온라인 식품 배송이 급증하면서 랩, 슬리브, 라벨과 같은 연포장재에 대한 수요가 증가하여 산업 성장을 주도하고 있습니다.

- 또한 국내 식품 가공 산업의 성장이 플라스틱 포장에 대한 수요를 주도하고 있습니다. 아랍에미리트에는 약 568개의 식음료 가공업체가 운영되고 있으며, 연간 596만 톤의 플라스틱 포장재를 생산하여 플라스틱 포장재 수요를 증가시키고 있습니다. 또한 관광객 증가, 소비자 선호도 변화, 인구의 소비 능력 증가로 인해 외식 산업이 증가하고 있으며, 이는 향후 몇 년 동안 시장 성장을 촉진할 가능성이 높습니다.

사우디아라비아의 괄목할 만한 성장 전망

- 사우디아라비아는 중동의 포장 산업에서 압도적인 존재감을 보이고 있습니다. 유명한 석유 및 가스 부문뿐만 아니라 다양한 산업 활동을 자랑하며 플라스틱 포장에 대한 연간 수요가 급증하고 있습니다.

- 세계적인 유가 하락에 따라 사우디는 비석유 부문의 강화가 시급하다는 것을 인식하고 있습니다. 이를 위해 사우디는 국가 산업 개발 및 물류 프로그램(NIDLP), 비전 2030 등 산업 생산 확대를 위한 여러 계획과 규제 개혁을 추진하고 있습니다.

- 사우디아라비아는 플라스틱 소비량에서 GCC를 선도하고 있습니다. 최근 GPCA의 추정에 따르면 1인당 플라스틱 소비량이 95kg을 초과하여 GCC 최고의 플라스틱 소비국임을 강조하고 있습니다. 또한, 관광 및 교육 목적으로 서유럽 문화에 대한 수용이 확대되고 있어 시장을 더욱 활성화할 수 있는 여건이 조성되고 있습니다. 푸드몰과 푸드코트의 인기가 급증하고 있는 것도 이러한 성장 궤도를 더욱 강조하고 있습니다.

- 또한, 조리식품 및 냉동식품 부문은 소비 전 최소한의 준비만 필요하거나 준비가 필요 없는 조리된 식품을 포함합니다. 중동 국가, 특히 아랍에미리트와 사우디아라비아에서는 빠르게 변화하는 도시 생활과 다양한 문화의 영향으로 이 부문의 인기가 높아지고 있습니다.

- 사우디아라비아의 가공육, 수산물 및 대체 육류 시장은 성장하고 있으며, 2023년 시장 규모는 약 1,499.10톤으로 2027년에는 약 1,839.50톤으로 증가할 것으로 예상되며, 이는 가공육에 대한 소비자 선호도의 변화와 증가를 반영하고 있습니다.

중동 및 아프리카의 플라스틱 포장 산업 개요

중동 및 아프리카의 플라스틱 포장 시장은 세분화되어 있으며, 여러 기업이 지역별로 사업을 전개하고 있습니다. 시장의 주요 업체들은 제품 혁신, 파트너십 등의 전략을 통해 시장 진입을 확대하고 경쟁을 유지하기 위해 노력하고 있습니다. 주요 시장 참여자로는 SABIC, Zamil Plastic Industries Co., Huhtamaki Flexibles UAE(Huhtamaki Oyj), National Plastic Factory LLC, Napco Group(Napco National) 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 재활용과 지속가능성 상황

- 산업 규제와 시책과 기준

- 수출입 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 산화 분해성 플라스틱 수요

- 가공식품 수요 꾸준한 증가

- 시장 과제

- 재활용과 안전한 폐기를 둘러싼 환경에 대한 우려

- 높은 원료 비용과 한정된 재활용 인프라

제6장 시장 세분화

- 경질 플라스틱 포장

- 재료 유형별

- 폴리에틸렌(PE)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리프로필렌(PP)

- 폴리스티렌(PS)과 발포 폴리스티렌(EPS)

- 폴리염화비닐(PVC)

- 기타

- 제품 유형별

- 보틀과 자

- 트레이·용기

- 뚜껑 및 마개

- 기타

- 최종 이용 산업별

- 식품

- 음료

- 의료

- 화장품·퍼스널케어

- 가정관리용품

- 기타 최종 이용 산업(산업, E-Commerce, 기타)

- 재료 유형별

- 연질 플라스틱 포장

- 재료 유형별

- 폴리에틸렌(PE)

- 이축연신 폴리프로필렌(BOPP)

- 캐스트 폴리프로필렌(CPP)

- 폴리염화비닐(PVC)

- 에틸렌 비닐 알코올(EVOH)

- 기타

- 제품 유형별

- 파우치

- 백

- 필름 및 랩

- 기타

- 최종 이용 산업별

- 식품

- 음료

- 의료

- 화장품·퍼스널케어

- 가정관리용품

- 기타 최종 이용 산업(산업, E-Commerce, 기타)

- 재료 유형별

- 국가별

- 아랍에미리트

- 사우디아라비아

- 이집트

- 남아프리카공화국

제7장 경쟁 구도

- 기업 개요

- Zamil Plastic Industries Co.

