|

시장보고서

상품코드

1683852

해양 음향 센서 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Marine Acoustic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

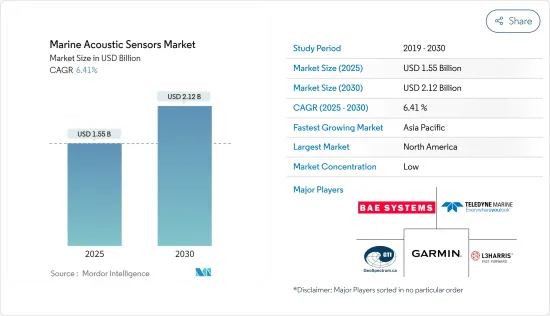

해양 음향 센서 시장 규모는 2025년에 15억 5,000만 달러에 이를 것으로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 6.41%로, 2030년에는 21억 2,000만 달러에 달할 것으로 예상되고 있습니다.

해양 음향 센서는 실시간 데이터 수집 및 환경 모니터링을 위해 다양한 선형 소형 장치에서 사용됩니다. 이러한 장치는 다수의 용도을 가진 다양한 형태로 제공됩니다. 해양 음향 센서는 해양 생물 검출, 모니터링 및 기타 목적에 사용됩니다.

주요 하이라이트

- 사물 인터넷(IoT) 기술은 최근의 지적 작업 기술 혁명의 개념으로 제시되었습니다. 해양 산업은 음향 센서 기술 용도의 급속한 증가 러시와 저비용 컴퓨팅 구성 요소의 능력을 통해 다양한 기회에 액세스할 수 있습니다.

- Dock은 세계적인 해양 기술에서 IoT의 급속한 채택으로 클라우드 기반 IoT를 지원하기 위한 외로운 네트워크에서 전 세계적으로 지원됩니다. 지능적이고 스마트한 항만은 IoT 스마트 포트를 통해 모든 장치가 연결되고 완전히 자동화되어 있다고 표현할 수 있습니다. 이는 스마트 포트의 중앙 인프라를 구성하는 음향 센서와 무선 장치를 포함한 지능형 센서의 네트워크로 구성됩니다.

- 군함, 잠수함, 선박을 경비하고 실시간 상황 인식을 제공하기 위한 기술 기반의 음향 센서의 대두가 예측 기간 중 시장 성장을 뒷받침하고 있습니다.

- 선박용 음향 센서는 신호 처리와 센서 기능을 하나의 제품으로 통합할 수 있습니다. 그러나 음향 센서는 안정성이나 신뢰성이 불충분한 운영상의 과제에 직면하고 있으며, 채용 확대에 영향을 미치고 있습니다.

- 완전 자율형 선박을 확대하기 위해 세계적으로 선도적 인 조선 회사와 시스템 개발 회사의 연구 개발 활동에 대한 투자가 증가하고 해양 음향 센서의 요구가 커지고 있습니다. 자율 선박은 해양 산업에 지속가능하고 안전하고 효율적인 공정 모드로 등장할 것으로 추정됩니다.

해양 음향 센서 시장 동향

수중 트랜스듀서가 제품 부문에서 주요 점유율을 차지

- 수중 변환기는 수중에서 하나의 에너지 형태를 다른 형태로 변환하는 장치입니다. 해양 기술에서는 전기 신호를 음파로 변환하는 장치(액추에이터)와 음파를 전기 신호로 변환하는 장치(센서)를 가리키는 경우가 많습니다. 하이드로폰은 소리 감지에 사용되는 특정 유형의 수중 트랜스듀서이지만, 다른 수중 트랜스듀서는 소나 신호의 방사 및 다양한 용도에 대한 진동 발생과 같은 다른 목적을 수행할 수 있습니다.

- 수중 트랜스미션에 관한 몇 가지 실험과 프로젝트가 진행되고 있으며, 수중 트랜스듀서 분야를 더욱 견인하고 있습니다. 예를 들어 2022년 11월 일본전신전화주식회사, NTT 도코모, NTT 커뮤니케이션즈 주식회사는 다양한 해양활동을 위한 광대역 무선통신의 실현에 관한 공동실험을 실시했습니다. 수중 음향 통신을 이용한 필드 실험으로, 얕은 해역(수심 30m 정도)에서 1Mbps/300m의 수중 트랜스미션에 성공했습니다.

- 또한 다양한 제품의 혁신과 개발, 방위 분야와의 연계도 이 조사 부문을 견인하고 있습니다. 예를 들어, 2023년 5월 미국 해군과 공동으로 Teledyne Marine은 헬리콥터의 해중 글라이더 개발을 처음으로 성공했으며 항공기에서 자율형 해중 로봇(AUV)을 출시하는 데 성공했습니다. 텔레다인 슬로컴 글라이더는 여러 개의 지속적인 전략 임무를 위한 장기 내구형 AUV입니다. 해군 해양국(NAVOCEANO)은 LBS 글라이더를 조종하고 해군 작전을 지원하는 수집 데이터를 포함합니다.

- 2023년 SIPRI는 미국 군사비가 세계 군사비의 37%를 차지한다고 보고했습니다.

북미가 큰 시장 점유율을 차지

- 배꼽 방어에서 수중통신 채택 증가, 자율형 수중항행체 증가, 과학탐사 및 데이터 수집 요구의 급증은 북미 수중통신시스템 시장의 성장을 가속하는 주요 요인으로 시장 조사를 더욱 추진하고 있습니다.

- 자율형 수중 차량은 군, 해군, 해안 경비대, 특히 해저 작전의 주류가 되고 있습니다. 미국 해군은 수뢰 대책(MCM), 정보, 감시, 정찰, 식별(ID), 대잠수함전(ASW) 등 다양한 용도로 이러한 차량을 폭넓게 사용하고 있습니다. 해군은 중국의 중대한 과제에 대항하기 위해 수중 차량의 조기 구매를 위한 취득 전략을 가속화하고 있습니다.

- 팬데믹의 피크 때 미국 해군 해 시스템 사령부 워싱턴은 해군 작전을 업그레이드하기 위해 보잉과 1,111만 달러 상당의 계약을 맺었습니다. 이 회사는 유도제어, 항행, 상황인식, 임무센서, 인구, 기간통신 등 미래의 해군작전을 위한 업그레이드가 기대되고 있었습니다. 예를 들어, 동시기에 미국 해군은 초대형 무인 잠수정(XLAUV)을 개발하기 위해 보잉사와 4,300만 달러 상당의 계약을 체결했습니다.

- 2022년 8월, 국방부의 산업 기반 정책실은 텍사스주 오스틴의 오스틴 센터 포 매뉴팩처링 앤 혁신(ACMI)과 함께 국방생산법(DPA) 타이틀 III 프로그램을 통해 선구적인 제조 파일럿 프로그램을 시작했습니다. 이 세계 최초의 파일럿 프로그램은 급속히 생산 규모를 확대할 수 있는 상용 및 군사 용도의 첨단 제조 기술에 초점을 맞출 것으로 기대되고 있었습니다. 이러한 군사 애플리케이션 개발도 이 지역 시장 연구를 촉진할 수 있습니다.

- 국방비 증가도 시장을 견인할 수 있습니다. 예를 들어, 미국 의회 예산국에 따르면, 미국의 국방비는 2033년까지 매년 증가할 것으로 예상됩니다. 미국의 국방비는 2033년에는 1조 1,000억 달러까지 증가할 것으로 예측됩니다.

해양 음향 센서 산업 개요

조사 대상 시장은 BAE Systems PLC, Garmin Ltd, Teledyne Marine Technologies(Teledyne Technologies Incorporated), Ocean Sonics Ltd, Geospectrum Technologies Inc. 등의 대기업이 존재하고 세분화되고 있습니다. 조사 대상 시장의 기업은 제품 제공을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

- 2023년 6월- Thales는 La Spezia 해군 기지에 통합 서비스 센터를 신설하여 이탈리아 해군과의 연계를 강화했습니다. 이 센터는 소해정에 탑재된 소나 시스템의 유지보수와 나폴리와 탈란토의 해군기지에서 활동하는 프리게이트함의 수중지원에 있어서 해군의 독점 서비스 파트너로서의 역할을 합니다.

