|

시장보고서

상품코드

1630342

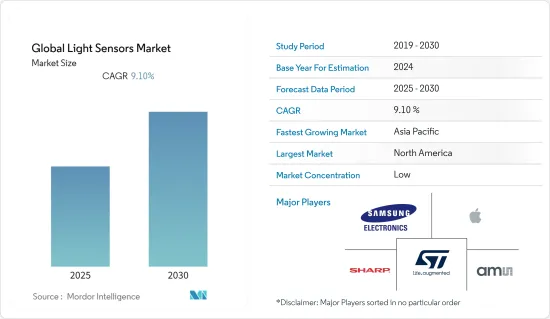

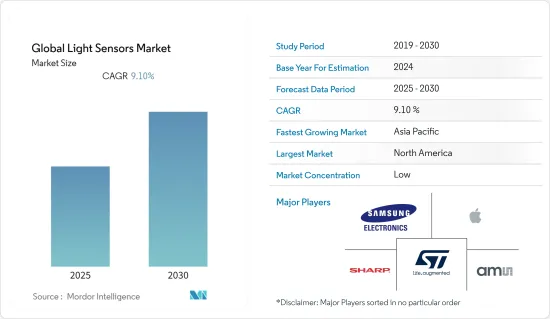

광센서 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Global Light Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

세계 광센서 시장은 예측 기간 동안 연평균 9.1%의 CAGR을 기록할 것으로 예상됩니다.

주요 하이라이트

- 예를 들어, 근접광센서는 적외선의 변화에 반응하여 움직임이나 다른 물체와의 근접을 감지합니다. 근접광센서는 차량이 물체에 부딪힐 위험이 있을 때 경보를 울리는 차량용 장치에 사용됩니다. 근거리 광센서는 보안 목적으로 움직임을 감지하는 실외 조명에서 흔히 볼 수 있습니다.

- 스마트폰 제조업체들은 제품의 품질과 가시성을 향상시키기 위해 새로운 기술을 적극적으로 도입하고 있습니다. 예를 들어, Oppo는 2022년 4월, 자사의 플래그십 모델 'Oppo F21 Pro'에 소니 IMX709 RGBW 셀카 센서를 탑재하여 이전 세대의 IMX615 RGB 센서에 비해 빛에 대한 감도가 60% 향상되고 노이즈가 35% 감소했다고 발표했습니다. 를 탑재한다고 밝혔습니다.

- 자동차 부문에서는 차선 보조, 자동 헤드라이트와 같은 신기술이 개발되면서 백미러, 실내 조명, 사이드미러, 레인 센서, 광학식 컨트롤 노브 등에 센서가 내장되고 있습니다. 또한, 항공우주 및 방위, 복도 매핑 및 지형 조사, 자동차, 광업, 석유 및 가스 등 다양한 산업에서 LiDAR 센서의 채택이 증가함에 따라 광센서 시장의 성장 기회를 창출하고 있습니다.

- COVID-19 팬데믹 기간 동안 소비자 가전 부문의 성장은 빠르게 변화하고 시장 진입 기업 간의 경쟁이 치열해졌습니다. 소비자 전자제품 제조업체는 현재 독특하고 차별화된 제품을 시장에 출시해야 한다는 압박을 받고 있으며, 삼성과 같은 대형 스마트폰 제조업체는 광센서 제조업체와 협력하여 두 기술을 통합하고 있습니다. 예를 들어, 2021년 11월 맥더미드알파 일렉트로닉스 솔루션즈(MacDermidAlpha Electronics Solutions)는 전 세계 반도체 선도기업인 STMicroelectronics와 함께 생산 비용을 크게 낮추면서 차량의 효율성과 주행거리를 향상시키는 전기자동차 인버터 어셈블리의 주요 소결 기술에 대한 협력을 발표했습니다.

- COVID-19로 인해 사람들의 우선순위가 기술과 건강으로 옮겨가면서 의료 장비와 같은 애플리케이션에서 환경광센서에 대한 수요가 증가하고 있습니다. 예를 들어, 2021년 10월 오스람은 UV-A 빛을 감지하는 모바일 기기 및 웨어러블용 환경광센서를 개발했습니다. 회사 측에 따르면, 태양광의 UV-C 부분은 지구의 대기에 의해 차단되지만 UV-A와 UV-B 복사는 지표면에 도달합니다. 일광화상은 UV-B 복사에 의해 발생하지만 UV-B는 피부의 상층부만 투과할 수 있습니다. 이번 COVID-19 위기는 기업들에게 사람의 손이 덜 필요한 기술에 대한 투자, 구현 및 연구 기회를 제공할 것으로 예상됩니다. 예를 들어, AI와 자동화의 조합을 생각해 보겠습니다.

광센서 시장 동향

민생용 전자기기가 큰 비중을 차지할 것으로 예상

- 광센서 시장의 소비자 전자기기 부문 확대는 모바일 기기에서 근접 센서와 환경 광센서의 사용 증가에 힘입어 아시아태평양은 삼성전자를 포함한 주요 OEM의 광센서 사용 증가로 인해 성장 잠재력이 높은 지역입니다. 한국의 삼성전자는 광센서 시장의 중요한 진입자로, 삼성 갤럭시 S6, 갤럭시 S6 엣지 등 모바일 기기를 포함한 다양한 제품 카테고리에 광센서를 통합하여 근접 감지 등 특정 작업을 수행합니다.

- LED TV, 스마트폰, 스마트 조명 시스템과 같은 스마트 가젯에 대한 전 세계 수요는 소형화 및 센서 기술의 향상으로 인해 증가하고 있습니다. 다양한 센서 기술과 통신 인터페이스가 이러한 가젯의 핵심을 이루고 있습니다. 커넥티드 제품과 5G 통신 기술의 등장으로 다양한 센서가 다양한 부문에서 채택될 것으로 예상됩니다. 또한, 광센서는 주거용 및 상업용 웨어러블 전자기기에 자주 채택되고 있습니다.

- 스마트폰, LCD/LED TV, 노트북은 광센서 장치의 수요 증가를 주도하는 애플리케이션 중 일부입니다. 센서가 주변 광량에 따라 화면의 밝기를 자동으로 조절하는 기능을 가지고 있어 전력 절감이 가능합니다. 조도 감지기를 포함한 다양한 디지털 센싱 구성요소를 이용한 조명 제어는 현대 IoT 조명 플랫폼의 또 다른 중점 사항입니다.

- AMS AG의 근접 감지 모듈과 통합형 환경광센서가 2020년 7월에 출시되어 모바일 단말기 주문자 상표 부착 생산업체(OEM)가 거의 베젤리스(bezel-less) 화면의 모바일 단말기를 제작할 수 있게 되었습니다. 이 모듈(TMD2755)은 시중에 나와 있는 다른 장치에 비해 면적이 40%, 부피가 60% 더 작습니다. 또한, TMD2755는 광센서와 근접 기능을 더 얇은 베젤에 넣을 수 있게함으로써 휴대폰 제조업체의 디스플레이 영역을 확대하려는 노력을 지원합니다. 이는 미드레인지 시장 부문에서 휴대폰에 대한 소비자의 관심이 높아지고 있는 주요 요인으로 꼽힙니다.

- 휴대폰, LCD, LED와 같은 전자기기에는 빛의 양에 따라 화면 밝기를 자동으로 변경하는 광센서 장치가 점점 더 많이 사용되고 있습니다. 이 기능은 이러한 기기의 전력 절감에 도움이 되고 있습니다. 휴대폰, 태블릿과 같은 소비자 전자제품에서 액세스, 인증, 계정 사용 가능 여부, 보안/개인 정보 사기 방지 등을 위해 얼굴 인식을 사용하는 것에 대한 관심이 높아짐에 따라 광센서 시장이 확대되고 있습니다.

- 웨어러블 기기의 채택이 급증하고 바이오메디컬 부문의 혁신적인 애플리케이션이 시장 성장을 촉진할 수 있습니다. 하지만, 센서의 추가 비용과 짧은 장치 수명은 시장 성장을 저해하는 요인으로 작용할 것으로 예상됩니다.

아시아태평양이 괄목할 만한 성장률을 기록할 것으로 전망

- 아시아태평양은 인구 규모가 크고 스마트폰 및 기타 소비자 전자제품의 수요와 생산이 증가함에 따라 광센서 시장을 주도할 것으로 예상됩니다. 예를 들어, ICEA(India Cellular and Electronics Association)에 따르면 인도의 휴대폰 생산액은 2019년 1조 7,000억 루피에서 2020년 2조 1,490억 루피로 증가했습니다. 바이러스 팬데믹의 영향에도 불구하고 2조 2,270억 인도 루피를 기록했습니다.

- 광센서가 내장된 핸드헬드 기기의 채택률 증가도 이 지역의 광센서 시장 성장에 기여하는 주요 요인 중 하나입니다.

- 인도 및 신흥국 등 신흥 경제국에서는 소비자들의 안전에 대한 관심이 높아지면서 자동차 제조업체들이 저가형 차량에 많은 센서를 탑재하고 있습니다. 이는 당분간 광센서에 대한 수요를 촉진할 것으로 예상됩니다.

- 또한, 사물인터넷(IoT), 얼굴 인식 등 최신 기술 도입에 대한 관심이 높아지고, 신흥국에서는 다양한 산업의 보안을 강화하기 위한 정부 규제로 인해 광센서 보급이 확대되고 있습니다.

- COVID-19의 발생도 광센서 시장 점유율 성장에 영향을 미칠 것으로 보입니다. 주로 중국, 일본, 싱가포르 정부가 스마트 시티 개발에 투자하기 시작했기 때문입니다. 또한, 스캐너, QR(Quick Response) 코드, 침입 감지 시스템(IDS)에 광센서가 널리 사용되고 있는 것도 시장 확대에 힘을 보태고 있습니다.

광센서 산업 개요

광센서 시장은 많은 대기업과 중소기업이 시장 경쟁을 벌이고 있기 때문에 세분화되어 있습니다. 제품 및 기술 발표, 전략적 파트너십, 인수, 사업 확장, 경쟁사와의 경쟁을 통해 이들 진입 기업은 시장에서 경쟁 우위를 확보하기 위해 노력하고 있습니다.

- 2022년 7월 - Vishay Intertechnology, Inc.의 옵토일렉트로닉스 그룹은 자동차, 스마트홈, 산업 및 사무용 애플리케이션을 위한 AEC-Q101 인증을 획득한 새로운 반사형 광센서를 발표했습니다. Semiconductors VCNT2025X01은 2.5mm x 2.0mm x 0.6mm의 소형 표면 실장 패키지에 적외선 이미터, 실리콘 광트랜지스터 검출기, 일광 차단 필터를 통합하여 이전 세대 솔루션보다 더 얇으면서도 더 높은 전류 전달률(CTR)과 작동 온도에서 더 높은 성능을 제공합니다. 및 동작 온도에서 성능 향상을 실현하였습니다.

- 2021년 7월 - Sharp Semiconductor는 I2C 통신 프로토콜을 지원하는 웨어러블 기기용 근접 센서 GP2AP130S00F를 개발했다고 발표했습니다. 평균 소비전류 40μA(typ.)의 저소비전류 설계로 배터리 전원으로 장시간 동작이 가능합니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 시장 성장 촉진요인

- 자동차 부문의 진보가 시장을 지지

- 스마트폰이나 PC 태블릿에의 광센서 탑재 확대

- 시장 성장 억제요인

- 낮은 광센서 능력이 시장 성장 억제요인으로

- 저가격 센서가 품질 저하 위협을 증대

- COVID-19의 산업에 대한 영향 평가

제5장 시장 세분화

- 유형

- 환경 광센서

- 근접 센서

- RGB 컬러 센싱

- 제스처 인식

- 자외선/적외선(IR) 검출

- 출력

- 아날로그

- 디지털

- 최종 이용 산업

- 가전제품

- 자동차

- 산업용

- 기타

- 지역

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제6장 경쟁 구도

- 기업 개요

- AMS AG

- Sharp Corporation

- STMicroelectronics NV

- Broadcom Inc.

- Vishay Intertechnology Inc.

- Apple Inc.

- Elan Microelectronic Corp.

- Everlight Electronics Co. Ltd

- Maxim Integrated Products Inc.

- Samsung Electronics Co. Ltd

- Sitronix Technology Corporation

- ROHM Co. Ltd

제7장 투자 분석

제8장 시장 기회와 향후 동향

ksm 25.01.23The Global Light Sensors Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- For instance, proximity light sensors respond to changes in infrared light to detect motion or proximity to another object. They are used for devices in vehicles that sound an alarm when the vehicle is close to bumping into an object. Proximity light sensors are common in outdoor lights to detect motion for security purposes.

