|

시장보고서

상품코드

1850370

센서 융합 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Sensor Fusion - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

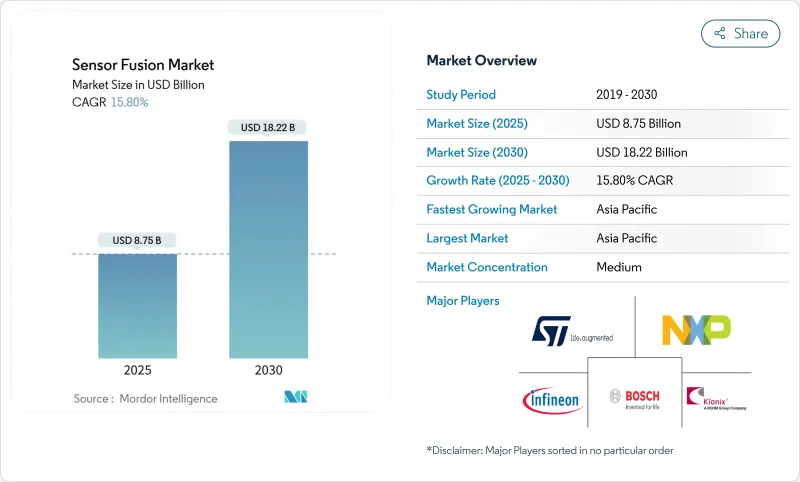

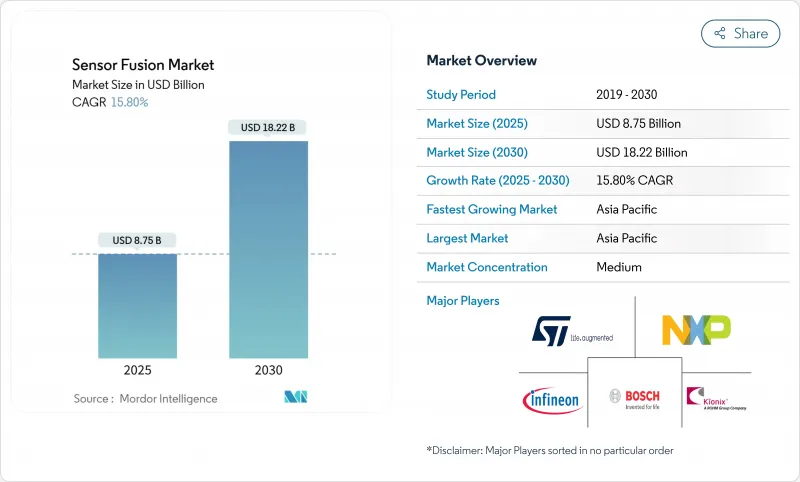

센서 융합 시장 규모는 2025년에 87억 5,000만 달러로 추정되고, 2030년에는 182억 2,000만 달러에 이를 것으로 예상되며, CAGR 15.8%로 확대될 전망입니다.

성장의 배경은 자율 주행 시스템에서 신뢰할 수 있는 실시간 지각의 필요성, 안전 규제 강화, 솔리드 스테이트 LiDAR 등 주요 하드웨어의 꾸준한 비용 절감입니다. 아시아태평양은 중국의 자율주행차(AV) 테스트 루트와 산업 자동화 프로젝트의 급속한 전개를 배경으로 채용을 선도하고 있습니다. 유럽의 안전 우선 정책과 미국의 V2X 인프라 투자가 더욱 기세를 이끌고 있습니다. Edge AI가 컴퓨팅을 클라우드에서 엔드포인트로 이동시키고 대기 시간 및 데이터 프라이버시 위험을 줄이면서 하드웨어는 여전히 수익의 대부분을 차지하지만 소프트웨어는 가치 점유율을 확대하고 있습니다. 현재 레이더와 카메라의 퓨전이 주력 구성이지만, LiDAR를 추가한 3센서 스위트가 가장 급속히 확대되어 경쟁 포지셔닝을 재구축하고 있습니다.