- 2023년 1월, 회사는 네덜란드 왕립 해양 연구소(NIOZ)가 새로운 AUV "GaviaOsprey"를 취득했다는 것을 발표했습니다. NIOZ는 네덜란드의 국립 해양 연구소로, 네덜란드의 해양에 관한 주요 과학적 의문을 해결하기 위해 학제 간 응용 해양 연구를 실시했습니다. NIOZ는 적도에서 극점까지, 대륙붕에서 심해까지, 현재부터 과거까지 기후 변화에서 해양의 역할을 연구하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

제5장 시장 역학

- 시장 성장 촉진요인

- 수중 위치 확인을 위한 음향 내비게이션 도입 확대

- 각국의 방위비 증가

- 시장의 과제

- 호환성 및 설치 문제, 주파수 대역 제한

- KPI 분석

제6장 시장 세분화

- 제품별

- 하이드로폰

- 수중 트랜스듀서

- 음향 견인 어레이

- 사이드 스캔 소나

- 지역별

- 북미

- 유럽

- 아시아

- 호주 및 뉴질랜드

- 라틴아메리카

제7장 용도 분석

- 용도별

- 수심 측정

- 해양 이미징

- 해양 생물 탐지

- 군사

- 해양 연구 및 모니터링

제8장 경쟁 구도

- 기업 프로파일

- BAE Systems PLC

- Garmin Ltd

- Teledyne Marine Technologies(Teledyne Technologies Incorporated)

- Ocean Sonics Ltd

- Geospectrum Technologies Inc.

- L3harris Technologies Inc.

- Hottinger Bruel & Kjaer(Spectris PLC)

- Cobham Ultra Seniorco Sa Rl

- Thales Group

- CTS Corporation

제9장 시장 전망

KTH 25.04.11The Marine Acoustic Sensors Market size is estimated at USD 1.55 billion in 2025, and is expected to reach USD 2.12 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Marine acoustic sensors are used in small devices in various ship types for real-time data collection and environmental monitoring. These devices come in a broad variety of forms with numerous uses. Marine acoustic sensors are used for marine life detection, monitoring, and other purposes.

Key Highlights

- The Internet of Things (IoT) technology has been presented as a recent intelligent work technical revolution concept. The marine industry will have access to a broad range of opportunities due to the rapidly increasing rush of acoustic sensor technology applications and the capabilities of low-cost computing components.

- Docks are being supported globally in solitary networks to support their cloud-based IoT due to the rapid adoption of IoT in global marine technology. An intelligent and smart port can be described as fully automated, with all devices connected via an IoT smart port. It comprises a network of intelligent sensors, including acoustic sensors and wireless devices that make the central infrastructure of a smart port.

- The rising technological-based acoustic sensors for military ships, submarines, and vessels to guard and give them real-time situational awareness are boosting the market growth during the forecast period.

- The marine acoustic sensors allow the integration of signal processing and sensor functions within one product. However, acoustic sensors have faced operational challenges like inadequate stability and reliability, impacting their adoption growth.

- Increased investments in R&D activities by leading shipbuilders and system developers globally for expanding fully autonomous ships have increased the need for marine acoustic sensors. Autonomous ships are estimated to launch as sustainable, safe, and efficient modes of process for the marine industry.

Marine Acoustic Sensors Market Trends

Underwater Transducer to Hold Major Share in the Product Segment

- An underwater transducer is a device that converts one form of energy to another underwater. Marine technology often refers to devices that can convert electrical signals into sound waves (actuators) or sound waves into electrical signals (sensors). While hydrophones are a specific type of underwater transducers used for sound detection, other underwater transducers can serve different purposes, such as emitting sonar signals or generating vibrations for various applications.

- Several experiments and projects in underwater transmission are happening, further driving the underwater transducer segment. For instance, in November 2022, the NTT Corporation, NTT DOCOMO, INC, and NTT Communications Corporation performed a joint experiment on achieving broadband wireless communication for various marine activities. It succeeded at 1-Mbps/300-m underwater transmission in a shallow sea area (water depth of about 30 m) using underwater acoustic communication in field experiments.

- Various product innovations, developments, and collaborations with the defense sector are also driving the studied segment. For instance, in May 2023, In collaboration with the US Navy, Teledyne Marine completed the first-ever successful undersea glider deployment from a helicopter, marking the first time an autonomous underwater vehicle (AUV) was successfully launched from an aircraft. The Teledyne Slocum glider is a long-endurance AUV for multiple persistent operational missions. The Naval Oceanographic Office (NAVOCEANO) pilots the LBS gliders and includes collected data supporting Navy operations.

- In 2023, SIPRI reported that the United States' military expenditure made up 37 percent of global military expenditure.

North America Holds Significant Market Share

- An increase in the adoption of underwater communication in navel defense, an increase in autonomous underwater vehicles, and a surge in the need for scientific exploration and data collection are the key factors driving the growth of the underwater communication systems market in North America, further driving the market studied.

- Autonomous underwater vehicles have become mainstream for the military, navy, and coastal security forces, especially subsea operations. The US Navy extensively uses these vehicles for various applications, such as mine countermeasures (MCM), intelligence, surveillance and reconnaissance, identification (ID), and anti-submarine warfare (ASW). The Navy has accelerated acquisition strategies for the faster purchase of underwater vehicles to counter significant challenges from China.

- During the peak time of the pandemic, US Naval Sea Systems Command Washington signed a contract worth USD 11.1 million with Boeing to upgrade naval operations. The company was expected to upgrade for future naval operations such as guidance and control, navigation, situational awareness, mission sensors, population, and core communication. For instance, at the same time, the US Navy signed a contract worth USD 43 million with Boeing to develop an Orca Extra Large Unmanned Undersea Vehicle (XLAUV).

- In August 2022, the Department of Defense's Industrial Base Policy Office launched a pioneering manufacturing pilot program through the Defense Production Act (DPA) Title III Program with the Austin Center for Manufacturing and Innovation (ACMI) in Austin, Texas. The first-of-its-kind pilot program was expected to focus on advanced manufacturing technology for commercial and military applications that can be rapidly scaled to production. These developments in military applications may also drive the market studied for the region.

- The increase in defense expenses may also drive the market studied. For instance, according to the US Congressional Budget Office, defense spending in the United States is predicted to increase yearly until 2033. Defense outlays in the United States are expected to increase up to USD 1.1 trillion in 2033.

Marine Acoustic Sensors Industry Overview

The market studied is fragmented with the presence of major players like BAE Systems PLC, Garmin Ltd, Teledyne Marine Technologies (Teledyne Technologies Incorporated), Ocean Sonics Ltd, and Geospectrum Technologies Inc. Players in the market studied are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- June 2023 - Thales reinforced its collaboration with the Italian Navy by inaugurating a new integrated service center at the La Spezia naval base. This center will serve as the exclusive service partner of the Navy for the upkeep of sonar systems installed on minesweeper vessels and the waterfront support of frigate vessels operating in the Naval Bases of Naples and Taranto.

- In January 2023, the company announced the acquisition of a new GaviaOsprey AUV by the Royal Netherlands Institute for Sea Research (NIOZ). NIOZ is the Netherlands' national oceanographic institute conducting multidisciplinary applied marine research to address major scientific questions about the company's oceans and seas. NIOZ studies the ocean's role in changing climate from equator to pole, from the continental shelf to the deep ocean, and from present to past.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment of Acoustic Navigation for Underwater Positioning

- 5.1.2 Rising Defense Spending in Several Countries

- 5.2 Market Challenges

- 5.2.1 Compatibility and Installation Issues and the Presence of a Limited Frequency Band

- 5.3 KPI Analysis

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Hydrophones

- 6.1.2 Underwater Transducer

- 6.1.3 Acoustic Towed Array

- 6.1.4 Side-scan Sonar

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

7 APPLICATION ANALYSIS

- 7.1 By Application

- 7.1.1 Water Depth and Bathymetry

- 7.1.2 Marine Imaging

- 7.1.3 Marine Life Detection

- 7.1.4 Military

- 7.1.5 Marine Research and Monitoring

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 BAE Systems PLC

- 8.1.2 Garmin Ltd

- 8.1.3 Teledyne Marine Technologies (Teledyne Technologies Incorporated)

- 8.1.4 Ocean Sonics Ltd

- 8.1.5 Geospectrum Technologies Inc.

- 8.1.6 L3harris Technologies Inc.

- 8.1.7 Hottinger Bruel & Kjaer (Spectris PLC)

- 8.1.8 Cobham Ultra Seniorco S.a R.l.

- 8.1.9 Thales Group

- 8.1.10 CTS Corporation