|

시장보고서

상품코드

1629779

미국의 음향 센서 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)US Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

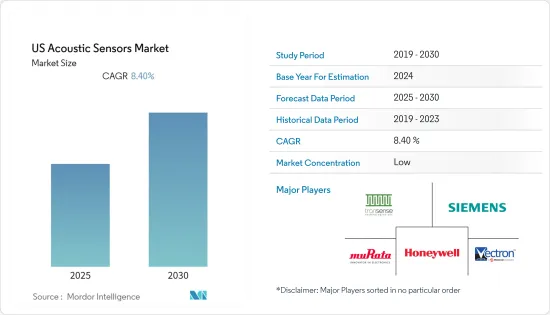

미국의 음향 센서 시장은 예측 기간 동안 CAGR 8.4%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 미국은 음향 센서에 대한 수요와 제조가 증가함에 따라 세계 SWA 센서 시장의 주요 혁신가이자 투자자 중 하나입니다. 이 지역의 최종사용자 산업은 첨단 기술에 대한 투자와 저비용 부품에 대한 채택을 늘리고 있으며, 이는 이 지역의 SAW 센서의 범위를 확장하고 있습니다.

- 또한, 세계 시장의 주요 벤더 대부분이 미국에 기반을 두고 있어 이 지역이 조사 시장에서 우위를 점하고 있습니다. 또한, 이들 지역 업체들은 대부분 제품 혁신과 기술 발전 측면에서 세계 경쟁사들을 크게 앞서고 있으며, 이는 세계 시장과 함께 지역 시장의 성장에 기여하고 있습니다. 미국은 음향 표면파 센서에 있어 세계적으로 중요한 시장 중 하나입니다.

- 2007-2008년 금융위기 이후 가장 강력하게 부상한 반도체 기업들은 여전히 기술 혁신에 집중하고 있으며, 다른 경쟁사들에 비해 상대적으로 높은 R&D 비용과 M&A를 유지하고 있습니다. 많은 업계 전문가들은 전염병으로 인해 예측 기간에도 동일한 추세가 반영될 것이라고 주장합니다.

- 2020년 11월 미국 반도체산업협회(SIA)는 2020년 10월 세계 반도체 매출액이 390억 달러로 2019년 10월 대비 6%, 2020년 9월 대비 3.1% 증가했다고 발표했습니다. 같은 달 WSTS는 2020년 세계 반도체 연간 예상 판매액이 5.1% 증가, 2021년에는 8.4% 증가할 것으로 예측했습니다.

미국의 음향 센서 시장 동향

압력 센서가 시장 성장을 견인

- 압력 센서는 센서에 가해지는 실제 압력을 측정하는 감압 소자(서로 다른 작동 원리를 사용)와 이 정보를 출력 신호로 변환하는 구성요소로 구성된 기기입니다. 이러한 센서는 석유 및 가스, 항공우주, 자동차, 의료, 소비재, 산업 등 다양한 산업분야에 적용이 확대되고 있어 큰 성장세를 보이고 있습니다.

- 석유 및 가스 산업에서 영구 음향 모니터링 시스템용 표면 탄성파 압력 센서의 채택이 증가하고 있으며, 다운홀 압력계 시장을 독점하고 있던 석영 진동자 및 광섬유를 대체하여 예측 기간 동안 시장을 주도할 것으로 예상됩니다.

- 이 압력 센서는 자동차 타이어 압력 모니터링 시스템에 사용할 수 있습니다. 이러한 종류의 센서는 SAW가 무선으로 배터리 없이 사용할 수 있다는 점을 이용하여, 1포트 SAW 공진기와 안테나를 통해 타이어 압력 모니터링 시스템(TMPS)이 다른 주파수의 신호로 자극을 받아 SAW에서 다시 수신할 수 있습니다.

- 최근 몇 년 동안 크로스 컨트리 및 오프로드 전용 차량에 혁신적인 타이어 공기압 제어 시스템이 장착된 것으로 확인되었습니다. 예를 들어, 메르세데스 G63 AMG 6X6의 경우 운전자는 앞바퀴와 뒷바퀴의 타이어 공기압을 별도로 확인하고 변경할 수 있습니다. 보도에 따르면 이 시스템은 타이어 공기압을 0.5바에서 1.8바까지 올리는 데 20초도 걸리지 않는다고 합니다.

