|

시장보고서

상품코드

1629807

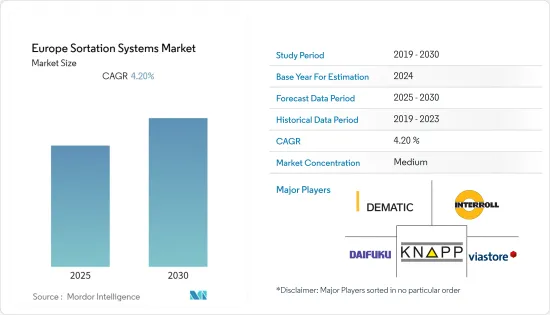

유럽의 분류 시스템 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Sortation Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

유럽의 분류 시스템 시장은 예측 기간 동안 CAGR 4.2%를 기록할 것으로 예상됩니다.

주요 하이라이트

- 주문 처리 센터에서 분류 기능을 수행하는 자율 로봇 기술 도입에 대한 관심이 높아진 배경에는 몇 가지 요인이 있습니다. 급속한 도시화와 재고 관리 단위(SKU)의 증가로 인해 유통업체와 도매업체가 업무상 적절한 의사결정을 내리는 것이 기술적으로 점점 더 어려워지고 있습니다. 이러한 요인으로 인해 인력, 장비 및 기술을 보다 혁신적으로 활용해야 할 필요성이 증가하고 있습니다. 자동 자재관리 시스템의 필요성을 높이는 주요 요인은 비용 절감, 노동 효율성 및 공간 제약입니다.

- 이 시장의 공급업체들은 자동화에 대한 관심이 높아짐에 따라 분류 시스템에 대한 새로운 주문을 받고 있습니다. 예를 들어, 2022년 2월 지멘스 물류는 GLS 스페인으로부터 마드리드에 위치한 GLS의 새로운 물류 센터에 소포 분류 기술 설계 및 통합을 수주했습니다. 따라서 세계 물류 및 창고의 확장은 시장 성장을 촉진하고 있습니다.

- 창고, 물류센터, 소매업체는 분류 프로세스를 정리하고 다양한 화물을 더 짧은 시간 내에 비용 효율적으로 처리할 수 있는 방법을 찾아야 합니다. 따라서 창고, 물류 센터 및 소매 업체는 대량의 물량을 정확하게 분류하기 위해 기존 분류 시스템을 업그레이드해야합니다.

- COVID-19로 인해 창고업체들은 자동화 및 로봇 도입 일정을 앞당기는 것을 고려하고 있습니다. 로봇을 성공적으로 도입한 사업자들은 E-Commerce 수요 증가에 대응하기 위해 작업자와의 상호 작용을 줄이고 생산성을 향상시킴으로써 보다 안전한 작업 환경을 조성할 수 있다는 것을 입증했습니다. 최근 몇 달 동안 E-Commerce가 급증하면서 이 지역의 분류 시장이 개선되었습니다.

- UPS 및 DHL과 같은 운송 회사는 E-Commerce 배송이 급증함에 따라 유럽 사업에 대한 투자를 발표했습니다. 예를 들어, 2021년 9월 UPS는 프라하에 새로운 분류 시설을 개설하여 유럽 네트워크를 확장했으며, UPS에 따르면 이 새로운 시설은 유럽 전역의 UPS 네트워크를 확장하기 위해 최근 완료된 20억 달러 규모의 다년간의 유럽 투자 계획의 일환이라고 합니다.

유럽의 분류 시스템 시장 동향

우편 및 소포 부문이 시장 성장을 견인할 것으로 예상

- 오늘날의 경쟁 환경에서는 가용 상품 수의 증가, 배송 빈도 증가, 소량 배송에 대한 수요로 인해 분류 프로세스의 자동화가 진행되고 있습니다. 영국의 도매 및 소매 부문은 향후 몇 년 동안 자동화가 더욱 가속화될 가능성이 높습니다. 노동력 부족이 예상되면서 기업들이 노동집약적이지 않은 운영을 모색하는 가운데, 물류 자동화의 필요성이 더욱 커지고 있습니다. 높은 수요와 추가적인 시장 성장 기회로 인해 자동화 물류 공급업체들의 전망은 밝습니다.

- 유럽위원회에 따르면 2021년 11월 유럽우정공사는 모든 유럽 시민이 기본적인 우편 및 소포 서비스를 이용할 수 있도록 하고, 단일 소포의 국경 간 배송 서비스에 대한 관세 투명성을 강화했습니다. 또한, 디지털화가 국내 우편 및 소포 서비스 시장을 변화시키고 있으며, 소비자의 요구와 기대가 변화하는 가운데 우편 사업자에게 새로운 기회를 창출하고 있다는 점을 강조했습니다. 이러한 노력은 이 지역의 우편 및 소포 분류 시스템에 대한 수요를 증가시키고 있습니다.

- 이 지역의 조직은 새로운 분류 시스템 혁신에 주력하고 있습니다. 예를 들어, Royal Mail은 2022년 7월 북아일랜드에서 최초의 자동 소포 분류기를 출시했으며, 하루에 157,000 개의 소포를 처리 할 수있는이 기계는 하루 157,000 개의 소포를 처리 할 수있어 야간 소포에 대한 수요 증가에 대응할 수 있습니다. 이 기계는 벨트 컨베이어와 스캔 기술을 결합한 지능형 시스템으로 발송할 소포를 분류합니다. 북아일랜드 뉴타운 애비(Newtownabbey)의 우편 센터에 설치된 이 기계는 시간당 최대 7,500개의 소포를 분류합니다. 분류된 소포는 로열 메일의 네트워크를 통해 각 지역의 배달 사무소로 발송됩니다. 모든 모양과 크기의 소포를 처리할 수 있으며, 무게가 20kg에 달하는 소포도 처리할 수 있습니다.

- 2022년 6월, 헝가리의 대형 소포 분류 센터인 Magyar Posta는 레오나르도의 새로운 분류 시스템을 통해 배송 능력을 강화했습니다. 이는 물류 업계의 최신 국제적인 이정표이며, 헝가리 사업자들이 레오나르도의 역량을 신뢰하고 있다는 것을 입증하는 것입니다. 양사는 20년 동안 탄탄한 협력 관계를 구축해 왔습니다. 이 시스템은 2023년까지 납품되어 연간 1억 개의 소포를 처리할 수 있으며, 계약에는 2031년까지 기술 지원이 포함되어 있습니다.

- 독일은 숙련된 제조업을 보유한 경제 강국 중 하나입니다. 인더스트리 4.0 구상(보다 지능적인 공장을 건설하기 위해 자원과 자금을 배분하는 것을 목표로 함)에서 알 수 있듯이, 독일은 제조업의 생산성을 향상시키기 위해 자동화 기술을 활용하는 것에 대한 관심이 높아지고 있습니다.

- 독일 분류 시스템 시장의 성장은 분류 시스템 분야의 세계 리더인 지멘스 우편 물류와 파셀 공항 물류의 존재에 힘입은 바도 있습니다. 이 두 회사는 국제 시장에서 성공적으로 설치했으며, 견고한 성장률로 지역 전체에서 분류 기술에 대한 인지도를 높이고 있습니다.

영국이 가장 큰 시장 점유율을 차지할 것으로 예상

- 분류 센터의 개념은 2013 년으로 거슬러 올라가며 아마존이 영국에서 처음으로 도입했습니다. 필요한 처리 능력을 달성하면서 운영 비용을 크게 절감한 후, 다른 주요 국가보다 앞서 다른 E-Commerce 업계도 영국에서 같은 개념을 채택했습니다.

- E-Commerce 붐으로 인해 택배는 영국, 독일 등 유럽 전역에서 놀라운 성장세를 보이고 있습니다. 이에 따른 택배 물량의 증가는 많은 택배업체와 우체국 직원들에게 큰 도전이 되고 있습니다. 택배 제품에 대한 수요 증가는 택배 소포 분류 및 관리 자동화의 도입을 촉진할 수 있습니다.

- 조직은 소비자의 요구에 따라 전략적으로 접근하고 있습니다. 예를 들어, LAC 물류는 모든 분류 상품에 대응하는 장비 세트를 제공하고 있습니다. 이 회사는 주로 소매업체와 물류업체가 서비스를 제공하는 우편/택배 시장에서 소포, 소포, 박스 등 다양한 상품의 물량이 크게 증가하고 있는 것에 주목하고 있습니다.

