|

시장보고서

상품코드

1911474

프랑스의 POS 단말기 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)France POS Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

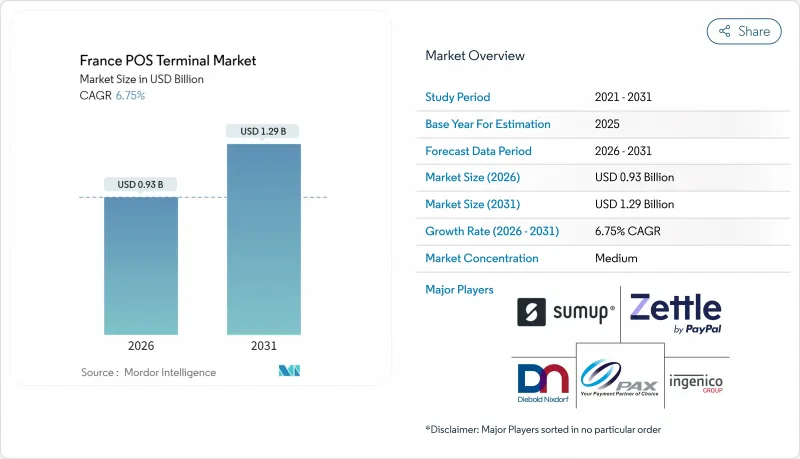

프랑스 POS 단말기 시장은 2025년 8억 7,000만 달러로 평가되었고 2026년에는 9억 3,000만 달러로 성장할 전망입니다. 2026-2031년에 걸쳐 CAGR은 6.75%를 나타내고, 2031년까지 12억 9,000만 달러에 달할 것으로 예측되고 있습니다.

견고한 수요는 비접촉 결제의 이용 증가, PSD2(제2차 결제 서비스 지령)와 견고한 고객 인증과 관련된 규제 요건, 유럽의 결제 이니셔티브(EPI)의 wero 서비스의 전개에 기인하고 있으며, 이들 모두가 가맹점에 구식 단말의 갱신을 촉구하고 있습니다. 하드웨어 공급업체는 약 230만 가맹점 거점에 이르는 업데이트 주기의 혜택을 누리지만, 소프트웨어 공급업체는 소규모 사업자를 위한 총소유비용(TCO) 절감을 실현하는 SoftPOS 솔루션을 통해 점유율을 확대하고 있습니다. 고정단말은 여전히 높은 볼륨 소매 환경에서 주류이지만, 접객산업, 기그 이코노미 사업자, 커브사이드 픽업 사업자가 결제의 유연성을 우선하는 가운데, 모바일 단말이 점증적인 성장을 획득하고 있습니다. 경쟁은 여전히 온화합니다. 월드라인은 인제니코를 통해 35%의 점유율을 유지하고 있지만 베리폰, PAX 기술, 급성장 중인 SoftPOS 진출기업이 가격 경쟁을 격화시켜 제품 혁신을 가속화하고 있습니다.

프랑스 POS 단말기 시장 동향과 인사이트

비접촉 결제 급증으로 단말기 요건 재구축

프랑스 소비자는 비접촉 결제 이용률을 2024년 POS 거래의 70%까지 끌어 올리고 유럽 평균의 58%를 웃돌았습니다. 50유로라는 높은 이용 한도액이 평균 거래액을 끌어 올려, 가맹점이 NFC와 기존 접촉식 결제 양쪽에 대응하는 듀얼 인터페이스 단말을 우선하는 동기가 되었습니다. 소매 대기업인 Carrefour나 오션에서는 이미 매장 거래의 80% 이상이 비접촉 결제가 되고 있으며, 노후화한 단말에서는 비접촉 결제율이 23% 저하하기 때문에 갱신 사이클이 가속하고 있습니다. 이러한 이유로 프랑스의 POS 단말기 시장은 NFC 성능, 배터리 지속 시간, 야외 시장 및 배송 차량에 적합한 오프라인 비접촉 기능에 중점을 둡니다. 지역 격차는 여전히 존재하며, 일드 프랑스 지역에서는 보급률이 85% 이상의 한편, 지방에서는 62%로 저수준이며, 접속성을 최적화한 솔루션을 제공하는 벤더에게 있어서 지리적인 공백지대가 되고 있습니다.