- Takween Advanced Industries

- Packaging Products Company(PPC)

- PrimePak Industries Nigeria Ltd(Enpee Group)

- Constantia Flexibles Afripack

- Huhtamaki South Africa(Pty) Ltd

- Al Bayader International(H&H Group of Companies)

- Napco National

- Falcon Pack

- Arabian Flexible Packaging LLC

- Hotpack Packaging Industries LLC

- ENPI Group

- Gulf East Paper and Plastic Industries LLC

- 히트맵 분석

제8장 투자 분석

제9장 시장 기회와 향후 동향

ksm 25.01.23The Middle East And Africa Plastic Packaging Market size in terms of shipment volume is expected to grow from 5.92 million metric tons in 2025 to 7.26 million metric tons by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- As consumer preferences increasingly lean towards health-conscious and sustainable products, and with evolving regulations in the Middle East and Africa, professionals in plastic packaging are feeling the pressure to innovate. They are adjusting materials, designs, and technologies to align with these shifting demands.

- The beverage sector, buoyed by a rise in bottled water and soft drink consumption, emerges as the dominant end-user of plastic packaging. A recent study by researchers from the UAE and Egypt unveiled a striking trend: even with the UAE's stringent municipal water quality standards, over 80% of participants opted for bottled plain drinking water.

- Oxo-degradable plastics are on the rise. Countries in the Middle East and Africa, such as the UAE, Saudi Arabia, Yemen, Ivory Coast, South Africa, Ghana, and Togo, are not only endorsing oxo-degradable plastics but some have even made their use mandatory.

- With East and West Africa witnessing booming domestic economies, a surge in consumer markets, rising incomes, and a youthful demographic, the continent is emerging as a pivotal hub for the plastic packaging industry.

- Regional government agencies are backing projects aimed at curbing carbon emissions and energy consumption, signaling a positive outlook for the market. For example, in February 2024, Qatar's Ministry of Municipality (MoM) began offering recyclable materials at no cost to local recycling factories, underscoring their commitment to sustainability and a circular economy.

- In another move, December 2023 saw the Alliance to End Plastic Waste ink a Memorandum of Understanding (MoU) with Saudi Investment Recycling Company (SIRC) in Dubai. This strategic collaboration is set to roll out effective waste management solutions in Saudi Arabia, specifically addressing challenges linked to certain plastics.

- New materials, set to gradually take the place of conventional plastics, present a challenge for market vendors. Furthermore, growing environmental concerns and a rising demand for sustainable packaging, such as those crafted from paper, could pose hurdles to the market's growth.

Middle East And Africa Plastic Packaging Market Trends

Flexible Packaging is Expected to Witness Significant Growth

- Countries like Saudi Arabia, the United Arab Emirates and Egypt are primarily fueling the rising demand for pharmaceutical packaging in the Middle East and Africa. This emphasis and a growing demand for flexible plastic solutions, particularly pouches across various industries, propel the market's expansion.

- With a rising demand for structured packaging, the sector is poised for significant volume growth during the forecast period. Furthermore, as meat and dairy consumption increases, so will the demand for plastic packaging. All these factors contribute to the burgeoning market for flexible plastic packaging.

- Middle Eastern manufacturers of plastic bags and pouches are expected to benefit from access to cost-effective feedstock and raw materials, such as crude oil and polypropylene. This advantage bolsters the local production of plastic pouches and their use in e-commerce.

- The changing consumer food preferences in the United Arab Emirates have created significant growth opportunities in the packaging industry, especially for the food and beverage industry. According to report by Alpen Capital, a financial institute in United Arab Emirates, the food industry in the Middle East and African region is estimated to grow due to its strategic location and region's growing population. Post-pandemic, the surge in online food delivery has enhanced the demand for flexible packaging such as wraps, sleeves , labels and others, which is driving industry growth.

- Additionally, growth in the food processing industry in the country drives the demand for plastic packaging. Around 568 food and beverage processors operate across the United Arab Emirates, producing 5.96 million metric tonnes annually, boosting the demand for plastic packaging in the country. Also, the rise in the food service industry in the country due to a boost in tourism, changing consumer preferences, and the growing spending capacity of the population is likely to boost the market growth in the coming years.

Saudi Arabia is Expected to Witness Significant Growth

- Saudi Arabia stands out as a dominant player in the Middle Eastern packaging industry. Beyond its renowned oil and gas sector, the nation boasts a diverse array of industrial activities, fueling a surging annual demand for plastic packaging.