- E-Commerce의 성장과 함께 영국의 분류 시스템 시장은 이 지역의 항공 산업이 주도하고 있습니다. 영국을 대표하는 4개의 공항이 승객 수 증가를 기록하기 위해 확장 계획을 발표했습니다. 예를 들어, 개트윅 공항은 2023년까지 승객 수를 약 5,300만 명 증가시키는 것을 목표로 5년간 11억 유로의 새로운 투자 계획을 발표했습니다.

- PSI Technologies는 식음료 산업을 전문으로 합니다. PSI Technologies는 연중무휴 24시간 운영의 고유한 요구 사항을 이해하여 계획된 유지보수를 최소화할 수 있습니다. 이 회사는 컬러 기반 식품 선별부터 고속 디스펜싱 및 충전 시스템까지 제공합니다. 이 회사의 제품은 식음료 생태계 전반에 걸쳐 광범위하게 사용되고 있습니다.

- AsendiaManagement SAS는 2022년 6월, 히드로의 소포 처리 센터에 자동 분류 로봇과 6대의 새로운 라벨링 로봇을 성공적으로 도입하여 2022년 5월부터 본격 가동에 들어갔습니다. 이 새로운 자동화 시스템은 소매업체, E-Commerce 브랜드 및 기타 고객의 소포 처리 능력을 크게 향상시켜 시간당 최대 7,200개의 소포를 처리할 수 있으며, 24시간 365일 운영할 수 있게 되었습니다. 이 회사는 이러한 개선을 위해 250만 유로를 투자했습니다.

유럽의 분류 시스템 산업 개요

유럽의 소팅 시스템 시장은 단편화되어 있고 경쟁이 치열합니다. 제품 출시, R&D 비용 급증, 제휴 및 인수는 치열한 경쟁을 유지하기 위해 기업이 채택하는 주요 성장 전략입니다.

- 2021년 8월 - Vanderlande는 물류 서비스 제공 업체인 Bleckmann과 협력하여 최신 창고 관리 혁신을 테스트했습니다. 이 직관적 인 시스템은 교육 시간을 단축하고 작업자의 성과를 향상시킵니다.

- 2021년 3월 - 파이브스는 DHL Express 이탈리아에 새로운 소포 처리 및 분류 솔루션을 제공했으며, 2021년 3월 DHL Express 이탈리아는 이탈리아 북부의 밀라노 말펜사 공항에 새로운 허브, 게이트웨이 및 서비스 센터를 개설했습니다. 오픈했습니다. DHL Express 이탈리아의 파트너로서 파이브스는 독자적인 기술을 바탕으로 고객의 요구 사항을 충족하는 솔루션을 설계했으며, DHL Express 이탈리아는 고속 및 고정밀 파이브스의 크로스 벨트 기술을 채택했습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- 밸류체인 분석

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 주문 정확도 향상과 SKU 증가에 대한 수요 증가

- 인건비와 산업 자동화에 대한 우려 고조

- E-Commerce 성장

- 시장 성장 억제요인

- 높은 도입 비용과 유지보수 비용

- 실시간에서의 기술적 과제와 숙련 노동자의 필요성

- 기술 현황

- 자동 분류 도입 개요(이점, 도입, 도입 후와 도입 전 과제, 입수 가능성(자동 분류 도입을 제공하는 벤더 리스트), 설계, 툴, 기타 사양면에서의 기술 진화)

제6장 시장 세분화

- 최종사용자별

- 우편·소포

- 공항

- 식품 및 음료

- 소매

- 의약품

- 기타 최종사용자

- 국가별

- 영국

- 프랑스

- 이탈리아

- 독일

- 기타 유럽

제7장 경쟁 구도

- 기업 개요

- TGW Systems Inc.

- Interroll Holding AG

- Dematic Corp.(KION Group)

- Daifuku Co. Ltd

- Viastore Systems Gmbh

- Bastian Solutions Inc.

