|

시장보고서

상품코드

1630307

미국의 자동 자재관리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United States Automated Material Handling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

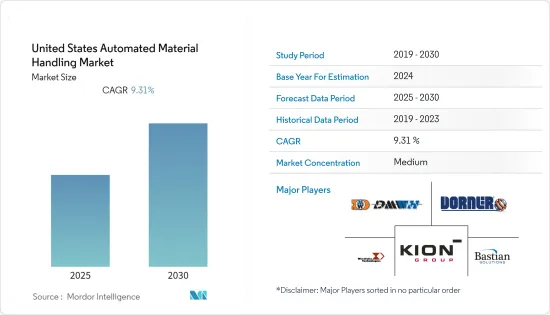

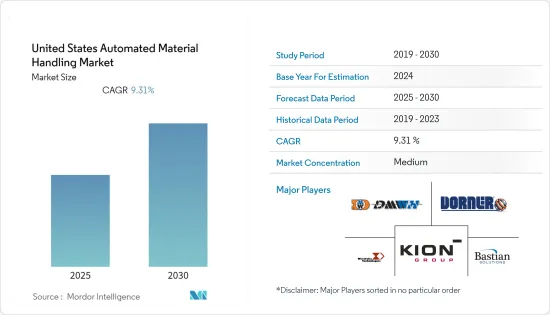

미국의 자동 자재관리(AMH) 시장은 예측 기간 동안 9.31%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 미국은 세계에서 가장 선진적인 경제 국가로, AMH 시장의 거대한 수요처인 미국 제조 부문은 이 지역 경제 생산량의 82%를 차지하는 압도적인 미국 경제에 의존하고 있습니다.

- 또한 미국은 자동화, AI, 기계 학습 등 지역 AMH 제조업체의 기술 발전 비율이 높고 산업을 빠르게 발전시키고 있기 때문에 세계 AMH 시장의 주요 투자자이자 혁신가 중 하나입니다. 북미에서는 첨단 자동 자재관리 시스템에 대한 수요 증가와 인건비 상승으로 인해 수작업으로 인한 불편함을 감수해야 하는 상황이 지속되고 있어 미국 AMH 시장을 더욱 견인하고 있습니다.

- 이 나라의 현대식 제조 시설은 더 높은 품질의 제품을 더 빠른 속도로 더 낮은 비용으로 생산하기 위해 새로운 기술과 혁신에 의존하고 있습니다. 혁신적인 소프트웨어와 하드웨어를 도입하는 것이 현재 경쟁 시장에서 살아남을 수 있는 유일한 실현 가능한 방법임이 입증되었습니다.

- 예를 들어, FDA 식품안전 현대화법(FSMA)은 식중독 및 이물질 혼입에 대한 대응에서 예방으로 초점을 전환하여 식품 회사를 변화시켰습니다. 그 결과, 세척 및 위생이 미국 벨트 제조업체의 가장 큰 우선 순위가되었습니다. 스테인리스 스틸도 미국에서 식품 가공용 벨트의 인기 소재로 부상했습니다. 미국 우체국은 롤러 컨베이어를 도입한 후 소포 취급 분야에서 60%의 에너지 절감을 달성했습니다.

- 또한, 자재 취급 산업은 전염병으로 인해 큰 혼란을 겪고 있습니다. 제조 시설과 물류 센터의 부분적 운영으로 인해 새로운 AMH 시스템 주문이 지연되었습니다. DHL의 보고서에 따르면 미국 내 주문 처리 센터 중 자동화 시스템을 사용하는 곳은 5-10%에 불과하며, 이는 전 세계 공급망에 심각한 영향을 미쳤으며, 수동 피킹을 수행하는 창고는 운영을 중단해야했습니다.

- 그러나 공급업체들은 팬데믹 기간 동안 AMH 제품을 강화하기 위해 노력했습니다. 예를 들어, 2020년 10월, 혁신적인 공급망 솔루션 공급업체인 StoecklinLogistics는 다이나믹 MASTerStacker Cranes(Unit Loaded ASRS) 제품 라인을 출시했습니다. 이 크레인은 높은 가속도와 이동 속도, 개선된 에너지 효율성, 모듈식 구조가 특징인 이 크레인은 성능이 크게 향상되고 높은 수준의 가용성을 제공합니다. 또한, 새로운 크레인은 휠과 호이스트의 직진성이 향상되고 속도가 빨라졌으며, 다양한 크레인 및 적재 용량에 걸쳐 표준화되어 조립 및 제조 시간이 단축되고, 구조가 가벼워졌으며, 유지보수를 위한 부품에 대한 접근성이 향상되었습니다.

미국의 자동 자재관리 시장 동향

자율이동로봇(AMR)이 큰 시장 점유율을 차지할 전망

- AMR은 물류 애플리케이션에서 AGV를 대체하고 있습니다. AGV와 달리 AMR은 관성측정장치(IMU), 레이저 스캐닝 거리 측정기, 2D 및 3D 컬러 카메라, 모터 컨트롤러에 연결된 보다 정교한 온보드 컴퓨터가 내장되어 있기 때문입니다. 이러한 AMR은 공장이나 창고에 추적 스트립을 설치할 필요가 없습니다.

- 또한 AMR은 특히 지게차를 점진적으로 대체할 것으로 예상됩니다. 또한 Mobile Industrial Robots Inc.는 1,000kg의 운반 능력을 갖추고 6대의 레이저 스캐너, 3D 카메라, 인공지능 카메라를 장착한 MiR1,000 AMR을 설계하는 첫 번째 이니셔티브를 취했습니다.

- 많은 물류 업무가 여전히 수작업과 종이 기반 피킹 시스템에 의존하고 있지만, 자율 이동 로봇은 이제 많은 불필요한 보행을 줄일 수 있습니다. 미국 인구조사국의 데이터 분석에 따르면, 평균적인 창고 노동자는 불필요한 움직임으로 인해 연간 7주 가까이 낭비하고 있으며, 그 비용은 43억 달러 이상에 달합니다.

- 또한, 북미의 공항 산업은 세계 최대 규모의 공항 산업입니다. 매년 약 10억 1,150만 명의 국내외 승객에게 서비스를 제공하고 있습니다. 또한, 세계 최대 규모의 공항이 밀집한 지역인 만큼 비즈니스 모델의 붕괴를 막기 위해 자동화 도입을 강화할 것으로 예상됩니다. 예를 들어, 자동 수하물 처리 시스템의 세계 공급업체인 크리스플랜트는 캐나다 항공 운송보안국(CATSA)이 캐나다 핼리팩스 국제공항에 배치한 보안 검사 장비와 통합된 완전 자동 수하물 처리 시스템을 설계, 제조 및 설치했습니다.

- 또한, 조사 대상 시장의 벤더들은 M&A 전략을 통해 이 지역에서 골격을 확장하고 있습니다. 예를 들어, 2020년 5월 Geek와 Conveyco는 북미, 특히 미국에서 AMR(Autonomous Mobile Robot) 솔루션에 대한 접근을 가속화하기 위해 전략적 파트너십을 체결했으며, Geek 솔루션의 입증된 효율성, 확장성 및 비용 절감은 이 파트너십을 통해 이 지역의 모든 산업 분야의 고객에게 큰 가치를 제공하고 유연한 물류를 가능하게 할 것으로 보입니다.

소매업이 큰 시장 점유율을 차지할 것으로 예상

- 미국 소매업과 E-Commerce 부문의 괄목할만한 성장과 창고 확장은 시장 성장의 주요 원동력이 되고 있습니다. Robo Business Warehouse Automation Report에 따르면, 미국 창고의 약 80%가 여전히 수작업으로 운영되고 있으며, 전체 창고의 15%만이 기계화되어 있고, 5%만이 자동화되어 있습니다. 기계화된 창고는 전체의 15%에 불과하며, 자동화된 창고는 5%도 채 되지 않습니다. 이는 AMH 시장이 예측 기간 동안 미국 전역에서 지속적으로 성장할 수 있는 긴 경로를 제공합니다.

- 또한 미국은 이 지역의 주요 소매 시장 중 하나입니다. 미국 GDP의 3분의 2 이상이 매년 소매 소비에서 창출되는 것으로 추정됩니다. 미국의 E-Commerce 부문은 오프라인 매장보다 매출이 지속적으로 성장하고 있습니다. 자동화가 중요한 차별화 요소로 떠오르면서 온라인 소매업체와 옴니채널 소매업체 간의 경쟁이 치열해지고 있습니다.

- 소매업은 컨베이어와 같은 자동 자재관리 시스템의 요구 사항이 필수적인 주요 산업 중 하나입니다. 컨베이어는 온라인 소매업체의 상품 이동에 큰 도움이 되며, 배송 효율을 향상시킵니다. 또한, 점점 더 많은 소매업체들이 창고 공간 확장에 투자하고 있습니다. 예를 들어, Blackstone Group은 미국의 소매 수요 증가에 대응하기 위해 1억 7,900만 평방 피트의 창고 공간에 187억 달러를 투자했으며, Amazon.com Inc.도 창고 증가 문제를 해결하기 위해 자동화 기술을 채택한 한 예입니다. 최근 몇 년 동안 아마존은 자동 자재관리 기계를 도입하고 창고에 많은 첨단 컨베이어 기술을 추가했습니다.

- E-Commerce 채널의 수요 증가에 따라 여러 기업이 이 지역에 풀필먼트 물류 센터를 설립하고 있습니다. 예를 들어, 2020년 12월 PFS는 댈러스 지역에 풀필먼트 물류 센터를 신설하고 4개 브랜드의 E-Commerce 주문 처리 프로그램을 운영한다고 발표했습니다. 풀필먼트 센터는 일반적으로 제품을 효율적으로 운반하기 위해 여러 개의 컨베이어 시스템을 갖추고 있으며, 이러한 확장 활동은 미국 컨베이어 시장에 긍정적인 영향을 미칠 것으로 예상됩니다.

- 그러나 COVID-19 사태로 인해 2020년 3월, 4월, 5월의 소매 판매는 부진했습니다. 이러한 요인은 이 달에 미국 소매 환경에서 자동 자재관리의 사용에 부정적인 영향을 미쳤습니다. 그러나 소매 부문은 2020년 하반기에 큰 폭의 상승세를 보이며 AMH와 같은 자동화 시스템 사용을 회복했습니다.

미국의 자동 자재관리 산업 개요

미국 자동 자재관리 시장은 세분화되어 있고 경쟁이 치열합니다. 제품 출시, 높은 R&D 비용, 파트너십, 인수합병 등이 국내 기업들이 치열한 경쟁을 유지하기 위해 채택하는 주요 성장 전략입니다.

- 2021년 1월 - TGW Logistics Group은 미국 미시간주 Norton Shores의 미국 컨베이어 자산 중 일부를 Material Handling Systems, Inc. 양사 간 계약이 체결되었으며, 2021년 말까지 인수가 완료될 예정이며, 링컨 인터내셔널은 M&A 프로세스 전반에 걸쳐 TGW를 지도했습니다. 이번 매각을 통해 TGW는 전략적 포트폴리오를 조정하고 북미에서 성장하는 통합 사업에 집중할 예정입니다.

