|

시장보고서

상품코드

1630297

인쇄회로기판 검사 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Printed Circuit Board Inspection Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

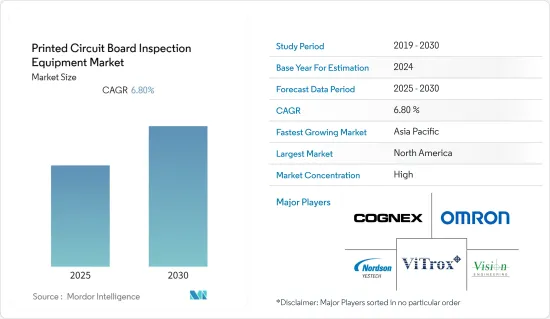

PCB 검사 장비 시장은 예측 기간 동안 6.8%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 생산 기술의 향상으로 인쇄회로기판의 고밀도화 및 다양화가 진행되고 있습니다. 따라서 수동 이미지 검사 외에도 인쇄회로기판의 결함을 정확하게 식별해야 할 필요성이 대두되고 있습니다. 기계 검사법은 인쇄회로기판의 품질 향상과 수율 향상에 도움이 됩니다. 또한, 인쇄회로기판(PCB) 생산량 증가와 산업 응용 분야 확대로 인한 PCB 제조의 복잡성 증가는 예측 기간 동안 PCB 검사 장비의 수요를 촉진하는 주요 요인 중 하나입니다. 계속 증가하는 제품 발전은 기업이 시장 조사에 투자하는 동기를 부여합니다.

- 2021년 8월, Nordson Corporation은 정밀 측정 솔루션 및 인라인 제조 공정 제어 업체인 NDC Technologies를 인수하여 포머의 검사 및 검사 플랫폼을 확장할 계획을 발표했습니다. 따라서 PCB 검사 장비의 기술 발전은 유리합니다.

- 소비자 기술 협회에 따르면 미국 하이테크 산업 매출은 2021년 4,870억 달러에 달해 전년 대비 7.5% 증가해 기록적인 성장세를 보일 것으로 예상됩니다. 또한 스마트 워치에 대한 수요는 기본적으로 기술에 정통하고 패션에 민감한 소비자가 주도하는 스마트 워치에 대한 수요는 출하량 기준으로 8 % 성장할 것으로 예상되며 전체 PCB 수요에 기여할 가능성이 높습니다.

- 또한 시장 역학을 연구하는 진입 기업은 다양한 산업 분야의 PCB 요구가 역동적이기 때문에 제품 혁신에 투자하고 있습니다. 이 또한 조사 대상 시장의 범위를 확대할 것으로 예상됩니다. 예를 들어, 옴론은 2021년 11월 AI를 탑재하여 PCB 서브 어셈블리의 고정밀 검사 프로세스를 자동화하는 PCB 검사 시스템 VT-S10 시리즈를 출시했습니다. 이를 통해 사용자는 특별한 작업자 기술이 필요하지 않습니다.

- 또한 Sullivanmaine.org가 2021년 6월에 발표한 보고서에 따르면, 65세 이상 인구의 스마트워치에 대한 관심은 향후 몇 년 동안 증가할 것으로 예상되며, 애플워치 관계자에 따르면 최소 300만-500만 개의 애플워치가 구매될 것으로 예상했습니다. 만대의 애플워치가 65세 이상 성인에 의해 구매되고 있다고 밝혔습니다. 이에 따라 PCB 검사 장비에 대한 수요가 증가하고 있습니다.

- 소형화에 대한 요구가 증가함에 따라 PCB 설계가 복잡해지고 있습니다. 이에 따라 PCB 검사 불량률도 비례적으로 증가하여 시장 수요에 도전이 되고 있습니다.

- 또한 중국은 원자재 및 완제품의 주요 공급국 중 하나이기 때문에 전자 부문은 COVID-19 사태로 인해 큰 영향을 받을 것으로 예상됩니다. 업계는 생산량 감소, 공급망 혼란, 가격 변동에 직면했습니다. 또한 이 기간 동안 유명 전자 기업의 매출도 영향을 받았습니다. 사람과 제품 모두에 대한 여행 제한은 단기적으로 시장 성장을 저해했습니다.

PCB 검사 장비 시장 동향

X선 검사가 주요 점유율을 차지

- X선 검사는 가장 널리 사용 가능하고 비용 효율적인 진단 영상 기술로 많은 사람들이 선호하며, PCB 검사에서 X- 레이는 PCB 조립 공정에서 대량으로 사용되어 PCB의 품질을 검사하는 데 사용됩니다.

- PCB는 의료 및 의료 부문에서 기본적으로 중요합니다. 미래를 향한 기술 혁신의 움직임은 진단, 치료 및 연구 전략을 자동화하는 방향으로 발전하고 있습니다. 이는 의료기기 및 장치에서 PCB 작업이 증가한다는 것을 의미합니다. 또한 IMF에 따르면, 2027년까지 X선 진단 이미징의 수익은 582억 7,000만 달러로 성장할 것으로 예상됩니다. 이러한 의료기기의 개발은 시장 성장을 더욱 촉진할 것으로 보입니다.

- 2021년 11월, 옴론은 5세대 이동통신 시스템(5G), 전기자동차, 자율주행 애플리케이션 제품 등 증가하는 요구사항에 대응하기 위해 세계에서 가장 빠른 CT형 엑스레이 검사 장비인 VT-X750-V3 시스템을 확장한다고 발표했습니다. VT-X750-V3는 5세대 이동통신 시스템(5G), 전기자동차, 자율주행 애플리케이션 제품 등의 증가하는 요구사항에 대응하기 위해 전자 기판의 첨단 3D 검사를 실현합니다.

- ViTrox는 첨단 3D X-Ray 검사(V810i 시리즈)를 제공하며, 다양한 크기의 PCB 어셈블리를 처리할 수 있도록 설계되었습니다. 최대 처리량으로 미크론 단위까지 검사할 수 있습니다. 또한 Viscom은 빠른 처리 속도와 최대 3장의 PCB에 대한 3D 화질을 특징으로 하는 3D AXI 시스템을 제공합니다. 숨겨진 솔더 조인트의 광범위한 검사에도 불구하고 높은 처리량이 요구되는 생산 라인에서 사용하기에 이상적입니다.

- 2021년 10월, 재작업 기술의 선구자이자 첨단 엑스레이 검사 및 부품 계수 시스템의 세계 공급업체인 VJ Electronix, Inc.는 SMTAI 참가자들에게 2022년 상반기에 출시될 새로운 엑스레이 검사 시스템을 미리 볼 수 있는 기회를 제공할 예정입니다.

- 또한 2021년 5월, 전자산업용 X선 검사 선도기업인 노드슨데이지(Nordson DAGE)는 고장 분석 실험실 및 생산 환경에서 최고의 특징 인식과 해상도를 갖춘 X선 시스템을 제공했습니다. 4세대 초고해상도 오프라인 엑스레이 검사 시스템 'Quadra 시리즈'를 출시합니다. 최신 Quadra 시리즈 엑스레이 검사는 압도적인 고화질을 최단 시간 내에 구현합니다.

아시아태평양 시장 성장세 확인

- 아시아태평양은 PCB 제조기업과 전자제품 제조기업이 많아 PCB 검사 장비 시장으로 지역 내 중요한 위치를 차지하고 있습니다.

- 다른 아시아 국가 중에서도 중국은이 지역에서 PCB 검사 장비의 중요성에 영향을 미치는 중요한 국가 중 하나이며, IPC가 2022년 1월에 발표한 보고서에 따르면 전 세계 PCB 수요는 6400억 달러에 달했습니다. 미국의 PCB 생산량은 총 수요의 4 %(약 29억 달러)를 충족하고 중국은 56 % 이상을 차지하며 아시아태평양 전체 PCB 제조의 90%를 공급합니다.

- 스마트폰 보급률의 증가로 아시아태평양은 세계 최대 모바일 시장 중 하나가 되었습니다. 그 배경에는 인구 증가와 도시화가 있으며, GSM 협회에 따르면 2025년까지 5 개의 연결 중 4 개 이상이 스마트폰이 될 것이라고합니다. 이러한 추세는 이 지역에서 PCB 사용을 증가시키고 PCB 검사 사용 사례를 증가시킬 것으로 예상됩니다.

- 또한 중국에는 많은 PCB 생산 시설이 있으며, AT&S의 가장 큰 생산 기지는 상하이에 있으며 다층 PCB에 중점을두고 있습니다. 이는 AT&S가 중국 내 대규모 이동통신 고객에 집중하고 있기 때문입니다.

- 다른 국가들도 시장 도입 확대를 목표로 하고 있습니다. 대만 인쇄 회로 협회(TPCA)는 650 개 회원사와 협력하여 국내외 인쇄회로기판 관련 개발 자료를 제공하고 있습니다. 최근에는 PCB 산업의 경쟁력 강화를 위해 회원사들과 함께 순환 경제와 스마트 제조를 추진하고 있습니다.

- 또한 Omron과 같은 기업은 검사 장비 제조업체와 협력하여 사람이 개입하지 않는 검사 장비를 설계하여 제품의 정확도를 더욱 높이고 있습니다. 예를 들어, FPCB를 개발하는 Cisel은 최근 Omron의 협동 로봇 TM5(cobot)를 채택하여 주요 자동차 제조업체의 파워 스티어링 시스템에 사용되는 기판의 전기 검사를 자동화하고 있습니다.

PCB 검사 장비 산업 개요

PCB 검사 장비 시장은 집중화되어 있고, 소수의 진입 기업이 시장 점유율의 대부분을 차지하고 있으며, PCB 검사 관련 제품을 제공하는 업체가 점차 등장하고 있습니다. 기존 경쟁업체들은 치열한 경쟁을 벌이고 있습니다. 또한 대기업의 혁신 전략이 조사된 시장을 주도하고 있습니다.

- 2021년 10월 - 옴론, PCB 검사 시스템 VT-S10 시리즈 출시. 업계 최초의 이미징 기술과 AI를 탑재하여 전자 어셈블리의 고정밀 검사 프로세스를 자동화하고 성능을 극대화하며 기술 수준 요구 사항을 최소화합니다.

- 2021년 1월 - 이스라엘의 CADY는 자동 PCB 검사를 개발하기 위해 300만 달러의 자금을 조달했습니다. 이 회사는 자동 PCB 설계 검사 소프트웨어를 개발하여 전기 회로도에 포함된 전기 부품 및 칩의 데이터 시트를 분석하고 설계 연결과 일치시켜 초기 단계에서 오류를 감지합니다. 이러한 기업은 PCB 검사 장비의 성장과 발전을 돕는 데 도움이 될 것으로 보입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- PCB 다양성과 고밀도화가 시장 수요를 촉진

- 시장 성장 억제요인

- 부품 소형화에 의한 복잡화가 시장 성장 과제

- 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

- COVID-19의 시장에 대한 영향

제5장 시장 세분화

- 검사 방법별

- 자동 광학 검사(AOI)

- X선 검사

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제6장 경쟁 구도

- 기업 개요

- Nordson YESTECH Inc

- Cognex Corporation

- Vision Engineering Inc

- ViTrox Corp Bhd

- Omron Electronics LLC

- Manncorp Inc.

- Gardien Services Inc

제7장 투자 분석

제8장 시장 전망

ksm 25.01.23The Printed Circuit Board Inspection Equipment Market is expected to register a CAGR of 6.8% during the forecast period.

Key Highlights

- The density and diversity of printed circuit boards are increasing due to improvements in production technology. As such, there is a need for accurately identifying defects on PCBs, apart from manual vision inspection. Machine inspection methods help in better quality and higher yield of the PCB. In addition, the growing production of printed circuit boards (PCB) and increasing complexity in PCB manufacturing due to the growing industrial adoption are some of the major factors driving the demand for PCB inspection equipment over the forecast period. The ever-increasing product advancement motivates companies to invest in the market studied.

- In August 2021, Nordson Corporation announced plans to acquire NDC technologies, a provider of precision measurement solutions and in-line manufacturing process control, to expand the formers test and inspection platform. Thus, favoring technological advancements for PCB inspection equipment.

- According to the Consumer Technology Association, U.S. tech industry revenue will reach a record-breaking USD 487 billion in 2021, a 7.5% jump YoY. Moreover, Smartwatches demand is projected to grow by 8% in unit shipments, essentially driven by tech-savvy and fashion-conscious consumers, likely contributing to the overall PCB demand.

- Further, the market-studied players are also investing in product innovation, as the need for PCBs for different industries is dynamic. This is also expected to expand the scope of the market studied. For instance, in November 2021, Omron launched the PCB inspection system VT-S10 Series which features AI to automate high-precision inspection processes for PCB sub-assemblies. This helps the users to eliminate the need for special operator skills.

- Moreover, According to a report published by Sullivanmaine.org in June 2021, the interest in smartwatches among the 65+ population is expected to increase in the coming years. According to an Apple Watch insider, the report also mentioned that at least 3-5 million Apple Watches have been purchased by adults age 65+. Thus, driving the need for PCB inspection equipment.

- The growing demand for miniaturization has led to the increasing PCB design complexity. This has led to a proportional PCB inspection failure rate, challenging the market demand.

- Furthermore, the electronics device sector is anticipated to be impacted significantly by the COVID-19 outbreak, as China is one of the major suppliers of raw materials and finished products. The industry faced a reduction in production, disruption in the supply chain, and price fluctuations. Further, the sales of prominent electronic companies were affected during the period. The travel restriction on both people and products hampered the market's growth in the short run.

PCB Inspection Equipment Market Trends

X-Ray Inspection to Gain Majority Share

- X-ray is the most widely available and cost-effective diagnostic imagining technique preferred among the population. In PCB inspection, X-ray is massively used in the process of PCB assembly to test the quality of PCBs, which is one of the essential steps for quality-oriented PCB manufacturers.

- PCBs are fundamentally critical in the fields of healthcare and medicine. The movement of innovation into the future, making the diagnostic, treatment, and research strategies progress towards becoming automated. This means there is more work for PCBs in medical devices and equipment. Further, according to IMF, the revenue from X-ray diagnostic imaging is anticipated to grow by USD 58.27 billion in 2027. Such developments in medical devices will further drive market growth.

- In November 2021, OMRON Corporation announced the expansion of a new VT-X750-V3 system, the world's fastest CT-type X-ray inspection device. The VT-X750-V3 delivers advanced 3D inspection of electronic substrates to meet the growing requirements of fifth-generation mobile communication systems (5G), electric automobiles, and autonomous driving application products.

- ViTrox provides advanced 3D X-Ray Inspection (V810i Series), designed to cater to different sizes of PCB assembly. It enables examination at the micron level with maximum throughput. Moreover, Viscom offers a 3D AXI system distinguished by fast handling and 3D image quality of up to 3 PCBs. It is ideal for use in production lines that require high throughput despite an extensive inspection of hidden solder joints.

- In October 2021, VJ Electronix, Inc., a pioneer in rework technologies and a global provider of advanced X-ray inspection and component counting systems, is planning to give SMTAI attendees a preview of a new x-ray inspection system available in the first half of 2022.

- Further, in May 2021, Nordson DAGE, the major player in X-ray inspection for the electronics industry, offered the highest feature recognition and resolution X-ray systems within failure analysis laboratories and the production environment. It is launching its 4th generation, ultra-high resolution, off-line X-ray system, the Quadra Series. The latest Quadra series X-ray inspection delivers unbeatable image quality in the shortest possible time. With its revolutionary QuadraNT X-ray tube and Aspire FP detector.

Asia Pacific to Witness the Significant Market Growth

- Asia-Pacific is a significant PCB inspection equipment market across regions, mainly due to the large number of PCB manufacturing and electronic products manufacturing companies in the region.

- China, among other Asian countries, is one of the significant countries influencing the importance of PCB inspection equipment in the region. According to a report published by IPC in January 2022, the worldwide demand for PCBs was USD 64.0 billion. U.S. PCB production met 4% of the total demand (approximately USD 2.9 billion), while China accounted for more than 56%, and the entire Asia-Pacific region provided 90% of PCB fabrication.

- Increasing smartphone adoption rates have made Asia-Pacific one of the largest mobile markets in the world. This is due to increasing population growth and urbanization. As per GSM Association, more than 4 out of 5 connections will be smartphones by 2025. This trend is expected to increase PCB usage in this region, thus increasing the use cases of PCB inspection.

- In addition, China is home to many PCB production facilities. AT&S' largest production unit is located in Shanghai, focusing on multi-layer PCB. This is because the company focuses on large volumes of mobile communications customers in China.

- Other countries are also aiming to increase market adoption. Taiwan Printed Circuit Association (TPCA) works with its 650 member companies to provide: development material on domestic and overseas printed circuit boards. In recent years, they have promoted the circular economy and smart manufacturing with members to enhance the competitiveness of the PCB industry.

- Companies such as Omron are also collaborating with inspection equipment manufacturers to design testing equipment with no human interaction, which further increases the products' accuracy. For instance, Cisel, a company developing FPCBs, has recently chosen an OMRON TM5 collaborative robot (cobot) to automate the electrical testing of boards used in the power steering system of a leading automotive manufacturer.

PCB Inspection Equipment Industry Overview

The PCB inspection equipment market is concentrated, with few players occupying the majority market share. Vendors are slowly emerging with offerings related to PCB inspection. Existing competitors are fiercely competitive. Further, large companies' innovation strategies will drive the studied market.

- October 2021 - Omron launched the PCB inspection system "VT-S10 series," which features an industry-first imaging technique and AI best to automate the high-precision inspection process for electronic assemblies, maximize performance and minimize skill-level requirements.

- January 2021 - CADY, an Israeli-based company, raised USD 3 million to develop automatic PCB inspections. The company developed an automated PCB design inspection software that parses the datasheets of electrical components and chips in the electrical schematic and cross-checks them against connections in the design to detect errors at early stages. Such companies would help to support the growth and development of PCBs inspection equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Diversity and Density of PCB is Fuelling the Market Demand

- 4.3 Market Restraints

- 4.3.1 Increasing Complexity Due to Miniaturisation of Components is Challenging the Market Growth

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Inspection Method

- 5.1.1 Automatic Optical Inspection (AOI)

- 5.1.2 X-Ray Inspection

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia Pacific

- 5.2.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Nordson YESTECH Inc

- 6.1.2 Cognex Corporation

- 6.1.3 Vision Engineering Inc

- 6.1.4 ViTrox Corp Bhd

- 6.1.5 Omron Electronics LLC

- 6.1.6 Manncorp Inc.

- 6.1.7 Gardien Services Inc

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

샘플 요청 목록