- In light of declining global crude oil prices, Saudi Arabia recognizes the imperative to bolster its non-oil sector. To this end, the nation has rolled out several initiatives and regulatory reforms, including the National Industrial Development and Logistics Program (NIDLP) and Vision 2030, aiming to amplify industrial production.

- Saudi Arabia leads the GCC in plastic consumption. Recent GPCA estimates highlight a per capita plastic consumption exceeding 95 kg, underscoring its position as the GCC's top plastic consumer. Additionally, a growing embrace of Western culture, spurred by tourism and educational pursuits, is poised to further energize the market. The burgeoning popularity of food malls and courts further underscores this growth trajectory.

- Furthermore, the ready-to-eat meals and frozen food segment offers prepared food that requires minimal or no preparation before consumption. This segment is gaining popularity in Middle Eastern countries, particularly in the United Arab Emirates and Saudi Arabia, due to the fast-paced urban lifestyle and diverse cultural influences.

- The Saudi Arabian market for processed meat, seafood, and meat alternatives is experiencing growth. In 2023, the market volume was approximately 1,499.10 metric tons. Projections indicate an increase to about 1,839.50 metric tons by 2027, reflecting the country's changing and growing consumer preferences for processed meat.

Middle East And Africa Plastic Packaging Industry Overview

The Middle East and Africa Plastic Packaging Market is fragmented in nature, with multiple players in the market operating regionally. The major vendors in the market adopt strategies such as product innovation and partnerships, among others, to expand their reach and stay competitive in the market. Some of the major players in the market are SABIC, Zamil Plastic Industries Co., and Huhtamaki Flexibles UAE (Huhtamaki Oyj), National Plastic Factory LLC, Napco Group (Napco National), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Recycling and Sustainability Landscape

- 4.5 Industry Regulation, Policy and Standards

- 4.6 Import-Export Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Oxo-Degradable Plastics

- 5.1.2 Steady Rise in Demand for Processing Food

- 5.2 Market Challenges

- 5.2.1 Environmental Concerns over Recycling and Safe Disposal

- 5.2.2 High Raw Material Costs and Limited Recycling Infrastructure

6 MARKET SEGMENTATION

- 6.1 Rigid Plastic Packaging

- 6.1.1 By Material Type

- 6.1.1.1 Polyethylene (PE)

- 6.1.1.2 Polyethylene Terephthalate (PET)

- 6.1.1.3 Polypropylene (PP)

- 6.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 6.1.1.5 Polyvinyl Chloride (PVC)

- 6.1.1.6 Other Material Types

- 6.1.2 By Product Type

- 6.1.2.1 Bottles and Jars

- 6.1.2.2 Trays and containers

- 6.1.2.3 Caps and Closures

- 6.1.2.4 Other Product Types

- 6.1.3 By End-User Industry

- 6.1.3.1 Food

- 6.1.3.2 Beverage

- 6.1.3.3 Healthcare

- 6.1.3.4 Cosmetics and Personal Care

- 6.1.3.5 Household Care

- 6.1.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.1.1 By Material Type

- 6.2 Flexible Plastic Packaging

- 6.2.1 By Material Type

- 6.2.1.1 Polyethylene (PE)

- 6.2.1.2 Bi-Orientated Polypropylene (BOPP)

- 6.2.1.3 Cast Polypropylene (CPP)

- 6.2.1.4 Polyvinyl Chloride (PVC)

- 6.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.2.1.6 Other Material Types

- 6.2.2 By Product Type

- 6.2.2.1 Pouches

- 6.2.2.2 Bags

- 6.2.2.3 Films & Wraps

- 6.2.2.4 Other Product Types

- 6.2.3 By End-User Industry

- 6.2.3.1 Food

- 6.2.3.2 Beverage

- 6.2.3.3 Healthcare

- 6.2.3.4 Cosmetics and Personal Care

- 6.2.3.5 Household Care

- 6.2.3.6 Other End-User Industries (Industrial, E-Commerce, Among Others)

- 6.2.1 By Material Type

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Zamil Plastic Industries Co.

- 7.1.2 Takween Advanced Industries

- 7.1.3 Packaging Products Company (PPC)

- 7.1.4 PrimePak Industries Nigeria Ltd (Enpee Group)

- 7.1.5 Constantia Flexibles Afripack

- 7.1.6 Huhtamaki South Africa (Pty) Ltd

- 7.1.7 Al Bayader International (H&H Group of Companies

- 7.1.8 Napco National

- 7.1.9 Falcon Pack

- 7.1.10 Arabian Flexible Packaging LLC

- 7.1.11 Hotpack Packaging Industries LLC

- 7.1.12 ENPI Group

- 7.1.13 Gulf East Paper and Plastic Industries LLC

- 7.2 Heat Map Analysis