옴니 채널 소매의 디지털화가 인프라 현대화를 가속

통합 상거래 전략을 통해 소매업체는 통합 장치를 통해 온라인 모바일 매장의 데이터 스트림을 동기화해야 합니다. Fnac-Darty는 2024년에 1만 5,000대의 통합 단말기를 도입하여 단일 화면에서 주문, 반품 및 재고 조회를 처리하는 시스템에 대한 수요를 실증했습니다. 매출액 1,000만 유로 이상의 체인점의 약 68%가 2026년까지 업그레이드를 계획하고 있으며, 고정레지레인에서 점포 내를 이동하는 모바일 스테이션으로의 전환이 진행됨에 따라 프랑스의 POS 단말기 시장이 확대되고 있습니다. 모바일 단말기의 도입은 대기 시간 단축, 직원 효율성 향상, 클라우드 플랫폼에 대한 로열티 분석 데이터의 연계를 실현하고, 소프트웨어 중심공급자가 결제 앱, CRM, 재고 관리 툴을 구독 형태로 번들하는 것을 촉진하고 있습니다.

중소기업의 비용 의식이 도입 장벽에

프랑스 중소기업의 약 73%가 하드웨어 업데이트의 주요 장벽으로 비용을 들고 있습니다. 200-800유로의 단말 가격과 월 15-45유로의 이용료가, 박리 다매의 경영을 압박하고 있기 때문입니다. GPRS 폴백을 여전히 필요로 하는 지역에서는 연결성의 격차가 예산을 더욱 부풀리고 있습니다. 정부는 '프랑스 루랑스' 계획에 따라 500유로의 보조금을 제공하고 있지만, 복잡한 절차가 참여를 제한하고 많은 서비스 제공업체가 프로그램의 적용을 받지 않습니다. 벤더는 24-36개월의 단말 분할 지불 제공이나 SoftPOS 앱의 추진으로 대응하고 있습니다만, 보급률은 여전히 완만한 성장에 머물고 있습니다.

부문 분석

2025년 시점에서 접촉형 결제 단말기가 프랑스 POS 단말기 시장의 55.92%를 차지하고 있습니다만, 비접촉 단말은 CAGR8.11%로 성장을 지속하여, 2031년 이전에 과반수를 차지할 전망입니다. 이 전환은 2026년 도입 예정인 디지털 유로 검사 운용과 연동하고 있으며, CBDC 거래에 대응하는 듀얼 모드 단말이 필수가 됩니다. 고가의 럭셔리 제품과 자동차 대리점은 50 유로 이상의 거래에 여전히 PIN 기반 칩 인증에 의존하고 있지만, 소비자의 선호도는 NFC의 압도적인 우위를 보여줍니다.

비접촉 결제의 향후 성장은 2023년 이후의 듀얼 인터페이스 카드 발행률 94%와 컬트방케일 방식의 오프라인 비접촉 결제 상한 25유로에 기인합니다. 이러한 특성은 연결이 불안정한 옥외 시장과 배송 차량의 적용 범위를 넓혀 컴팩트하고 배터리 효율적인 리더 수요 증가를 촉진합니다. 지역 격차는 여전히 존재합니다. 일드 프랑스 지역에서는 비접촉 결제의 보급률이 85%에 달하는 한편, 지방 지역에서는 62%에 머물고 있어 미개척 잠재 수요를 살리기 위해, 저통신 환경용 바리에이션의 투입이 촉진되고 있습니다. 이러한 전개가 확대됨에 따라 프랑스의 POS 단말기 시장에서의 비접촉 하드웨어의 규모는 시장 전체의 평균을 상회할 전망이며, 벤더 각 사가 NFC 무선의 신뢰성, 안테나 설계, EMV 레벨 3 인증 사이클에 주력하는 자세를 강화하고 있습니다.

기타 혜택

- 엑셀 형태 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 프랑스 소비자 비접촉 결제의 보급률 급증

- 옴니채널 소매의 디지털화가 POS 갱신 사이클을 가속

- EU와 각국의 현금없는 경제 추진 시책과 PSD2에 의한 보안 강화

- 스마트폰 소프트 POS와 탭 결제가 중소 소매업체의 하드웨어 총 소유 비용을 삭감

- 유럽의 결제 이니셔티브(EPI)가 레거시 POS에 있어서의 계좌간 QR 결제 대응을 준비중

- 점포내 BNPL(후불 결제) / 결제시의 단기 분할 지불 옵션에 대한 수요 증가

- 시장 성장 억제요인

- 프랑스 중소기업(SME)의 높은 단말기 구입 및 유지보수 비용 부담

- 강화된 PCI-DSS/SCA 사이버 보안 컴플라이언스 부담

- 다가오는 포스트 양자암호로의 업그레이드로 복잡해 지는 펌웨어 라이프 사이클

- 이커머스로의 유동 인구 이동에 따른 기존 고정형 POS 가동률 저하

- 산업 밸류체인 분석

- 규제 상황

- 기술 전망

- 거시경제 요인의 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 결제 수단별

- 접촉형

- 비접촉형

- POS 유형별

- 고정형 POS 시스템

- 모바일 / 휴대용 POS 시스템

- 최종 사용자 산업별

- 소매

- 숙박

- 헬스케어

- 운송 및 물류

- 기타

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Ingenico Group SA(Worldline)

- Verifone Systems, Inc.

- PAX Technology Ltd.

- NCR Corporation

- Castles Technology Co., Ltd.

- SumUp Payments Limited

- Zettle(Paypal)

- myPOS World Ltd.

- NEC Corporation

- AURES Group SA

- Diebold Nixdorf

- BBPOS Limited

- Newland Payment Technology Co., Ltd.

- Shenzhen Xinguodu Technology Co., Ltd.

- Fujian Centerm Information Co., Ltd.

- Bitel Co., Ltd.

- Wiseasy Technology Co., Ltd.

- Fujian Landi Commercial Equipment Co., Ltd.

- dejamobile SAS

- Innovorder SAS

제7장 시장 기회와 장래의 전망

SHW 26.02.05The France POS Terminal Market is expected to grow from USD 0.87 billion in 2025 to USD 0.93 billion in 2026 and is forecast to reach USD 1.29 billion by 2031 at 6.75% CAGR over 2026-2031.

Robust demand arises from rising contactless-payment usage, regulatory mandates linked to PSD2 and Strong Customer Authentication, and the rollout of the European Payments Initiative's wero service, all of which compel merchants to refresh legacy devices. Hardware suppliers benefit from a replacement cycle encompassing roughly 2.3 million merchant locations, while software vendors gain share through SoftPOS offerings that lower total cost of ownership for micro-enterprises. Fixed terminals still dominate high-volume retail environments, yet mobile devices capture incremental growth as hospitality, gig-economy and curbside-pickup operators prioritize payment flexibility. Competition remains moderate: Worldline commands a 35% position via Ingenico, but Verifone, PAX Technology and fast-scaling SoftPOS players intensify pricing pressure and speed product innovation.

France POS Terminal Market Trends and Insights

Contactless Payment Surge Reshapes Terminal Requirements

French consumers pushed contactless uptake to 70% of POS transactions in 2024, eclipsing the 58% European average. The higher EUR 50 limit enhanced average ticket values and motivated merchants to prioritize dual-interface devices that support both NFC and traditional contact entry. Retailers Carrefour and Auchan already see contactless exceeding 80% of in-store volume, accelerating refresh cycles as aging terminals correlate with 23% lower contactless rates. The France POS terminal market consequently concentrates on NFC performance, battery longevity and offline contactless functions that suit outdoor markets and delivery fleets. Regional disparities remain, penetration tops 85% in Ile-de-France but lags at 62% in rural departements, offering vendors geographic white space for connectivity-optimized solutions.

Omnichannel Retail Digitalisation Accelerates Infrastructure Modernisation

Unified commerce strategies compel retailers to synchronize online, mobile and in-store data streams through integrated devices. Fnac-Darty installed 15,000 unified terminals in 2024, showcasing demand for systems that process orders, returns and inventory queries from a single screen. Nearly 68% of chains above EUR 10 million revenue plan upgrades by 2026, boosting the France POS terminal market as operators replace fixed checkout lanes with mobile stations that roam shop floors. Mobile deployments shorten wait times, improve staff efficiency and feed loyalty analytics into cloud platforms, encouraging software-centric suppliers to bundle payment apps, CRM and inventory tools via subscription.

SME Cost Sensitivity Creates Adoption Friction

Almost 73% of French SMEs cite cost as the main barrier to hardware refresh, as devices priced at EUR 200-800 and monthly fees of EUR 15-45 erode thin margins. Connectivity gaps further inflate budgets in rural areas that still require GPRS fall-back. Though the government offers EUR 500 subsidies under France Relance, complex paperwork limits participation, leaving many service providers outside the program. Vendors respond by financing terminals over 24-36 months or promoting SoftPOS apps, yet penetration gains remain gradual.

Other drivers and restraints analyzed in the detailed report include:

- EU Policy Framework Mandates Security and Interoperability Upgrades

- SoftPOS Technology Reduces Barriers for Micro-Merchant Adoption

- Cybersecurity Compliance Burden Intensifies Operational Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Contact-based solutions controlled 55.92% of the France POS terminal market share in 2025, yet contactless devices are forecast to record an 8.11% CAGR, pushing the segment toward majority status well before 2031. This transition parallels the digital euro pilot slated for 2026, which requires dual-mode devices capable of CBDC transactions. High-value luxury and automotive merchants still lean on PIN-based chip entry for transactions above EUR 50, but consumer preference signals inexorable NFC dominance.

Subsequent growth in contactless acceptance stems from 94% dual-interface card issuance since 2023 and the Carte Bancaire scheme's offline-contactless limit of EUR 25. These features broaden applicability to outdoor markets and delivery vans with intermittent connectivity, spurring incremental volumes for compact, battery-efficient readers. Regional disparities persist: Ile-de-France logs 85% contactless penetration, whereas rural areas hover at 62%, encouraging suppliers to launch low-connectivity variants that exploit untapped potential. As these deployments scale, the France POS terminal market size for contactless hardware is set to outpace overall market averages, reinforcing vendors' focus on NFC radio integrity, antenna design and EMV Level 3 certification cycles.

The France POS Terminal Market Report is Segmented by Mode of Payment Acceptance (Contact-Based, and Contactless), POS Type (Fixed Point-Of-Sale Systems, and Mobile/Portable Point-Of-Sale Systems), End-User Industry (Retail, Hospitality, Healthcare, Transportation and Logistics, and Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ingenico Group SA (Worldline)

- Verifone Systems, Inc.

- PAX Technology Ltd.

- NCR Corporation

- Castles Technology Co., Ltd.

- SumUp Payments Limited

- Zettle (Paypal)

- myPOS World Ltd.

- NEC Corporation

- AURES Group SA

- Diebold Nixdorf

- BBPOS Limited

- Newland Payment Technology Co., Ltd.

- Shenzhen Xinguodu Technology Co., Ltd.

- Fujian Centerm Information Co., Ltd.

- Bitel Co., Ltd.

- Wiseasy Technology Co., Ltd.

- Fujian Landi Commercial Equipment Co., Ltd.

- dejamobile SAS

- Innovorder SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in contactless-payment penetration among French consumers

- 4.2.2 Omnichannel retail digitalisation accelerating POS refresh cycles

- 4.2.3 EU and national policies promoting cash-lite economy and PSD2-driven security upgrades

- 4.2.4 SoftPOS and Tap-to-Pay on smartphones slashing hardware TCO for micro-merchants

- 4.2.5 European Payments Initiative (EPI) preparing account-to-account QR acceptance on legacy POS

- 4.2.6 Rising demand for in-terminal BNPL / short-instalment options at checkout

- 4.3 Market Restraints

- 4.3.1 High upfront terminal and maintenance costs for French SMEs

- 4.3.2 Heightened PCI-DSS/SCA cybersecurity compliance burden

- 4.3.3 Looming post-quantum crypto upgrades complicating firmware lifecycles

- 4.3.4 Foot-traffic shift to e-commerce leaving legacy fixed POS capacity under-utilised

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Mode of Payment Acceptance

- 5.1.1 Contact-based

- 5.1.2 Contactless

- 5.2 By POS Type

- 5.2.1 Fixed Point-of-Sale Systems

- 5.2.2 Mobile / Portable Point-of-Sale Systems

- 5.3 By End-User Industry

- 5.3.1 Retail

- 5.3.2 Hospitality

- 5.3.3 Healthcare

- 5.3.4 Transportation and Logistics

- 5.3.5 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ingenico Group SA (Worldline)

- 6.4.2 Verifone Systems, Inc.

- 6.4.3 PAX Technology Ltd.

- 6.4.4 NCR Corporation

- 6.4.5 Castles Technology Co., Ltd.

- 6.4.6 SumUp Payments Limited

- 6.4.7 Zettle (Paypal)

- 6.4.8 myPOS World Ltd.

- 6.4.9 NEC Corporation

- 6.4.10 AURES Group SA

- 6.4.11 Diebold Nixdorf

- 6.4.12 BBPOS Limited

- 6.4.13 Newland Payment Technology Co., Ltd.

- 6.4.14 Shenzhen Xinguodu Technology Co., Ltd.

- 6.4.15 Fujian Centerm Information Co., Ltd.

- 6.4.16 Bitel Co., Ltd.

- 6.4.17 Wiseasy Technology Co., Ltd.

- 6.4.18 Fujian Landi Commercial Equipment Co., Ltd.

- 6.4.19 dejamobile SAS

- 6.4.20 Innovorder SAS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment