|

시장보고서

상품코드

1629789

중남미의 유전 서비스 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)South And Central America Oil Field Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

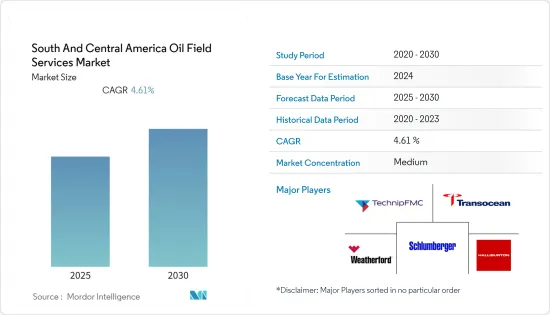

중남미의 유전 서비스 시장은 예측 기간 동안 4.61%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 장기적으로 이 지역의 해양 사업 증가와 셰일가스 등 비전통 탄화수소에 대한 수요 증가가 예측 기간 동안 시장을 견인할 것으로 예상됩니다.

- 한편, 재생에너지 사용이 증가함에 따라 전력 생산을 위한 천연가스와 같은 탄화수소에 대한 수요는 감소할 것으로 예상됩니다. 따라서 예측 기간 동안 시장 성장은 둔화될 것으로 보입니다.

- 멕시코와 아르헨티나에서 셰일 오일 및 가스 매장량이 발견되고 있으며, 그 개발은 향후 중남미의 유전 서비스 시장에 몇 가지 기회를 가져올 것으로 예상됩니다.

- 브라질은 예측 기간 동안 중남미의 유전 서비스 시장에서 큰 성장을 이룰 가능성이 높습니다.

중남미의 유전 서비스 시장 동향

시추 서비스가 시장을 독점할 것으로 전망

- 시추는 탐사 및 생산(E&P) 단계 전체에서 가장 비용이 많이 드는 부분 중 하나이며, 신규 유정 시추가 이루어지고 있습니다. 업계에서는 시추에 전체 유정 비용의 70% 이상이 소요된다는 추정이 많습니다. 따라서 시추 서비스는 시장에 많은 자금을 가져다 줄 것으로 예상됩니다.

- 세계 탄화수소 수요 증가와 러시아와 우크라이나 분쟁으로 인한 가격 상승으로 이 지역 대부분의 국가들은 석유 생산량을 늘리고 석유에서 더 많은 이익을 얻기 위해 새로운 유정을 시추하는 데 많은 자금을 지출하고 있습니다. 중남미의 시추기 수는 2021년 1월에 119개에 불과했지만 2023년 2월에는 181개로 증가했습니다.

- 예를 들어, 아르헨티나 국영 석유 및 가스 생산 기업인 YPF는 2018-2022년까지 300억 달러를 투자하여 2022년까지 탄화수소 생산량을 매년 5%씩 증가시켜 2022년까지 일일 석유 환산량 70만 배럴에 도달할 수 있도록 할 계획이었습니다. 이 회사는 29개의 프로젝트를 개발하고 1,600개의 유정을 개발할 계획이었으며, 2022년 1월 아르헨티나의 셰일가스 생산량은 2021년 1월부터 전년 동월 대비 42% 증가한 6,900만 입방미터의 일일 생산량을 기록했다고 보고했습니다.

- 이는 냉각 시스템을 제조하는 기업들에게 새로운 비즈니스 기회를 열어줄 가능성이 높으며, 2021년 9월 아르헨티나 정부는 탄화수소에 대한 투자를 장려하는 법안을 통과시켰습니다. 이 법안은 거대한 바카 무에르타 셰일층 등에서 석유 및 가스 수출과 국내 생산을 늘리는 것을 목표로 했습니다.

- 이상과 같이 중남미의 유전 서비스 시장은 향후 몇 년 동안 시추 서비스 분야에서 큰 성장을 보일 것으로 예상됩니다.

큰 폭의 시장 성장이 기대되는 브라질

- 대서양 심해 및 초심해 활동으로 인해 브라질은 2021-2022년 동안 탐사 및 생산이 크게 증가함에 따라 유전 서비스에 더 많은 자금이 투입될 것으로 예상됩니다.

- 지난해의 성장은 주로 해양 부문에서 이루어졌습니다. 유전 서비스에 대한 지출 증가는 시추 및 완성 작업의 증가와 관련이있을 수 있으며, 이는 유압 시스템용 냉각 시스템에 대한 수요를 촉진할 것으로 예상됩니다.

- 브라질은 많은 대규모 해양 업스트림 프로젝트가 진행 중이며, 2025년까지 전 세계 해양 원유 및 콘덴세이트의 20% 이상을 생산할 것으로 예상됩니다.

- BP Statistical Review of World Energy에 따르면 2022년 브라질의 석유 생산량은 하루 310만 7,000배럴에 달할 것으로 예상했습니다.

- 생산량의 대부분은 캄포스 분지의 파오 데 아쿠칼 유전과 카르칼라 유전에서 생산될 것으로 예상됩니다. 이 두 유전에서 생산이 시작됨에 따라 업스트림 및 미드스티림 산업에서 냉각 시스템에 대한 수요가 크게 증가하여 예측 기간 동안 유전 서비스 시장을 주도할 것으로 예상됩니다.

- 이상과 같이 브라질은 예측 기간 동안 중남미의 유전 서비스 시장에서 큰 성장을 이룰 가능성이 높습니다.