- Murata Machinery Ltd

- Fives Group

- Vanderlande Industries Nederland BV

- Beumer Group GmbH

- Honeywell Intelligrated

- Siemens AG

- KNAPP AG

제8장 투자 분석

제9장 시장 전망

ksm 25.01.23The Europe Sortation Systems Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- Several factors are driving the growing interest in the adoption of autonomous robotics technology to perform sorting functions in order fulfillment centers. With the rapid urbanization and growth in stock-keeping units (SKUs), distributors and wholesalers are finding it technically challenging to make the right decisions for their operations. This factor is driving the need for a more innovative way of using labor, equipment, and technology. Key factors driving the need for an automated material handling system are cost savings, labor efficiency, and space constraints.

- Vendors in the market are gaining new orders for sortation systems due to increased focus on automation. For instance, in February 2022, Siemens Logistics received a contract from GLS Spain to design and integrate parcel sorting technology in GLS's new logistics center in Madrid. Therefore, the expansion of logistics and warehouses worldwide is driving the market's growth.

- Warehouses, distribution centers, and retailers must find ways to organize their sorting processes and handle different packages in less time and cost-effectively, as ineffective sorting wastes time and effort, thus damaging business profits. Therefore, warehouses, distribution centers, and retailers must upgrade their existing sorting systems to accurately sort large volumes of packages.

- The COVID-19 pandemic resulted in warehouse operators considering accelerating their schedules for adopting automation and robotics. Successful implementations demonstrated that these operators created safer jobs by reducing worker interactions and increasing productivity to meet the growing demand for e-commerce. The surge in e-commerce over the past few months has improved the sortation market in the region.

- Shipping companies such as UPS and DHL announced investments in their European operations due to a surge in e-commerce shipments. For instance, in September 2021, UPS opened a new sorting facility in Prague, expanding its European network. According to UPS, the new facility is part of its recently completed USD 2-billion multi-year European investment plan to expand the UPS network across Europe.

Europe Sortation System Market Trends

The Post and Parcel Segment is Expected to Drive the Market's Growth

- The increasing number of available products and the demand for more frequent and smaller deliveries in today's competitive environment are automating the sorting processes. The UK wholesale and retail sector has a high chance of automation in the next few years. The predicted labor shortage is also strengthening the case for logistics automation as firms seek to make their operations less labor-intensive. High demand and opportunities for further market growth have resulted in a positive outlook among automated logistics suppliers.

- According to the European Commission, in November 2021, the European Postal Service made basic post and parcel services accessible to all European citizens and increased tariff transparency for cross-border delivery services for single parcels. However, it also highlighted the way digitization is transforming the domestic market for postal and parcel services, creating new opportunities for postal operators amid changing consumer needs and expectations. Such initiatives are boosting the demand for post and parcel sortation systems in the region.

- Organizations in the region are focused on innovating new sorting systems. For instance, in July 2022, Royal Mail launched the first automatic parcel sorter in Northern Ireland. Capable of processing 157,000 packages per day, the machine can help meet the growing demand for overnight packages per day. This machine is an intelligent system that combines conveyor belts and scanning technology to sort packages for shipping. Installed at the Postal Center in Newtown Abbey, Northern Ireland, the machine sorts up to 7,500 parcels per hour. It dispatches them via the Royal Mail network to local delivery offices. It can handle parcels of any shape and size, with some packages weighing up to 20 kg.

- In June 2022, Magyar Posta, Hungary's leading parcel sorting center, increased its distribution capacity with Leonardo's new sorting system. This is the latest international milestone in the logistics industry and confirms the Hungarian operator's trust in Leonardo's capabilities. They have had a solid cooperation for two decades. The system will be delivered by 2023 and can process up to 100 million parcels per year, and the contract includes technical support until 2031.

- Germany is one of the largest economies with a skilled manufacturing industry. As evidenced by the Industry 4.0 initiative (which aims to allocate resources and funding to build more intelligent factories), the country has a growing interest in using automation technology to improve manufacturing productivity.

- The growth of the sortation systems market in Germany can also be supported by the presence of the global leaders in sortation systems, Siemens Postal and Parcel Airport Logistics. These companies have made successful installations across international markets and are increasing awareness about sortation technology across regions with solid growth rates.

United Kingdom is Expected to Hold the Largest Market Share

- The concept of a sortation center dates back to 2013 and was first introduced by Amazon in the United Kingdom. After recording significant savings in operating costs while achieving the required throughput, other e-commerce industries adopted the same concept in the United Kingdom before other major countries.

- Due to the e-commerce boom, parcel delivery is experiencing tremendous growth across Europe, mainly in countries such as the United Kingdom and Germany. The resulting increase in parcel volume is a significant challenge for many courier and postal companies. The increasing demand for delivered products may boost the adoption of automation in sorting and managing shipping packages.

- Organizations are taking strategic approaches according to consumers' requirements. For instance, LAC Logistics offers a complete range of equipment for all sorted commodities. The company mainly focuses on the significant increase in the volume of various products, such as parcels, packets, and boxes, in the postal/express delivery market served by retailers and logistics companies.

- Along with e-commerce growth, the market for sortation systems in the United Kingdom is driven by the region's aviation industry. Four leading UK airports announced expansion plans to record passenger growth. For instance, Gatwick Airport announced a new EUR 1.1 billion investment plan over five years, aiming to increase passenger numbers by around 53 million by 2023.

- PSI Technologies excels in the food and beverage industry. The company understands the unique requirements of 24/7 operations, thus minimizing planned maintenance. It offers color-based food sorting to high-speed dispensing and filling systems. Its products are widely used throughout the food and beverage ecosystem.

- In June 2022, AsendiaManagement SAS successfully installed automated sorting robots and six new labeling robots at its parcel processing center in Heathrow, which became fully operational in May 2022. The new automated system has significantly increased parcel throughput for retailers, e-commerce brands, and other customers, reaching speeds of up to 7,200 parcels per hour and allowing sites to operate 24/7. The company invested its CAPEX of EUR 2.5million in these improvements.

Europe Sortation System Industry Overview

The European sortation systems market is fragmented and highly competitive. Product launches, high expenses on R&D, partnerships, and acquisitions are the prime growth strategies adopted by companies to sustain the intense competition.

- August 2021 - Vanderlande partnered with Bleckmann, a logistic service provider, to test its latest warehousing innovation, which aims to improve the manual sortation of batch-picked items to orders. This intuitive system can also reduce training time and increase operator performance.

- March 2021 - Fives provided DHL Express Italy with a new parcel handling and sorting solution. In March 2021, DHL Express Italy inaugurated the new Hub, Gateway, and Service Center at the Milan Malpensa Airport in northern Italy. As a partner of DHL Express Italy, Fives designed the solution based on proprietary technologies to meet customers' requirements. DHL Express Italy selected Fives' cross belt technology due to its high speed and accuracy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Improving Order Accuracy and SKU Proliferation

- 5.1.2 Increasing Concerns About Labor Costs and Industrial Automation

- 5.1.3 Growth in E-commerce

- 5.2 Market Restraints

- 5.2.1 High Deployment and Maintenance Costs

- 5.2.2 Real-time Technical Challenges and the Need for Skilled Workforce

- 5.3 Technology Snapshot

- 5.3.1 Overview of Automated Sorter Induction (Advantages, Adoption, Challenges Post-adoption and Pre-adoption, Availability (List of Vendors Offering Automated Sortation Induction), Technological Evolution in Terms of Design, Tools, and Other Specifications)

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Post and Parcel

- 6.1.2 Airport

- 6.1.3 Food and Beverages

- 6.1.4 Retail

- 6.1.5 Pharmaceuticals

- 6.1.6 Other End-user Industries

- 6.2 By Country

- 6.2.1 United Kingdom

- 6.2.2 France

- 6.2.3 Italy

- 6.2.4 Germany

- 6.2.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 TGW Systems Inc.

- 7.1.2 Interroll Holding AG

- 7.1.3 Dematic Corp. (KION Group)

- 7.1.4 Daifuku Co. Ltd

- 7.1.5 Viastore Systems Gmbh

- 7.1.6 Bastian Solutions Inc.

- 7.1.7 Murata Machinery Ltd

- 7.1.8 Fives Group

- 7.1.9 Vanderlande Industries Nederland BV

- 7.1.10 Beumer Group GmbH

- 7.1.11 Honeywell Intelligrated

- 7.1.12 Siemens AG

- 7.1.13 KNAPP AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

샘플 요청 목록