|

시장보고서

상품코드

1630193

철강 완제품 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Finished Steel Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

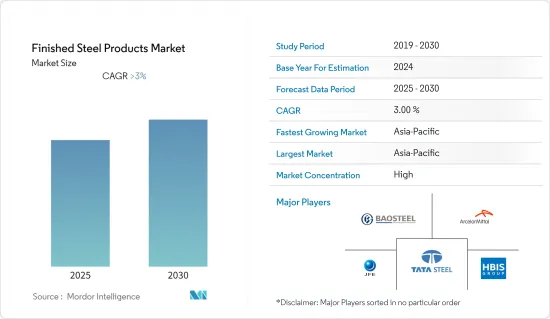

철강 완제품 시장은 예측 기간 동안 3% 이상의 CAGR을 기록할 것으로 예상됩니다.

COVID-19는 건축 및 건설, 전기 및 전자, 운송을 포함한 모든 주요 최종사용자 산업이 일시적으로 가동 중단되면서 시장에 부정적인 영향을 미쳤습니다. 제조 공장의 가동 중단으로 인해 이들 산업에서 다양한 상품의 생산 공정이 저하되어 철강 완제품 및 아연도금 강판과 관련된 활동의 성장이 제한되었습니다. 그러나 2021년에는 건설 및 운송 활동이 플러스 성장을 기록할 것으로 예상되며, 그 결과 예측 기간 동안 철강 완제품 시장이 회복될 것으로 보입니다.

주요 하이라이트

- 시장 성장을 이끄는 주요 요인은 건설 산업의 증가입니다.

- 대체품의 가용성과 온도에 따른 특성 변화가 시장 성장을 저해할 것으로 보입니다.

- 철 스크랩의 가용성이 증가함에 따라 향후 몇 년 동안 시장에 기회를 가져올 가능성이 높습니다.

- 아시아태평양이 시장을 장악할 것으로 예상되며, 예측 기간 동안 가장 높은 CAGR을 보일 가능성이 높습니다.

철강 완제품 시장 동향

수송 산업에서의 사용 증가

- 철강은 전 세계 자동차 제조업체들이 선택하는 효율적인 소재가 되었습니다. 자동차 산업에서 철강 제품의 수요를 증가시키는 특징으로는 고강도, 안전성, 다른 재료에 비해 상대적으로 저렴한 비용 등이 있습니다.

- 세계철강협회에 따르면 2022년 조강 생산량은 18억 7,850만 톤에 달할 것입니다. 건축 인프라 산업은 철강 완제품의 가장 큰 소비자로 전 세계 철강 소비량의 약 50%를 차지하며, 자동차 산업과 운송 산업이 그 뒤를 잇습니다.

- 그러나 자동차 경량화에 대한 요구가 높아지면서 자동차 산업의 철강 소비 증가를 방해하고 있습니다. 이는 향후 몇 년 동안 철강 소비에 영향을 미칠 것으로 보입니다.

- 또한, 특히 유럽, 중국, 미국에서는 환경 문제에 대한 우려로 화석연료 사용을 중단하려는 정부 계획이 많아 향후 몇 년 동안 전기자동차의 개발이 가속화될 것으로 보입니다.

- IEA에 따르면, 2022년 1분기 전 세계 전기자동차 판매량은 200만 대를 기록해 2021년 동기 대비 75% 증가했습니다. 올해 말까지 약 180만대로 22% 더 증가할 것으로 예상하고 있습니다.

- 이러한 요인으로 인해 철강 완제품 시장은 예측 기간 동안 전 세계적으로 성장할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양이 시장을 독점할 것으로 예상됩니다. 중국은 가장 빠르게 경제가 발전하는 국가 중 하나이며 세계 최대 생산국 중 하나입니다. 중국의 제조 부문은 중국 경제에 큰 기여를 하고 있습니다.

- 중국은 세계 최대의 자동차 제조국입니다. 중국의 자동차 부문은 연비를 보장하고 배기가스 배출을 최소화하는 제품을 만드는 데 주력하고 있으며(오염이 심각해지고 환경에 대한 관심이 높아짐에 따라), 제품 진화를 위해 노력하고 있습니다.

- 인도 철강부에 따르면 2021-22년 총 철강 완제품 소비량은 111.8MT이며, 2024-25년에는 160MT, 2030-31년에는 250MT에 달할 것으로 예상됩니다.

- 이러한 요인으로 인해 이 지역의 철강 완제품 시장은 예측 기간 동안 안정적인 성장을 보일 것으로 예상됩니다.

철강 완제품 산업 개요

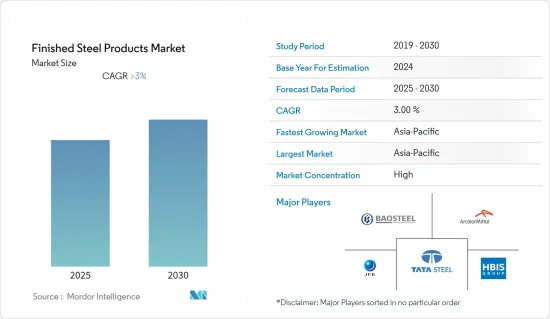

철강 완제품 시장은 그 특성상 부분적으로 통합되어 있습니다. 시장의 주요 기업으로는 ArcelorMittal, HBIS Group, Baosteel Group, Tata Steel, JFE Steel Corporation 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 건설 산업으로부터의 수요 확대

- 성장 억제요인

- 대체품의 입수 가능성

- 온도에 의한 특성 변화

- 산업 밸류체인 분석

- Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 정도

제5장 시장 세분화

- 형태

- 플레이트

- 스트립

- 로드

- 프로파일

- 튜브

- 와이어

- 기타 형태

- 프로세스

- 열간 압연

- 냉간 압연

- 단조

- 기타

- 최종 이용 산업

- 운송

- 건설

- 에너지

- 용기포장

- 전기·전자

- 기타

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 스페인

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카공화국

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 시장 점유율 분석

- 주요 기업의 전략

- 기업 개요

- ArcelorMittal

- Baosteel Group

- China Ansteel Group Corporation Limited

- Gerdau S/A

- HBIS GROUP

- JFE Steel Corporation

- Jiangsu Shagang Group

- NIPPON STEEL CORPORATION

- Nucor

- POSCO

- Tata Steel

- United States Steel

제7장 시장 기회와 향후 동향

- 철스크랩 입수 가능성 증가

The Finished Steel Products Market is expected to register a CAGR of greater than 3% during the forecast period.

The COVID-19 outbreak negatively impacted the market since all the major end-user industries, including building and construction, electrical and electronics, and transportation, were shut down on a temporary basis. Due to the non-functioning of the manufacturing plants, the production process of various goods in these industries declined, resulting in restricted growth in the activities involving finished steel products and galvanized steel. However, in 2021, the construction and transportation activities registered positive growth, resulting in the recovery of the finished steel products market in the forecast period.

Key Highlights

- The major factor driving market growth is the increasing construction industry.

- The availability of substitutes and their changing properties with temperature are likely to hinder the growth of the market.

- The increasing availability of steel scrap is likely to create opportunities for the market in the coming years.

- The Asia-Pacific region is expected to dominate the market and is also likely to witness the highest CAGR during the forecast period.

Finished Steel Products Market Trends

Increasing Usage in the Transportation Industry

- Steel has been an efficient material of choice for automakers globally. Some of the characteristics that increase the demand for steel products in the automotive industry include high strength, safety, and relatively low costs compared to other materials.

- According to the World Steel Association, in 2022, the production of crude steel will be 1,878.5 million tons. The building and infrastructure industry is the largest consumer of finished steel and accounts for approximately 50% of total world steel consumption, followed by the automotive and transportation industries.

- However, the increasing need to reduce the weight of an automobile is hindering the growth in the consumption of steel products in the automotive industry. This will affect the consumption of steel in the coming years.

- Also, the development of electric vehicles may continue to pick up speed in the coming years, especially in Europe, China, and the United States, where many government programs are trying to get people to stop using fossil fuels because of environmental concerns.

- According to the IEA, the global sales of electric cars in 2022 were 2 million units in the first quarter, up 75% from the same period in 2021. It is expecting a further 22 percent increase, or around 1.8 million units, by the end of this year.

- Owing to all these factors, the market for finished steel products is likely to grow across the world during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market. China is one of the fastest-emerging economies and has become one of the biggest production houses in the world. The country's manufacturing sector is one of the major contributors to the country's economy.

- China is the largest manufacturer of automobiles in the world. The country's automotive sector has been shaping up for product evolution, with the country focusing on manufacturing products in order to ensure fuel economy and minimize emissions (owing to the growing environmental concerns due to mounting pollution in the country).

- In India, according to the Ministry of Steel, the total finished steel consumption for the fiscal year 2021-22 was 111.8 MT, which is expected to reach 160 MT by 2024-25 and is estimated at 250 MT by 2030-31.

- Due to all such factors, the market for finished steel products in the region is expected to have steady growth during the forecast period.

Finished Steel Products Industry Overview

The finished steel products market is partially consolidated in nature. Some of the major players in the market include ArcelorMittal, HBIS Group, Baosteel Group, Tata Steel, and JFE Steel Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Construction Industry

- 4.2 Restraints

- 4.2.1 Availability of Substitutes

- 4.2.2 Change in Properties with Temperature

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Form

- 5.1.1 Plate

- 5.1.2 Strip

- 5.1.3 Rod

- 5.1.4 Profile

- 5.1.5 Tube

- 5.1.6 Wire

- 5.1.7 Other Forms

- 5.2 Process

- 5.2.1 Hot-Rolling

- 5.2.2 Cold-Rolling

- 5.2.3 Forging

- 5.2.4 Other Processes

- 5.3 End-user Industry

- 5.3.1 Transportation

- 5.3.2 Construction

- 5.3.3 Energy

- 5.3.4 Containers and Packaging

- 5.3.5 Electrical and Electronics

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ArcelorMittal

- 6.4.2 Baosteel Group

- 6.4.3 China Ansteel Group Corporation Limited

- 6.4.4 Gerdau S/A

- 6.4.5 HBIS GROUP

- 6.4.6 JFE Steel Corporation

- 6.4.7 Jiangsu Shagang Group

- 6.4.8 NIPPON STEEL CORPORATION

- 6.4.9 Nucor

- 6.4.10 POSCO

- 6.4.11 Tata Steel

- 6.4.12 United States Steel

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Availability of Steel Scrap