- 또한 NHTSA는 2002년부터 TPMS(타이어 공기압 모니터링 시스템)의 사용을 의무화하고 있습니다. 따라서 미국 자동차 부문은 탄탄한 자동차 부문에 힘입어 시장을 선도하고 있습니다.

소비자용 전자제품의 시장 점유율이 가장 높음

- 스마트폰 판매량 증가와 가전제품의 신흥 RF 기술 채택 증가로 인해 음향 센서 및 기타 관련 장비의 판매가 크게 증가하여 조사 대상 시장의 범위가 확대되고 있습니다.

- LTE, 4G, 5G 장비, 특히 5G 스마트폰의 생산 확대는 SAW 기술 제공업체에게 큰 성장 기회를 제공하고 있으며, RF 필터는 다양한 스마트폰이 정보를 송수신하는 데 사용하는 서로 다른 주파수 대역의 무선 신호를 분리하기 때문에 이러한 장비의 표준 부품이 되고 있습니다. 표준 부품이 되고 있습니다. 새로운 첨단 SAW 필터는 2.7GHz 이하의 주파수 대역에서 BAW 필터와 경쟁할 수 있는 고성능 솔루션을 제공하기 때문에 5G 기술의 출현과 함께 높은 성장 기회를 얻을 수 있습니다.

- 예를 들어, 미국의 Qualcomm Technologies Inc.는 2020년 2월 Qualcomm ultraSAW 필터 기술을 발표했습니다. 이는 주로 5G/4G 모바일 기기를 대상으로 하는 이 회사의 무선 기술 포트폴리오에서 또 하나의 획기적인 혁신입니다. 회사 측에 따르면, RF 필터는 서로 다른 주파수 대역에서 무선 신호를 분리하고 삽입 손실을 1dB까지 개선하여 퀄컴의 ultraSAW 필터는 2.7GHz 이하 주파수 대역에서 경쟁사 필터보다 더 높은 성능의 솔루션을 제공한다고 밝혔습니다.

- 또한 많은 연구자들이 무선 패시브 가속도계 및 압력 센서로 사용할 수 있는 SAW MEMS 마이크로폰의 가능성을 모색하고 있습니다. 세계 MEMS 마이크 시장은 2024년까지 16억 7,000만 달러가 넘을 것으로 예상됩니다.

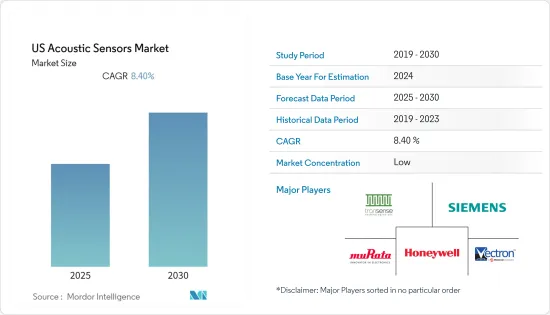

미국의 음향 센서 산업 개요

음향 센서는 제조가 비교적 간단한 장치입니다. 따라서 시장은 매우 세분화되어 있으며, 많은 세계 제조업체와 현지 제조업체가 시장 역학에 기여하고 있으며, MEMS 시장은 꾸준히 성장하고 있지만, 주요 기업은 치열한 경쟁에 직면하여 가격 하락과 낮은 마진을 강요당하고 있습니다. 이 시장에는 신규 진입 기업이 지속적으로 증가하고 있습니다.

- 2020년 12월, 미국에 본사를 둔 음파 고주파수 RF 필터 통합 디바이스 제조업체(IDM)인 Akoustis Technologies Inc.는 자사의 5.2/5.6GHz RF 공존 필터 솔루션이 Wi-Fi 6의 두 번째 고객으로부터 디자인 승을 획득했다고 발표했습니다. 이 회사는 2021년 상반기에 생산이 시작될 것으로 예상하고 있습니다.

- 2020년 9월, Sandia National Laboratories는 Autonomous Medical Devices Incorporated(AMDIs)의 Optikus 핸드헬드 진단 기기를 위한 통합 핵산 증폭 시스템 개발에 큰 진전을 이루었습니다. 이 노력은 SARS-CoV-2를 위한 LAMP(loop-mediated isothermal amplification) 프라이머 세트를 개발하여 SAW 센서에서 직접 증폭하는 것을 입증했습니다.

- 2020년 5월, 샌디에이고에 본사를 둔 로즈웰 바이오테크놀러지스(Roswell BIoTechnologies)와 나노 혁신 기업 Imec은 2021년 최초의 분자 전자공학 바이오센서 칩을 상용화하기 위해 협력하기로 했습니다. 이러한 칩은 COVID-19 및 기타 질병 탐지, 정밀 의료, 휴대용 또는 핸드헬드 기기에서 저비용으로 유전체 시퀀싱을 수행하는 데 도움이 될 것으로 보입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 통신 시장 성장

- 낮은 제조 비용

- 시장 성장 억제요인

- 음향 센서 기술적 과제

- 밸류체인/공급망 분석

- Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향 평가

제5장 시장 세분화

- 유형별

- 유선

- 무선

- 파동 유형별

- 표면파

- 벌크파

- 센싱 파라미터별

- 온도

- 압력

- 토크

- 질량

- 습도

- 점도

- 화학 증기

- 용도별

- 자동차

- 항공우주 및 방위

- 가전제품

- 의료

- 산업용

- 기타

제6장 경쟁 구도

- 기업 개요

- Siemens AG

- Transense Technologies plc

- pro-micron GmbH

- Honeywell Sensing and Productivity Solutions

- Murata Manufacturing Co., Ltd.

- Vectron International, Inc.(Microchip technology Incorporated)

- ifm efector, inc.

- Dytran Instruments, Inc.

- Campbell Scientific, Inc.

제7장 투자 기회

제8장 시장 전망

ksm 25.01.23The US Acoustic Sensors Market is expected to register a CAGR of 8.4% during the forecast period.

Key Highlights

- The United States is one of the foremost innovators and investors in the global SWA sensor market, owing to the growing regional demand and manufacturing of acoustic wave sensors. The regional end-user industry is increasingly investing in advanced technologies and adopting low-cost components, expanding the scope of SAW sensors in the region.

- In addition to that, most of the significant global market vendors are US-based, which provides an upper hand to the region in the studied market. Also, most of these regional vendors are far ahead of their global competitors in terms of product innovation and technological advancement, which is also helping the regional market's growth along with the global market's. The United States is one of the significant markets for surface acoustic wave sensors globally.

- After the financial crisis of 2007-2008, the semiconductor companies that emerged strongest still focused on innovations and maintained relatively higher R&D spending and M&As, as compared to other competitors. Many industry experts claim that the same trend is expected to reflect the forecast period due to the pandemic.

- In November 2020, the Semiconductor Industry Association (SIA) of the United States announced that sales of global semiconductors reached USD 39.0 billion for October 2020, an increase of 6% compared to October 2019 and 3.1% more than September 2020. In the same month, WSTS also forecasted that the projected annual global sales of semiconductors for 2020 would increase by 5.1%, followed by 8.4% in 2021.

US Acoustic Sensors Market Trends

Pressure Sensors to Drive the Market Growth

- The pressure sensor is an instrument consisting of a pressure-sensitive element to determine the actual pressure applied to the sensor (using different working principles) and some components to convert this information into an output signal. These sensors have witnessed significant growth due to the increasing applications across various industries, such as oil and gas, aerospace, automotive, healthcare, consumer goods, industrial, etc.

- The growing adoption of surface acoustic wave pressure sensors for permanent sound monitoring systems in the oil and gas industry has replaced the quartz crystals, and fiber optics which dominated the market for downhole pressure gauges, is expected to drive the market in the forecast period.

- These pressure sensors can be used in a car tire pressure monitoring system. This kind of sensor takes advantage of the fact that a SAW can be used wirelessly and without a battery. With a one-port SAW resonator and antenna, the Tire Pressure Monitoring System (TMPS) can be stimulated by signals of different frequencies and then received back from the SAW.

- In the past few years, exclusive cross-country and off-road cars have been witnessed installing innovative tire pressure control systems. For instance, the G63 AMG 6X6 from the Mercedes enables the driver to check and vary the tire pressure of both the front and rear axles separately. Reportedly, the system takes less than 20 seconds to raise the tire pressure from 0.5 bar to 1.8 bar.

- Furthermore, the NHTSA has mandated the use of TPMS (tire pressure monitoring system) since 2002. Hence, the US automotive sector has been leading the market studied, owing to a robust automotive sector.

Consumer Electronics holds the highest market share

- There is a significant surge in acoustic sensors and other related equipment sales due to the increasing smartphone sales and the increasing adoption of emerging RF technologies in consumer electronics, expanding the scope of the market studied.

- The growing production of LTE, 4G & 5G devices, especially 5G smartphones, also creates a massive growth opportunity for the SAW technology provider. RF filters are becoming standard components in these devices as they isolate radio signals from the different spectrum bands used by various smartphones to receive and transmit information. New advanced SAW filters offer a higher performance solution than competing for BAW filters in the sub-2.7 GHz frequency range, hence having higher growth opportunities with the emergence of 5G technology.

- For instance, in February 2020, US-based Qualcomm Technologies Inc. announced the Qualcomm ultraSAW filter technology, another groundbreaking innovation in its wireless technology portfolio mainly targeting 5G/4G Mobile Devices. According to the company, RF filters isolate radio signals from the different spectrum bands, and by achieving as much as 1 dB improvement in insertion loss, Qualcomm ultraSAW filters offer a higher performance solution than competing filters in the sub-2.7 GHz frequency range.

- Many researchers are also exploring the scope of the SAW MEMS microphone that can also be used as a wireless passive accelerometer and pressure sensor. The global MEMS microphone market will be expected to cross USD 1.67 billion by 2024.

US Acoustic Sensors Industry Overview

Acoustic sensors are a relatively simple device to manufacture. Consequently, the market is highly fragmented, with many global and local manufacturers contributing to the market dynamics. The MEMS market is seeing steady growth, but companies have to face cut-throat competition leading to brutal price declines and low margins. The market is continually adding new entrants into the market.

- December 2020, a US-based integrated device manufacturer (IDM) of acoustic wave high-band RF filters for mobile and other wireless applications, Akoustis Technologies Inc, announced that the company had been awarded a design win from a second Wi-Fi 6 customer for its 5.2/5.6 GHz RF coexistence filter solutions. The company expects the design to enter production in the first half of 2021.

- September 2020, US-based Sandia National Laboratories have made significant progress toward developing an integrated nucleic acid amplification system for Autonomous Medical Devices Incorporated (AMDIs) Optikus handheld diagnostic device. This effort developed a set of loop-mediated isothermal amplification (LAMP) primers for SARS-CoV-2 and then demonstrated amplification directly on the SAW sensor.

- May 2020, San Diego-based Roswell Biotechnologies and nano innovator, Imec collaborated to make the first molecular electronics biosensors chips commercially available in 2021. Such chips would help detect COVID-19 and other diseases and for precision medicine, as well as low-cost genome sequencing on portable or even handheld devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Telecommunications Market

- 4.2.2 Low Manufacturing Costs

- 4.3 Market Restraints

- 4.3.1 Technical Challenges Associated with Acoustic Sensors

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of the Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Wave Type

- 5.2.1 Surface Wave

- 5.2.2 Bulk Wave

- 5.3 By Sensing Parameter

- 5.3.1 Temperature

- 5.3.2 Pressure

- 5.3.3 Torque

- 5.3.4 Mass

- 5.3.5 Humidity

- 5.3.6 Viscosity

- 5.3.7 Chemical Vapor

- 5.4 By Application

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defense

- 5.4.3 Consumer Electronics

- 5.4.4 Healthcare

- 5.4.5 Industrial

- 5.4.6 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Siemens AG

- 6.1.2 Transense Technologies plc

- 6.1.3 pro-micron GmbH

- 6.1.4 Honeywell Sensing and Productivity Solutions

- 6.1.5 Murata Manufacturing Co., Ltd.

- 6.1.6 Vectron International, Inc. (Microchip technology Incorporated)

- 6.1.7 ifm efector, inc.

- 6.1.8 Dytran Instruments, Inc.

- 6.1.9 Campbell Scientific, Inc.

7 INVESTMENT OPPORTUNITIES

8 FUTURE OF THE MARKET

샘플 요청 목록