|

시장보고서

상품코드

1851707

미국의 페인트 및 코팅 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)United States Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

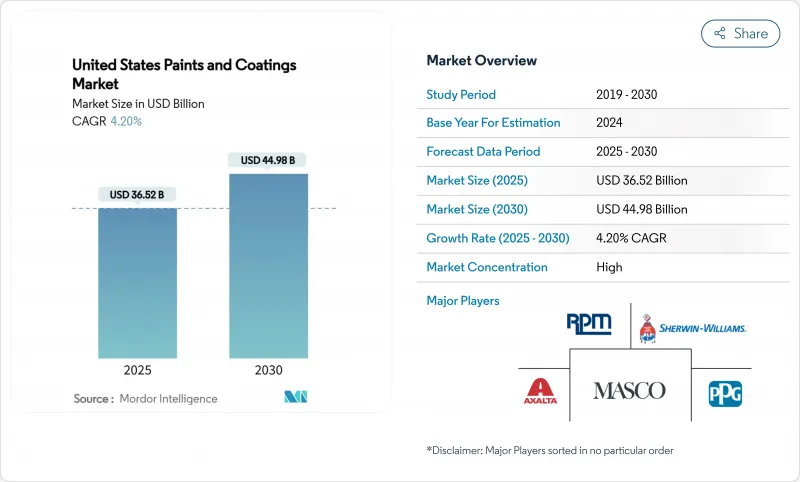

미국의 페인트 및 코팅 시장 규모는 2025년에 365억 2,000만 달러로 추정되고, 예측 기간(2025-2030년) CAGR 4.20%로 성장할 전망이며, 2030년에는 449억 8,000만 달러에 달할 것으로 예측됩니다.

현재의 확대는 건축용 재도장의 지속적인 힘, 수성 제제에 대한 급격한 경주, 연방 정부의 인프라 정비의 파도가 보호 제품의 양을 끌어올리고 있기 때문입니다. 근본적인 수요는 삼베르트 지역으로의 인구 이동, 남동부의 제조업 재편, 전자상거래에 의한 페인트 판매의 꾸준한 증가에 의해 강화되고 있습니다. 생산자는 또한 불안정한 이산화 티타늄 비용과 핍박한 노동 조건에 따라 가격 인상이 정착되기 때문에 눈앞의 가격 결정력에서도 혜택을 받고 있습니다. 그러나 경쟁의 치열성은 사모 주식의 지원을 받은 통합 기업이 바이 앤 빌드 기술을 적용하는 한편, 대기업 기존 기업이 보다 이익률이 높은 산업용 틈새 시장을 우선하여 포트폴리오를 축소하고 있기 때문에 높아지고 있습니다.

미국의 페인트 및 코팅 시장 동향 및 인사이트

연방 인프라 투자 및 고용법

IIJA는 40,000개 이상의 교량 및 도로 프로젝트에 자금을 제공했으며, 그 채택 이후 고속도로 및 도로에 대한 지출을 36% 증가시켰습니다. 국토 교통성의 사양이 최저 낙찰 가격의 페인트 시스템보다 부식 방지를 우선하고 있기 때문에 고성능 에폭시, 폴리아스파라긴, 진클리치 프라이머가 이익을 얻고 있습니다. 수도 사업에서 NSF 인증 라이닝의 사양은 식수 인프라에 대한 연방 정부의 지출이 62% 급증함에 따라 확대되고 있습니다. 운송 건설은 2025년에 추가로 8% 증가할 것으로 예상되며, 보호 페인트 도포업자들에게 눈에 보이는 2년의 주문 파이프라인이 형성됩니다. 인플레이션은 할당된 자금의 일부를 흡수하고 수량 증가를 억제하지만 각 기관이 수명이 긴 시스템을 지정하기 때문에 가격 구성은 플러스를 유지합니다. 노동력 확보가 주요 발판이 되어 프로젝트 스케줄이 길어지고 소비는 보다 많은 분기에 이릅니다.

주택 리폼 붐

주택 재도장의 양은 3% 이하의 주택 융자를 가진 소유자가 이사가 아닌 개축을 촉진하는 '록인' 효과 덕분에 신축 주택의 연조를 상쇄했습니다. 샤윈 윌리엄스는 2024년까지 재도장 범주가 한 자릿수의 고성장을 이룰 것으로 보고했습니다. 밀레니얼 세대가 최초의 가구를 형성하고, 베이비부머 세대가 노후화한 주택을 개수하는 것으로, 지속적인 갤런 수가 지지됩니다. 디지털 컬러 툴과 익일 배송이 DIY에 대응할 수 있는 층을 확대해, 전문의 도장 장인은 모바일 주문을 이용해 점포에 대한 방향을 줄이고 있습니다. 리폼 수요는 본질적으로 재량적이지만, 인구동태의 펀더멘탈스와 주택 스톡의 노후화가 경기 사이클을 통해 회복력을 가져오고 있습니다.

불안정한 TiO2 가격

산화티타늄은 건축용 백색 페인트에 대한 원료 비용의 최대 50%를 차지하고, 배합업자는 이것을 드러내고 있습니다. 2024년 여름 급등으로 마진이 압축되었기 때문에 일본 페인트 등은 2025년 계약에 대해 최대 9%의 가격 인상을 발표했습니다. 선도적인 제조업체는 다년간 공급 계약과 안료 확장 기술로 헤지하고 있지만 중소형 제조업체는 재고 손실의 위험이 있습니다. 불투명도를 최적화한 수지 시스템이나 은폐성을 희생하지 않고 TiO2 장전량을 저감하는 나노입자 분산액의 연구개발이 활발해지고 있지만, 상업 규모로의 보급에는 아직 3-4년이 걸립니다.

부문 분석

아크릴계 수지는 벽용 페인트 및 유지관리용 마감재 모두 경도와 유연성의 균형이 잡혀 있기 때문에 2024년 매출의 35%를 차지하며 가장 큰 비율을 차지했습니다. 최종 사용자는 차세대 수성 아크릴의 저온 피막 형성과 악취 감소를 높이 평가했습니다. 폴리우레탄은 자동차 제조업체나 바닥 코팅의 지정업자가 용제형에 필적하는 내구성을 가지는 2액형의 수성 유형을 채용하고 있기 때문에 CAGR 5.10%로 진전하고 있습니다. 배합업자는 가혹한 자외선 하에서도 황변하기 어려운 지방족 이소시아네이트의 진보를 활용하고 있습니다. 알키드는 점유율을 떨어뜨리면서도 속건성 금속 프라이머와 비용에 민감한 계약자 시장에 기여하고 있습니다. 폴리에스테르 수지는 울타리와 HVAC 패널에 분체 코팅 틈새를 개척하고 있습니다. 특수한 하이브리드 시스템은 높은 마진을 획득하고, 중견 제조업체가 아크릴 수지의 범용품 공급자에 대항할 수 있는 가격 설정이 되고 있습니다. 미국의 페인트 시장은 산업용 및 자동차용으로 폴리우레탄이 아크릴의 주도권을 깎을 것으로 예상되지만, 소비자용 및 건축용에서는 아크릴이 우위를 유지할 것으로 보입니다.

수성 시스템은 2024년 매출의 67%를 차지했으며, 규제와 소비자의 기세를 반영합니다. 레올로지 개질제와 비응집성 바인더의 끊임없는 진보로 용제 대체품과의 성능 차이가 줄어들고 미국의 페인트 및 코팅 시장이 보다 친환경적인 선택으로 이행하는 동안 동향을 뛰어넘는 성장을 견인하고 있습니다. 파우더 기술은 제로 VOC 증명과 재생 가능한 오버 스프레이로 가전제품, 금속 가구 및 자동차 휠로 점유율을 확대하고 있습니다. 솔벤트 기반 플랫폼은 경화 조건이 심한 일부 헤비 듀티 및 해양 환경에서는 여전히 필수적이지만, 계속되는 대기질 규제에 의해 그 점유율은 계속 하락할 것으로 보입니다. 색상의 유연성과 높은 멤브레인성을 필요로 하는 페인트 공장에서는 분말과 액체의 하이브리드 라인이 상승하고 있습니다. 이러한 변화를 총칭하여 기술 믹스가 재구성되어 큐어 에너지 모델링, 분말 스프레이 로봇, LED-UV 램프 시스템에 대한 투자가 촉진됩니다.

미국의 페인트 시장 세분화 보고서는 수지 유형별(아크릴, 알키드, 폴리우레탄, 에폭시, 폴리에스테르, 기타 수지 유형), 기술별(수계, 용제계, 분체 페인트, UV 기술), 유통 채널별(직영점, 독립계 페인트 판매점, 기타), 최종 사용자 산업별(건축, 자동차, 목재, 보호 도료, 일반 산업, 기타)로 구분되고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 연방 인프라 투자 및 고용 촉진법이 교량 및 고속도로용 코팅제 수요 환기

- 주택 리폼 붐이 DIY 건축용 페인트 판매량 촉진

- 미국의 대기 배출 기준을 충족시키기 위해 분체 페인트 및 UV 경화형 페인트로의 시프트 진행

- 제조업의 리쇼어링이 미국 남동부의 공업용 페인트 수요 촉진

- 자동차 부문의 성장

- 시장 성장 억제요인

- 산화티타늄의 가격 변동이 생산자의 이폭 압박

- 프로젝트 완료를 늦추는 공업 도장 기술자의 부족

- 도료 소매업의 재고 사이클을 파괴하는 운임 인플레이션

- 소금 비 사이딩과 복합 사이딩으로의 시프트가 외벽 페인트 소비 감소 초래

- 밸류체인 분석

- 규제 전망

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 업계 간 경쟁

제5장 시장 규모 및 성장 예측

- 수지 유형별

- 아크릴

- 알키드

- 폴리우레탄

- 에폭시

- 폴리에스테르

- 기타 수지 유형

- 기술별

- 수성

- 용제계

- 분체 코팅

- UV 기술

- 유통 채널별

- 직영점

- 독립계 페인트 판매점

- 대형 소매점 및 홈 센터

- 산업용 OEM에 직접 판매

- 전자상거래

- 최종 사용자 업계별

- 건축

- 자동차

- 목재

- 보호 페인트

- 일반 산업

- 운송

- 포장

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Akzo Nobel NV

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Carboline

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tnemec

- Wacker Chemie AG

제7장 시장 기회 및 향후 전망

AJY 25.11.24The United States Paints And Coatings Market size is estimated at USD 36.52 billion in 2025, and is expected to reach USD 44.98 billion by 2030, at a CAGR of 4.20% during the forecast period (2025-2030).

The current expansion rests on the sustained strength of architectural repaint activity, the sharp pivot toward waterborne formulations, and a federal infrastructure wave lifting volumes of protective products. Underlying demand is reinforced by population migration to the Sun Belt, manufacturing reshoring in the Southeast, and a steady rise in e-commerce paint sales. Producers also benefit from near-term pricing power as volatile titanium-dioxide costs and tight labor conditions make price increases stick. Competitive intensity, however, is heightening as private-equity backed consolidators apply a buy-and-build playbook while large incumbents prune portfolios to favor higher-margin industrial niches.

United States Paints And Coatings Market Trends and Insights

Federal Infrastructure Investment and Jobs Act

The IIJA has funded more than 40,000 bridge and roadway projects, lifting highway and street spending by 36% since its adoption. High-performance epoxy, polyaspartic, and zinc-rich primers benefit because DOT specifications prioritize corrosion protection over lowest-bid paint systems. Specifications for NSF-certified linings in water projects are expanding alongside a 62% federal outlay jump in drinking-water infrastructure. Transportation construction is projected to climb another 8% in 2025, creating a visible two-year order pipeline for protective-coatings applicators. Inflation is absorbing a portion of allocated funds, tempering volume upside, yet price-mix remains positive as agencies specify longer-life systems. Labor availability is the main gating factor, prolonging project schedules and stretching consumption over more calendar quarters.

Home Remodeling Boom

Residential repaint volumes have offset softness in new-build housing thanks to a "lock-in" effect that encourages owners with sub-3% mortgages to renovate rather than relocate. Sherwin-Williams reported high-single-digit growth in repaint categories through 2024. Millennials forming first-time households and baby boomers retrofitting aging homes underpin sustained gallonage. Digital color tools and next-day delivery have expanded the addressable DIY audience, while pro painters use mobile ordering to cut store trips. Remodel demand is inherently discretionary, yet demographic fundamentals and an aging housing stock provide resilience through economic cycles.

Volatile TiO2 Pricing

TiO2 constitutes up to 50% of a white architectural coating's raw-material cost, exposing formulators. Margins compressed during the 2024 summer spike, prompting Nippon Paint and others to announce up to 9% price rises for 2025 contracts. Larger players hedge through multi-year supply deals and pigment-extension technology, while smaller producers risk inventory losses. R&D is intensifying around opacity-optimized resin systems and nanoparticle dispersions that lower TiO2 loading without sacrificing hide, yet widespread commercial scale is still three to four years away.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Powder and UV-Curable Coatings

- Manufacturing Reshoring

- Shortage of Skilled Industrial Painters

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic chemistries generated the largest slice of 2024 revenue at 35% because they balance hardness and flexibility across both wall paints and maintenance finishes. End-users appreciate low-temperature film formation and odor reduction in next-generation waterborne acrylics. The polyurethane cohort is advancing at a 5.10% CAGR as automakers and floor-coating specifiers adopt two-component water-borne versions that rival solvent-borne durability. Formulators capitalize on aliphatic isocyanate advances that resist yellowing under harsh UV. Alkyds are losing share yet still serve quick-dry metal primers and cost-sensitive contractor markets. Polyester resins are carving powder-coating niches on fencing and HVAC panels. Specialty hybrid systems fetch higher margins, allowing mid-size producers to defend pricing against bulk commodity acrylic suppliers. Over the forecast horizon, the US paints and coatings market will see polyurethane chip away at acrylic leadership in industrial and automotive uses, although acrylic will stay dominant in consumer and builder channels.

Water-borne systems held 67% of 2024 sales, reflecting regulatory and consumer momentum. Continuous advances in rheology modifiers and coalescent-free binders have closed historical performance gaps versus solvent alternatives, driving above-trend growth as the US paints and coatings market shifts toward greener options. Powder technology is gaining share in appliances, metal furniture, and automotive wheels thanks to zero-VOC credentials and reclaimable overspray. Solvent-borne platforms remain essential in select heavy-duty and marine settings where cure conditions are severe, but successive air-quality rules will keep eroding their share. Hybrid powder-liquid lines are emerging in job-coat shops that need color flexibility and high film build capabilities. Collectively, these shifts are reshaping the technology mix and fueling investment in cure-energy modeling, powder spray robots, and LED-UV lamp systems.

The United States Paints and Coatings Market Report Segments the Industry by Resin Type (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Other Resin Types), Technology (Water-Borne, Solvent-Borne, Powder Coating, and UV Technology), Distribution Channel (Company-Owned Stores, Independent Paint Dealers, and More), and End-User Industry (Architectural, Automotive, Wood, Protective Coatings, General Industrial, and More).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BASF

- Beckers Group

- Benjamin Moore & Co.

- Carboline

- Diamond Vogel

- Dunn-Edwards Corporation

- Hempel A/S

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Parker Hannifin

- PPG Industries, Inc.

- RPM International Inc.

- Rust-Oleum Corporation

- Sika AG

- The Sherwin-Williams Company

- Tnemec

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal Infrastructure Investment and Jobs Act Catalyzing Bridge and Highway Coatings Demand

- 4.2.2 Home Remodeling Boom Elevating DIY Architectural Paint Volumes

- 4.2.3 Shift to Powder and UV-Curable Coatings to Meet U.S. Air-Emission Standards

- 4.2.4 Manufacturing Reshoring Spurring Industrial Coatings Demand in U.S. Southeast

- 4.2.5 Growth in the Automotive Sector

- 4.3 Market Restraints

- 4.3.1 Volatile TiO2 Pricing Compressing Producer Margins

- 4.3.2 Shortage of Skilled Industrial Painters Delaying Project Completions

- 4.3.3 Freight-Cost Inflation Disrupting Paint-Retailer Inventory Cycles

- 4.3.4 Shift to PVC and Composite Siding Reducing Exterior Paint Consumption

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Acrylic

- 5.1.2 Alkyd

- 5.1.3 Polyurethane

- 5.1.4 Epoxy

- 5.1.5 Polyester

- 5.1.6 Other Resin Types

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coating

- 5.2.4 UV technology

- 5.3 By Distribution Channel

- 5.3.1 Company-Owned Stores

- 5.3.2 Independent Paint Dealers

- 5.3.3 Big-Box Retailers and Home Centers

- 5.3.4 Direct to Industrial OEM

- 5.3.5 E-Commerce

- 5.4 By End-user Industry

- 5.4.1 Architectural

- 5.4.2 Automotive

- 5.4.3 Wood

- 5.4.4 Protective Coatings

- 5.4.5 General Industrial

- 5.4.6 Transportation

- 5.4.7 Packaging

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BASF

- 6.4.4 Beckers Group

- 6.4.5 Benjamin Moore & Co.

- 6.4.6 Carboline

- 6.4.7 Diamond Vogel

- 6.4.8 Dunn-Edwards Corporation

- 6.4.9 Hempel A/S

- 6.4.10 Masco Corporation

- 6.4.11 Nippon Paint Holdings Co., Ltd.

- 6.4.12 Parker Hannifin

- 6.4.13 PPG Industries, Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Rust-Oleum Corporation

- 6.4.16 Sika AG

- 6.4.17 The Sherwin-Williams Company

- 6.4.18 Tnemec

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Self-Healing Protective Coatings for Offshore Wind Infrastructure