|

시장보고서

상품코드

1630380

태양광 발전용 웨이퍼 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Solar Photovoltaic Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

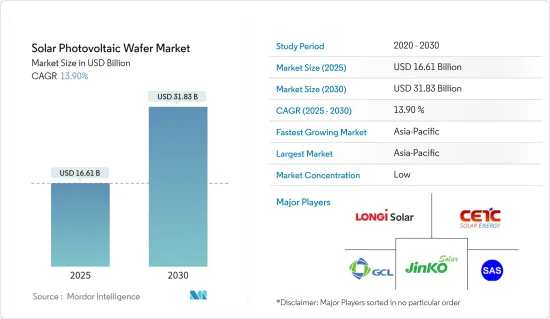

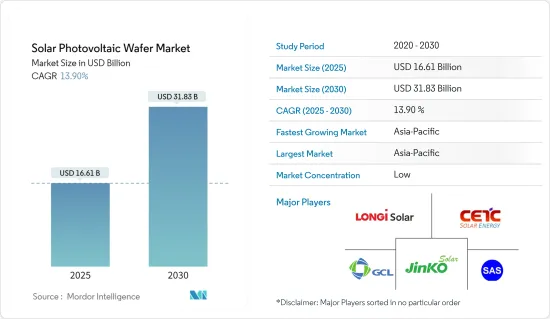

태양광 발전용 웨이퍼 시장 규모는 2025년에 166억 1,000만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 13.9%로, 2030년에는 318억 3,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 신재생에너지에 대한 세계 수요 증가와 정부의 지원정책이 예측기간 동안 시장의 주요 성장요인이 될 것으로 예상됩니다.

- 한편, 태양광 웨이퍼는 시장에서 입수 가능한 박막과 같은 대체품에 비해 고가이기 때문에 예측기간 동안의 성장이 억제될 것으로 예상됩니다.

- 그럼에도 불구하고 웨이퍼 기술의 기술적 진보는 예측 기간 동안 시장에 몇 가지 기회를 만들 것으로 예상됩니다.

- 아시아태평양은 향후 태양광 발전 프로젝트와 정부의 지원 정책에 따라 시장을 독점할 것으로 예상됩니다.

태양광 발전용 웨이퍼 시장 동향

단결정 태양광 발전용 웨이퍼가 시장을 독점할 전망

- 태양광 웨이퍼는 결정 실리콘의 얇은 조각으로 태양전지(PV)의 집적 회로를 제조하기 위한 마이크로 경제 디바이스의 기판으로서 기능하여 태양광을 흡수하여 발전을 보조합니다.

- 단결정 태양전지판은 효율이 높고 점유 면적이 작기 때문에 예측 기간 동안 단결정 태양 웨이퍼가 시장을 독점할 것으로 예상됩니다.

- 프라운호퍼 ISE에 따르면, 단결정 태양전지의 효율은 태양전지 중에서 가장 높습니다(26.7%). 이것은 특히 대규모 유틸리티 스케일 프로젝트에서 더 높은 발전량을 초래하여 전력 요금의 평준화 비용을 더욱 절감합니다.

- 2023년 8월, Trina Solar는 베트남에서 210mm 단결정 웨이퍼를 생산하기 시작했습니다. 이 공장에서는 연간 6.5GW의 웨이퍼 생산이 가능합니다. 이 새로운 생산 능력을 통해 Trina Solar는 전 세계에 유연하게 제품을 공급할 수 있습니다.

- 인도는 태양광 발전용 웨이퍼에 중요한 시장입니다. 이 나라의 태양광 발전 부문이 급성장하는 가운데 국내 수요에 맞추어 수입 의존도를 줄이기 위해 태양전지, 웨이퍼, 잉곳의 생산 능력도 확대되고 있습니다.

- 2022년 12월, Adani Solar는 인도 최대의 단결정 실리콘 잉곳을 발표했습니다. 이 새로운 제조 라인은 태양 웨이퍼, 셀 및 모듈 전용 실리콘 잉곳을 생산합니다. 이 장비는 M10 및 G12 웨이퍼를 생산할 수 있는 대형 단결정 실리콘 잉곳을 생산합니다. 이 회사에 따르면 2023년 말까지 2GW의 잉곳 및 웨이퍼 생산 능력을 추가하고 2025년까지 10GW까지 확대하는 것을 목표로 하고 있습니다.

- 따라서, 상기한 요인으로 인해 단결정 태양광 발전용 웨이퍼 부문은 예측 기간 동안 태양광 발전용 웨이퍼 시장을 독점할 것으로 예상됩니다.

가장 빠르게 성장할 아시아태평양 지역

- 아시아태평양은 예측 기간 동안 가장 빠르게 성장하는 시장이 될 것으로 예상됩니다. 인도, 일본, 중국 등의 국가들은 미래에 대규모 태양광 발전의 도입을 목표로 하고 있습니다.

- 중국의 대규모 프로젝트는 앞으로 태양광 발전용 웨이퍼의 큰 수요를 창출할 것으로 예상됩니다. 또한 중국은 태양광 하드웨어 제조 세계의 거점이기 때문에 JinkoSolar, JA Solar, Yingli 등의 중국 업체들이 태양전지, 웨이퍼, 잉곳 기술의 연구 개발의 최전선에 있어 시장에 큰 자극을 줄 것으로 예상됩니다.

- 2023년 상반기, Polaris Solar Photovoltaic Networks Statistics에 따르면, 1월부터 6월까지 중국의 실리콘 웨이퍼 생산량은 442GW에 달하고, 57억 달러에 달했습니다.

- 2023년 7월, 호주 정부는 신재생에너지 공급망 개발을 위한 3,370만 달러의 투자를 발표했습니다. 이 자금은 호주와 남동아시아 국가에서 프로젝트 개발을 위한 연구를 지원하는 것으로, 특히 태양전지 잉곳 웨이퍼 제조 및 배터리 셀 부품 제조를 언급합니다.

- 2022년 아시아의 태양광 발전 설비 용량은 603GW 이상으로 추정되며 예측 기간 동안 꾸준히 성장할 것으로 예상됩니다. 태양에너지의 향후 성장에 따라 태양광 시장도 크게 성장할 것으로 추정됩니다.

- 아시아태평양에서는 다수의 프로젝트가 건설 중이며 각국이 의욕적인 태양에너지 목표를 내세우고 있기 때문에 예측 기간 동안 가장 빠른 속도로 성장할 것으로 예상됩니다.

태양광 발전용 웨이퍼 산업 개요

태양광 발전용 웨이퍼 시장은 단편화되고 있습니다. 주요 기업으로는 Jinko Solar Holding Co., GCL-Poly Energy Holdings Limited Ltd., LONGi Green Energy Technology, CETC Solar Energy Holdings Co., Sino-American Silicon Products Inc. 등이 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 신재생에너지 수요 증가

- 정부의 지원 정책

- 억제요인

- 박막과 같은 대체품에 비해 고비용

- 성장 촉진요인

- 공급망 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계의 강도

제5장 시장 세분화

- 유형별

- 단결정 웨이퍼

- 다결정 웨이퍼

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 노르딕

- 터키

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 호주

- 일본

- 말레이시아

- 베트남

- 태국

- 인도네시아

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 칠레

- 콜롬비아

- 기타 남미

- 중동 및 아프리카

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카

- 카타르

- 나이지리아

- 카타르

- 이집트

- 북미

- 시장 기업 순위

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Jinko Solar Holding Co., Ltd.

- GCL-Poly Energy Holdings Limited

- LONGi Green Energy Technology Co Ltd

- CETC Solar Energy Holdings Co

- Sino-American Silicon Products Inc

- Targray Technology International Inc

- Renewable Energy Corporation

- JA Solar Holdings, Co., Ltd.

- 시장 기업 순위

제7장 시장 기회와 앞으로의 동향

- 웨이퍼 기술의 진보

The Solar Photovoltaic Wafer Market size is estimated at USD 16.61 billion in 2025, and is expected to reach USD 31.83 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing global demand for renewable energy and supportive government policies are expected to be the primary growth driver for the market during the forecast period.

- On the other hand, photovoltaic wafers are costly compared to alternatives like thin films available in the market, which are expected to restrain growth in the forecast period.

- Nevertheless, the tecchnological advancement in wafer technology is expected to create several opportunities for the market during the forecast period.

- Asia pacific is expected to dominate the market owing to upcoming solar projects and supportive government policies.

Solar Photovoltaic Wafer Market Trends

Monocrystalline Solar Photovoltaic Wafer is Expected to Dominate the Market

- A solar wafer is a thin slice of crystalline silicon that works as a substrate for microeconomic devices for fabricating integrated circuits in photovoltaics (PVs) to manufacture solar cells and assist in power generation by absorbing sunlight.

- Due to the higher efficiency and lower space occupancy of monocrystalline solar panels, monocrystalline solar wafers are expected to dominate the market during the forecast period.

- According to Fraunhofer ISE, monocrystalline solar cells had the highest efficiency (26.7%) of any solar cell. This translates to higher electricity production, especially in large utility-scale projects, further reducing the levelized cost of electricity, which is expected to give the technology an advantage over other technology types, driving the segment during the forecast period.

- In August 2023, Trina Solar began producing 210mm Monocrystalline Wafers in Vietnam. The factory will be able to produce 6.5 GW of wafers annually. With this new capacity, Trina Solar will have greater flexibility in being able to deliver its products worldwide.

- India is a significant market for solar photovoltaic wafers. As the country's solar photovoltaic sector grows rapidly, it is also expanding its solar cell, wafer, and ingot production capacity to match domestic demand and reduce dependence on imports.

- In December 2022, Adani Solar unveiled India's largest monocrystalline silicon ingot. The new manufacturing line will produce silicon ingots exclusively for producing solar wafers, cells, and modules. The facility will produce large-sized monocrystalline silicon ingots capable of producing M10 and G12 wafers. According to the company, it aims to add 2 GW of ingot and wafer capacity by the end of 2023 and scale it up to 10 GW by 2025.

- Therefore, owing to the above points, the monocrystalline solar photovoltaic wafers segment is expected to dominate thesolar photovoltaic wafer market during the forecast period.

Asia-Pacific to Grow at Fastest Rate

- Asia-Pacific is expected to become the fastest-growing market in the forecast period. Countries like India, Japan, and China are aiming to instal solar power on a large scale in the future.

- Significant projects in China are expected to create a large demand for solar photovoltaic wafers in the upcoming period. Additionally, as China is the global hub for solar PV hardware manufacturing, Chinese manufacturers such as JinkoSolar, JA Solar, Yingli, etc. are at the forefront of research and development in solar cell, wafer, and ingot technology, which is expected to provide a significant impetus to the market.

- In first half of 2023, Accordng to Polaris Solar Photovoltaic Networks Statistics, Silicon wafer prodcution in china reached 442GW from January to June and was worth USD 5.7 billion.

- In July 2023, the Australian government announced USD 33.7 million in investment to develop renewable energy supply chains. The funding will support research to develop projects in Australia and southern and southeast Asian countries, particularly mentioning solar ingot and wafer production and battery cell component manufacturing.

- In 2022, the installed capacity of solar photovoltaic in Asia was estimated at more than 603 GW, which is expected to grow steadily during the forecast period. With the future growth of solar energy, the market for solar wafers is also estimated to grow considerably.

- With a large number of projects under construction and ambitious solar energy goals for countries in Asia-Pacific, the region is anticipated to grow at the fastest rate in the forecast period.

Solar Photovoltaic Wafer Industry Overview

The solar photovoltaic wafer market is fragmented. Some of the major companies (in no particular order) include Jinko Solar Holding Co., GCL-Poly Energy Holdings Limited Ltd, LONGi Green Energy Technology Co Ltd, CETC Solar Energy Holdings Co, and Sino-American Silicon Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Renewable Energy

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost Compared to Alternatives like Thin Films

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monocrystalline Wafer

- 5.1.2 Polycrystalline Wafer

- 5.2 Geogrpahy

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Vietnam

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Nigeria

- 5.2.5.6 Qatar

- 5.2.5.7 Egypt

- 5.2.1 North America

- 5.3 Market Player Ranking

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Jinko Solar Holding Co., Ltd.

- 6.3.2 GCL-Poly Energy Holdings Limited

- 6.3.3 LONGi Green Energy Technology Co Ltd

- 6.3.4 CETC Solar Energy Holdings Co

- 6.3.5 Sino-American Silicon Products Inc

- 6.3.6 Targray Technology International Inc

- 6.3.7 Renewable Energy Corporation

- 6.3.8 JA Solar Holdings, Co., Ltd.

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement in Wafer technology