- 2020년 7월 - Vanderlande는 ADAPTO를 활용한 GtP(Goods to Person) 피킹 솔루션을 기반으로 독자적인 3D 셔틀 기반 자동 창고 시스템(AS/RS)인 홈픽(HOME PICK)을 개발했습니다. ADAPTO와 모듈형 워크스테이션을 사용하여 식품 소매업체가 중앙집중식 주문처리센터(CFC)를 통해 규모의 경제를 실현하는 데 이상적이며, HOMEPICK의 확장성은 미래지향적이기까지 합니다. 시퀀싱된 주문은 배송 경로별로 적절한 주문과 최대 배송 성능을 보장하여 시간과 비용을 크게 절약할 수 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자의 교섭력

- 신규 참여업체의 위협

- 경쟁 기업 간의 경쟁 관계

- 대체품의 위협

- 산업 밸류체인 분석

- COVID-19의 시장에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 제조 복잡화와 기술 이용 가능성 증가

- 주문 정확도 향상과 SKU 증가에 대한 수요 증가

- 스마트 시티 물류의 출현과 창고 용도에서 로보틱스 보급

- 시장 성장 억제요인

- 공급망 스킬 격차와 노동력 부족

- 높은 초기 비용

제6장 시장 세분화

- 제품 유형별

- 하드웨어

- 소프트웨어

- 서비스

- 기기 유형별

- 무인운반차(AGV)

- 자동 지게차

- 자동 견인/트랙터/예인

- 유닛 로드

- 조립 라인

- 특수 용도

- 자율 이동 로봇(AMR)

- 레이저 유도차

- 자동 창고(ASRS)(ASRS)

- 고정 통로(스태커 크레인 + 셔틀 시스템)

- 캐러셀(수평 캐러셀 + 수직 캐러셀)

- 수직 리프트 모듈

- 자동 컨베이어

- 벨트

- 롤러

- 팔레트

- 오버헤드

- 팔레타이저

- 기존(하이 레벨 + 로 레벨)

- 로봇

- 분류 시스템

- 무인운반차(AGV)

- 최종 이용 산업별

- 공항

- 자동차

- 식품 및 음료

- 소매/창고/배송센터/물류센터

- 일반 제조업

- 의약품

- 우편·소포

- 기타

제7장 경쟁 구도

- 기업 개요

- Kion Group AG

- Bastian Solutions Inc.

- DMW&H

- Westfalia Technologies Inc.

- Dorner Manufacturing Corporation

- Cornerstone Automation Systems LLC

- Oceaneering International Inc.

- Aethon Inc.

- Daifuku Co. Ltd

- Remtec Automation

- Siggins Company

- Honeywell Intelligrated

- Vanderlande Industries B.V.

제8장 투자 분석

제9장 시장 기회와 향후 동향

ksm 25.01.23The United States Automated Material Handling Market is expected to register a CAGR of 9.31% during the forecast period.

Key Highlights

- The United States is the most advanced economies in the world. The country's manufacturing sector, which is a huge source of demand for the AMH market, hinges on the dominant US economy, accounting for 82% of the region's economic output.

- Moreover, United States is one of the major investors and innovators in the global AMH market owing to the high rate of technological advancements among regional AMH manufacturers, such as automation, AI, and machine learning, and are rapidly driving the industry forward. Increasing demand for advanced automated material handling systems and ever-increasing labor costs with the inconvenience of employing a manual workforce in North America is further driving the United States AMH market.

- Modern manufacturing facilities in the country rely on new technologies and innovations to produce higher quality products at faster speeds, with lower costs. Implementing innovative software and hardware proves the only feasible way to survive in the current competitive market.

- For instance, the FDA Food Safety Modernization Act (FSMA) transforms food companies by shifting the focus from responding to foodborne illness and foreign material contamination to preventing it. As a result, cleanability and sanity have become the biggest priorities of belt manufacturers in the US. Stainless steel also emerged as a popular belt type for food processing in the country. The US post offices also witnessed a 60% energy savings in parcel-handling applications after employing roller conveyors.

- Furthermore, the material handling industry in the country has been significantly disrupted due to the pandemic outbreak. Partial operations within manufacturing facilities and distribution centers have resulted in delayed orders for new AMH systems. During the peak pandemic, warehouses that used manual picking had to halt their operations, thus severely impacting the global supply chain. DHL reported that only 5-10% of the fulfillment centers in the United States are using automated systems already.

- However, vendors strived to enhance their AMH product offerings during the pandemic. For instance, in October 2020, StoecklinLogistics, a supplier of innovative supply chain solutions, introduced a line of dynamic MASTerStacker Cranes (unit load ASRS) that feature high acceleration and moving speeds, improved energy efficiency, and modular construction that delivers vastly improved performance and high levels of availability. The new cranes also have more straightforward and faster wheels and hoists, greater standardization across different cranes and load-carrying capacities, shorter assembly and manufacturing times, lighter construction, and improved accessibility to components for maintenance.

US Automated Material Handling Market Trends

Autonomous Mobile Robots (AMR) is Expected to Hold Significant Market Share

- AMRs are replacing AGVs in logistical applications. This is because, unlike AGVs, AMRs incorporate more sophisticated onboard computers that are coupled to inertial measurement units (IMU), laser scanning range finders, 2D and 3D color cameras, and motor controllers. Such AMRs do not require tracking strips to be placed in a factory or warehouse.

- Moreover, it is expected that AMRs would gradually replace forklifts in particular too. Further, Mobile Industrial Robots Inc. has taken the first initiative to design the MiR1000 AMR. It can tolerate a payload of 1000kg and equip with six laser scanners, 3D cameras, and an artificially intelligent camera.

- While many logistics operations still rely on manual and paper-based picking systems, autonomous mobile robots can now eliminate a lot of unnecessary walking. According to US Census Bureau data analysis, the average warehouse worker wastes nearly seven weeks per year in unnecessary motion, accounting for more than USD 4.3 billion in labor.

- Moreover, the North American airport industry is one of the largest airport industries in the world. It provides services to about 1,011.5 million domestic and international passengers every year. It is also home to some of the world's biggest airports and is expected to bolster the adoption of automation to ensure no disruptions in the business model. For instance, Crisplant, a foremost global supplier of automated baggage handling systems, designed, manufactured, and installed fully automated baggage handling systems, integrated with the security screening equipment deployed by the Canadian Air Transport Security Authority (CATSA), in Canada's Halifax International Airport.

- Further, vendors in the studied market are expanding their foothold in the region by the merger and acquisition strategy. For instance, in May 2020, Geek+ and Conveyco entered into a strategic partnership to accelerate access to AMR (Autonomous Mobile Robot) solutions in North America, especially in the United States. The demonstrated efficiency, scalability, and cost-saving of Geek+ solutions will bring significant value and enable flexible logistics for customers across industries in the region through this partnership.

Retail Industry is Expected to Hold Significant Market Share

- The significant growth of the United States retail and e-commerce sector and warehouse expansion is becoming a primary driver of market growth. Most of the region's retailers plan to automate their warehouse establishments rather than expand in a high-priced rental environment. According to the Robo Business Warehouse Automation Report, almost 80% of the United States' warehouses are still manually operated. Only 15% of all the warehouse establishments were mechanized, and not more than 5% were automated. This provides a long runway for the AMH market to grow consistently across the country over the forecast period.

- Moreover, the United States stands to be one of the major retail markets in the region. It is estimated that more than two-thirds of the country's GDP is generated from retail consumption every year. In the country's e-commerce sector, the sales growth continues to increase more than the physical stores. With automation being the key differentiating factor, there is increasing competition between online and omnichannel retailers.

- Retail is one of the major industries, wherein the requirement for automated material handling systems such as conveyors is essential. It immensely helps online retailers with the movement of goods and increases good delivery efficiency. Furthermore, retailers are increasingly investing in expanding warehouse space. For example, Blackstone Group invested USD 18.7 billion on 179 million square feet of US warehouse space to cater to the country's growing retail demand. Amazon.com Inc is another such example, adopting automation techniques to solve its warehouse growing problems. In recent years, the company has been rolling out automated material handling machines and has added many advanced conveyor technologies to its warehouses.

- Multiple companies in the region are starting fulfillment distribution centers with the growing demand from e-commerce channels. For instance, in December 2020, PFS announced its new fulfillment distribution center in the Dallas area and operated e-commerce fulfillment programs for four brands. The fulfillment centers are generally equipped with several conveyor systems to efficiently transport products, and such expansion activities are expected to impact the conveyor market in the United States positively.

- However, the outbreak of COVID-19 dented the retail sales in March, April, and May in 2020. Such factors negatively impacted the usage of automated material handling in the United States' retail landscape in those months. However, the retail sector witnessed a significant surge in late 2020, which bounced back the usage of automated systems such as AMH.

US Automated Material Handling Industry Overview

The United States automated material handling market is fragmented and highly competitive. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- January 2021 - TGW Logistics Group planned to sell certain US conveyor assets in Norton Shores (Michigan) to Material Handling Systems, Inc. (MHS). The contract between the two companies has been signed, and the acquisition is expected to take effect by the end of 2021. Lincoln International guided TGW through the whole M&A process. With the sale, TGW adjusts its strategic portfolio and focuses on the growing integration business in North America.

- July 2020 - Vanderlande created the HOME PICK, based on a goods-to-person (GtP) picking solution that makes use of ADAPTO and is a unique 3D, shuttle-based automated storage and retrieval system (AS/RS). It is ideal for food retailers to realize economies of scale through centralized fulfillment centers (CFCs). By using ADAPTO and modular workstations, HOMEPICK's scalability also makes it future-proof. The sequenced orders ensure the proper order per delivery route and maximum delivery performance, which results in significant time and cost savings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Manufacturing Complexity and Technology Availability

- 5.1.2 Increasing Demand for Improving Order Accuracy and SKU Proliferation

- 5.1.3 Emergence of Smart City Logistics and Wide Adoption of Robotics in Warehouse Applications

- 5.2 Market Restraints

- 5.2.1 Gap in Supply Chain Skills and Workforce Shortage

- 5.2.2 High initial costs

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Equipment Type

- 6.2.1 Automated Guided Vehicle (AGV)

- 6.2.1.1 Automated Forklift

- 6.2.1.2 Automated Tow/Tractor/Tug

- 6.2.1.3 Unit Load

- 6.2.1.4 Assembly Line

- 6.2.1.5 Special Purpose

- 6.2.2 Autonomous Mobile Robots (AMR)

- 6.2.3 Laser Guided Vehicle

- 6.2.4 Automated Storage and Retrieval System (ASRS)

- 6.2.4.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.4.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.4.3 Vertical Lift Module

- 6.2.5 Automated Conveyor

- 6.2.5.1 Belt

- 6.2.5.2 Roller

- 6.2.5.3 Pallet

- 6.2.5.4 Overhead

- 6.2.6 Palletizer

- 6.2.6.1 Conventional (High Level + Low Level)

- 6.2.6.2 Robotic

- 6.2.7 Sortation System

- 6.2.1 Automated Guided Vehicle (AGV)

- 6.3 By End-user Vertical

- 6.3.1 Airport

- 6.3.2 Automotive

- 6.3.3 Food and Beverage

- 6.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 6.3.5 General Manufacturing

- 6.3.6 Pharmaceuticals

- 6.3.7 Post and Parcel

- 6.3.8 Other End-Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kion Group AG

- 7.1.2 Bastian Solutions Inc.

- 7.1.3 DMW&H

- 7.1.4 Westfalia Technologies Inc.

- 7.1.5 Dorner Manufacturing Corporation

- 7.1.6 Cornerstone Automation Systems LLC

- 7.1.7 Oceaneering International Inc.

- 7.1.8 Aethon Inc.

- 7.1.9 Daifuku Co. Ltd

- 7.1.10 Remtec Automation

- 7.1.11 Siggins Company

- 7.1.12 Honeywell Intelligrated

- 7.1.13 Vanderlande Industries B.V.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록