|

시장보고서

상품코드

1630456

영국의 해양 석유 및 가스 해체 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)UK Offshore Oil And Gas Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

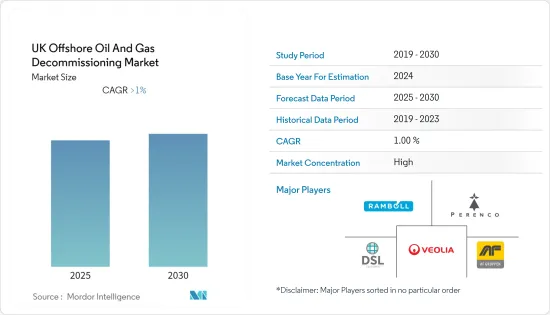

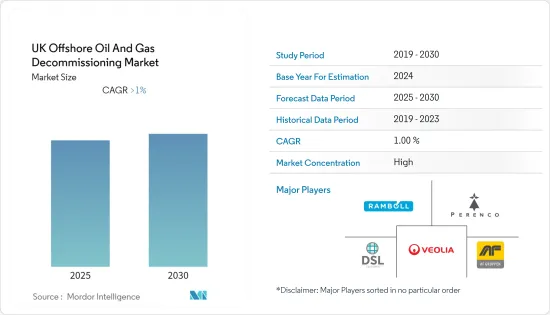

영국의 해양 석유 및 가스 해체 시장은 예측 기간 동안 1% 이상의 CAGR을 기록할 것으로 예상됩니다.

COVID-19는 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 전염병 이전 수준에 도달했습니다.

주요 하이라이트

- 시장은 천연가스 및 원유 생산량 감소와 대체 에너지원의 증가에 의해 주도될 가능성이 높습니다.

- 그러나 폐로에 필요한 높은 비용과 고급 전문 지식을 바탕으로 시장은 제한적일 가능성이 높습니다.

- 북해 유전이 성숙해지면서 석유 및 천연가스 생산량이 감소함에 따라 폐로에 대한 수요가 증가할 것으로 예상됩니다. 이는 시장 관계자들에게 좋은 기회가 될 수 있습니다.

영국 석유 및 가스 해체 시장 동향

폐로 프로젝트 증가가 시장 견인

- 사업, 에너지 및 산업전략부(Department for Business, Energy, and Industrial Strategy)의 산하 기관인 Offshore Petroleum Regulator for Environment and Decommissioning(OPRED), 1998년에 제정된 석유 및 가스법의 규정을 준수하도록 보장하는 역할을 담당하고 있습니다.

- 지난 9월, Spirit Energy는 해양 컨설턴트 회사인 ABL을 고용하여 영국 해역에 위치한 3기의 해양 시추선 폐로 작업을 지원했으며, Spirit Energy Production과의 계약의 일환으로 ABL의 애버딘 지사는 북해 남부 및 아일랜드 해에서 영국 사업자의 폐로 포트폴리오에 MWS와 해양 컨설팅 서비스를 포함시켰습니다. 3개의 석유 및 가스 플랫폼은 2025년까지 지속되는 프로젝트의 일환으로 보관될 예정입니다. Audrey A, Audrey B 및 Ensign 플랫폼의 윗면과 재킷은 복원의 일환으로 제거해야 합니다. 많은 프로젝트가 해체 작업을 준비하고 있으며, 이는 시장 성장에 도움이 될 수 있습니다.

- 2022년 2월, 케치 가스전과 스쿠너 가스전의 소유주인 운영사 DNO North Sea와 파트너인 Tullow Oil SK(영국에 본사를 둔 석유 및 가스 회사)는 20개의 플랫폼 유정과 1개의 해저 유정을 보유하게 됩니다. 양사는 가스전의 경제적 수명을 연장할 수 있는 실행 가능한 방법을 찾지 못했기 때문에 폐기를 결정하기 전에 몇 가지 기술적, 사업적 대안을 검토했습니다. 이러한 시설은 경제적 수명이 다한 시추선의 폐기에 대한 인센티브가 되어 시장 성장에 도움이 될 수 있습니다.

- 영국의 천연가스 생산량은 2020년 381억1천만 입방피트에서 2021년 31억6천만 입방피트로 16.9% 감소할 것으로 예상됩니다. 예측 기간 동안 생산량은 더 감소할 수 있으며, 이는 시장 진입자들이 원가 이하로 충분한 생산량을 확보하지 못할 경우 시추기를 폐기할 동기를 부여하여 영국 해양 석유 및 가스 해체 시장을 활성화시킬 수 있습니다.

- 향후 몇 년 동안 영국의 해양 석유 및 가스 해체 시장은 해체 프로젝트의 증가에 의해 주도될 가능성이 높습니다.

심해 및 초심해 부문, 성장세 확인

- 심해 플랫폼 해체 및 철거는 철거 설계 과정에서 방법론, 엔지니어링 및 절차에 세심한 주의를 기울여야 합니다. 따라서 프로젝트를 완료하기 위해서는 보다 진보된 전문 지식과 우수한 장비가 필요합니다.

- 북해와 같은 지역에서는 많은 수심이 깊은 플랫폼이 수명이 다하여 해체 작업이 필요할 것으로 예상됩니다. 이러한 대형, 심해 플랫폼의 해체 과정은 더욱 복잡해질 것으로 예상되며, 이러한 작업을 안전하고 효과적으로 계획하고 실행하기 위해서는 보다 세밀하고 엔지니어링적인 솔루션이 필요합니다. 해체 대상 시추선 수가 증가함에 따라 시장 성장을 견인할 것으로 예상됩니다.

- 우물을 청소하고 우물에 플러그를 조심스럽게 설치해야 합니다. 이는 수중 유정을 개방된 상태로 두어 환경 문제를 예방하기 위해 정확하게 수행되어야 합니다. 심해와 초심해에서는 폐정 비용이 훨씬 더 높습니다. 이 부문에서 생태계에 미치는 영향을 현대화하려는 노력이 증가하고 있으며, 이는 시장 성장을 촉진할 것으로 예상됩니다.

- IEA에 따르면 영국의 석유 및 천연가스 생산은 거의 전적으로 해양 유전에서 생산됩니다. Baker Hughes Company는 영국 지역의 리그 수가 2022년 12월에 약 10기가 될 것으로 추정하고 있습니다. 생산 비용이 상승하거나 원유 가격이 채굴 비용보다 낮을 경우 이 지역의 기업들은 시추기를 폐기할 수 있습니다.

- 따라서 심해 및 초심해 부문은 투자 증가와 기술 발전으로 인해 예측 기간 동안 성장을 보일 것으로 예상됩니다.

영국의 해양 석유 및 가스 해체 산업 개요

영국의 해양 석유 및 가스 해체 시장은 비교적 통합된 시장입니다. 이 시장의 주요 기업들(순서에 관계없이)은 Veolia Environnement S.A., Derrick Services(UK) Ltd, Perenco SA, Ramboll Group A/S, AF Gruppen ASA 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 조사 방법

제3장 주요 요약

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 원유 생산량(단위 : 100만 배럴/일, 2021년)

- 천연가스 생산량(단위 : 10억 입방피트, 2021년)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- PESTLE 분석

제5장 수심별 시장 세분화

- 천해

- 심해와 초심해

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Veolia Environnement S.A.

- Derrick Services(UK) Ltd.

- Perenco SA

- Ramboll Group A/S

- AF Gruppen ASA

- John Lawrie Group Ltd.

제7장 시장 기회와 향후 동향

ksm 25.01.23The UK Offshore Oil And Gas Decommissioning Market is expected to register a CAGR of greater than 1% during the forecast period.

COVID-19 had a detrimental effect on the market.Presently, the market has reached pre-pandemic levels.

Key Highlights

- The market is likely to be driven by things like the decrease in natural gas and crude oil production and the rise in alternative energy sources.

- But the market is likely to be limited by the high cost and high level of expertise needed for decommissioning.

- The North Sea fields are maturing, and the demand for decommissioning is expected to rise as crude oil and natural gas production reduces. This may act as an opportunity for the market players.

UK Offshore Oil And Gas Decommissioning Market Trends

Increasing Decommissioning Projects to Drive the Market

- The Petroleum Act of 1998 says how offshore oil and gas infrastructure and pipelines on the United Kingdom Continental Shelf (UKCS) should be taken down.The Offshore Petroleum Regulator for Environment and Decommissioning (OPRED), which is part of the Department for Business, Energy, and Industrial Strategy, is in charge of ensuring that the Petroleum Act of 1998's provisions are followed.

- In September 2022, Spirit Energy hired marine consultancy ABL to assist in the decommissioning of three offshore rigs in the United Kingdom's seas. As part of the contract with Spirit Energy Production, ABL's Aberdeen branch will provide MWS and maritime consultancy services for the UK operator's decommissioning portfolio in the southern North Sea and the Irish Sea. The three oil and gas platforms will be put into storage as part of the project, which will last until 2025. The topside and jackets for the Audrey A, Audrey B, and Ensign platforms will need to be removed as part of the restoration. Many projects are in preparation for decommissioning and may aid the growth of the market.

- In February 2022, the operator DNO North Sea and the partner Tullow Oil SK, an oil and gas firm with headquarters in the UK, which are the owners of the Ketch and Schooner gas fields, will have 20 platform wells and one subsea well. The firms considered several technical and business alternatives before deciding to decommission the fields since they were unable to discover a workable way to extend their economic life. The cost of decommissioning has been estimated at USD 33 million.Facilities such as these may incentivize the decommissioning of the rigs due to the end of the rig's economic life, which may aid the growth of the market.

- Natural gas production in the country decreased by 16.9%, to 3.16 billion cubic feet per day in 2021 from 3.81 billion cubic feet per day in 2020. The output may decline further in the forecast period, which could incentivize the market players to decommission the rigs in case they are not able to produce enough below the cost price and thereby boost the United Kingdom offshore oil and gas decommissioning market.

- In the next few years, the United Kingdom's offshore oil and gas decommissioning market is likely to be driven by a growing number of decommissioning projects.

Deepwater and Ultra-Deep Water Segment to Witness Growth

- For the decommissioning and removal of a deepwater platform, the removal design process needs to pay close attention to the methodology, engineering, and procedures. All of these are likely to be more complicated than for smaller shallow water platforms.This requires higher expertise and better equipment to complete the project.

- Many of the platforms in deeper water are reaching the end of their useful lives in areas such as the North Sea, and decommissioning is expected to become necessary. The process of decommissioning these larger and deeper water platforms is expected to be more complex and require more detailed and engineered solutions to plan and execute such operations safely and effectively. An increasing number of rigs to decommission is expected to aid the market.

- The main parts of the decommissioning process are plugging and abandoning the wells, which also cost the most.The wellbore must be cleaned out and plugs carefully installed in the well. This must be done correctly to prevent any environmental issues from leaving the underwater well open. In deep and ultra-deep water, it accounts for even higher costs for decommissioning. Increasing efforts to modernize the ecological effects in this area are expected to aid the market's growth.

- According to the IEA, nearly all United Kingdom petroleum and natural gas production comes from offshore fields. The rig count in the United Kingdom region was estimated by Baker Hughes Company to be around 10 units in December 2022. The companies in the region may choose to decommission the rigs if the production costs increase or the crude oil prices go below the extraction costs.

- Hence, the deep water and ultra-seep water segments are expected to witness growth in the forecast period due to an increase in investments and advancements in technology.

UK Offshore Oil And Gas Decommissioning Industry Overview

The United Kingdom offshore oil and gas decommissioning market is moderately consolidated. Some of the key players (not in any particular order) in this market are Veolia Environnement S.A., Derrick Services (UK) Ltd., Perenco SA, Ramboll Group A/S, and AF Gruppen ASA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Crude Oil Production, in million barrels per day, till 2021

- 4.4 Natural Gas Production, in billion cubic feet, till 2021

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 PESTLE Analysis

5 MARKET SEGMENTATION BY WATER DEPTH

- 5.1 Shallow Water

- 5.2 Deepwater and Ultra-Deep Water

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Veolia Environnement S.A.

- 6.3.2 Derrick Services (UK) Ltd.

- 6.3.3 Perenco SA

- 6.3.4 Ramboll Group A/S

- 6.3.5 AF Gruppen ASA

- 6.3.6 John Lawrie Group Ltd.