세계의 센서 융합 시장 동향 및 인사이트

유럽 OEM 채택 가속화하는 유로 NCAP 5성급 평가를 위한 센서 융합 의무화

유로 NCAP의 2025년 로드맵에서는 멀티센서 지각이 유럽 자동차 제조업체에게 양보할 수 없는 안전 기준으로 승격하고 있습니다. 승용차 플랫폼은 카메라, 레이더, 최근에는 LiDAR을 조화시켜 낮과 밤 모두에서 엄격한 보행자 감지 테스트를 통과해야 합니다. 미국 NHTSA 정책이 일치하면 세계 무결성이 강화되고 공급업체는 지역 간 개발을 상각할 수 있습니다. Aptiv와 같은 Tier-1은 대기 시간을 줄이고 지저분한 도시 장면에서 물체 감지를 선명하게 하는 Over-the-Air 업그레이드 가능한 ADAS 스택을 지원합니다. 알고리즘 업그레이드는 하드웨어를 재설계하지 않고도 측정할 수 있는 안전성을 향상시켜 규제를 뒷받침하면 소프트웨어의 혁신을 가속화합니다.

솔리드 스테이트 LiDAR의 비용 저하로 중국 전역의 미드 부문 차량에 멀티 센서 스위트를 탑재 가능

차량용 등급의 솔리드 스테이트 LiDAR의 단가는 초기 상업 수준에서 약 99.5% 하락하여 중국의 광대한 중형 시장 부문에서 3개의 센서 융합 스위트를 실현 가능하게 하고 있습니다. 2025년에는 LiDAR를 탑재한 국산차가 전년 대비 2배인 94차종이 됩니다. 베이징의 2025년 4월 L3 프레임워크는 더욱 수요를 끌어올리고 OEM은 라이드 헤일링과 개인 사용 프로그램을 통해 더 높은 자율성을 수익화할 수 있게 됩니다. 현지 공급업체인 Hesai와 RoboSense는 중국의 LiDAR 매출 랭킹에서 화웨이에 이어 세계 비용 압축을 가속화하는 치열한 가격 경쟁 환경을 강화하고 있습니다.

상호 운용성을 억제하는 통합된 퓨전 아키텍처 표준의 부족

공통 데이터 형식이나 검증 프레임워크가 없기 때문에 OEM 및 공급업체는 맞춤형 퓨전 파이프라인을 설계하고, 통합 비용을 증가시키며, 구성 요소 호환성을 방해합니다. NIST는 공급업체 간의 호환성을 가속화하기 위해 표준화된 참조 데이터 세트와 평가 기준을 요구합니다. 또한 한 플랫폼에서 수집된 증거가 다른 플랫폼으로 이동하지 못할 수 있으며, 모델 라인 간의 기능 전개가 지연되기 때문에 단편화는 자동차의 호모로게이션을 복잡하게 합니다.

부문 분석

2024년 하드웨어 시장 규모는 57억 달러로 총 지출의 65%에 해당하며, 지각에서 카메라, 레이더, LiDAR, IMU의 필수적인 역할을 강조하고 있습니다. 자동차가 30개 이상의 센서를 탑재하게 되어 하드웨어의 성장은 계속되고 있지만, 가격 하락이 수익 확대를 억제하고 있습니다. 이와는 대조적으로, 소프트웨어 슬라이스는 OTA 업데이트를 통해 판매 후 새로운 수익 단계가 해제되기 때문에 2030년까지 18.9%의 연평균 복합 성장률(CAGR)로 확대됩니다.

정교한 퓨전 알고리즘은 설치된 하드웨어의 성능을 향상시키고 물리적 변경 없이 마진이 풍부한 업그레이드를 제공합니다. CEVA의 FSP201 센서 허브 MCU는 이러한 추세를 보여줍니다. 단일 저전력 칩은 무인 항공기 및 웨어러블을 위한 관성, 음성 및 환경 데이터를 융합하여 최적화된 코드가 향후 수년간 센서 융합 시장을 계속 끌어올리는 방법을 보여줍니다.

레이더 카메라 시스템은 2024년 센서 융합 시장 점유율의 38%를 차지했으며, 비용과 악천후에 대한 견고성의 균형을 맞추고 있습니다. 대부분의 L2 ADAS 스택은 적응형 크루즈 컨트롤과 자동 브레이크를 위해 이 조합에 의존합니다. 그러나 3센서 플랫폼과 관련된 센서 융합 시장 규모는 솔리드 스테이트 LiDAR의 가격 하락에 따라 2030년까지 연평균 복합 성장률(CAGR) 22.5%로 급증할 것으로 예측되고 있습니다.

LiDAR을 통합함으로써 심도 정밀도 및 중복성이 향상되며, L3 이상의 자율성에 필수적입니다. 교세라의 카메라와 LiDAR의 퓨전 센서는 2개의 모달리티를 하나의 인클로저에 담아 시차를 줄이면서 교정 요구를 간소화합니다. 이러한 패키징 효율은 공간 및 열 예산이 엄격한 비용 중심 부문에 필수적입니다.

센서 융합 시장은 제품별(하드웨어, 소프트웨어), 융합 방식별(레이더+카메라 퓨전, 라이더+카메라 퓨전 등), 알고리즘 유형별(칼만 필터(EKF, UKF), 베이지안 네트워크 등), 용도별, 차량 유형별, 지역별로 분류되어 있습니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역 분석

아시아태평양은 센서 융합 시장에서 가장 큰 점유율을 차지하며, 2024년에는 33억 달러에 이르렀으며 CAGR은 17.2%로 추이합니다. 중국의 50개가 넘는 AV 테스트 존은 산업용 로봇에 대한 국가 보조금과 함께 규모를 확대하고 있습니다. 일본과 한국은 세계 공급망에 공급하는 소형 센서 노하우를 제공합니다. 북미의 센서 융합 시장 규모는 후진을 배려하고 있지만, 실리콘 밸리의 AI 인재의 풍부함과 미국이 L4 지각의 리던던시의 전제조건인 V2X 무선을 고속도로의 통로에 임베딩하는 것을 추진하고 있기 때문에 혜택을 받고 있습니다.

유럽의 방향성은 엄격한 안전 규칙 및 데이터 프라이버시 규칙에 의해 결정됩니다. 이 지역의 Tier-1 공급업체는 유로 NCAP의 다중 센서 요구사항을 충족하기 위해 정밀 공학을 활용하여 기능적 안전성 지표로 유럽 플랫폼을 지속적으로 이끌고 있습니다. 중동 전역에서 방위의 현대화는 멀티 센서 타겟팅 시스템을 뒷받침하고 있습니다. 이러한 프로젝트는 나중에 소비자용 AV로 이행하는 듀얼 유스 IP를 생성하는 경우가 많습니다. 아프리카와 남미는 LiDAR의 보급이 제한적이어서 데이터 인프라가 성숙하지 않기 때문에 지연을 겪고 있지만, 스마트 시티의 자금 조달의 일부는 교통 관리 및 공공 안전 드론을 위해 센서 융합을 시험적으로 도입하고 있습니다.

베이징의 AV령부터 브뤼셀의 AI법까지, 지역별 규제 프레임워크이 센서 융합 전개의 페이스와 깊이를 결정합니다. 대륙을 가로질러 호모로게이션 프로세스에 익숙한 공급업체는 인증 툴 체인을 지각 스택에 번들로 제공하여 규제 차이를 서비스 수익으로 바꿉니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 유로 NCAP 5성 평가를 위한 센서 융합의 의무화에 의해 유럽 OEM의 채용 가속

- 솔리드 스테이트 LiDAR의 비용 저하에 의해 중국 전토의 중급차에 멀티 센서 스위트 탑재 가능

- 엣지 AI 칩의 진보에 의해 모바일 및 XR 디바이스에서 리얼타임 멀티 모달 퓨전 가능

- 고정밀도가 요구되는 스마트 팩토리에 AMR 로봇 도입 센서 융합

- 중동에서 멀티 센서 표적 및 항법 시스템에 대한 자금 원조를 실시하는 방위 현대화 프로그램

- 미국에서 레벨 4 자동 운전을 실현하기 위해 V2X 데이터 스트림을 Fusion Stack에 통합

- 시장 성장 억제요인

- 통일된 Fusion 아키텍처 표준의 부족이 상호 운용성 저해

- 비자동차용 IoT 디바이스의 BoM을 상승시키는 높은 계산 오버헤드

- 신흥 시장에서 LiDAR의 한정된 보급으로 멀티 모달 퓨전 도입 제한

- 클라우드 지원 파이프라인에서의 데이터 프라이버시 및 사이버 보안 우려

- 밸류체인 및 공급망 분석

- 규제 또는 기술 전망

- 멀티 센서 융합 플랫폼의 기술 진화 로드맵

- 엣지 AI 통합 및 SoC의 진보

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력 및 소비자

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 주요 시장 동향

- 주요 특허 및 조사 활동

- 주요 용도 신흥 용도

- 어댑티브 크루즈 컨트롤(ACC)