- Smartphone manufacturers are actively incorporating new technologies into their devices to improve their product quality in terms of product quality and vision. For instance, in April 2022, Oppo announced that its model, Oppo F21 Pro, will feature the flagship Sony IMX709 RGBW selfie sensor that is 60% more sensitive to light and reduces noise by 35% when compared to the previous generation IMX615 RGB sensor.

- In the automotive segment, with the development of new technologies such as lane assist, automatic headlights, and many more, these sensors are being integrated into rear-view mirrors, interior lighting, side-view mirrors, rain sensor, optical control knobs, and many more. Also, the increased adoption of LiDAR sensors in various industry verticals, such as aerospace and defense, corridor mapping and topographical survey, automotive, mining, and oil and gas, has also created growth opportunities for the light sensors market across industries.

- During the Covid-19 pandemic, the consumer electronics sector's growth rapidly changed, increasing competition among market players. Consumer electronics manufacturers are currently under enormous pressure to bring unique and differentiated products to market. Major smartphone manufacturers like Samsung collaborate with light sensor manufacturers to integrate both technologies. For instance, in November 2021, MacDermidAlpha Electronics Solutions announced a collaboration with STMicroelectronics, a global semiconductor leader helping customers across the spectrum of sensing applications, on a key sinter technology for Electric Vehicles inverter assemblies to increase vehicle efficiency and range while lowering production costs significantly.

- Due to the massive COVID-19 outbreak, people's priorities shifted to technology and health, increasing demand for ambient light sensors in applications such as medical devices. For instance, in October 2021, Osram developed an ambient light sensor for mobile devices and wearables that detects UV-A light. According to the company, while the UV-C portion of sunlight is blocked by the earth's atmosphere, UV-A and UV-B radiation reach the earth's surface. Sunburn is caused by UV-B radiation, which only penetrates the upper layers of the skin. This COVID-19 crisis is expected to provide opportunities for businesses to invest in, implement, and research technologies requiring a less human touch. For example, consider the combination of AI and automation.

Light Sensors Market Trends

Consumer Electronics is Expected to Hold a Major Share

- The consumer electronics sector's expansion in the light sensors market has been propelled by the increasing use of proximity sensors and ambient light sensors in mobile devices. Due to a surge in the use of light sensors by the leading OEMs, including Samsung Electronics Co., Ltd., APAC may present prospects for growth (South Korea). The South Korean company Samsung Electronics Co., Ltd. is a significant player in the market for light sensors. It has integrated light sensors into a variety of product categories, including mobile devices like the Samsung Galaxy S6 and Samsung Galaxy S6 edge, that carry out specific tasks like proximity detection.

- Global demand for smart gadgets, such as LED televisions, smartphones, and smart lighting systems, has risen as a result of miniaturization and improvements in sensor technology. Different sensor technologies and communication interfaces are at the heart of these gadgets. The adoption of various sensors across sectors is projected to increase with the advent of connected products and 5G communication technology. Additionally, optical sensors are frequently employed in both residential and commercial wearable electronics equipment.

- Smartphones, LCD/LED televisions, and laptops are some of the applications that are driving the increase in demand for light sensor devices. As a result of the sensors' ability to automatically adjust the screen brightness based on how much ambient light these devices get, electricity savings are made possible. The control of lighting utilizing various digital sensing components involving illuminance detectors is another key emphasis of contemporary IoT lighting platforms.

- The proximity detection module and integrated ambient light sensor from AMS AG were released in July 2020, enabling mobile handset Original Equipment Manufacturers (OEMs) to create mobile handsets with almost bezel-less screens. In comparison to other devices on the market, the module (TMD2755) is 40% lower in area and 60% smaller in volume. Moreover, TMD2755 aids mobile phone manufacturers' efforts to expand the viewable display area by allowing the light-sensing and proximity features to be contained in a thinner bezel. This has been cited as a major contributor to rising consumer interest in mobile phones in the mid-range market segment.

- Electronic devices like mobile phones, LCDs, and LEDs are increasingly using light sensor devices to automatically alter the screen brightness in reaction to the quantity of light they are exposed to. This capability helps these devices conserve electricity. Light sensors are expanding in this market as a result of the growing focus on using facial recognition in consumer electronics, such as mobile phonesand tablets, for access and authentication, account accessibility, and security/identity fraud protection.

- The surge in the adoption of wearable devices and innovative applications in the biomedical sector may boost the growth of the market. However, the extra costs incurred due to the incorporation of sensors in devices and reduction in the life of the device are expected to hinder the market growth.

Asia-Pacific is Expected to Register a Significant Growth Rate

- Asia-Pacific is expected to dominate the light sensors market, owing to its larger population size and increasing demand and production of smartphones and other consumer electronics. For instance, according to India Cellular and Electronics Association (ICEA), the value of mobile phone production in India increased from INR 1,700 billion in 2019 to INR 2,149 billion in 2020. In 2021, the value totaled to INR 2,227 billion, despite the impact of the coronavirus pandemic.

- An increase in the adoption rate of handheld devices with inbuilt light sensors is also one of the key factors contributing to the growth of the light sensors market in the region.

- With an increase in the safety concerns among the consumers in the developing economies, such as India and the ASEAN countries, the automobile manufacturers are incorporating more sensors in low-cost vehicles. This is expected to drive the demand for light sensors in the foreseeable future.

- Further, the growing emphasis on the adoption of the latest technologies, such as the Internet of Things (IoT), facial recognition, and government regulations in the emerging economies to enhance security across various industry verticals are leading to increased deployment of light sensors, which is, in turn, boosting the growth of the industry in the region.

- The COVID-19 outbreak is also expected to impact the growth of the Light sensors market share. Primarily due to the governments in China, Japan, and Singapore starting to invest in the development of smart cities. Furthermore, the widespread use of light sensors in scanners, Quick Response (QR) codes, and intrusion detection systems (IDS) is driving market expansion.

Light Sensors Industry Overview

The light sensors market is fragmented, due to many large and small players churning the competition in the market. Through product and technology launches, strategic partnerships, acquisitions, expansions, and collaborations, these players are trying to gain a competitive edge in the market.

- July 2022 - The Optoelectronics group of Vishay Intertechnology, Inc. introduced a new AEC-Q101-qualified reflective optical sensor for automotive, smart home, industrial, and office applications. Offering a lower profile than previous-generation solutions while delivering improved performance with a higher current transfer ratio (CTR) and operating temperature, the Vishay Semiconductors VCNT2025X01 integrates an infrared emitter, silicon phototransistor detector, and daylight blocking filter in a miniature 2.5 mm by 2.0 mm by 0.6 mm surface-mount package.

- July 2021 - Sharp Semiconductor Co., Ltd. announced the development of the GP2AP130S00F proximity sensor for wearable devices that supports the I2C communication protocol. Its low current consumption design with an average current consumption of 40 μA (typ.) enables long-duration operation on battery power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Advancements in the Automotive Sector Fuel the Market

- 4.4.2 Growing Implementation of Light Sensors in Smartphones and PC Tablets

- 4.5 Market Restraints

- 4.5.1 Low Light Sensing Capabilities Act as a Restraining Factor

- 4.5.2 Low-cost Sensors are Increasing the Threat to Scale Down the Quality

- 4.6 Assessment of the Impact of COVID-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Ambient Light Sensing

- 5.1.2 Proximity Detector

- 5.1.3 RGB Color Sensing

- 5.1.4 Gesture Recognition

- 5.1.5 UV/Infrared Light (IR) Detection

- 5.2 Output

- 5.2.1 Analog

- 5.2.2 Digital

- 5.3 End-user Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 AMS AG

- 6.1.2 Sharp Corporation

- 6.1.3 STMicroelectronics NV

- 6.1.4 Broadcom Inc.

- 6.1.5 Vishay Intertechnology Inc.

- 6.1.6 Apple Inc.

- 6.1.7 Elan Microelectronic Corp.

- 6.1.8 Everlight Electronics Co. Ltd

- 6.1.9 Maxim Integrated Products Inc.

- 6.1.10 Samsung Electronics Co. Ltd

- 6.1.11 Sitronix Technology Corporation

- 6.1.12 ROHM Co. Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록