중남미의 유전 서비스 산업 개요

중남미의 유전 서비스 시장은 적당히 세분화되어 있습니다. 이 시장의 주요 기업으로는 Schlumberger NV, Transocean LTD, Weatherford International plc, Halliburton Company, TechnipFMC PLC 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 해양 사업 증가

- 비전형적 에너지원에 대한 수요 증가

- 성장 억제요인

- 재생에너지에 대한 수요

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 서비스

- 시추 서비스

- 완공 서비스

- 생산 설비

- 기타

- 배치 장소

- 온쇼어

- 오프쇼어

- 지역

- 멕시코

- 브라질

- 아르헨티나

- 기타 중남미

제6장 경쟁 구도

- 합병, 인수, 제휴, 합작투자

- 주요 기업의 전략

- Key Companies Profile

- Schlumberger NV

- Transocean LTD.

- Weatherford International plc

- Halliburton Company

- TechnipFMC PLC

- COSL/Shs A Vtg 1.00(China Oilfield Services Limited)

- Saipem SpA

- National-Oilwell Varco, Inc.

- Superior Energy Services, Inc.

제7장 시장 기회와 향후 동향

- 멕시코와 아르헨티나의 셰일 석유 및 가스 매장량

The South And Central America Oil Field Services Market is expected to register a CAGR of 4.61% during the forecast period.

Key Highlights

- Over the long term, factors such increasing number of offshore operations in the region and rising demand from unconventional hydrocarbons, like shale gas, etc, is expected to drive the market in the forecast period.

- On the other hand, as more renewable energy is used, the demand for hydrocarbons like natural gas to make electricity is expected to go down. This will slow the growth of the market during the forecast period.

- Nevertheless, shale oil and gas reserves have been discovered in Mexico and Argentina, and their exploitation is expected to create several opportunities for the South and Central American oil field services market in the future.

- Brazil is likely to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Market Trends

Drilling Services Expected to dominate the market

- Drilling is one of the most cost-intensive parts of the entire exploration and production (E&P) phase, and new wells are being drilled. Most estimates in the industry say that drilling costs more than 70% of the total cost of a well. Because of this, drilling services are expected to bring in a lot of money for the market.

- As the global demand for hydrocarbons has gone up and prices have gone up because of the conflict between Russia and Ukraine, most countries in the region are spending a lot of money drilling new wells to increase oil production and make more money from oil.The rig count in South and Central America increased from just 119 in January 2021 to 181 in February 2023.

- For instance, YPF, Argentina's state-run oil and gas producer, planned to invest USD 30 billion between 2018 and 2022. It wanted to increase hydrocarbon production by 5% per year until it reached 700,000 barrels of oil equivalent per day by 2022. The company planned to develop 29 projects and drill 1,600 wells. In January 2022, it was reported that Argentina's shale gas production witnessed a 42% YoY growth from January 2021, up to 69 million cubic meters per day.

- This is likely to open up new business opportunities for companies that make cooling systems. In September 2021, the government of Argentina passed a bill to encourage investment in hydrocarbons. The goal was to increase oil and gas exports and domestic production in the huge Vaca Muerta shale formation and elsewhere.

- Due to the above, the South and Central American oil field services market is expected to see a lot of growth in drilling services over the next few years.

Brazil Expected to See Significant Market Growth

- Due to its deep-water and ultra-deep-water activities in the Atlantic Ocean, Brazil is likely to have a large share of the market. Exploration and production have grown a lot between 2021 and 2022, which has led to more money being spent on oilfield services.

- The growth during the last year mainly came from the offshore sector. The increased spending on oilfield services can be related to increased drilling and completion practices, which are expected to drive the demand for cooling systems for hydraulic systems.

- Brazil has a number of large-scale offshore upstream projects in the works, and it is expected that by 2025, the country will produce more than 20% of the world's offshore crude oil and condensate. According to the BP Statistical Review of World Energy, Brazil's oil production in 2022 was 3,107 thousand barrels per day.

- The majority of the production is expected to come from the Pao de Acucar in the Campos basin and Carcara fields. With the commencement of production from these two fields, the demand for cooling systems in the upstream industry, as well as the midstream industry, is expected to increase significantly, driving the oilfield services market during the forecast period.

- Hence, owing to the above points, Brazil is likely going to see significant growth in the South and Central American oil field services market during the forecast period.

South and Central America Oil Field Services Industry Overview

The South and Central America oil field services market is moderately fragmented. Some of the key players in this market (in no particular order) include Schlumberger NV, Transocean LTD, Weatherford International plc, Halliburton Company, and TechnipFMC PLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Number of Offshore Operations

- 4.5.1.2 Demand Coming for Unconventional Energy Sources

- 4.5.2 Restraints

- 4.5.2.1 Demand for Renewable Energy

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Service

- 5.1.1 Drilling Services

- 5.1.2 Completion Services

- 5.1.3 Production Equipment

- 5.1.4 Other Serivices

- 5.2 Location of Deployment

- 5.2.1 Onshore

- 5.2.2 Offshore

- 5.3 Geography

- 5.3.1 Mexico

- 5.3.2 Brazil

- 5.3.3 Argentina

- 5.3.4 Rest of The South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Key Companies Profile

- 6.3.1 Schlumberger NV

- 6.3.2 Transocean LTD.

- 6.3.3 Weatherford International plc

- 6.3.4 Halliburton Company

- 6.3.5 TechnipFMC PLC

- 6.3.6 COSL/Shs A Vtg 1.00 (China Oilfield Services Limited)

- 6.3.7 Saipem SpA

- 6.3.8 National-Oilwell Varco, Inc.

- 6.3.9 Superior Energy Services, Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shale Oil and Gas Reserves in Mexico and Argentina

샘플 요청 목록