- 자동 긴급 브레이크(AEB)

- 전자 안정 제어(ESC)

- 전방 충돌 경보(FCW)

- 기타 신흥 용도

- 투자 상황

제5장 시장 규모 및 성장 예측

- 제품별

- 하드웨어

- 소프트웨어

- 융합 방식별

- 레이더 카메라 융합

- LiDAR 카메라 퓨전

- 레이더 LiDAR 융합

- IMU GPS 융합

- 3센서 융합(카메라 레이더 LiDAR)

- 알고리즘 유형별

- 칼만 필터(EKF, UKF)

- 베이지안 네트워크

- 신경망 및 딥러닝

- GNSS 및 INS 통합

- 용도별

- ADAS(선진 운전 지원 시스템)(ADAS)

- ACC

- AEB

- ESC

- FCW

- 레인키프 어시스트(LKA)

- 자율주행(레벨 3-5)

- 소비자용 전자기기(AR/VR, 스마트폰, 웨어러블)

- 로봇 공학 및 드론

- 산업 자동화 및 스마트 제조

- 방위 및 항공우주

- ADAS(선진 운전 지원 시스템)(ADAS)

- 차량 유형별

- 승용차

- 소형 상용차

- 대형 상용차

- 기타 자율주행차(셔틀, AGV)

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 카리브해 제도

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 이스라엘

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 이집트

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors NV

- STMicroelectronics NV

- Infineon Technologies AG

- Texas Instruments Inc.

- Nvidia Corporation

- Qualcomm Incorporated

- Analog Devices Inc.

- Mobileye Global Inc.

- Aptiv PLC

- Renesas Electronics Corporation

- Valeo SA

- ZF Friedrichshafen AG

- Arbe Robotics Ltd.

- BASELABS GmbH

- LeddarTech Inc.

- TDK Corporation

- Kionix Inc.(ROHM)

- Memsic Inc.

- CEVA Inc.

- AMD Xilinx

제7장 시장 기회 및 향후 전망

AJY 25.11.10The sensor fusion market size is estimated at USD 8.75 billion in 2025 and is set to reach USD 18.22 billion by 2030, expanding at a 15.8% CAGR.

Growth rests on the need for reliable, real-time perception in autonomous systems, tighter safety regulations, and steady cost declines in key hardware such as solid-state LiDAR. Asia-Pacific leads adoption on the back of China's rapid rollout of autonomous vehicle (AV) testing routes and industrial automation projects. Europe's safety-first policies and the United States' V2X infrastructure investments provide additional momentum. Hardware still dominates revenue, yet software is capturing a rising share of value as edge AI shifts compute from the cloud to the endpoint, trimming latency and data-privacy risk. Radar-camera fusion is currently the workhorse configuration, but three-sensor suites that add LiDAR are scaling fastest and reshaping competitive positioning as component prices fall.

Global Sensor Fusion Market Trends and Insights

Mandate of Sensor Fusion for Euro NCAP 5-Star Ratings Accelerating European OEM Adoption

Euro NCAP's 2025 roadmap elevates multi-sensor perception to a non-negotiable safety baseline for European automakers. Passenger-car platforms must harmonize cameras, radar, and increasingly LiDAR to pass demanding pedestrian detection tests in both daylight and darkness. Converging policies by NHTSA in the United States reinforce global alignment, enabling suppliers to amortize development across regions. Tier-1s such as Aptiv respond with over-the-air-upgradable ADAS stacks that lower latency and sharpen object detection in cluttered urban scenes. The regulatory push accelerates software innovation because algorithm upgrades deliver measurable safety gains without re-engineering hardware.

Solid-State LiDAR Cost Decline Enabling Multi-Sensor Suites in Mid-Segment Cars across China

Unit prices for automotive-grade solid-state LiDAR have fallen roughly 99.5% from early commercial levels, making three-sensor fusion suites viable in China's sprawling mid-market segment. In 2025, 94 domestic vehicle models ship with LiDAR, double the prior year. Beijing's April 2025 L3 framework further catalyses demand, letting OEMs monetize higher autonomy through ride-hailing and personal-use programs. Local suppliers Hesai and RoboSense trail only Huawei in China's LiDAR revenue ranking, reinforcing a fiercely price-competitive environment that speeds global cost compression.

