|

시장보고서

상품코드

1631584

유럽의 코워킹 스페이스 - 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Coworking Spaces - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

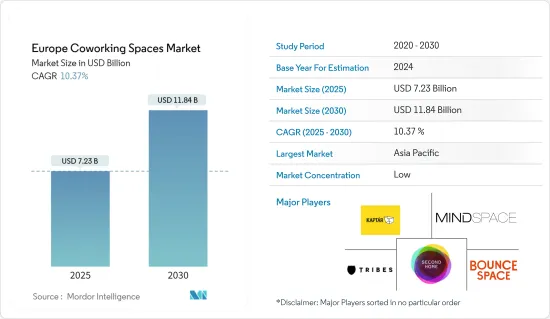

유럽의 코워킹 스페이스 시장 규모는 2025년 72억 3,000만 달러로 예측되며, 예측 기간(2025-2030년) 동안 10.37%의 CAGR로 2030년에는 118억 4,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- Workthere에 따르면, 2023년 유럽의 코워킹 스페이스 시장은 예상을 뒤엎고 성장했습니다. 소프트 오피스 전문기업인 Workthere는 2024년에도 운영자들은 시설과 지속가능성에 중점을 둔 최고급 공간을 계속 찾을 것으로 예상하고 있습니다.

- 인재 유치와 확보가 사상 최고치를 기록하는 가운데, 최고급 공간에 대한 수요는 계속되고 있으며, 운영자는 더 많은 편의시설을 제공함으로써 게임을 한 단계 업그레이드해야 합니다. 테넌트를 확보하고 새로운 테넌트를 유치하기 위해 사업자들은 이미 헬스장, 요가, 카페, 야외 공간뿐만 아니라 개인 요리사가 있는 5성급 호텔이나 옥상 바 같은 편의시설을 포함한 기준을 설정하고 있습니다.

- 임차인들은 최고의 입지를 원하며, 교통이 편리하고 직원들을 위한 편의시설이 잘 갖추어진 곳을 원합니다. 많은 시장에서 이는 중심업무지구(CBD)에서 운영되는 플렉스 오피스 사업자의 증가로 이어지고 있으며, 이는 2024년까지 지속될 것으로 예상됩니다. 반면, 유럽, 특히 마드리드, 뮌헨, 바르셀로나 등 주요 도시에서는 공실률이 5%를 크게 밑도는 등 오피스 공간이 부족하여 공실률과 가동률에 큰 영향을 미칠 것으로 보입니다.

- 지난 2년 동안 운영비용이 상승하면서 많은 운영사의 수익률에 영향을 미치고 있으며, 유럽 대부분의 도시에서 책상 가격은 고급형에서는 상승했지만, 저가형에서는 더 어려워졌습니다. 2024년에는 운영업체들이 회의실 및 이벤트 매출 증가, 코워킹 데스크 매출 증가, 고객에 대한 기술 패키징 업셀링 등 데스크 요금 이외의 마진을 늘릴 수 있는 기회를 찾거나 부수적인 수익에 눈을 돌리는 등 수익성을 본격적으로 중시하게 될 것으로 예상됩니다.

유럽의 코워킹 스페이스 시장 동향

유연하고 저렴한 사무공간을 찾는 유럽 스타트업과 중소기업의 증가가 시장 성장을 견인하고 있습니다.

소프트 오피스나 코워킹 스페이스는 사무실 공간의 임대, 임대, 구매 비용을 크게 절약할 수 있기 때문에 스타트업 기업에게 유용합니다. 필요, 예산, 시간에 맞춰 사무공간을 이용할 수 있습니다.

코워킹이 대중화되면서 코워킹이 필수적인 네트워킹에도 도움이 된다고 말하는 기업가들이 늘고 있습니다. 코워킹은 임대와 관련해서도 유연하며, 여러 가지 옵션 중에서 선택할 수 있습니다. 또한, 전 세계 어디에서나 일할 수 있고, 접근성이 좋은 프리미엄급 장소에서 일할 수 있다는 장점도 있습니다.

2022년 12월, 영국에는 700개 이상의 이커머스 스타트업이 등록되어 유럽 최대의 이커머스 스타트업 생태계를 형성하고 있습니다. 이에 비해 프랑스는 270개의 E-Commerce 스타트업이 등록되어 250개에 불과한 독일에 이어 두 번째로 많았습니다. 불과 1년 전만 해도 독일은 유럽 전체에서 두 번째로 큰 E-Commerce 및 소매 스타트업 생태계를 가지고 있었습니다.

독일에서 E-Commerce 산업은 2022년 스타트업 투자가 가장 많은 산업 중 건강, 에너지, 소프트웨어, 분석 및 기타 산업에 이어 6위를 차지했습니다. 그러나 2022년 5월까지 독일은 전체 자금 조달 측면에서 유럽 E-Commerce B2B 스타트업의 상위 4곳의 본거지였습니다.

원격 근무의 부상과 유연한 근무 방식에 대한 수요 증가가 시장을 주도하고 있습니다.

코워킹 스페이스는 비즈니스를 위한 최적의 장소가 되고 있습니다. 전 세계는 성장을 위한 유연성과 공간을 제공하는 코워킹 스페이스로 빠르게 이동하고 있습니다.

1,000명의 비즈니스 리더를 대상으로 한 설문 조사에 따르면 재택근무가 가져다주는 자유는 사람들의 일하는 방식을 영구적으로 바꾸고 있습니다. 조사에 따르면, 사무공간을 보유한 기업의 거의 절반(45%)이 2025년 말까지 사무실 공간을 축소할 계획이며, COVID-19 사태가 시작된 이후 7곳 중 1곳(18%)은 이미 사무실 공간을 축소한 것으로 나타났습니다. 이 조사에 따르면 향후 5년간 약 1,800만 평방피트의 사무실 공간이 노후화되어 현재 점유 면적의 18%를 차지할 것이라고 합니다. 이는 영국 도시의 모습과 인상에 큰 영향을 미칠 것으로 예상됩니다.

영국 기업들은 또한 더 짧고 유연한 임대차 계약을 원하고 있으며, WeWork와 같은 코워킹 스페이스의 채택을 늘리고 있습니다. 사무실을 고수할 계획인 기업 중 13%는 사무실의 주요 기능이 휴식 공간이나 회의실과 같은 협업 공간으로 이동하고 있기 때문에 1인당 책상 공간이 적은 숙소를 찾을 것이라고 답했습니다.

이 새로운 환경에서는 유연성이 변화의 원동력이 되어 사무실 공간을 잠재력 있는 공간으로 변모시키고 있습니다. 예를 들어, 런던 교외의 작은 사무실 공간은 1인당 하루 265유로(287.51달러) 이하의 비용으로 팀을 모으고 있습니다. 이러한 연성 공간은 기능적일 뿐만 아니라 현대 직장 생활의 진화하는 요구에 부응하고 진화하는 현대 업무 공간의 본질에 대응하고 있습니다.

유럽의 코워킹 스페이스 산업 개요

이 산업은 상당히 세분화되어 있으며, 유럽의 코워킹 스페이스 시장에는 많은 기업들이 진출해 있습니다. 또한, 캐주얼한 환경의 사무실에 대한 빠른 수요를 충족시키기 위해 더 많은 기업들이 시장에 진입하고 있습니다. 시장의 주요 기업으로는 KAPTAR, Mindspace, BounceSpace, Second Home, Tribes 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 유연하고 합리적인 오피스 공간을 요구하는 유럽의 신흥 기업이나 중소기업 증가

- 리모트 워크 증가와 유연한 근무 형태에 대한 수요 상승

- 시장 성장 억제요인

- 경제적인 불확실성이 시장 진전에 영향

- 기존 오피스 공간 제공 기업과의 경쟁

- 시장 기회

- 기존 오피스 공간 프로바이더와의 제휴

- 커뮤니티 형성 중시

- 산업의 매력 - Porter's Five Forces 분석

- 신규 참여업체의 위협

- 구매자/소비자의 협상력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간의 경쟁 강도

제5장 시장 세분화

- 비즈니스 유형별

- 신규 공간

- 확대

- 체인

- 비즈니스 모델별

- 하위 임대 모델

- 수익 공유 모델

- 소유자-운영자 모델

- 최종사용자별

- 독립 프로페셔널

- 스타트업 팀

- 중소기업(SME)

- 대기업

- 국가별

- 영국

- 프랑스

- 독일

- 스페인

- 이탈리아

- 기타 유럽

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 개요

- KAPT-R

- Mindspace

- BounceSpace

- Second Home

- Tribes

- Mokrin House

- Paper Hub

- Impact Hub

- WeWork

- Mortimer House*

- 기타 기업

제7장 투자 분석

제8장 시장 전망

제9장 부록

ksm 25.02.04The Europe Coworking Spaces Market size is estimated at USD 7.23 billion in 2025, and is expected to reach USD 11.84 billion by 2030, at a CAGR of 10.37% during the forecast period (2025-2030).

Key Highlights

- The coworking spaces market in Europe defied the odds in 2023, according to Workthere. The flexible office specialist estimated that operators would continue to look for top-of-the-line spaces with more emphasis on facilities and sustainability in 2024.

- With talent attraction and retention at all-time highs, there will continue to be a demand for top-of-the-line space, and operators will need to step up their game by offering more amenities. To compete for tenants and attract new ones, operators are already setting standards that go beyond gyms, yoga, cafes, and outdoor space to include amenities like five-star hotels with private chefs or rooftop bars.

- While occupiers are looking for the best locations, they are also looking for locations that offer the best transport connections and full amenities for their employees. For many markets, this has led to an increase in the number of flex office operators operating in central business districts (CBDs), which is expected to continue in 2024. On the other hand, a shortage of office space in Europe, particularly in major cities such as Madrid, Munich, and Barcelona, where vacancy rates are well below 5%, will have a major impact on occupancies and availability.

- Operational costs have increased over the last two years, impacting profit margins for a number of operators, and while the desk prices increased at the high end in most European cities, it has been more difficult at the low end. Operators are projected to place a genuine emphasis on profitability in 2024 by looking for opportunities to grow margin outside of desk rates and by looking at ancillary revenue, including through more sales of meeting rooms and events, more sales of coworking desks, or upselling technology packages to their customers.

Europe Coworking Spaces Market Trends

Market Growth Driven by the Increasing Number of Startups and Small Businesses in Europe Looking for Flexible and Affordable Office Spaces

Flexible offices and coworking spaces come in handy for startups because they can save a lot of money on renting, leasing, or buying office space. They can avail of office space according to their needs, budget, and time.

As coworking becomes more popular, more entrepreneurs are talking about how coworking also helps with essential networking. Coworking offers a lot of flexibility when it comes to leasing, and there are several different options to choose from. It also offers the advantage of being able to work from anywhere in the world, as well as being able to work in premium and easy-to-access locations.

In December 2022, the United Kingdom had more than 700 e-commerce startups registered, making it the largest e-commerce startup ecosystem across Europe. In comparison, France had 270 e-commerce startup companies registered, second only to Germany, which had less than 250 startups registered. Just one year earlier, Germany had the second-largest e-commerce and retail startup ecosystem across Europe.

In Germany, the e-commerce industry ranked sixth among industries with the highest number of startup investments in 2022, after industries including health, energy, software, and analytics. However, by May 2022, Germany was home to four of the top European e-commerce B2B startups in terms of overall funding.

Rise of Remote Work and Growing Demand for More Flexible Work Arrangements are Driving the Market

Coworking spaces are fast becoming the perfect fit for businesses. The world is rapidly moving toward coworking spaces that offer the flexibility and space to grow.

The freedom afforded by working from home, according to the research of 1,000 business leaders, is set to permanently alter the way people work. A study found that nearly half of the enterprises with office space (45%) plan to downsize by the end of 2025, and one in seven (18%) have already done so since the COVID-19 pandemic began. According to the study, about 18 million sq. ft of office space will become obsolete in the next five years, accounting for 18% of all currently occupied square footage. This is expected to have a significant impact on the way UK cities appear and feel.

UK businesses are also looking for shorter, flexible leases, which is increasing their adoption of coworking spaces such as WeWork, with 12% intending to use these locations more often instead of an 'owned' office. Among businesses planning to stick to the office, 13% stated they would look for accommodation with less desk space per head as the office's main function would now shift toward more space for collaboration, such as break-out areas and meeting rooms.

In this new landscape, flexibility is the driving force for change, transforming office spaces into spaces of possibility. For example, small office spaces outside of London are attracting teams for under EUR 265 (USD 287.51) per person per day. These flexible spaces respond to the ever-evolving nature of modern workspaces that not only function but also respond to the evolving needs of contemporary professional life.

Europe Coworking Spaces Industry Overview

The industry is quite fragmented, with many players operating in the European coworking spaces market. Many more are also entering the market to cater to the rapid demand for offices with casual environments. Some major players in the market include KAPTAR, Mindspace, BounceSpace, Second Home, and Tribes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Number of Startups and Small Businesses in Europe Looking for Flexible and Affordable Office Space

- 4.2.2 Rise of Remote Work and Growing Demand for More Flexible Work Arrangements

- 4.3 Market Restraints

- 4.3.1 Economic Uncertainties Affecting the Progress

- 4.3.2 Competition from Traditional Office Space Providers

- 4.4 Market Opportunities

- 4.4.1 Partnerships with Traditional Office Space Providers

- 4.4.2 Emphasis on Community Building

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Business Type

- 5.1.1 New Spaces

- 5.1.2 Expansions

- 5.1.3 Chains

- 5.2 By Business Model

- 5.2.1 Sub-lease Model

- 5.2.2 Revenue Sharing Model

- 5.2.3 Owner-operator Model

- 5.3 By End User

- 5.3.1 Independent Professionals

- 5.3.2 Startup Teams

- 5.3.3 Small to Medium-sized Enterprises (SMEs)

- 5.3.4 Large-scale Corporations

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 France

- 5.4.3 Germany

- 5.4.4 Spain

- 5.4.5 Italy

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 KAPT-R

- 6.2.2 Mindspace

- 6.2.3 BounceSpace

- 6.2.4 Second Home

- 6.2.5 Tribes

- 6.2.6 Mokrin House

- 6.2.7 Paper Hub

- 6.2.8 Impact Hub

- 6.2.9 WeWork

- 6.2.10 Mortimer House*

- 6.3 Other Companies