Lack of Uniform Fusion Architecture Standards Hindering Interoperability

Without common data formats and validation frameworks, OEMs and suppliers design bespoke fusion pipelines, elevating integration cost and hindering component interchangeability. NIST calls for standardized reference datasets and evaluation metrics to accelerate cross-vendor compatibility. Fragmentation also complicates automotive homologation because evidence collected on one platform may not transfer to another, slowing feature rollouts across model lines.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI Chip Advancements Allowing Real-Time Multi-Modal Fusion in Mobile and XR Devices

- Deployment of AMR Robots in Smart Factories Demanding High-Accuracy Sensor Fusion

- Data-Privacy and Cyber-Security Concerns Around Cloud-Aided Sensor Fusion Pipelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The sensor fusion market size for hardware stood at USD 5.7 billion in 2024, equal to 65% of total spending, underscoring the indispensable role of cameras, radar, LiDAR, and IMUs in perception. Hardware growth continues as vehicles exceed 30 discrete sensors, yet price erosion tempers revenue expansion. The software slice, by contrast, is scaling at an 18.9% CAGR to 2030 as OTA updates unlock new revenue stages post-sale, a shift already evident in Aptiv's Gen 6 ADAS rollouts.

Sophisticated fusion algorithms elevate installed hardware performance, yielding margin-rich upgrades without physical changes. CEVA's FSP201 sensor hub MCU illustrates the trend: a single low-power chip fuses inertial, audio, and environmental data for drones and wearables, signalling how optimized code will keep lifting the sensor fusion market for years to come.

Radar-camera systems controlled 38% of sensor fusion market share in 2024, balancing cost and robustness against poor weather. Most L2 ADAS stacks rely on this pairing for adaptive cruise control and automatic braking. The sensor fusion market size tied to three-sensor platforms is predicted to surge, however, on a 22.5% CAGR through 2030 as solid-state LiDAR prices tumble.

Integrating LiDAR enhances depth accuracy and redundancy, critical for L3 and above autonomy. Kyocera's camera-LiDAR fusion sensor collapses two modalities into one housing, reducing parallax while simplifying calibration demands. This packaging efficiency is vital for cost-sensitive segments where space and heat budgets are tight.

Sensor Fusion Market Sensor Fusion Market Segmented by Offering (Hardware, Software), Fusion Method (Radar + Camera Fusion, Lidar + Camera Fusion and More), Algorithm Type (Kalman Filter (EKF, UKF), Bayesian Networks and More), Application, Vehicle Type and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controls the largest slice of the sensor fusion market, reaching USD 3.3 billion in 2024 and advancing on a 17.2% CAGR. China's 50-plus AV test zones, alongside national subsidies for industrial robotics, create scale. Japan and South Korea contribute miniaturized sensor know-how that feeds global supply chains. The sensor fusion market size in North America trails but benefits from Silicon Valley's deep AI talent pool and the U.S. push to embed V2X radios in highway corridors, a prerequisite for L4 perception redundancy.

Europe's direction is set by stringent safety and data-privacy rules. The region's Tier-1 suppliers leverage precision engineering to meet Euro NCAP's multi-sensor demands, keeping European platforms ahead on functional-safety metrics. Across the Middle East, defense modernization fuels multi-sensor targeting systems; these projects often birth dual-use IP that later migrates into civilian AVs. Africa and South America lag due to limited LiDAR penetration and less mature data infrastructure, but pockets of smart-city funding are piloting sensor fusion for traffic management and public-safety drones.

Collectively, regional regulatory frameworks, from Beijing's AV decree to Brussels' AI Act, dictate the pace and depth of sensor fusion rollouts. Suppliers accustomed to cross-continent homologation processes are turning regulatory variance into service revenue by offering certification toolchains bundled with their perception stacks.

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

- Infineon Technologies AG

- Texas Instruments Inc.

- Nvidia Corporation

- Qualcomm Incorporated

- Analog Devices Inc.

- Mobileye Global Inc.

- Aptiv PLC

- Renesas Electronics Corporation

- Valeo S.A.

- ZF Friedrichshafen AG

- Arbe Robotics Ltd.

- BASELABS GmbH

- LeddarTech Inc.

- TDK Corporation

- Kionix Inc. (ROHM)

- Memsic Inc.

- CEVA Inc.

- AMD Xilinx

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandate of Sensor Fusion for Euro NCAP 5-Star Ratings Accelerating European OEM Adoption

- 4.2.2 Solid-State LiDAR Cost Decline Enabling Multi-Sensor Suites in Mid-Segment Cars across China

- 4.2.3 Edge-AI Chip Advancements Allowing Real-time Multi-Modal Fusion in Mobile and XR Devices

- 4.2.4 Deployment of AMR Robots in Smart Factories Demanding High-Accuracy Sensor Fusion

- 4.2.5 Defense Modernization Programs Funding Multi-Sensor Targeting and Navigation Systems in Middle East

- 4.2.6 Integration of V2X Data Streams into Fusion Stacks to Unlock L4 Autonomous Driving in the US

- 4.3 Market Restraints

- 4.3.1 Lack of Uniform Fusion Architecture Standards Hindering Interoperability

- 4.3.2 High Computational Overhead Raising BoM for Non-Automotive IoT Devices

- 4.3.3 Limited LiDAR Penetration in Emerging Markets Restricts Multi-Modal Fusion Adoption

- 4.3.4 Data-Privacy and Cyber-Security Concerns Around Cloud-Aided Sensor Fusion Pipelines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.5.1 Technology Evolution Roadmap for Multi-Sensor Fusion Platforms

- 4.5.2 Edge-AI Integration and SoC Advancements

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Key Market Trends

- 4.7.1 Key Patents and Research Activities

- 4.7.2 Major and Emerging Applications

- 4.7.2.1 Adaptive Cruise Control (ACC)

- 4.7.2.2 Autonomous Emergency Braking (AEB)

- 4.7.2.3 Electronic Stability Control (ESC)

- 4.7.2.4 Forward Collision Warning (FCW)

- 4.7.2.5 Other Emerging Applications

- 4.8 Investment Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.2 By Fusion Method

- 5.2.1 Radar + Camera Fusion

- 5.2.2 LiDAR + Camera Fusion

- 5.2.3 Radar + LiDAR Fusion

- 5.2.4 IMU + GPS Fusion

- 5.2.5 3-Sensor Fusion (Camera + Radar + LiDAR)

- 5.3 By Algorithm Type

- 5.3.1 Kalman Filter (EKF, UKF)

- 5.3.2 Bayesian Networks

- 5.3.3 Neural Network / Deep Learning

- 5.3.4 GNSS/INS Integration

- 5.4 By Application

- 5.4.1 Advanced Driver Assistance Systems (ADAS)

- 5.4.1.1 ACC

- 5.4.1.2 AEB

- 5.4.1.3 ESC

- 5.4.1.4 FCW

- 5.4.1.5 Lane-Keep Assist (LKA)

- 5.4.2 Autonomous Driving (Level 3-5)

- 5.4.3 Consumer Electronics (AR/VR, Smartphones, Wearables)

- 5.4.4 Robotics and Drones

- 5.4.5 Industrial Automation and Smart Manufacturing

- 5.4.6 Defense and Aerospace

- 5.4.1 Advanced Driver Assistance Systems (ADAS)

- 5.5 By Vehicle Type

- 5.5.1 Passenger Cars

- 5.5.2 Light Commercial Vehicles

- 5.5.3 Heavy Commercial Vehicles

- 5.5.4 Other Autonomous Vehicles (Shuttles, AGVs)

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Caribbeans

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Israel

- 5.6.5.4 Turkey

- 5.6.5.5 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Egypt

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Continental AG

- 6.4.3 NXP Semiconductors N.V.

- 6.4.4 STMicroelectronics N.V.

- 6.4.5 Infineon Technologies AG

- 6.4.6 Texas Instruments Inc.

- 6.4.7 Nvidia Corporation

- 6.4.8 Qualcomm Incorporated

- 6.4.9 Analog Devices Inc.

- 6.4.10 Mobileye Global Inc.

- 6.4.11 Aptiv PLC

- 6.4.12 Renesas Electronics Corporation

- 6.4.13 Valeo S.A.

- 6.4.14 ZF Friedrichshafen AG

- 6.4.15 Arbe Robotics Ltd.

- 6.4.16 BASELABS GmbH

- 6.4.17 LeddarTech Inc.

- 6.4.18 TDK Corporation

- 6.4.19 Kionix Inc. (ROHM)

- 6.4.20 Memsic Inc.

- 6.4.21 CEVA Inc.

- 6.4.22 AMD Xilinx

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment